FizmoFX 2025 Review: Everything You Need to Know

Executive Summary

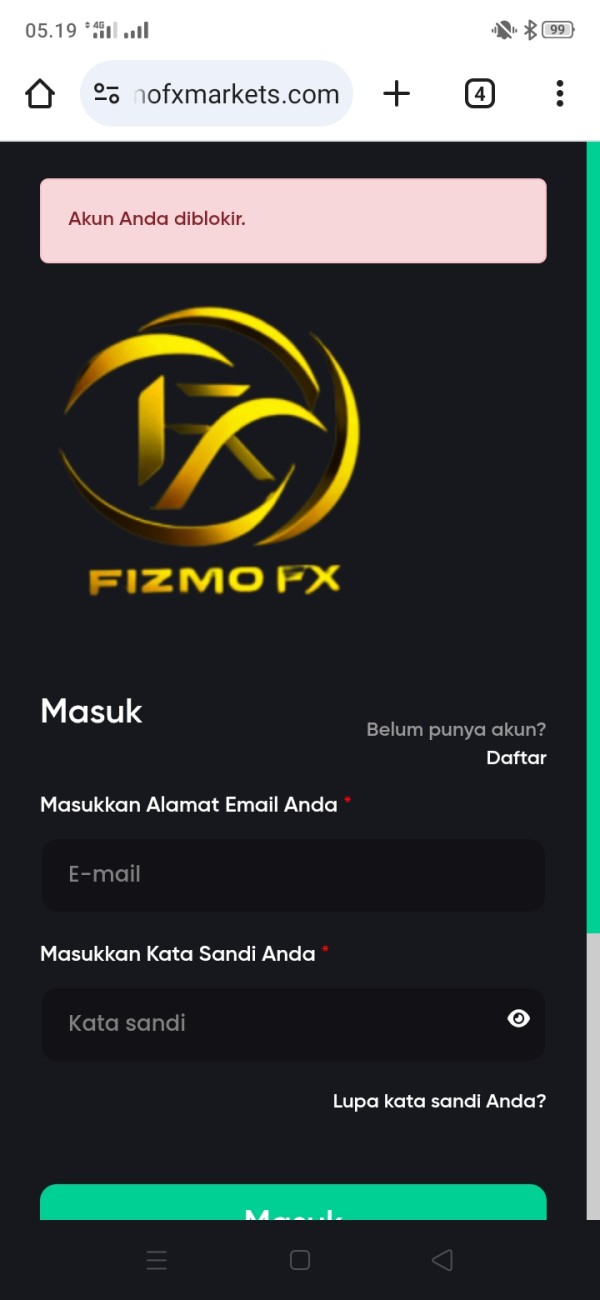

This fizmofx review looks at a broker with serious concerns about legitimacy and investor fund security. The review gives an overall negative assessment. FizmoFX works as an online trading platform that offers forex and related investment instruments, but it lacks proper regulatory oversight which creates major red flags for potential investors.

FizmoFX provides standard and professional accounts with no commission structure. The broker also offers ECN accounts that feature commission-based pricing with tighter spreads. FizmoFX operates across multiple jurisdictions, including Saint Lucia, which is known for its lenient regulatory environment. User feedback shows generally positive customer support experiences, but there are ongoing reports of withdrawal difficulties that significantly hurt the broker's credibility.

The platform targets traders who care about trading costs and want responsive customer support. However, the lack of regulatory protection and concerning user reports about fund withdrawal issues make this broker unsuitable for most serious traders. With a trust rating of only 8% based on user feedback, FizmoFX fails to meet the basic safety standards expected in the modern forex trading environment.

This review matters for traders considering FizmoFX as their trading partner. It highlights critical safety concerns that outweigh any potential benefits the broker might offer.

Important Notice

Regional Entity Differences: FizmoFX operates across multiple jurisdictions with varying regulatory standards. The broker's presence in Saint Lucia, known for its relaxed regulatory framework, should be carefully considered by potential clients. Different regional operations may offer varying levels of investor protection and service quality.

Review Methodology: This assessment uses available user feedback, market commentary, and publicly accessible information. Due to the broker's limited transparency and regulatory status, some information may be incomplete or subject to change. Potential investors should conduct their own research before making any investment decisions.

Rating Framework

Broker Overview

FizmoFX operates as an online trading platform in the competitive forex and CFD market. Specific details about its founding year and corporate background remain unclear from available sources. The broker positions itself as a service provider offering various account types designed to accommodate different trading preferences and capital levels, but the lack of transparent corporate information raises immediate concerns about the company's commitment to regulatory compliance and investor protection.

The broker's business model centers around providing forex trading services and related financial instruments through what appears to be a multi-tier account structure. FizmoFX offers standard and professional accounts with commission-free trading. The broker also provides ECN accounts that feature commission-based pricing with potentially tighter spreads. This approach suggests an attempt to cater to both retail traders seeking simple pricing structures and more sophisticated traders who prefer institutional-style execution.

