TradeFX Review 1

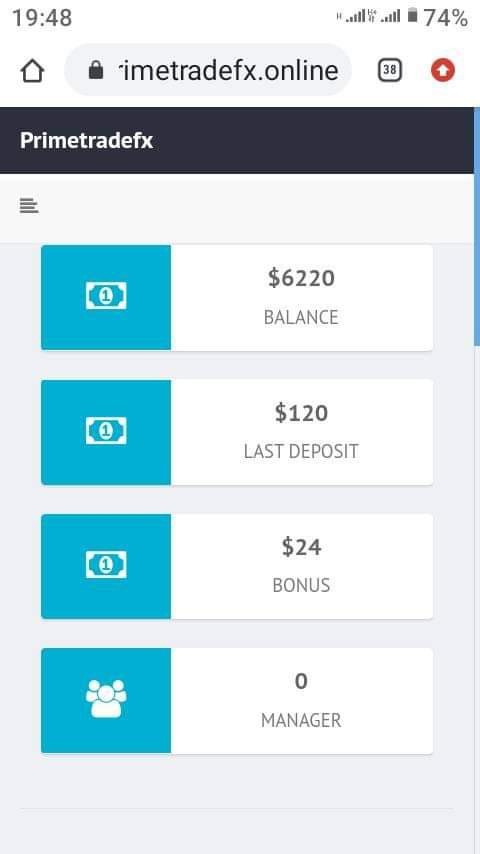

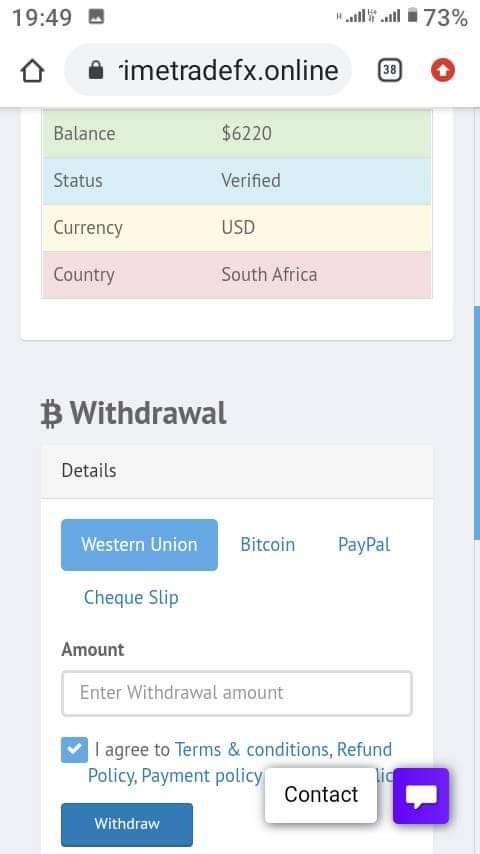

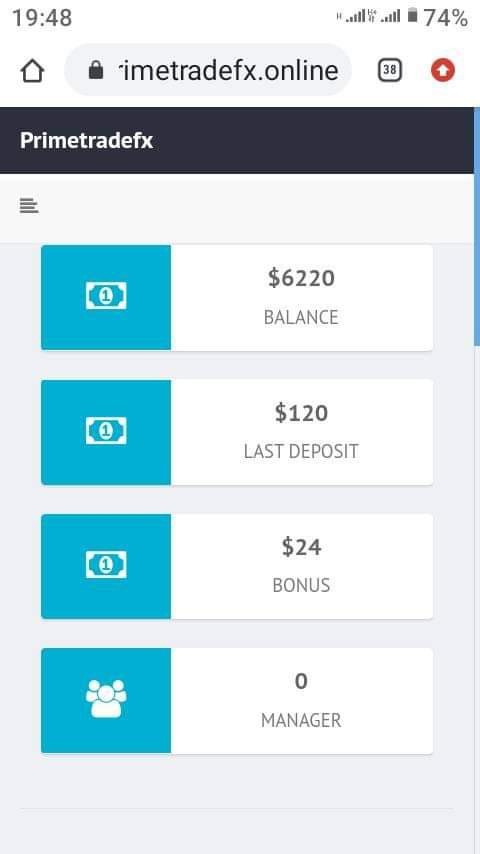

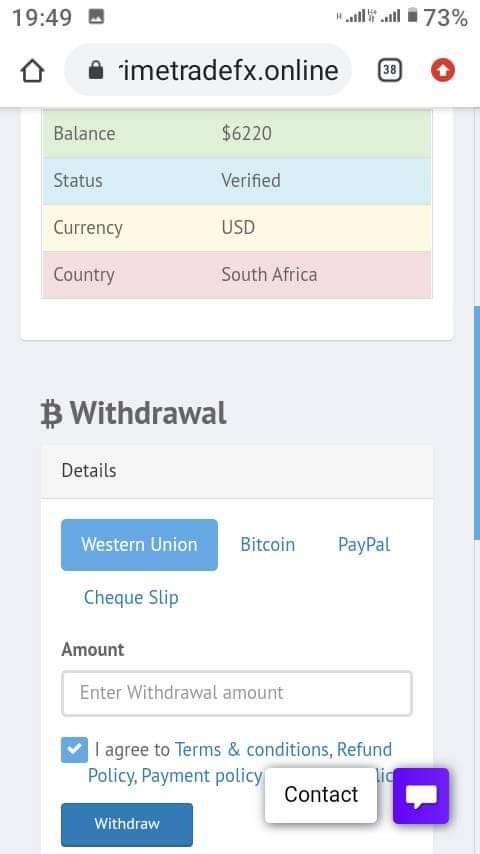

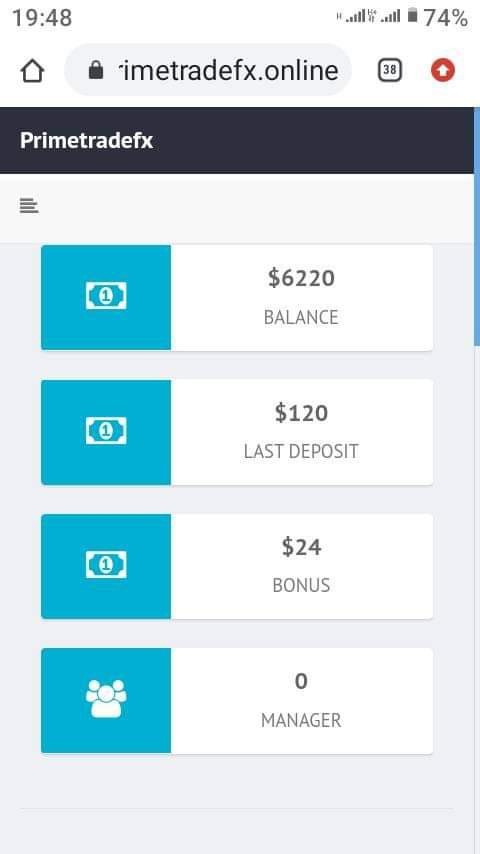

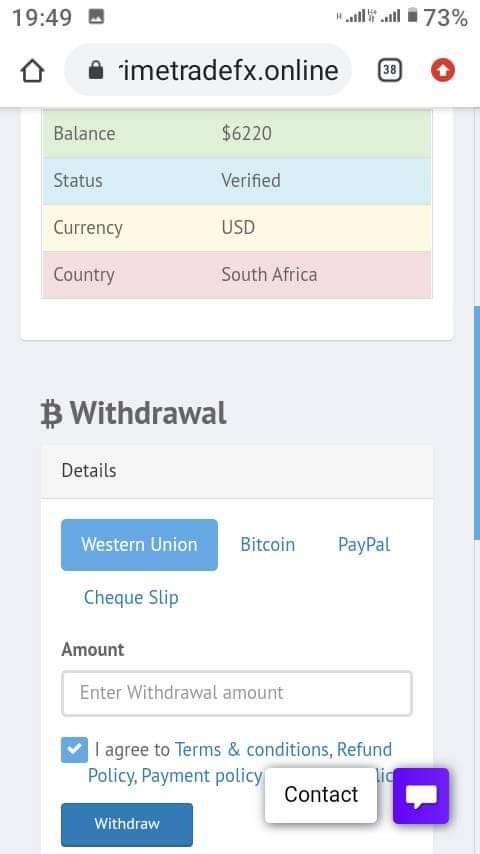

i cant withdraw my money 6k usd inside the portal. they give a lot of excuses. please stay away

TradeFX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

i cant withdraw my money 6k usd inside the portal. they give a lot of excuses. please stay away

TradeFX is an established forex broker that has been operating for over 12 years. The company has its headquarters in the UK. Based on available information, the broker offers multiple account types with reasonable trading conditions and primarily targets small to medium-sized investors who want variable spreads and high leverage options. The platform uses the popular MetaTrader 4 trading software. It offers commission-free trading on most account types, except for ECN Pro accounts.

The broker's asset portfolio includes over 50 currencies, more than 50 stocks, 15 indices, oil, and gold trading opportunities through CFD instruments. TradeFX presents itself as a leading market provider for international payments and currency exchange, but this tradefx review reveals both strengths and areas that need careful consideration. The platform appears suitable for traders who prioritize MT4 functionality and diverse trading instruments. However, regulatory transparency remains a concern that potential clients should thoroughly investigate before committing funds.

