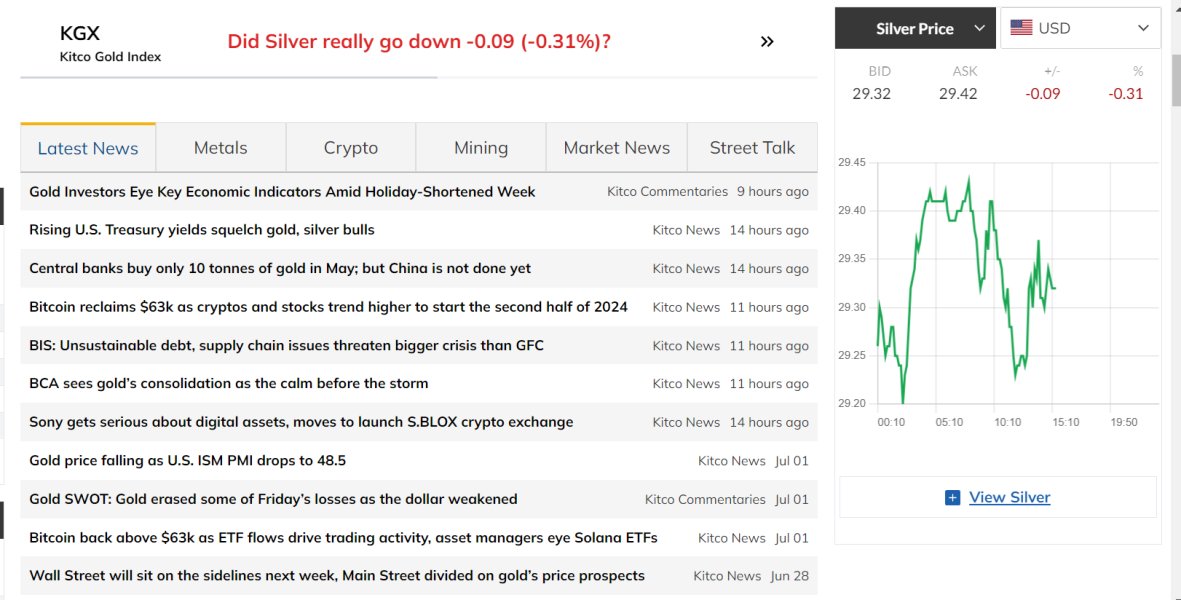

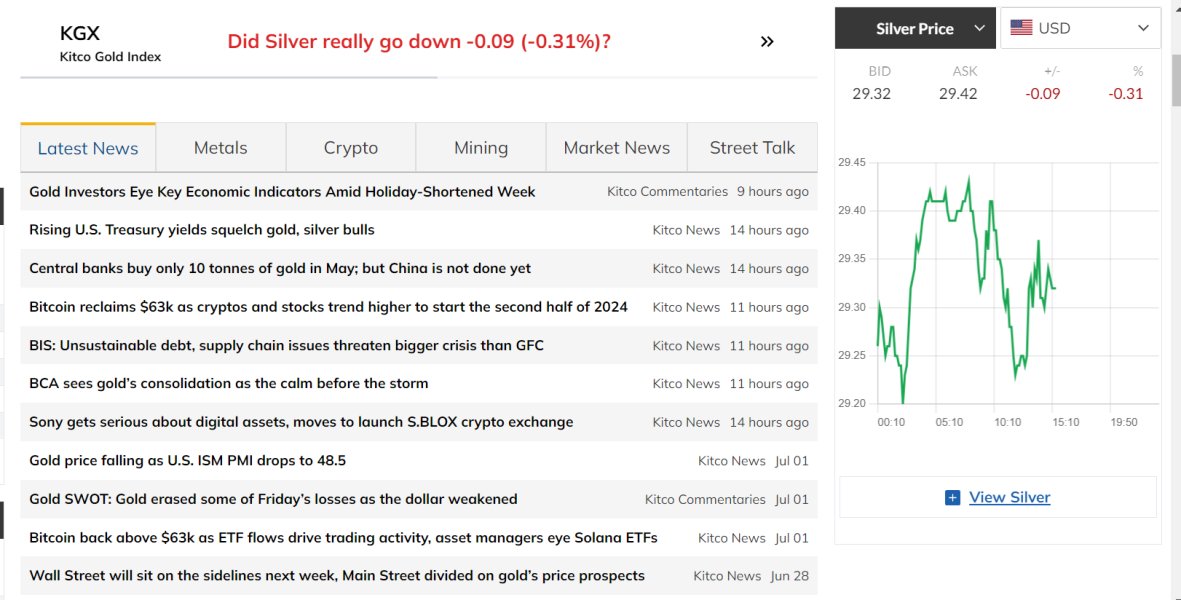

Kitco 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Kitco Markets has emerged as a prominent player in the global trading arena, boasting a wide range of financial instruments including forex, commodities, and precious metals. Established as a resource for investors, it offers access to trading and market information, catering mainly to experienced traders who are aware of the inherent risks of engaging with unregulated brokers. It is important to approach Kitco Markets with caution given its lack of regulatory oversight and reports of negative user experiences, particularly concerning withdrawal issues and fee transparency. While traders may find diverse trading options enticing, the potential risks may overshadow these benefits, particularly for those unaccustomed to navigating the world of unregulated trading environments.

