TriumphFX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

TriumphFX, a broker primarily involved in forex and CFD trading, presents an attractive option for those seeking low-cost execution and high leverage. Founded in 2009 and registered under multiple regulatory bodies including the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC), TriumphFX aims to provide access to the forex market with a focus on direct transaction routing to liquidity providers.

However, potential clients must weigh the advantages of competitive trading conditions against significant risks. Numerous complaints have arisen surrounding withdrawal difficulties, account freezes, and general fund safety. These factors raise substantial concerns among traders about the broker's credibility and operational integrity, especially in an environment that increasingly scrutinizes offshore trading entities.

The ideal customer for TriumphFX encompasses retail traders who are familiar with navigating regulatory complexities and prioritize cost-efficiency. Conversely, novice or risk-averse traders seeking a robust regulatory backing and a varied range of trading instruments should consider alternatives.

⚠️ Important Risk Advisory & Verification Steps

Before engaging with TriumphFX, potential clients are strongly advised to consider the following risks:

- Withdrawal Difficulties: Numerous clients have reported unable to retrieve funds following withdrawal requests.

- Regulatory Concerns: TriumphFX's claim to multiple regulatory licenses has been labeled by some authorities as “suspicious,” with doubts regarding compliance with local and international trading laws.

- Limited Educational Resources: New or inexperienced traders might find the broker lacking in educational offerings to facilitate effective trading.

How to Self-Verify TriumphFX's Legitimacy:

- Check Regulatory Websites:

- Visit CySEC's site and check TriumphFX's license status.

- Look up VFSC to verify the broker's registration number.

- Look for Feedback on Independent Review Sites:

- Explore user experiences on platforms like Trustpilot or WikiFX to gauge real customer sentiments about their withdrawal experiences.

- Seek out Regulatory Warnings:

- Research warnings from financial authorities in your jurisdiction about TriumphFX or related entities.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2009, TriumphFX operates as an STP (Straight Through Processing) broker, emphasizing high-quality execution in forex trading. Headquartered in Cyprus, the company holds licenses from both the CySEC and VFSC, which initially suggest a regulated operational environment. However, a closer look reveals a patchy regulatory history and subsequent claims of being a "suspicious clone."

Despite past accolades, such as 'Most Reliable Forex Broker of the Year 2017,' the broker now faces skepticism due to emerging complaints and reports of withdrawal issues.

Core Business Overview

TriumphFX specializes in forex and CFDs, offering a limited selection of 60 currency pairs and only 4 precious metals for trading. Their primary trading platform is MetaTrader 4, which provides users with standard analytical tools, although many experienced traders may find it lacking in advanced functionalities. The leverage offered varies drastically, reaching up to 1:500 for clients registered in offshore entities, while it is limited to 1:30 for those under CySEC.

Regulatory Claims: TriumphFX's operations are regulated by:

- CySEC (License No. 293 / 16)

- VFSC (License No. 17901)

However, warnings have been issued by other regulatory bodies against the broker, raising red flags for potential clients.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Regulatory stability is crucial for any financial broker, yet TriumphFX's claims have been met with skepticism. While it is overseen by CySEC, multiple warnings from regulatory authorities in Southeast Asia, including the Monetary Authority of Singapore (MAS) and the Indonesian financial watchdogs, have surfaced, describing TriumphFX as a potentially dubious broker. The conflicting narratives regarding regulatory status fuel a considerably low trust factor.

User Self-Verification Guide

- Visit the CySEC official website to confirm TriumphFXs license and regulatory standing.

- Check the VFSC database to verify the broker's operational legitimacy.

- Consult user feedback on independent review platforms to gauge experiences concerning fund safety.

Industry Reputation and Summary

The reputation of TriumphFX suffers from growing complaints about fund withdrawals and lack of transparency in their operations. The dominance of negative user experiences necessitates caution among potential clients.

