JFD Bank 2025 Review: Everything You Need to Know

Executive Summary

JFD Bank is a well-established foreign exchange and CFD broker. The company has been serving traders since 2011 with reliable service and strong regulatory oversight. This jfd bank review shows that the company operates under multiple regulatory frameworks, including BaFin in Germany, CySEC in Cyprus, and VFSC in Vanuatu. These regulations provide traders with enhanced security and regulatory oversight that protects their investments.

The broker stands out through its comprehensive offering of over 1,500 trading instruments across nine asset classes. This includes 600 physical stocks from major US and European companies that traders can access directly. Key highlights include leverage of up to 1:400 for non-EU clients and 1:30 for EU clients due to ESMA regulations. The minimum deposit requirement is $500 USD, which makes it accessible to serious traders.

JFD Bank uses STP and DMA execution models for faster order processing. This positioning makes it a suitable choice for intermediate to advanced traders seeking diversified investment opportunities across multiple markets. The broker serves primarily retail and institutional investors looking for multi-asset trading capabilities across forex, commodities, metals, indices, and equity markets.

However, traders should note that 27% of retail investor accounts lose money when trading CFDs with JFD Bank according to available data. This emphasizes the importance of risk management and proper education before engaging in leveraged trading activities that can result in significant losses.

Important Notice

JFD Bank operates through multiple entities across different jurisdictions. This means trading conditions and regulatory protections may vary depending on your location and which entity you trade with. European Union clients are subject to ESMA regulations that limit leverage to 1:30 for their protection. Clients in other jurisdictions may access higher leverage ratios up to 1:400, which increases both potential profits and risks.

This jfd bank review is based on publicly available information and regulatory filings as of 2025. Potential traders should verify current terms and conditions directly with the broker before opening an account to ensure accuracy. The evaluation methodology employed in this review considers regulatory compliance, trading conditions, available instruments, and publicly disclosed information from official sources.

Traders should conduct their own due diligence and consider their individual financial circumstances before making any trading decisions. CFD trading involves significant risk of loss due to leverage and market volatility.

Rating Framework

Broker Overview

Company Background and History

JFD Bank was established in 2011. The company has since developed into a multi-jurisdictional financial services provider with offices strategically located across Europe and beyond for better client service. The company maintains its primary operations from Munich and Ludwigsburg in Germany, Limassol in Cyprus, Port Vila in Vanuatu, and Varna in Bulgaria.

This geographic diversification allows JFD Bank to serve clients across different regulatory environments. The broker maintains compliance with local financial regulations in each jurisdiction where it operates. JFD Bank has built its reputation on providing institutional-grade trading infrastructure to retail and professional clients who demand high-quality execution.

The broker's business model centers around STP and DMA execution methods. This means client orders are routed directly to liquidity providers without dealer intervention, which can reduce conflicts of interest and improve execution quality for traders.

Trading Infrastructure and Asset Coverage

JFD Bank offers access to an extensive range of financial instruments. The broker provides over 1,500 tradeable assets spanning nine distinct asset classes for comprehensive market exposure. The offering includes traditional forex pairs, CFDs on commodities, precious metals, global indices, and notably, 600 physical stocks from leading US and European companies.

These stocks are listed on major exchanges and provide direct ownership rather than CFD exposure. This comprehensive asset coverage positions JFD Bank as a one-stop solution for traders seeking portfolio diversification across multiple markets. The broker operates under strict regulatory oversight from BaFin, CySEC, and VFSC.

This ensures compliance with international financial standards and provides clients with regulatory protections. These protections include segregated client funds and participation in investor compensation schemes where applicable under local regulations.

Regulatory Coverage and Compliance

JFD Bank maintains regulatory authorization across multiple jurisdictions for comprehensive client protection. BaFin regulation in Germany provides the highest level of regulatory oversight within the European Union framework with strict capital requirements. CySEC regulation in Cyprus offers additional EU-wide passporting rights that allow the broker to serve clients across Europe.

VFSC regulation in Vanuatu serves international clients outside the European regulatory perimeter. Each regulatory framework provides different levels of protection and compensation schemes for client funds and investments.

