BelleoFX 2025 Review: Everything You Need to Know

Executive Summary

BelleoFX is a new forex broker that gets mixed reactions from traders. The company won "Top Forex Broker 2024" at the Forex Traders Summit Dubai 2024, but users have raised serious concerns about possible fraud. This belleofx review shows a broker that offers high leverage up to 1:500 and uses the MetaTrader 5 platform, but many clients don't trust it.

The broker wants experienced traders who need high-leverage trading. However, new clients must think carefully about the platform's features versus the many warning signs from current users. BelleoFX says it works under FSC (Mauritius) and FSA rules, though the specific license numbers are hard to find in public records.

User reviews keep pointing out problems with closed accounts and taken profits. This makes the broker a risky choice for traders who care about account safety and fund protection.

Important Disclaimers

Regional Entity Differences: BelleoFX works under different rules in different countries. Users should check the specific rules that apply to their area and know that protections may be very different between different company branches.

Review Methodology: This review uses user feedback, market research, and public platform information. The broker doesn't share much about how it operates, so this assessment relies mostly on user experiences and outside evaluations to give a fair view of the broker's services and trustworthiness.

Rating Framework

Broker Overview

BelleoFX started in 2020 as a Dubai-based online trading broker. The company serves global clients with forex and other financial trading services, using the slogan "Financial Markets Made Easy" to show they want to make trading accessible for investors building diverse portfolios. Even though it's new to the market, BelleoFX has tried to build trust through industry events and award recognition.

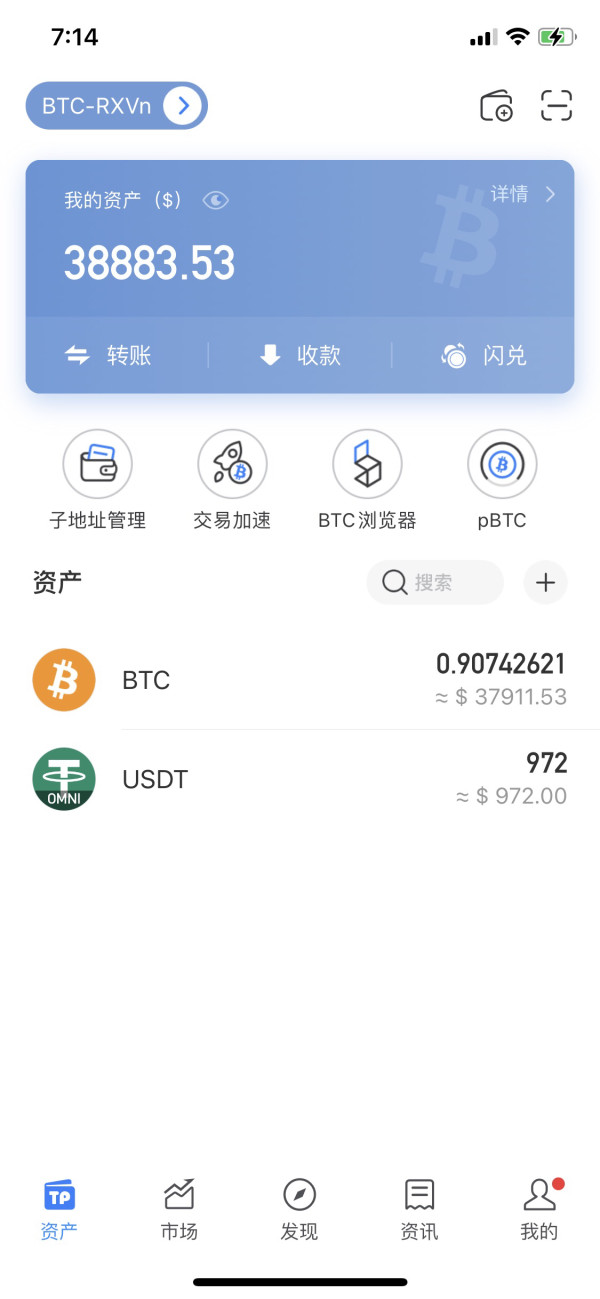

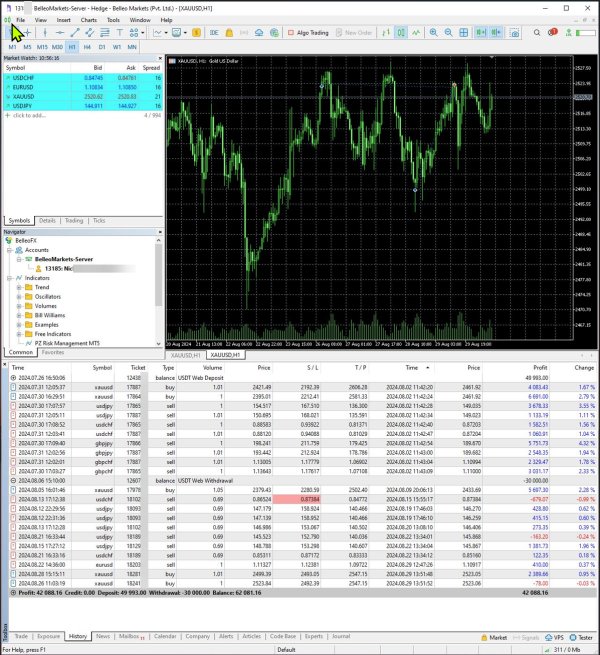

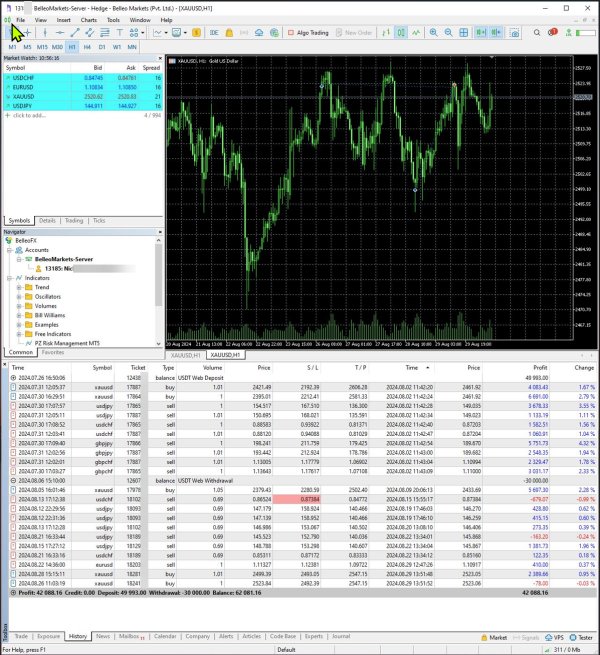

The broker mainly uses the MetaTrader 5 platform. It offers access to different types of investments including forex pairs, CFDs, and other financial tools, and according to company information, BelleoFX wants to make online trading simple while giving experienced traders the advanced tools they need. However, the difference between what the company promises in marketing and what users actually experience has created big concerns in the trading community.

