Tredero 2025 Review: Everything You Need to Know

Executive Summary

Tredero operates as an online forex and CFD broker in the competitive financial trading landscape. However, it shows a mixed picture for potential clients who want reliable trading services. This Tredero review reveals a platform that offers trading across multiple asset classes including forex, indices, commodities, and cryptocurrencies. The company describes its interface as user-friendly and accessible to traders of all levels.

Review platforms show that Tredero has received an overall rating of 1.0 out of 5 stars from one major review site. Another platform shows an average score of 3 from 423 customer evaluations, which indicates mixed user experiences. The broker appears to cater to both beginners seeking an accessible entry point into trading and experienced traders looking for diverse market access. However, the polarized user feedback suggests significant concerns that potential clients should consider carefully.

The platform's primary appeal lies in its multi-asset approach and intuitive design. It positions itself as suitable for traders across different experience levels, which could attract a wide range of users. However, the substantial negative feedback and low overall ratings indicate potential issues with service delivery and platform performance. Prospective clients should carefully consider these concerns before committing to this broker, as 108 customers specifically reported poor performance experiences.

Important Notice

Regional Entity Differences: This review is based on publicly available information and user feedback. Traders should be aware that regulatory oversight and service quality may vary significantly across different jurisdictions, which could affect their trading experience and legal protections. The absence of clear regulatory information in available materials suggests potential legal and financial risks for traders in various regions.

Review Methodology: This evaluation synthesizes user feedback from multiple review platforms, publicly available company information, and industry analysis. Given the limited detailed information available about specific trading conditions and regulatory status, prospective clients are strongly advised to conduct additional due diligence before opening accounts with this broker.

Rating Framework

Broker Overview

Tredero positions itself as a comprehensive online trading platform serving the forex and CFD markets. The broker operates with a business model focused on providing access to multiple financial markets through a single platform, which simplifies the trading process for users. The company's approach centers on offering what it describes as user-friendly trading technology combined with diverse asset coverage spanning traditional forex pairs, global indices, commodities, and the growing cryptocurrency market.

The broker's operational structure appears designed to accommodate both retail traders seeking straightforward market access and more sophisticated investors requiring advanced trading capabilities. However, the specific founding date and detailed company background remain unclear from available public information, which may concern traders who prioritize transparency in broker selection and want to understand the company's history and track record.

Available information suggests that Tredero operates through a web-based platform. However, specific details about whether it offers popular industry-standard platforms like MetaTrader 4 or MetaTrader 5 are not clearly documented in accessible materials. The broker's asset coverage includes the four major categories that most modern traders expect: foreign exchange pairs, stock indices from major global markets, commodity futures, and digital currencies. This comprehensive approach reflects current market demands but raises questions about the depth and quality of execution across such diverse asset classes, as maintaining high standards across multiple markets can be challenging for brokers. This Tredero review finds that while the broker's scope appears ambitious, the lack of detailed operational information and mixed user feedback suggests potential gaps between marketing promises and actual service delivery.

Regulatory Status: Available information does not specify particular regulatory jurisdictions or oversight bodies. This represents a significant concern for trader protection and fund security, as regulatory oversight provides essential safeguards for client funds.

Deposit and Withdrawal Methods: Specific payment processing options and supported financial instruments are not detailed in accessible materials. Traders must contact the broker directly to learn about available funding options and withdrawal procedures.

Minimum Deposit Requirements: The entry-level investment amount needed to begin trading has not been clearly specified in available documentation. This lack of transparency makes it difficult for potential clients to plan their initial investment and assess whether the broker fits their budget.

Bonus and Promotions: Current promotional offerings, welcome bonuses, or ongoing trading incentives are not outlined in accessible broker information. Many brokers use promotional offers to attract new clients, but Tredero's approach to marketing incentives remains unclear.