Regional Entity Differences: TradeFX's regulatory information is not clearly disclosed in available materials. Investors must independently verify regulatory compliance and legal requirements in their respective jurisdictions before engaging with the broker's services.

Review Methodology: This evaluation is based on publicly available information and user feedback from various sources. No direct platform testing or on-site verification has been conducted for this assessment.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | 7/10 | Multiple account types available, commission-free structure for most accounts, reasonable leverage levels |

| Tools and Resources | 8/10 | MT4 platform support, diverse trading instruments covering forex and CFDs |

| Customer Service | 6/10 | Limited specific information about service quality and response times |

| Trading Experience | 7/10 | MT4 platform reliability, positive user feedback exists but lacks detail |

| Trust and Safety | 5/10 | Insufficient regulatory disclosure, unclear fund protection measures |

| User Experience | 6/10 | Some positive feedback available, but comprehensive user satisfaction data unavailable |

TradeFX has established itself in the forex market for over 12 years. The company positions itself as a comprehensive provider of international payment solutions and currency exchange services. The company operates from Trade FX Ltd, located at 266 Farnham Road Slough Berkshire SL1 4XL UK, and focuses primarily on forex and CFD trading services. The broker's business model targets both private clients seeking international investment opportunities and businesses requiring same-day international payment processing with currency risk management solutions.

The platform's core offering centers around the MetaTrader 4 trading environment and provides access to a substantial range of tradeable assets. TradeFX's asset portfolio includes over 50 currency pairs, more than 50 individual stocks, 15 major indices, plus commodities including oil and gold through CFD instruments. According to available information, the broker operates with a commission-free structure across most account types and implements variable spreads as the primary revenue model. However, specific regulatory oversight details remain unclear in publicly available documentation, which represents a significant consideration for potential clients in this tradefx review.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing TradeFX operations. Prospective clients must conduct independent verification.

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures are not detailed in accessible materials.

Minimum Deposit Requirements: Concrete minimum deposit amounts for different account tiers are not specified in available documentation.

Bonus and Promotions: Current promotional offerings or bonus structures are not explicitly outlined in reviewed materials.

Tradeable Assets: The platform provides access to an extensive range including 50+ currency pairs, 50+ individual stocks, 15 major indices, oil, and gold through CFD trading mechanisms.

Cost Structure: TradeFX implements variable spreads across its trading instruments. The broker offers commission-free execution on most account types. The ECN Pro account represents the exception and incorporates commission charges alongside potentially tighter spreads.

Leverage Ratios: The broker offers reasonable leverage levels according to available information. However, specific maximum ratios are not detailed.

Platform Options: Trading operations are conducted exclusively through the MetaTrader 4 platform. The platform supports various analytical tools and automated trading capabilities.

Geographic Restrictions: Specific regional limitations or prohibited jurisdictions are not clearly defined in accessible materials.

Customer Support Languages: Available customer service language options are not specified in reviewed documentation.

This tradefx review highlights the need for prospective clients to conduct direct inquiries regarding these operational details.

TradeFX's account structure demonstrates flexibility by offering multiple account types designed to accommodate various trading preferences and risk tolerances. The commission-free model across most account categories provides cost-effective trading for volume-conscious traders and is particularly beneficial for those executing frequent transactions. However, the ECN Pro account introduces commission charges and presumably offers enhanced execution conditions and tighter spreads in exchange.

The broker's approach to leverage appears reasonable according to available information. However, specific maximum ratios require direct verification. This conservative stance potentially appeals to risk-conscious traders while maintaining accessibility for those seeking enhanced market exposure. The variable spread structure allows for competitive pricing during optimal market conditions, though traders should anticipate wider spreads during volatile periods.

Account opening procedures and minimum deposit requirements remain unclear in public documentation. This necessitates direct broker contact for precise details. The absence of Islamic account information in available materials may limit accessibility for Sharia-compliant trading requirements. Overall, while TradeFX's account framework shows promise, the lack of transparent condition disclosure impacts the comprehensiveness of this tradefx review assessment.

The MetaTrader 4 platform foundation provides TradeFX clients with industry-standard trading functionality. This includes comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. MT4's proven reliability and extensive customization options represent significant advantages for both novice and experienced traders seeking familiar trading environments.

TradeFX's asset diversity spans forex, stocks, indices, and commodities through CFD instruments and offers portfolio diversification opportunities within a single platform. The inclusion of over 50 currency pairs covers major, minor, and exotic combinations, while the 50+ stock selection and 15 indices provide exposure to global equity markets. Commodity access through oil and gold CFDs rounds out the offering for traders seeking alternative asset exposure.

However, specific research and analysis resources, educational materials, and market commentary availability remain unspecified in reviewed documentation. The absence of proprietary analytical tools or third-party research partnerships limits the platform's value proposition for traders requiring comprehensive market insights. Advanced trading features beyond standard MT4 functionality are not detailed and potentially restrict sophisticated trading strategies. These resource limitations represent notable considerations in evaluating TradeFX's competitive positioning.