This makes this belleofx review very important for potential clients. The broker's business focuses on high-leverage trading opportunities, with maximum leverage reaching 1:500, which attracts traders who want bigger market exposure, but the rules framework and how open the company is about its operations remain problem areas. Specific licensing details and complete fee information are not easy to find in public records.

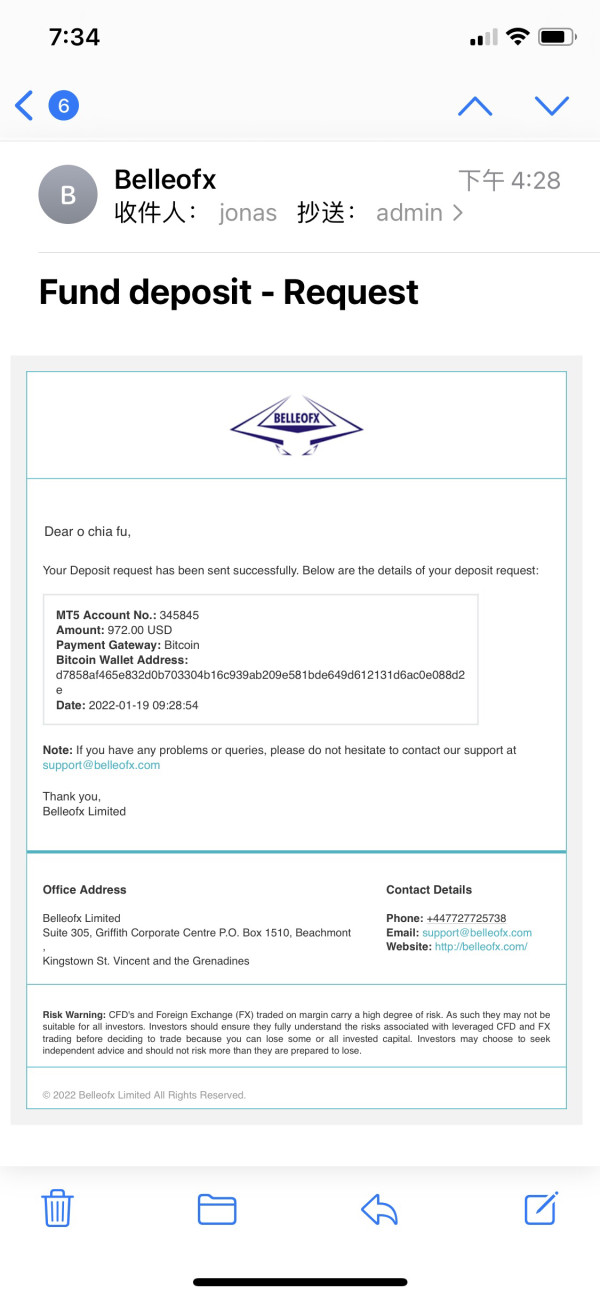

Regulatory Status: BelleoFX claims it follows FSC (Mauritius) and FSA rules, but specific license numbers and verification details are not clearly shown in available documents. This lack of openness about regulatory credentials raises questions about whether the broker follows proper compliance standards.

