Is Stockity safe?

Pros

Cons

Is Stockity Safe or a Scam?

Introduction

Stockity is a relatively new player in the forex trading market, having been established in 2023. It positions itself as a user-friendly platform catering to both novice and experienced traders. With the rise of online trading platforms, it's essential for traders to carefully evaluate the safety and legitimacy of these brokers. This article aims to provide a comprehensive analysis of Stockity, focusing on its regulatory status, company background, trading conditions, and customer experiences. The investigation draws from multiple sources, including user reviews, regulatory databases, and industry reports, to present a balanced view of whether Stockity is indeed safe or a potential scam.

Regulation and Legitimacy

One of the primary indicators of a trading platform's reliability is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards. Stockity claims to be registered in the Marshall Islands under the company name Caracol Ltd. However, it lacks regulation from major financial authorities, which raises concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Marshall Islands | Unverified |

The absence of a recognized regulatory body means that Stockity does not have to comply with the rigorous standards set by authorities such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC). This lack of oversight can lead to questionable practices and a higher risk of fraud. Furthermore, Stockity's registration in an offshore jurisdiction, often associated with less stringent regulations, adds another layer of concern regarding its operational integrity.

Company Background Investigation

Stockity was launched in 2023, making it a relatively new entrant in the trading space. The company is owned by Caracol Ltd, which operates from a registered address in the Marshall Islands. The management team‘s experience and background remain largely undisclosed, which is a significant red flag for potential investors. Transparency in a broker’s ownership and management structure is crucial for building trust, and the lack of information can lead to skepticism.

The companys website provides minimal information about its history and the people behind it. This opacity can be indicative of a lack of accountability. Moreover, the absence of a clear corporate structure can lead to difficulties in resolving disputes or seeking redress in the event of issues arising from trading activities. In summary, while Stockity presents itself as a legitimate trading platform, the lack of transparency and regulatory oversight raises questions about its trustworthiness.

Trading Conditions Analysis

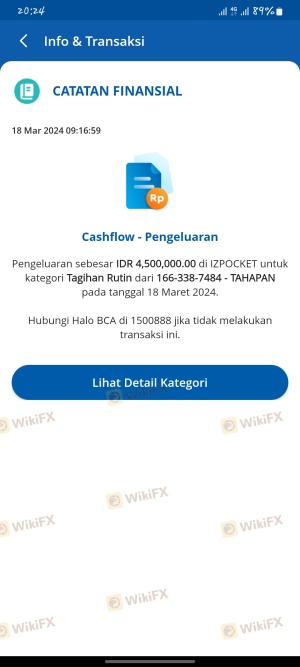

When evaluating a trading platform, understanding the cost structure is vital. Stockity offers a low minimum deposit requirement of $10, which makes it accessible for new traders. However, the overall fee structure is not clearly outlined, which can lead to unexpected costs.

| Fee Type | Stockity | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-3 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not disclosed | 0.5% - 2% |

The absence of a transparent fee structure can be a red flag for traders. While low entry costs are appealing, hidden fees can erode profits significantly. Additionally, the lack of information regarding overnight interest rates raises concerns about potential costs that traders may incur without prior knowledge. Traders should approach Stockity with caution, ensuring they fully understand any fees that may apply.

Customer Funds Security

The safety of customer funds is a paramount concern for traders. Stockity claims to implement various security measures, including fund segregation and encryption protocols. However, without regulatory oversight, the effectiveness of these measures cannot be independently verified.

The platform does not provide clear details on investor protection schemes or negative balance protection, which are critical for safeguarding traders' funds. In the event of insolvency, the lack of such protections can result in significant losses for traders. Additionally, historical data on any past security breaches or fund mismanagement is not available, which further complicates the assessment of Stockity's commitment to fund safety.

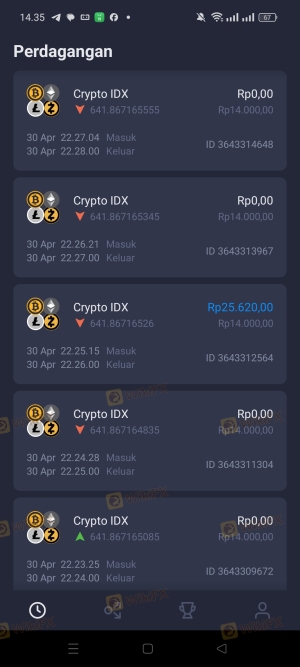

Customer Experience and Complaints

User feedback is invaluable in determining the reliability of any trading platform. Reviews of Stockity reveal a mix of positive experiences and significant complaints. Many users appreciate the platform's user-friendly interface and the availability of a demo account. However, common complaints include slow withdrawal processes and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Unresolved |

Several users have reported frustration with the withdrawal process, citing delays that can extend beyond the promised timeframe. This lack of responsiveness can be detrimental, especially for traders who require timely access to their funds. While Stockity does provide a support channel, the effectiveness of their responses has been called into question by multiple users.

Platform and Trade Execution

The trading platform's performance is crucial for a seamless trading experience. Stockity offers a proprietary platform that is generally well-received for its user-friendly design. However, there are concerns regarding order execution quality. Reports of slippage and rejected orders have surfaced, which can significantly impact trading outcomes.

The platforms stability is another area of concern. While many users report satisfactory performance, others have experienced technical glitches that hinder trading activities. These issues can lead to missed opportunities and financial losses, further complicating the evaluation of Stockity's reliability.

Risk Assessment

Using Stockity comes with a variety of risks, primarily due to its unregulated status and lack of transparency. Traders should be aware of the following risk factors:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation from major bodies |

| Financial Risk | Medium | Potential for hidden fees |

| Operational Risk | Medium | Technical glitches and slippage |

Traders should approach Stockity with caution, particularly given the high regulatory risk. To mitigate potential losses, it is advisable to start with a demo account and to only invest funds that one can afford to lose.

Conclusion and Recommendations

In conclusion, while Stockity presents itself as a promising trading platform, the evidence suggests that traders should exercise caution. The lack of regulatory oversight, combined with a lack of transparency regarding the company's operations and fee structure, raises significant red flags.

Is Stockity safe? The answer is unclear, and potential traders are advised to consider alternative platforms with proven regulatory compliance and transparent operational practices. For those determined to proceed with Stockity, it is crucial to conduct thorough research and to remain vigilant regarding the risks involved. Reliable alternatives include platforms like IG, OANDA, and Forex.com, which are well-regulated and offer robust security measures.

Is Stockity a scam, or is it legit?

The latest exposure and evaluation content of Stockity brokers.

Stockity Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Stockity latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.