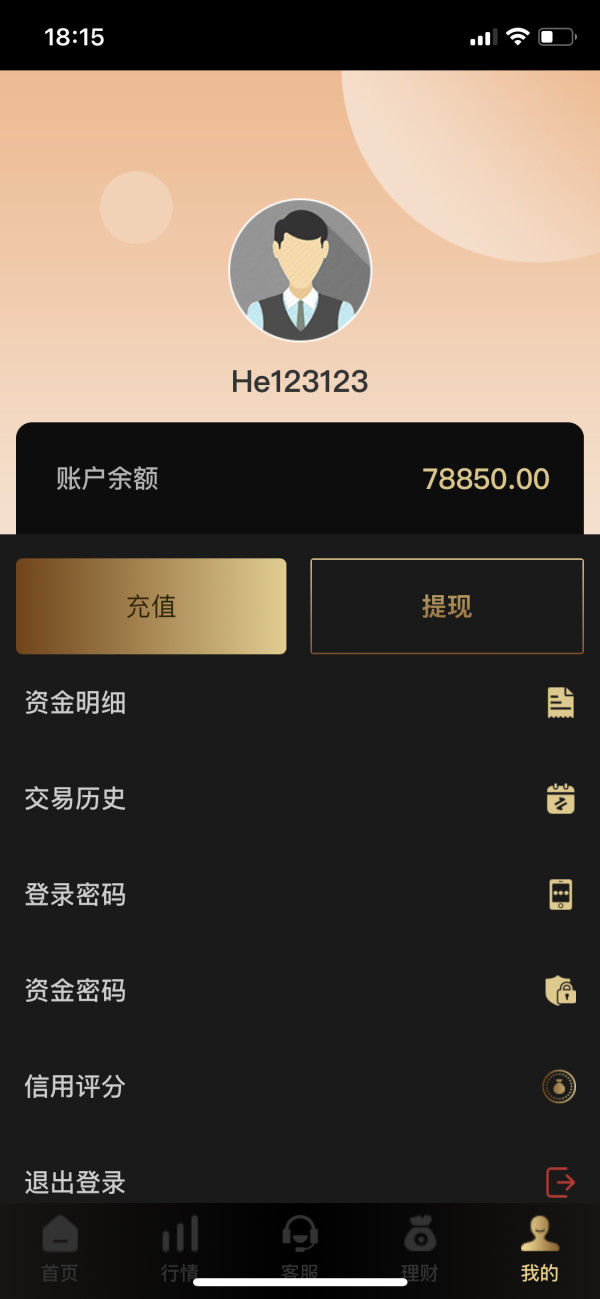

Minimum Deposit and Account Access

The broker sets its minimum deposit requirement at $500 USD. This positioning places it in the mid-range category for initial capital requirements among forex and CFD brokers. This threshold makes the platform accessible to serious retail traders while filtering out casual market participants who may not be committed to learning proper trading techniques.

The deposit requirement reflects the broker's focus on serving intermediate to advanced traders. New traders should ensure they understand the risks before depositing funds and beginning live trading activities.

Leverage Structure

JFD Bank offers differentiated leverage based on client location and regulatory requirements. Non-EU clients can access leverage up to 1:400 for maximum trading flexibility, while EU clients are restricted to 1:30 maximum leverage. This restriction complies with ESMA regulations implemented to protect retail investors from excessive leverage risks that can lead to significant losses.

Higher leverage increases both potential profits and potential losses from market movements. Traders should understand leverage mechanics before using these tools in their trading strategies.

Available Trading Instruments

The broker's instrument selection encompasses forex major, minor and exotic pairs for currency trading. CFDs on global indices provide exposure to stock market movements without owning individual stocks directly. Commodities include energy and agricultural products that respond to supply and demand factors, while precious metals offer portfolio diversification and inflation hedging opportunities.

Direct access to 600 physical stocks from major US and European exchanges provides ownership of actual company shares. This diversity enables traders to implement sophisticated trading strategies across correlated and uncorrelated asset classes for better risk management.

Execution Model and Technology

JFD Bank employs STP and DMA execution models according to available information. These models route client orders directly to institutional liquidity providers for faster processing and potentially better pricing. This approach typically results in faster execution speeds and reduced slippage compared to market maker models where the broker takes the opposite side of client trades.

The technology infrastructure supports high-frequency trading and algorithmic strategies. However, specific platform details and performance metrics were not detailed in available sources for this review.

Geographic Restrictions and Service Availability

While JFD Bank operates across multiple jurisdictions, specific geographic restrictions vary by location. Service availability details were not comprehensively outlined in available materials for this review. Prospective clients should verify service availability in their jurisdiction directly with the broker before attempting to open an account.

Different jurisdictions may have varying account types and trading conditions. Clients should understand their local regulatory environment and how it affects their trading relationship with the broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

JFD Bank's account structure demonstrates a balanced approach to serving different trader segments. The $500 minimum deposit requirement strikes a reasonable balance between accessibility and commitment to serious trading. This deposit level compares favorably with industry standards, falling in the middle range between ultra-low-barrier brokers and high-minimum institutional platforms that require much larger initial investments.

The leverage structure shows regulatory compliance awareness with appropriate risk management measures. EU clients receive ESMA-compliant 1:30 maximum leverage while international clients can access up to 1:400 leverage based on their jurisdiction. This differentiated approach demonstrates the broker's commitment to regulatory compliance while maximizing opportunities for clients in less restrictive regulatory environments.

However, specific account type details were not comprehensively outlined in available materials. The lack of detailed information about account tiers, Islamic account availability, or premium account features limits comprehensive evaluation. The broker's multi-jurisdictional regulatory framework provides different levels of protection depending on client location and chosen entity.

BaFin and CySEC regulation offer robust European Union protections including investor compensation schemes. These protections include segregated client fund requirements that keep client money separate from company operating funds for enhanced security.

JFD Bank excels in providing comprehensive market access through its extensive instrument selection. The broker offers over 1,500 tradeable assets across nine asset classes for sophisticated portfolio construction and risk management strategies. This breadth of coverage is particularly valuable for traders seeking exposure to multiple markets through a single platform rather than maintaining accounts with multiple brokers.

The inclusion of 600 physical stocks from major US and European exchanges represents a significant advantage. These stocks provide direct ownership rather than CFD exposure, which appeals to long-term investors and traders who want actual equity positions. The broker's asset class diversity spanning forex, commodities, metals, indices, and equities provides substantial opportunities for correlation trading and hedging strategies.

