Strike Pro 2025 Review: Everything You Need to Know

Executive Summary

Strike Pro is a forex broker registered in Saint Vincent and the Grenadines. It has been operating since 2019. This strike pro review shows a mixed picture of a broker that offers good entry-level conditions but faces serious trust issues. The broker presents itself as an easy-to-use trading platform with a very low minimum deposit of just $1 and leverage up to 1:500. This makes it appealing to new traders and those with little money.

However, our detailed analysis finds major questions about the broker's legitimacy and trustworthiness. Many user reports and industry sources show concerns about the broker's regulatory transparency and overall reliability. Strike Pro claims to offer trading in forex, commodities, stocks, and cryptocurrencies. The limited regulatory oversight from Saint Vincent and the Grenadines raises red flags for potential investors.

The broker seems to target beginners and low-capital investors with its minimal entry requirements. But the lack of complete information about trading platforms, customer service quality, and fund security measures suggests potential investors should be very careful. This evaluation stays neutral while highlighting both the apparent accessibility and the significant trust concerns surrounding this broker.

Important Notice

This Strike Pro evaluation is based on publicly available information and user feedback collected from various online sources. The broker's registration in Saint Vincent and the Grenadines may impact regulatory transparency and legal protections available to traders.

Saint Vincent and the Grenadines is known for having relatively relaxed financial regulations compared to major financial centers. This could affect investor protection standards. Our assessment methodology relies on public information, user testimonials, and industry reports rather than direct testing or site visits.

Potential traders should conduct their own due diligence and consider consulting with financial advisors before making investment decisions. Regional regulatory differences may significantly impact the services and protections available to traders in different jurisdictions.

Rating Framework

Overall Rating: 5.7/10

Broker Overview

Strike Pro emerged in the forex market in 2019 as a trading platform registered in Saint Vincent and the Grenadines. The company positions itself as a complete financial services provider, offering access to multiple asset classes including foreign exchange, precious metals, commodities, energy products, stocks, and digital currencies.

According to available company information, Strike Pro aims to make trading accessible by removing traditional barriers such as high minimum deposits and complex account opening procedures. The broker's business model centers on providing retail traders with direct market access through what appears to be a market maker structure. However, specific execution details remain unclear from available documentation.

Strike Pro markets itself as particularly suitable for newcomers to forex trading. It emphasizes ease of access and straightforward account management. However, this strike pro review must note that complete details about the company's operational structure, management team, and specific trading infrastructure are notably absent from readily available sources.

The broker's asset coverage spans traditional forex pairs, gold and silver trading, agricultural and industrial commodities, crude oil and natural gas, major international stocks, and popular cryptocurrencies. This diverse offering suggests an attempt to serve as a one-stop trading destination. However, the depth and quality of execution across these various markets remains unclear.

The company's regulatory framework, limited to Saint Vincent and the Grenadines registration, provides minimal oversight compared to major financial jurisdictions. This significantly impacts the overall assessment of this broker's credibility and trader protection standards.

Regulatory Framework

Strike Pro operates under registration in Saint Vincent and the Grenadines, a jurisdiction known for relatively permissive financial regulations. This regulatory environment provides limited oversight compared to major financial centers like the UK's FCA or Cyprus's CySEC.

This potentially affects trader protection standards and dispute resolution mechanisms.

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods was not detailed in available sources. This lack of transparency about payment processing represents a significant information gap.

Potential traders should investigate this before opening accounts.

Minimum Deposit Requirements

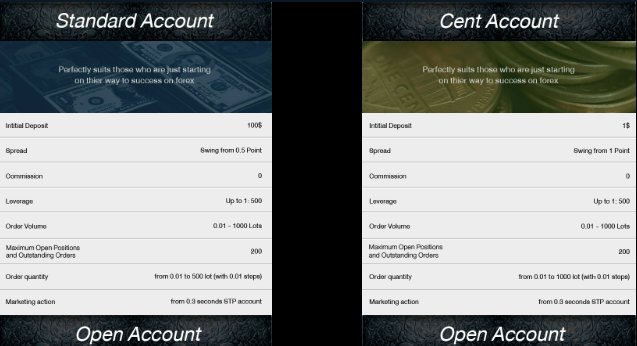

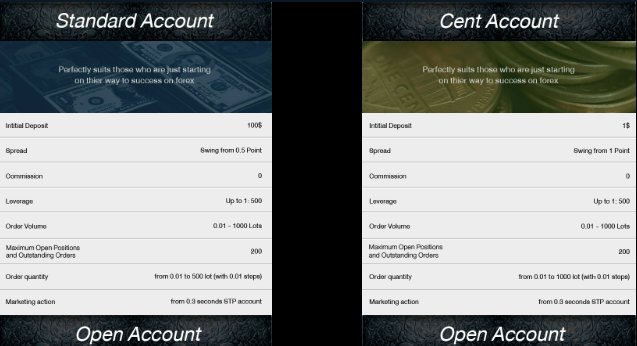

The broker's standout feature is its exceptionally low $1 minimum deposit requirement, making it one of the most accessible brokers in terms of entry capital. This minimal threshold particularly appeals to beginners wanting to test live trading with minimal financial exposure.

