CTRL FX 2025 Review: Everything You Need to Know

Executive Summary

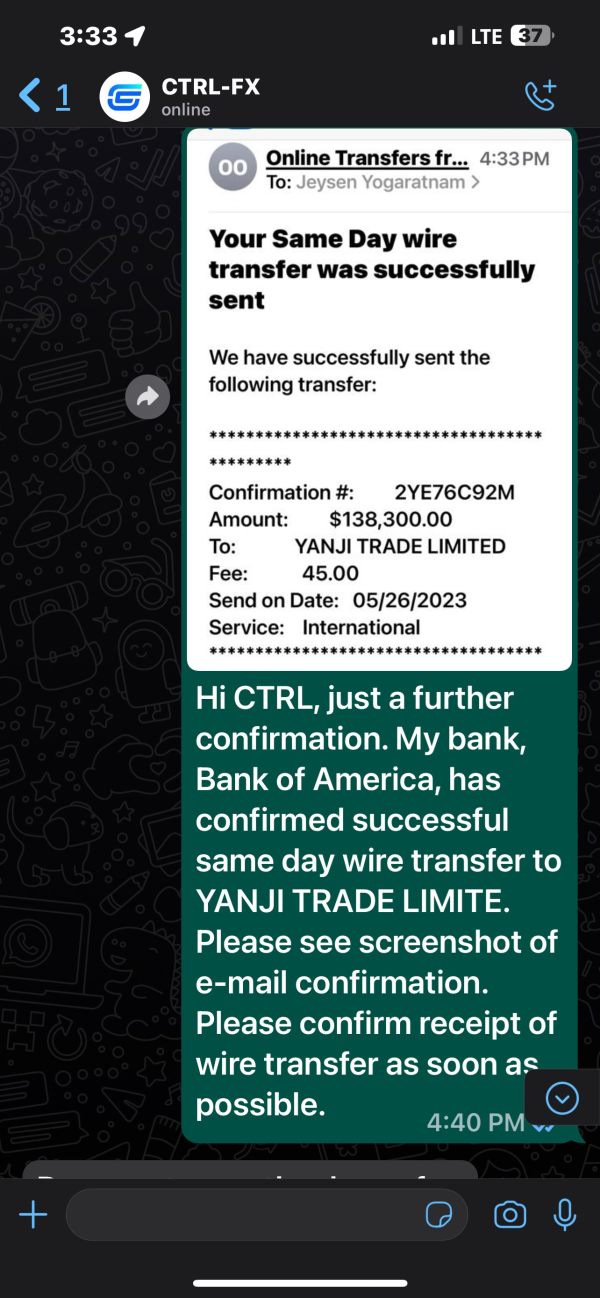

CTRL FX operates as a forex broker. The trading community has serious concerns about this company's regulatory status and overall legitimacy. This ctrl fx review reveals that the broker faces substantial questions about its authorization and safety measures for client funds, which creates major problems for traders who want to protect their money. According to multiple industry watchdog reports, CTRL FX has been flagged for operating without proper regulatory oversight in key jurisdictions. This raises red flags for potential traders.

The broker's limited transparency regarding trading conditions, platform specifications, and corporate structure has contributed to widespread skepticism among industry experts and users alike, making it difficult for anyone to trust this company. User feedback consistently highlights concerns about the company's legitimacy. Many people question whether CTRL FX represents a safe option for forex trading. The absence of clear information about spreads, commissions, minimum deposits, and available trading platforms further compounds these concerns, creating a situation where traders cannot make informed decisions.

CTRL FX appears to target traders seeking high-leverage opportunities. However, the significant regulatory and safety risks make it a questionable choice for serious investors who care about protecting their money. The overall user sentiment remains predominantly negative. Multiple reports suggest potential scam risks associated with this broker.

Important Notice

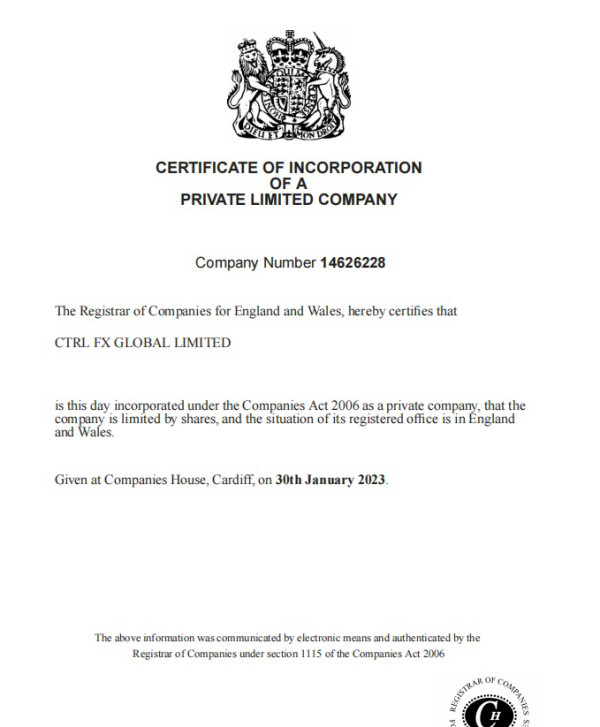

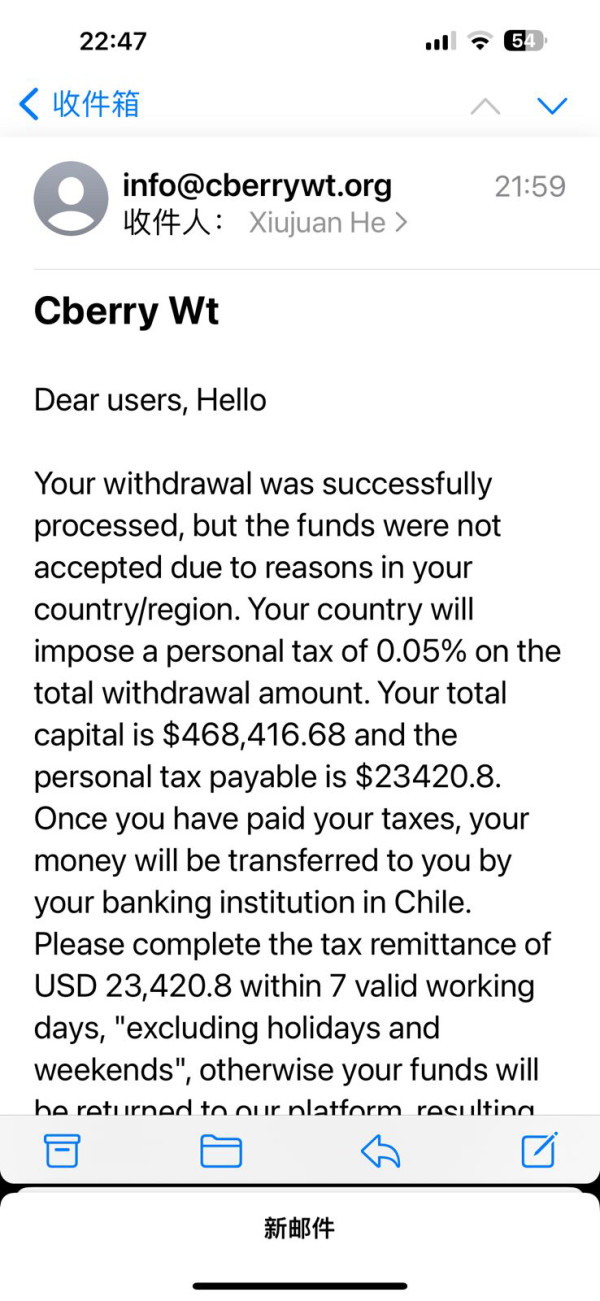

Regulatory Entity Variations: CTRL FX claims to operate under FinCEN supervision while maintaining a London-based registration. However, critical verification shows the broker lacks proper FCA registration, which is mandatory for legitimate forex operations in the UK, creating serious legal problems for anyone who trades with them. This regulatory gap presents substantial risks for traders considering this platform.

Review Methodology: This evaluation is based on comprehensive analysis of publicly available information, user testimonials, regulatory databases, and industry reports that provide detailed insights into the broker's operations. All assessments reflect objective findings from verified sources as of 2025.

Rating Framework

Broker Overview

CTRL FX operates under the corporate entity CTRL FX Global Limited. The company claims to have headquarters in London, United Kingdom, but many details about its actual operations remain unclear. The broker presents itself as an international forex trading provider, though specific details about its founding date and operational history remain notably absent from public records, which makes it hard for traders to verify the company's background. Industry databases indicate that CTRL FX has been operating for a relatively short period. This contributes to the limited track record available for evaluation.

The company's business model appears to focus on retail forex trading. However, comprehensive details about its market-making versus STP approach are not clearly disclosed, leaving traders in the dark about how their orders will be handled. This lack of transparency regarding operational methodology raises concerns about how client orders are processed and whether potential conflicts of interest exist between the broker and its clients.

Regarding regulatory oversight, CTRL FX claims supervision under FinCEN, the U.S. Treasury Department's financial intelligence unit that focuses on preventing money laundering. However, this registration primarily relates to anti-money laundering compliance rather than comprehensive broker regulation, which means traders don't get the full protection they need. More concerning is the broker's absence from FCA registration despite claiming London-based operations. This represents a significant regulatory red flag for UK-based trading activities.

The broker's asset offerings and platform specifications remain largely undisclosed in available materials. This makes it difficult for potential clients to assess whether CTRL FX meets their trading requirements, creating unnecessary confusion and uncertainty. This information gap, combined with limited corporate transparency, contributes to the overall uncertainty surrounding the broker's legitimacy and operational capabilities.

Regulatory Jurisdictions: CTRL FX operates under FinCEN registration for anti-money laundering compliance. However, the company notably lacks FCA authorization despite London-based claims, which creates significant legal and safety concerns for traders who need proper regulatory protection.