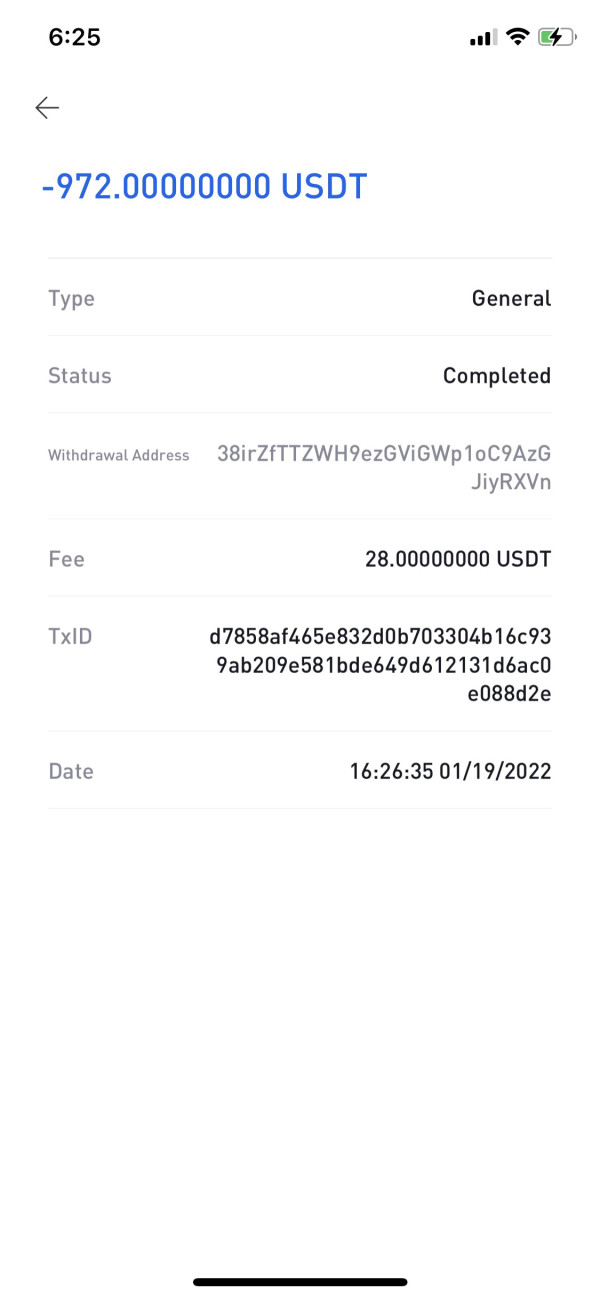

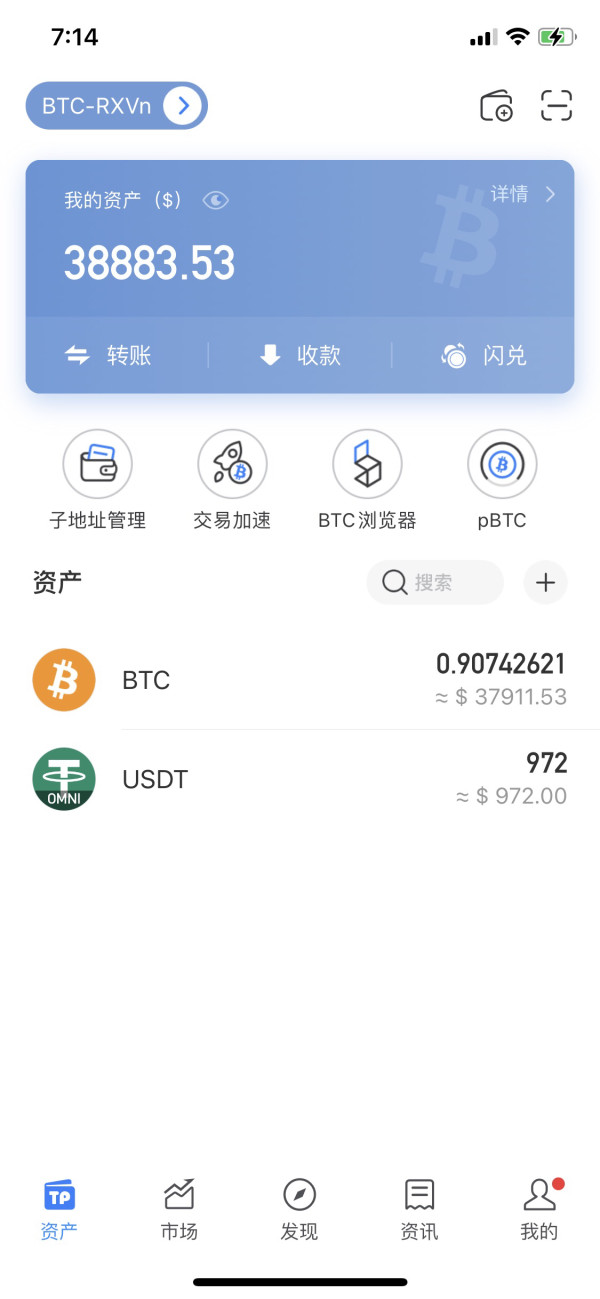

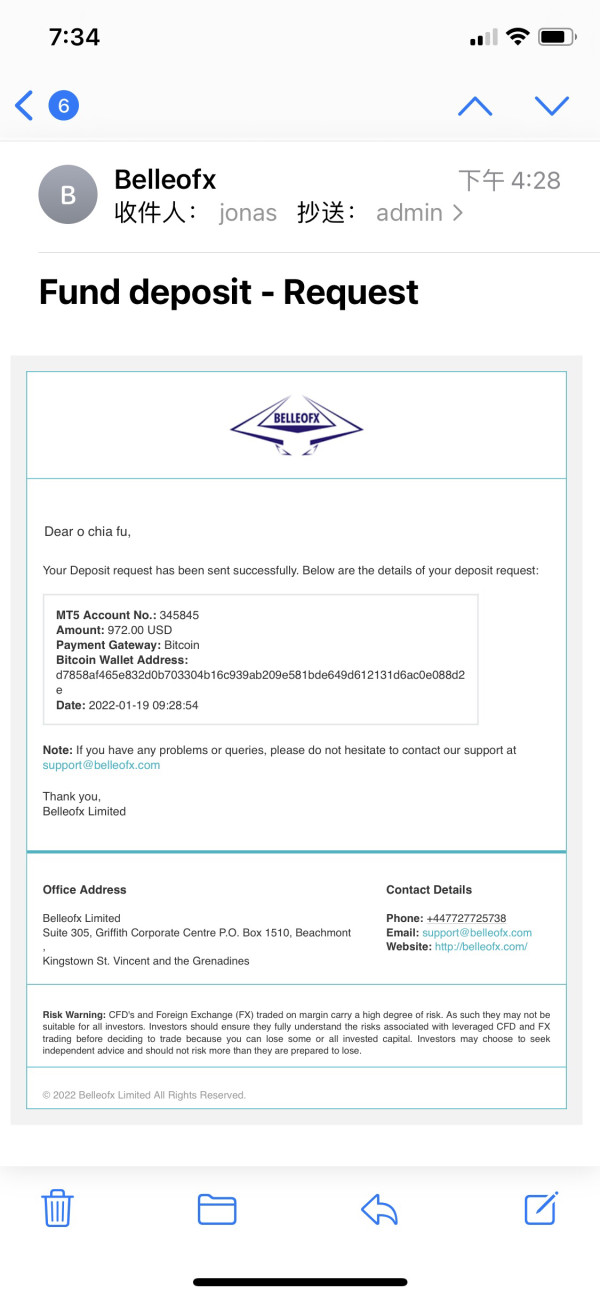

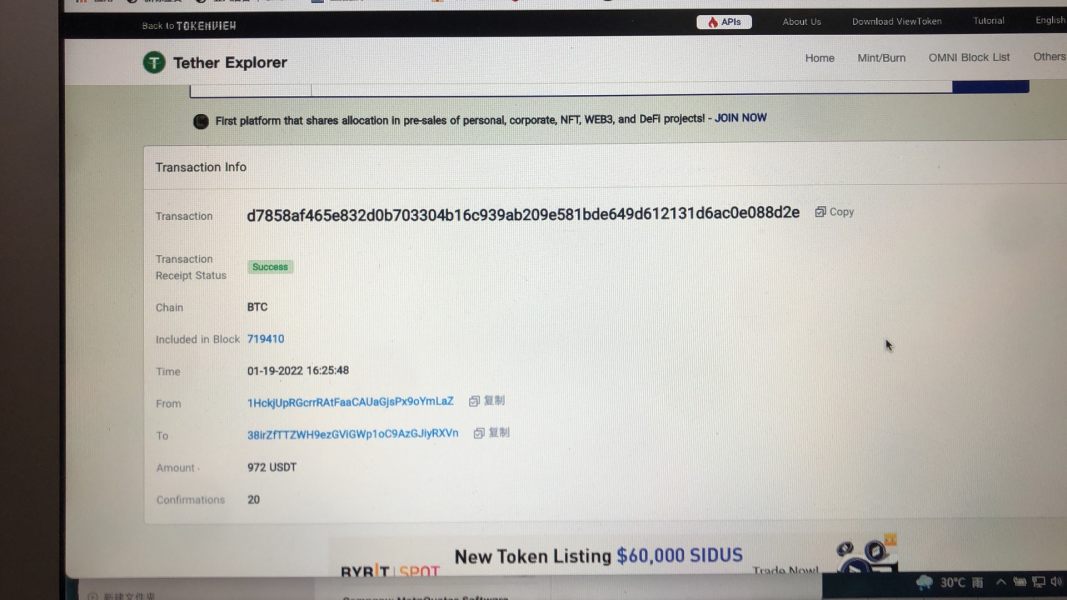

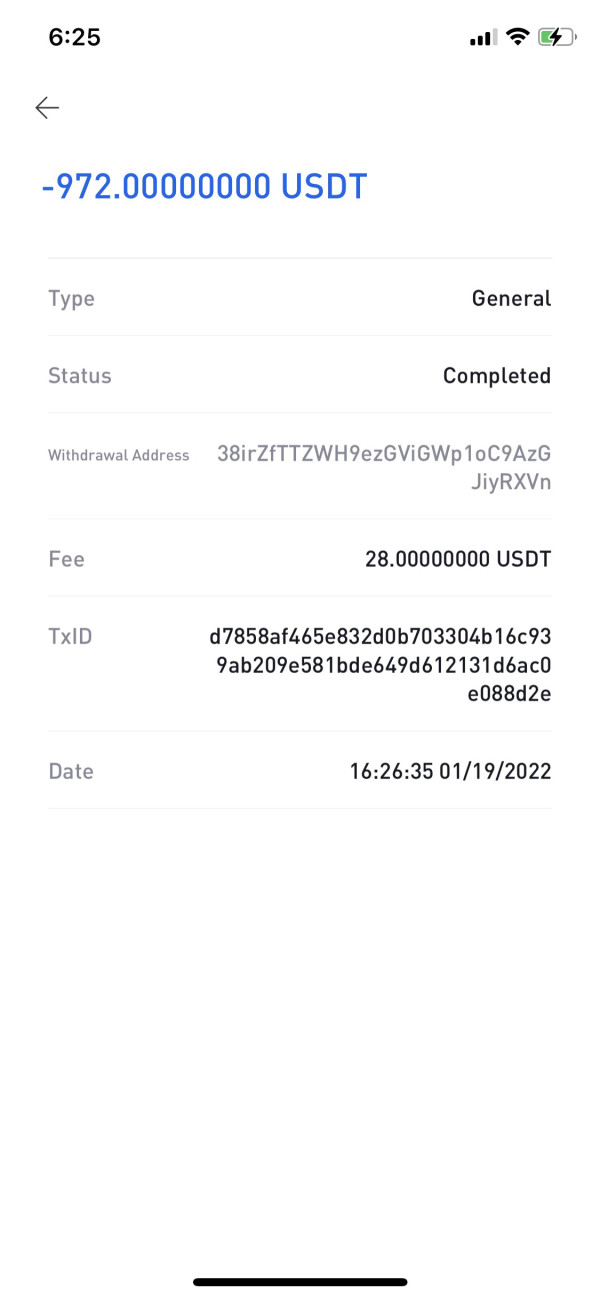

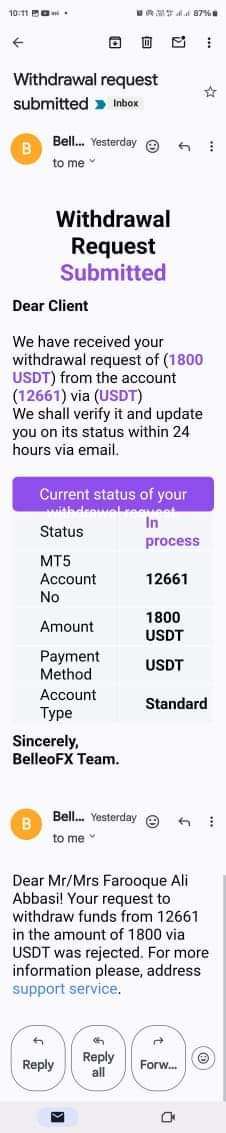

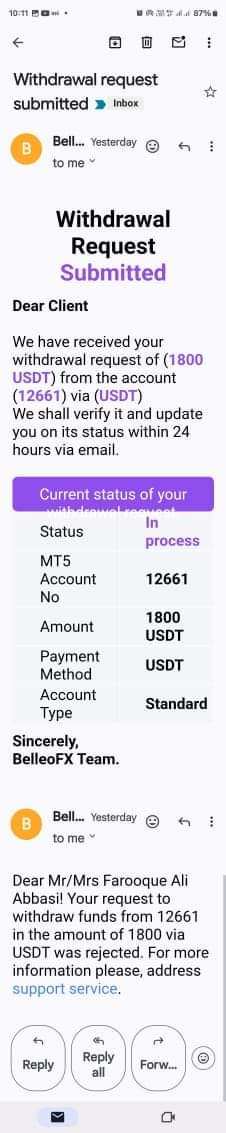

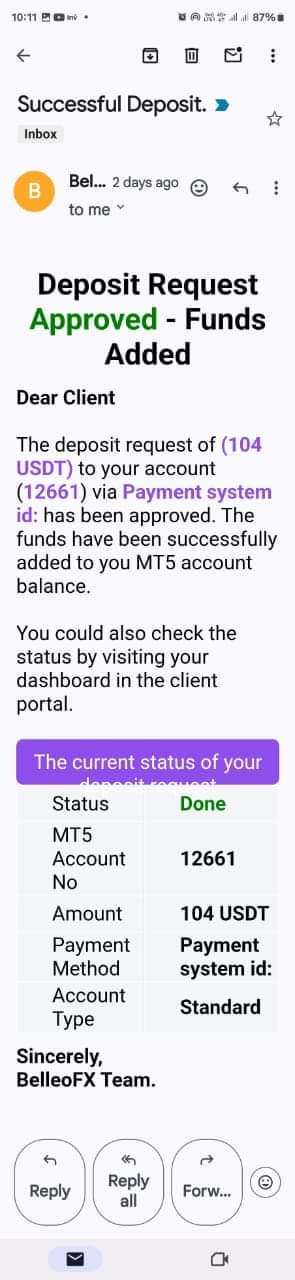

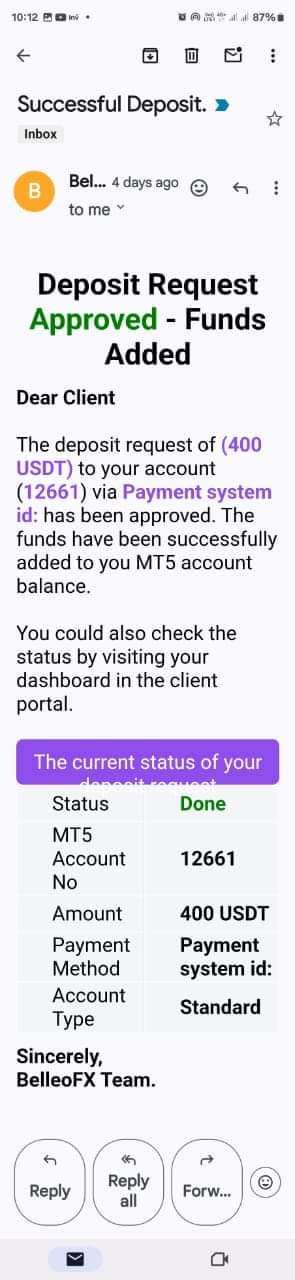

Deposit and Withdrawal Methods: Specific information about supported deposit and withdrawal methods is not detailed in available sources. This represents a big transparency gap for potential clients checking how accessible and convenient the broker is.

Minimum Deposit Requirements: The broker sets a fairly accessible minimum deposit of $100 USD. This makes it competitive for entry-level traders, though this low barrier may also attract less experienced traders who might be more vulnerable to the reported problems.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specified in available documentation. This limits potential clients' ability to evaluate additional value offered by the broker.