FizmoFX operates across multiple regions including Saint Lucia and lacks proper regulatory oversight from major financial authorities. This fizmofx review must emphasize that the absence of regulation from established bodies like the FCA, ASIC, or CySEC represents a fundamental weakness in the broker's offering. The company's presence in jurisdictions with lenient regulatory frameworks should serve as a warning sign for potential clients considering their services.

Regulatory Status: FizmoFX operates in multiple regions with its most notable presence in Saint Lucia. This jurisdiction is known for minimal regulatory oversight. The broker lacks authorization from major regulatory bodies, which significantly impacts investor protection and fund security.

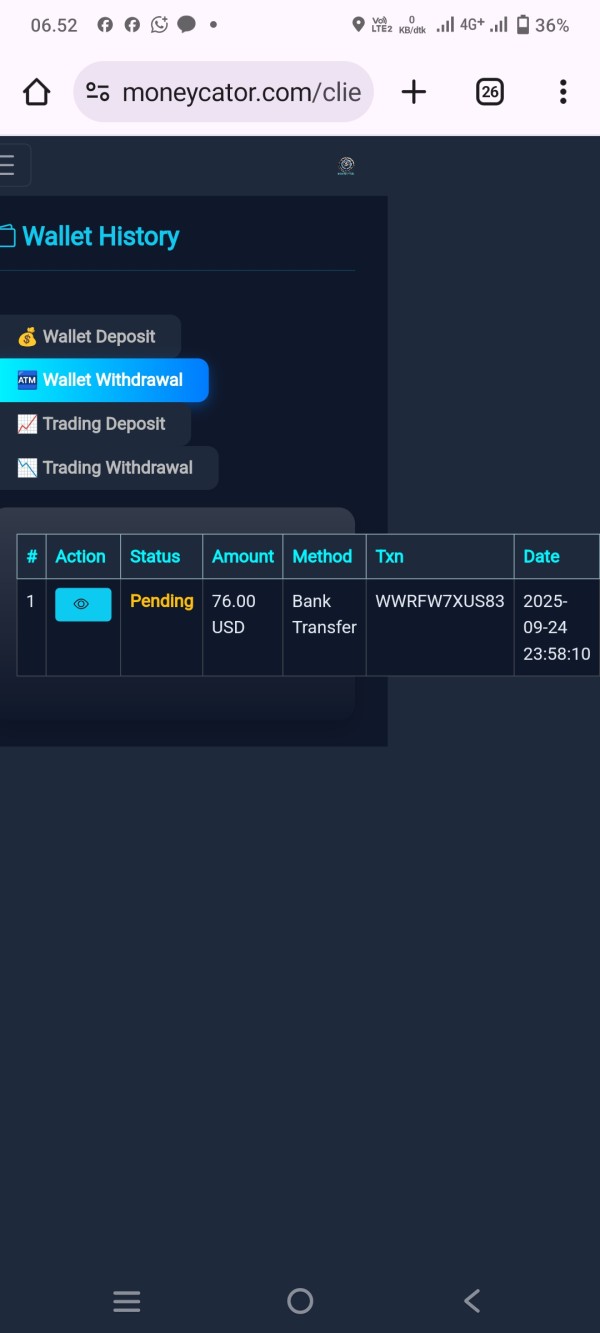

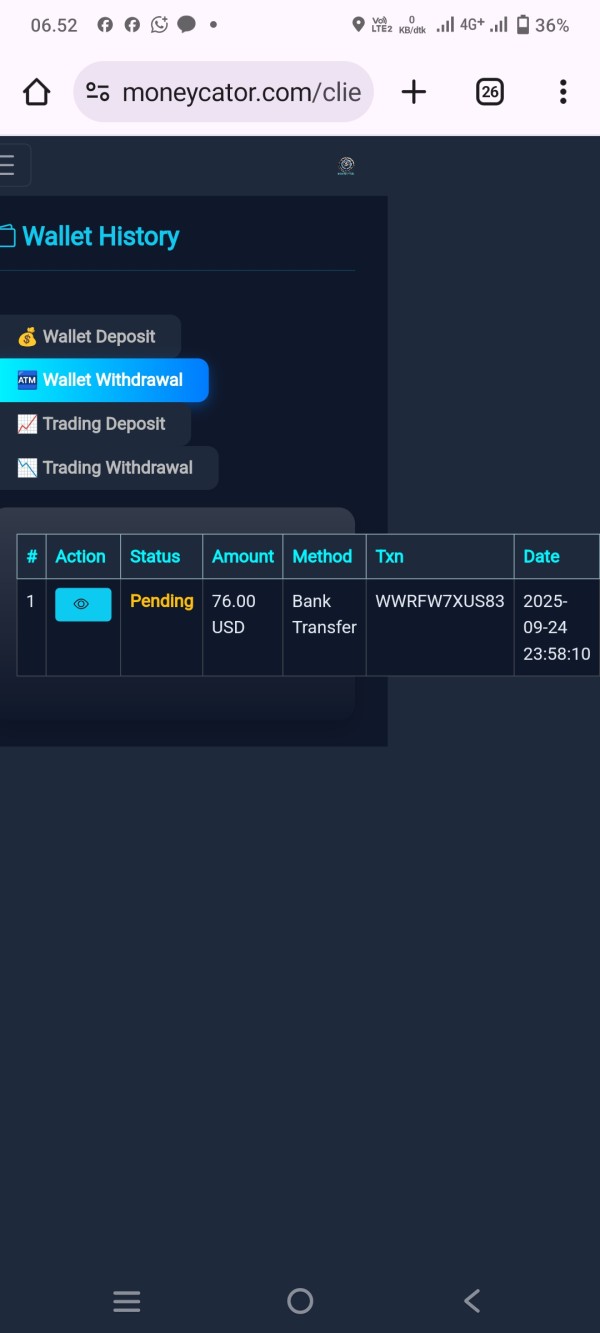

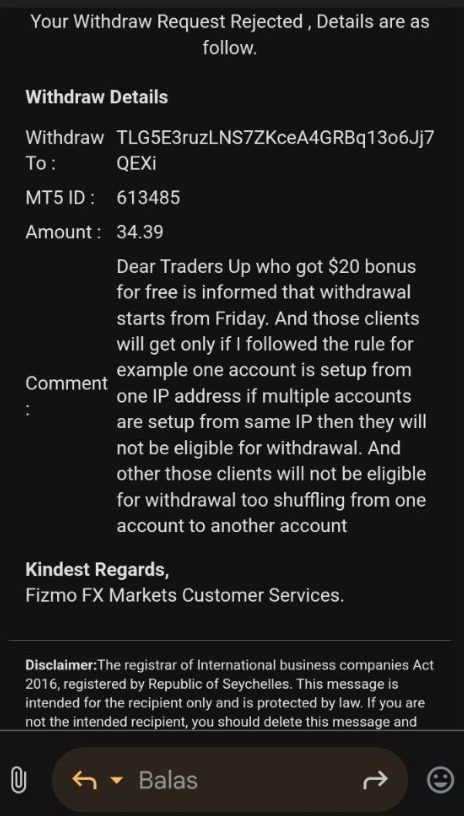

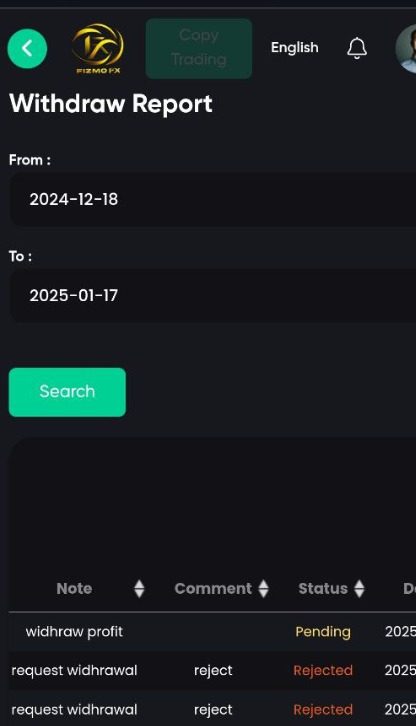

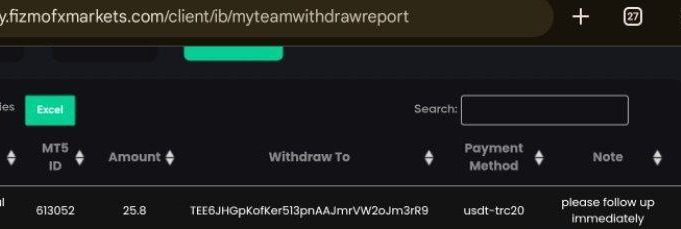

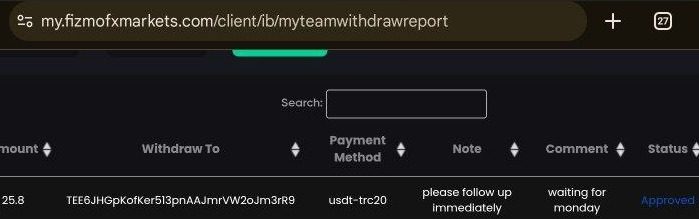

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available sources. User feedback suggests difficulties with withdrawal processes that have affected client satisfaction.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in available documentation. Potential clients must contact the broker directly for this crucial information.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not detailed in available sources. This suggests either limited promotional activity or poor transparency in marketing communications.

Tradeable Assets: FizmoFX primarily focuses on forex trading, but the complete range of available instruments and asset classes requires clarification directly from the broker. Comprehensive asset lists are not readily available.

Cost Structure: The broker offers standard and professional accounts with commission-free trading. ECN accounts feature commission-based pricing with tighter spreads. This tiered approach allows traders to choose between simplified pricing and potentially better execution conditions.

