maxi markets 2025 Review: Everything You Need to Know

Abstract

This maxi markets review shows a negative view of the broker despite its claims of regulation. Evidence suggests it is not truly regulated. Founded in 2008, the broker says it supports both retail and institutional investors, offering the widely used MetaTrader4 platform and many asset classes, including forex, stocks, indices, precious metals, and energy. While maxi markets promotes these features as advantages, the regulatory problems—citing oversight by the Marshall Islands Registry yet being flagged as unregulated—create major concerns for potential users. The platform aims to attract traders focused on portfolio diversification. However, the unclear regulatory environment seriously hurts trust and reliability. Furthermore, despite providing a strong trading interface and a range of financial products, key details such as minimum deposit requirements, commission structures, and specific bonus promotions remain hidden. This lack of transparency, coupled with mixed user feedback, shows the need for caution when evaluating maxi markets as a viable trading partner.

Important Considerations

Due to varying regional entities and uncertain regulatory information, users should exercise extreme caution when evaluating maxi markets for their trading needs. The available data shows that while the broker claims to be regulated, it is effectively flagged as unregulated by trusted sources. This review is based on a detailed analysis of available information and user feedback. It is important to note that certain operational aspects—such as deposit methods and bonus promotions—are not clearly detailed in the source materials. Therefore, the risks associated with unclear regulatory oversight, compared with more transparent brokers, should be carefully considered.

Scoring Framework

Broker Overview

Maxi markets started in 2008 with the goal of serving both retail and institutional investors looking for diverse financial products. The company presents itself as a full-service broker offering various instruments in foreign exchange trading alongside other financial products. Its business model focuses on portfolio diversification, appealing especially to traders seeking to access multiple asset classes. Despite this broad focus, maxi markets' overall reputation has been hurt by concerns about its regulatory status. The broker claims a level of oversight; however, available information shows that it is marked as unregulated. This contradiction in regulatory claims has led to major worry within the trading community, particularly among risk-averse investors who prioritize transparency and strong regulatory compliance.

In terms of trading tools and infrastructure, maxi markets uses the well-established MetaTrader4 platform. This choice is popular among traders worldwide for its reliability, ease of use, and advanced charting capabilities. The platform supports an impressive variety of asset classes, including forex, stocks, indices, precious metals, and energy, providing traders with multiple avenues for investment. Despite offering these potential benefits, the broker's regulatory oversight by the Marshall Islands Registry raises doubt about the safety of funds and overall trustworthiness. The combination of a highly functional trading platform against the backdrop of major regulatory concerns creates a mixed picture for investors. As such, maxi markets appears suited for more experienced traders who can navigate complex risk scenarios and who might be willing to trade off regulatory assurance for platform versatility.

Regulatory Region:

Maxi markets claims to be under the regulatory control of the Marshall Islands Registry. However, despite this claim, it is widely reported as being unregulated. This difference has raised serious concerns among industry watchers.