Available Trading Assets: The platform supports trading in forex pairs, CFDs, and various other financial instruments. However, the complete asset list and specific market coverage details are not fully documented in accessible sources.

Cost Structure: Critical information about spreads, commissions, and other trading costs remains unclear in public documentation. This makes it difficult for traders to accurately assess the total cost of trading with BelleoFX.

Leverage Options: The broker offers leverage up to 1:500. This represents one of its key competitive features for traders seeking bigger market exposure, though such high leverage also increases risk exposure significantly.

Platform Selection: BelleoFX primarily supports MetaTrader 5, a widely recognized and professionally accepted trading platform. It provides standard charting tools, technical analysis capabilities, and automated trading support.

Geographic Restrictions: Specific information about regional trading restrictions and availability limitations is not detailed in available sources.

Customer Support Languages: The range of supported languages for customer service is not specified in accessible documentation. However, this belleofx review notes this as an important consideration for international traders.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

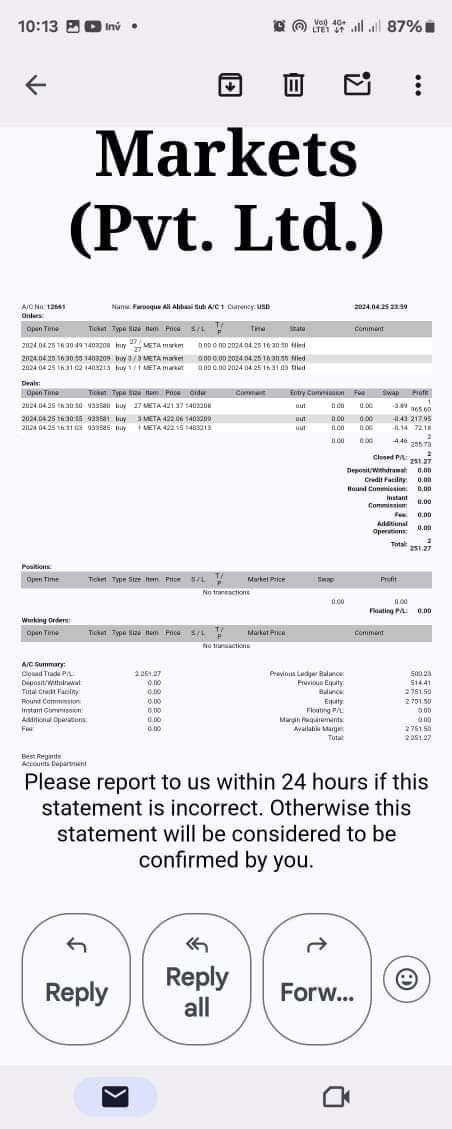

BelleoFX's account conditions show both good and bad points. The broker's minimum deposit requirement of $100 USD makes it accessible for new traders, while the maximum leverage of 1:500 appeals to experienced traders seeking bigger market exposure, but the lack of detailed information about account types, specific features, and complete fee structures significantly hurts the overall evaluation.