Leverage Ratios: Specific leverage offerings are not detailed in available sources. This represents another area where the broker lacks transparency in its public communications.

Trading Platform Options: Information about specific trading platforms is not clearly specified in available documentation. This includes whether MT4 or MT5 are available.

Geographic Restrictions: Specific regional restrictions and availability are not detailed in current sources.

Customer Service Languages: The range of languages supported by customer service is not specified in available information.

This fizmofx review highlights significant gaps in publicly available information. These gaps raise concerns about the broker's transparency and professional standards.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

FizmoFX offers a tiered account structure designed to accommodate different trading preferences and experience levels. The broker provides standard and professional accounts that operate on a commission-free basis, which can be attractive to traders seeking straightforward pricing without additional transaction costs. Additionally, ECN accounts are available with commission-based pricing and tighter spreads, potentially offering better execution for more active traders.

This fizmofx review must note that crucial details about minimum deposit requirements remain unclear from available sources. The lack of transparent information about account opening procedures and specific account features represents a significant weakness in the broker's public communications. User feedback does not provide clear insights into the account opening process or specific benefits associated with different account tiers.

The absence of information about special account features suggests either limited product diversity or poor communication of available services. Islamic accounts for Muslim traders are not mentioned in available sources. Without clear documentation of leverage ratios, margin requirements, and other essential trading conditions, potential clients cannot make informed decisions about account suitability.

The commission-free structure for standard accounts appears competitive, but the overall lack of transparency regarding account conditions significantly impacts the evaluation. Professional traders typically require detailed information about all trading conditions before committing to a broker, and FizmoFX's limited disclosure fails to meet these standards.

The evaluation of FizmoFX's trading tools and resources is severely hampered by the lack of detailed information in available sources. No specific trading tools, analytical resources, or educational materials are mentioned in user feedback or promotional materials. This suggests either limited offerings or poor communication of available features.

Modern forex traders expect access to comprehensive market analysis, technical indicators, economic calendars, and educational resources to support their trading decisions. The absence of clear information about these essential tools raises questions about FizmoFX's commitment to providing a complete trading environment. Research and analysis resources, which are crucial for informed trading decisions, are not detailed in available documentation.

This gap is particularly concerning for traders who rely on fundamental analysis and market research to guide their strategies. Educational resources that help new traders develop their skills appear to be either absent or poorly promoted. Automated trading support, including expert advisors and algorithmic trading capabilities, is not mentioned in available sources.

This represents a significant limitation for traders who rely on automated strategies or systematic trading approaches. The lack of information about platform capabilities and third-party tool integration further limits the broker's appeal to experienced traders.

Customer Service and Support Analysis (Score: 7/10)

Customer service represents one of the few areas where FizmoFX receives relatively positive feedback from users. According to available user reports, the broker's customer support team demonstrates reasonable responsiveness and helpfulness in addressing client inquiries. This positive aspect provides some reassurance about the broker's commitment to client relationships, despite other significant concerns.