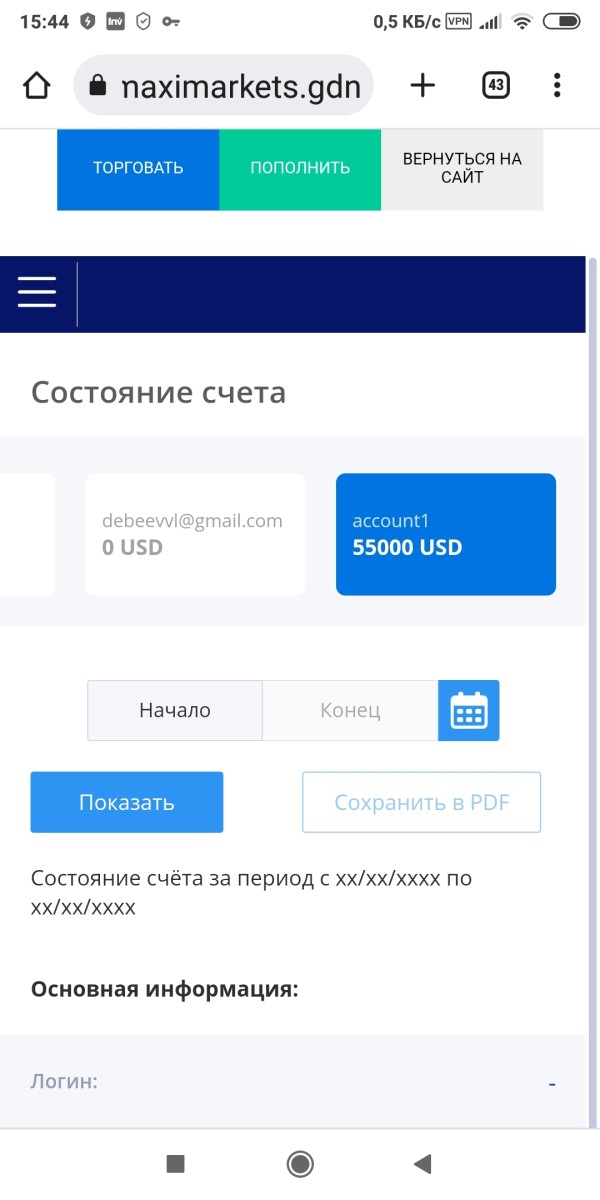

Deposit and Withdrawal Methods:

Specific details about deposit and withdrawal methods for maxi markets are not provided in the available documentation. As such, potential users should seek further clarity directly with the broker.

Minimum Deposit Requirement:

There is no detailed information on the minimum deposit requirements. This lack of disclosure adds to the uncertainty surrounding the broker's account conditions.

Bonus and Promotions:

The review does not include any substantial details on bonus promotions or other incentive programs offered by maxi markets. The absence of such information may signal a lower level of transparency in their promotional strategies.

