Is VOBLAST safe?

Business

License

Is Voblast Safe or Scam?

Introduction

Voblast is a relatively new player in the forex market, positioning itself as a CFD brokerage that offers trading services across various financial instruments, including forex pairs, indices, stocks, and cryptocurrencies. Given the competitive nature of the forex industry, it is essential for traders to exercise caution when selecting a broker. The potential for fraud and mismanagement is significant, especially with unregulated entities. Therefore, evaluating the credibility of Voblast is crucial for any trader considering opening an account. This article aims to provide a comprehensive assessment of Voblast's safety by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy and safety. Voblast operates without any known regulatory oversight, which raises significant concerns. The absence of regulation means that there is no governing body to hold the broker accountable for its practices or to protect clients' funds. This lack of oversight is particularly alarming given the broker's operations from Saint Vincent and the Grenadines, a jurisdiction often associated with lax regulatory frameworks.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The importance of regulation cannot be overstated; it provides a safety net for traders, ensuring that brokers adhere to strict operational standards and maintain transparency. Without this, traders are at risk of losing their investments without recourse. The lack of any valid regulatory information for Voblast indicates a high-risk environment for potential investors.

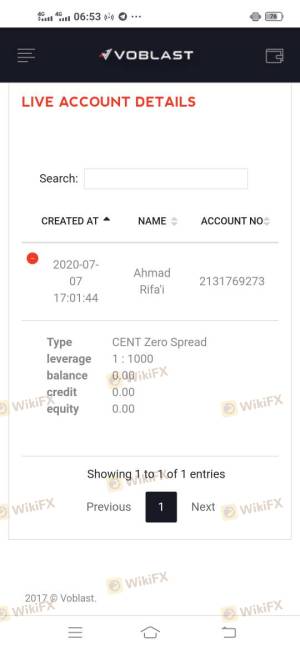

Company Background Investigation

Voblast's company history and ownership structure are somewhat opaque. The broker appears to have been established in 2021, but details about its founders or the organizational framework are not readily available. This lack of transparency raises questions about the broker's legitimacy. A reputable broker typically discloses its management team, including their backgrounds and qualifications, to build trust with potential clients.

The absence of information regarding Voblasts management team further complicates the assessment of its credibility. A well-established broker usually has a transparent communication strategy, providing clients with insights into its operations and leadership. In the case of Voblast, the lack of such information may indicate a deliberate effort to obscure potential red flags.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is paramount. Voblast offers a low minimum deposit requirement of just $10, which may attract novice traders. However, the broker's fee structure and trading costs deserve scrutiny. The spreads for standard accounts start at 1.2 pips, which is relatively average compared to industry standards.

| Fee Type | Voblast | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The leverage offered by Voblast is up to 1:1000, which can amplify both potential profits and losses. This high leverage is a double-edged sword and poses significant risks, especially for inexperienced traders. Overall, while the trading conditions may seem attractive at first glance, they are coupled with high-risk factors that traders should consider carefully.

Client Fund Safety

The security of client funds is a crucial aspect of any brokerage's operations. Voblast does not appear to provide adequate information regarding its client fund protection measures. There is no indication of segregated accounts or investor protection schemes, which are essential for safeguarding clients' assets. The absence of such measures heightens the risk of loss in the event of the broker's insolvency or fraudulent activities.

Historically, unregulated brokers have faced numerous issues related to fund security, including the inability to withdraw funds and allegations of misappropriation. Given Voblast's lack of regulatory oversight, potential clients should be wary of the risks associated with entrusting their funds to this broker.

Customer Experience and Complaints

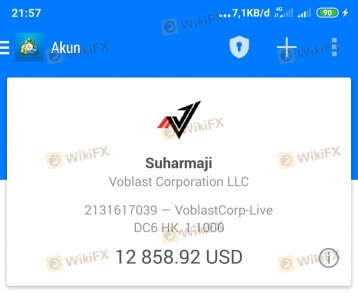

Customer feedback is often a telling indicator of a broker's reliability. Reviews and experiences shared by users of Voblast suggest a mixed bag of satisfaction and frustration. Common complaints include difficulties in withdrawing funds and poor customer service responses.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

One notable case involved a trader who reported being unable to withdraw their funds for several weeks, citing vague reasons from customer support. Such complaints are concerning and indicate potential systemic issues within the brokerage.

Platform and Trade Execution

Voblast offers a web-based trading platform, which lacks some of the features typically found in more established platforms like MetaTrader 4. The performance and stability of the platform are critical for traders, as any downtime or execution delays can lead to significant losses. Reports of slippage and rejected orders have been noted, which are red flags for any trader.

The quality of trade execution is paramount, and any signs of manipulation or inefficiencies can severely impact a trader's experience. While Voblast claims to provide a reliable trading environment, the lack of transparency and user feedback suggests that traders may encounter challenges.

Risk Assessment

Using Voblast carries several inherent risks, primarily due to its unregulated status and lack of transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | No protection measures |

| Customer Service Risk | Medium | Poor response to complaints |

To mitigate these risks, potential clients are advised to conduct thorough due diligence and consider alternative brokers with established regulatory frameworks and better reputations.

Conclusion and Recommendations

In summary, the evidence suggests that Voblast presents several red flags that potential traders should consider before engaging. The lack of regulation, transparency issues, and numerous customer complaints indicate a high-risk environment. While the low minimum deposit and high leverage may seem appealing, the associated risks far outweigh the potential benefits.

For traders seeking a safe and reliable trading experience, it is advisable to explore alternative brokers that are regulated by reputable authorities. Brokers with a proven track record of customer satisfaction and robust fund protection measures should be prioritized. Ultimately, the question remains: Is Voblast safe? The answer leans towards caution, and potential clients should tread carefully.

Is VOBLAST a scam, or is it legit?

The latest exposure and evaluation content of VOBLAST brokers.

VOBLAST Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VOBLAST latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.