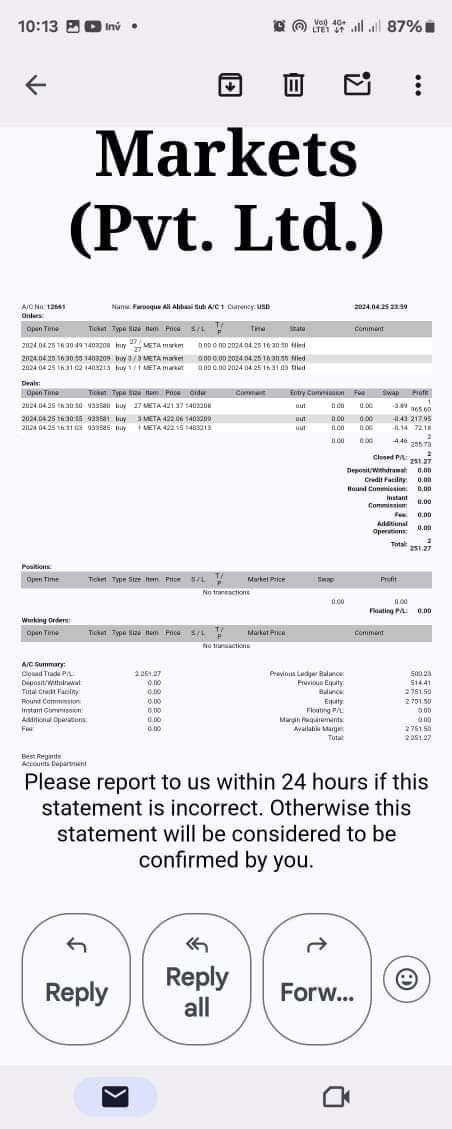

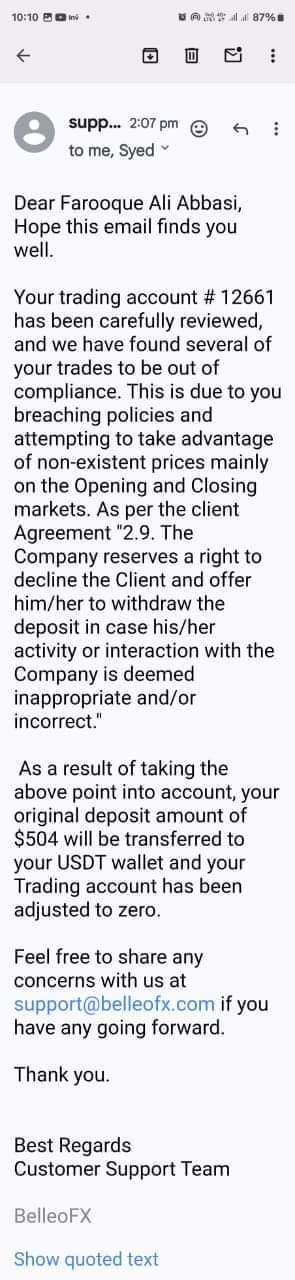

User feedback consistently points out concerns about account condition transparency. This especially applies to the terms that control profit withdrawals and account maintenance, and according to user reports, traders have experienced unexpected account closures and problems accessing earned profits. This suggests that the actual account conditions may be more restrictive than first presented.

The absence of clearly documented account tiers, special features such as Islamic accounts, or detailed opening procedures makes assessment even harder. When compared to established brokers in the market, BelleoFX's minimum deposit requirement stays competitive, but the lack of transparency about ongoing costs, maintenance fees, and withdrawal conditions puts it at a big disadvantage.

This belleofx review emphasizes that potential clients should carefully examine all account terms before putting in funds. This is especially important given the reported differences between marketed conditions and actual user experiences.

The broker's tool and resource offering centers around the MetaTrader 5 platform. This provides a solid foundation for technical analysis and trade execution, and MT5 offers comprehensive charting capabilities, multiple timeframes, and extensive technical indicator libraries that meet the needs of both intermediate and advanced traders. The platform also supports automated trading through Expert Advisors, which adds value for traders using algorithmic strategies.

However, checking BelleoFX's additional tools and resources reveals big gaps in available information. Research and analysis resources, which are crucial for informed trading decisions, are not well-documented or prominently featured in the broker's public materials, and educational resources, including webinars, tutorials, and market analysis content, appear limited based on available information. This could disadvantage newer traders seeking comprehensive learning support.

User feedback about the quality and reliability of available trading tools indicates basic functionality but limited innovation beyond standard MT5 features. The absence of proprietary tools, advanced market research, or comprehensive educational programs places BelleoFX behind more established brokers that invest heavily in client education and market analysis resources, and this limitation particularly affects the broker's value proposition for traders who rely on comprehensive research and educational support for their trading strategies.

Customer Service and Support Analysis (Score: 5/10)

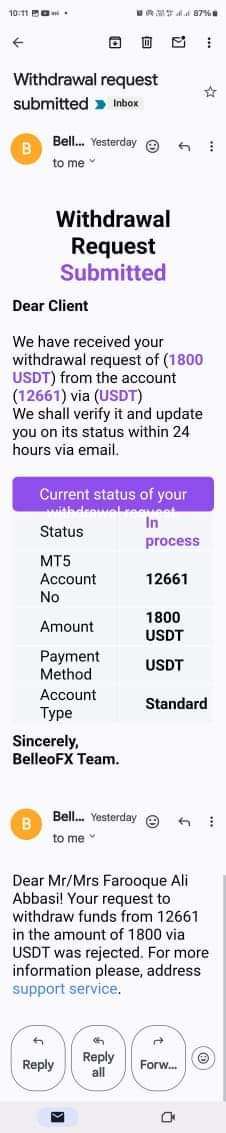

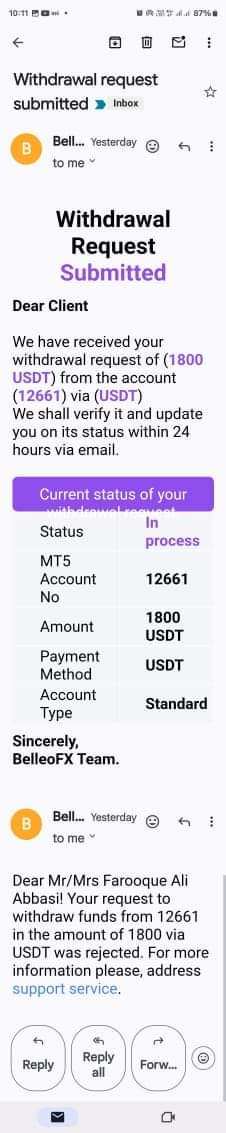

Customer service represents one of BelleoFX's biggest problem areas based on consistent user feedback and reported experiences. Users frequently mention extended response times, limited problem-solving capabilities, and insufficient support during critical trading situations, and the lack of detailed information about support channels, availability hours, and multilingual capabilities makes these concerns worse.

