Vortexyl 2025 Review: Everything You Need to Know

Vortexyl has garnered a mixed reputation among traders and analysts alike. While some users praise its user-friendly interface and educational resources, numerous reports highlight serious concerns regarding its regulatory status and withdrawal issues. This review aims to synthesize key insights from various sources to provide a comprehensive understanding of Vortexyl's offerings and potential risks.

Note: It is essential to consider the varying regulatory environments across regions, as this may impact the legitimacy and operational practices of brokers like Vortexyl. This review strives for fairness and accuracy by referencing multiple sources.

Ratings Overview

We rate brokers based on user feedback, expert analysis, and overall service quality.

Broker Overview

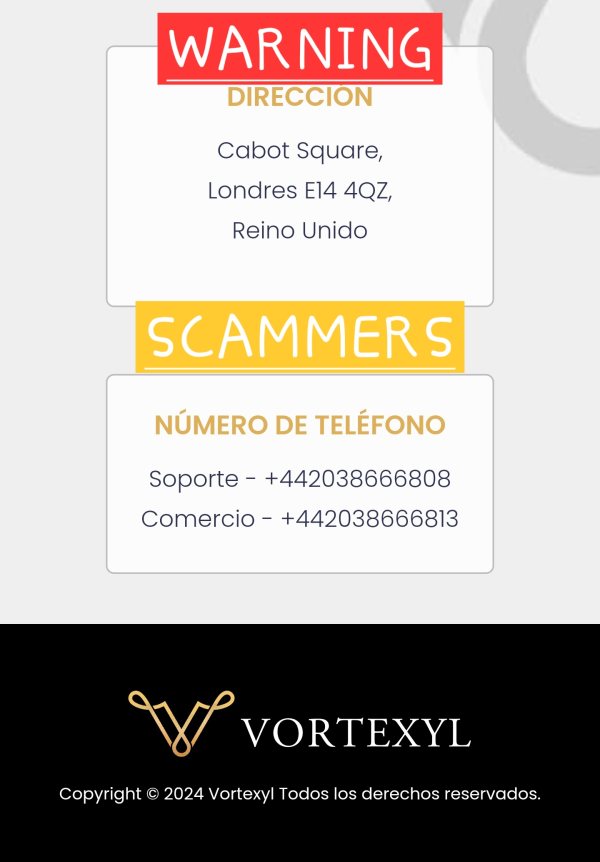

Vortexyl claims to operate as a technologically advanced online CFD platform, though the specifics about its establishment year remain unclear, with some sources suggesting it was launched in late 2023. The broker primarily offers a web-based trading platform, lacking support for popular platforms like MT4 or MT5, which are favored by many traders. Vortexyl provides access to various asset classes, including Forex, stocks, commodities, and cryptocurrencies. However, it is crucial to note that Vortexyl is unregulated, with no oversight from major financial authorities such as the Financial Conduct Authority (FCA) in the UK.

Detailed Section

Regulatory Geography

Vortexyl operates without any regulatory oversight, raising significant concerns regarding its legitimacy. The Comisión Nacional del Mercado de Valores (CNMV) in Spain has issued warnings against Vortexyl for providing investment services without proper authorization. This lack of regulation poses a high risk to traders, as their funds may not be protected.

