BNC Review 2

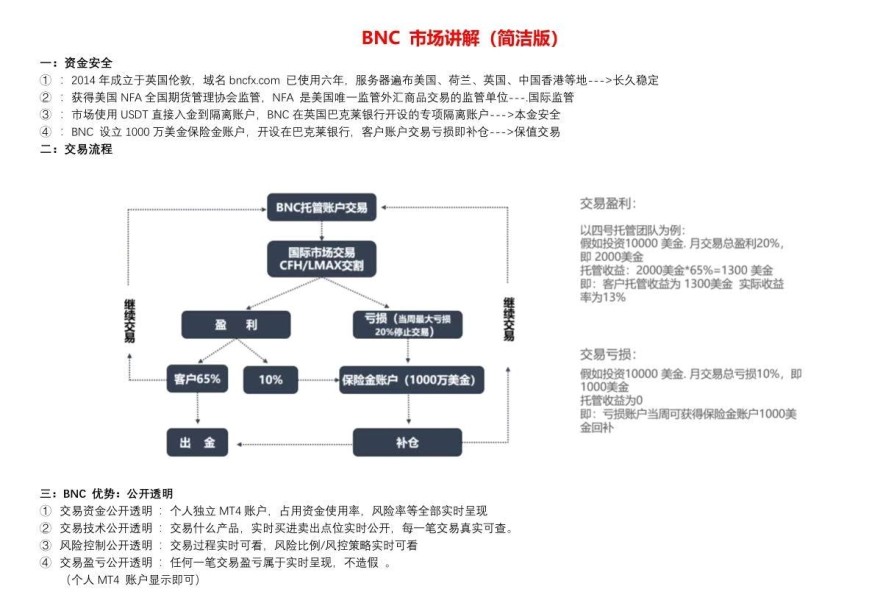

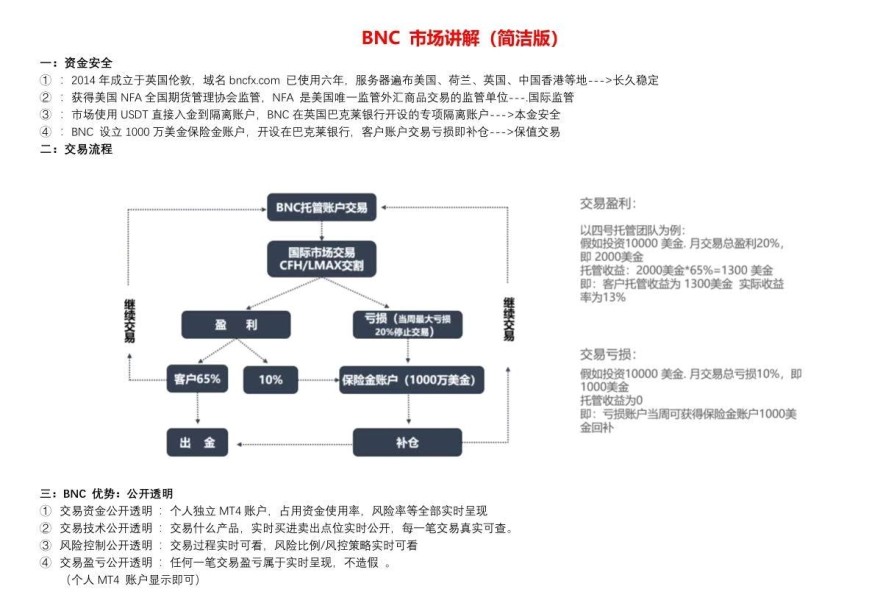

Raise funds illegally by 13% of the rate per mensel。 The principal criminals are surnamed Fan and Du

The capital plate ran away with the excuse of upgrading.

BNC Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

Raise funds illegally by 13% of the rate per mensel。 The principal criminals are surnamed Fan and Du

The capital plate ran away with the excuse of upgrading.

BNC Brokers shows mixed results in the forex market. Our detailed bnc review shows that BnC Levels gets good feedback from users for its trading platform, but there are concerns about regulation, especially with Bnc Bank operations. The broker offers zero-commission trading on online stocks and ETFs, plus cross-chain features through its Bifrost platform.

The platform targets investors who want low trading costs and different trading experiences across many asset types. BnC Levels is known as a trustworthy trading platform that offers flexible and varied trading experiences. However, the lack of clear information about trading conditions like spreads, minimum deposits, and leverage creates transparency problems that users should think about.