Available materials did not specify current bonus or promotional programs. The absence of clearly outlined promotional terms suggests either limited marketing initiatives or insufficient transparency in promotional communications.

Tradeable Assets

Strike Pro offers trading across multiple asset classes including major and minor forex pairs, precious metals (gold and silver), agricultural and industrial commodities, energy products (crude oil and natural gas), international stocks, and popular cryptocurrencies. This diverse range aims to provide complete market exposure through a single platform.

Cost Structure

Specific information about spreads, commissions, and other trading costs was not available in the reviewed materials. This lack of transparent pricing information represents a significant concern for potential traders seeking to understand their total trading costs.

According to this strike pro review, traders should request detailed cost breakdowns before committing funds.

Leverage Options

The broker offers maximum leverage of 1:500, which is relatively high and suitable for experienced traders. However, it is potentially dangerous for beginners due to increased risk exposure.

Detailed information about specific trading platforms was not available in the reviewed sources. This represents another significant information gap that affects the overall evaluation.

Geographic Restrictions

Specific information about geographic restrictions or prohibited jurisdictions was not detailed in available materials.

Customer Support Languages

Available documentation did not specify supported languages for customer service communications.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Strike Pro's account conditions receive high marks primarily due to the exceptionally accessible $1 minimum deposit requirement. This ultra-low entry threshold removes traditional barriers that prevent many potential traders from accessing forex markets.

For comparison, most established brokers require minimum deposits ranging from $100 to $500, making Strike Pro's offering genuinely distinctive in the market. However, the high rating is tempered by significant information gaps regarding account types, features, and specific terms.

Available materials did not detail whether multiple account tiers exist, what features differentiate various account types, or whether specialized accounts like Islamic accounts are available. The account opening process, verification requirements, and typical approval timeframes also remain unclear from available documentation.

The 1:500 maximum leverage offering aligns with industry standards for offshore brokers. However, this high leverage ratio requires careful risk management, particularly for the beginner traders that the low minimum deposit appears to target.

The combination of minimal entry requirements with high leverage could create dangerous scenarios for inexperienced traders who might not fully understand the associated risks. This strike pro review notes that while the accessibility is commendable, the lack of complete account information prevents a higher rating despite the attractive entry conditions.

The evaluation of Strike Pro's tools and resources reveals significant information deficiencies that impact the overall assessment. Available materials provided minimal details about trading tools, analytical resources, educational content, or platform capabilities.

This results in a middle-ground rating that reflects uncertainty rather than confirmed quality or deficiency. Professional trading typically requires access to complete charting tools, technical indicators, economic calendars, market analysis, and educational resources.

However, available documentation did not specify what analytical tools are integrated into Strike Pro's platform, whether advanced charting capabilities are available, or what research resources are provided to traders. Educational resources represent a critical component for brokers targeting beginners.

Yet no information was available regarding tutorials, webinars, trading guides, or educational content libraries. Similarly, details about automated trading support, expert advisor compatibility, or algorithmic trading capabilities were absent from reviewed materials.

The lack of information about mobile trading applications, platform customization options, or third-party tool integrations further limits the assessment. Without concrete details about these essential trading components, potential users cannot adequately evaluate whether Strike Pro's offerings meet their analytical and educational needs.

Customer Service and Support Analysis (6/10)

Customer service evaluation for Strike Pro faces significant limitations due to insufficient information about support channels, response times, and service quality. The moderate rating reflects the absence of both strongly positive and notably negative feedback.

This suggests either limited user engagement or insufficient data collection about customer service experiences. Available materials did not specify customer support channels such as live chat availability, email response times, telephone support hours, or ticket system functionality.

Multi-language support capabilities, which are crucial for international brokers, also remained unspecified in reviewed documentation. Service quality indicators such as average response times, problem resolution rates, and customer satisfaction scores were not available in accessible sources.

Without user testimonials specifically addressing customer service experiences, it becomes impossible to assess whether Strike Pro provides adequate support for trader inquiries and technical issues. The broker's target demographic of beginning traders typically requires more intensive customer support than experienced traders.