Trading Costs Analysis

Advantages in Commissions

TriumphFX does promote some competitive commission structures. For instance, spreads can be as low as 0.5 pips for VIP account holders; however, users on standard accounts often start at much higher spreads of around 1.6 pips.

The "Traps" of Non-Trading Fees

Despite the appealing trading costs, hidden fees can pose a significant risk. Many users have reported withdrawal fees upward of $30 and other charges that could turn optimal trading conditions into a cost burden quickly.

User Review: "I tried to withdraw $500 after some profits, and was shocked to find a withdrawal fee of $30 on top of the delays!"

Cost Structure Summary

While some user types — notably higher-tier accounts — benefit from low trading costs, the hidden non-trading charges can significantly impact profitability, particularly for retail traders just starting.

TriumphFX's primary trading interface, the MetaTrader 4 (MT4) platform, is widely recognized. It supports various functionalities, but does lack advanced tools available in its competitor platforms. Users expecting a more modern trading environment with tailored analytics may find MT4 a bit underwhelming.

TriumphFX's educational resources fall short, offering minimal material aside from basic trading guides and a limited glossary. Users may find the lack of comprehensive educational tools challenging, especially in a volatile trading landscape.

General user feedback often captures mixed experiences. Many express satisfaction with the MT4 function yet lament the absence of more sophisticated features and educational content:

"The platform itself is fine, but if you're new, it's hard to find enough resources to truly understand trading.

User Experience Analysis

Account Opening Process

The onboarding process is relatively straightforward but can become cumbersome due to the level of documentation required. Many users have noted delays in verification impacting their ability to trade promptly after signing up.

Trading Experience

Users' trading experiences highlight swift execution, though concerns over slippage during volatile market conditions often arise. Many customers appreciate the platform's operation but have raised issues regarding user interface intuitiveness.

