Is TriumphFX safe?

Pros

Cons

Is TriumphFX A Scam?

Introduction

TriumphFX is an international brokerage firm that has been providing forex trading services since 2009. With its headquarters in Cyprus and additional offices in various countries, it positions itself as a reliable platform for both novice and experienced traders. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams and fraudulent practices makes it crucial to thoroughly evaluate the legitimacy of any trading platform. This article aims to provide an objective analysis of TriumphFX, assessing its regulatory status, company background, trading conditions, customer experiences, and overall safety. The information presented is based on extensive research, including reviews from multiple financial websites and regulatory bodies.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a broker is vital for assessing its legitimacy. TriumphFX operates under multiple licenses, including those from the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) of Seychelles. The presence of these licenses suggests a level of oversight, but the quality and reliability of these regulatory bodies can vary significantly.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 293/16 | Cyprus | Active |

| FSA | SD 080 | Seychelles | Active |

| VFSC | 17901 | Vanuatu | Revoked |

CySEC is generally regarded as a reputable regulator within the European Union, offering a robust framework for investor protection. However, the FSA of Seychelles is often criticized for its lax regulatory standards, which can expose traders to higher risks. Additionally, TriumphFX's offshore entity in Vanuatu has faced scrutiny, including the revocation of its license in the past. This raises questions about the overall safety of funds deposited with TriumphFX, particularly for clients who may be assigned to its offshore branches.

Company Background Investigation

Founded in 2009, TriumphFX has grown to establish a presence in various regions, including Europe and Asia. The company is owned by Triumph International Limited, which operates multiple entities under different regulatory jurisdictions. The management team comprises professionals with experience in the financial services industry, but the lack of detailed information about their backgrounds raises concerns about transparency.

Investors must consider the level of disclosure provided by the broker regarding its ownership structure and management. TriumphFX has been criticized for not being sufficiently transparent in its operations, which can lead to mistrust among potential clients. The company's history of regulatory issues, including the temporary loss of its CySEC license, further complicates its credibility.

Trading Conditions Analysis

TriumphFX offers a variety of trading accounts, each with different fee structures and trading conditions. The overall cost structure is competitive, but it is essential to scrutinize any unusual or problematic fees that may arise during trading.

| Fee Type | TriumphFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.6 pips (Standard) | 1.2 pips |

| Commission Model | $6 per lot (Premium) | $3 per lot |

| Overnight Interest Range | 2.5% | 1.5% |

The spreads offered by TriumphFX are higher than the industry average, particularly on standard accounts. This can significantly impact profitability, especially for high-frequency traders. Additionally, the commission structure, particularly on premium accounts, may deter some traders. The lack of a clear explanation regarding additional fees, such as withdrawal charges, adds to the complexity of the overall cost structure.

Customer Funds Security

The safety of customer funds is paramount when evaluating a broker. TriumphFX claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. These measures are designed to ensure that client funds are kept separate from the broker's operational funds, providing a layer of security in the event of insolvency.

However, it is crucial to note that these protections primarily apply to clients trading under the CySEC-regulated entity. For those trading with the offshore entity in Seychelles, the level of protection is significantly lower, as the FSA does not mandate the same level of fund segregation or investor compensation schemes. Historical issues, including complaints about withdrawal difficulties, raise concerns about the effectiveness of TriumphFX's security measures.

Customer Experience and Complaints

Customer feedback on TriumphFX reveals a mixed bag of experiences. While some users report positive experiences, including successful withdrawals and satisfactory trading conditions, others have expressed serious concerns regarding the broker's responsiveness and reliability.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Blocking | High | Unresolved |

| Poor Customer Support | Medium | Limited availability |

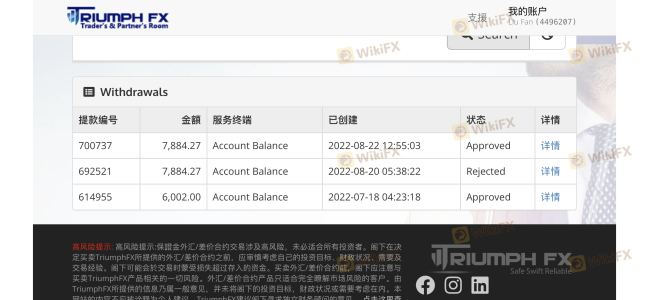

Common complaints include difficulties in withdrawing funds, with some users reporting that their accounts were blocked after attempting to withdraw larger sums. The company's response to these issues has been criticized as inadequate, with many users feeling that their concerns were not addressed in a timely manner.

Platform and Trade Execution

TriumphFX primarily utilizes the MetaTrader 4 platform, which is widely regarded for its user-friendly interface and advanced trading features. However, the platform's performance can vary, particularly during periods of high market volatility.

Concerns about order execution quality, including instances of slippage and re-quotes, have been raised by users. While the broker claims to offer market execution without dealer intervention, reports of execution issues suggest that traders may experience challenges in fast-moving markets.

Risk Assessment

Using TriumphFX involves several risks that traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore operations pose potential legal issues. |

| Withdrawal Risk | High | Complaints about withdrawal difficulties are prevalent. |

| Execution Risk | Medium | Reports of slippage and execution delays. |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts to familiarize themselves with the platform, and consider diversifying their investments across multiple brokers.

Conclusion and Recommendations

In conclusion, the evidence suggests that while TriumphFX is a regulated broker, there are significant concerns regarding its legitimacy and reliability. The combination of a solid regulatory framework in Cyprus and a problematic offshore presence creates a complex risk landscape for potential investors.

Given the mixed reviews and the history of regulatory issues, traders should exercise caution when considering TriumphFX as their broker. It is advisable to explore alternative brokers with stronger regulatory oversight and a better reputation for customer service. Brokers such as Pepperstone or XM may offer more reliable trading conditions and a greater level of investor protection.

Ultimately, the question of "Is TriumphFX safe?" is nuanced. While it operates under a regulatory framework, the potential risks associated with its offshore operations and the history of customer complaints warrant careful consideration before making any investment decisions.

Is TriumphFX a scam, or is it legit?

The latest exposure and evaluation content of TriumphFX brokers.

TriumphFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TriumphFX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.