This makes service quality particularly important for Strike Pro's positioning. However, the absence of detailed support information raises concerns about whether adequate assistance is available when traders encounter problems or have questions about platform functionality.

Trading Experience Analysis (6/10)

The trading experience assessment for Strike Pro encounters substantial limitations due to insufficient information about platform performance, execution quality, and user interface design. The moderate rating reflects uncertainty rather than confirmed strengths or weaknesses in the trading environment.

Platform stability and execution speed represent critical factors for trading success. Yet available materials provided no specific data about server uptime, order execution times, or slippage rates.

User feedback regarding platform reliability, connection stability, and overall performance was notably absent from reviewed sources. Order execution quality, including information about requotes, slippage during volatile market conditions, and fill rates, could not be assessed due to lack of available data.

These factors significantly impact trading profitability and user satisfaction but remain unverified for Strike Pro's platform. Mobile trading capabilities, which are increasingly important for modern traders, were not detailed in available documentation.

The absence of information about mobile app functionality, cross-device synchronization, and mobile-specific features limits the assessment of Strike Pro's complete trading offering. This strike pro review emphasizes that without concrete user experiences and platform performance data, potential traders cannot adequately evaluate whether Strike Pro provides a satisfactory trading environment for their specific needs and trading styles.

Trust Factor Analysis (4/10)

The trust factor represents Strike Pro's most concerning evaluation area, with significant issues affecting overall broker credibility. The low rating stems from regulatory limitations, transparency concerns, and user-reported doubts about the broker's legitimacy and reliability.

Saint Vincent and the Grenadines registration provides minimal regulatory oversight compared to established financial jurisdictions. This regulatory framework offers limited investor protection, reduced transparency requirements, and fewer mechanisms for dispute resolution.

The absence of regulation from recognized authorities like FCA, CySEC, or ASIC significantly impacts trader protection standards. Fund security measures, including client fund segregation, deposit insurance, and operational transparency, were not detailed in available materials.

This lack of information about asset protection raises serious concerns for potential depositors who need assurance about fund safety and withdrawal reliability. Company transparency issues include limited information about management team, financial statements, operational history, and corporate governance.

The absence of detailed company information makes it difficult for potential clients to assess the broker's stability and long-term viability. User reports suggesting concerns about legitimacy and reliability further compound trust issues.

While specific complaint details were not available, the existence of user skepticism about the broker's credibility represents a significant red flag that potential traders should carefully consider.

User Experience Analysis (5/10)

User experience evaluation for Strike Pro faces challenges due to limited feedback and insufficient information about platform usability and overall trader satisfaction. The moderate rating reflects mixed signals rather than clearly positive or negative user experiences.

Available materials provided minimal user testimonials or detailed feedback about platform navigation, account management interfaces, and overall usability. Without complete user reviews, it becomes difficult to assess whether Strike Pro delivers satisfactory experiences across different trader skill levels and requirements.

The registration and verification process details were not available, preventing assessment of account opening convenience and time requirements. Similarly, information about fund management procedures, including deposit processing times and withdrawal experiences, was notably absent from reviewed sources.

Interface design quality, platform responsiveness, and overall user satisfaction metrics could not be evaluated due to insufficient user feedback and platform screenshots. These factors significantly impact daily trading experiences but remain unverified for Strike Pro's platform.

The broker's positioning toward beginning traders suggests user experience should be particularly streamlined and intuitive. Yet the absence of specific usability information prevents confirmation of whether Strike Pro successfully serves this target demographic's needs.

Conclusion

This complete strike pro review reveals a broker with mixed characteristics that require careful consideration by potential traders. Strike Pro's primary strength lies in its exceptional accessibility, with the $1 minimum deposit requirement genuinely lowering barriers for newcomers to forex trading.

The 1:500 leverage offering and diverse asset coverage further enhance its appeal for traders seeking complete market access. However, significant concerns overshadow these positive aspects.

The limited regulatory framework in Saint Vincent and the Grenadines, combined with substantial information gaps about platform features, customer service quality, and operational transparency, raises serious questions about the broker's overall reliability and trader protection standards. Strike Pro appears most suitable for absolute beginners willing to risk minimal capital while learning forex trading basics, and experienced traders who understand the risks associated with less regulated brokers.

However, traders seeking robust regulatory protection, complete educational resources, and proven operational reliability should consider more established alternatives with stronger regulatory oversight and transparent operational histories. The main advantages include ultra-low entry requirements and potentially diverse trading opportunities, while significant disadvantages include limited regulatory protection, insufficient operational transparency, and concerning user feedback about legitimacy.

Potential traders should exercise extreme caution and conduct thorough due diligence before committing funds to this platform.