Leap Capital Markets 2025 Review: Everything You Need to Know

Leap Capital Markets has emerged as a new player in the forex brokerage landscape since its establishment in 2023. However, its lack of regulatory oversight and mixed user feedback have raised significant concerns. This review synthesizes user experiences, expert opinions, and key characteristics of the broker to provide a comprehensive overview.

Note: It is important to be aware of the different entities operating across regions, as this can impact the regulatory scrutiny and safety of trading with Leap Capital Markets. The insights presented here are based on a thorough analysis of various sources to ensure fairness and accuracy.

Rating Overview

We score brokers based on user feedback, expert opinions, and factual data.

Broker Overview

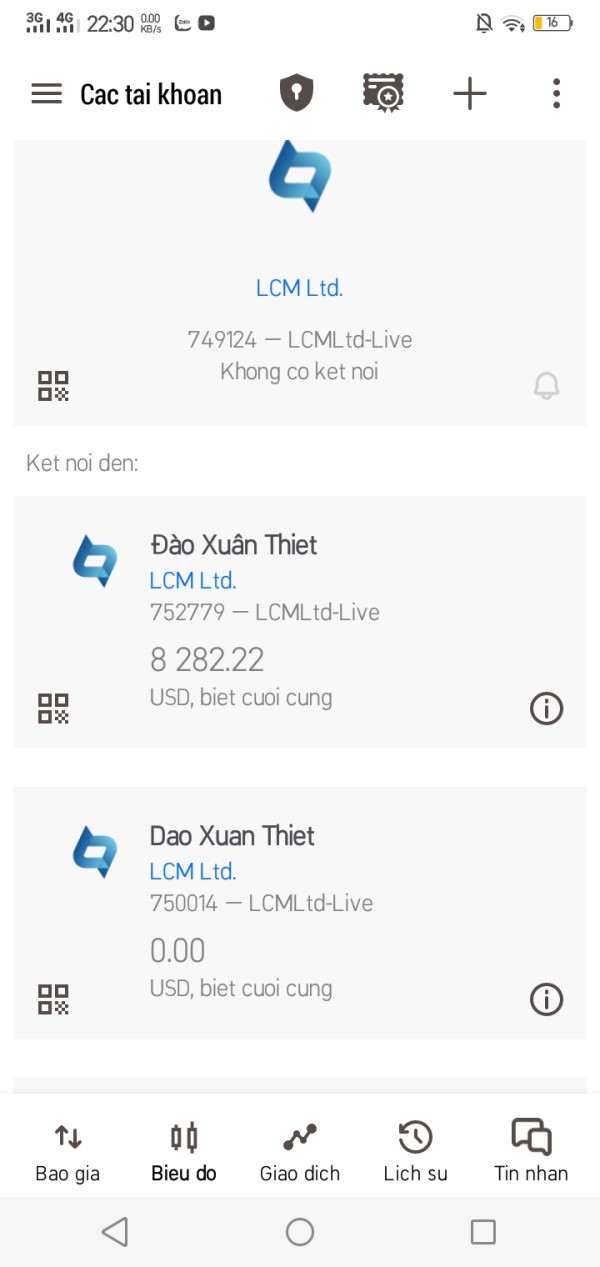

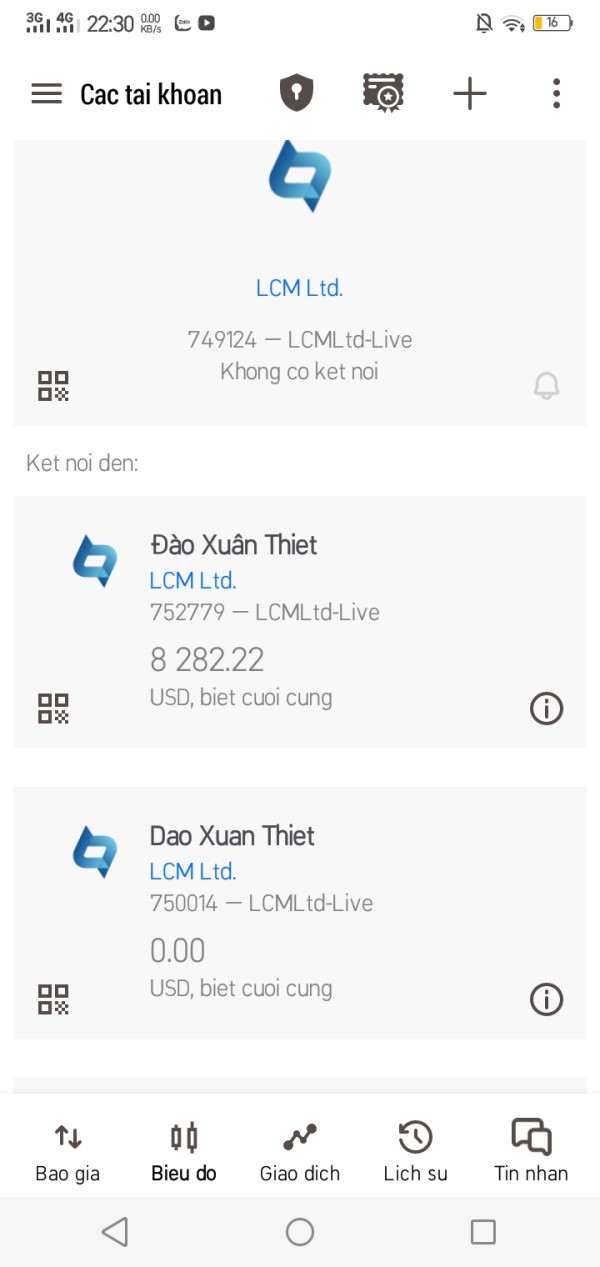

Leap Capital Markets is a forex brokerage firm that positions itself as an accessible platform for traders worldwide. Founded in 2023 and registered in China, the broker operates with offshore activities in Saint Lucia. It offers a variety of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies. The trading is facilitated through the widely recognized MetaTrader 5 (MT5) platform, allowing users to engage in diverse trading strategies. However, a critical drawback is its lack of regulation, which raises questions about the safety and transparency of its operations.

Detailed Review

Regulatory Status:

Leap Capital Markets operates without regulation from any major financial authority, which is a significant red flag for potential traders. According to WikiFX, the broker has a regulatory index of 0.00, indicating a complete absence of oversight. This unregulated status can lead to increased risks for traders, as there are no guaranteed protections in place.

