EURONEXT FX Review 1

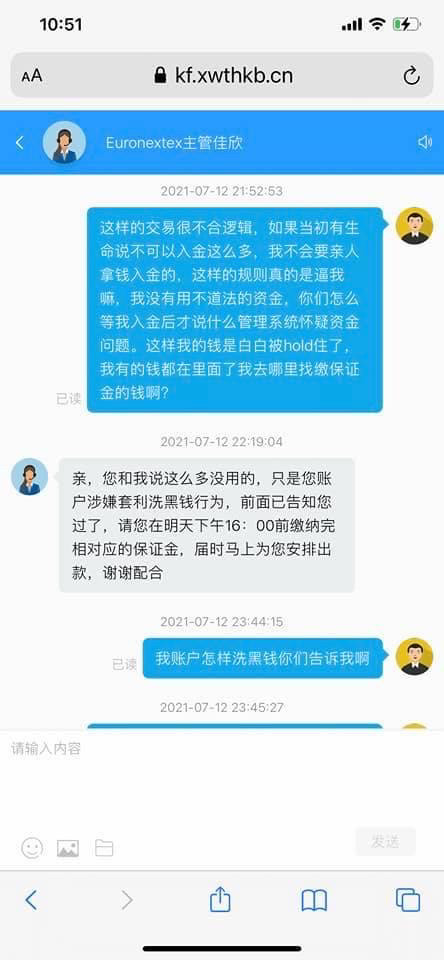

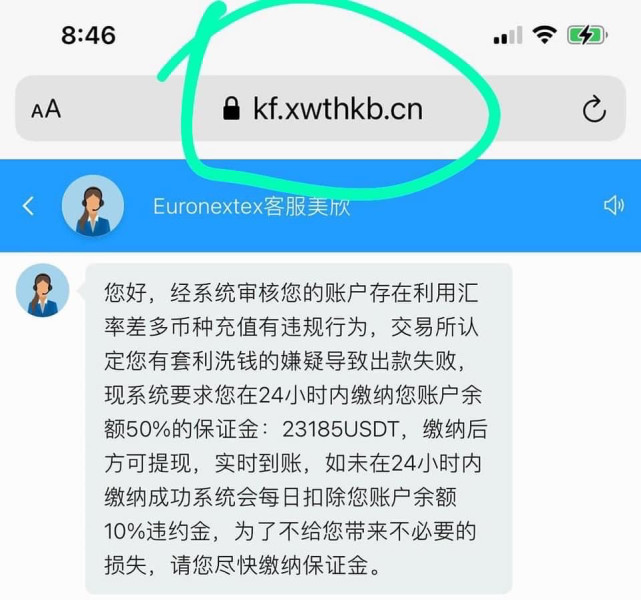

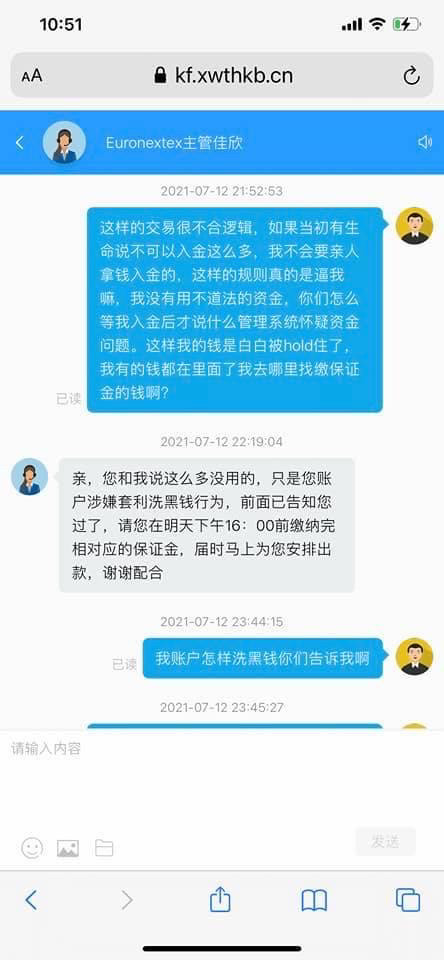

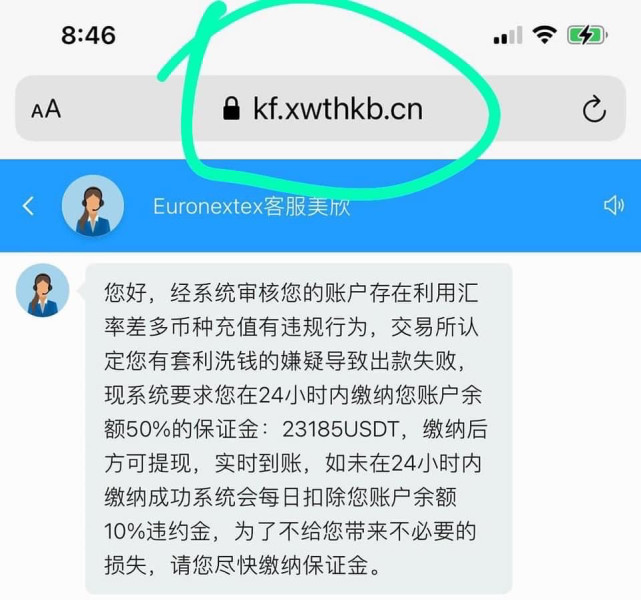

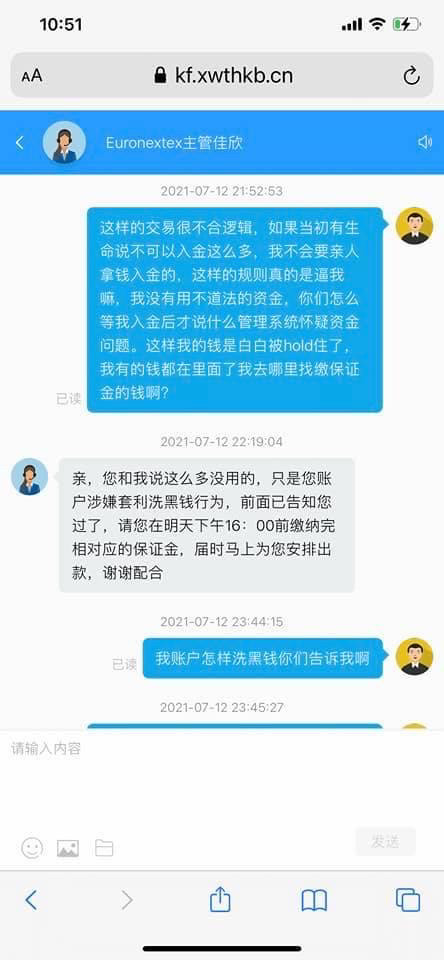

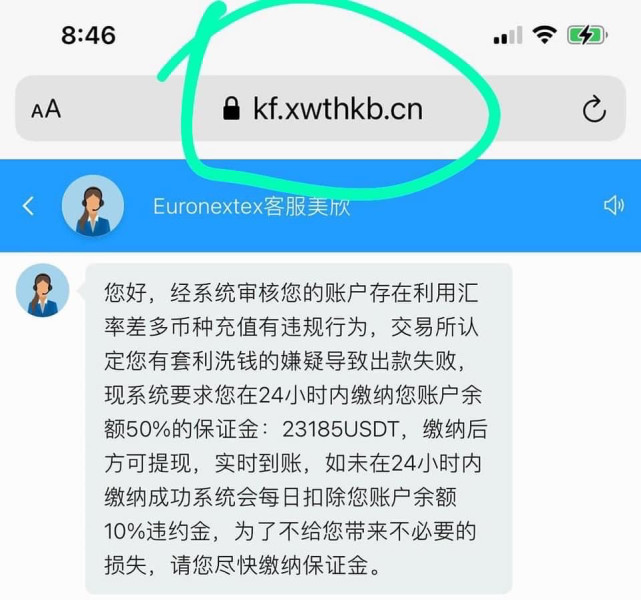

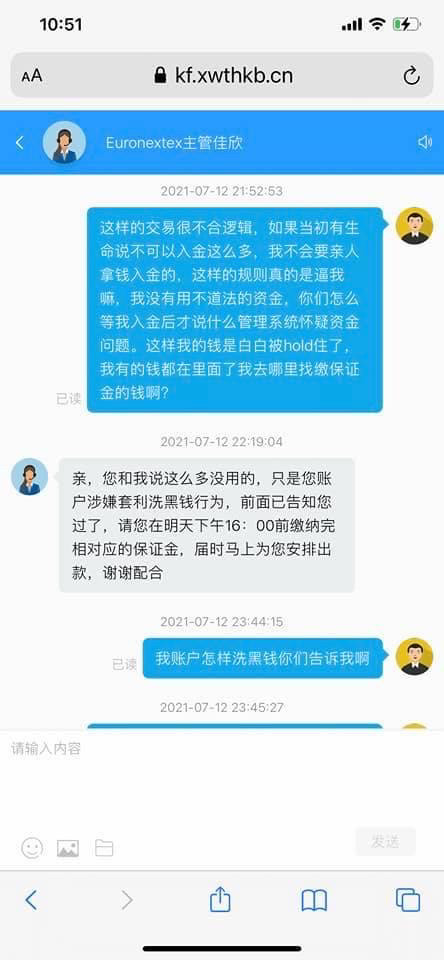

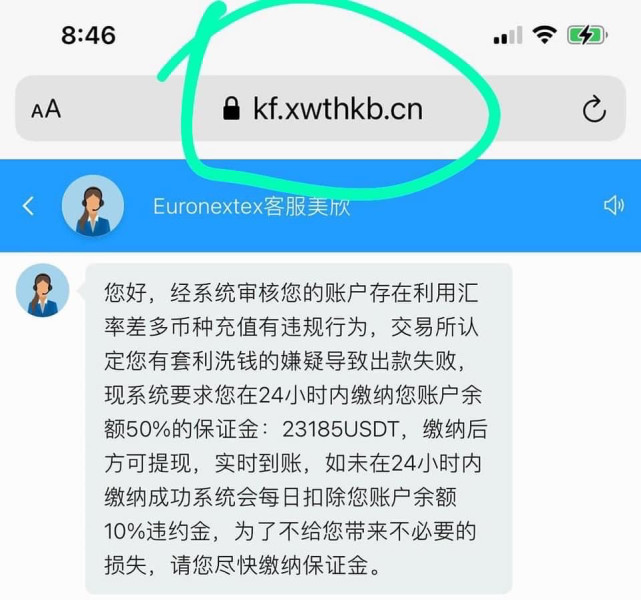

The platform has cooperating trader teachers to take us to buy and sell actions. The teachers in the platform are very patient and help us to answer our usual doubts. But the platform does not withdraw.

EURONEXT FX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The platform has cooperating trader teachers to take us to buy and sell actions. The teachers in the platform are very patient and help us to answer our usual doubts. But the platform does not withdraw.

Euronext FX is a specialized Electronic Communication Network broker. It has carved its niche in the forex and precious metals trading space since its establishment in 2012. This euronext fx review reveals a platform dedicated to providing transparent trading environments and rapid execution solutions for professional traders seeking institutional-grade services.

The broker has key distinguishing features. These include its provision of Non-Deliverable Forward trading capabilities and its regulatory authorization from the Monetary Authority of Singapore. Operating as an ECN model, Euronext FX connects traders directly to interbank liquidity pools, ensuring competitive pricing and minimal conflicts of interest.

