Migros Bank 2025 Review: Everything You Need to Know

Executive Summary

This migros bank review gives you a complete look at Switzerland's traditional banking institution. It shows a mixed but generally okay trading environment for forex and financial services. Based on detailed user feedback from 798 customer reviews and business performance data, Migros Bank shows solid customer satisfaction levels, with users saying they have no regrets about choosing this institution as their primary banking partner.

Two key features define Migros Bank's market position. First, it has a large minimum deposit requirement of CHF 7,500 that targets well-funded traders. Second, it achieved impressive business growth in 2021 across its core financial services. The bank has continuously expanded its service range. It uses high customer confidence to drive significant volume and earnings growth.

The institution mainly attracts traders and clients with considerable financial resources. It positions itself as a premium service provider rather than an entry-level platform. This strategic focus on higher-net-worth individuals shows in both its account requirements and service delivery approach, making it suitable for experienced traders seeking traditional banking stability combined with modern trading capabilities.

Important Disclaimers

This evaluation acknowledges certain limits in available regulatory information. Specific supervisory details were not fully covered in source materials. Readers should independently verify current regulatory status and compliance requirements based on their jurisdiction and trading needs.

This migros bank review methodology relies mainly on documented user feedback, business performance indicators, and publicly available service information. Analysis includes customer satisfaction data from multiple review platforms and the bank's reported 2021 business growth metrics to provide balanced assessment perspectives.

Rating Framework

Broker Overview

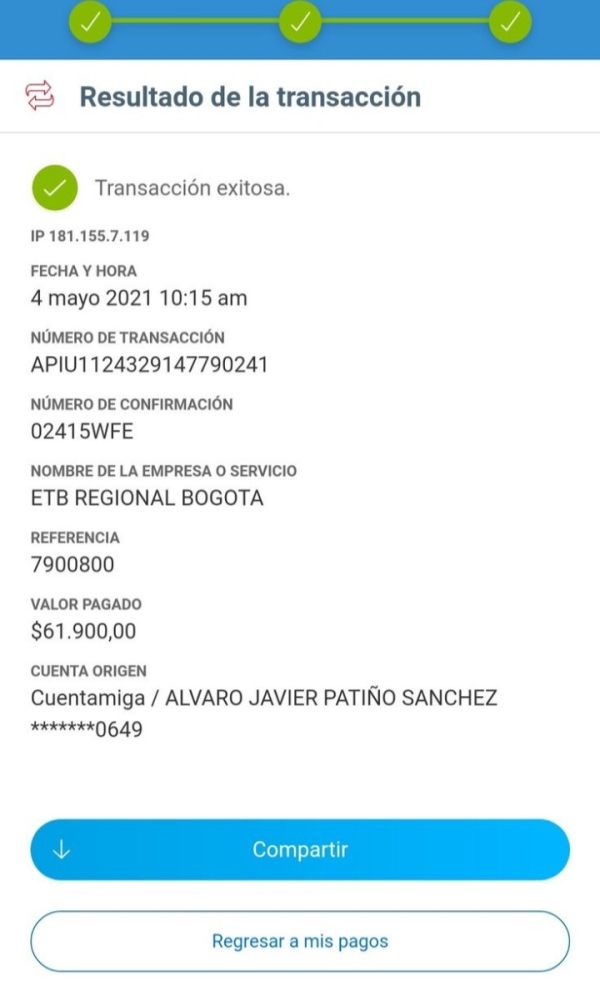

Migros Bank operates as a well-established Swiss financial institution. It has shown remarkable resilience and growth in recent years. According to annual reporting data, the bank experienced significant expansion in both volumes and earnings throughout its core business operations in 2021.

This growth trajectory reflects sustained customer confidence and the institution's ability to adapt its services to evolving market demands. The bank's business model centers on providing comprehensive financial services while continuously expanding its offering portfolio. This expansion strategy has proven successful, as evidenced by the substantial growth metrics achieved during challenging market conditions.

The institution maintains a focus on traditional banking values while incorporating modern trading and investment capabilities. Regarding trading platform specifications and asset class coverage, detailed information remains limited in available source materials. The bank appears to offer online trading services as part of its broader financial services portfolio, though specific platform features and supported instruments require further investigation.

Regulatory oversight information was not comprehensively detailed in reviewed materials. This suggests potential clients should verify current supervisory arrangements independently.

Regulatory Jurisdiction: Specific regulatory information was not detailed in available source materials, requiring independent verification.

Deposit and Withdrawal Methods: Available source materials did not provide comprehensive details regarding supported payment methods and processing procedures.

Minimum Deposit Requirements: CHF 7,500 represents the entry threshold. This positions Migros Bank in the premium service category.

Promotional Offers: Current bonus structures and promotional campaigns were not specified in reviewed materials.

Tradeable Assets: While online trading services are confirmed, specific asset categories and instrument availability require clarification through direct inquiry.

Cost Structure: Detailed fee schedules, spread information, and commission structures were not comprehensively covered in available documentation. This necessitates direct consultation for accurate pricing details.

Leverage Options: Specific leverage ratios and margin requirements were not detailed in source materials.

Platform Selection: Available materials confirm online trading capability without specifying particular platform software or proprietary solutions.

Geographic Restrictions: Regional availability and access limitations were not explicitly outlined in reviewed information.

Customer Service Languages: Multi-language support capabilities were not specifically documented in available materials.