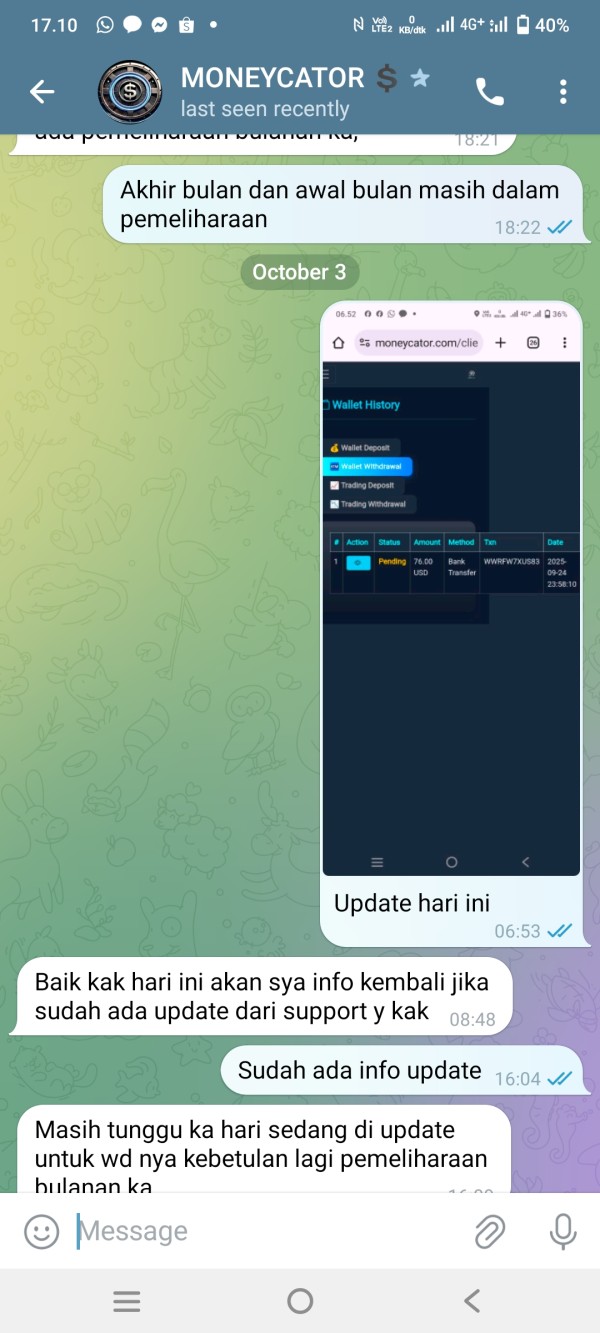

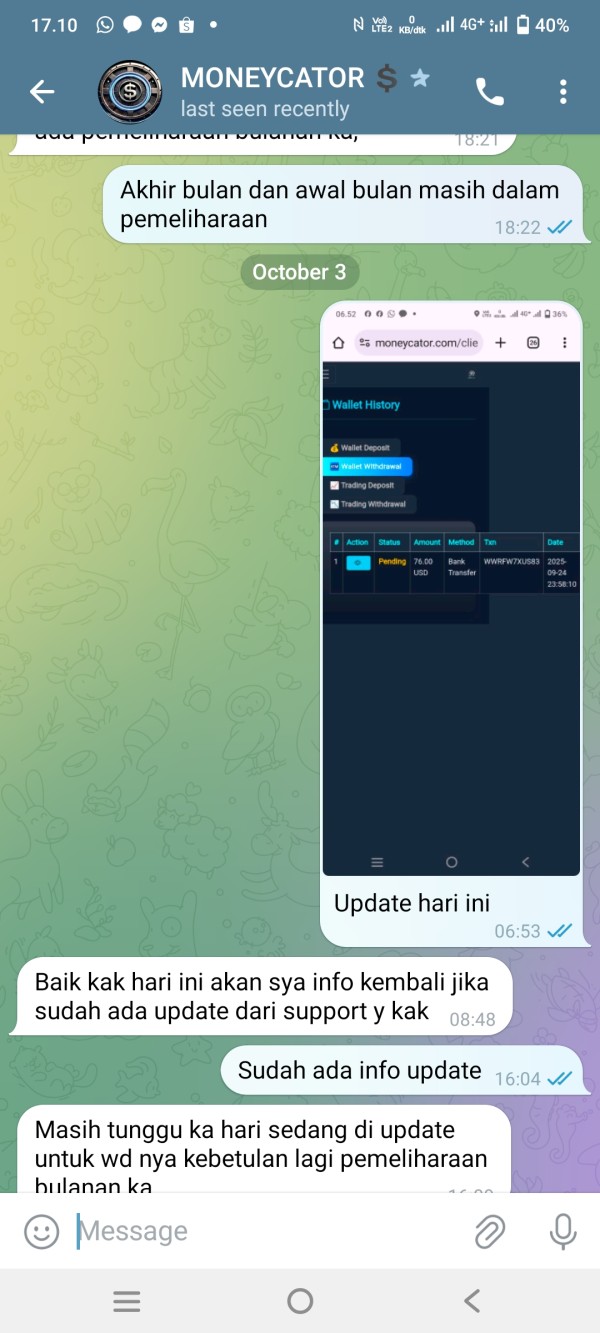

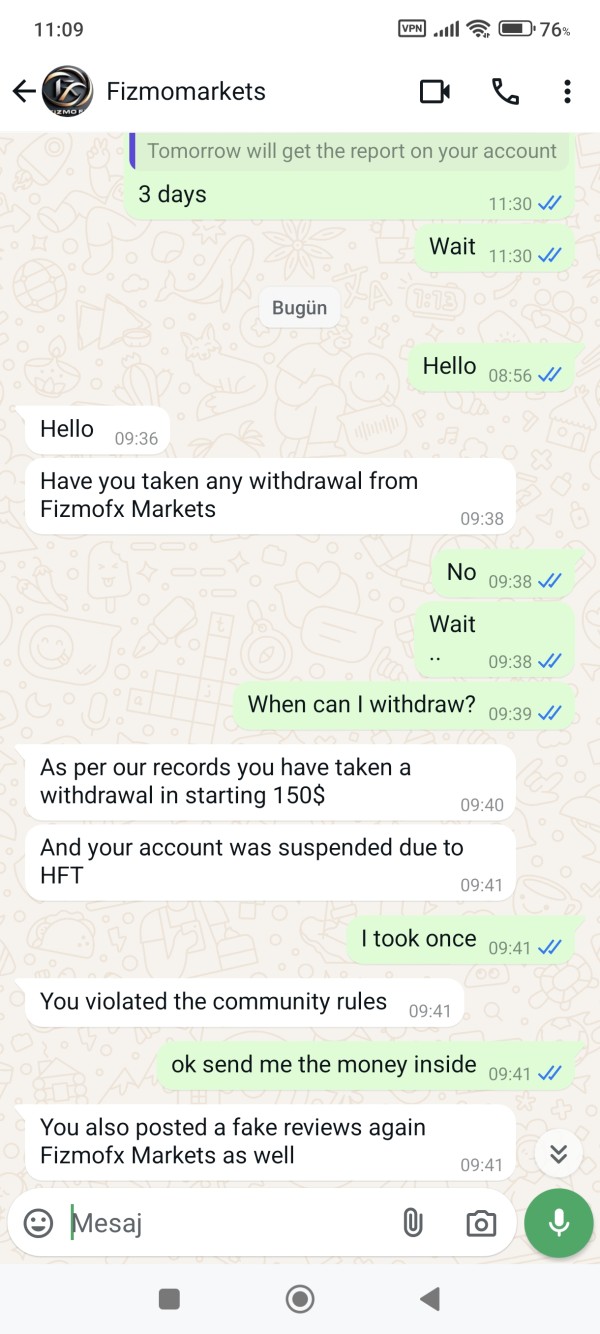

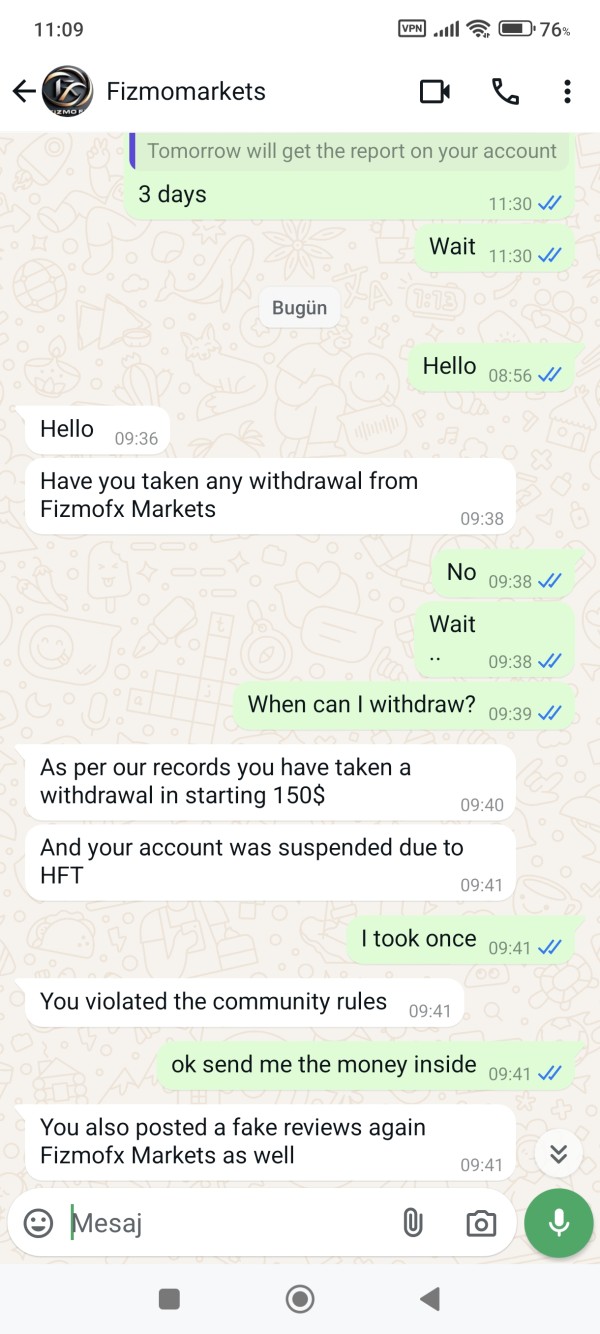

User feedback indicates that customer service representatives are generally knowledgeable and willing to assist with account-related questions and technical issues. The speed of response appears to meet reasonable expectations, though specific response time guarantees are not documented in available sources. However, the positive customer service experience is significantly undermined by persistent reports of withdrawal difficulties.

While support staff may be helpful with general inquiries, their ability to resolve fundamental issues like fund withdrawals appears limited. This disconnect between helpful customer service and operational problems suggests systemic issues within the organization. The availability of customer service channels, operating hours, and multilingual support options are not clearly detailed in available sources.

This lack of transparency about service availability could impact client satisfaction, particularly for traders in different time zones or those requiring support in specific languages. Despite the relatively positive feedback about customer service interactions, the inability to effectively resolve withdrawal issues represents a critical failure that overshadows other customer service strengths.

