WSM 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive wsm review gives you a balanced look at WSM as a trading platform that works in financial markets. WSM runs through multiple companies including WSM FX and WSM International Broker, and both are registered in Saint Vincent and the Grenadines. The platform offers ways to invest in different types of assets like currency pairs, indices, and commodities, and it targets traders who want high-risk investment opportunities.

But our research shows big concerns about regulatory oversight since WSM operates without formal supervision from major financial authorities. This unregulated status creates important questions about trader protection and how transparent their operations are. The platform seems to focus on investors who are comfortable with risk and higher volatility trading environments, but specific trading conditions and account details are mostly hidden from public view.

Based on user feedback and operational analysis that we could find, WSM shows both opportunities and risks that potential traders must think about carefully before they start trading.

Important Disclaimer

This review looks at WSM's services based on information that anyone can find and feedback from users. Readers should know that WSM operates through different legal entities - WSM FX and WSM International Broker - and both are registered in Saint Vincent and the Grenadines, though neither has formal regulatory authorization from major financial supervisory bodies.

Our assessment uses user testimonials, company information that anyone can access, and standard evaluation criteria that the industry uses. Because there is limited transparency in some operational areas, certain parts of our analysis may reflect information gaps that potential users should consider when making trading decisions.

Overall Rating Framework

Broker Overview

WSM operates in the online financial trading sector through its registered entities in Saint Vincent and the Grenadines. The company focuses on giving people access to various financial markets including foreign exchange, indices, and commodity trading. While we don't have clear documentation about when the company started, the platform has built a presence in the retail trading space.

The company structure includes WSM FX and WSM International Broker as separate legal entities, and both maintain registration in the same Caribbean jurisdiction. This setup allows the platform to offer services across different market segments while keeping a centralized business approach. WSM's primary business model revolves around online trading services, and it gives clients access to currency pairs, market indices, and commodity instruments.

The platform operates without formal regulatory oversight from major financial authorities, which significantly impacts its operational framework and client protection measures. This wsm review emphasizes how important it is to understand these structural elements when you evaluate whether the platform suits your individual trading needs.

Regulatory Status

WSM operates through entities registered in Saint Vincent and the Grenadines without formal regulatory supervision from major financial authorities. This unregulated status represents a significant consideration for potential traders who are evaluating platform safety and compliance standards.

Available Trading Assets

The platform provides access to currency pairs, indices, and commodities, which offers diversified trading opportunities across multiple asset classes. However, specific details about the number of available instruments and trading specifications remain undisclosed in available documentation.

Account Requirements

Minimum deposit requirements, account types, and specific trading conditions are not detailed in accessible platform information. This creates uncertainty for prospective clients regarding entry requirements and trading parameters.

Information about bonus structures, promotional campaigns, or incentive programs is not available in current platform documentation. This suggests either absence of such offerings or limited promotional transparency.

Cost Structure

Trading spreads, commission rates, and fee structures are not specifically outlined in available materials. This makes cost comparison with other platforms challenging for potential users.

Leverage Specifications

Maximum leverage ratios and margin requirements are not clearly specified in accessible platform information. This represents a significant information gap for risk assessment purposes.

Specific trading platform software, mobile applications, and technological infrastructure details are not comprehensively documented in available sources.

Geographic Restrictions

Service availability limitations and restricted jurisdictions are not clearly outlined in accessible platform documentation.

Customer Support Languages

Available customer service languages and support channels are not specified in current wsm review materials.

Account Conditions Analysis

WSM's account structure remains largely hidden based on available information, which presents challenges for potential traders who want to understand entry requirements and trading parameters. The platform does not provide clear documentation about account types, minimum deposit thresholds, or specific trading conditions that would typically guide trader decision-making processes.

The absence of detailed account information raises questions about operational transparency and client onboarding procedures. Without clear specifications about account tiers, benefits, or requirements, prospective traders cannot adequately assess whether the platform aligns with their trading capital and strategy requirements. User feedback suggests uncertainty about account opening processes and verification requirements.