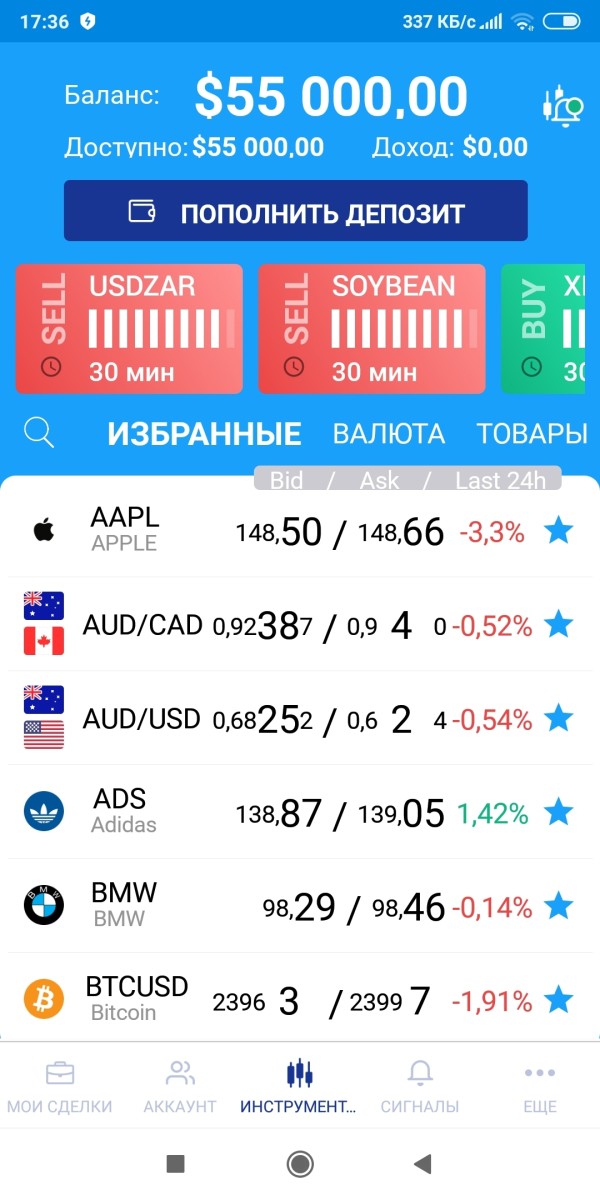

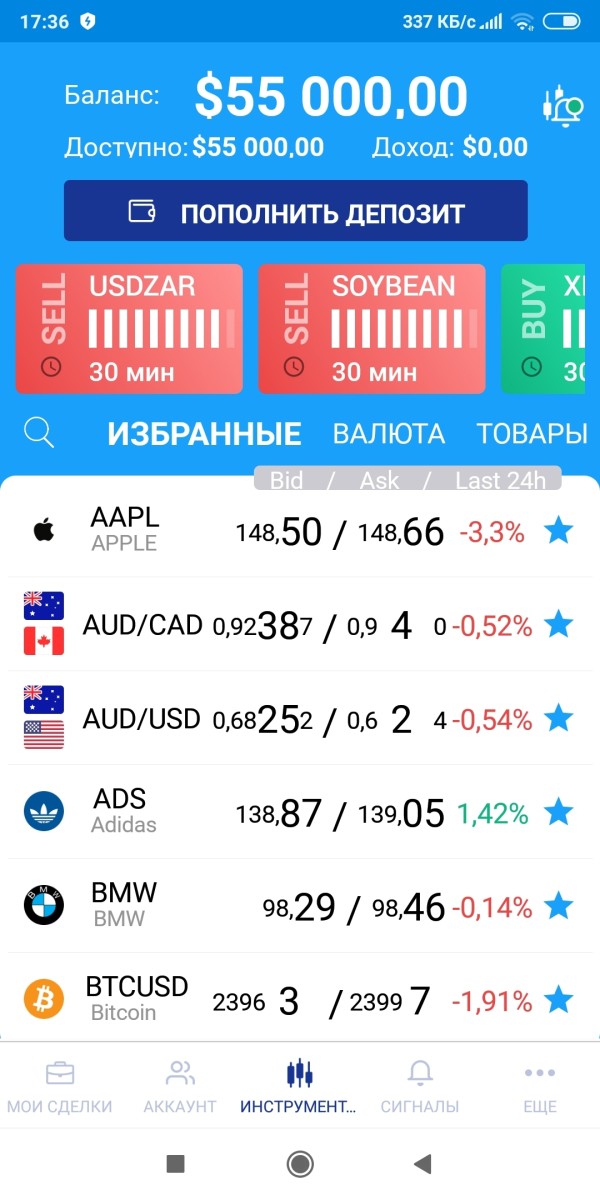

Tradable Assets:

Maxi markets provides access to a diverse range of tradable assets, including forex pairs, stocks, indices, precious metals, and energy products. This diversification supports traders looking to build a varied portfolio tailored to different market conditions.

Cost Structure:

Critical pricing details, including spreads and commissions, are not made clear in the broker's information. This lack of clarity in cost structure means that users might encounter unexpected trading expenses, as point spreads and commission details remain undisclosed. The lack of transparency in fee disclosures is a key concern for many potential traders.

Leverage Ratio:

Information about leverage ratios is not provided in the available data. This absence of details highlights one of the many operational aspects that remain unclear.

