BCB Review 2

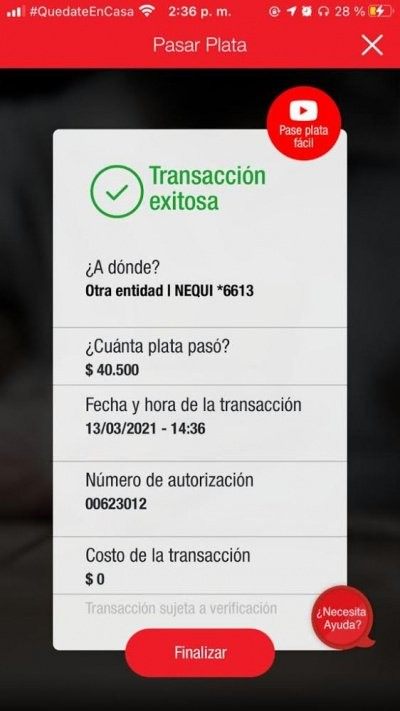

The operation did not match and led to the losses of the investment. I lost more than 50,000 pesos. The customer service was terrible.

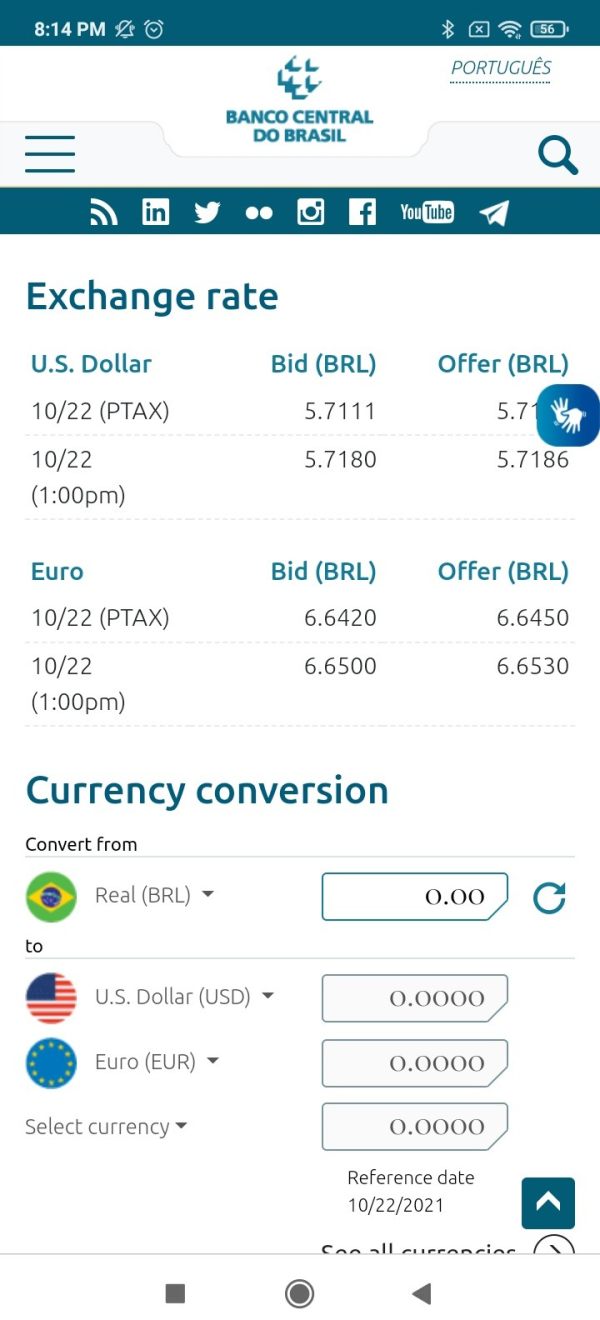

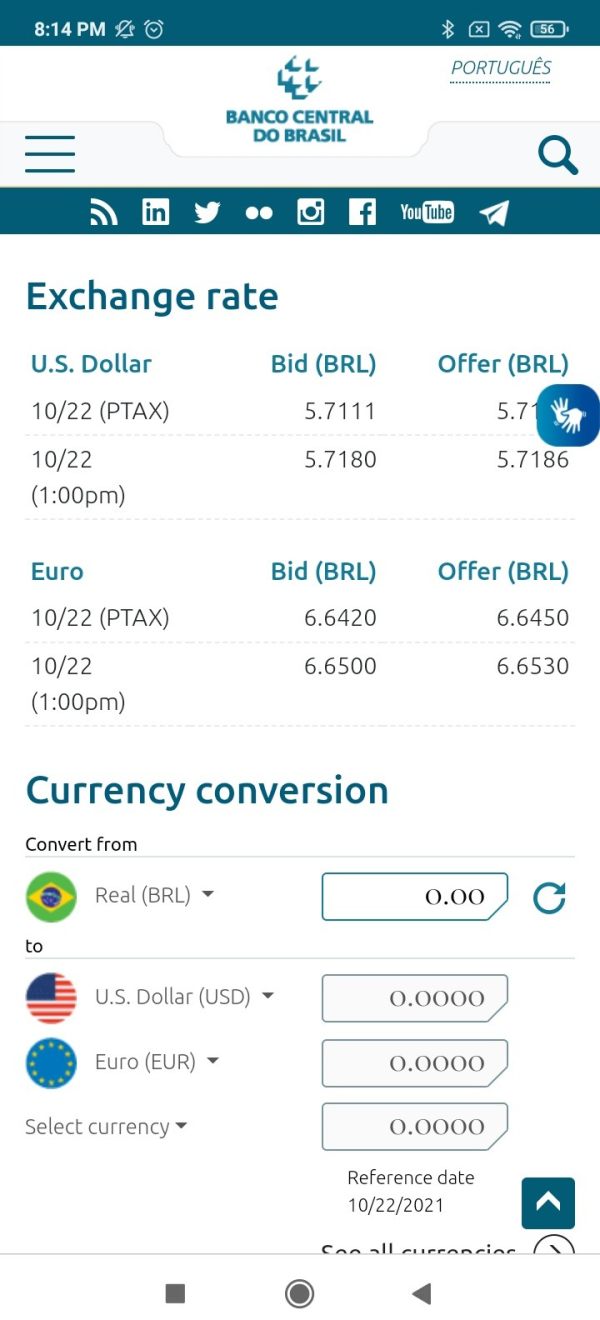

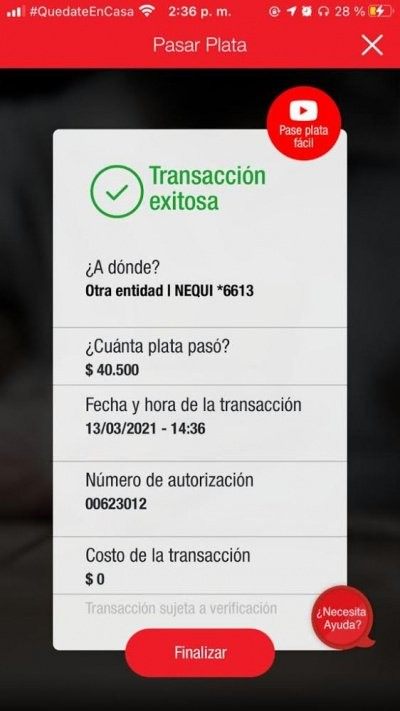

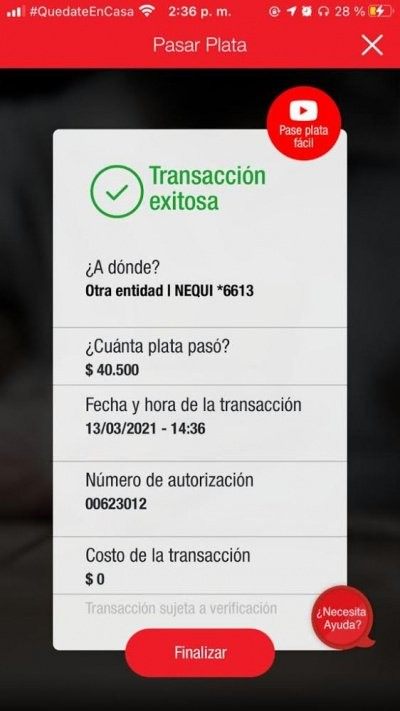

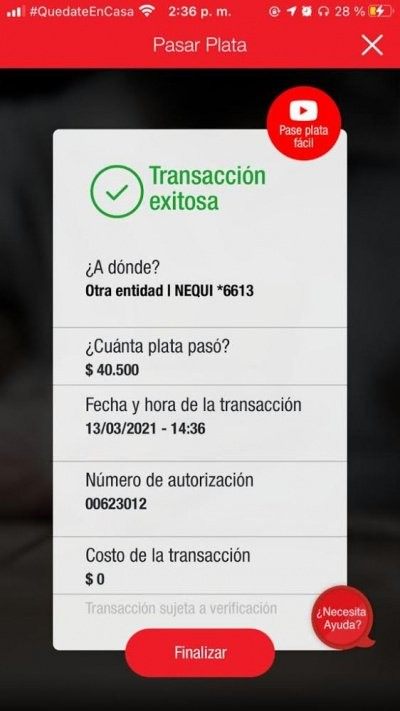

I deposited 40.500 pesos but they never paid me the bonus.

BCB Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

The operation did not match and led to the losses of the investment. I lost more than 50,000 pesos. The customer service was terrible.

I deposited 40.500 pesos but they never paid me the bonus.

BCB represents a diverse financial services entity operating across multiple sectors. Our comprehensive bcb review reveals significant transparency challenges that potential clients should carefully consider before making any decisions.

Based on available information, BCB Community Bank offers various banking products and services to its customers. BCB Brokerage operates as an investment banking firm headquartered in Mumbai, India, serving clients in that region. However, the lack of clear regulatory information and limited transparency regarding core trading services raises important considerations for potential clients who want to understand what they're getting into.

The BCB ecosystem appears fragmented across different geographical regions and service offerings. This fragmentation makes it challenging to provide a unified assessment that covers all aspects of their operations. While some user feedback indicates satisfaction with certain services, the absence of detailed information about trading conditions, regulatory oversight, and operational transparency suggests that prospective clients should exercise considerable caution. This review aims to provide clarity on what is known about BCB's operations while highlighting areas where information remains insufficient for informed decision-making that could affect your financial future.