Customer service quality and accessibility information remains limited in available TradeFX documentation. This creates uncertainty regarding support standards and response capabilities. The absence of specific customer service channels, operating hours, and response time commitments makes it difficult to assess the broker's dedication to client support excellence.

Multi-language support availability is not specified and potentially limits accessibility for non-English speaking clients. Live chat, telephone support, and email response systems are not explicitly detailed, leaving prospective clients uncertain about preferred communication methods and availability windows. The lack of dedicated account management services or premium support tiers for higher-volume clients represents another information gap.

Problem resolution procedures and escalation processes are not outlined in accessible materials. This raises questions about dispute handling and client advocacy capabilities. Educational support through webinars, tutorials, or market analysis sessions is not mentioned and limits the broker's value proposition for developing traders. Without comprehensive customer service transparency, this aspect of TradeFX operations remains a significant unknown factor requiring direct investigation by prospective clients.

The MetaTrader 4 platform provides TradeFX clients with a stable and familiar trading environment. However, specific performance metrics regarding execution speed and platform reliability are not detailed in available information. User feedback suggests positive experiences exist, but comprehensive performance data and independent testing results are not accessible for objective evaluation.

Order execution quality, including slippage rates and requote frequency, remains unspecified in reviewed materials. The variable spread structure suggests market-making operations, though the specific execution model and liquidity provider relationships are not transparent. Trade execution speeds and server locations, critical factors for active trading strategies, are not documented in available resources.

Mobile trading capabilities through MT4 mobile applications are presumably available. However, specific mobile platform features and optimization are not detailed. Advanced order types, one-click trading functionality, and platform customization options follow standard MT4 capabilities, but broker-specific enhancements are not highlighted. The absence of detailed trading condition specifications and performance metrics limits the depth of trading experience assessment in this tradefx review.

Regulatory oversight represents the most significant concern in TradeFX's trust profile. Specific regulatory authorities and license numbers are not clearly disclosed in available documentation. This regulatory opacity creates substantial uncertainty regarding client fund protection, dispute resolution mechanisms, and operational oversight standards. Prospective clients must independently verify regulatory compliance in their jurisdictions.

Fund segregation policies, client money protection schemes, and insurance coverage details are not specified in accessible materials. The absence of transparent financial reporting, audited statements, or third-party fund security verification creates additional uncertainty regarding capital protection measures. Negative balance protection policies and risk management procedures are not explicitly outlined.

Industry reputation indicators, including awards, certifications, or professional association memberships, are not prominently featured in available information. Historical performance data, company financial stability indicators, and management team credentials are not transparently disclosed. These transparency limitations significantly impact trust assessment and represent primary concerns for risk-conscious investors considering TradeFX services.

Overall user satisfaction metrics and comprehensive feedback analysis are not readily available in reviewed TradeFX materials. This limits objective user experience assessment. While some positive feedback is mentioned, detailed user testimonials, satisfaction surveys, or independent review aggregations are not accessible for thorough evaluation.

Platform interface design and usability follow standard MT4 conventions and provide familiar navigation and functionality for experienced MT4 users. However, broker-specific interface enhancements, custom tools, or user experience improvements are not detailed in available documentation. Registration and account verification processes are not explicitly outlined and create uncertainty about onboarding efficiency and requirements.

Funding operation experiences, including deposit processing times, withdrawal procedures, and transaction fees, are not comprehensively detailed. Common user complaints or recurring issues are not transparently addressed in available materials and limit insight into potential operational challenges. The target user profile appears focused on small to medium-sized investors seeking MT4 functionality, though specific user demographic data and satisfaction metrics require direct investigation.

TradeFX presents itself as an established forex broker with over 12 years of market presence. The company offers a straightforward trading environment through the reliable MetaTrader 4 platform. The broker's commission-free structure across most account types and diverse asset selection including forex, stocks, indices, and commodities provides reasonable value for cost-conscious traders seeking portfolio diversification opportunities.

However, significant transparency concerns regarding regulatory oversight, fund protection measures, and operational details limit the comprehensiveness of this evaluation. The absence of clear regulatory disclosure represents a primary consideration for risk-aware investors, while limited customer service information and user feedback data create additional uncertainty. TradeFX appears most suitable for small to medium-sized investors comfortable with MT4 platforms and variable spread trading conditions, though thorough due diligence regarding regulatory compliance and operational transparency remains essential before account opening.

Prospective clients should conduct direct broker verification regarding regulatory status, account conditions, and service standards to make informed decisions based on their individual trading requirements and risk tolerance levels.

FX Broker Capital Trading Markets Review