Market diversification capabilities allow traders to spread risk across different asset classes and geographic regions. This comprehensive offering positions JFD Bank competitively against specialized single-asset brokers and demonstrates institutional-level market access capabilities for retail clients.

However, specific details about research tools, market analysis resources, educational materials, or trading automation support were not available. These gaps limit the ability to fully assess the broker's value-added services beyond raw market access capabilities.

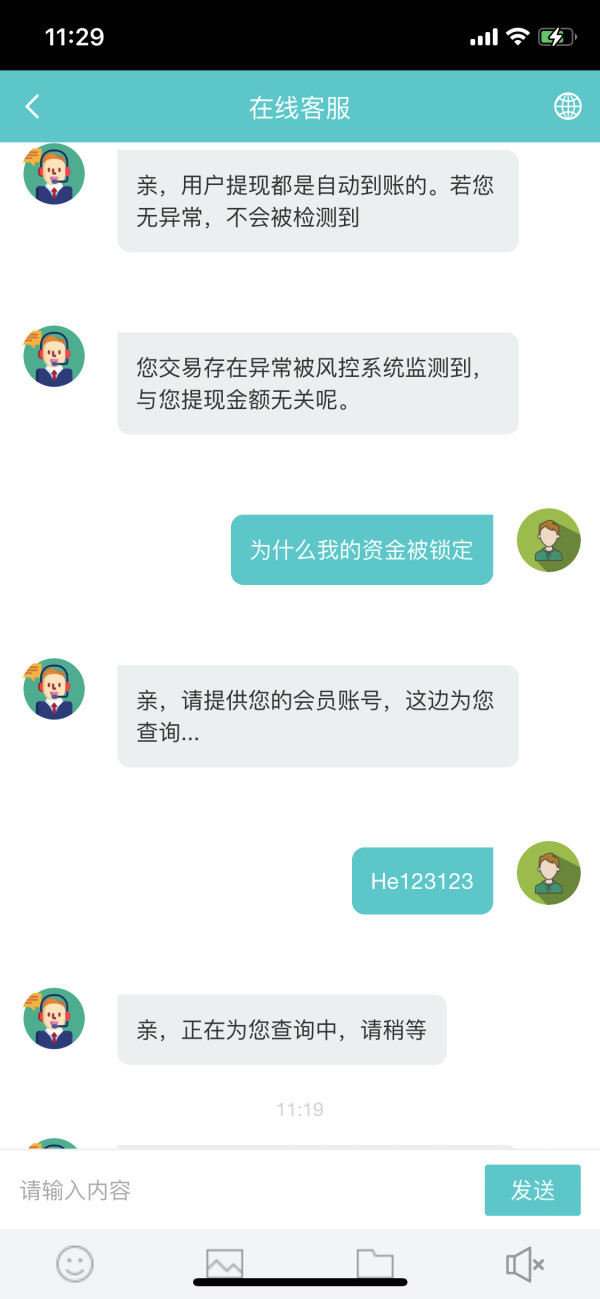

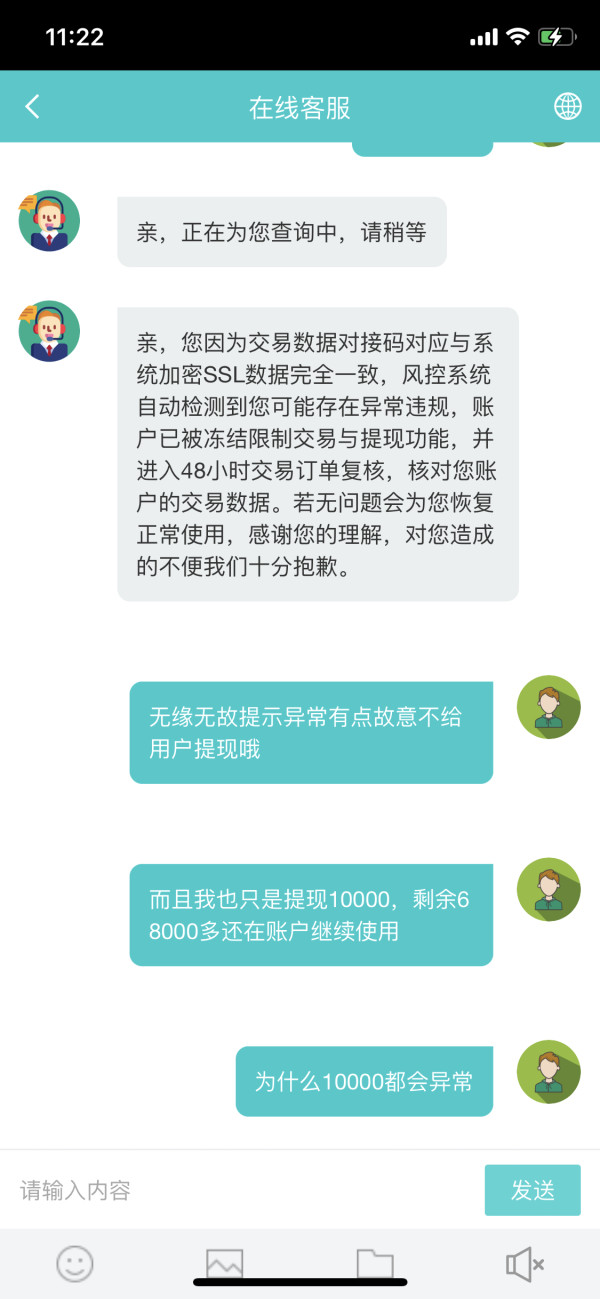

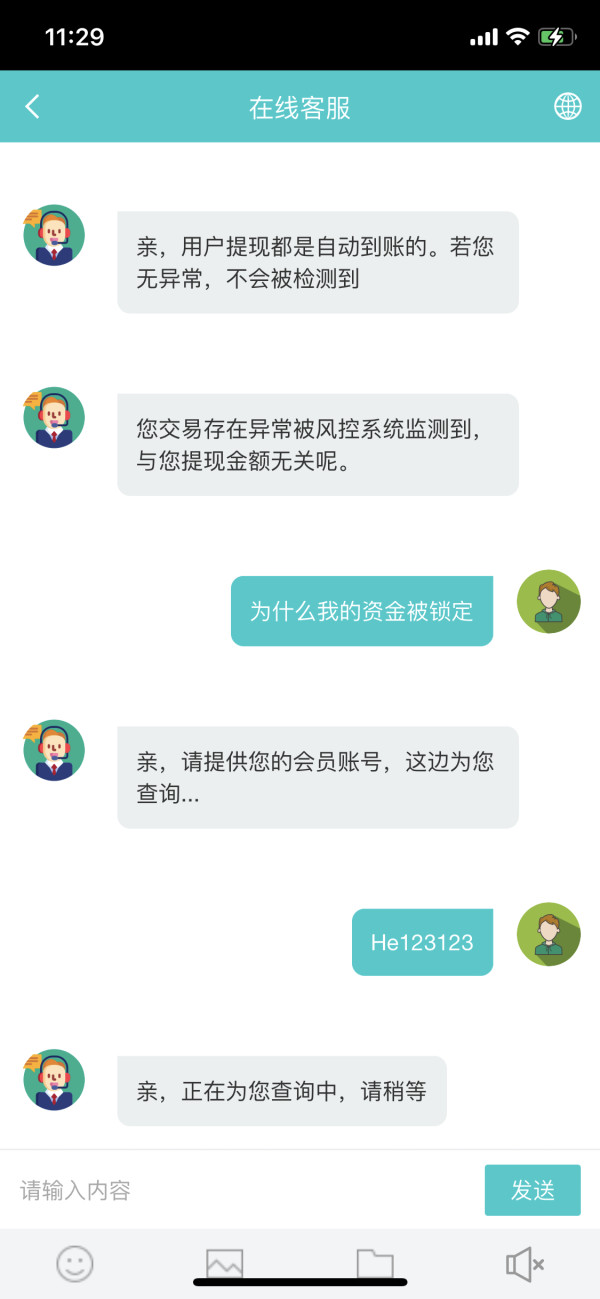

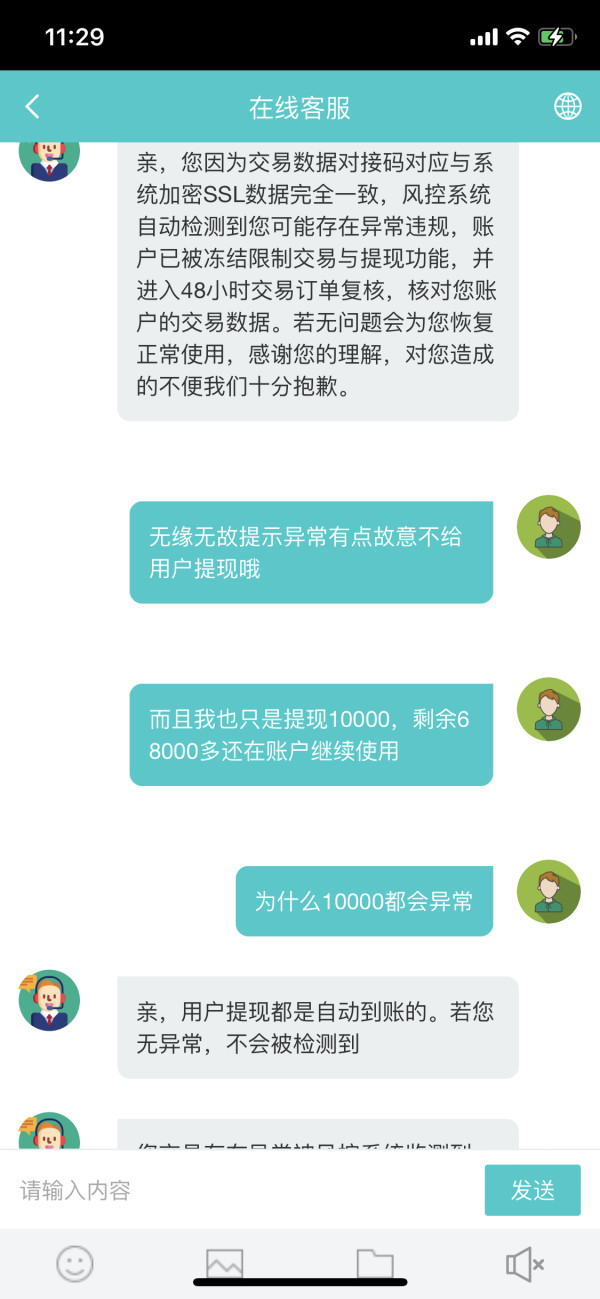

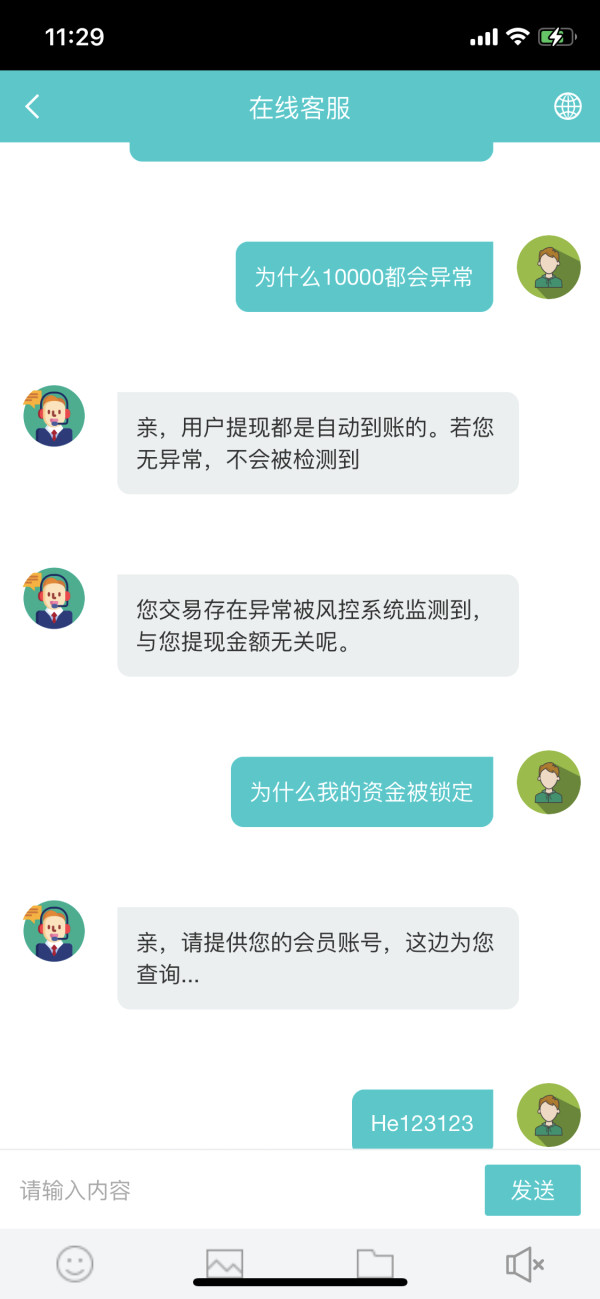

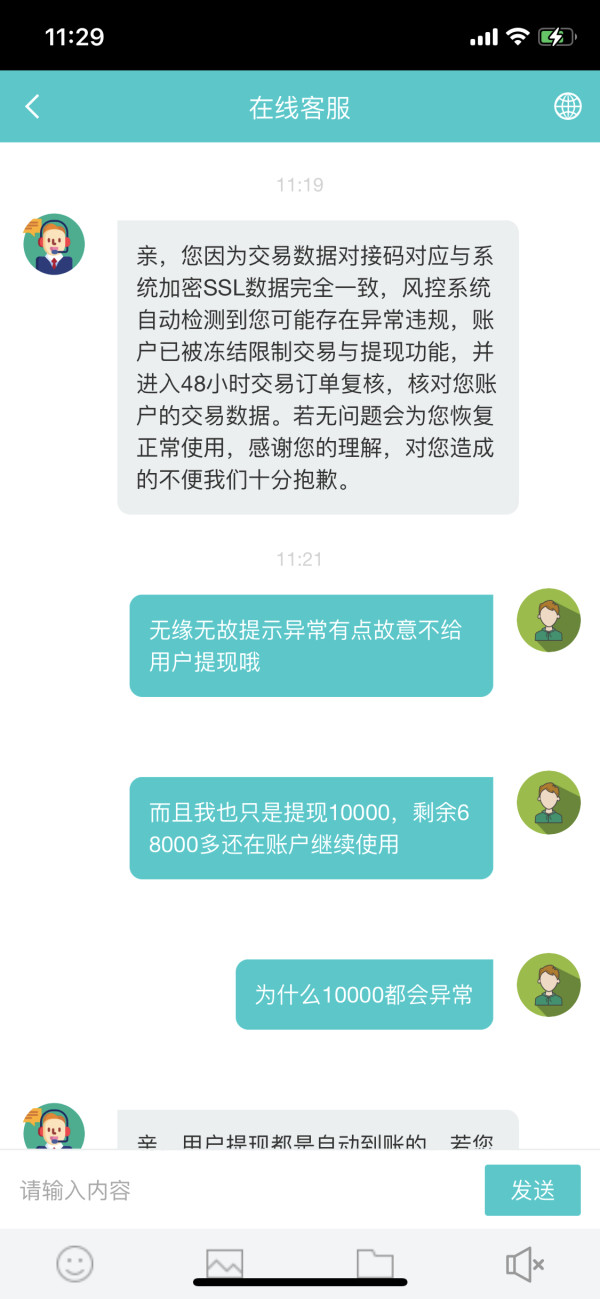

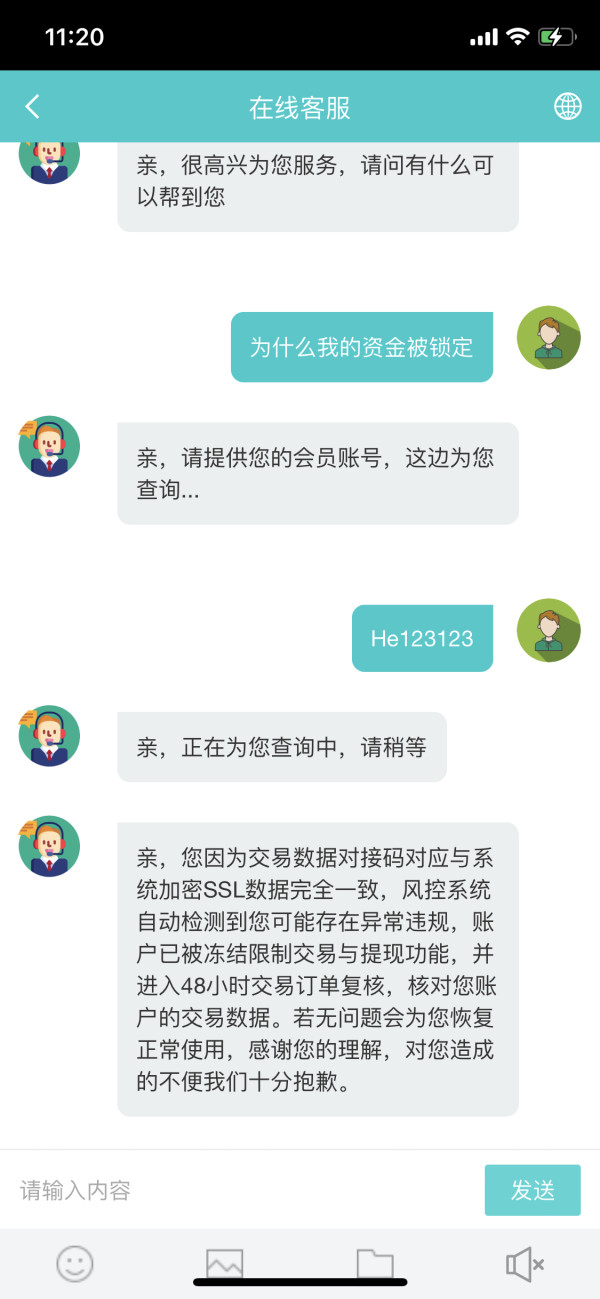