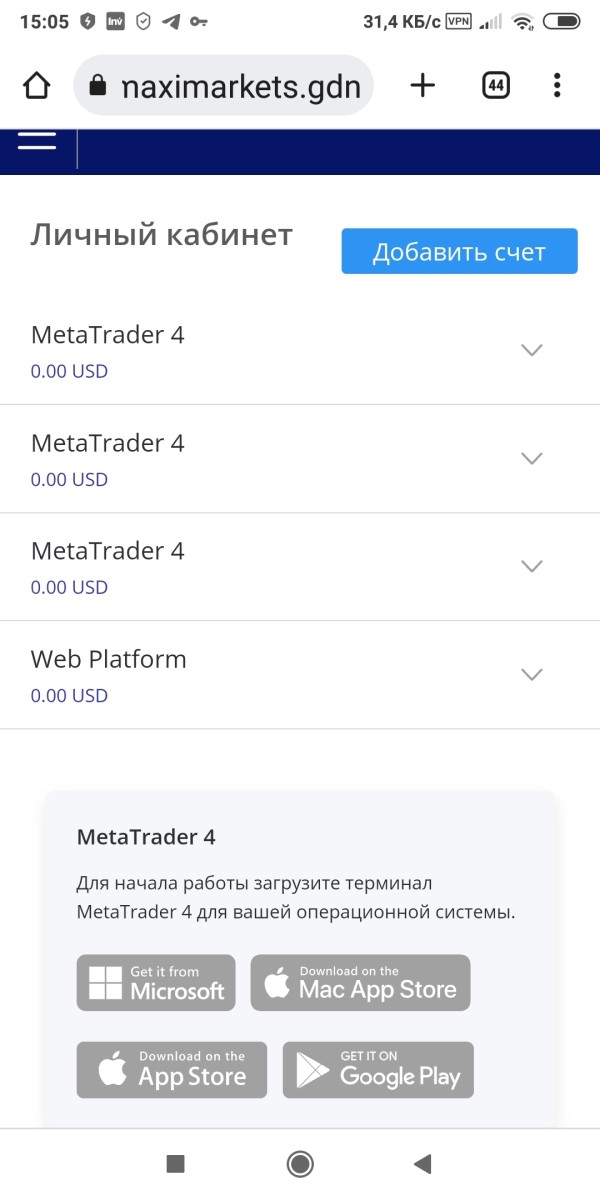

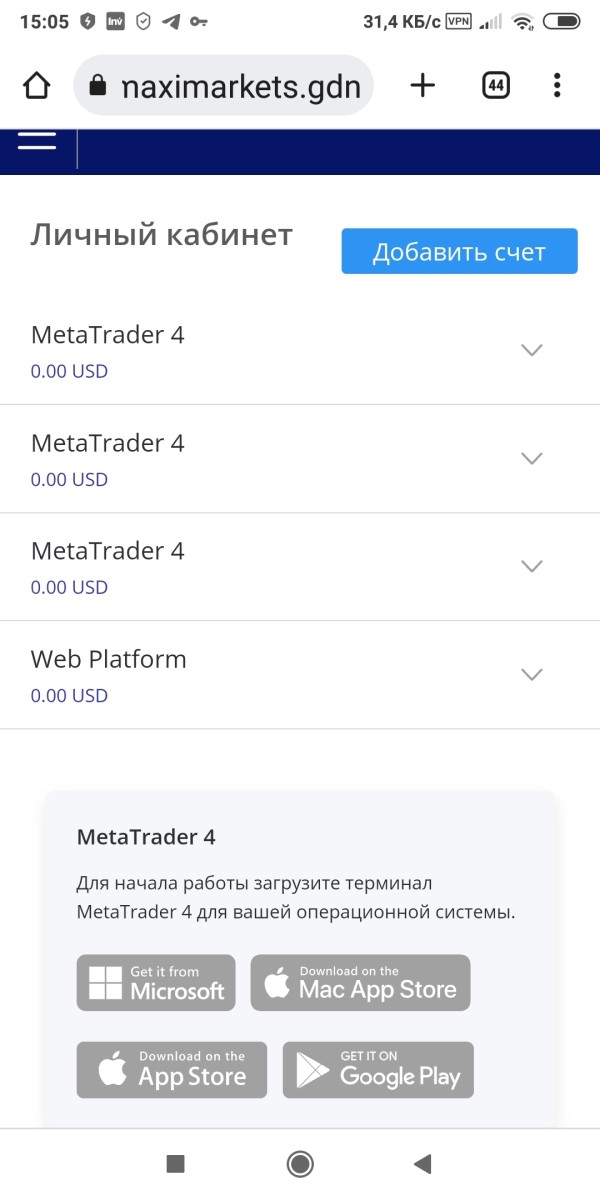

Platform Options:

Maxi markets offers the MetaTrader4 trading platform, a reliable and tested solution in the trading industry known for its comprehensive charting and technical analysis tools. This platform supports both manual and automated trading strategies, which can be crucial for informed decision-making.

Regional Restrictions:

There is insufficient detail on any regional restrictions or limitations regarding maxi markets. Without clear guidance on geographic availability, prospective users must inquire further before committing funds.

Customer Service Language:

While maxi markets provides 24/7 customer support, the specifics about the languages available remain unclear. This could potentially affect non-English speaking traders who require localized support.