Trading Experience Analysis (Score: 5/10)

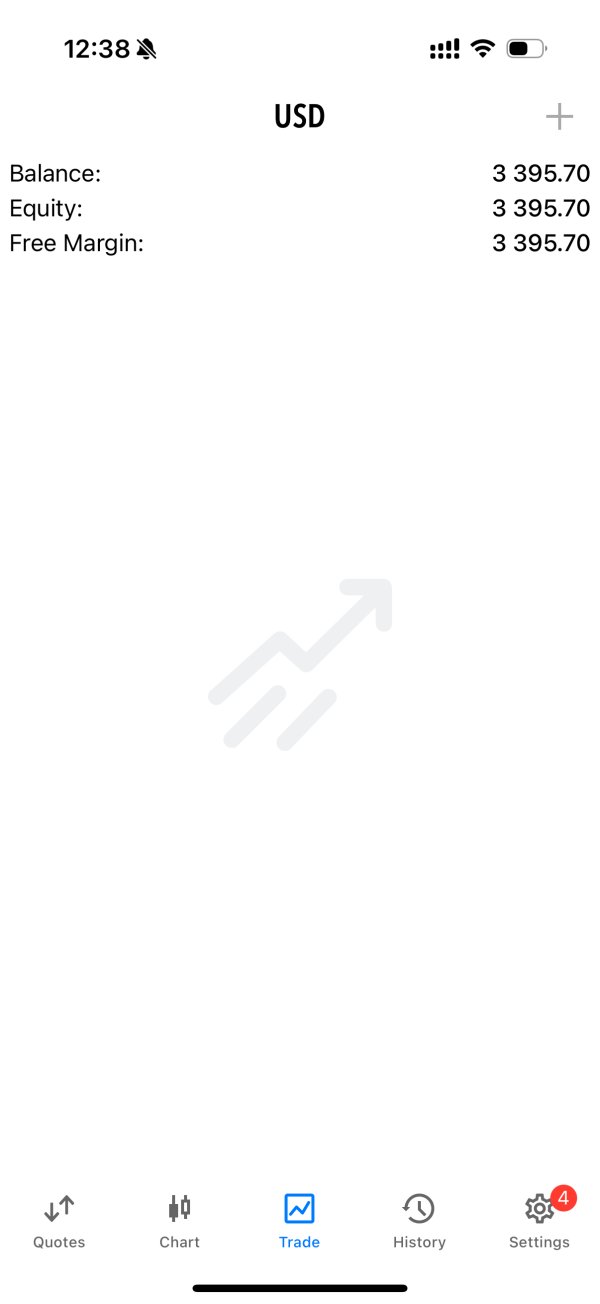

The trading experience offered by FizmoFX receives mixed reviews based on available user feedback. Several concerning issues impact overall execution quality. User reports indicate problems with slippage and requotes, which are fundamental execution issues that can significantly impact trading profitability and strategy effectiveness.

Platform stability and execution speed appear to be inconsistent based on user feedback, though specific performance metrics and testing data are not available in current sources. These stability concerns are particularly problematic for traders employing short-term strategies or those requiring precise order execution timing. The lack of detailed information about specific trading platforms represents a significant limitation in evaluating the overall trading experience.

Without clear documentation of platform features, charting capabilities, and order management tools, potential clients cannot assess whether the trading environment meets their technical requirements. This fizmofx review notes that mobile trading capabilities and cross-platform synchronization are not detailed in available sources, which is concerning given the importance of mobile access in modern trading. The absence of information about platform customization options and advanced trading features further limits the assessment of trading experience quality.

Spread stability and liquidity conditions are not clearly documented, making it difficult for traders to understand the true cost of trading and execution quality they can expect. These gaps in information, combined with user reports of execution issues, contribute to the moderate rating for trading experience.

Trust and Safety Analysis (Score: 3/10)

Trust and safety represent the most significant concerns in this FizmoFX evaluation. Fundamental issues should deter most potential clients. The broker operates without proper regulatory oversight from established financial authorities, creating substantial risks for client fund security and operational accountability.

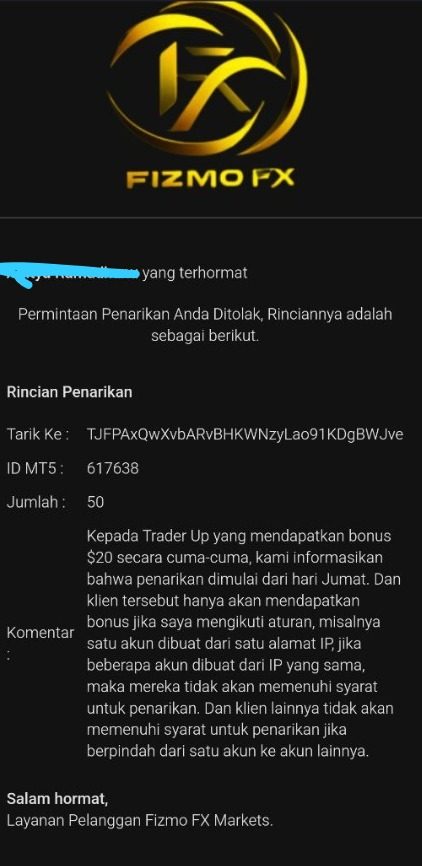

FizmoFX's lack of regulation from major bodies like the FCA, ASIC, or CySEC means that clients have limited recourse in case of disputes or operational failures. The broker's presence in Saint Lucia, known for its minimal regulatory requirements, does not provide the investor protections that traders should expect from a legitimate financial services provider. The trust rating of only 8% based on user feedback represents an extremely low confidence level that reflects serious concerns about the broker's reliability and operational integrity.