⚠️ Important Risk Advisory & Verification Steps

Investing can involve significant risks. Thus, potential traders should adhere to these guidelines:

- Unregulated Status: Kitco Markets operates without proper licensing from recognized financial authorities, raising doubts about investor protection.

- Negative Feedback: There are numerous complaints regarding withdrawal difficulties and a lack of transparency surrounding fees.

- Conflicting Information: Discrepancies between claimed regulation and actual status should prompt further investigation.

Self-verification steps:

- Research the broker using reputable regulatory body websites.

- Read authentic user reviews for insights into their experiences.

- Test the waters by starting with a small, manageable investment and attempt a withdrawal to assess the process.

Ratings Framework

Broker Overview

Company Background and Positioning

Founded in 1977, Kitco is headquartered in Montreal, Canada, and is well known in the precious metals industry. Initially established as a bullion dealer, the company has developed a significant presence in the trading of precious commodities, specifically gold, silver, and platinum. With a global footprint that includes claims of offices in Hong Kong, London, and New York, Kitco's long-standing reputation in the industry positions it as a significant player. However, its operational status—registered in Saint Vincent and the Grenadines—raises concerns about regulatory oversight, as offshore brokers often lack necessary licenses to protect investors.

Core Business Overview

Kitco's business model focuses on a diverse array of financial instruments catering to both the forex and commodities markets. This includes trading options in forex, indices, precious metals, and commodities. The platform employs the widely-used MetaTrader 4 (MT4) for trading, providing users with an interface for executing trades and monitoring market trends. However, multiple sources highlight that there's a lack of available legal documents detailing terms of use and trading conditions, further confusing users about account types and related fees.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Discrepancies in regulatory claims are a critical concern for potential investors. Kitco asserts a global presence, referencing operations in multiple jurisdictions, yet it fails to provide credible regulatory backing. The lack of oversight allows Kitco to operate with minimal accountability, which can jeopardize customer funds. For self-verification, traders are encouraged to consult authoritative regulatory websites, such as the Financial Services Authority or regional financial watchdogs. Furthermore, user feedback emphasizes a lack of transparency regarding fund safety and management, further highlighting the need for caution.

Trading Costs Analysis

Kitco presents appealing trading costs initially, often advertising low or no commissions and spreads starting at 0.0 pips. However, upon closer inspection, several user complaints center on hidden fees associated with withdrawals and account management, which can increase the overall trading costs unexpectedly. Experienced traders note that while low initial costs may seem attractive, the overall cost structure varies greatly depending on the type of trading account and additional fees that may not be clearly communicated.

The MetaTrader 4 platform is touted for its combination of professional depth and user-friendliness, allowing traders to access advanced trading features and market analysis tools. However, criticism arises regarding the quality and availability of educational resources within the platform, suggesting that while it may serve seasoned traders well, novices might struggle to navigate its complexities without adequate support. User feedback indicates a mixed reception concerning the overall functionality and ease of use of Kitcos platform.

User Experience Analysis

User experiences with Kitco Markets are heavily influenced by reported issues with withdrawals and transparency regarding operations. Many users have voiced concerns about lengthy withdrawal delays and the complexities involved in executing these transactions smoothly. The lack of clear communication from customer support representatives has exacerbated these issues, highlighting a significant area for improvement in the overall user experience on the platform.

Customer Support Analysis

Customer support is available through multiple channels including email, live chat, and phone, providing 24/5 assistance. However, despite these options, numerous complaints indicate slow response times and unresolved queries from clients. This inconsistency can lead to frustrations for traders needing urgent assistance with their accounts. The overall dissatisfaction may reflect deeper operational inefficiencies within the company.

Account Conditions Analysis

While Kitco encompasses a broad range of trading options, the conditions surrounding account types and trading arrangements are vague. Potential customers often report difficulties in finding clear information about account types, minimum deposits, and conditions applicable to each account, leading to confusion. Furthermore, the absence of legal documentation accentuates concerns about the operational legitimacy of Kitco Markets, warranting caution among prospective investors.

Quality Control

In addressing potential discrepancies between claims and realities surrounding Kitco Markets, it is paramount to rely solely on verifiable facts. Users must be guided to independently validate the legitimacy of claims made about the company through thorough research and scrutiny of regulatory bodies. Balancing potential positive experiences with negative feedback will provide a more holistic view of the company's offerings.

In conclusion, the complexities surrounding Kitco Markets warrant careful consideration, particularly for novice investors. The diverse trading options may seem attractive, but the lack of regulatory oversight combined with negative user feedback raises serious questions about the safety and reliability of engaging with this broker. Investors are strongly advised to seek out regulated alternatives to mitigate potential losses and risks associated with unverified trading environments.