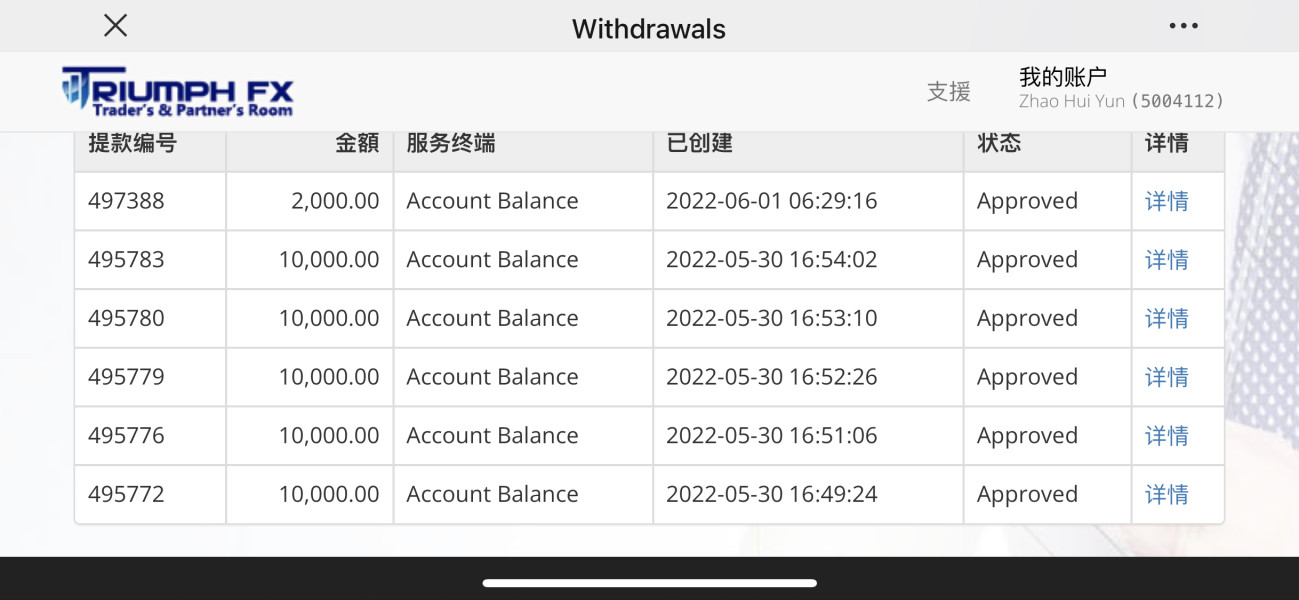

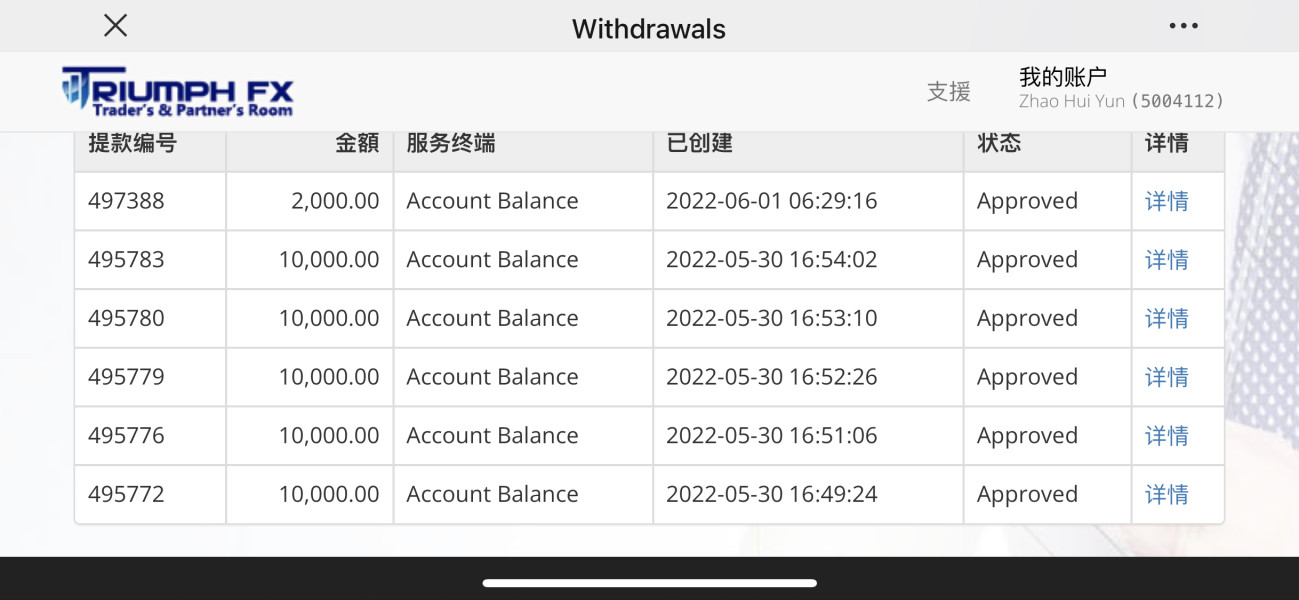

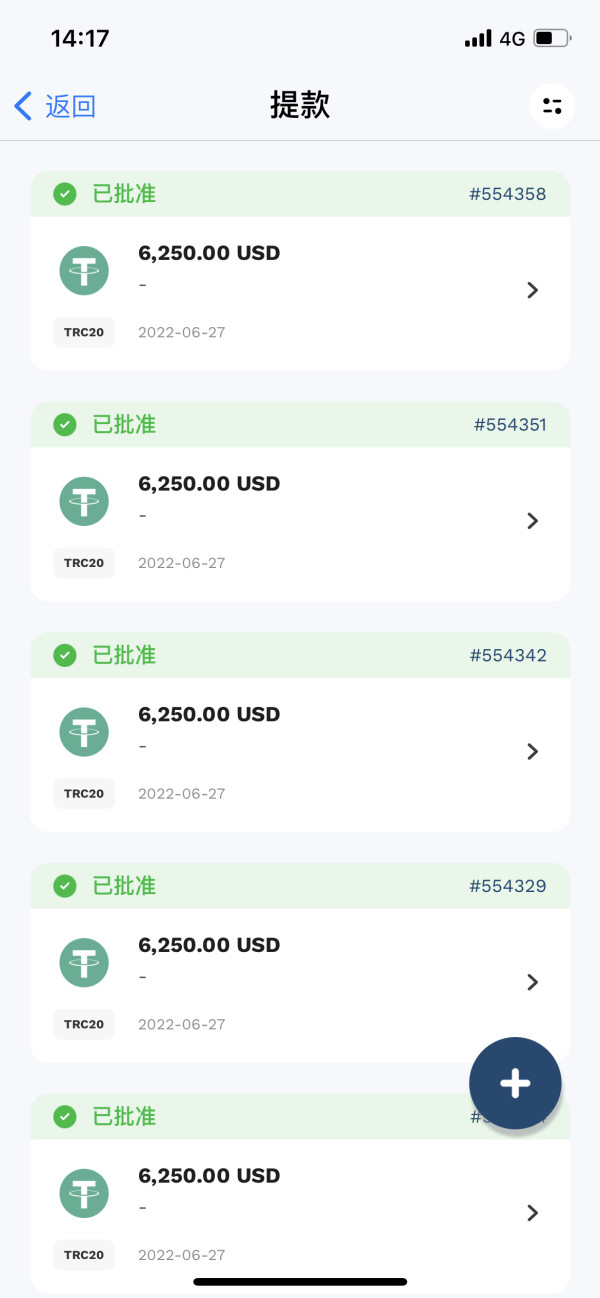

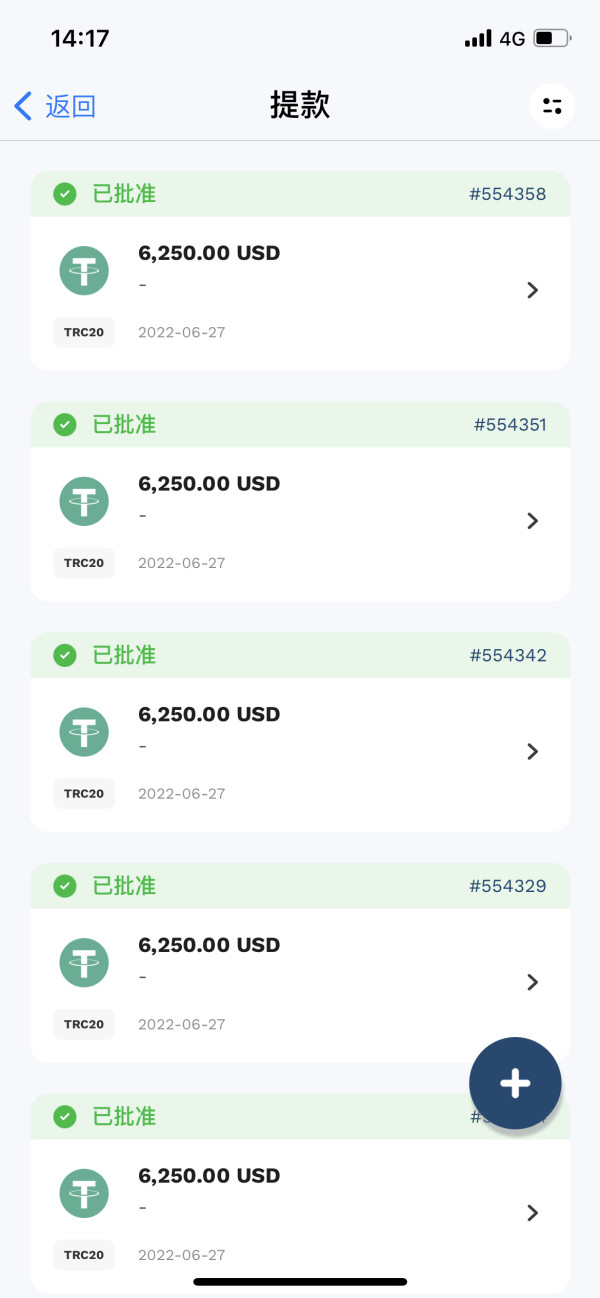

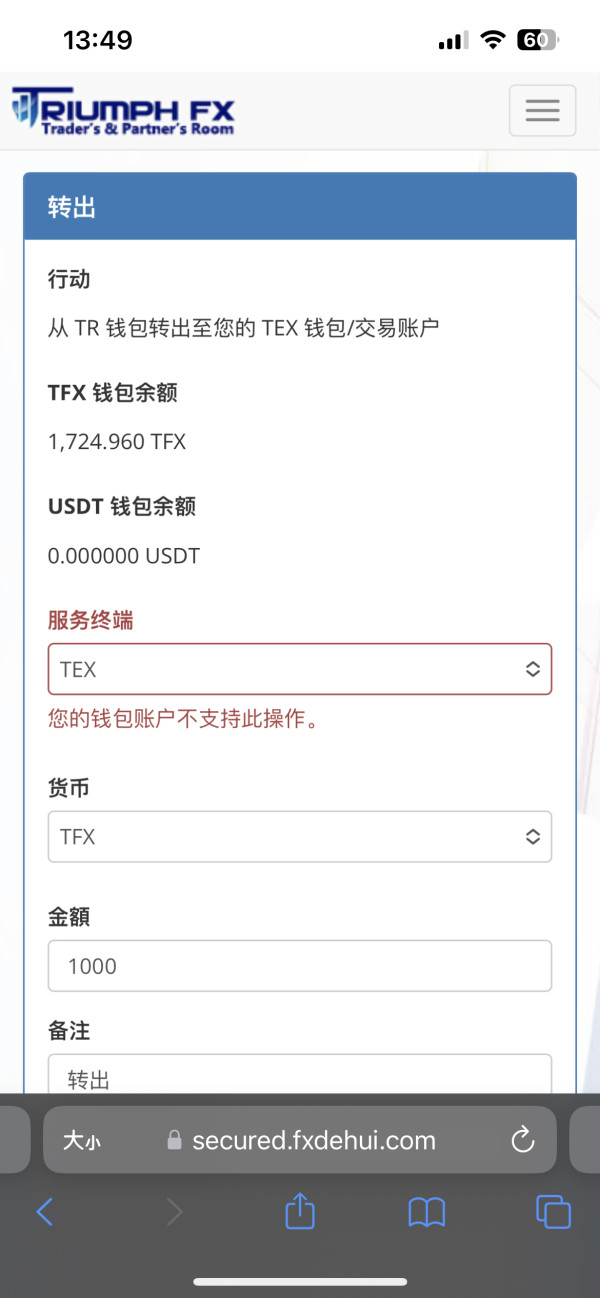

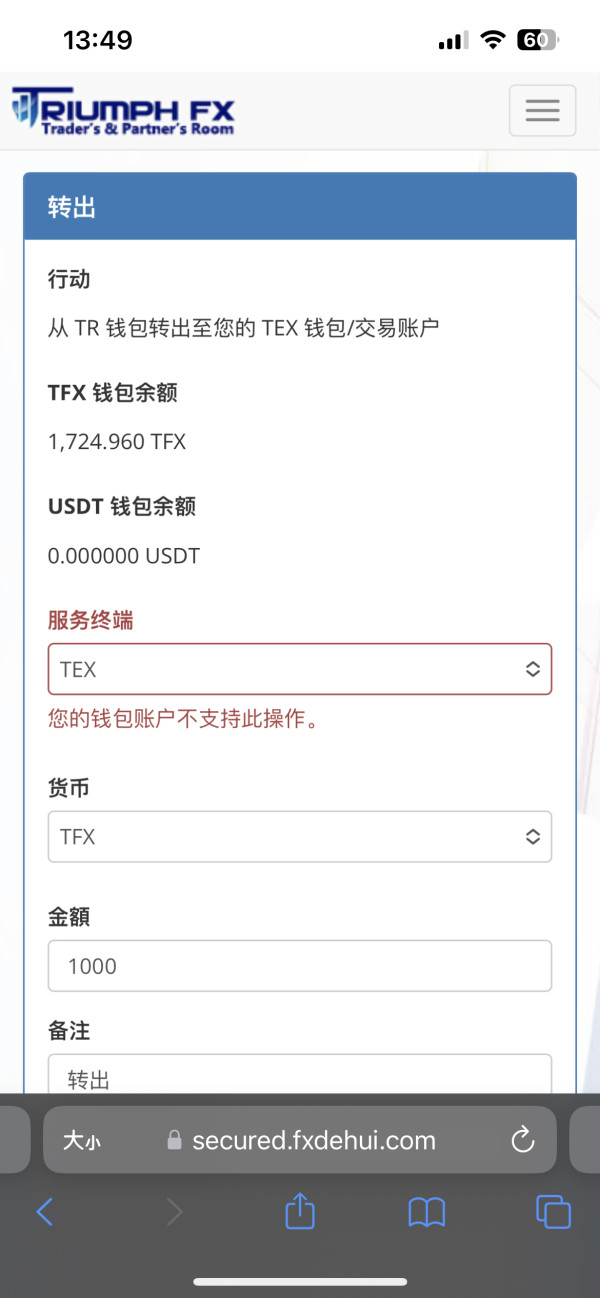

Withdrawal Experience

Troubling accounts of withdrawal issues plague TriumphFX, with many users reporting prolonged waits or outright failures to retrieve funds. As one unhappy trader noted:

"I placed a withdrawal request weeks ago, and all I hear are excuses; it's frustrating!"

Customer Support Analysis

Availability and Responsiveness

Customer support operates predominantly on a ticket-based system, causing delays in response times that users frequently criticize. Overall availability appears insufficient, especially during peak trading hours.