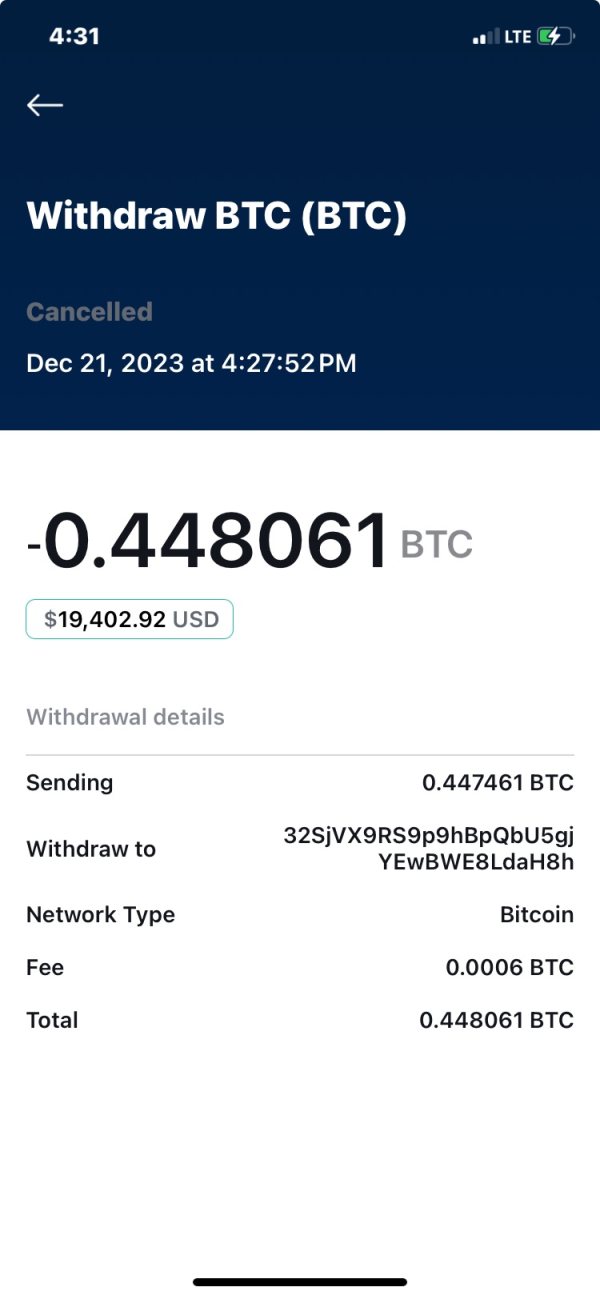

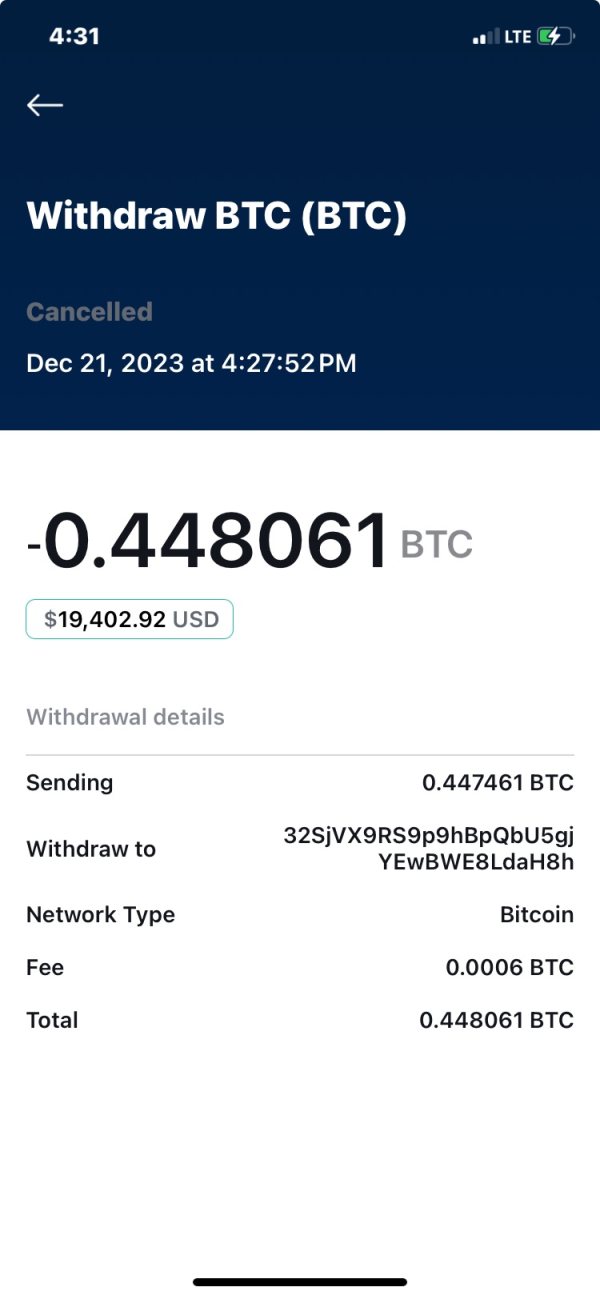

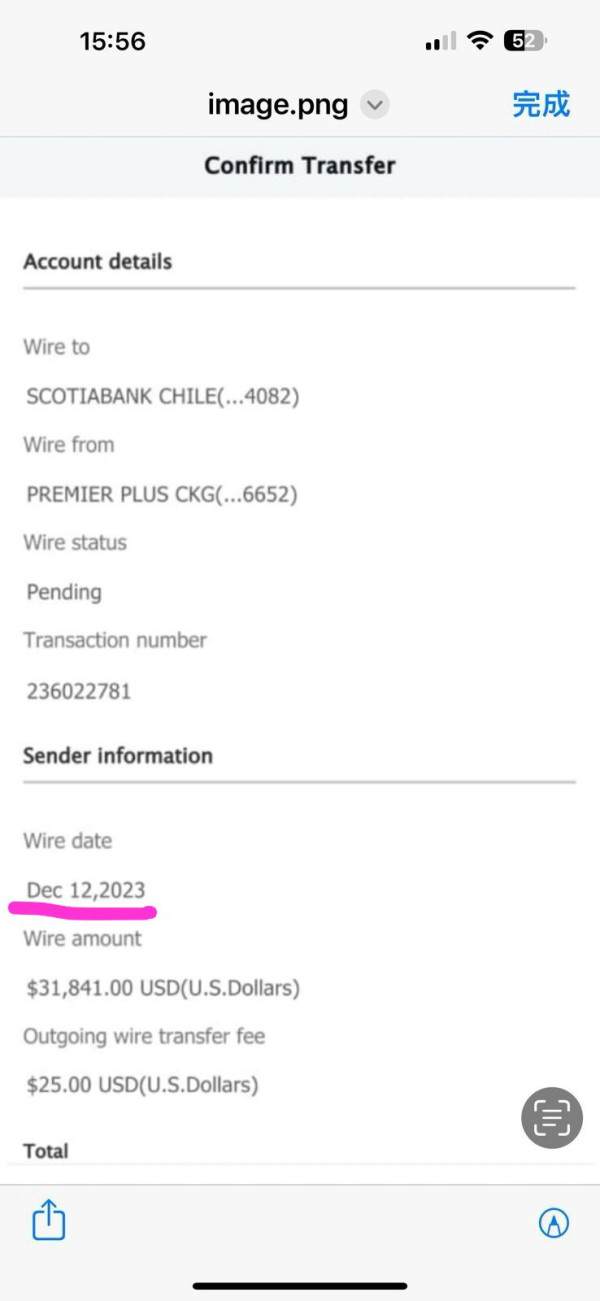

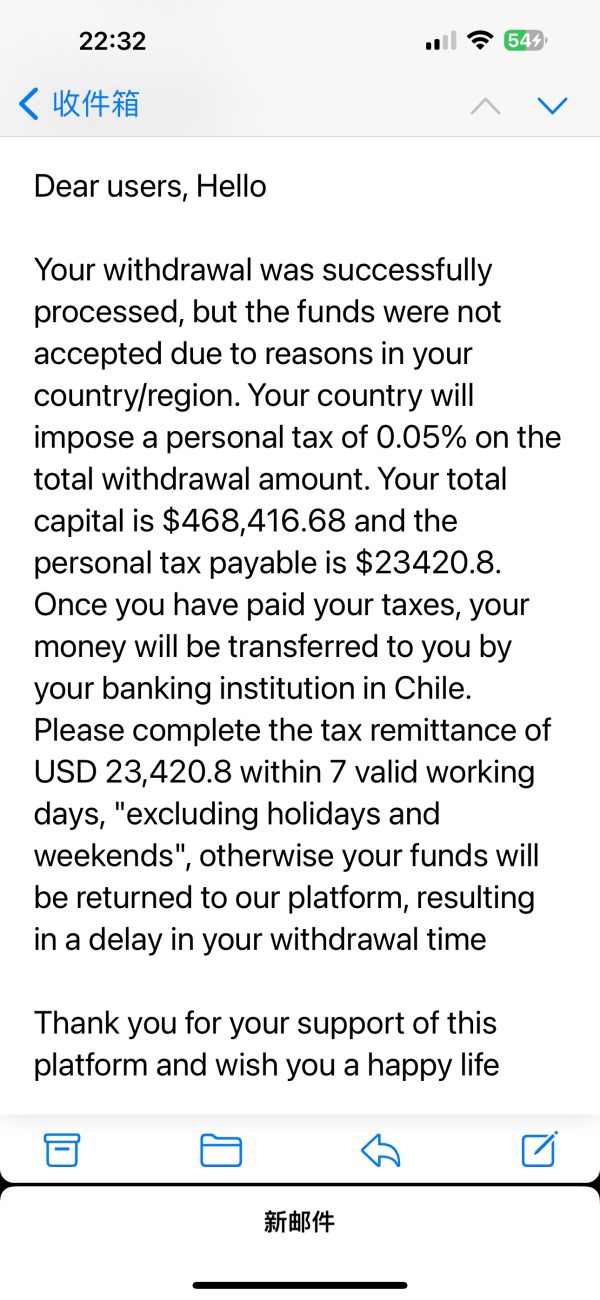

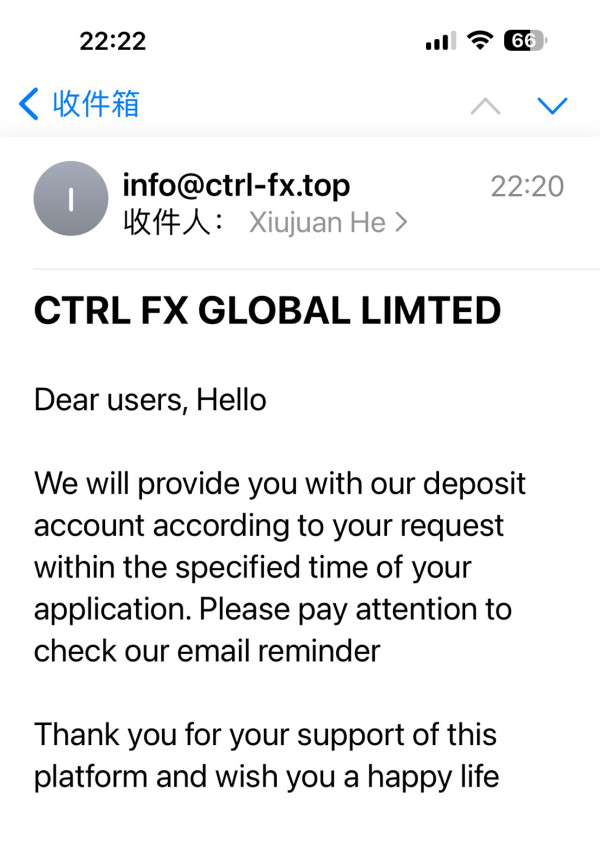

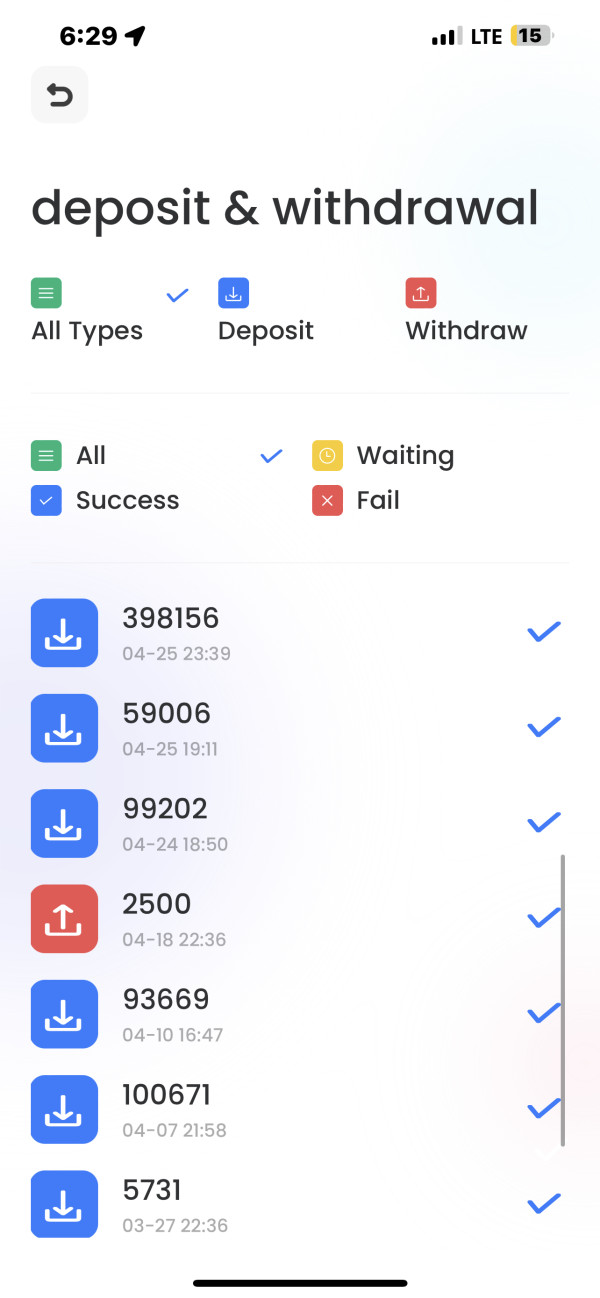

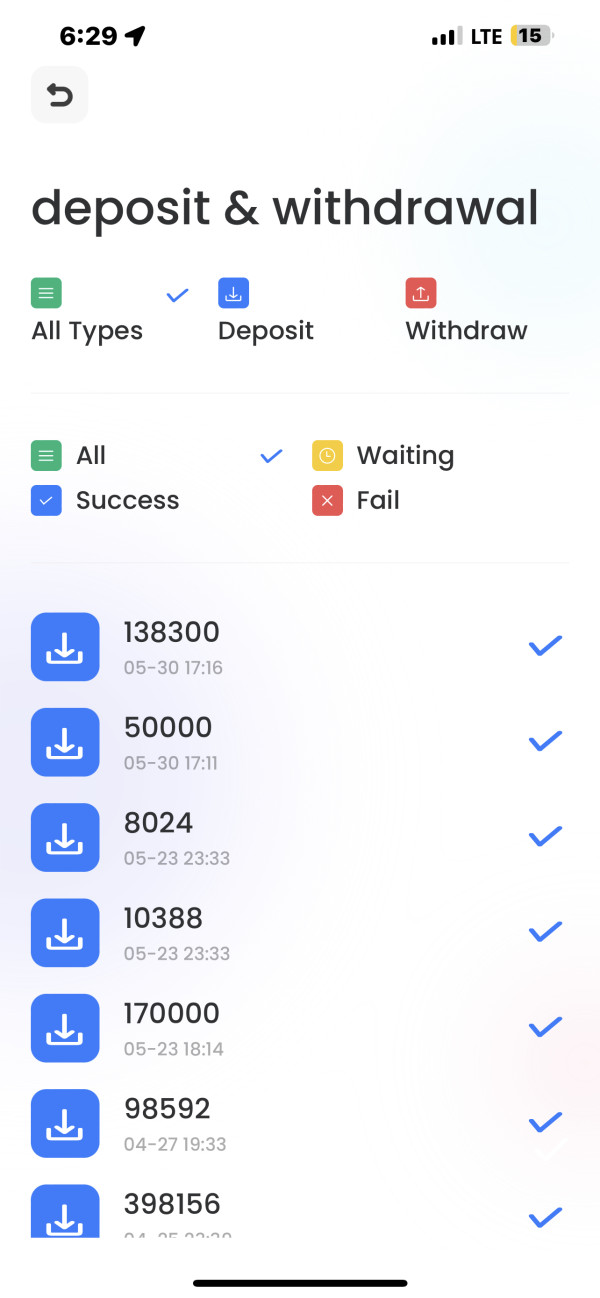

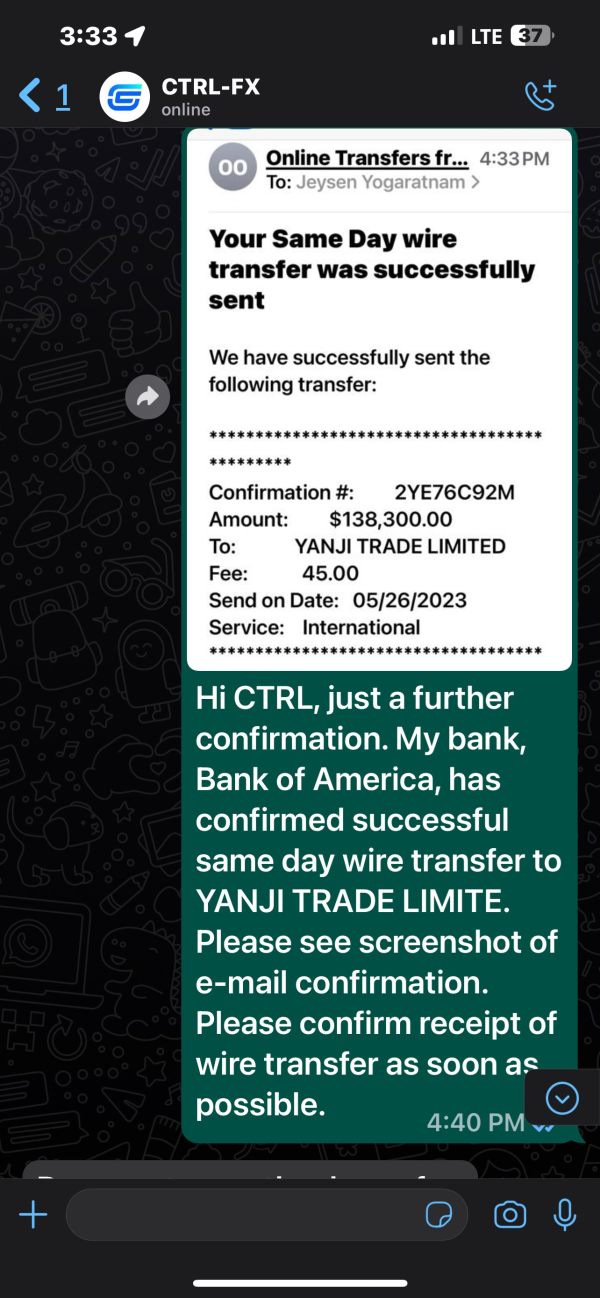

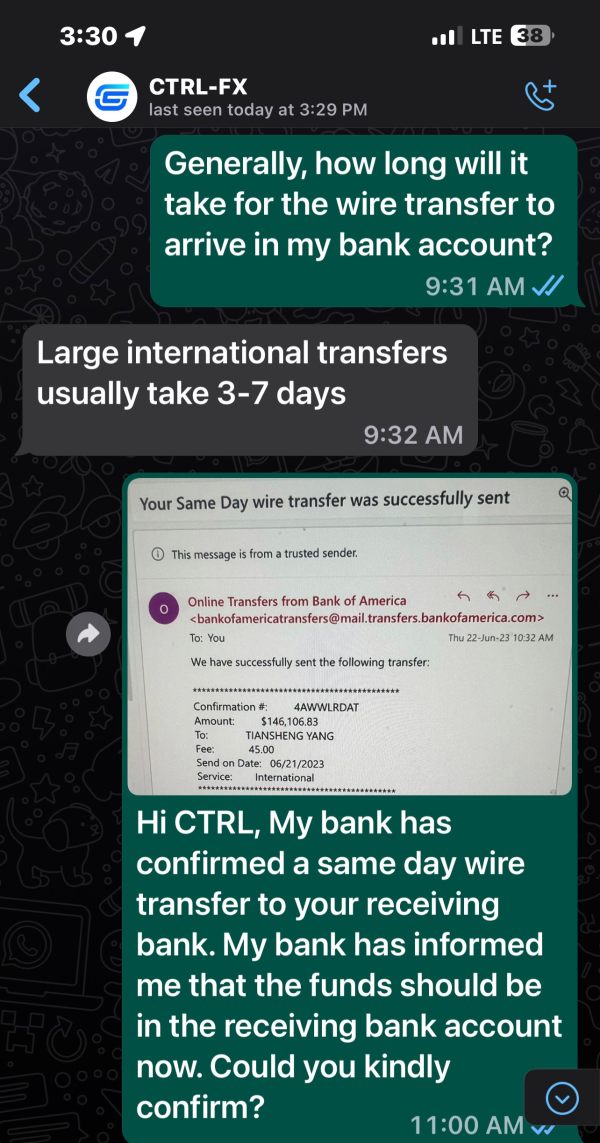

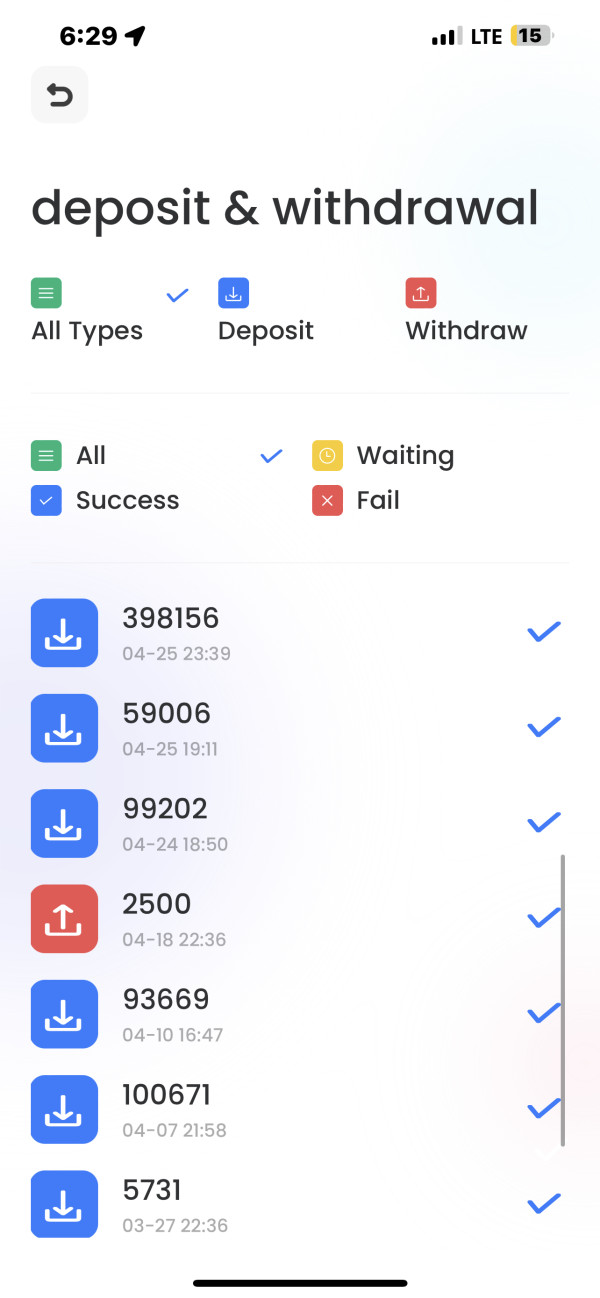

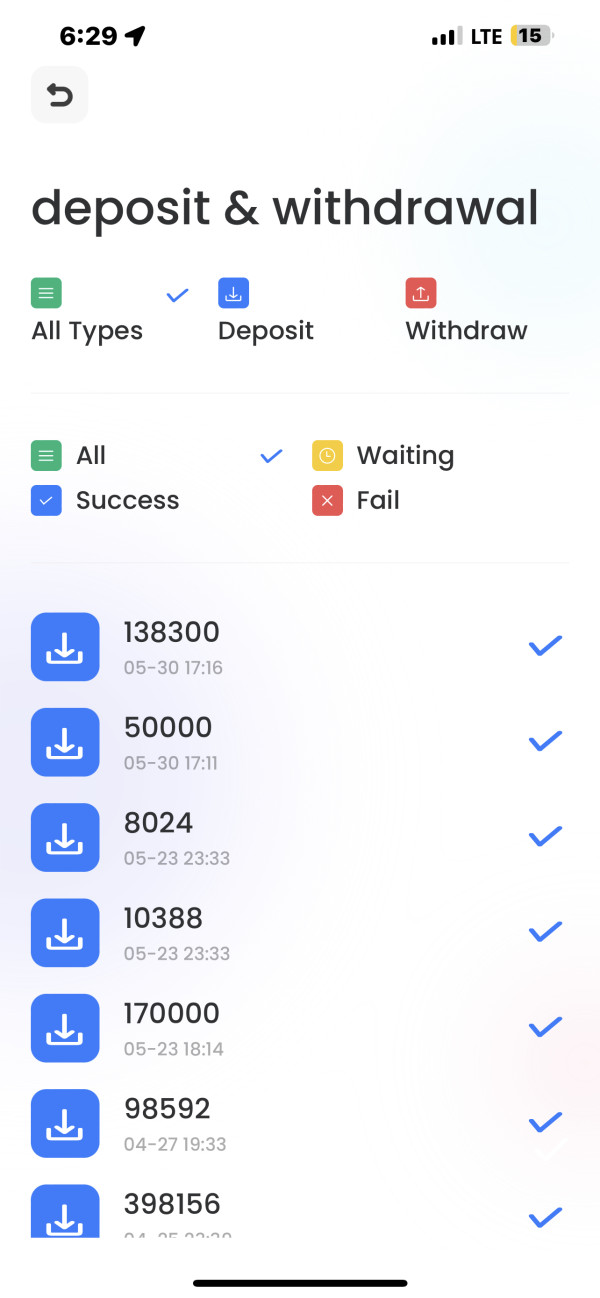

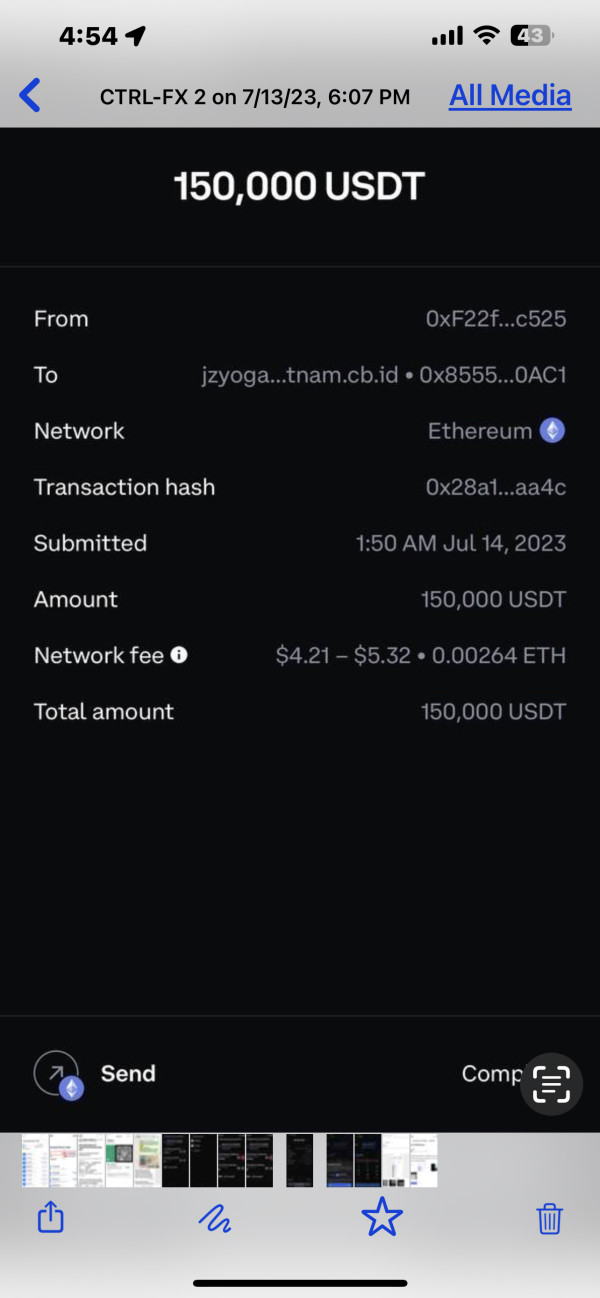

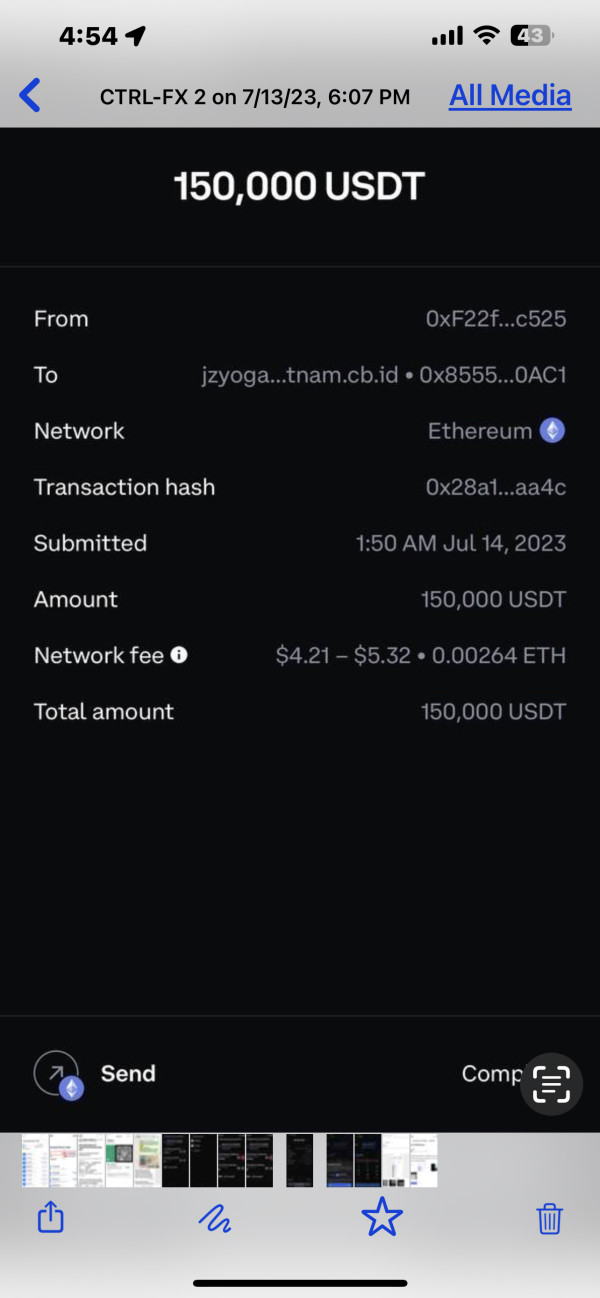

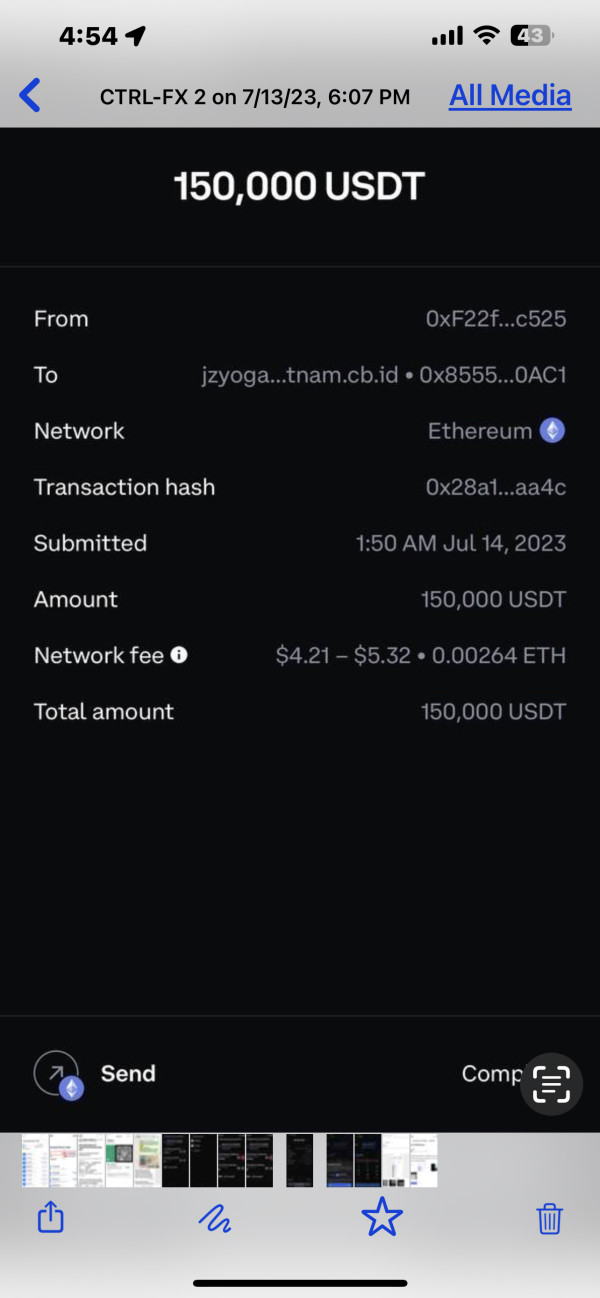

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not disclosed in available materials. This creates uncertainty about fund management procedures.

Minimum Deposit Requirements: The broker has not published clear minimum deposit amounts for different account types. This makes it impossible to assess accessibility for various trader categories.

Bonus and Promotions: No specific promotional offers or bonus programs are detailed in publicly available information. This suggests either absence of such programs or poor marketing transparency.

Tradeable Assets: Available trading instruments, including forex pairs, commodities, indices, and cryptocurrencies, are not comprehensively listed in accessible broker materials, leaving traders without essential information about what they can actually trade.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed. This prevents accurate cost analysis for potential clients.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in available documentation, making it impossible for traders to plan their risk management strategies effectively.