Some traders have questioned whether WSM operates as a legitimate forex broker or represents potential fraudulent activity, which highlights how important due diligence is in account evaluation processes. The lack of specialized account features such as Islamic accounts, professional trader classifications, or institutional services further limits the platform's appeal to diverse trader segments. This wsm review emphasizes that account condition transparency represents a critical area requiring improvement for enhanced trader confidence and regulatory compliance.

WSM offers investment opportunities across currency pairs, indices, and commodities, which provides traders with diversified market access. However, the platform's educational resources, analytical tools, and research capabilities remain largely undocumented in available materials, and this limits traders' ability to assess the comprehensiveness of available trading support.

The platform's tool offerings appear focused on basic market access rather than comprehensive trading support systems. Advanced charting capabilities, technical analysis tools, and fundamental research resources are not clearly outlined in accessible documentation, which potentially limits the platform's appeal to sophisticated traders requiring comprehensive analytical support. Automated trading support, expert advisor compatibility, and algorithmic trading capabilities are not specified in available platform information.

This absence of automation details may concern traders who want to implement systematic trading strategies or utilize advanced trading technologies. Educational resources such as webinars, tutorials, market analysis, and trading guides are not prominently featured in available platform materials. The lack of educational support may particularly impact novice traders who want to develop their market knowledge and trading skills through broker-provided resources.

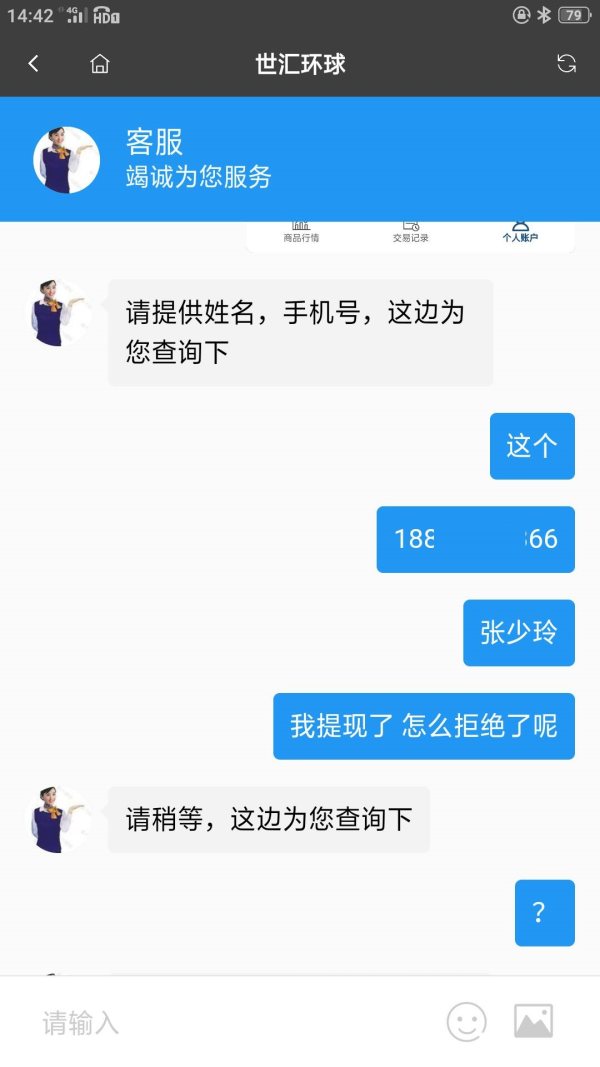

Customer Service and Support Analysis

WSM's customer service infrastructure remains largely undocumented in available platform materials, which creates uncertainty about support availability and service quality. The absence of clear customer service channels, contact methods, and support hours represents a significant operational transparency gap.

Response time expectations, service quality standards, and problem resolution procedures are not outlined in accessible platform documentation. This lack of customer service information makes it difficult for potential traders to assess the level of support they can expect when encountering trading issues or requiring assistance. Multilingual support capabilities and available service languages are not specified in current platform materials.

For international traders, the absence of language support information may influence platform selection decisions, particularly for non-English speaking clients who need native language assistance. The platform does not provide clear escalation procedures, complaint handling processes, or dispute resolution mechanisms in available documentation. This absence of formal support structures may concern traders who want assurance about problem resolution capabilities and customer protection measures.