Detailed Scoring Analysis

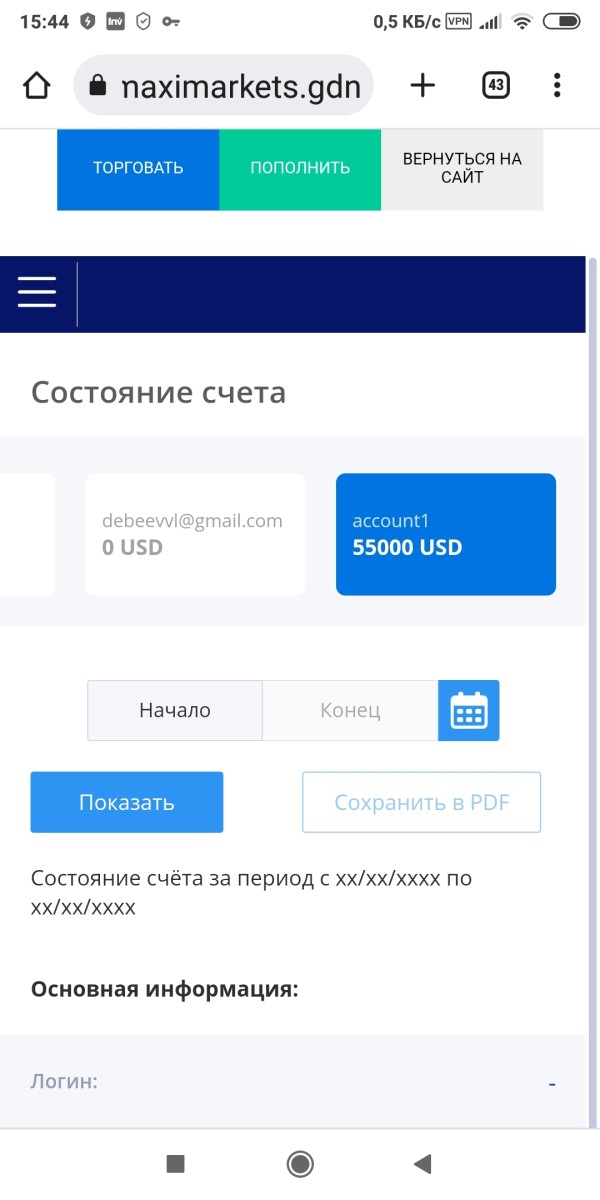

2.6.1 Account Conditions Analysis

Maxi markets provides limited information about account conditions, leaving significant gaps for potential users. The review does not detail the various account types available, such as standard or specialized accounts like Islamic accounts. In addition, there is no disclosure about minimum deposit requirements or account opening procedures. As a result, traders are left uncertain about the financial commitment required to start trading with maxi markets. The lack of clear details on commission structures further complicates the evaluation, as transparent pricing is essential for traders to understand their cost exposure. Comparatively, many brokers offer detailed accounts of these factors which allows for a straightforward decision-making process. Given that account conditions are critical for risk management and regulatory compliance checks, this unclear approach significantly hurts maxi markets' overall appeal. The absence of specific user feedback about these aspects only deepens the concern for new customers who might otherwise expect more comprehensive disclosure.

Maxi markets offers a solid suite of trading tools centered around the reputable MetaTrader4 platform. The platform itself is known for its reliability, advanced charting, and flexibility, making it a favored choice among both novice and experienced traders. The availability of multiple asset classes adds to the platform's appeal, allowing for a diversified investment strategy. However, the review points out that there is no detailed information on the additional research and educational resources that could further aid traders in making informed decisions. Additionally, while the platform supports automated trading, details about the extent and depth of automation options are not provided. The absence of comprehensive educational materials and market analysis tools means that traders may need to rely on external resources. Despite these shortcomings, the strength of the MetaTrader4 platform provides a competitive edge. Nonetheless, future improvements in transparency around additional tools and research support would be highly desirable to enhance overall trader confidence.