Important Notice

This bcb review is based on publicly available information and user feedback analysis. Readers should note that BCB Community Bank and BCB Brokerage may represent different entities with varying services and regulatory frameworks that operate under different rules and guidelines. The evaluation methodology employed in this review relies on accessible data sources. Users are strongly advised to conduct independent verification of regulatory status and service terms before engaging with any BCB-related financial services that could impact their financial well-being. Information gaps identified in this assessment should be addressed directly with the respective BCB entities to ensure you have complete and accurate information.

| Criterion | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account condition information not detailed in available materials |

| Tools and Resources | N/A | Comprehensive tool and resource information not specified in available materials |

| Customer Service | N/A | Detailed customer service information not provided in available materials |

| Trading Experience | N/A | Specific trading experience details not available in accessible sources |

| Trust and Safety | N/A | Regulatory information and safety measures not clearly documented in available materials |

| User Experience | N/A | Detailed user experience information not comprehensively available in accessible sources |

BCB operates as a multi-faceted financial services organization with presence in both community banking and investment banking sectors. According to SmartAsset, BCB Community Bank provides various banking products and services to customers who need traditional banking solutions. However, specific details about establishment dates and comprehensive company background remain unclear in available documentation that we could access for this review.

The organization appears to maintain operations across different geographical regions. BCB Brokerage is specifically identified as an investment banking firm based in Mumbai, India, according to PitchBook data that tracks financial services companies. The business model encompasses traditional banking services through the community bank division, while the brokerage arm focuses on investment banking activities that serve different client needs.

However, the relationship between these entities and their operational integration remains unclear from available sources. The lack of detailed information about trading platforms, primary business focus, and comprehensive service offerings makes it challenging to provide definitive characterization of BCB's core business model that potential clients can rely on. Available materials do not specify the types of trading platforms offered, comprehensive asset classes available for trading, or primary regulatory oversight bodies that monitor their operations.

This information gap represents a significant concern for potential clients seeking clarity about BCB's operational framework and regulatory compliance status.

Regulatory Oversight: Available materials do not specify primary regulatory bodies overseeing BCB operations. This represents a critical information gap for potential clients evaluating safety and compliance standards that protect their investments.

Deposit and Withdrawal Methods: Specific information about available funding methods, processing times, and associated fees is not detailed in accessible documentation. Clients need this information to understand how they can move money in and out of their accounts efficiently.