Comprehensive Rating Analysis

Account Conditions Analysis

Migros Bank's account structure reflects a premium positioning strategy. The CHF 7,500 minimum deposit requirement serves as the primary barrier to entry. This substantial threshold effectively filters the client base toward more experienced traders and higher-net-worth individuals, aligning with the bank's traditional Swiss banking heritage and quality service focus.

The elevated minimum deposit requirement limits accessibility for novice traders but potentially ensures a more stable client base. It allows the institution to provide enhanced service levels. However, this approach excludes many retail traders who might benefit from the bank's services but lack the required capital commitment.

Account opening procedures and specific account type variations were not detailed in available source materials. This suggests interested clients should engage directly with the institution for comprehensive account information. The absence of detailed account feature information represents a transparency gap that could impact potential client decision-making processes.

Customer feedback regarding account conditions appears generally positive. Users express satisfaction with their banking relationship choice, though specific commentary on account features and benefits remains limited in available reviews.

The availability of trading tools and analytical resources represents a significant information gap in this migros bank review. While the institution confirms online trading capabilities, specific details regarding charting software, technical analysis tools, and research resources were not comprehensively documented in available materials.

Educational resource availability remains unclear based on reviewed information. This includes market analysis, trading guides, and educational webinars. This lack of detailed tool and resource information may concern potential clients who prioritize comprehensive analytical support for their trading activities.

Automated trading support capabilities were not specified in available documentation. This includes expert advisor compatibility and algorithmic trading features. Modern traders increasingly expect robust automation options, making this information gap potentially significant for platform evaluation purposes.

The absence of detailed tool and resource information suggests either limited offerings in this area or insufficient marketing communication regarding available capabilities. Prospective clients should directly inquire about specific tool availability and functionality to make informed decisions.

Customer Service and Support Analysis

Customer service evaluation relies mainly on general satisfaction indicators rather than specific service quality metrics. User feedback suggests overall contentment with the banking relationship. Customers express no regret about choosing Migros Bank as their financial services provider.

Response time data, support channel availability, and service hour information were not detailed in available materials. This limits comprehensive service quality assessment. The lack of specific customer service metrics represents a transparency gap that could impact client expectations and satisfaction levels.

Multi-language support capabilities were not explicitly documented in reviewed materials. These are crucial for international clients. Given Switzerland's multilingual environment, this information absence seems particularly notable and should be clarified through direct inquiry.

Problem resolution effectiveness and customer service case studies were not provided in available documentation. This limits insight into the institution's ability to address client concerns and technical issues effectively.

Trading Experience Analysis

Platform stability and execution quality assessment faces significant limitations. This is due to insufficient specific user feedback in available materials. While general customer satisfaction appears positive, detailed trading experience metrics remain unclear.

Order execution speed, slippage rates, and platform uptime statistics were not documented in reviewed materials. This prevents comprehensive trading environment evaluation. These technical performance indicators are crucial for serious traders and represent important evaluation criteria.

Mobile trading capabilities and application functionality were not detailed in available information. This is despite mobile trading's increasing importance for modern traders. This information gap may concern clients who prioritize mobile access and functionality.

Trading environment characteristics require clarification through direct consultation. This includes liquidity provision and market access quality, as available materials did not provide sufficient detail for comprehensive assessment.

Trust and Reliability Analysis

Trust assessment reveals mixed indicators. Strong customer confidence levels are offset by limited regulatory transparency in available materials. Users demonstrate high satisfaction with their banking relationship choice, suggesting positive real-world experience with the institution's reliability and service delivery.

Regulatory oversight information gaps represent a significant concern for comprehensive trust evaluation. While Swiss banking generally maintains high regulatory standards, specific supervisory details should be independently verified by potential clients.

Fund security measures were not detailed in available documentation. This includes deposit protection schemes and segregation practices. These safety mechanisms are fundamental for client confidence and require clarification through direct inquiry.

Company transparency regarding operations, fee structures, and service terms could be improved. This is based on available information gaps identified throughout this evaluation process.

User Experience Analysis

Overall user satisfaction demonstrates moderate positive sentiment. Customers express contentment with their decision to choose Migros Bank. However, detailed user experience metrics and specific satisfaction indicators remain limited in available feedback.

Interface design and platform usability information were not comprehensively covered in available materials. This prevents detailed user experience assessment. Modern traders expect intuitive, responsive interfaces, making this information gap potentially significant.

Registration and account verification processes were not detailed in reviewed materials. The substantial minimum deposit requirement suggests a thorough onboarding procedure designed for serious clients.

Common user complaints appear centered around accessibility barriers created by high minimum deposit requirements. However, specific user experience issues were not extensively documented in available feedback.

Conclusion

This migros bank review reveals an institution with solid fundamentals and strong customer satisfaction. However, it has limited transparency regarding specific trading features and services. Migros Bank appears well-suited for well-capitalized traders seeking traditional Swiss banking stability combined with modern trading capabilities.

The institution's primary strength lies in customer confidence and business growth momentum. Main limitations include high entry barriers and insufficient detailed information about trading tools and services. Potential clients should conduct direct consultations to clarify specific service features and capabilities before making commitment decisions.

Migros Bank represents a viable option for experienced traders with substantial capital. It works best for those who prioritize banking stability and traditional service quality over cutting-edge trading technology and low-cost access.