Da Xin, known in Chinese as 達 信 金融, was founded approximately 2–5 years ago and claims to operate from China. It lacks any valid regulatory licenses, marking it as a high-risk player in the forex market. This absence of oversight raises serious concerns about its operational practices and fund safety.

Da Xin primarily engages in forex trading, offering access to various asset classes, including CFDs and commodities. However, the broker's representations of regulatory compliance are misleading, as there are no valid regulatory bodies overseeing its operations. This lack of regulatory framework poses a substantial risk to traders.

The risk in trading with Da Xin stems heavily from its lack of regulatory oversight. Without the checks and balances that come from regulation, traders are exposed to significant uncertainties.

The contradictory information surrounding Da Xin's regulatory status intensifies the inherent risks. Traders must independently verify any claims made by the broker. Below is a self-verification guide:

- Visit Regulatory Websites: Use platforms like NFA and FCA to check if Da Xin is mentioned.

- Confirm Contact Information: Ensure that the broker's physical address is verifiable through mapping services.

- Look for Registration Information: Search for any official registrations that indicate legitimacy.

- Assess Social Media Presence: Investigate the broker's visibility on platforms like Twitter and Facebook for additional user feedback.

- Gather User Reviews: Visit forums and financial review sites for diverse testimonials regarding users' experiences.

