UNIQUE FXTRADE Review 1

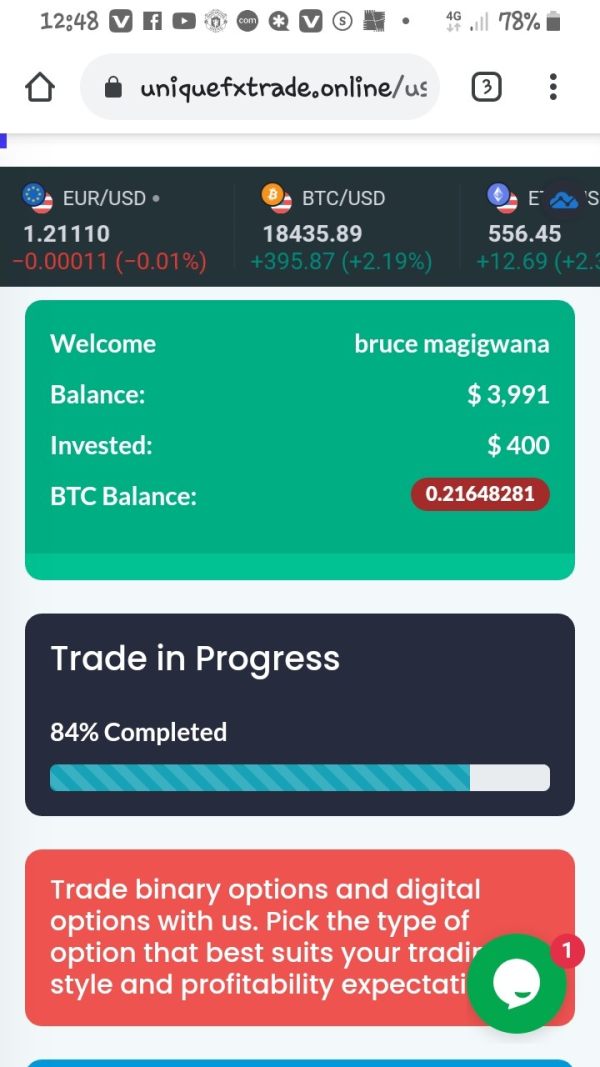

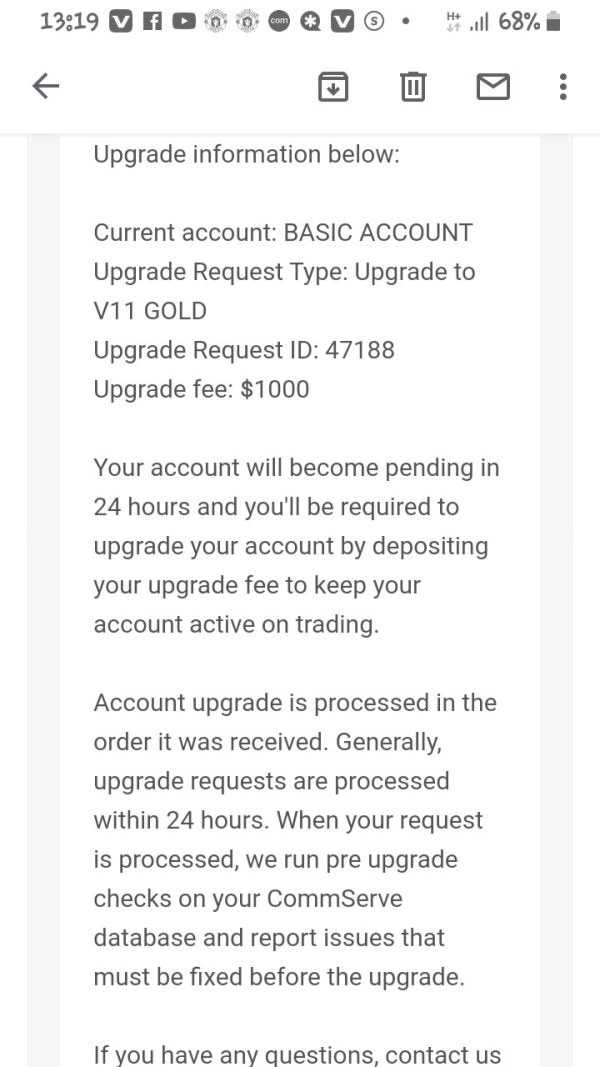

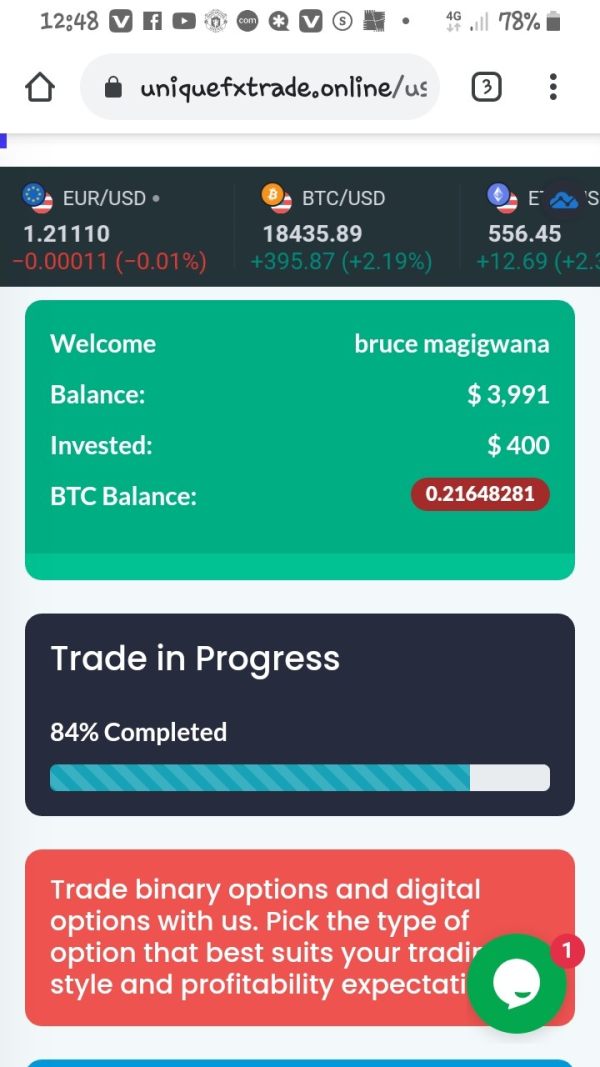

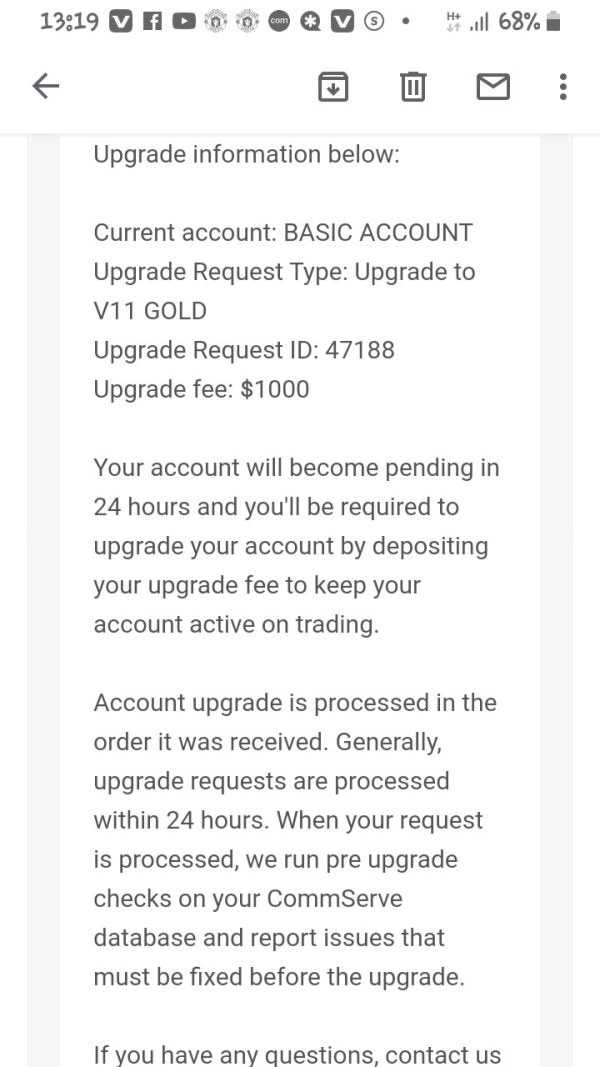

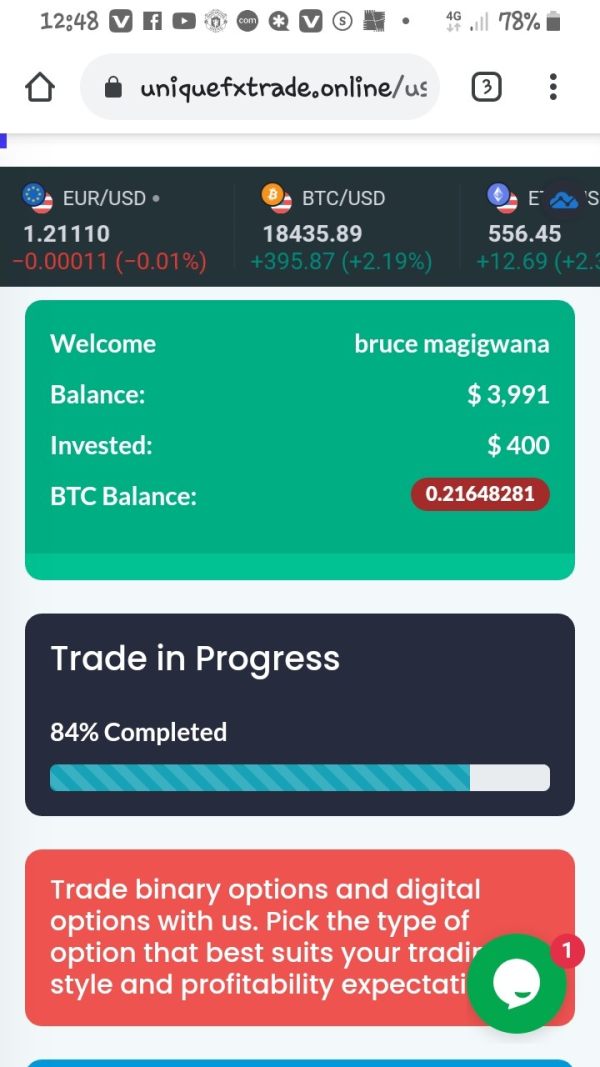

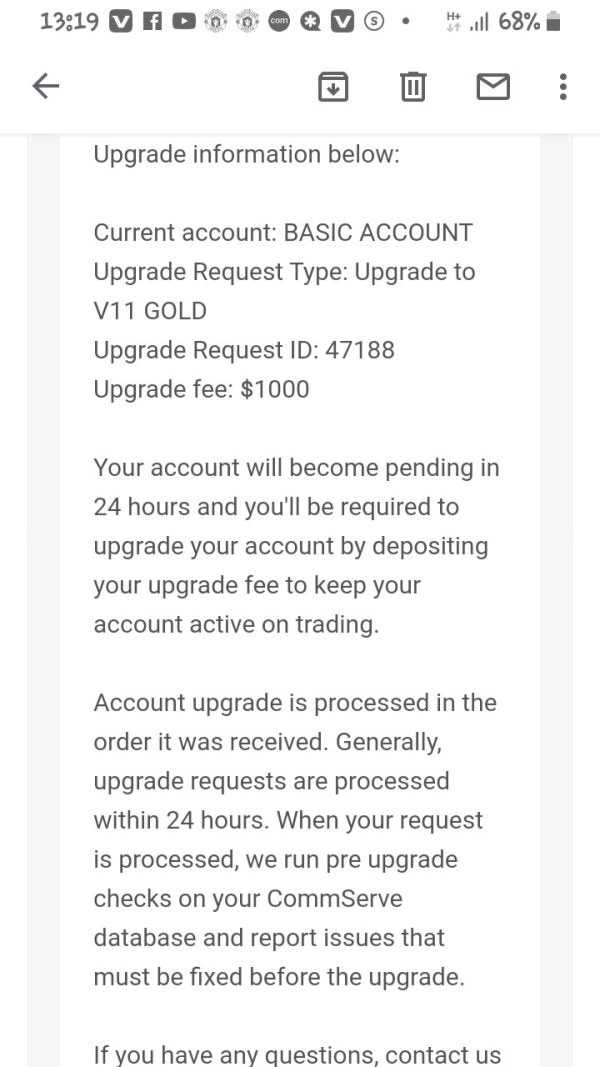

They said they are legit brokers once you invest they keep asking for more money

UNIQUE FXTRADE Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

They said they are legit brokers once you invest they keep asking for more money

This unique fxtrade review gives you a complete look at a trading platform that has caught attention in the forex world, though not always for good reasons. The platform gets poor reviews from users, with many trust issues showing up across the trading community. Based on what users say and company background info, unique fxtrade connects to OANDA, which started online forex trading back in 1996. However, user reviews show worrying patterns, with sites like Fxtrade-exchange.com getting just 1 out of 5 stars on average.