Trading Experience Analysis

User feedback about WSM's trading experience presents mixed perspectives, with some traders reporting fair payout systems while others express concerns about platform legitimacy. The trading environment appears characterized by high volatility opportunities that require patience and risk tolerance from participants.

Platform stability, execution speed, and order processing capabilities are not comprehensively documented in available materials. Without clear performance metrics, traders cannot adequately assess the technical reliability of the trading infrastructure or expect consistent execution quality. Mobile trading capabilities and cross-platform functionality remain unspecified in accessible platform documentation.

Modern traders increasingly require robust mobile trading solutions, which makes this information gap particularly relevant for platform evaluation purposes. User testimonials suggest variable satisfaction levels with the trading environment. Some users report positive experiences with slot payout fairness in the casino division, while others question the overall legitimacy of the forex trading operations.

This wsm review notes that such mixed feedback requires careful consideration when evaluating platform suitability.

Trust and Safety Analysis

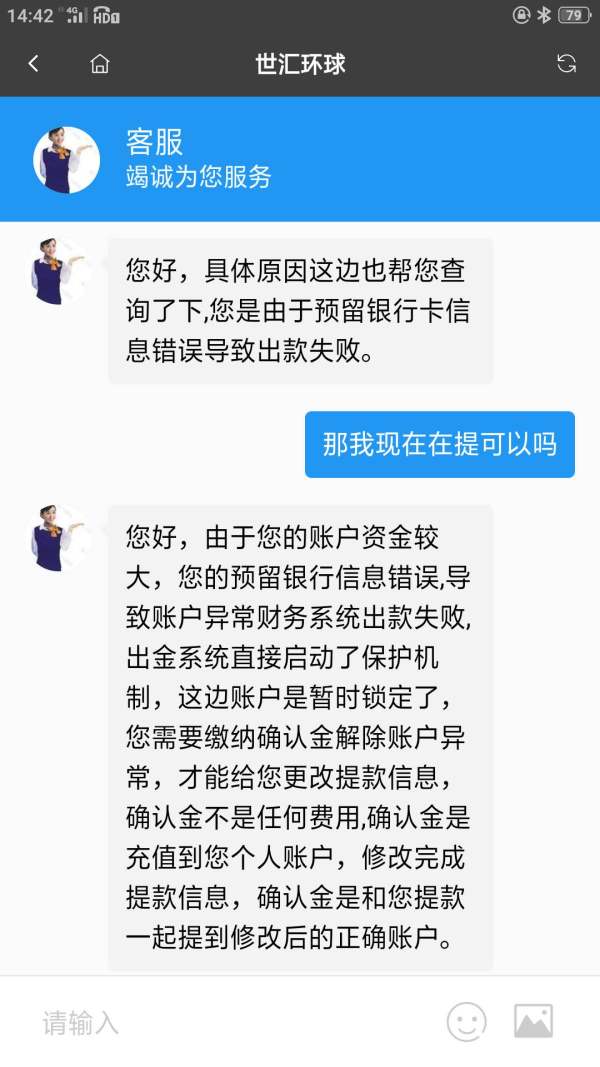

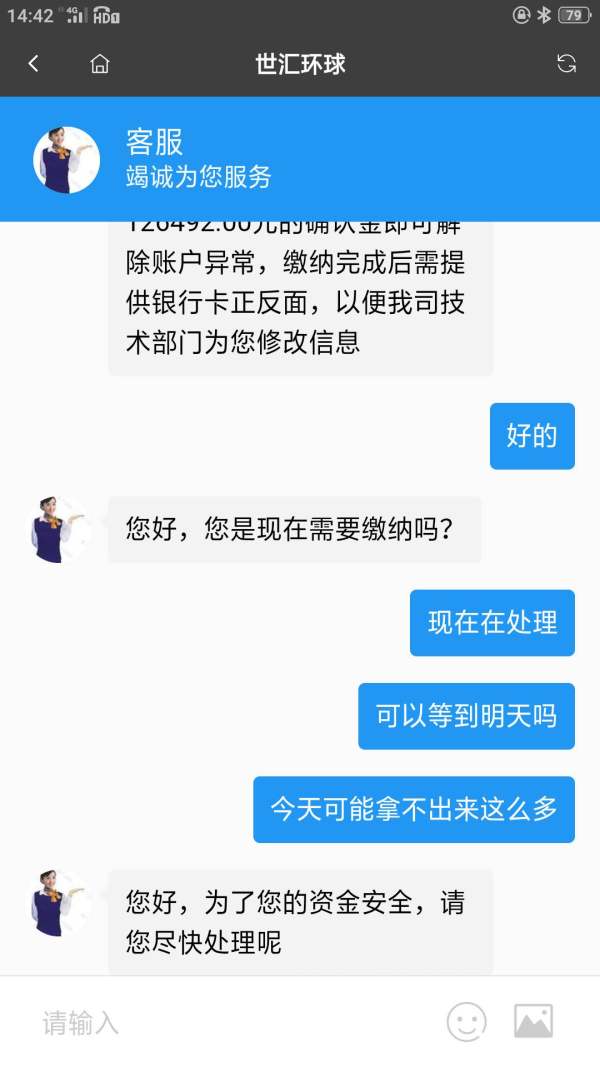

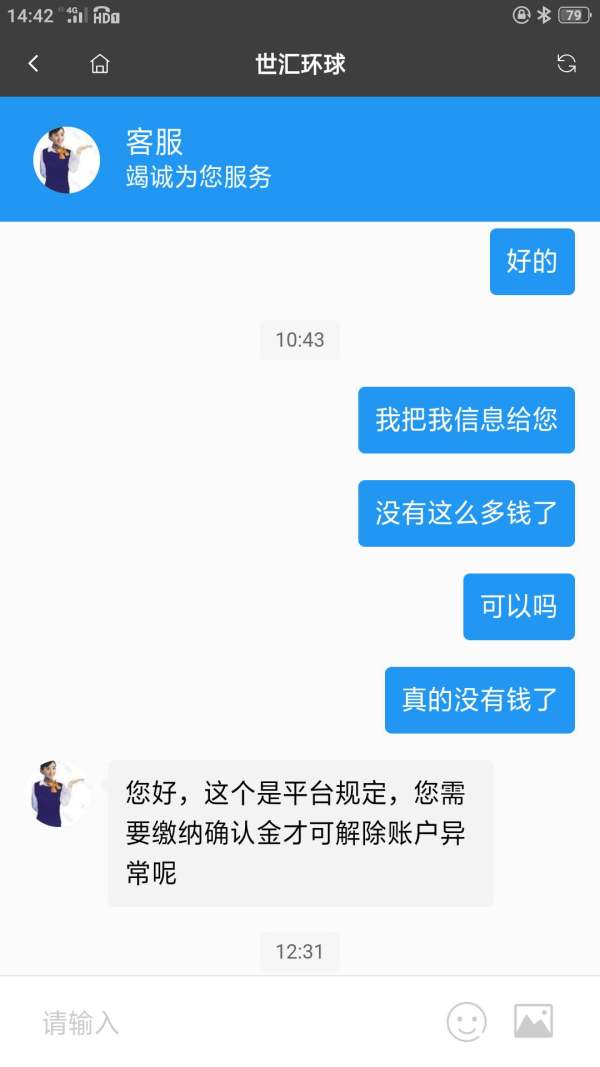

WSM's unregulated status represents the most significant trust and safety concern identified in this analysis. Operating without formal oversight from major financial authorities eliminates many standard client protection measures typically associated with regulated brokers, including segregated client funds, compensation schemes, and regulatory dispute resolution mechanisms.