Deposit/Withdrawal Options

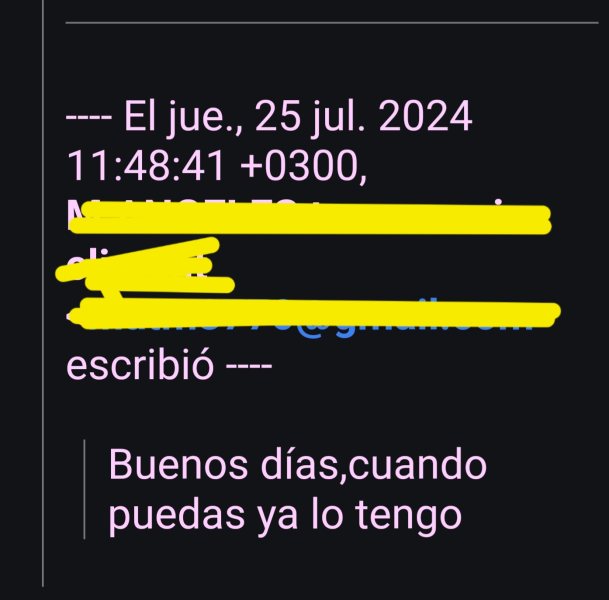

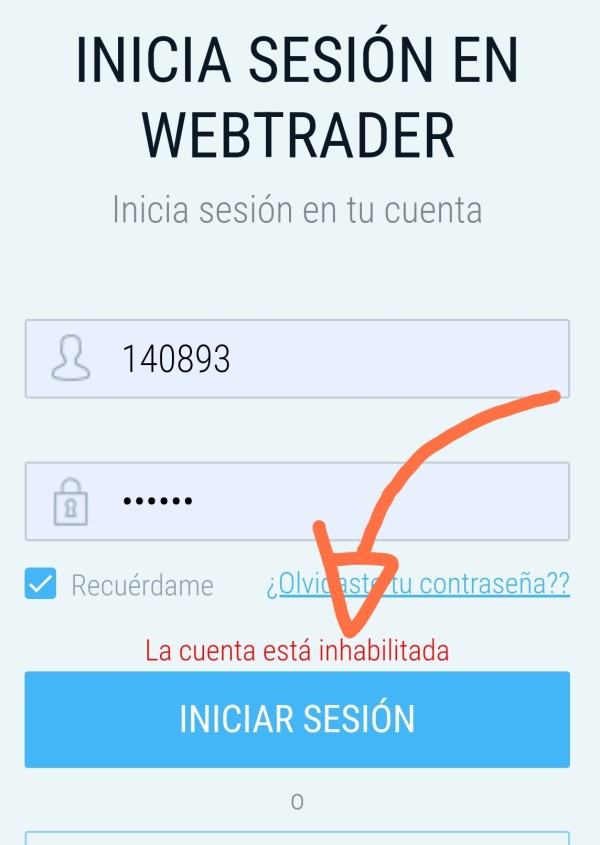

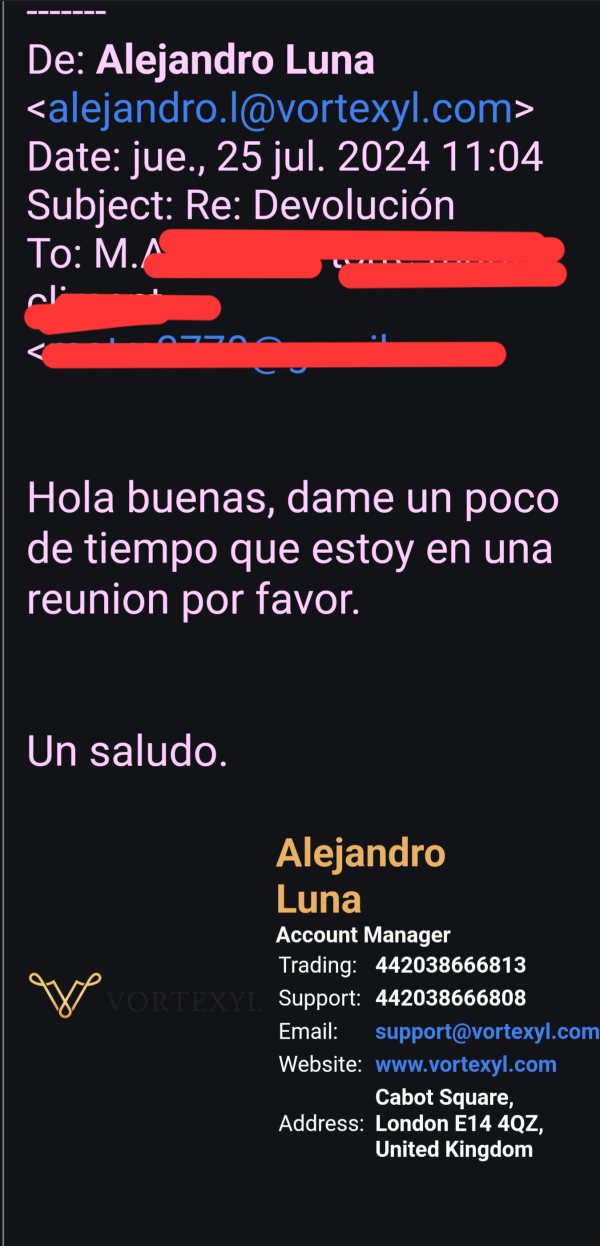

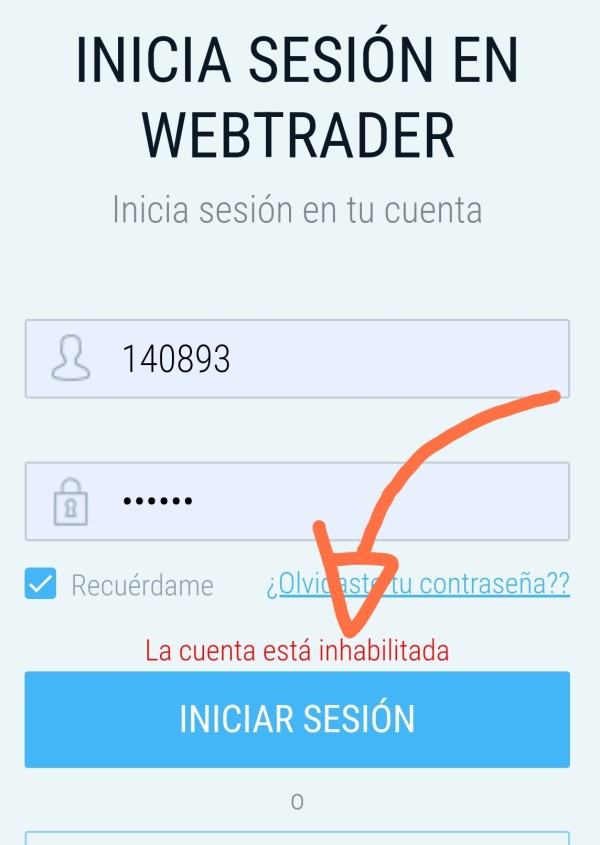

Vortexyl accepts deposits in various currencies, including USD, EUR, and GBP. The minimum deposit requirement is reported to be around $250, which is relatively standard in the industry. However, users have reported challenges in withdrawing their funds, with some claiming that their requests were blocked or delayed indefinitely.

The broker offers various promotional bonuses, but the terms and conditions surrounding these offers are often vague. Many users have expressed concerns that these bonuses come with unrealistic trading requirements, making it difficult to withdraw any earned funds.

Tradeable Asset Classes

Vortexyl provides a diverse range of assets for trading, including Forex pairs, stocks, commodities, and cryptocurrencies. However, all instruments are available only as CFDs, which may not be suitable for all traders, particularly those looking for direct asset ownership.

Costs (Spreads, Fees, Commissions)

The specifics regarding spreads and commissions are not clearly outlined on the Vortexyl website, leading to speculation about potentially high costs. Users have reported experiencing high spreads, particularly for Forex trading, which can significantly impact profitability.

Leverage

Vortexyl offers leverage of up to 1:200, which is considerably higher than what is permitted by many regulatory bodies. This high leverage can amplify both gains and losses, posing additional risks to traders.

Vortexyl operates primarily through a web-based platform, lacking dedicated mobile applications or support for widely-used platforms like MT4 or MT5. This limitation may hinder the trading experience for those accustomed to more robust trading tools.