Minimum Deposit Requirements: Minimum deposit thresholds for different account types are not specified in available materials. This makes it difficult for potential clients to assess accessibility and determine if they can afford to start trading.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not documented in accessible sources. Many traders look for these offers when choosing a broker to maximize their initial investment potential.

Tradeable Assets: Comprehensive information about available financial instruments, including forex pairs, commodities, indices, and other tradeable assets, is not detailed in available materials. Traders need to know what they can trade before committing to a platform.

Cost Structure: Detailed fee schedules, spread information, commission rates, and other cost-related details are not specified in accessible documentation. This represents a significant transparency concern since trading costs directly impact profitability for all traders.

Leverage Options: Maximum leverage ratios and leverage policies across different asset classes are not documented in available sources. Leverage information is crucial for traders who want to amplify their trading positions responsibly.

Platform Selection: Information about trading platform options, including proprietary platforms, MetaTrader availability, or mobile trading solutions, is not specified in accessible materials. Modern traders expect access to reliable, user-friendly platforms that work across multiple devices.

Regional Restrictions: Geographic limitations or restricted territories are not clearly documented in available sources. International traders need to know if they can legally access BCB services from their location.

Customer Support Languages: Available customer service languages and support options are not specified in accessible documentation. Multilingual support is essential for international clients who may need assistance in their native language.

This comprehensive bcb review reveals significant information gaps across critical service areas. These gaps highlight the need for enhanced transparency and detailed disclosure of operational parameters that clients deserve to know.

The evaluation of BCB's account conditions faces substantial limitations due to insufficient publicly available information. Available materials do not provide specific details about account type varieties, their distinctive features, or the characteristics that differentiate various account offerings from one another. This lack of transparency makes it challenging for potential clients to understand what account options might be available and how they align with different trading needs or investment objectives that vary from person to person.

Minimum deposit requirements, which represent crucial decision factors for many traders, are not specified in accessible documentation. Without this fundamental information, prospective clients cannot assess whether BCB's services align with their financial capacity or investment budget constraints. Additionally, the account opening process, required documentation, verification procedures, and timeline for account activation remain unclear from available sources that we reviewed for this analysis.

Specialized account features, such as Islamic-compliant accounts for Muslim traders, VIP accounts for high-volume clients, or demo accounts for practice trading, are not documented in accessible materials. This information gap extends to account-related fees, maintenance charges, inactivity fees, and other cost considerations that typically influence account selection decisions for traders at all experience levels. The absence of clear account condition information significantly impacts the ability to provide meaningful assessment in this bcb review that could help potential clients make informed decisions.

Assessment of BCB's trading tools and resources encounters significant challenges due to limited available information about platform capabilities and analytical offerings. Available materials do not specify the types of trading tools provided, their sophistication level, or how they compare to industry standards that professional traders expect. This includes uncertainty about chart analysis capabilities, technical indicators, automated trading support, and other essential trading functionalities that modern platforms typically offer.

Research and market analysis resources, which are crucial for informed trading decisions, are not detailed in accessible documentation. The availability of economic calendars, market news feeds, expert analysis, daily market reports, and educational content remains unclear from available sources that we could examine. This information gap extends to trading signals, market insights, and other analytical support services that experienced traders typically expect from professional brokers who want to help their clients succeed.

Educational resources represent another area where information is insufficient for proper evaluation. The availability of webinars, trading courses, video tutorials, e-books, and other learning materials is not documented in accessible sources that could help us understand BCB's commitment to client education. For novice traders, the absence of clear information about educational support and skill development resources represents a significant concern when evaluating BCB's suitability for their trading journey and long-term success.

Evaluation of BCB's customer service capabilities faces substantial limitations due to insufficient information about support channels, availability, and service quality standards. Available materials do not specify the customer service channels offered, such as live chat, telephone support, email assistance, or social media support options that clients can use when they need help. This fundamental information gap makes it difficult to assess how clients can reach support when needed during critical trading situations.

Response time expectations, service level agreements, and support availability hours are not documented in accessible sources. For traders operating across different time zones or requiring urgent assistance during volatile market conditions, the absence of clear information about support availability represents a significant concern that could affect their trading success. Additionally, the quality of support provided, staff expertise levels, and problem resolution capabilities remain unclear from available documentation that we reviewed.