The platform does have some good features that make it stand out. Users can customize the interface completely, setting and saving their preferred trading parameters. The system also works with MT5, giving traders access to advanced tools and technical analysis features that professionals use. OANDA has been around for almost thirty years and built a solid reputation in the industry. But current user feedback points to major problems with service quality and keeping customers happy.

The platform seems to target traders who want a personalized trading experience. It appeals especially to those who value interface customization and advanced platform features. Still, anyone thinking about using this platform should carefully read the very negative user reviews before making any decisions.

Regional Entity Differences: The information we have doesn't give detailed regulatory frameworks for different areas. Users in various regions might face different trading conditions, regulatory protections, and service standards based on where they live and which specific entity serves their area.

Review Methodology: This review uses available user feedback, company background information, and public data. Some parts of the platform's services stay unclear because source materials don't have complete information, so potential users need to investigate further on their own.

| Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A/10 | Insufficient information available in source materials |

| Tools and Resources | 8/10 | MT5 integration with customization features |

| Customer Service | 5/10 | Mixed feedback despite some positive recovery cases |

| Trading Experience | 6/10 | Powerful platform features offset by user concerns |

| Trust and Reliability | 3/10 | Significant trust issues reflected in user ratings |

| User Experience | 4/10 | Negative user feedback impacts overall experience |

Company Background and History

OANDA, the parent company behind the fxTrade platform, started in the forex industry in 1996. The company positioned itself as a pioneer in online currency trading from the beginning. OANDA was among the first companies to offer retail forex trading through internet-based platforms, building its reputation on innovative trading solutions. The company has developed various trading technologies and expanded globally over nearly three decades, though recent user feedback shows challenges in keeping service quality standards high.

OANDA's journey from a currency data provider to a full-service forex broker shows how the retail trading industry has changed. The company's focus on technological innovation led to creating its own fxTrade platform. Later, this platform integrated with the popular MetaTrader 5 platform to offer better functionality and broader market access.