User testimonials reveal frustrating experiences with customer service representatives who appear either unwilling or unable to address account-related issues effectively. Particularly concerning are reports of inadequate support during account closure incidents and profit withdrawal complications, where users describe feeling abandoned by the support team during critical situations requiring immediate assistance.

The absence of comprehensive customer service information creates problems. This includes specific contact methods, guaranteed response times, and escalation procedures, which suggests a lack of commitment to customer support excellence, and without clear communication channels or documented service level agreements, traders face uncertainty about receiving timely assistance when needed. This problem becomes particularly serious given the account-related issues reported by users, where effective customer support could potentially resolve conflicts and maintain client relationships.

Trading Experience Analysis (Score: 6/10)

The trading experience with BelleoFX presents a complex picture influenced by both platform capabilities and execution quality concerns. While the MetaTrader 5 platform provides familiar functionality and professional-grade tools, user feedback indicates inconsistent performance during high market volatility periods, and traders report concerns about slippage, requotes, and platform stability that can significantly impact trading outcomes.

Order execution quality emerges as a particular area of concern. Users describe experiences of delayed fills, price discrepancies, and unexpected rejections during critical market moments, and these execution issues become particularly problematic for scalping strategies and high-frequency trading approaches that require precise timing and minimal latency. The lack of detailed execution statistics or transparency about order routing practices makes it difficult to assess the true quality of trade execution.

Platform functionality, while benefiting from MT5's comprehensive feature set, appears to lack additional enhancements or optimizations that could improve the overall trading experience. Users seeking advanced order types, sophisticated risk management tools, or enhanced mobile trading capabilities may find the offering limited compared to more innovative brokers, and this belleofx review notes that while the basic trading infrastructure is functional, the overall experience falls short of expectations set by industry leaders in terms of execution quality and platform innovation.

Trust and Reliability Analysis (Score: 4/10)

Trust and reliability represent BelleoFX's most significant challenges. Multiple red flags emerge from user feedback and operational transparency issues, and the broker's regulatory status, while claiming FSC and FSA oversight, lacks specific license number verification and detailed compliance information that traders typically expect from reputable brokers. This regulatory opacity creates immediate concerns about client fund protection and operational legitimacy.