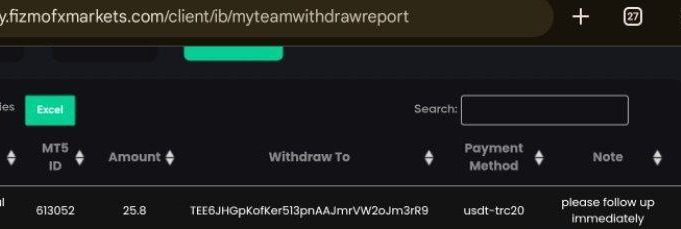

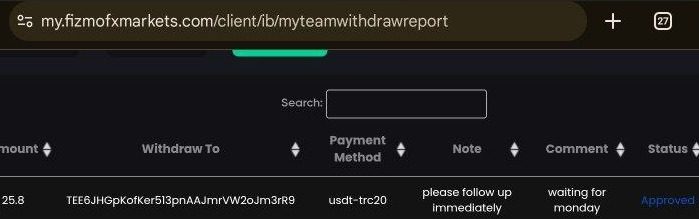

This poor trust rating is supported by persistent user reports of withdrawal difficulties, which represent the most serious red flag for any financial services provider. Fund safety measures, segregation of client accounts, and insurance protections are not detailed in available sources, suggesting either inadequate safeguards or poor transparency about existing protections. Without clear documentation of fund protection measures, clients cannot assess the security of their investments.

The broker's limited transparency about corporate structure, ownership, and financial standing further undermines trust and confidence. Legitimate brokers typically provide comprehensive information about their corporate governance and financial stability, areas where FizmoFX appears to fall significantly short of industry standards.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with FizmoFX shows significant variation. Experiences range from acceptable to highly problematic depending on the specific aspect of service. While some users report positive interactions with customer support, the persistent withdrawal difficulties create substantial dissatisfaction that overshadows other potentially positive aspects.

Interface design and platform usability are not well-documented in available sources, making it difficult to assess the quality of the user interface and overall platform experience. Modern traders expect intuitive, well-designed platforms that support efficient trading workflows, and the lack of detailed platform information suggests potential limitations in this area. Registration and account verification processes are not clearly described in available documentation, which could indicate either streamlined procedures or inadequate know-your-customer protocols.

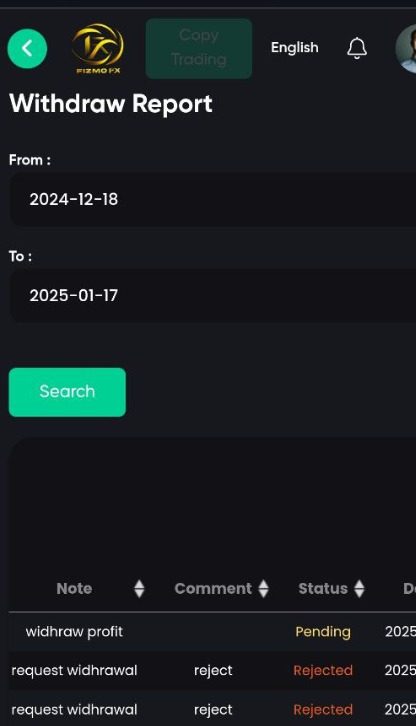

Given regulatory concerns, unclear verification processes raise additional questions about compliance standards. The fund management experience appears to be the most problematic aspect of user interaction with FizmoFX, with multiple reports of withdrawal difficulties that create significant user frustration. These operational problems represent fundamental failures in service delivery that impact overall user satisfaction.

User complaints consistently focus on withdrawal problems and concerns about the broker's legitimacy, indicating systemic issues that affect the core user experience. The broker appears to attract traders sensitive to trading costs, but fails to deliver the reliable service quality that these users ultimately require for successful trading relationships.

Conclusion

This fizmofx review concludes that the broker presents significant risks that outweigh any potential benefits for most traders. FizmoFX offers competitive trading costs through its commission-free account options and demonstrates reasonable customer service responsiveness, but fundamental issues with regulatory compliance and fund security create unacceptable risks for client investments.

The broker may appeal to traders who prioritize low trading costs and value responsive customer support. However, these benefits are overshadowed by the lack of proper regulatory oversight and persistent withdrawal difficulties reported by users. The 8% trust rating reflects serious concerns about operational reliability that cannot be ignored.

Primary advantages include relatively low trading costs and generally positive customer service interactions. Critical disadvantages include the absence of regulatory protection, concerning withdrawal processes, and limited transparency about essential trading conditions and corporate structure. These fundamental weaknesses make FizmoFX unsuitable for traders seeking a reliable, long-term trading partner.