Big Boss 2025 Review: Everything You Need to Know

Executive Summary

In this comprehensive big boss review, we examine a Hong Kong-based forex and CFD broker that has been operating since 2013. Big Boss positions itself as a trading platform offering high leverage ratios up to 1:555 and substantial deposit bonus campaigns reaching up to $42,000. The broker operates under IFSA regulation. It provides both standard and professional account options to accommodate different trading preferences.

Big Boss caters primarily to traders seeking high leverage opportunities and diverse asset classes, including forex currency pairs, CFDs, precious metals like gold and silver, energy commodities such as oil, and cryptocurrencies including Bitcoin. The platform uses MetaTrader 4 as its primary trading interface. This maintains industry-standard functionality while focusing on competitive trading conditions. With a minimum deposit requirement of $100 USD, the broker aims to attract both novice and experienced traders looking for accessible entry points into leveraged trading markets.

The broker's business model centers on providing comprehensive trading services across multiple asset classes. It emphasizes promotional incentives and flexible account structures to differentiate itself in the competitive online trading landscape.

Important Disclaimer

This big boss review is based on the most recent available information as of 2025. Trading conditions may vary due to market changes and regulatory updates. Different regional regulations may impact user experience and fund security, particularly given the broker's IFSA regulatory status. Traders should be aware that regulatory differences across jurisdictions can affect the level of protection and services available to them.

The information presented in this review reflects current publicly available data. Specific terms and conditions may change. Potential clients are advised to verify all details directly with the broker before making trading decisions or depositing funds.

Rating Framework

Broker Overview

Big Boss emerged in the forex and CFD trading landscape in 2013. The company established its headquarters in Hong Kong to serve international trading markets. The company has positioned itself as a provider of high-leverage trading services, targeting traders who seek substantial leverage ratios and diverse investment opportunities. According to available reports, Big Boss has built its reputation around offering competitive trading conditions and promotional incentives designed to attract both new and experienced traders.

The broker's business model focuses on providing comprehensive access to global financial markets through leveraged trading products. Big Boss operates as a market maker. It offers services across multiple asset classes while maintaining competitive spreads and execution standards. The company has developed its services to accommodate various trading styles and risk appetites, from conservative approaches to high-risk, high-reward strategies.

Asset diversity and platform integration represent core strengths of Big Boss's offering. The broker provides access to forex currency pairs, contracts for difference (CFDs), precious metals including gold and silver, energy commodities such as oil, and cryptocurrency markets featuring Bitcoin and other digital assets. This comprehensive asset selection operates through the MetaTrader 4 platform, which serves as the primary trading interface. The IFSA regulatory framework provides oversight for the broker's operations. This establishes a foundation for regulatory compliance and operational standards in this detailed big boss review.

Regulatory Framework: Big Boss operates under IFSA (International Financial Services Authority) regulation. This provides a regulatory foundation for its trading services. While the specific license number was not detailed in available sources, the IFSA oversight establishes certain operational standards and compliance requirements for the broker's activities.

Minimum Deposit Requirements: The broker maintains an accessible entry point with a $100 USD minimum deposit requirement. This positions itself competitively within the retail trading market and accommodates traders with varying capital levels.

Promotional Offerings: Big Boss features substantial deposit bonus campaigns with potential rewards reaching up to $42,000. This represents one of the more significant promotional structures in the retail trading sector.

Asset Coverage: The platform provides comprehensive market access including forex currency pairs, CFDs across various markets, precious metals (gold and silver), energy commodities (oil), and cryptocurrency markets featuring Bitcoin and additional digital assets.

Cost Structure: Specific information regarding spreads, commissions, and overnight financing costs was not detailed in available source materials. This requires direct verification with the broker.

Leverage Specifications: Maximum leverage reaches 1:555. This provides substantial purchasing power for qualified traders while requiring appropriate risk management considerations.

Platform Technology: MetaTrader 4 serves as the primary trading platform. It offers industry-standard charting, analysis tools, and order execution capabilities.

Geographic Restrictions: Specific regional limitations and service availability details were not comprehensively covered in reviewed materials.

Customer Support Languages: Multi-language support capabilities were not specifically detailed in available documentation. This requires direct confirmation for language-specific service needs.

This big boss review analysis reveals a broker structure focused on competitive leverage ratios and promotional incentives. Several operational details require direct verification with the company.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Big Boss demonstrates strong performance in account conditions through its dual-tier account structure offering both standard accounts with zero commission and professional accounts featuring reduced spreads. The $100 USD minimum deposit requirement positions the broker competitively within the retail trading market. This makes trading accessible to a broad range of participants without imposing prohibitive entry barriers.