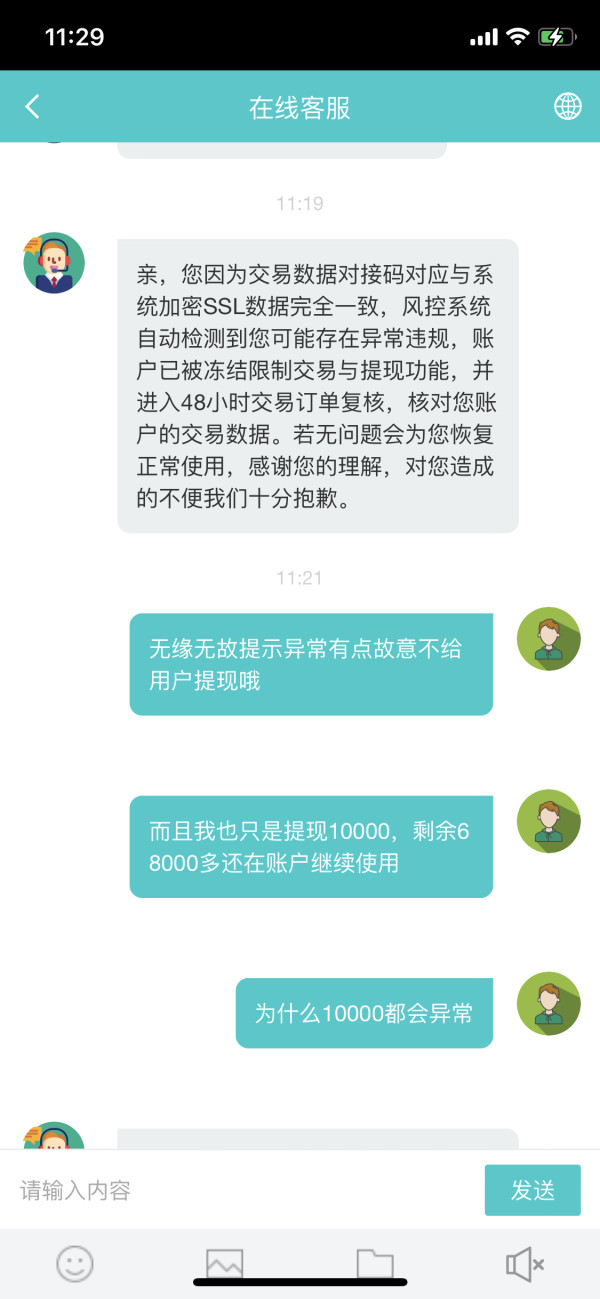

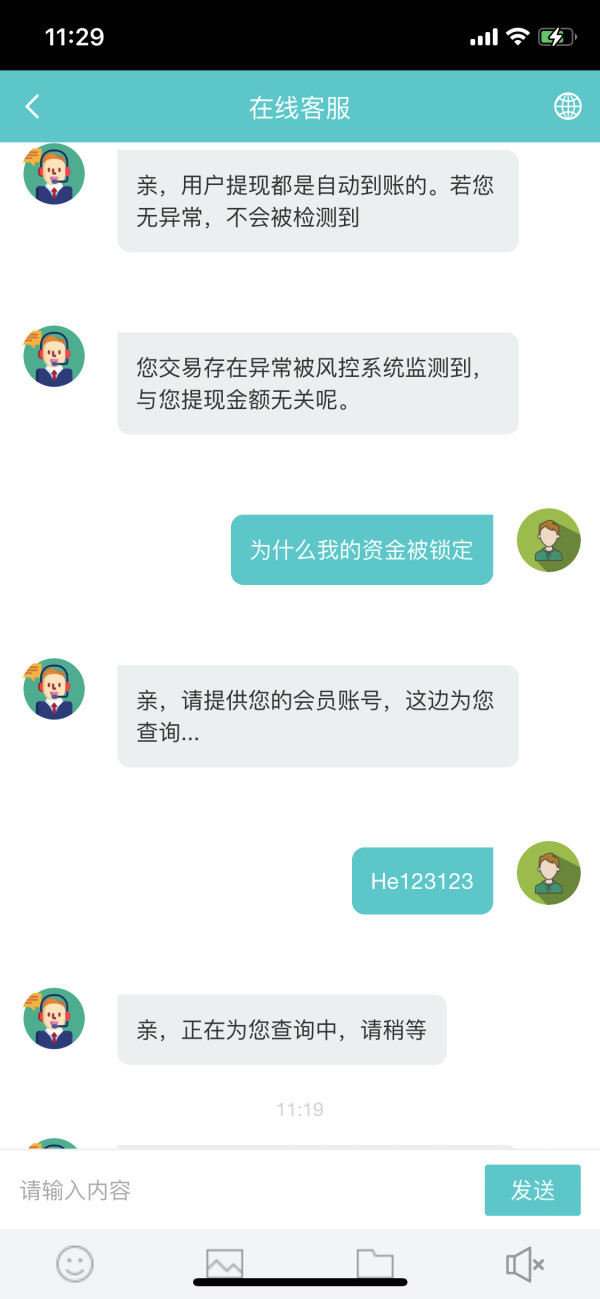

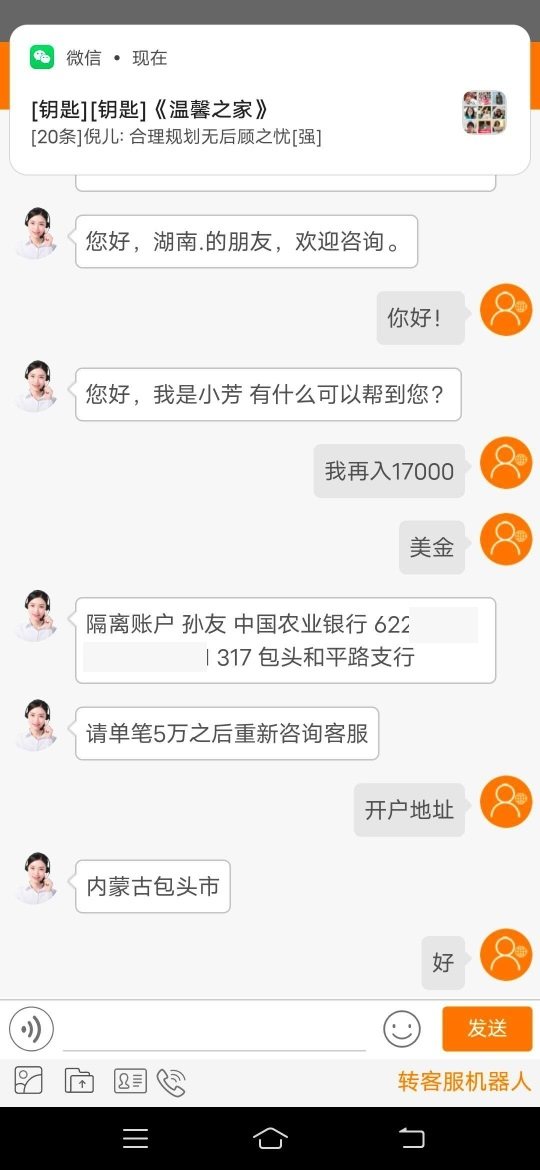

Customer Service and Support Analysis (Score: 6/10)

Customer service evaluation is constrained by limited available information about JFD Bank's support infrastructure. The broker's multi-jurisdictional presence suggests potential for localized support in different languages and time zones for better client service. However, specific details about support channels, availability hours, or service level commitments were not detailed in available materials for this review.