Quality of Support

The quality of assistance remains questionable, as users report inadequate and slow resolution of issues. Many have voiced diminished confidence in support, leading to increased dissatisfaction overall.

Summary of Customer Support Experience

In conclusion, TriumphFXs customer support system has significant room for improvement if they wish to harmonize the trading experience. Users have consistently highlighted long wait times and uninformative responses from support teams.

Account Conditions Analysis

Account Types Overview

TriumphFX presents five distinct account types, each catering to varying levels of expertise and capital. Options range from a Standard Fixed Account, which requires a $100 minimum deposit, to a VIP Account demanding $5,000 with better spreads and no direct commissions.

Minimum Deposits and Leverage

Minimum deposits start from $100, with leverage options scaling up to 1:500 depending on which division the account falls under. However, users have highlighted that account conditions can sometimes feel restrictive, particularly regarding the number of assets available for trading.

Summary of Account Conditions

While TriumphFX offers attractive entry points with various account options, the limited asset selection and hidden fees present a disadvantage for traders seeking diversified investment strategies.

Final Thoughts

In closing, TriumphFX does provide a compelling market entry for retail traders, thanks to its low minimum deposit and high leverage options. However, the growing negative sentiment regarding regulatory compliance and user experience casts a long shadow over its credibility.

For those considering TriumphFX, it is crucial to conduct thorough research and remain aware of the inherent risks involved. Benefiting from cost-effective trading strategies is enticing, but the importance of securing your investments should never be overlooked.

While experienced traders familiar with navigating regulatory landscapes may still find value in TriumphFX, novices and risk-averse individuals would do well to seek alternatives to ensure a safer trading environment.