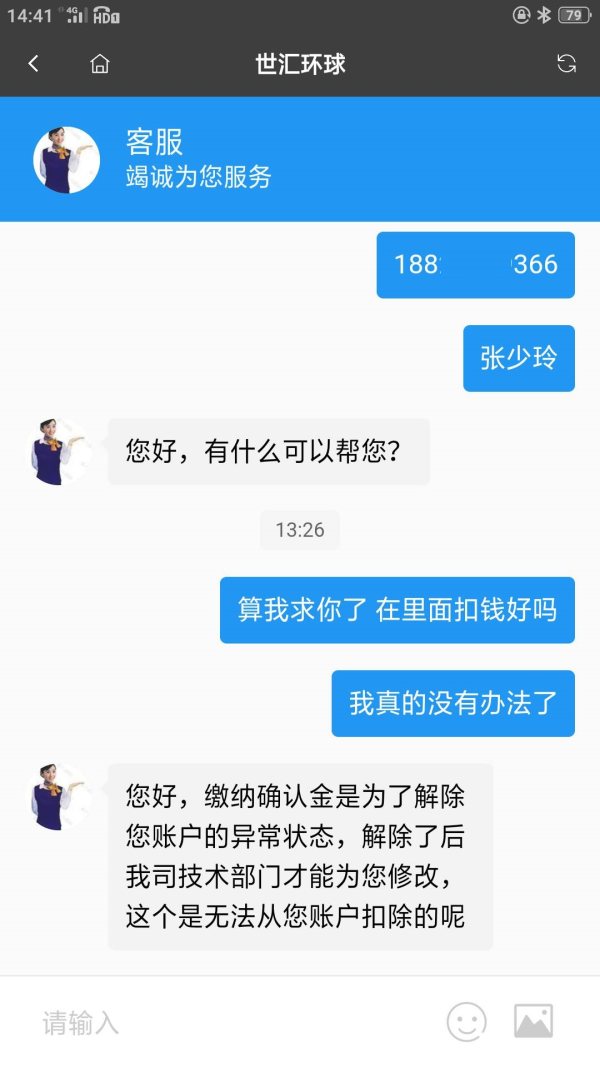

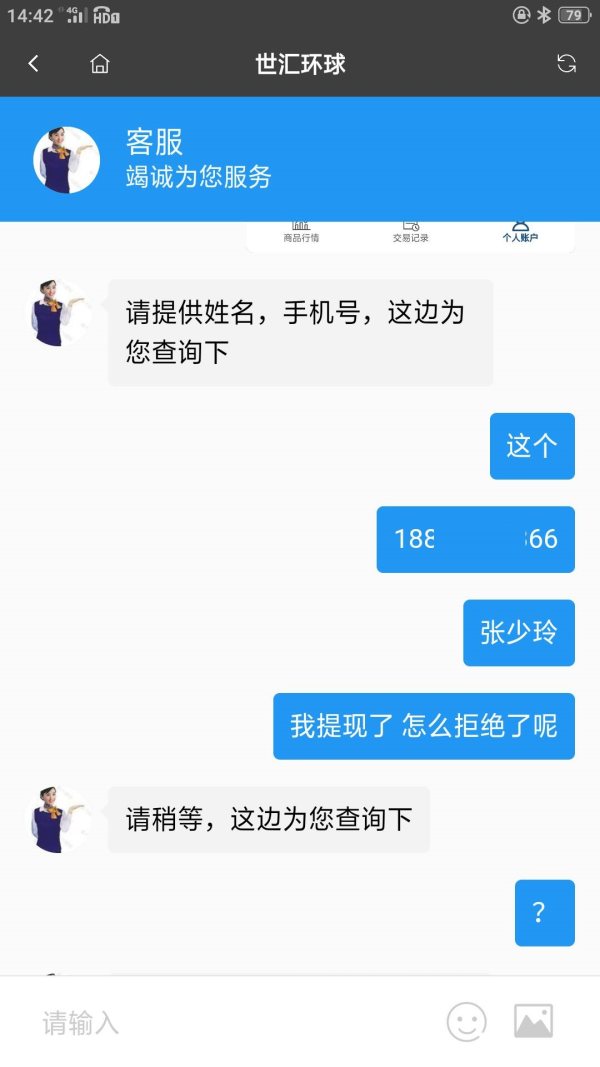

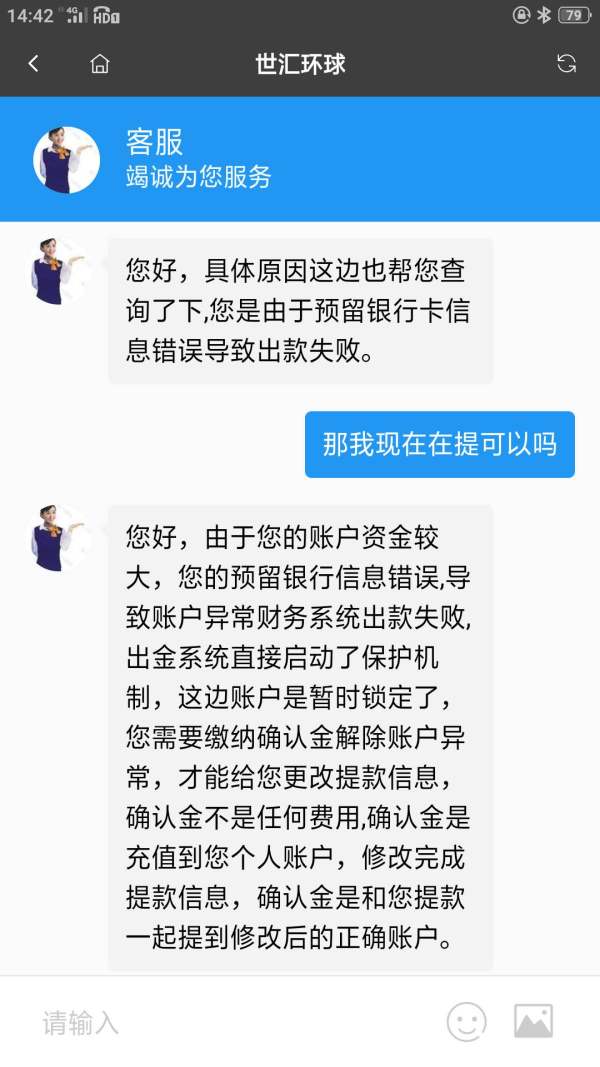

The platform's registration in Saint Vincent and the Grenadines provides basic corporate structure but lacks the comprehensive regulatory framework offered by major financial jurisdictions. This regulatory gap significantly impacts trader protection and recourse options in case of disputes or operational issues. User feedback includes specific concerns about whether WSM operates as a legitimate forex broker or represents potential fraudulent activity.

Such questions highlight how important enhanced due diligence is when considering platform engagement, particularly given the absence of regulatory oversight. Fund security measures, client money protection protocols, and operational transparency standards are not clearly documented in available platform materials. Without clear information about asset protection and operational safeguards, traders face increased uncertainty about fund safety and platform reliability.

User Experience Analysis

WSM's user experience reflects the diverse nature of its service offerings, with feedback varying significantly across different platform divisions. Users report that high-volatility games and trading opportunities require patience, which suggests that the platform caters to risk-tolerant individuals who are comfortable with extended waiting periods for significant returns.

Interface design, navigation ease, and platform usability are not comprehensively documented in available materials. Modern trading platforms typically emphasize user-friendly design and intuitive functionality, which makes this information gap relevant for user experience assessment. Registration and account verification processes remain undocumented in accessible platform materials.