The platform primarily targets forex and precious metals traders. It particularly focuses on those who prioritize transparency, execution speed, and access to professional-grade trading infrastructure. With operations spanning Singapore and London, Euronext FX leverages best-in-class technology to deliver flexible execution solutions alongside quantitative market data products, positioning itself as a neutral yet competent choice in the competitive ECN broker landscape.

This review covers Euronext FX operations across different jurisdictions. It has particular focus on its Singapore and London entities that provide NDF trading services. Traders should note that regulatory requirements and service offerings may vary between different regional operations, and specific regulatory compliance may differ based on the trader's location and the entity they engage with.

This euronext fx review is based on publicly available information and user feedback. Readers should be aware that detailed regulatory information for all jurisdictions may not be comprehensively covered in available materials, and traders are encouraged to verify current regulatory status independently before making trading decisions.

| Category | Score | Justification |

|---|---|---|

| Account Conditions | N/A | Specific account details not available in source materials |

| Tools and Resources | 8/10 | Comprehensive offering of spot FX, precious metals, and NDF trading via ECN model |

| Customer Service | N/A | Service details not specified in available information |

| Trading Experience | 9/10 | Strong focus on rapid execution solutions with positive user feedback |

| Trust and Regulation | 7/10 | MAS licensing in Singapore provides regulatory oversight and transparency |

| User Experience | N/A | Detailed user experience metrics not available in source materials |

Euronext FX emerged in 2012 as a specialized Electronic Communication Network designed specifically for spot foreign exchange trading. The company has positioned itself as a technology-driven solution provider, focusing on delivering institutional-grade trading infrastructure to both professional and sophisticated retail traders. According to available information, Euronext FX strives to offer customers access to large pools of diversified liquidity at unparalleled speed, with complete transparency and optimal geographic positioning through matching engines in strategic trading locations globally.

The broker operates under an ECN business model. This fundamentally differentiates it from traditional market makers by providing direct market access to interbank liquidity. This approach ensures that traders receive competitive spreads and transparent pricing, as the platform acts as a conduit rather than a counterparty to trades. The company's commitment to technological excellence is evident in its infrastructure investments and its focus on quantitative market data products alongside execution services.