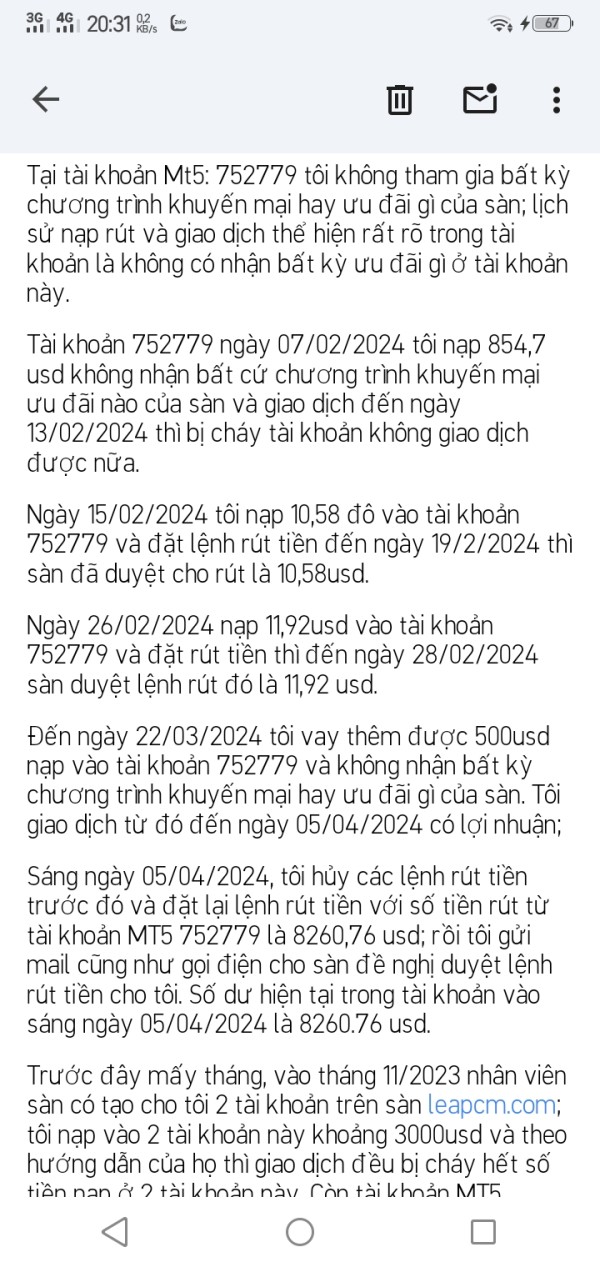

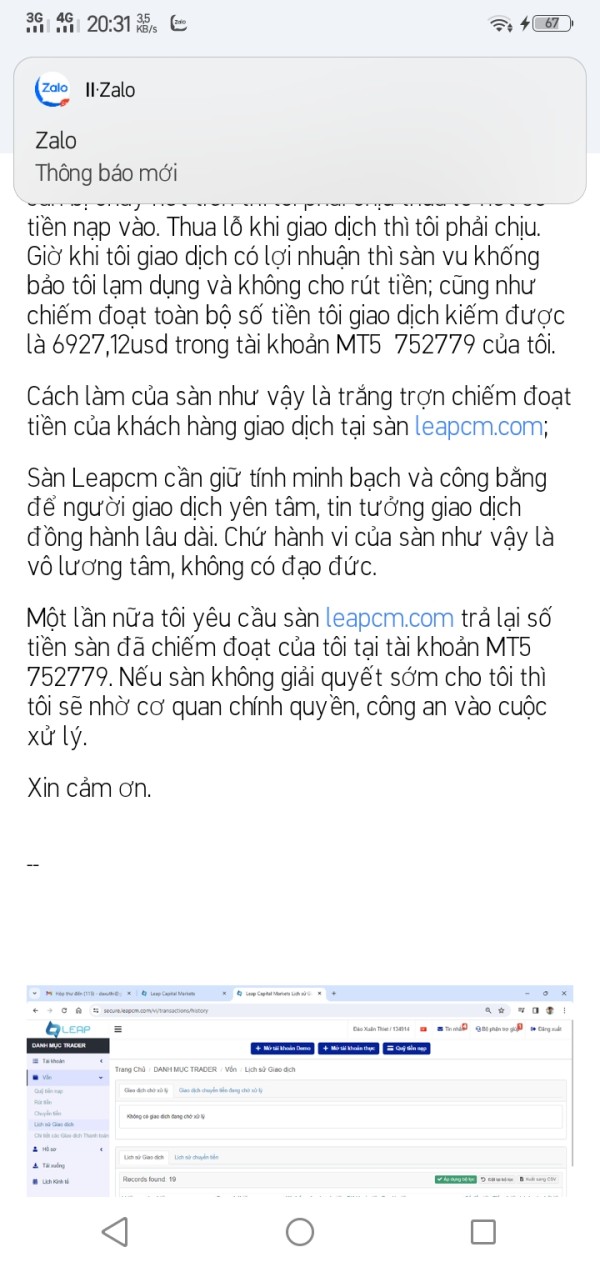

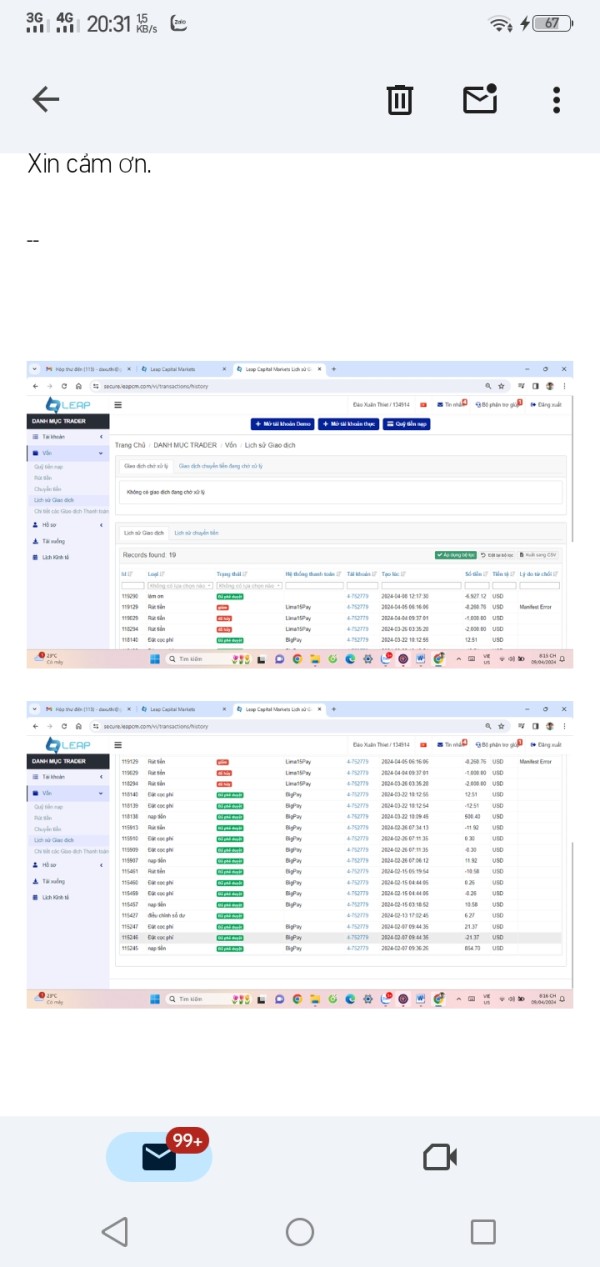

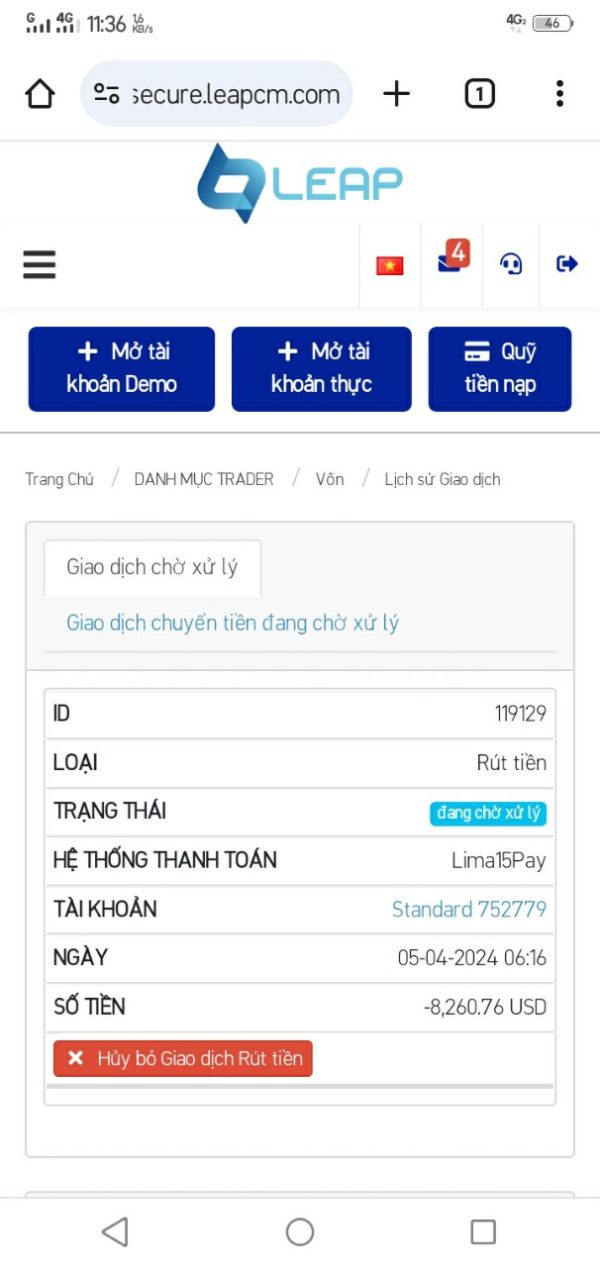

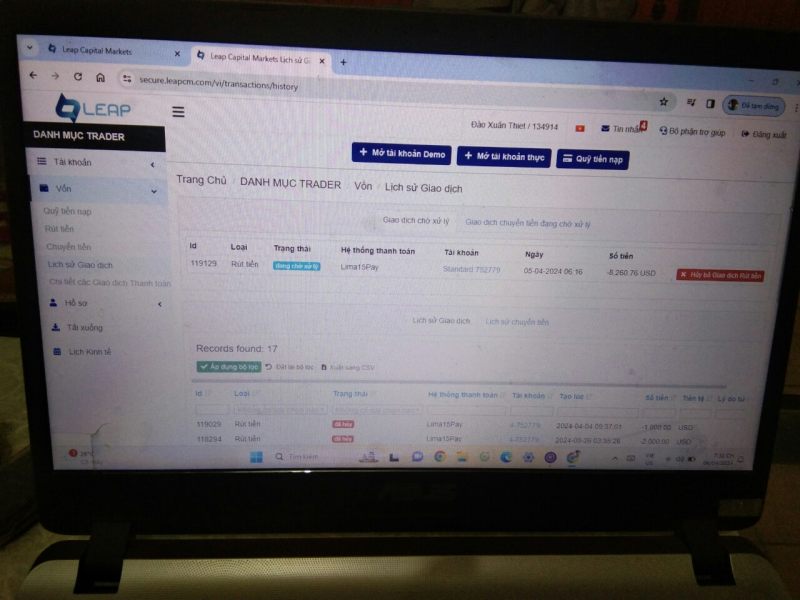

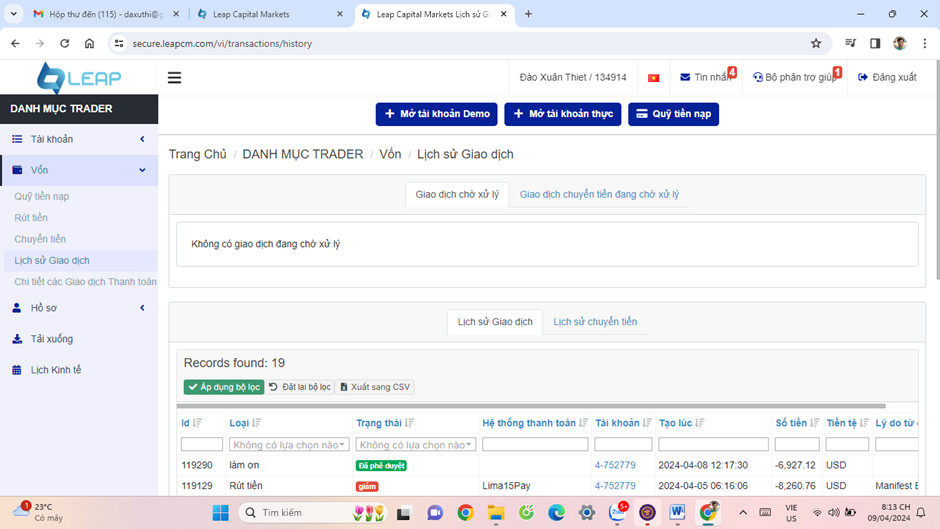

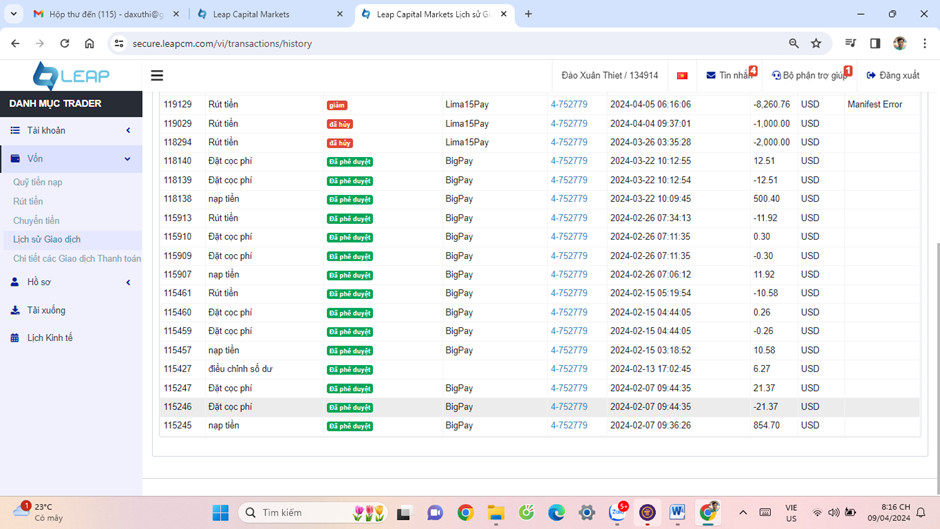