Restricted Regions

Due to its unregulated status, Vortexyl may not be accessible or suitable for traders in several jurisdictions. Users are advised to check their local regulations before engaging with the broker.

Available Customer Service Languages

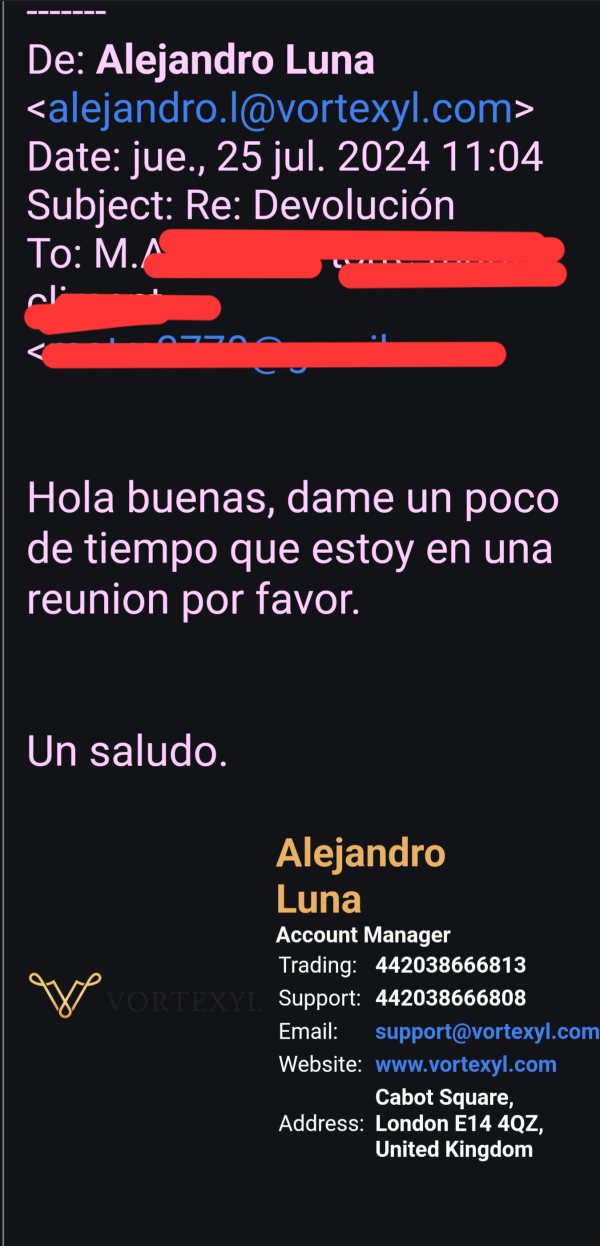

Vortexyl reportedly offers customer support in multiple languages, including English and Spanish. However, user reviews indicate that the quality of customer service can be inconsistent, with some users experiencing long wait times for responses.

Repeated Ratings Overview

Detailed Breakdown of Ratings

-

Account Conditions (4/10): Users report a relatively straightforward account setup process, but the minimum deposit and withdrawal issues raise concerns.

Tools and Resources (6/10): Vortexyl provides educational resources aimed at helping traders improve their skills, but the lack of advanced trading platforms limits its appeal.

Customer Service and Support (5/10): While customer service is available in multiple languages, response times can be slow, and many users have reported difficulties in resolving issues.

Trading Experience (4/10): The web-based trading platform lacks many features that traders expect, such as advanced charting tools and automated trading options.

Trustworthiness (2/10): The absence of regulation and numerous warnings from financial authorities significantly undermine Vortexyl's credibility.

User Experience (5/10): While some users appreciate the platform's interface, the overall experience is marred by withdrawal issues and lack of transparency.

In conclusion, the Vortexyl review reveals a broker that presents significant risks to potential investors. The lack of regulation, withdrawal issues, and mixed user experiences suggest that traders should proceed with caution. Always conduct thorough research and consider regulated alternatives for a safer trading environment.