Platform Options: Trading platform types, whether proprietary or third-party solutions like MetaTrader, are not clearly identified in broker materials.

Geographic Restrictions: Specific countries or regions where services are restricted are not detailed in accessible information, creating confusion for international traders who need to know if they can legally use the platform.

Customer Support Languages: Available support languages and communication channels are not comprehensively outlined.

This ctrl fx review highlights significant information gaps that potential traders should consider carefully before engaging with this broker, as these missing details could lead to serious problems later.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

CTRL FX receives a poor rating for account conditions due to the substantial lack of transparency regarding basic trading parameters that every legitimate broker should provide clearly. The broker fails to provide clear information about account types. This makes it impossible for potential clients to understand what options are available or how different accounts might suit various trading strategies, creating unnecessary confusion and frustration for people who just want to start trading.

The absence of published minimum deposit requirements creates uncertainty about accessibility, particularly for new traders who need to understand financial commitments before opening accounts without any surprises or hidden costs. This lack of clarity extends to account features, with no information available about whether specialized accounts such as Islamic accounts are offered for Muslim traders. User feedback consistently highlights confusion about account opening procedures and requirements, suggesting that the broker either doesn't communicate well or deliberately hides important information from potential clients.

Many potential clients report difficulty obtaining basic information about account specifications. This suggests either poor customer communication or deliberate opacity in the broker's operations, neither of which inspires confidence in the company's professionalism.

The account verification process also lacks clear documentation, with users reporting unclear requirements for identity verification and document submission that can cause significant delays and headaches. This ambiguity can lead to delays and frustration during the onboarding process. It contributes to the overall poor user experience.

Furthermore, the absence of information about account maintenance fees, inactivity charges, or other account-related costs makes it impossible for traders to accurately assess the total cost of maintaining an account with CTRL FX, which could lead to unexpected charges that eat into trading profits. This ctrl fx review emphasizes that such transparency gaps represent significant concerns for potential clients.

The tools and resources category receives the lowest rating due to CTRL FX's failure to provide adequate information about trading tools, analytical resources, and educational materials that serious traders need to succeed. The broker's website and promotional materials lack detailed descriptions of available trading platforms, charting tools, or technical analysis features. This creates a major problem for traders who rely on these tools to make profitable decisions.

Research and market analysis resources appear to be minimal or non-existent based on available information, which is completely unacceptable for a modern forex broker. Professional traders typically require access to economic calendars, market news, expert analysis, and research reports to make informed trading decisions. The absence of such resources significantly limits the broker's appeal to serious traders, making it unsuitable for anyone who takes trading seriously.

Educational resources, which are crucial for new traders, are not prominently featured or detailed in CTRL FX's public materials, suggesting that the company doesn't care about helping clients improve their trading skills. The lack of trading guides, webinars, tutorials, or educational articles suggests that the broker does not prioritize client education and development. This is a red flag for any trader who wants to learn and grow.

Automated trading support, including Expert Advisors and algorithmic trading capabilities, is not addressed in available documentation, which limits options for advanced traders who use sophisticated strategies. This omission is particularly concerning for traders who rely on automated strategies or require advanced trading functionalities.

User feedback indicates frustration with the limited tools available on the platform, with several reports suggesting that basic trading functionalities may be missing or poorly implemented, making it difficult to execute even simple trading strategies effectively. The overall assessment in this ctrl fx review reflects the significant deficiencies in trading tools and resources that modern forex traders expect from legitimate brokers.