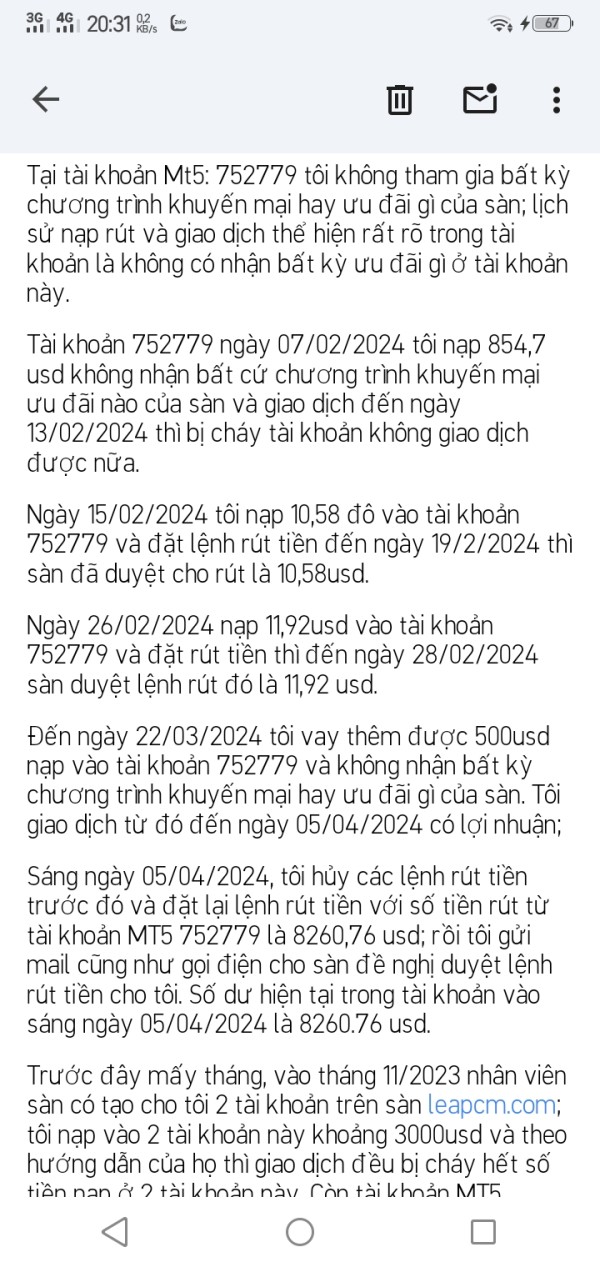

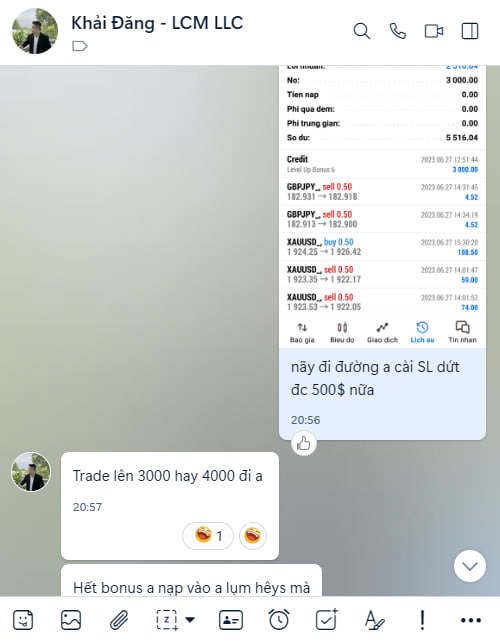

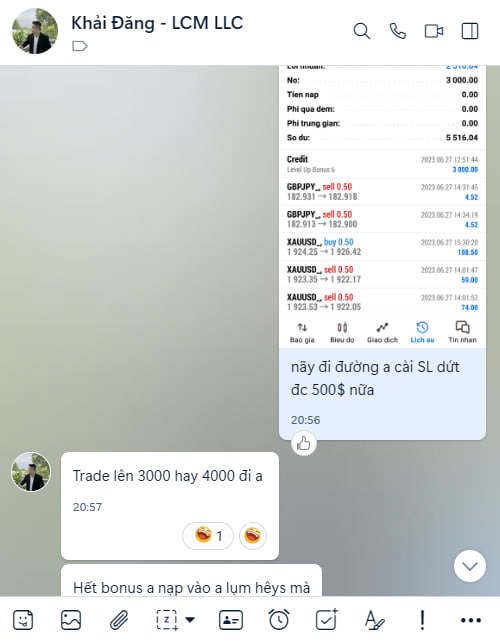

Deposit/Withdrawal Methods:

The broker claims to support various payment methods, including Visa, Mastercard, Skrill, Neteller, Bitcoin, Ethereum, and