The account structure accommodates different trading preferences and experience levels. Standard accounts provide commission-free trading, which can benefit traders who prefer transparent, spread-based pricing models. Professional accounts offer tighter spreads for traders who can benefit from reduced market access costs. This particularly helps those executing higher-frequency trading strategies or larger position sizes.

User feedback suggests that "Big Boss is a noteworthy forex and CFD broker" worth consideration. This indicates general satisfaction with account accessibility and structure. Compared to industry standards, the $100 minimum deposit falls within the accessible range, competing favorably with many established brokers who often require higher initial investments.

The account opening process details were not extensively covered in available sources. This suggests potential clients should verify specific requirements and procedures directly with the broker. Similarly, specialized account features such as Islamic accounts or institutional services require direct confirmation. This big boss review finds the account conditions generally competitive, though comprehensive details on account features and opening procedures would strengthen the overall offering.

The broker's tools and resources center around the MetaTrader 4 platform. This provides industry-standard functionality for technical analysis, automated trading, and order management. MT4's established reputation offers traders familiar interface elements and comprehensive charting capabilities across the diverse asset classes supported by Big Boss.

Platform integration supports multiple asset categories including forex pairs, CFDs, precious metals, energy commodities, and cryptocurrencies. This provides traders with consolidated access to various markets through a single interface. This multi-asset approach enables portfolio diversification and cross-market trading strategies within the MT4 environment.

However, available information does not detail specific research and analysis resources, educational materials, or advanced trading tools beyond the standard MT4 functionality. The absence of comprehensive educational resources or proprietary analysis tools may limit the platform's appeal for traders seeking extensive learning materials or advanced market research capabilities.

Automated trading support through MT4's Expert Advisor functionality provides algorithmic trading capabilities. Specific broker policies regarding automated trading, VPS services, or advanced execution features were not detailed in reviewed materials. The platform's mobile accessibility and additional trading tools require direct verification with the broker to assess the complete technology offering.

Customer Service and Support Analysis (N/A)

Comprehensive customer service information was not available in the reviewed source materials. This prevents a detailed assessment of support quality and availability. Key service elements including customer service channels, response times, service quality standards, and multilingual support capabilities require direct verification with the broker.

The absence of detailed customer service information in available sources represents a significant information gap for potential clients evaluating the broker's support infrastructure. Essential factors such as live chat availability, phone support hours, email response times, and technical support quality could not be assessed based on current data.

Without specific user feedback regarding customer service experiences, problem resolution effectiveness, or support team expertise, this big boss review cannot provide a comprehensive evaluation of the customer service dimension. Potential clients should prioritize direct contact with the broker's support team to assess response quality and availability before committing to account opening.

The lack of publicly available customer service information may indicate either limited transparency in this area or insufficient coverage in reviewed sources. Prospective traders should request detailed information about support channels, availability hours, and service standards as part of their broker evaluation process.

Trading Experience Analysis (N/A)

Platform stability, execution speed, and order processing quality could not be comprehensively evaluated based on available source materials. While Big Boss utilizes the established MetaTrader 4 platform, specific performance metrics regarding execution quality, slippage rates, and platform uptime were not detailed in reviewed sources.

The MT4 platform foundation suggests access to standard trading functionality including various order types, technical indicators, and charting tools. However, broker-specific implementation quality, server performance, and execution policies require direct assessment to evaluate the complete trading experience.

Mobile trading capabilities, platform customization options, and advanced trading features beyond standard MT4 functionality were not specifically addressed in available materials. The trading environment quality, including spread consistency, execution transparency, and market access during volatile conditions, requires verification through direct platform testing or user feedback.

Without comprehensive user testimonials or technical performance data, this big boss review cannot provide detailed insights into the practical trading experience. Potential clients should consider demo account testing and direct platform evaluation to assess execution quality and overall trading environment suitability for their specific requirements.

Trust Factor Analysis (6/10)

Big Boss operates under IFSA regulation, which provides a regulatory framework for its operations. Specific license details and regulatory standing require verification. The IFSA oversight establishes certain compliance standards, but the level of investor protection and regulatory enforcement may differ from major financial jurisdictions.

Fund safety measures, client money segregation policies, and investor compensation schemes were not detailed in available source materials. These crucial trust factors require direct clarification with the broker, as they significantly impact client fund security and operational transparency.

Company transparency regarding ownership structure, financial standing, and operational history was not comprehensively covered in reviewed sources. The broker's industry reputation, regulatory compliance history, and handling of any negative events require additional research beyond the current information scope.

Third-party evaluations and independent assessments of the broker's trustworthiness were limited in available materials. User trust feedback and community reputation indicators suggest general acceptance, with some sources noting Big Boss as "worth consideration," though comprehensive reputation analysis requires broader source verification.