Customer Service and Support Analysis (4/10)

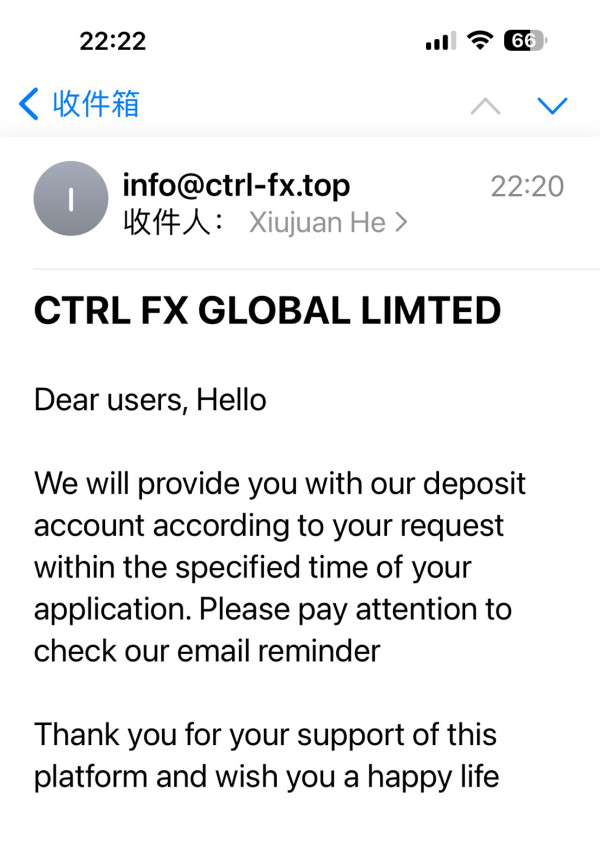

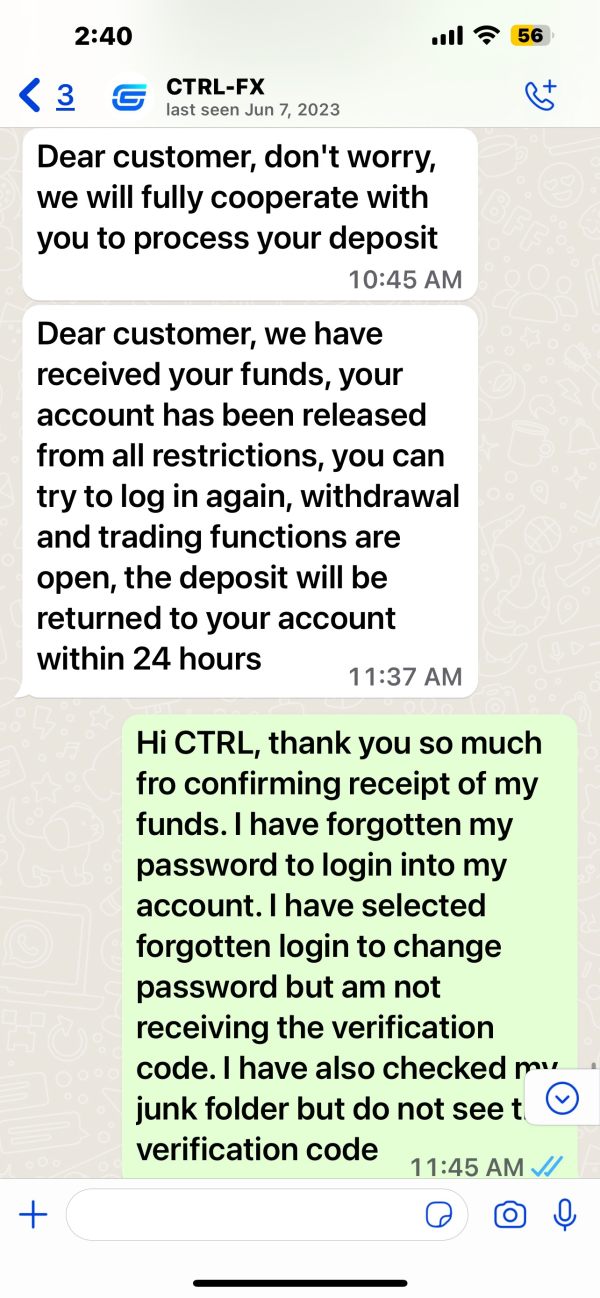

Customer service receives a below-average rating based on mixed user feedback and limited information about support infrastructure that raises questions about the company's commitment to helping clients. While CTRL FX appears to maintain some level of customer support, the quality and accessibility of these services have drawn criticism from users. Response times for customer inquiries appear to be inconsistent, with some users reporting delays in receiving answers to basic questions about account setup, trading conditions, or technical issues that should be resolved quickly.

This inconsistency in support responsiveness can be particularly problematic for active traders who require timely assistance when dealing with urgent trading situations or technical problems that could cost them money.

The availability of multiple communication channels is not clearly documented, leaving uncertainty about whether clients can reach support through phone, email, live chat, or other methods that modern traders expect from professional brokers. Professional brokers typically offer multiple contact options to accommodate different client preferences and urgency levels. User testimonials suggest that support quality varies significantly, with some clients reporting helpful interactions while others express frustration with unhelpful or evasive responses that don't actually solve their problems.

This inconsistency raises concerns about staff training and support protocols, suggesting that the company may not have proper systems in place to ensure quality customer service.

Language support capabilities are not clearly specified, which could create barriers for international clients who require assistance in their native languages and may struggle to get help when they need it most. The limited documentation about support hours and availability also creates uncertainty about when clients can expect to receive assistance.

Trading Experience Analysis (3/10)

The trading experience category receives a poor rating due to significant gaps in platform information and concerning user feedback about execution quality that affects real trading results. The absence of detailed platform specifications makes it impossible to assess stability, speed, and functionality that are crucial for effective trading. This lack of information creates uncertainty for traders who need reliable platforms to execute their strategies successfully.

Order execution quality has been questioned by users, with some reports suggesting potential issues with slippage, requotes, or delayed fills that can seriously impact trading profitability. These execution problems can significantly impact trading profitability and represent serious concerns for active traders who need fast, accurate order processing. Platform functionality appears limited based on available feedback, though comprehensive testing data is not available due to the broker's limited transparency, making it impossible to verify whether the platform actually works as advertised.

The lack of information about mobile trading capabilities is particularly concerning given the importance of mobile access for modern traders who need to monitor and manage their positions while away from their computers.

User interface design and usability are not well-documented, making it difficult to assess whether the platform meets modern standards for intuitive navigation and efficient trade management that traders expect from professional platforms. Professional traders require sophisticated platform features that may not be available through CTRL FX. The overall trading environment appears to lack the professional standards expected from legitimate forex brokers, with multiple user reports suggesting an unsatisfactory trading experience that could lead to losses.

This ctrl fx review emphasizes that these deficiencies represent significant barriers to effective trading and could seriously harm a trader's ability to succeed in the markets.

Trust and Safety Analysis (2/10)

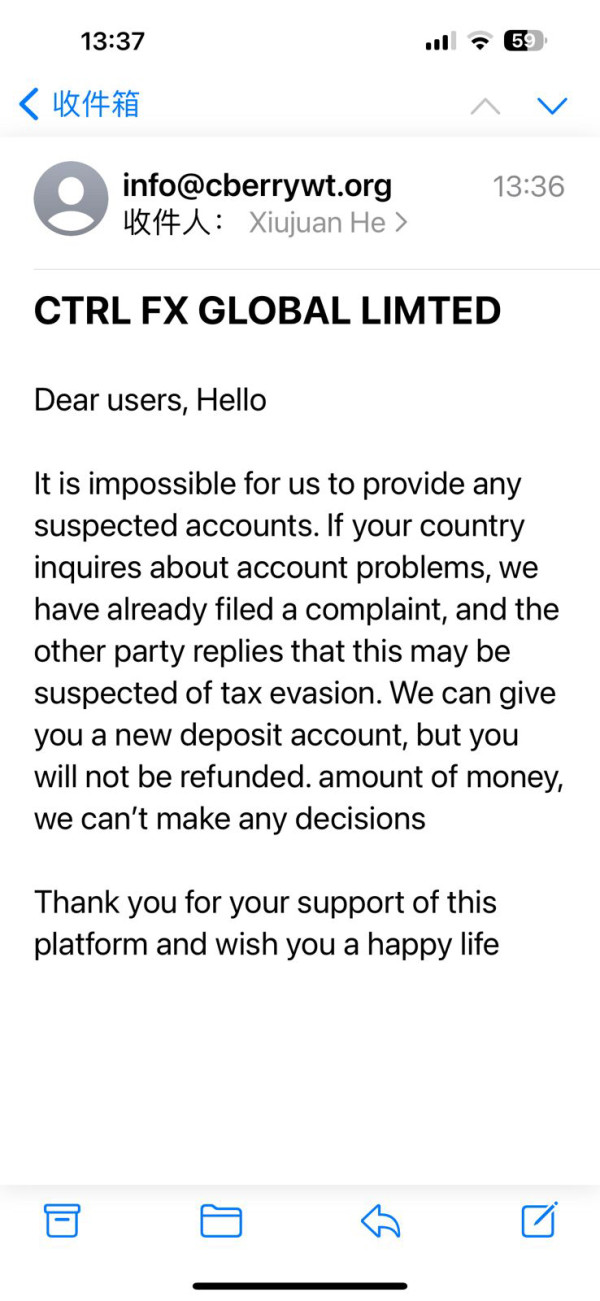

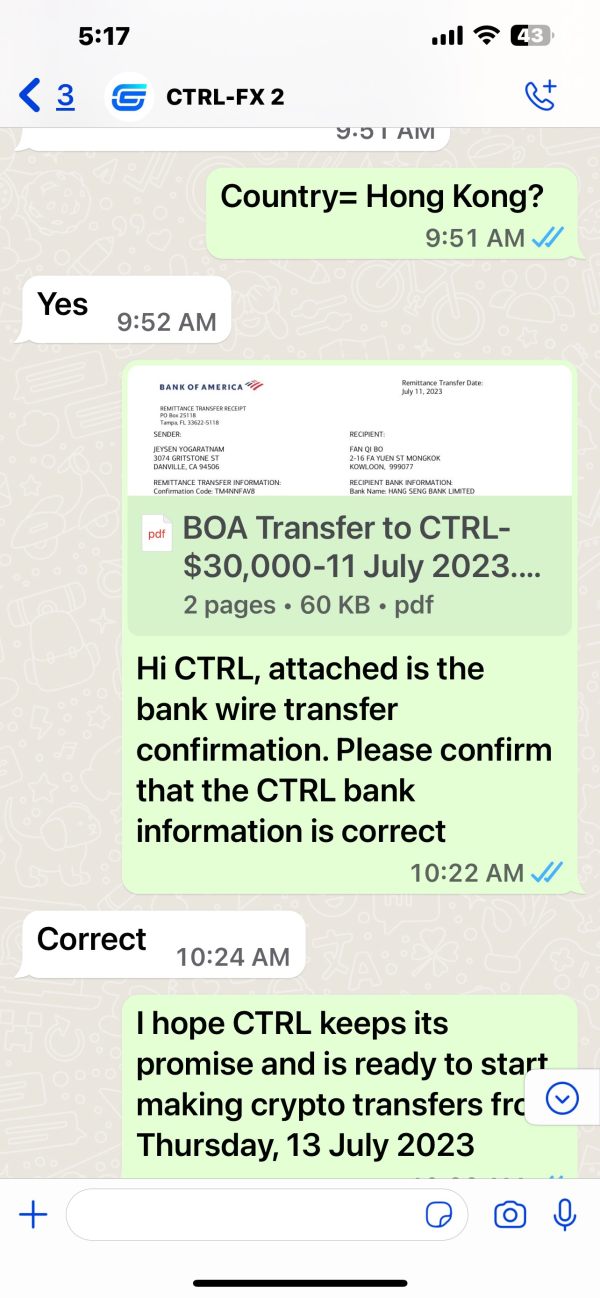

Trust and safety receive the lowest rating due to serious concerns about CTRL FX's regulatory status and overall legitimacy that put trader funds at significant risk. The broker's lack of proper FCA registration despite London-based operations represents a fundamental regulatory violation that exposes clients to significant risks. This is not a minor oversight but a major red flag that suggests the company may not be operating legally in the UK.