2.6.3 Customer Service and Support Analysis

Customer service at maxi markets is available 24/7, which is an important feature for traders who require immediate assistance across global time zones. However, the analysis reveals that the quality and responsiveness of the customer support team have received mixed reviews. Some customers report adequate service, while others indicate delays and a general lack of clarity in responses. Moreover, specific details about the channels through which support is accessible are not provided. This lack of specificity can be particularly problematic for traders who depend on multilingual support services. The limited information on response times and resolution efficiency does little to build confidence among potential users. Although ongoing support is a positive sign, the overall inconsistent feedback shows that improvement in customer service delivery is needed. Addressing these concerns by providing clear support channels, faster response times, and multilingual offerings would enhance trader satisfaction significantly.

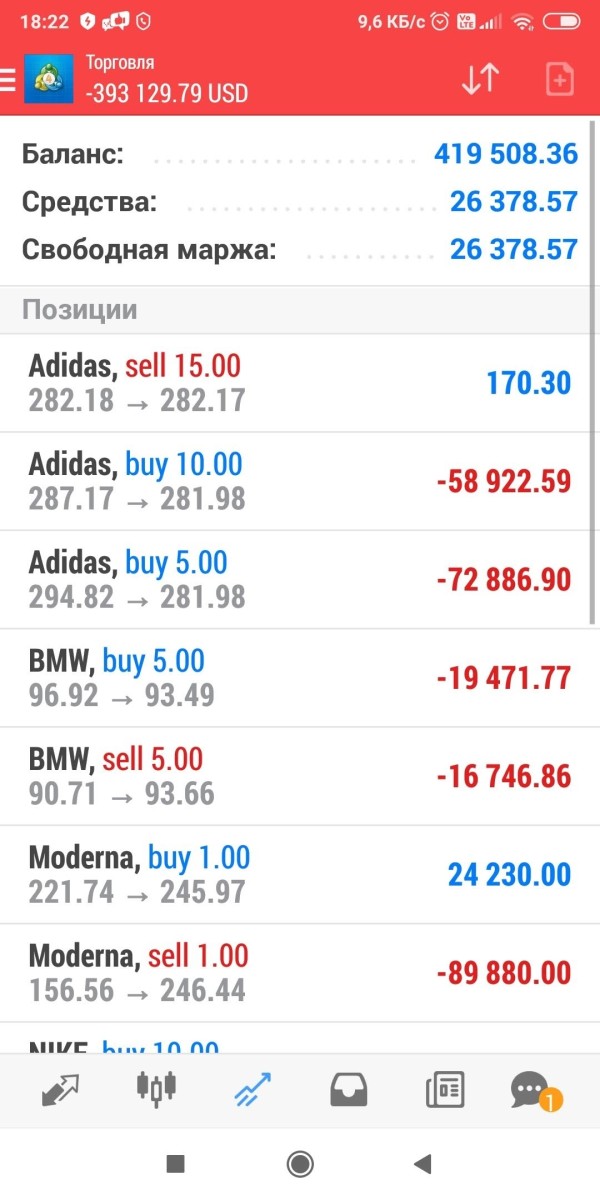

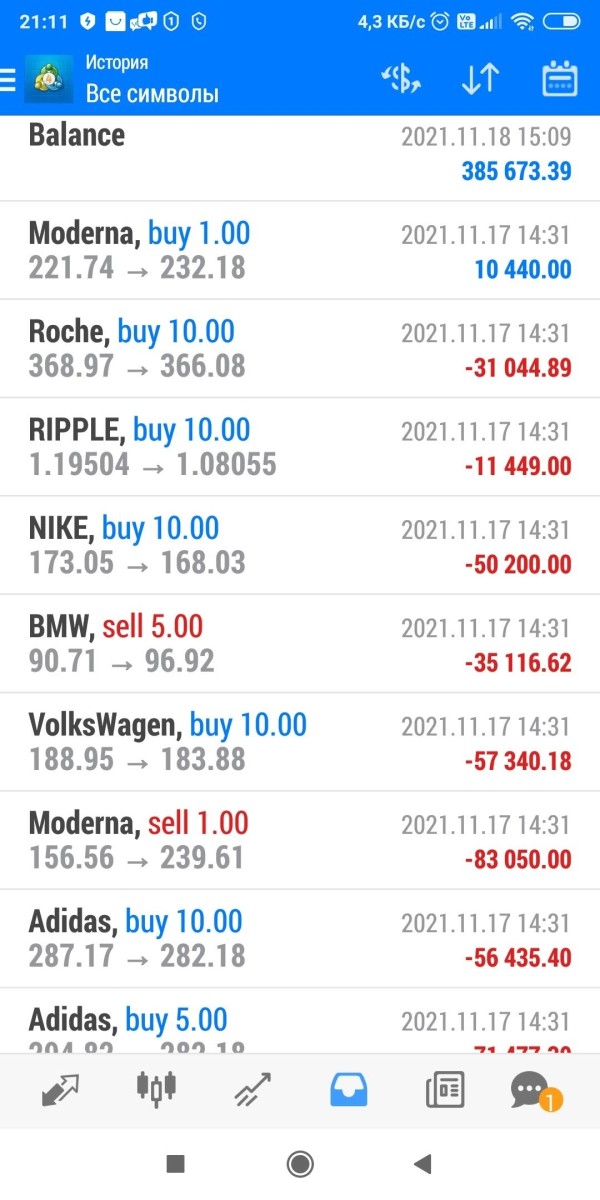

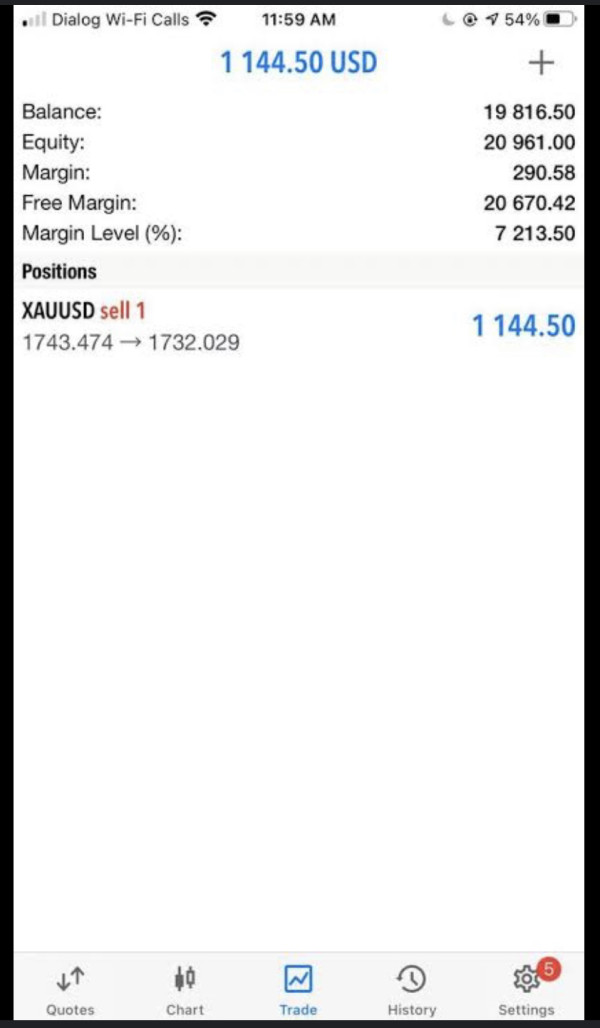

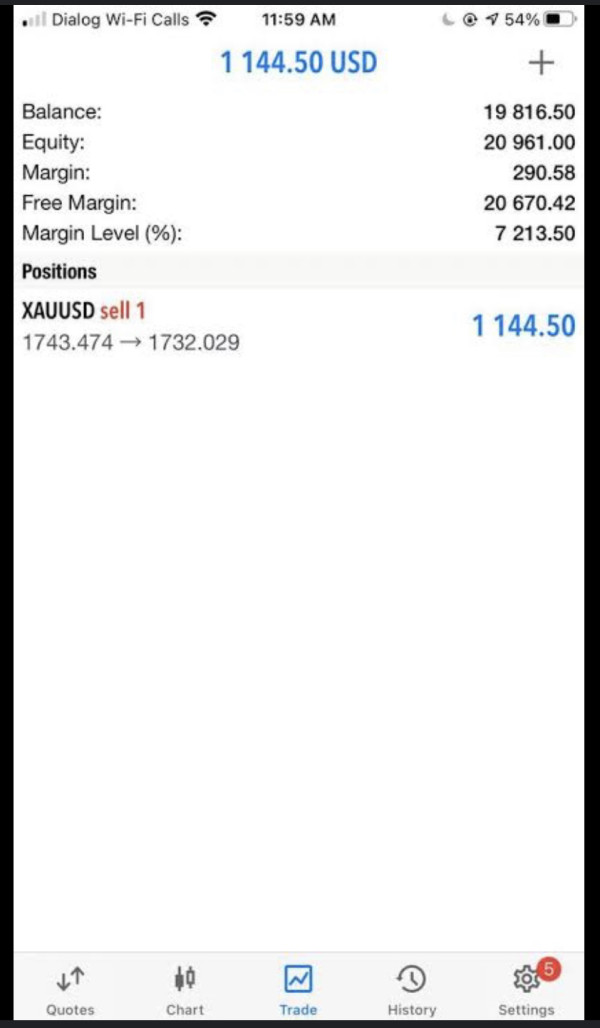

2.6.4 Trading Experience Analysis

The trading experience provided by maxi markets appears to benefit from the solid performance of the MetaTrader4 platform. Users have noted that the platform generally offers reliable stability and a smooth interface, which is crucial for executing trades efficiently. However, the review highlights that there is limited data available about order execution quality, including potential issues like slippage or requotes during high market volatility. The platform's functionality is strong, yet