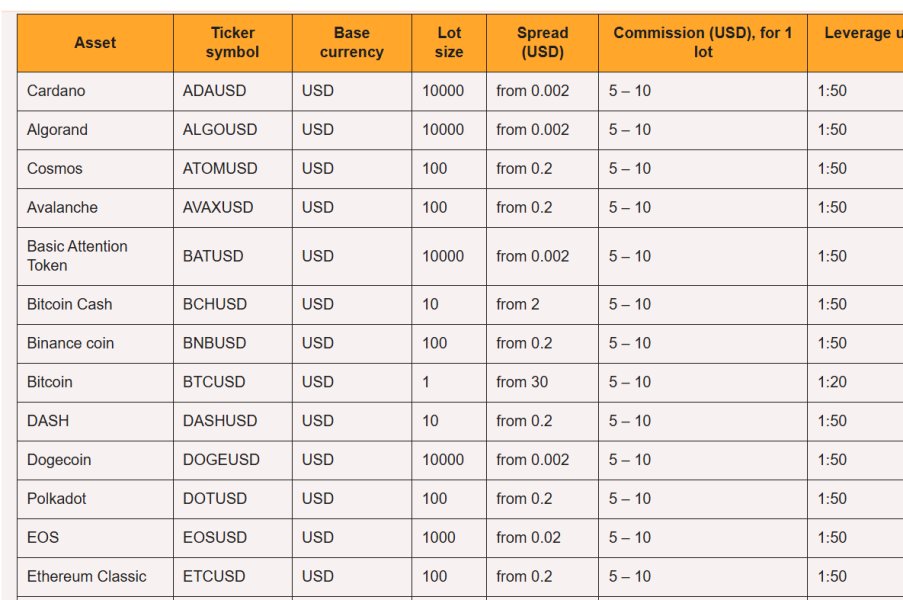

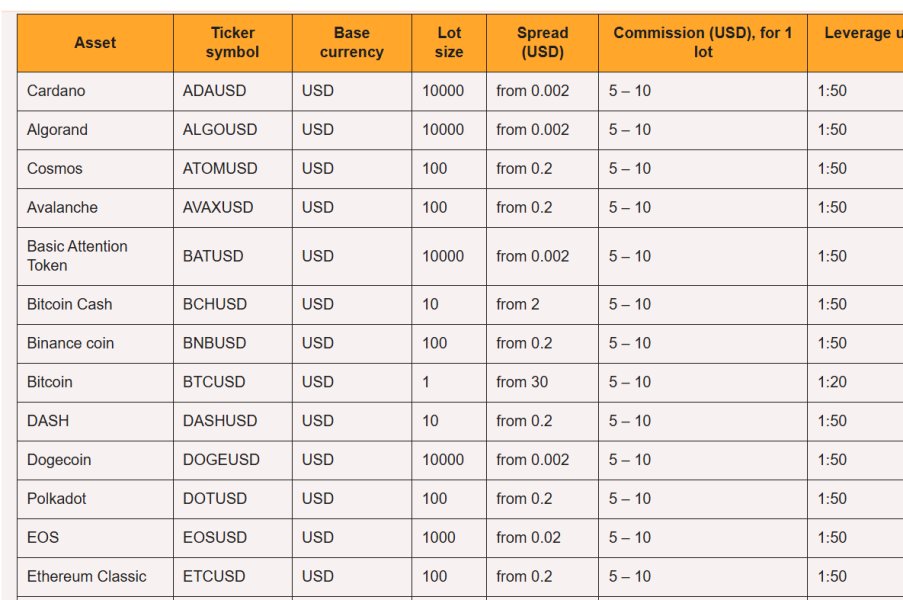

Tradeable Assets: The platform provides access to forex currency pairs, global stock indices, commodity markets, and cryptocurrency trading opportunities across multiple digital assets. This diverse selection could appeal to traders who want to diversify their portfolios across different market sectors.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs requires direct verification with the broker. Specific pricing is not readily available in public materials, which makes it difficult for traders to compare costs with other brokers.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in current accessible information. Leverage details are crucial for traders to understand their potential risk exposure and margin requirements.