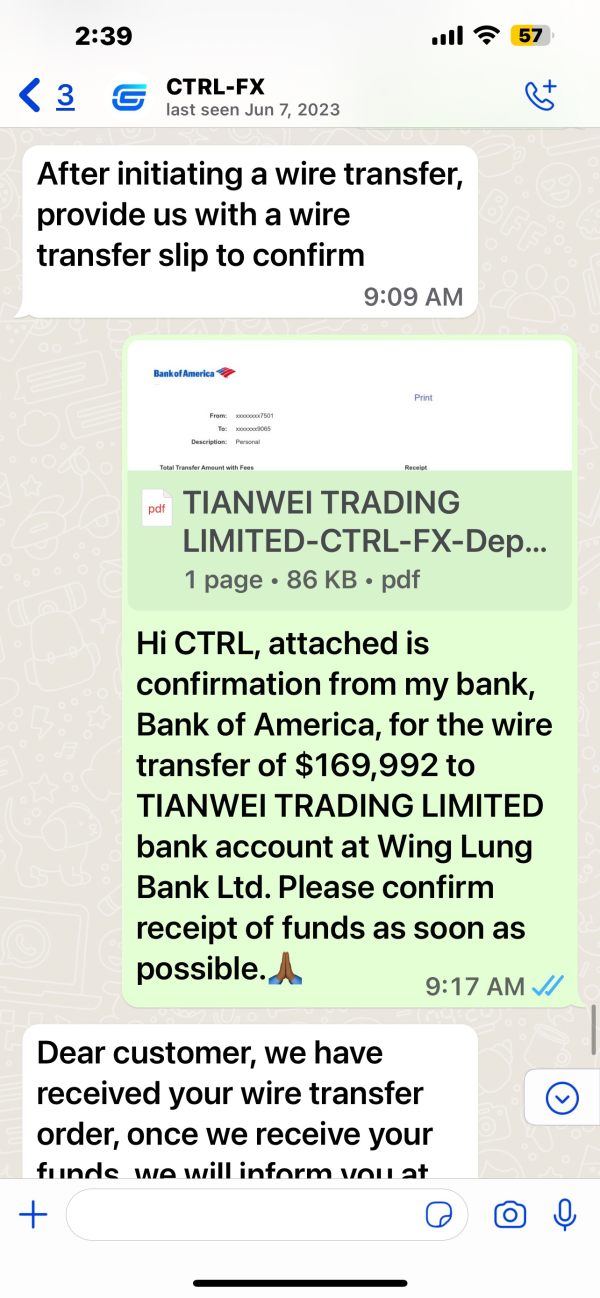

While CTRL FX claims FinCEN registration, this authorization relates primarily to anti-money laundering compliance rather than comprehensive broker regulation that actually protects traders from fraud and misconduct. The absence of robust regulatory oversight means that client funds lack the protection typically provided by established financial regulators. This creates a dangerous situation where traders have little recourse if something goes wrong with their money.

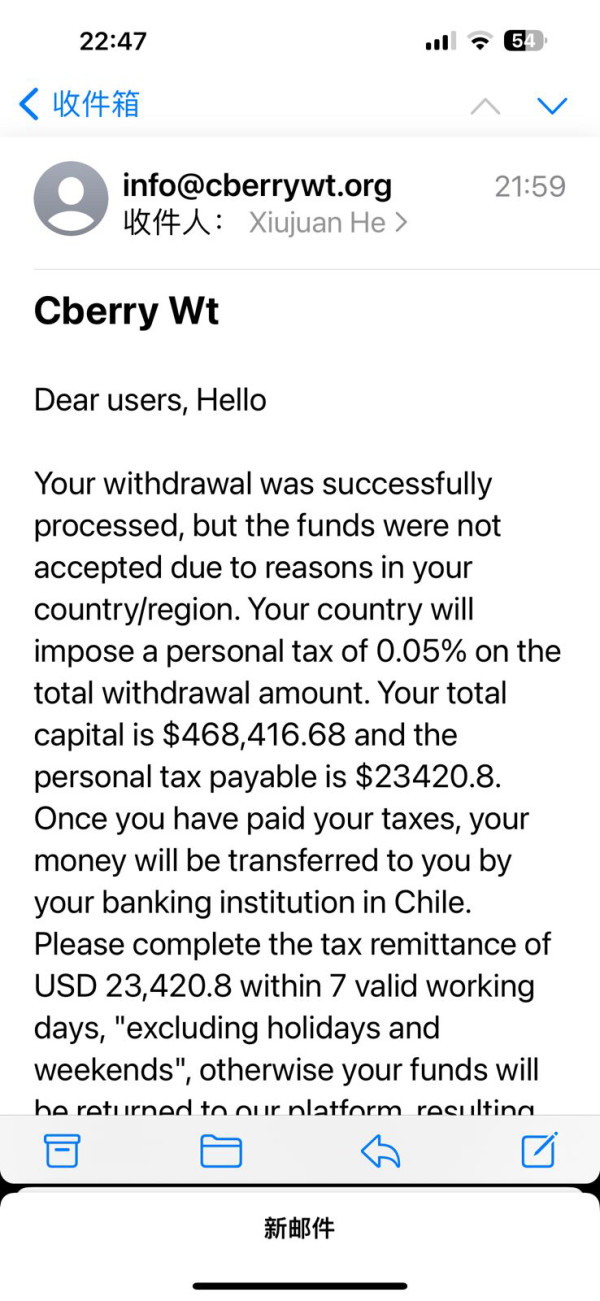

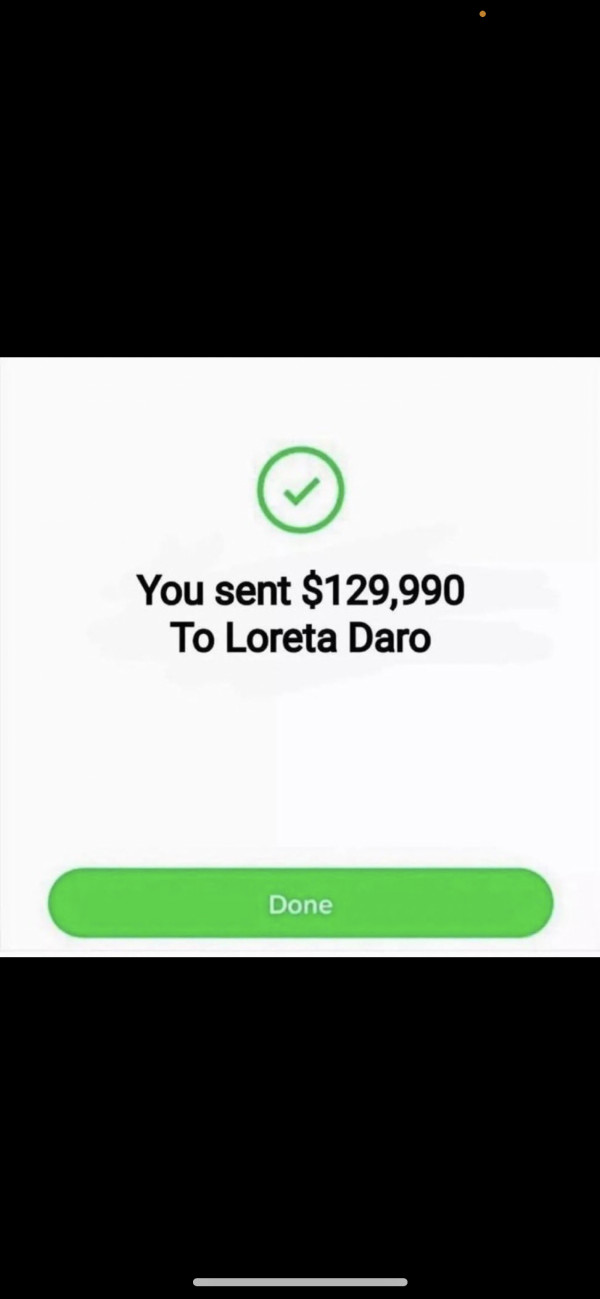

Fund security measures are not clearly documented, creating uncertainty about segregation of client funds, insurance coverage, or compensation schemes that protect traders in case of broker insolvency, which means traders could lose everything if the company fails. These protections are standard among legitimate brokers and their absence is extremely concerning for anyone considering this broker.

Corporate transparency is severely lacking, with limited information available about company ownership, management team, or operational procedures that would allow traders to verify the company's legitimacy. This opacity makes it difficult to assess the broker's stability and long-term viability, creating additional uncertainty about the safety of deposited funds.