Business Model and Service Offering

Unique fxtrade works by combining fxTrade and MT5 platforms, giving users access to forex and CFD trading across multiple asset types. The platform's business model focuses on offering customizable trading environments where users can adjust their interface and trading parameters to match their specific strategies and preferences. This unique fxtrade review shows that while the technology foundation looks strong, the actual service delivery has faced criticism from users.

The platform serves retail traders who want advanced customization options and professional-grade trading tools. However, the gap between technological capabilities and user satisfaction suggests possible problems in service delivery, customer support, or platform reliability. Prospective traders should carefully evaluate these issues before choosing this platform.

Regulatory Framework: The source materials we have don't give specific information about regulatory oversight, licensing jurisdictions, or compliance frameworks that govern unique fxtrade operations.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and fees isn't detailed in the available source materials.

Minimum Deposit Requirements: The platform's minimum deposit amounts and account funding requirements aren't specified in current information sources.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns aren't mentioned in available materials.

Tradable Assets: The platform gives access to forex currency pairs and CFD instruments, though the complete range of available markets and instruments needs clarification directly from the broker.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs isn't detailed in source materials. This represents a significant information gap for potential users.

Leverage Options: The available leverage ratios and margin requirements aren't specified in current information sources.

Platform Selection: Users can access trading through the integrated fxTrade and MT5 platform combination. This offers both proprietary and third-party trading solutions.

Geographic Restrictions: Information about restricted countries or regional limitations isn't provided in available source materials.

Customer Support Languages: The range of supported languages for customer service isn't specified in current information sources.

This unique fxtrade review shows that potential users need to contact the broker directly for complete details about these essential trading conditions and service parameters.

Evaluating account conditions for unique fxtrade faces major limitations because available source materials don't have enough information. Traditional account evaluation looks at account type variety, minimum deposit requirements, account opening procedures, and special account features like Islamic accounts or professional trader classifications. However, current information sources don't cover these details comprehensively.

The lack of clear account condition information creates a concerning gap for potential traders. Traders need clear understanding of financial commitments and account structures before engaging with any trading platform. Professional traders typically expect detailed information about account tiers, associated benefits, and qualification requirements for different account types.

We can't provide a meaningful evaluation of this crucial aspect without specific user feedback about account opening experiences, deposit processes, or account management procedures. The absence of this information in the unique fxtrade review materials suggests either limited transparency from the broker or insufficient comprehensive analysis in available sources.

Potential users should contact the broker directly to get detailed account condition information before making any trading commitments. This represents essential information for making informed decisions.

The platform's integration with MT5 represents a major strength in available trading tools and technical analysis capabilities. MetaTrader 5 provides comprehensive charting tools, technical indicators, and automated trading support through Expert Advisors. This offers professional-grade functionality for serious traders.

The customizable interface feature lets users personalize their trading environment according to their specific needs and preferences. This flexibility can make trading more efficient for users who need specific layout configurations or parameter settings for their trading strategies.

However, available source materials don't give detailed information about additional research resources, educational materials, or proprietary analysis tools that might add to the standard MT5 offering. Many competitive brokers provide market analysis, economic calendars, trading signals, and educational content to support trader development and decision-making.

The absence of detailed information about research and educational resources in this evaluation limits our ability to assess the complete value proposition. While MT5 integration provides solid technical capabilities, the broader ecosystem of trader support tools remains unclear based on available information.

Customer service evaluation shows mixed signals based on limited available feedback. Some users have reported positive experiences with support teams helping recover funds from fraudulent activities. However, the overall service rating stays moderate because of broader user satisfaction concerns.

Available information suggests that response times may be longer than industry standards. This potentially impacts user experience during critical trading situations or urgent account issues. Professional forex traders typically need rapid response times for technical issues, account problems, or trading disputes.

Service quality assessment shows average performance in professional competency and problem-solving capabilities. However, without detailed information about available support channels, operating hours, or escalation procedures, it becomes difficult to provide comprehensive evaluation of the support infrastructure.