The absence of detailed customer service information represents a transparency gap. Potential clients may find this concerning, particularly given the importance of reliable support in financial services when issues arise. Modern traders expect multi-channel support including phone, email, live chat, and potentially social media engagement for quick problem resolution.

These specifics could not be verified from available sources for this jfd bank review. Without concrete user feedback or service quality metrics, it's challenging to assess response times or resolution effectiveness accurately.

Overall client satisfaction with support services remains unclear. This information gap suggests potential clients should directly inquire about support capabilities and test responsiveness during the account evaluation process before committing funds.

Trading Experience Analysis (Score: 7/10)

JFD Bank's implementation of STP and DMA execution models typically provides superior trading conditions. These models route orders directly to institutional liquidity providers rather than taking the opposite side of client trades. This execution approach generally results in faster order processing, reduced slippage, and elimination of potential conflicts of interest that exist in market maker models.

The broker's regulatory compliance across multiple jurisdictions suggests adherence to execution quality standards. BaFin and CySEC oversight requires best execution practices that benefit client order processing and pricing. However, specific performance metrics such as average execution speeds, slippage statistics, or platform uptime data were not available in source materials for verification.

The extensive instrument selection contributes positively to trading experience by enabling diverse strategy implementation. Portfolio construction within a single platform environment simplifies account management and reduces the complexity of maintaining multiple broker relationships. This jfd bank review notes that access to 1,500+ instruments across nine asset classes provides substantial flexibility.

Both short-term trading and long-term investment approaches are supported by the comprehensive instrument selection. However, specific platform interface and functionality details were not comprehensively covered in available information, which limits the complete assessment of user experience quality.

Trust and Reliability Analysis (Score: 8/10)

JFD Bank demonstrates strong regulatory credentials through its authorization by multiple respected financial regulators. BaFin in Germany, CySEC in Cyprus, and VFSC in Vanuatu provide oversight and client protection measures. BaFin regulation represents particularly robust oversight within the European Union framework with strict capital requirements and operational standards.

Client fund segregation mandates and participation in investor compensation schemes provide substantial client protections. The broker's establishment in 2011 indicates operational longevity and market survival through various economic cycles including the 2020 pandemic and recent market volatility. This suggests business model sustainability and competent management that can navigate challenging market conditions.

However, available sources noted that 27% of retail investor accounts lose money when trading CFDs with JFD Bank. This statistic aligns with industry-wide averages but emphasizes the inherent risks in leveraged trading that all clients should understand. The multi-jurisdictional regulatory approach provides clients with different protection levels depending on their location and chosen entity.

EU clients receive the highest level of regulatory protection through BaFin and CySEC oversight. This regulatory diversification demonstrates compliance commitment while serving different market segments effectively across various jurisdictions and regulatory frameworks.

User Experience Analysis (Score: 6/10)

User experience evaluation is limited by the absence of comprehensive platform interface details. Mobile application information and detailed user feedback were not available in source materials for this review. The broker's focus on providing institutional-grade access to 1,500+ instruments suggests a platform designed for serious traders rather than beginners.

Specific usability features, interface design quality, or mobile trading capabilities were not detailed in available information. The account opening process, verification procedures, and onboarding experience details were also not available, which represents important gaps for potential clients. Modern traders expect streamlined digital onboarding with efficient KYC processes and rapid account activation for quick market access.

These specifics could not be assessed from available information sources. This jfd bank review notes that the target audience appears to be intermediate to advanced traders based on the minimum deposit requirement. The comprehensive instrument offering suggests the platform may prioritize functionality over simplicity, which could appeal to experienced traders but might overwhelm beginners.

However, without detailed user interface information or client feedback, comprehensive user experience assessment remains limited. Potential clients should request platform demonstrations or trial access to evaluate usability before committing to live trading accounts.

Conclusion

JFD Bank presents itself as a well-regulated, multi-jurisdictional broker suitable for intermediate to advanced traders. The broker provides comprehensive market access across diverse asset classes with strong regulatory oversight and institutional-grade execution capabilities. The regulatory credentials, particularly BaFin oversight in Germany, provide strong client protections that exceed many competitors in the industry.

The extensive offering of 1,500+ trading instruments across nine asset classes enables sophisticated trading strategies. Portfolio diversification opportunities are substantial, allowing traders to spread risk across multiple markets and asset types through a single platform relationship.

The broker appears most suitable for traders who prioritize regulatory compliance, market access breadth, and institutional-grade execution. These features may be more important than ultra-low costs or beginner-focused educational features for serious traders. The $500 minimum deposit requirement and comprehensive instrument selection suggest targeting of committed retail traders and smaller institutional clients.

Key strengths include strong regulatory oversight, extensive market access, and STP/DMA execution models. These execution models typically provide superior trading conditions compared to market maker brokers that take opposite positions to client trades. However, limited transparency regarding customer service capabilities, specific platform features, and user feedback represents areas where additional information would benefit potential clients.

Additional research and direct broker contact would help potential clients make fully informed decisions. Traders should verify current terms, test platform functionality, and assess customer service quality before opening live trading accounts with any broker.