Tether, but lacks detailed written information about these methods. Prospective traders are encouraged to contact the broker directly for clarification on deposit and withdrawal options.

Minimum Deposit:

Leap Capital Markets allows for a remarkably low minimum deposit, starting at $0, which can be attractive for new traders looking to enter the market without significant financial commitment. However, this can also lead to a higher risk of inexperienced traders entering the market without adequate preparation.

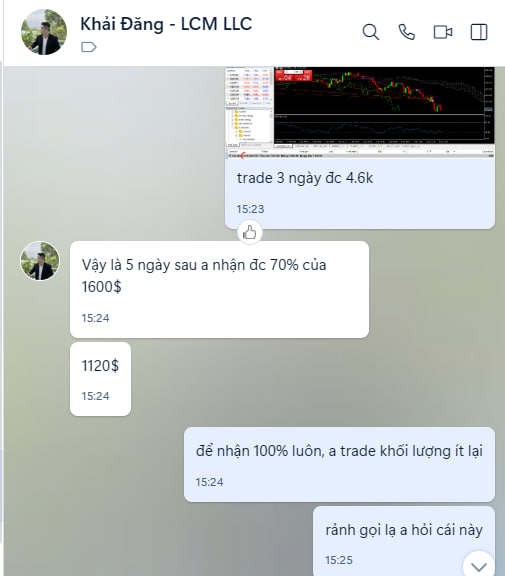

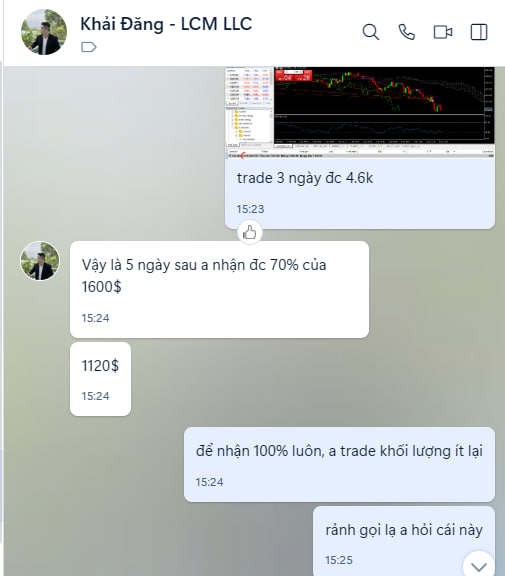

Bonuses/Promotions:

There is no clear information regarding bonuses or promotional offers from Leap Capital Markets, which can be a disadvantage compared to other brokers that provide incentives to attract new clients.