The lack of specific information about multilingual support capabilities, regional support offices, or specialized support for different account types represents additional gaps in available assessment materials. These factors significantly impact user experience, particularly for international traders or those needing support in languages other than English.

Platform stability and performance represent critical factors in trading experience evaluation. Based on available user feedback, the platform appears to have stability issues during high-traffic periods. This can significantly impact trading effectiveness and user satisfaction.

Order execution quality shows concerns about slippage and requoting situations, which directly affect trading profitability and strategy implementation. Professional traders need consistent execution quality with minimal slippage and transparent order processing to maintain confidence in their trading environment.

The platform offers comprehensive technical indicators and charting tools through its MT5 integration. This provides robust analytical capabilities for technical analysis and strategy development. These features support sophisticated trading approaches and detailed market analysis.

However, mobile trading experience information isn't detailed in available source materials. This represents a significant gap given how important mobile trading capabilities are in modern forex trading. The trading environment's stability regarding spread consistency and liquidity provision appears to meet average industry standards but may not satisfy traders requiring premium execution quality.

This unique fxtrade review shows that while technical capabilities exist, execution reliability concerns may impact overall trading satisfaction for serious traders.

Trust assessment reveals significant concerns based on user feedback and available rating information. The average rating of 1 out of 5 on platforms like Fxtrade-exchange.com shows substantial trust issues within the user community. This represents a major red flag for potential users.

The absence of specific regulatory information in available source materials creates additional uncertainty about oversight and compliance frameworks. Professional traders typically need clear understanding of regulatory protections and dispute resolution mechanisms before committing funds to any trading platform.

While OANDA as the parent company maintains an established industry reputation since 1996, the disconnect between historical company standing and current user satisfaction suggests potential issues in service delivery or platform management. These issues require careful consideration by potential users.

Company transparency about operations, fee structures, and business practices appears limited based on available information. This contrasts with industry best practices for reputable brokers. The handling of negative events and user complaints appears inadequate based on user feedback patterns.

Fund security measures and client protection protocols aren't detailed in available source materials. This represents a critical information gap for risk assessment by potential users.

Overall user satisfaction analysis reveals concerning trends with mostly negative feedback and an average rating of 1 out of 5. This shows widespread dissatisfaction among the user base. This level of negative feedback suggests systemic issues affecting user experience across multiple service areas.

Interface design offers customization capabilities that could enhance user experience for traders requiring specific layout configurations. However, the implementation of these features appears to fall short of user expectations based on available feedback patterns.

The registration and verification processes aren't detailed in available source materials. This prevents comprehensive evaluation of onboarding experience quality. Similarly, fund operation experiences including deposits and withdrawals lack detailed user feedback in current information sources.

Common user complaints appear to center around trust-related issues, though specific patterns of dissatisfaction aren't comprehensively detailed in available materials. The concentration of negative feedback suggests potential issues with service delivery, platform reliability, or customer support effectiveness.

User demographic analysis shows that the platform might suit traders with strong customization requirements. But the overwhelming negative feedback suggests that even this target audience faces significant satisfaction challenges with the current service delivery model.

This unique fxtrade review reveals a platform with significant technological capabilities overshadowed by substantial user trust and satisfaction issues. The MT5 integration and customizable interface features provide solid technical foundations. However, the overwhelming negative user feedback and average rating of 1 out of 5 raise serious concerns about service quality and reliability.

The platform may suit traders with strong requirements for interface customization and advanced trading tools. But potential users should carefully weigh these benefits against the documented trust issues and negative user experiences. The lack of transparent information about key trading conditions, regulatory oversight, and service parameters further complicates the evaluation process.

Given the significant trust concerns and limited transparent information available, potential users should exercise extreme caution and conduct thorough due diligence before considering this platform for their trading activities.

FX Broker Capital Trading Markets Review