Platform Options: The broker emphasizes user-friendly platform design, though specific software details, mobile applications, and advanced trading tools require further investigation. Modern traders often need mobile access and sophisticated analytical tools for effective trading.

Geographic Restrictions: Service availability across different countries and jurisdictions is not clearly outlined in available materials. This information gap could affect international traders who need to verify whether they can legally access the platform from their location.

Customer Support Languages: Multilingual support capabilities and communication channels are not specified in accessible broker information. This Tredero review notes that such fundamental information gaps may indicate transparency issues that potential clients should address directly with the broker before account opening.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account structure and conditions offered by Tredero present a mixed picture based on available information. While the broker claims to accommodate both beginner and experienced traders, specific details about account tiers, minimum deposit requirements, and account-specific benefits remain largely undocumented in accessible materials, which creates uncertainty for potential clients. This lack of transparency in account conditions represents a significant concern for potential clients who need clear understanding of their trading environment before committing funds.

The absence of detailed information about account types suggests either limited variety in offerings or poor communication of available options. Most reputable brokers clearly outline their account structures, including differences between basic, premium, and professional accounts, along with corresponding benefits and requirements that help traders choose the most suitable option. The fact that such fundamental information is not readily available raises questions about the broker's commitment to transparency and client education.

User feedback indicating poor performance from 108 customers suggests that whatever account conditions exist may not meet trader expectations. Without clear information about spreads, commission structures, or minimum balance requirements, traders cannot make informed decisions about whether the broker's account conditions align with their trading strategies and financial capabilities, which could lead to disappointing experiences. This Tredero review finds that the opacity surrounding account conditions contributes to the overall low trust rating and suggests potential clients should demand detailed clarification before proceeding.

Tredero's trading tools and resources appear to cover basic market needs, though detailed specifications about analytical capabilities, charting tools, and research resources are not comprehensively documented. The broker mentions providing access to multiple asset classes, which suggests some level of market analysis and trading tool availability, but the depth and quality of these resources remain unclear from available information that potential clients can review.

The platform's emphasis on user-friendliness could indicate simplified tools that benefit beginners who are just starting their trading journey. However, this might come at the expense of advanced analytical capabilities that experienced traders require for sophisticated market analysis and strategy development. Without specific information about technical analysis tools, fundamental research resources, economic calendars, or market commentary, it's difficult to assess whether the broker provides sufficient support for informed trading decisions.

The moderate rating reflects the assumption that basic trading functionality exists given the broker's operational status. However, the lack of detailed tool descriptions and user testimonials about resource quality prevents a higher evaluation and raises questions about the platform's capabilities. Most competitive brokers highlight their analytical capabilities, educational resources, and research partnerships prominently, and the absence of such information in Tredero's available materials suggests either limited offerings or inadequate marketing of existing capabilities.

Customer Service and Support Analysis (4/10)

Customer service quality emerges as a significant concern based on available user feedback and the overall low satisfaction ratings across review platforms. The poor average ratings and numerous negative reviews suggest systemic issues in customer support delivery, though specific details about response times, communication channels, and problem resolution effectiveness are not documented in accessible materials that would help explain these problems.

The fact that 108 customers specifically reported poor performance experiences indicates potential issues with support quality, problem resolution, or communication effectiveness. Without information about available support channels, operating hours, or multilingual capabilities, it's impossible to assess whether service issues stem from limited availability or poor service quality during interactions, which makes it difficult for potential clients to set appropriate expectations.

Professional forex brokers typically provide multiple communication channels including live chat, email, and phone support with clearly stated response time commitments. The absence of such information in Tredero's available materials, combined with negative user feedback, suggests that customer support may not meet industry standards that traders expect from professional brokers. The below-average rating reflects these concerns while acknowledging that some level of support must exist for the broker to maintain operations.