Beyond traditional spot forex trading, Euronext FX has expanded its offering to include precious metals trading and Non-Deliverable Forward contracts. The NDF trading capability, available through both Singapore and London operations via Euronext Markets Singapore, represents a sophisticated addition that caters to institutional clients and professional traders requiring exposure to emerging market currencies. This comprehensive approach to product offering, combined with regulatory oversight from the Monetary Authority of Singapore for its Singapore subsidiary, establishes Euronext FX as a credible participant in the professional trading ecosystem.

Euronext FX operates under regulatory supervision in Singapore. Its subsidiary Euronext Markets Singapore holds Recognition as a Recognised Market Operator licensed by the Monetary Authority of Singapore. This regulatory framework provides oversight for the company's NDF trading operations in both Singapore and London locations.

The platform offers a focused selection of trading instruments. These include spot foreign exchange pairs, precious metals, and Non-Deliverable Forward contracts. The NDF offering represents a particular strength, providing access to emerging market currency exposure through cash-settled derivatives.

Operating as an Electronic Communication Network, the platform utilizes advanced matching engines positioned strategically across global trading locations to ensure optimal execution speed and access to diversified liquidity pools.

Euronext FX maintains operational presence in key financial centers including Singapore and London. The company has matching engine infrastructure designed to serve global trading requirements across different time zones.

Note: Specific details regarding deposit methods, minimum deposit requirements, promotional offerings, detailed cost structures, leverage ratios, and regional restrictions are not detailed in available source materials for this euronext fx review.

The specific account conditions offered by Euronext FX are not comprehensively detailed in available source materials. This represents a significant information gap for potential clients seeking to understand the broker's account structure, minimum deposit requirements, and available account types.

Without detailed information about account tiers, minimum funding requirements, or special account features such as Islamic accounts, it becomes challenging to assess how competitive Euronext FX's account conditions are relative to industry standards. The absence of this information in public materials may indicate either a focus on institutional clients who typically negotiate terms individually, or a need for direct contact with the broker to obtain account-specific details.

Professional traders evaluating this euronext fx review should note that the lack of publicly available account condition information necessitates direct communication with the broker. This is necessary to understand eligibility requirements, funding thresholds, and any special terms that may apply to different trader categories. This approach is not uncommon among ECN brokers that primarily serve institutional or high-net-worth individual clients.

The ECN business model typically involves commission-based pricing rather than spread markups. However, specific commission structures and any account maintenance fees remain unspecified in available materials.

Euronext FX demonstrates strong capabilities in its core offering of trading tools and resources. It earns an 8/10 rating based on the breadth and quality of its instrument selection. The broker's provision of spot foreign exchange, precious metals, and Non-Deliverable Forward trading represents a comprehensive suite that caters to diverse trading strategies and market exposures.

The ECN model employed by Euronext FX provides inherent advantages in terms of market access and liquidity provision. By connecting traders directly to interbank liquidity pools, the platform ensures access to institutional-grade pricing and market depth. The inclusion of NDF trading capabilities particularly distinguishes the broker from many competitors, as these instruments require sophisticated infrastructure and regulatory compliance that many smaller brokers cannot provide.

The platform's emphasis on quantitative market data products alongside execution services suggests a commitment to providing traders with the analytical tools necessary for informed decision-making. However, specific details about research resources, educational materials, and automated trading support are not elaborated in available source materials.

The geographic distribution of matching engines across strategic trading locations indicates a technological infrastructure designed to minimize latency and optimize execution quality. This technical foundation supports the broker's commitment to providing unparalleled speed in trade execution, which is crucial for ECN operations where timing can significantly impact trading outcomes.

Customer service and support capabilities for Euronext FX are not detailed in available source materials. This makes it impossible to provide a comprehensive assessment of this crucial aspect of broker operations. The absence of information regarding customer service channels, availability hours, response times, and multilingual support represents a significant gap in publicly available information.

For an ECN broker serving professional and institutional clients, customer service typically involves dedicated relationship management and technical support capabilities. However, without specific information about Euronext FX's approach to client support, potential traders cannot assess whether the broker meets industry standards for service quality and availability.

The lack of detailed customer service information may reflect the broker's focus on serving sophisticated clients who require less hand-holding. It may also indicate that such information is provided through direct client relationship management rather than public channels. Professional traders considering Euronext FX should prioritize obtaining detailed information about support channels, escalation procedures, and service level commitments during their evaluation process.

