Is TradeFX safe?

Business

License

Is TradeFX Safe or Scam?

Introduction

TradeFX is a forex and CFD brokerage that has gained attention in the trading community for its various account types and the popular MetaTrader 4 trading platform. As with any financial service provider, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with both legitimate opportunities and potential scams, making it essential for traders to assess the credibility and safety of brokers like TradeFX. This article aims to provide an objective analysis of TradeFX, examining its regulatory status, company background, trading conditions, and customer experiences. The evaluation is based on data collected from various reputable financial websites and user reviews, ensuring a comprehensive understanding of whether TradeFX is safe for traders.

Regulation and Legality

One of the primary factors determining the safety of a forex broker is its regulatory status. TradeFX operates without a license from any recognized financial authority, raising significant concerns about its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict standards of conduct and financial practices. The absence of regulation means that TradeFX is not subject to oversight, which can lead to potential exploitation of traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Singapore | Unregulated |

The lack of a regulatory framework for TradeFX exposes traders to higher risks, including the possibility of fraud and financial mismanagement. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), provide a level of assurance to traders by enforcing compliance and offering recourse in the event of disputes. With TradeFX being unregulated, traders have limited options for recourse if issues arise. Historical compliance issues or regulatory warnings against similar brokers further amplify the concerns surrounding TradeFX's safety.

Company Background Investigation

TradeFX is registered in Singapore, with its parent company being Trade FX Pte Ltd. However, it is important to note that registration as a business does not equate to regulatory approval. The company has been operational since 2018, but it lacks transparency regarding its ownership structure and management team. A detailed background check reveals no significant professional experience or credentials among its leadership, which can be a red flag for potential investors.

The level of transparency and information disclosure regarding TradeFX is notably low. The absence of comprehensive details about the company's operations, financial health, and ownership can lead to skepticism among potential traders. In the financial services industry, transparency is vital for building trust, and the lack thereof raises questions about the broker's reliability. Without clear information about the management team and their expertise, traders may find it challenging to assess whether TradeFX is a trustworthy partner for their trading endeavors.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. TradeFX offers a variety of account types, each with different minimum deposit requirements and spreads. However, the overall cost structure appears to be less competitive compared to industry standards. Traders should be wary of any hidden fees or unfavorable trading conditions.

| Fee Type | TradeFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.8 pips | 1.0-1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The advertised spreads for major currency pairs are significantly higher than industry averages, which can erode potential profits for traders. Additionally, the commission structure is not clearly defined, leaving traders uncertain about potential costs. The high minimum deposit requirement of $250 may also act as a barrier for new traders, particularly given the broker's unregulated status. Overall, the trading conditions at TradeFX raise concerns about its competitiveness and transparency.

Client Funds Security

The safety of client funds is paramount when choosing a forex broker. TradeFX has not demonstrated adequate measures to protect client funds. The lack of regulatory oversight means that there are no enforced standards for fund segregation, investor protection, or negative balance protection. This raises significant concerns about the security of traders' investments.

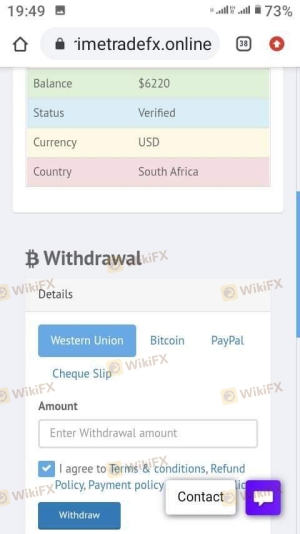

Historically, unregulated brokers have faced issues related to fund mismanagement and withdrawal difficulties. Reports from users indicate that there have been instances where clients faced challenges in withdrawing their funds, which is a serious red flag. Without a regulatory framework to ensure proper fund handling, traders using TradeFX may be at risk of losing their investments without any recourse.

Customer Experience and Complaints

Customer feedback is a critical component in assessing a broker's reputation. Reviews of TradeFX reveal a mixed bag of experiences, with several users reporting issues related to fund withdrawals and customer support. Common complaints include difficulties in accessing funds after a withdrawal request, which is a significant concern for any trader.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

Several users have reported that their accounts were suspended following withdrawal requests, indicating potential operational issues within the broker. The response from TradeFX to these complaints has been criticized for being inadequate, which further diminishes trust among existing and potential clients. These patterns of complaints highlight the need for caution when considering TradeFX as a trading partner.

Platform and Execution

The trading platform provided by TradeFX is the widely used MetaTrader 4 (MT4), known for its robust features and user-friendly interface. However, the performance and stability of the platform are crucial for a positive trading experience. User experiences indicate that while the platform is functional, there have been reports of slippage and order rejections, which can be detrimental to traders.

The quality of order execution is essential for traders, especially in fast-moving markets. Any signs of manipulation or irregularities in execution can compromise the integrity of the trading experience. Traders should be vigilant for any signs of platform issues that could affect their ability to execute trades effectively.

Risk Assessment

Using TradeFX carries inherent risks, primarily due to its unregulated status and the associated lack of investor protection. The following risk assessment summarizes the key risk areas:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities. |

| Financial Risk | High | Potential loss of funds without recourse. |

| Operational Risk | Medium | Issues with platform stability and support. |

To mitigate these risks, traders are advised to conduct thorough research and consider using regulated brokers that offer better protection for their investments. Ensuring that funds are kept with reputable institutions and avoiding high-leverage trading can also help reduce exposure to risk.

Conclusion and Recommendations

In conclusion, the evidence suggests that TradeFX is not a safe broker for traders. The lack of regulation, combined with reports of withdrawal issues and inadequate customer support, raises significant concerns about the broker's credibility. Traders should be cautious and consider alternative, more secure options for their trading needs.

For those seeking reliable trading partners, it is advisable to explore brokers that are regulated by top-tier authorities, such as the FCA or ASIC. These brokers offer a higher level of investor protection and transparency, ensuring a safer trading environment. In light of the findings, it is clear that potential clients should approach TradeFX with extreme caution and consider their investment options carefully.

Is TradeFX a scam, or is it legit?

The latest exposure and evaluation content of TradeFX brokers.

TradeFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TradeFX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.