BNC focuses on providing easy trading solutions, though regulation varies a lot across its different business parts. This requires careful thought from potential clients.

This bnc review addresses big operational differences between BNC's various business parts. Regulation standards vary a lot across these entities, with some lacking strict financial oversight. Bnc Bank has been identified as not meeting strict regulatory standards, which affects overall trust ratings.

Our evaluation uses publicly available information and user feedback for complete analysis. However, readers should know that information updates may have delays, and market conditions can change quickly. We recommend checking current terms and conditions directly with the broker before making any trading decisions.

| Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 5/10 | Limited information available on spreads, minimum deposits, and leverage ratios |

| Tools and Resources | 7/10 | Diverse trading tools through Bifrost and BnC Levels platforms |

| Customer Service | 4/10 | Insufficient information about customer service channels and response times |

| Trading Experience | 6/10 | Positive user feedback for BnC Levels, but lacks comprehensive performance data |

| Trust and Regulation | 3/10 | Bnc Bank lacks strict regulatory oversight, affecting overall credibility |

| User Experience | 5/10 | Mixed user reviews with varying satisfaction levels across different services |

BNC operates as a financial services provider with several different business parts serving different market segments. The Bifrost platform launched in October 2021, built on the Polkadot system with a market value of about $5 million, ranking at position 1032 in the cryptocurrency market. This shows the broker's involvement in both traditional forex trading and new decentralized finance sectors.

The company's business model centers on providing access to global markets through various trading platforms. BnC Levels serves as the main trading interface, offering access to multiple asset classes and promising flexible trading experiences for different investor needs.

The broker's platform supports trading across forex, stocks, indices, commodities, and cryptocurrencies. However, specific regulatory information and detailed company background remain limited in available documentation, which presents challenges for thorough research processes that traders typically require when selecting a broker.

Regulatory Jurisdiction: Available information does not specify particular regulatory authorities overseeing BNC's operations. Regulatory standards vary significantly across different business entities.

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal processes is not detailed in available resources.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in current documentation.

Bonus and Promotions: No specific promotional offers or bonus structures are mentioned in available materials.

Tradeable Assets: The platform supports multiple asset classes including forex pairs, stocks, indices, commodities, and cryptocurrencies. This provides diverse trading opportunities.

Cost Structure: Zero-dollar commission structure applies to online stock and ETF transactions. However, specific spread information remains unspecified.

Leverage Ratios: Detailed leverage information is not provided in available documentation.

Platform Options: BnC Levels serves as the primary trading platform interface.

Geographic Restrictions: Specific regional limitations are not detailed in current materials.

Customer Support Languages: Language support information is not specified in available documentation. This comprehensive bnc review highlights significant information gaps that potential users should address through direct broker contact.

BNC's account structure presents several areas of concern due to limited transparency in available documentation. The absence of detailed information about account types makes it challenging for potential traders to make informed decisions. While the broker advertises zero-commission trading on stocks and ETFs, the lack of comprehensive details about spreads and other trading costs creates uncertainty about the true cost of trading.

The account opening process details are not readily available. This is concerning for traders who value transparency and straightforward procedures. Additionally, there is no mention of specialized account types such as Islamic accounts, professional accounts, or demo accounts for practice trading.

User feedback suggests that some traders have expressed dissatisfaction with trading conditions. The minimum deposit requirements remain unspecified, making it difficult for potential clients to assess accessibility. This bnc review identifies account conditions as an area requiring significant improvement in terms of transparency and detailed information provision to meet industry standards.

BNC demonstrates strength in providing diverse trading tools through its Bifrost platform and BnC Levels interface. The integration of cross-chain features represents an innovative approach to modern trading infrastructure. Users have responded positively to BnC Levels, indicating that the platform delivers on its promise of flexible and diverse trading experiences.

The Bifrost platform's foundation on Polkadot technology suggests sophisticated technical infrastructure. With a circulating supply of 46 million tokens and established market presence since October 2021, the platform demonstrates operational stability and continued development. The multi-asset trading capability spanning forex, stocks, indices, commodities, and cryptocurrencies provides comprehensive market access through a single interface.

However, specific information about research and analysis resources, educational materials, and automated trading support remains limited. The absence of detailed information about charting tools, technical indicators, market analysis reports, and educational resources represents a significant gap in the platform's resource offering evaluation. While user feedback suggests positive experiences with available tools, the lack of comprehensive feature documentation makes it difficult to assess the full scope of trading resources available to users.