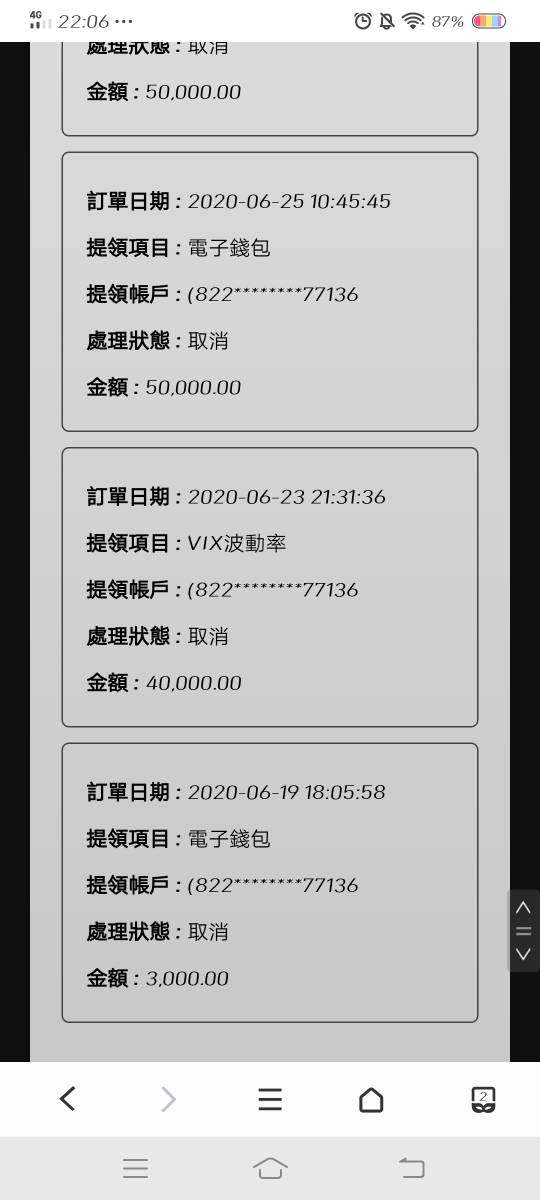

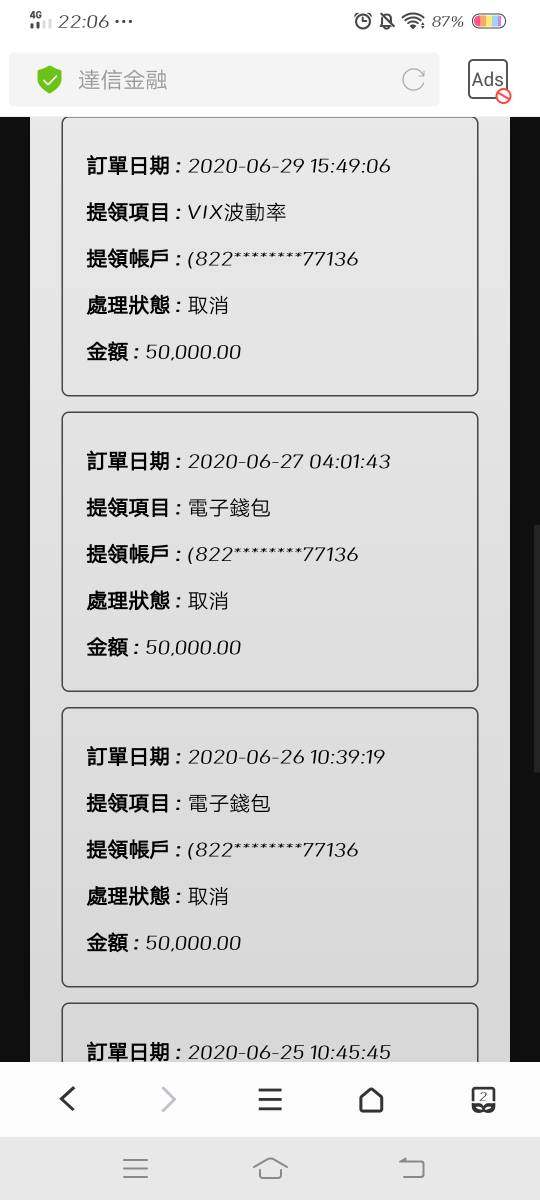

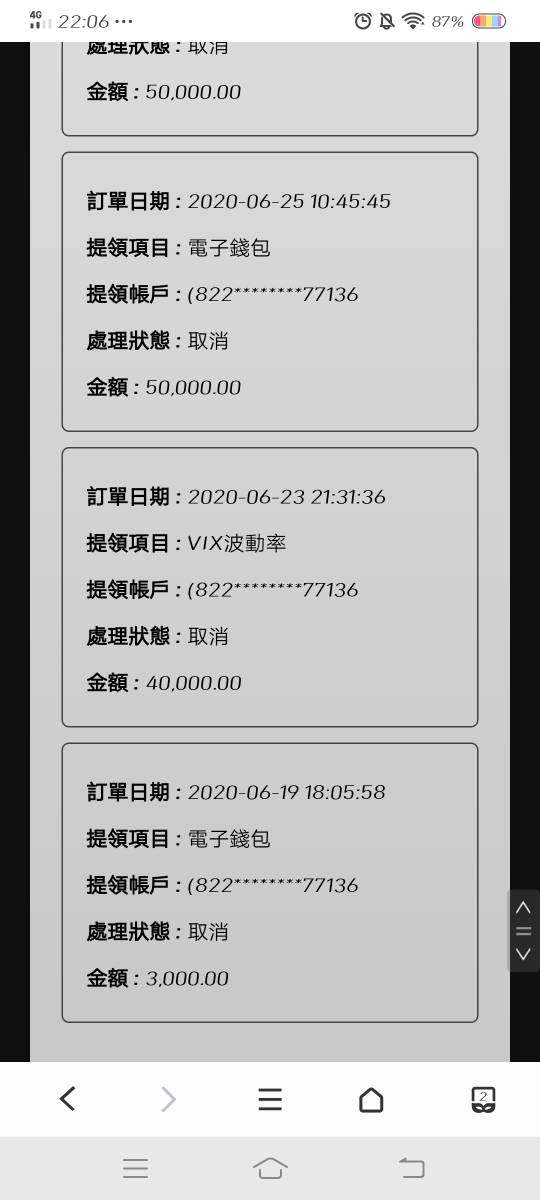

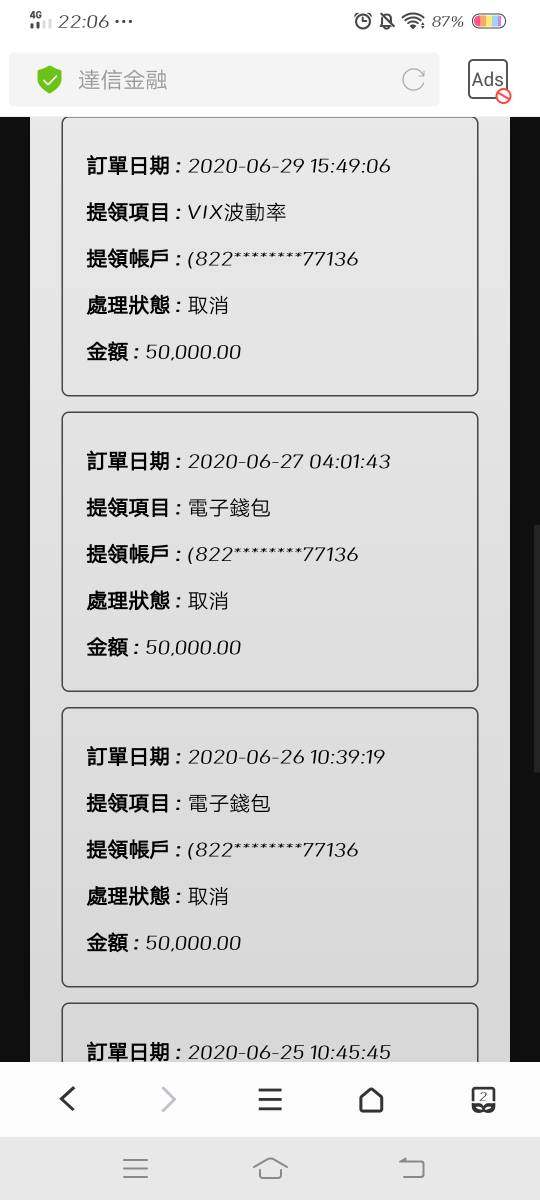

“...Da Xin has given no access to withdrawals for 2 months. The service doesnt reply.” — User Complaint

Evaluating community sentiment regarding fund safety remains critical, especially given the historical behavior of unreliable brokers.

Trading Costs Analysis

Da Xin presents a dual-edged sword when it comes to trading costs. On one hand, the broker offers competitive commission structures. On the other hand, users remain apprehensive about unexpected fees, notably high withdrawal charges.

Traders reported the following concerns:

“I deposited 61 thousand in total and profited...but the service continued to ask me to add fund and even gave no reply later. I was scammed of 60 thousand by this illegal platform.” — User Complaint

This highlights the importance of understanding the full cost structure beyond mere trading fees. While low commission rates can attract traders, hidden charges, such as the withdrawal fee of $30, can erode overall profitability.

Da Xins trading platform is noted for its lack of sophisticated features typically offered by established brokers. While it provides basic tools, advanced traders may find themselves limited by its capabilities.

The assessment is predominantly based on user feedback, which illustrates a mix of usability experiences:

“...mixed feedback on service quality.” — Summary of User Experience

This suggests that while Da Xin's platform may cater to basic trading needs, it fails to meet the expectations of more seasoned traders seeking in-depth market analysis and nuanced trading capabilities.

User Experience Analysis

The user experience associated with Da Xin is marred by reports of poor service quality and withdrawal issues. Despite some positive feedback regarding its trading tools, negative experiences regarding customer support dominate users' perceptions.