the absence of detailed performance metrics reduces the overall enthusiasm from the trading community. Additionally, while the desktop platform is well-regarded, there is minimal information on mobile trading experiences which could be a significant factor for on-the-go traders. Overall, while the trading environment is functional with key tools support, the incomplete disclosure about trade execution metrics and mobile performance suggests that traders should remain cautious. Future updates from maxi markets could benefit from enhanced transparency around these technical performance aspects.

2.6.5 Trustworthiness Analysis

Trust is a fundamental component in broker evaluations, and in the case of maxi markets, regulatory concerns are paramount. Maxi markets claims oversight by the Marshall Islands Registry; however, multiple sources highlight that it is effectively unregulated. This difference raises serious concerns about the security of client funds and the overall integrity of the broker. The absence of detailed information about funds segregation, capital adequacy measures, or any strong investor protection schemes further worsens these issues. Additionally, there have not been clear disclosures about any negative events or how the broker handles potential disputes. Without transparent reporting and solid regulatory backing, maxi markets falls short in establishing the level of trust that cautious investors require. The existing information, which also lacks third-party validation or comprehensive external audits, suggests that traders face a high level of uncertainty about their money's security. Consequently, the trust score remains particularly low, serving as a significant warning signal for prospective clients.

2.6.6 User Experience Analysis

User experience with maxi markets is characterized by mixed reviews. While the platform infrastructure—centered on the MetaTrader4 system—is familiar to many and appreciated for its technical strength, the overall user satisfaction remains below average. Reports indicate a high bounce rate of 77%, which speaks volumes about the dissatisfaction among a significant portion of users. Critical aspects such as the ease of navigation, efficiency of the registration and verification process, and the smoothness of fund operations are not well addressed in the available information. Furthermore, complaints about unclear fee structures and the absence of detailed guidance on account management contribute to the negative sentiment. The interface design, though functional, does not seem to inspire confidence in first-time users or those seeking a more intuitive trading environment. Continuous improvements in user interface design and a more streamlined registration process would help elevate the overall experience. Providing clearer, more transparent operational details and responsive customer feedback channels would undoubtedly enhance trader satisfaction in future iterations.

Conclusion

In summary, maxi markets presents itself as a broker with a diversified asset offering and access to the robust MetaTrader4 platform. However, significant concerns about its regulatory status and overall transparency cannot be overlooked. With incomplete disclosures on account details, cost structures, and support mechanisms, the broker poses considerable risks, especially for less experienced traders. While the platform may appeal to experienced investors who can navigate uncertain regulatory waters, caution is strongly advised before committing funds.