The moderate trust factor rating reflects the IFSA regulatory foundation balanced against limited transparency information and the need for additional verification of key trust elements.

User Experience Analysis (N/A)

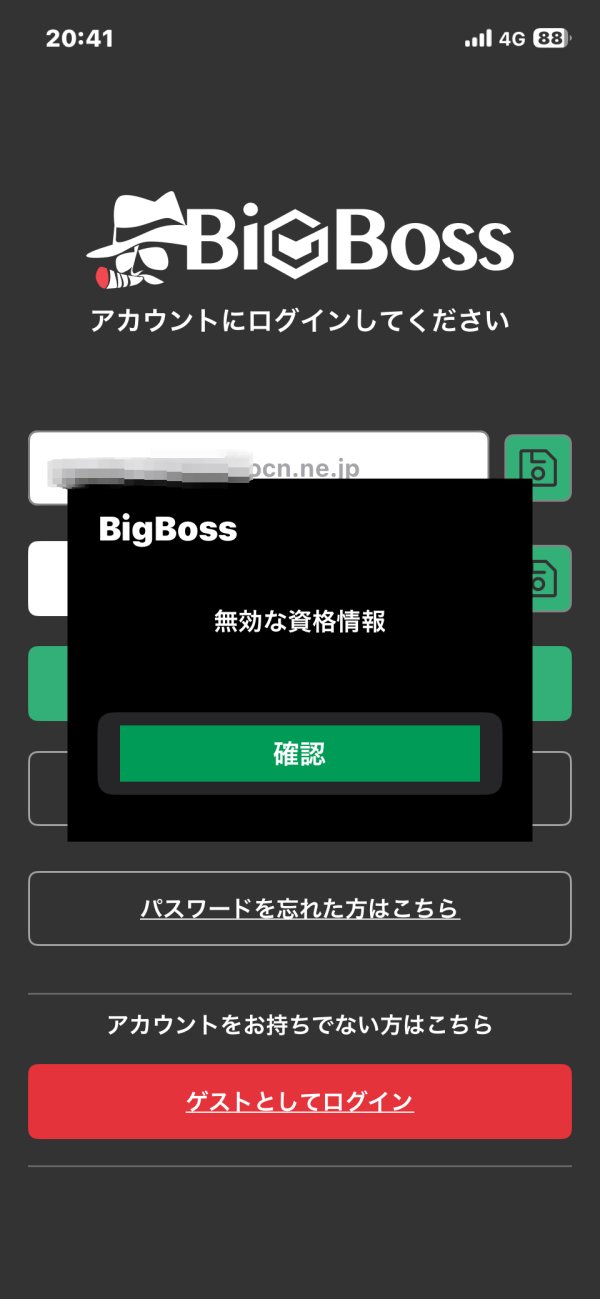

Overall user satisfaction metrics, interface design quality, and platform usability assessments were not available in sufficient detail from reviewed sources. The registration and account verification processes, including required documentation and approval timeframes, require direct confirmation with the broker.

Fund operation experiences, including deposit and withdrawal processes, processing times, and method availability, were not comprehensively detailed in available materials. These practical aspects significantly impact user experience but could not be evaluated based on current information.

The broker appears primarily suited for high-leverage trading enthusiasts, based on the 1:555 maximum leverage offering and promotional structure. However, detailed user demographic analysis and satisfaction surveys were not available for comprehensive user experience assessment.

Available user feedback suggests that "Big Boss is a noteworthy forex and CFD broker," indicating general positive reception. Specific user experience elements require additional verification. Common user complaints, platform usability issues, and improvement suggestions were not detailed in reviewed sources, limiting the scope of user experience analysis in this big boss review.

Conclusion

Big Boss presents itself as a noteworthy forex and CFD broker offering competitive features including high leverage ratios up to 1:555 and substantial deposit bonus campaigns reaching $42,000. The broker's $100 minimum deposit requirement and diverse asset selection make it accessible to traders seeking high-risk, high-reward opportunities across multiple markets.

The platform's strengths lie in its flexible deposit requirements, comprehensive asset coverage including cryptocurrencies, and the established MetaTrader 4 platform foundation. However, areas requiring improvement include enhanced transparency in customer service capabilities, detailed cost structure disclosure, and comprehensive user experience documentation.

This big boss review concludes that while Big Boss offers attractive promotional incentives and competitive leverage ratios, potential clients should conduct thorough due diligence regarding customer service standards, regulatory compliance details, and platform performance before committing to trading activities. The broker may particularly appeal to experienced traders comfortable with high-leverage environments and seeking diverse market access through a single platform.