Streamlined onboarding procedures represent crucial elements of positive user experience, particularly for new traders who want efficient account activation. User feedback suggests that the platform may be most suitable for high-risk tolerance investors who are comfortable with volatile trading environments. Some users appreciate the fair payout systems in certain platform divisions, while others express concerns about overall operational legitimacy and transparency.

The platform's target demographic appears to include traders who want high-volatility investment opportunities rather than conservative, steady-growth strategies. This wsm review suggests that user satisfaction correlates strongly with individual risk tolerance and trading objective alignment.

Conclusion

This comprehensive wsm review reveals a platform with significant regulatory and transparency limitations that potential traders must carefully consider. While WSM offers access to diverse investment opportunities across currency pairs, indices, and commodities, the unregulated operational status and limited transparency about trading conditions create substantial concerns for trader protection and operational reliability.

The platform appears most suitable for high-risk tolerance traders who are comfortable with volatile trading environments and willing to accept the inherent risks associated with unregulated broker engagement. However, the absence of regulatory oversight, unclear trading conditions, and mixed user feedback suggest that conservative traders or those requiring comprehensive client protection should consider alternative, regulated platforms. WSM's primary advantages include diversified market access and opportunities for high-volatility trading, while significant disadvantages encompass regulatory absence, operational opacity, and questionable legitimacy concerns raised by some users.

Potential traders should conduct thorough due diligence and consider their risk tolerance carefully before engaging with this platform.