Trading Asset Classes:

The broker offers a diverse range of trading instruments, including forex, indices, stocks, commodities, and cryptocurrencies. This variety allows traders to diversify their portfolios and explore different trading strategies. However, the quality of execution and available trading tools remains a concern, particularly given the broker's unregulated status.

Costs (Spreads, Fees, Commissions):

Leap Capital Markets features various account types, with spreads starting from 0.0 pips on its zero account, which includes a nominal commission of $10 per lot traded. The standard account offers competitive spreads of 1.0 pips with zero commission, while the VIP account provides even tighter spreads of 0.4 pips without commissions. However, the presence of commissions on certain accounts raises questions about the overall cost-effectiveness of trading with this broker.

Leverage:

The broker offers a maximum leverage of up to 1:1000, which can amplify both potential profits and losses. While high leverage can be appealing to experienced traders, it also poses significant risks, particularly for those who may not fully understand the implications of trading with such high leverage.

Allowed Trading Platforms:

Leap Capital Markets primarily uses the MetaTrader 5 platform, which is known for its advanced features and user-friendly interface. This platform is accessible on various devices, including desktop and mobile, allowing traders to manage their accounts conveniently.

Restricted Regions:

Leap Capital Markets does not accept clients from several jurisdictions, including the United States, Canada, Japan, and North Korea. This limitation may exclude a significant number of potential traders from accessing its services.

Available Customer Service Languages:

Customer support is available through multiple channels, including email and social media platforms. However, the overall quality of customer service has received mixed reviews, with some users reporting slow response times.