Moreover, several individuals have expressed frustration:

“...I was introduced here by a sister. At first, she asked me to deposit 1000... I could only withdraw a fraction during a financial crunch.” — User Complaint

This paints a troubling picture of the broker's overall user engagement and responsiveness, which is essential for fostering trust among traders.

Customer Support Analysis

Da Xin's customer support has garnered criticism for being inadequate and slow to respond. Multiple complaints indicate a high level of dissatisfaction among users, particularly regarding withdrawal inquiries and overall support responsiveness.

Feedback indicates that:

“...the service...even gave no reply later.” — User Complaint

These concerns necessitate extreme caution for potential clients considering this broker, especially when timely support is critical in a trading environment.

Account Conditions Analysis

The terms and conditions associated with Da Xin are described as vague and often misleading, contributing to user dissatisfaction. The lack of transparency regarding withdrawal processes and account management creates a perilous environment for traders.

To mitigate risks, it's crucial for traders to thoroughly read and understand the broker's policies before committing funds. Additionally, a careful examination of the operational practices should be undertaken.

Conclusion

In summary, Da Xin is a high-risk forex broker that poses significant challenges in terms of trustworthiness, trading costs, customer support, and overall user experience. Without regulatory oversight, the risks of engaging with this broker significantly outweigh the potential rewards.

Traders are strongly advised to perform due diligence, verify details independently, and consider alternative brokers with robust regulatory frameworks to ensure a safer trading experience.