Regarding the legitimacy of JIAOZI FUTURES forex brokers, it provides CFFEX and WikiBit, .

Is JIAOZI FUTURES safe?

Risk Control

Software Index

Is JIAOZI FUTURES markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

成都交子期货有限公司

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

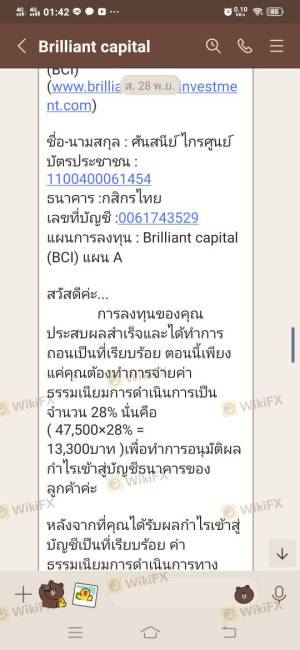

Is Brilliant Safe or a Scam?

Introduction

Brilliant is a forex broker that has gained attention in the trading community for its offerings in the forex and CFD markets. Established in China, it positions itself as a reputable platform for traders seeking access to various financial instruments. However, the world of forex trading is fraught with risks, and traders must exercise caution when selecting a broker. The importance of due diligence cannot be overstated, as the consequences of choosing an unreliable broker can be severe, including potential loss of funds and access to trading accounts. This article aims to provide an objective analysis of Brilliant, assessing its safety, regulatory status, and overall legitimacy through a comprehensive evaluation framework based on multiple sources.

Regulation and Legitimacy

The regulatory status of a forex broker is critical for ensuring the safety of traders' funds and the integrity of trading operations. Brilliant claims to be regulated, but the specifics of its regulatory oversight warrant scrutiny. The table below summarizes the core regulatory information regarding Brilliant:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | Not Specified | China | Verified |

Brilliant is regulated by the China Financial Futures Exchange (CFFEX), which is primarily focused on futures trading. While this regulatory oversight may provide some level of assurance, it is essential to consider the quality of regulation and historical compliance. Notably, there are reports of low safety ratings and complaints regarding the broker's operations. The lack of comprehensive regulatory oversight, especially in the context of forex trading, raises questions about the overall safety of using Brilliant. Therefore, traders should remain cautious and conduct thorough research before engaging with this broker.

Company Background Investigation

Understanding the background of a broker is crucial for evaluating its credibility. Brilliant has been operational for over a decade, with its headquarters located in Chengdu, China. The company's ownership structure and management team play a significant role in shaping its operational integrity. However, information about the management team is limited, and there are concerns about transparency regarding the company's operations.

The level of transparency and information disclosure is vital for building trust with clients. In the case of Brilliant, there seems to be a lack of readily available information regarding its management, which could potentially indicate issues with transparency. Furthermore, the absence of a detailed company history and ownership structure raises red flags about the broker's legitimacy. Traders should be wary of engaging with a broker that does not provide clear and accessible information about its operations and management.

Trading Conditions Analysis

The trading conditions provided by a broker can significantly impact a trader's experience and profitability. Brilliant's fee structure and trading costs are essential aspects to consider. The following table compares key trading costs associated with Brilliant against the industry average:

| Fee Type | Brilliant | Industry Average |

|---|---|---|

| Spread for Major Pairs | Variable | 1.0 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | 2.5% - 3.0% | 2.0% - 2.5% |

While Brilliant advertises competitive spreads, the lack of a clear commission structure may lead to hidden costs that could affect profitability. Additionally, the overnight interest rates appear to be higher than the industry average, which could deter long-term traders. It is crucial for traders to fully understand the cost implications of trading with Brilliant, as unexpected fees can quickly erode profits.

Client Fund Safety

Ensuring the safety of client funds is paramount in the forex trading industry. Traders need to be aware of the measures that a broker has in place to protect their investments. Brilliant claims to implement various safety measures, including segregating client funds and offering negative balance protection. However, the effectiveness of these measures is questionable given the lack of comprehensive regulatory oversight.

Moreover, there have been reports of difficulties in fund withdrawals and complaints related to fund safety, which raises concerns about the broker's commitment to protecting client assets. Traders should be vigilant and consider potential risks associated with fund safety when trading with Brilliant. The historical issues regarding fund withdrawals further emphasize the need for caution.

Customer Experience and Complaints

Customer feedback is a critical indicator of a broker's reliability and service quality. In the case of Brilliant, user reviews reveal a mixed bag of experiences. While some traders report satisfactory experiences, others highlight significant issues, particularly concerning withdrawals and customer support. The table below summarizes the main types of complaints received about Brilliant:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Lack of Transparency | Medium | Limited Response |

| Customer Support Accessibility | High | Poor Availability |

Typical complaints include difficulties in withdrawing funds and a lack of timely responses from customer support. These patterns of complaints are concerning and suggest that potential users should approach Brilliant with caution. The severity and frequency of these complaints indicate that there may be underlying issues that could affect the trading experience.

Platform and Trade Execution

The performance and reliability of a trading platform are vital for a successful trading experience. Traders using Brilliant have reported varying experiences regarding the platform's stability and execution quality. While the broker claims to provide a user-friendly interface, issues such as slippage and order rejections have been noted by some users.

It is essential for traders to assess whether the platform meets their trading needs and whether it shows any signs of manipulation. A reliable trading platform should offer seamless execution and minimal slippage to ensure that traders can capitalize on market opportunities effectively.

Risk Assessment

Trading with any broker carries inherent risks, and evaluating these risks is crucial for informed decision-making. The following risk assessment summarizes key risk areas associated with using Brilliant:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited regulatory oversight |

| Fund Safety Risk | High | Historical issues with fund withdrawals |

| Customer Service Risk | Medium | Poor response times to complaints |

Given the high-risk levels associated with regulatory oversight and fund safety, traders are advised to exercise caution when considering Brilliant as a trading option. Implementing risk mitigation strategies, such as setting strict withdrawal limits and closely monitoring account activity, can help manage potential risks.

Conclusion and Recommendations

In conclusion, while Brilliant presents itself as a legitimate forex broker, several factors raise concerns regarding its safety and reliability. The lack of comprehensive regulation, coupled with historical issues related to fund withdrawals and customer complaints, suggests that traders should approach this broker with caution.

For traders seeking reliable alternatives, it is advisable to consider brokers with strong regulatory oversight, transparent operations, and positive customer feedback. Some reputable options include brokers like IG, OANDA, and Forex.com, which are recognized for their regulatory compliance and strong customer service. Ultimately, the key to successful trading lies in thorough research and careful evaluation of potential brokers.

In summary, Is Brilliant safe? The evidence suggests that potential traders should carefully weigh the risks before engaging with this broker.

Is JIAOZI FUTURES a scam, or is it legit?

The latest exposure and evaluation content of JIAOZI FUTURES brokers.

JIAOZI FUTURES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JIAOZI FUTURES latest industry rating score is 7.80, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.80 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.