Conclusion

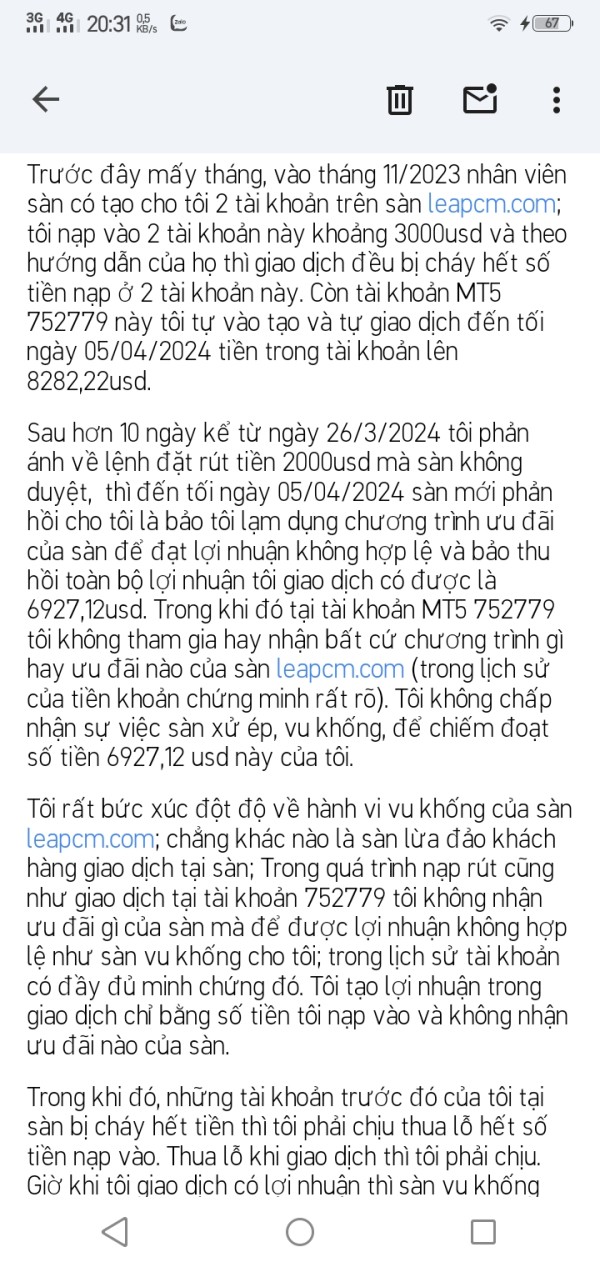

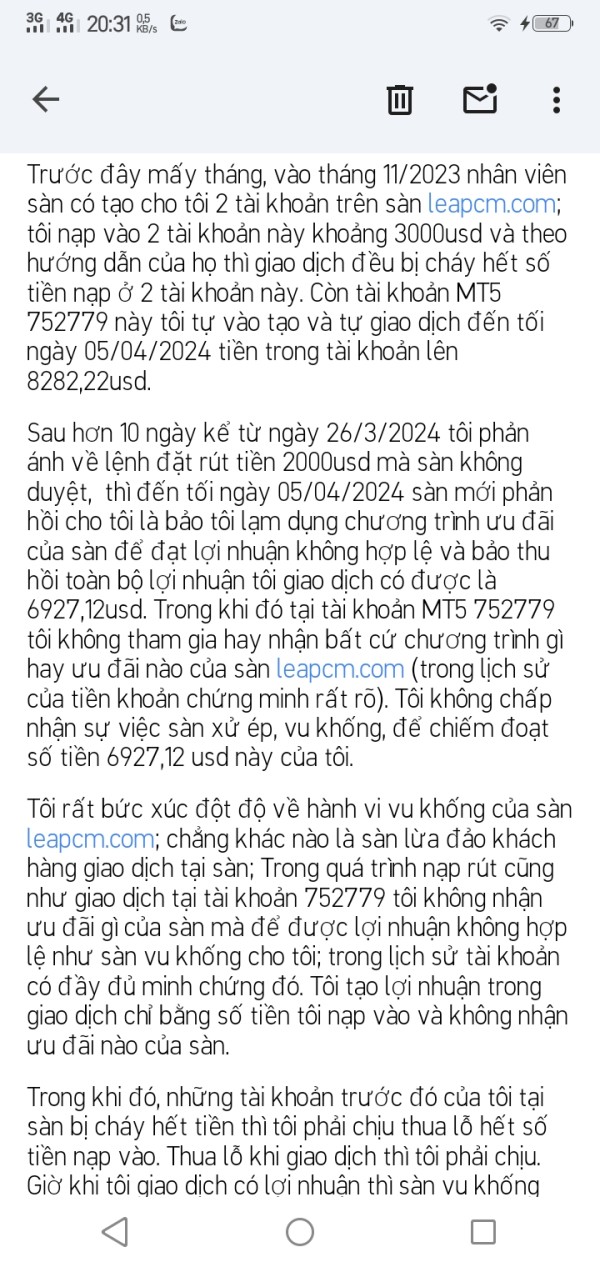

Based on the available information, Leap Capital Markets presents a mixed bag for potential traders. While it offers a wide range of trading instruments and low entry barriers, the lack of regulation and mixed user feedback on customer service and trustworthiness are significant concerns. Traders should exercise caution and conduct thorough research before engaging with this broker. Exploring alternative brokers with established regulatory compliance and a strong commitment to security and transparency is advisable for a safer trading experience.

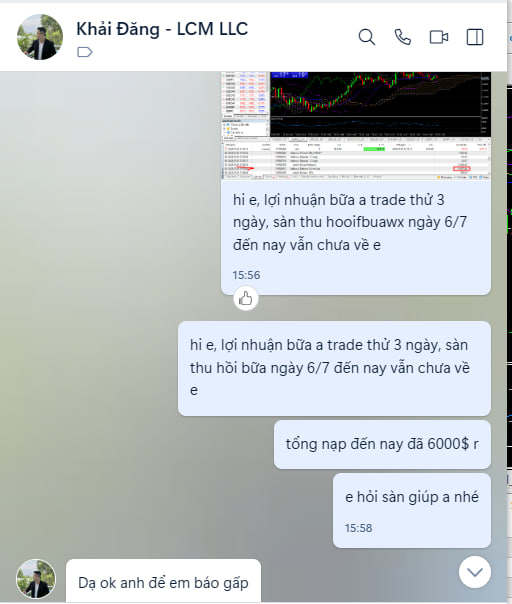

User Experience Insights

Users have expressed concerns regarding the broker's unregulated status, with some highlighting the importance of security and trust in trading. According to various reviews, the absence of regulatory oversight raises legitimate doubts about the broker's commitment to safety and adherence to industry standards.

Expert Opinions

Experts have consistently warned against trading with unregulated brokers like Leap Capital Markets, emphasizing the risks involved. According to Scamadviser, the site has a low trust score of 29/100, indicating potential risks associated with using this broker.

In summary, while Leap Capital Markets may attract some traders due to its low minimum deposit and wide range of instruments, the risks associated with its unregulated status cannot be overlooked. The decision to trade with this broker should be made with careful consideration of the associated risks.