Multilingual support capabilities, which are essential for international clients, are not specified in accessible materials. The languages supported, regional support offices, and cultural sensitivity in customer service delivery are not documented in sources we could access. This information gap is particularly relevant for clients whose primary language may not be English and who require support in their native language for complex trading or account-related inquiries that require clear communication.

Assessment of the trading experience with BCB encounters significant challenges due to limited information about platform performance, execution quality, and overall trading environment. Available materials do not provide specific details about platform stability, system uptime, execution speeds, or technical reliability during high-volume trading periods when markets become volatile. These factors are crucial for traders who require consistent platform performance for their trading strategies to work effectively.

Order execution quality, including slippage rates, requote frequency, and execution transparency, is not documented in accessible sources. Professional traders particularly value information about execution statistics, average execution times, and how orders are processed during volatile market conditions that can affect profitability. The absence of this information makes it difficult to assess whether BCB's execution capabilities meet professional trading standards that serious traders require.

Mobile trading capabilities and platform accessibility across different devices are not specified in available documentation. In today's trading environment, mobile platform functionality, cross-device synchronization, and the ability to trade on-the-go represent essential features that most traders consider mandatory. The lack of clear information about mobile trading solutions and their capabilities represents a significant information gap in this bcb review that limits our ability to assess modern trading convenience.

The evaluation of BCB's trustworthiness and safety measures reveals critical information gaps that raise substantial concerns about transparency and regulatory compliance. Available materials do not specify primary regulatory bodies overseeing BCB operations, regulatory license numbers, or compliance standards maintained by the company. This fundamental lack of regulatory transparency represents a significant red flag for potential clients evaluating the safety of their funds and trading activities with any financial services provider.

Client fund protection measures, including segregated account policies, deposit insurance coverage, and fund safety protocols, are not documented in accessible sources. Professional traders and investors typically require clear information about how their funds are protected, where client money is held, and what safeguards exist in case of operational difficulties that could threaten their capital. The absence of this crucial information significantly impacts confidence in BCB's safety standards and ability to protect client assets.

Company transparency regarding financial statements, audit reports, ownership structure, and operational history is not evident from available materials. The lack of clear corporate information, management team details, and business registration verification makes it challenging to assess BCB's legitimacy and operational stability over time. This transparency deficit represents a major concern for clients seeking assurance about their chosen broker's credibility and long-term viability in the competitive financial services marketplace.

Assessment of the overall user experience with BCB faces limitations due to insufficient comprehensive user feedback and detailed interface information in available sources. While some general user satisfaction indicators may exist, specific details about platform usability, interface design quality, and navigation efficiency are not comprehensively documented in accessible materials that could provide insight into daily user interactions. Modern traders expect intuitive, responsive platforms that make trading efficient and enjoyable.

The registration and account verification process experience, including required documentation, verification timeframes, and process complexity, is not detailed in available sources. New users typically value streamlined onboarding processes, clear verification requirements, and efficient account setup procedures that get them trading quickly. The absence of specific information about these processes makes it difficult to assess user experience quality during initial engagement with BCB services when first impressions matter most.

Ongoing user experience factors, such as platform responsiveness, feature accessibility, customer portal functionality, and overall service satisfaction, are not comprehensively documented in available materials. Common user complaints, frequently reported issues, and areas for improvement are not clearly identified from accessible sources that could help potential clients understand what to expect. This limits the ability to provide balanced user experience assessment that reflects real-world usage patterns and client satisfaction levels.

This comprehensive bcb review reveals a financial services organization operating across multiple sectors but lacking the transparency and detailed disclosure expected in today's competitive marketplace. While BCB appears to maintain operations in both community banking and investment banking sectors, the significant information gaps identified across all major evaluation criteria raise substantial concerns for potential clients seeking reliable financial services partners who prioritize transparency and client protection.

The absence of clear regulatory information, detailed service specifications, and comprehensive operational transparency makes it challenging to recommend BCB for clients prioritizing safety, reliability, and professional service standards. Prospective clients should exercise considerable caution and conduct thorough independent verification before engaging with BCB services, particularly given the limited availability of crucial information about trading conditions, regulatory oversight, and client protection measures that are essential for safe trading. Given these significant transparency concerns and information gaps, potential clients may want to consider alternative brokers that provide more comprehensive disclosure and clearer regulatory oversight for their trading and investment needs.

FX Broker Capital Trading Markets Review