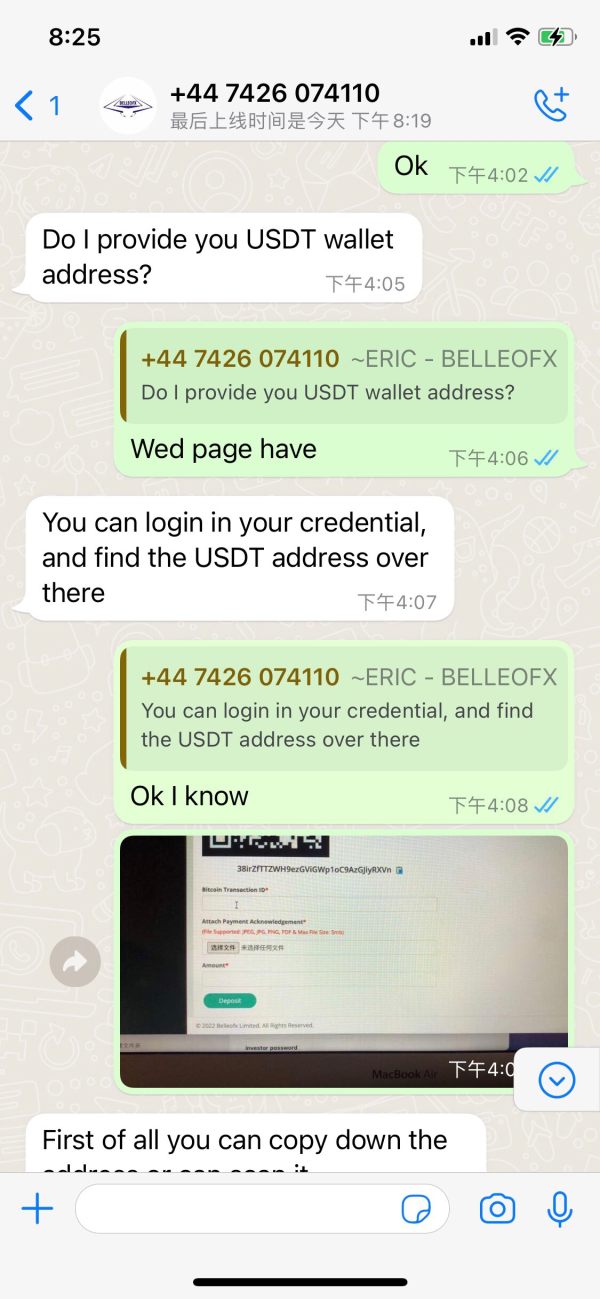

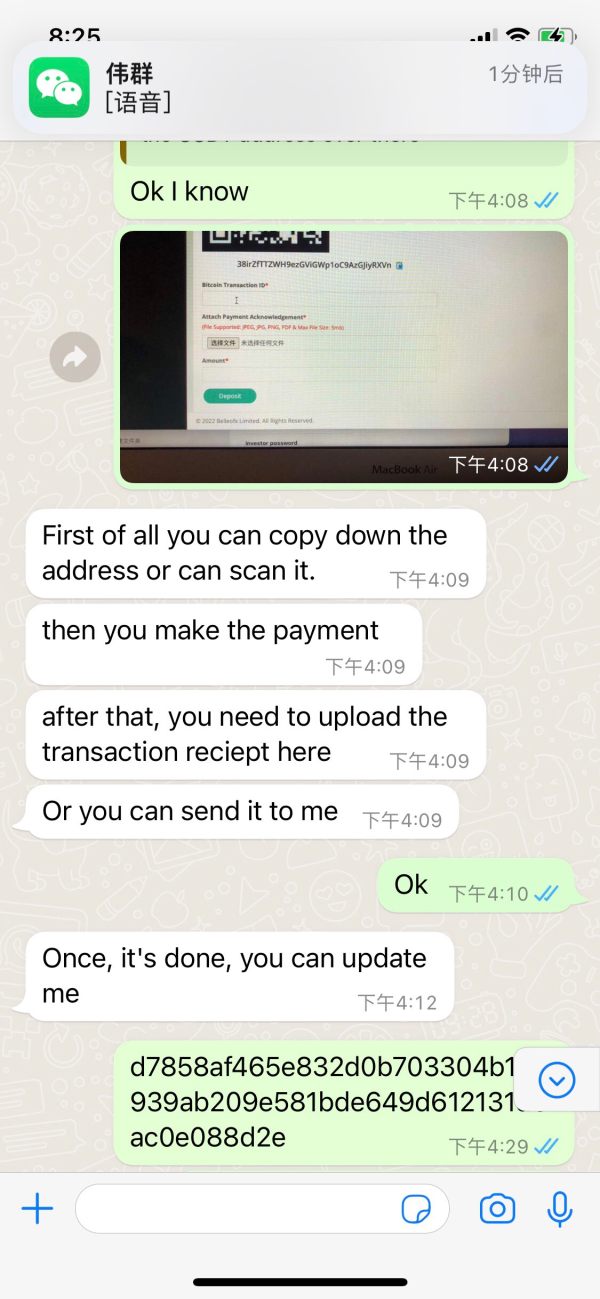

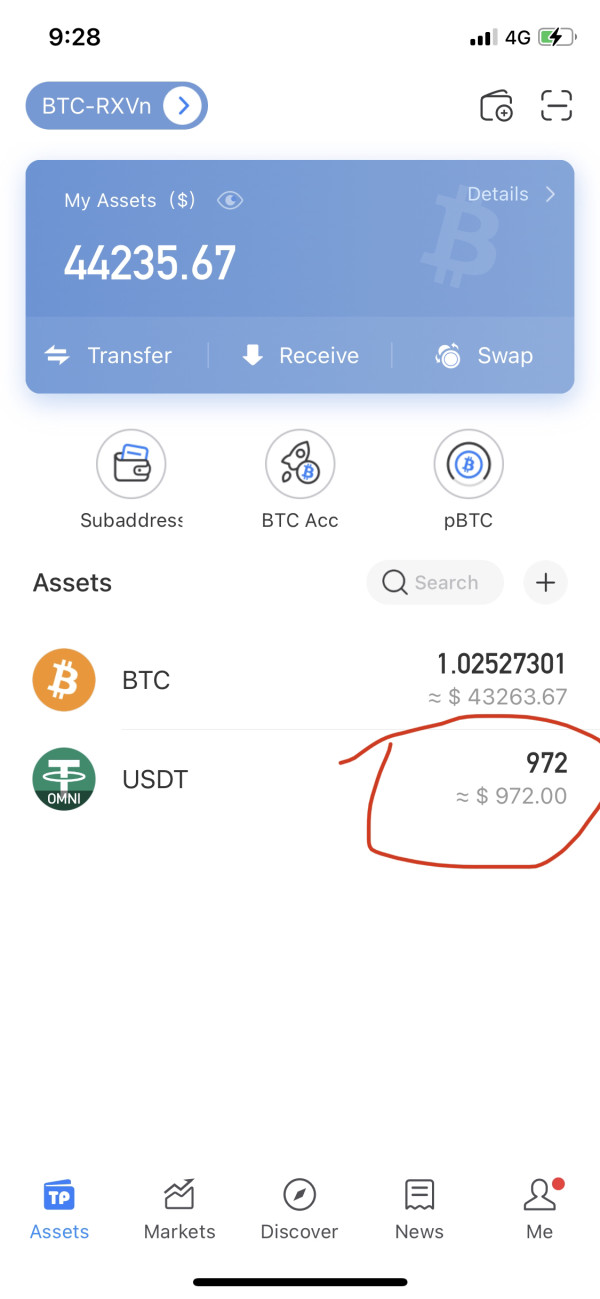

User reports of account closures and profit confiscation represent the most serious trust concerns. Multiple traders describe situations where successful trading resulted in account termination and profit forfeiture, and according to Scam Detector's risk assessment, BelleoFX receives a score of 66, indicating moderate to high risk levels that potential clients should carefully consider. These reports suggest systematic issues rather than isolated incidents, pointing to potential fundamental problems with the broker's business practices.

The company's transparency about fund safety measures, segregation practices, and dispute resolution procedures remains inadequate based on available information. While the broker received recognition as "Top Forex Broker 2024" from the Forex Traders Summit Dubai 2024, this award appears inconsistent with the substantial negative user feedback regarding trustworthiness and ethical practices, and the disconnect between industry recognition and user experiences raises questions about the credibility of both the award and the broker's actual operational standards.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with BelleoFX remains disappointingly low based on available feedback and reported experiences. The platform's interface design, while benefiting from MT5's familiar layout, receives mixed reviews for navigation convenience and overall usability, and users describe a generally functional but uninspiring experience that lacks the polish and innovation found in leading broker platforms.

The registration and account verification process information is not well-documented in available sources. This creates uncertainty about onboarding efficiency and requirements, and this lack of clarity extends to fund management operations, where users report slow and problematic deposit and withdrawal experiences that significantly impact overall satisfaction. The absence of streamlined processes and clear communication during fund operations contributes to user frustration and decreased confidence.

Common user complaints center primarily on account closure incidents and profit-related issues. They also extend to general platform performance and customer service experiences, and the user profile that might find BelleoFX suitable appears limited to experienced traders willing to accept significant risks in exchange for high leverage access. However, even this demographic should exercise extreme caution given the reported issues, and improvements in transparency, customer service quality, and operational reliability would be essential for enhancing user experience and building sustainable client relationships.

Conclusion

BelleoFX presents a complex case study of a broker offering potentially attractive features overshadowed by serious operational and trust concerns. While the platform provides high leverage opportunities up to 1:500 and access to the professional-grade MetaTrader 5 platform, the substantial user feedback regarding account closures and profit confiscation creates significant red flags that cannot be ignored.

This broker may appeal to highly experienced traders seeking maximum leverage and willing to accept substantial risks. However, the overwhelming evidence suggests extreme caution is warranted, and the combination of regulatory opacity, poor customer service feedback, and serious trust issues makes BelleoFX a high-risk choice that most traders should avoid. The disconnect between industry recognition and user experiences further complicates the evaluation, suggesting that potential clients should prioritize user feedback over promotional claims when making their decision.