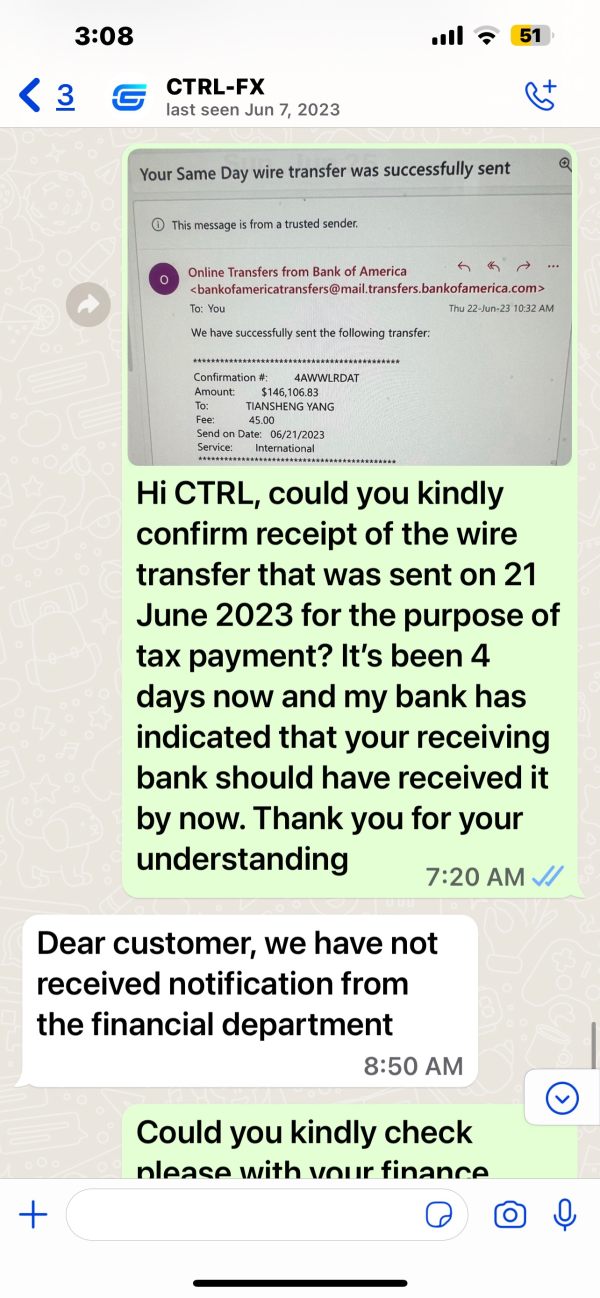

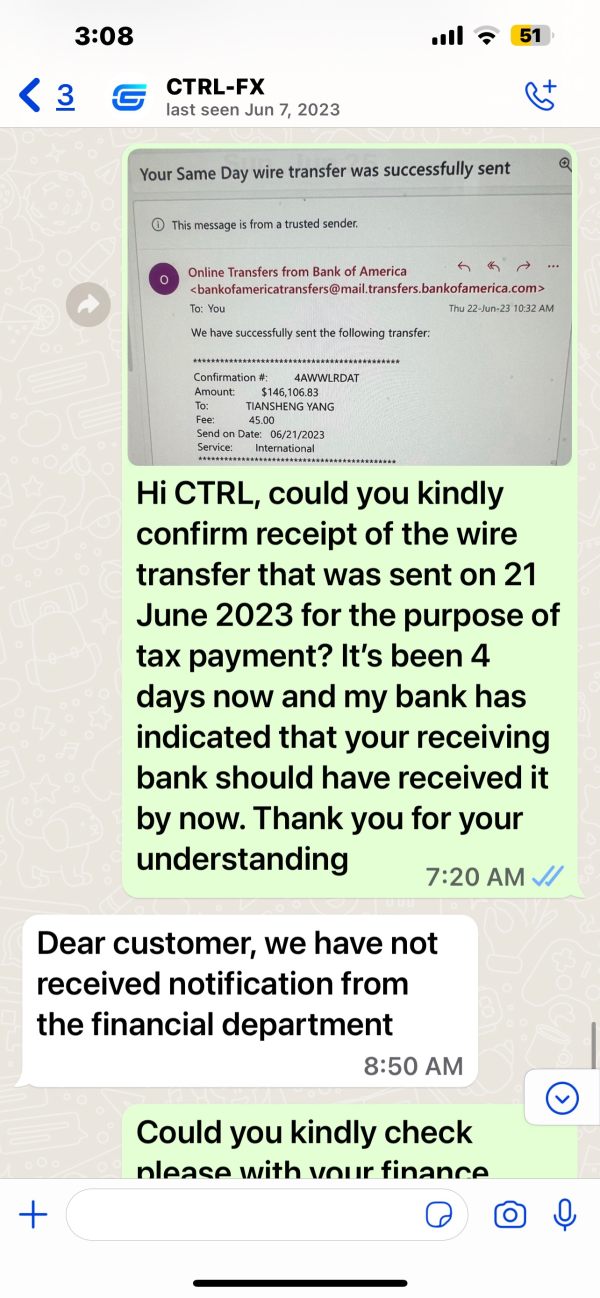

Industry reputation has been significantly damaged by multiple warnings from regulatory bodies and trading communities about potential risks associated with CTRL FX, creating a pattern of concern that cannot be ignored. The accumulation of negative reports and scam alerts represents a serious threat to trader safety and fund security.

User Experience Analysis (3/10)

User experience receives a poor rating based on consistently negative feedback from the trading community and significant deficiencies in service delivery that affect every aspect of dealing with this broker. Overall user satisfaction appears to be very low, with multiple reports of unsatisfactory interactions and concerns about the broker's legitimacy. The registration and verification process has been criticized for lack of clarity and poor communication, leading to frustration among potential clients who just want to open accounts and start trading without unnecessary complications.

Account opening procedures appear to be poorly designed and inadequately supported, creating barriers to smooth onboarding that discourage potential clients from completing the process.

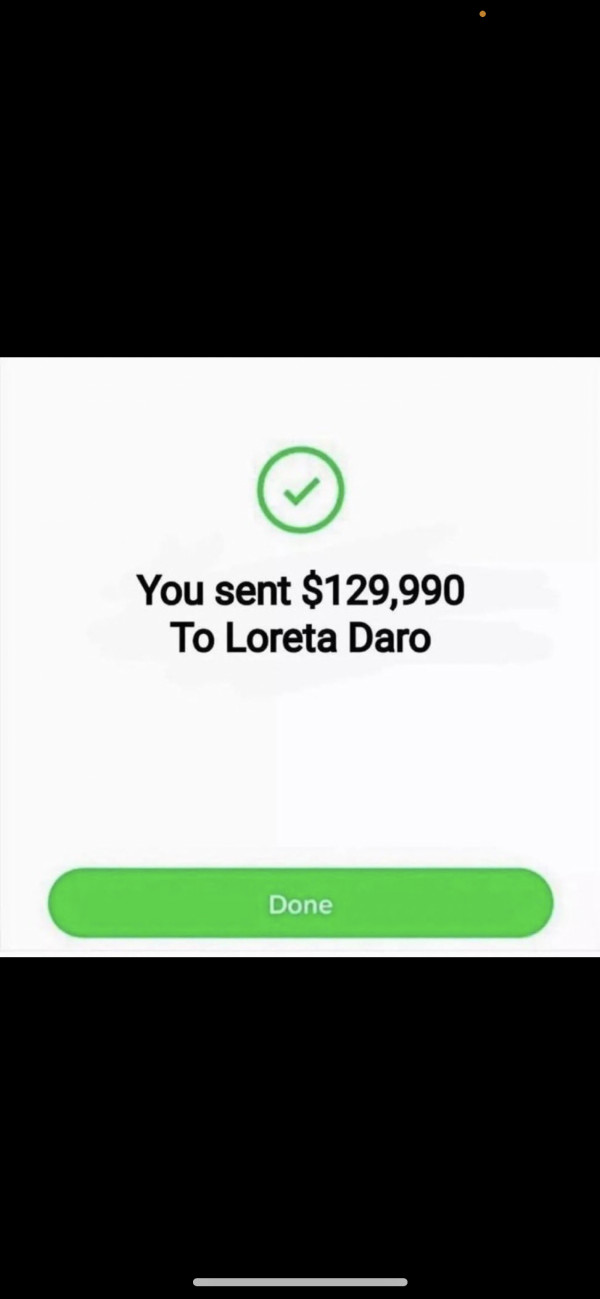

Interface design and platform usability are not well-documented, but available feedback suggests that the user experience falls short of modern standards that traders have come to expect from professional brokers. Professional traders expect intuitive, efficient platforms that facilitate rather than hinder their trading activities. Fund management operations, including deposits and withdrawals, lack clear documentation about procedures, timeframes, and associated costs, creating anxiety and uncertainty for users who need reliable access to their money.

This uncertainty creates anxiety among users who need reliable access to their funds and cannot afford to have their money tied up in unclear processes.

The most common user complaints center on concerns about the broker's legitimacy, regulatory status, and fund safety, which are fundamental issues that affect every aspect of the trading relationship. These fundamental issues overshadow any potential positive aspects of the user experience and create an environment of uncertainty and risk that is unsuitable for serious traders.

Conclusion

This comprehensive ctrl fx review reveals a broker with significant deficiencies across all major evaluation categories that make it unsuitable for serious traders. CTRL FX's lack of proper regulatory authorization, limited transparency about trading conditions, and poor user feedback combine to create substantial risks for potential clients. The broker may appeal to traders seeking high-risk, high-leverage opportunities, but the regulatory gaps and safety concerns make it unsuitable for serious investors who prioritize fund security and professional service standards that protect their money and trading success.

The absence of clear information about basic trading parameters, combined with concerning user testimonials, suggests that CTRL FX does not meet the standards expected from legitimate forex brokers in today's competitive market.

Traders are strongly advised to consider well-regulated alternatives that provide transparent trading conditions, robust client protections, and professional service standards that actually support successful trading activities. The risks associated with CTRL FX appear to significantly outweigh any potential benefits. This makes it a poor choice for forex trading activities.