Given the technical nature of ECN trading and the complexity of instruments like NDFs, robust technical support and client relationship management are essential for operational success. This makes this information gap particularly noteworthy for potential clients.

Euronext FX receives a strong 9/10 rating for trading experience. This is based primarily on its demonstrated commitment to providing rapid execution solutions and the positive user feedback referenced in available materials. The broker's focus on execution speed represents a fundamental strength for an ECN platform, where the ability to access liquidity quickly and efficiently directly impacts trading outcomes.

The Electronic Communication Network model inherently provides advantages in terms of execution quality. Trades are matched directly with interbank liquidity rather than being processed by a dealing desk. This approach minimizes conflicts of interest and typically results in more competitive pricing, particularly during high-volume trading periods when liquidity is most abundant.

The strategic positioning of matching engines across global trading locations demonstrates Euronext FX's understanding of the importance of latency optimization in modern electronic trading. This infrastructure investment suggests that the platform can deliver consistent execution quality across different trading sessions and geographic regions.

However, specific technical performance metrics such as average execution speeds, slippage statistics, or platform uptime data are not provided in available materials. Similarly, detailed information about mobile trading capabilities, platform functionality, and user interface design is not available for this euronext fx review.

The positive user feedback mentioned in source materials provides some validation of the platform's execution capabilities. However, more comprehensive user experience data would strengthen the assessment of overall trading experience quality.

Euronext FX achieves a 7/10 rating for trust and regulation. This is anchored primarily by its regulatory authorization from the Monetary Authority of Singapore for its Singapore subsidiary, Euronext Markets Singapore. The MAS license as a Recognised Market Operator provides meaningful regulatory oversight and demonstrates the broker's commitment to operating within established financial services frameworks.

The Singapore regulatory environment is generally regarded as robust and well-supervised. This provides confidence in the operational standards and compliance requirements that Euronext FX must maintain. The RMO designation specifically relates to the operation of financial markets and trading systems, which aligns well with the broker's ECN business model and NDF trading capabilities.

However, the trust assessment is limited by the lack of detailed information about additional regulatory authorizations, client fund protection measures, segregation policies, and insurance coverage. For a comprehensive trust evaluation, traders typically require transparency about how client funds are protected, whether through segregated accounts, insurance policies, or regulatory compensation schemes.

The absence of detailed information about the company's operational history, any regulatory actions or sanctions, and third-party auditing or verification processes represents gaps in the available trust indicators. Additionally, while the Singapore operation is clearly regulated, the regulatory status of other operational entities or jurisdictions is not specified in available materials.

The broker's establishment in 2012 provides some operational track record. However, specific information about company stability, financial backing, or industry recognition is not detailed in accessible sources.

User experience assessment for Euronext FX is significantly limited by the absence of detailed information in available source materials. Without specific data about user interface design, platform usability, registration procedures, or comprehensive user feedback, it becomes impossible to provide a meaningful rating for this critical aspect of broker evaluation.

The lack of detailed user experience information represents a notable gap. This is particularly true given the importance of platform usability in determining trader satisfaction and operational efficiency. Professional traders typically require intuitive interfaces, streamlined account management processes, and efficient fund operation capabilities to maintain their trading workflows effectively.

While the broker's focus on institutional-grade technology and ECN infrastructure suggests attention to functional requirements, the actual user experience encompasses broader considerations. These include ease of account opening, verification processes, deposit and withdrawal efficiency, and overall platform navigation.

The absence of documented user complaints or satisfaction metrics in available materials makes it difficult to assess how well Euronext FX meets trader expectations in practical day-to-day operations. For potential clients evaluating this euronext fx review, obtaining firsthand user experience information through direct platform testing or communication with existing clients may be necessary to make informed decisions about platform suitability.

This euronext fx review reveals Euronext FX as a specialized ECN broker that demonstrates clear strengths in execution technology and regulatory compliance. However, it faces limitations in publicly available information about user services and account conditions. The broker's focus on providing transparent trading environments and rapid execution solutions positions it well for professional traders seeking institutional-grade access to forex and precious metals markets.

The platform appears most suitable for experienced traders who prioritize execution quality and transparency over extensive educational resources or comprehensive account options. The inclusion of NDF trading capabilities and MAS regulatory authorization provides credibility and sophistication that appeals to professional trading requirements.

However, the significant information gaps regarding account conditions, customer service capabilities, and detailed user experience metrics limit the comprehensiveness of this evaluation. Potential clients should prioritize direct communication with Euronext FX to obtain complete information about services, terms, and operational procedures before making trading decisions.

FX Broker Capital Trading Markets Review