Customer service represents a significant area of concern in this bnc review. The absence of detailed information about support channels, availability, and service quality raises questions about the broker's commitment to client support. Without clear information about contact methods, response times, or support hours, potential clients cannot adequately assess the level of assistance they might expect.

The absence of information about multilingual support capabilities is particularly concerning for international traders. Professional forex brokers typically provide comprehensive customer support documentation, including available channels such as live chat, email, phone support, and response time commitments. The lack of such information suggests either inadequate support infrastructure or poor communication about available services.

No specific user feedback about customer service experiences is available in current documentation. Additionally, there are no mentioned case studies or examples of problem resolution, which would typically demonstrate the broker's effectiveness in handling client issues. The absence of dedicated account management services or educational support further compounds concerns about the overall client service experience.

User feedback regarding BnC Levels indicates generally positive trading experiences. Users appreciate the platform's flexibility and diversity in trading options. The promise of varied trading experiences appears to be fulfilled based on available user testimonials, suggesting that the platform successfully delivers on its core value proposition.

However, specific technical performance data, including execution speeds, slippage rates, and platform stability metrics, are not available. The absence of detailed information about order execution quality, platform uptime statistics, and mobile application performance makes it difficult to thoroughly assess the trading environment's reliability. Professional traders typically require comprehensive performance data to evaluate whether a platform meets their execution standards.

The trading environment's technical specifications remain unspecified. Without detailed information about mobile trading capabilities, platform customization options, and advanced trading features, it's challenging to determine whether the platform meets the needs of various trader types. This bnc review identifies trading experience as an area with positive user sentiment but insufficient technical documentation for comprehensive evaluation.

Trust and regulatory compliance represent the most significant concerns in BNC's operations. The identification of Bnc Bank as lacking strict financial regulatory oversight seriously impacts the overall trustworthiness assessment of the BNC brand. Regulatory compliance is fundamental to forex broker credibility, and the absence of rigorous oversight creates substantial risk for potential clients.

The lack of specific information about regulatory authorities makes it impossible to verify the broker's legal standing. Professional forex brokers typically maintain transparent regulatory information, including license details, regulatory body contacts, and compliance reports. The absence of such documentation raises red flags about operational legitimacy and client fund protection measures.

No information is available about fund segregation practices, investor protection schemes, or dispute resolution mechanisms. The company's transparency regarding ownership structure, financial reporting, and operational procedures remains unclear based on available documentation. Additionally, there is no mention of third-party audits, regulatory examinations, or industry certifications that would typically support credibility assessments.

The handling of negative events or regulatory actions is not documented. This comprehensive trust analysis reveals significant gaps that potential clients should carefully consider before engaging with BNC's services.

User experience feedback presents a mixed picture, with satisfaction levels varying significantly across different BNC services and platforms. While BnC Levels receives positive recognition for its trading capabilities, overall user sentiment appears inconsistent. Some users have expressed dissatisfaction with trading conditions, though specific details about these concerns are not elaborated in available sources.

The absence of detailed information about user interface design makes it difficult to assess the overall user experience comprehensively. Registration and account verification processes are not documented, which represents a significant gap in user experience evaluation. Smooth onboarding procedures are crucial for positive first impressions and user retention.

Fund management experiences, including deposit and withdrawal processes, are not detailed in available documentation. User complaints appear to focus on trading conditions, though the specific nature of these concerns requires further investigation. The target user profile seems to align with investors seeking low-cost trading solutions and diverse asset access, though the platform's ability to meet these expectations consistently remains questionable based on mixed feedback.

Recommendations for improvement include enhancing transparency about all services. The user experience would benefit significantly from clearer communication about service differences between various BNC entities.

This comprehensive bnc review reveals a broker with both notable advantages and significant areas of concern. BNC Brokers operates across multiple entities with varying levels of service quality and regulatory compliance. While the zero-commission structure for stock and ETF trading and the innovative Bifrost platform represent attractive features, the lack of regulatory oversight for some entities creates substantial trust issues.

The platform appears most suitable for investors seeking low-cost trading solutions and access to diverse asset classes. However, potential users should exercise caution due to regulatory concerns and limited transparency in key operational areas.

The main advantages include innovative platform technology, zero-commission offerings, and positive user feedback for BnC Levels. The primary disadvantages encompass insufficient regulatory oversight, limited customer service information, and significant transparency gaps in trading conditions and operational procedures.

FX Broker Capital Trading Markets Review