Trading Experience Analysis (5/10)

The trading experience with Tredero appears to deliver mixed results based on available user feedback and platform descriptions. While the broker emphasizes user-friendly design and multi-asset access, the significant negative feedback from users suggests potential issues with execution quality, platform stability, or overall trading environment effectiveness that could impact trader success.

The platform's claim of suitability for both beginners and experienced traders indicates some level of functionality across different user needs. However, specific details about execution speeds, order types, platform stability, and mobile trading capabilities are not well-documented in materials that potential clients can access before opening accounts. The moderate rating reflects this uncertainty, as trading experience quality often depends on technical factors that require detailed specification and user verification.

Without specific information about platform performance metrics, execution quality data, or detailed user testimonials about trading conditions, it's challenging to provide a comprehensive assessment. The average rating acknowledges that the broker maintains operational trading capabilities while recognizing that user satisfaction appears inconsistent based on available feedback from actual users. This Tredero review suggests that potential clients should test platform performance through demo accounts or small initial deposits before committing significant trading capital.

Trust and Reliability Analysis (3/10)

Trust and reliability represent the most concerning aspects of Tredero's profile based on available information. The absence of clear regulatory oversight information in accessible materials raises immediate red flags about fund safety, dispute resolution mechanisms, and operational accountability that are essential for trader protection. Reputable brokers typically prominently display their regulatory credentials, segregated account policies, and investor protection measures.

The poor overall ratings from review platforms, combined with the lack of regulatory transparency, create a concerning picture for potential clients prioritizing fund security. The 1.0 rating from one major review platform and the significant number of negative user experiences suggest systemic issues that extend beyond normal business operations challenges and may indicate fundamental problems with the broker's approach to client service.

Without verification of proper licensing, regulatory compliance, or fund segregation practices, traders face potentially significant risks when depositing funds with this broker. The financial services industry's regulatory framework exists specifically to protect client interests, and the apparent absence of clear regulatory oversight represents a fundamental trust issue that affects all other aspects of the broker's operations and client relationships.

User Experience Analysis (4/10)

User experience feedback presents a notably mixed picture, with the 423 customer reviews averaging a score of 3. This indicates widespread dissatisfaction despite some positive experiences from users who found value in the platform's offerings. The significant number of negative reviews, particularly the 108 customers reporting poor performance, suggests systemic issues with service delivery, platform functionality, or customer relationship management.

The broker's claim of suitability for both beginners and experienced traders appears contradicted by the substantial negative feedback. This often indicates that actual user experience fails to match marketing promises, which can lead to disappointment and frustration among clients who expected better service quality. While some users may find the platform adequate for basic trading needs, the overall satisfaction levels suggest that many clients encounter significant issues during their trading journey.

The below-average rating reflects the documented user dissatisfaction while acknowledging that some traders do find value in the platform's offerings. However, the high proportion of negative feedback relative to positive reviews indicates that user experience issues are widespread rather than isolated incidents that could be easily addressed. Potential clients should carefully consider this feedback pattern when evaluating whether Tredero meets their trading needs and service expectations.

Conclusion

This Tredero review reveals a broker that presents significant concerns despite its multi-asset trading offerings and claims of user-friendly design. The combination of poor overall ratings, lack of regulatory transparency, and substantial negative user feedback creates a risk profile that may not suit most traders' needs, regardless of their experience level or trading objectives.

While Tredero may appeal to some beginners due to its simplified approach, the documented user satisfaction issues and absence of clear regulatory oversight suggest potential problems. Even novice traders might benefit from considering more established alternatives that offer better transparency and regulatory protection for their funds. Experienced traders are likely to find the lack of detailed information about trading conditions, tools, and regulatory protections particularly concerning.

The broker's primary weaknesses center on transparency, regulatory clarity, and consistent service delivery. These represent fundamental requirements for safe and effective online trading that cannot be overlooked when choosing a broker. Until these core issues are addressed, potential clients should exercise extreme caution and thoroughly investigate alternatives before committing funds to this platform.