Revive 2025 Review: Everything You Need to Know

Summary

This revive review shows a complete look at a trading platform that has caught attention in the financial markets community. Based on what we know, Revive works as a trading service that gives access to Meta Trader 4 and Meta Trader 5 platforms, setting itself up as a solution for traders who want proven trading tools. The platform seems to target traders who care about getting industry-standard trading tools and reliable platform technology.

But our review shows big information gaps about key parts like regulatory oversight, account conditions, and complete service offerings. While user feedback can be found on Trustpilot, the overall assessment stays neutral because we don't have enough data for a complete review. The platform's main special feature seems to be its connection with MT4/MT5 platforms, which appeals to traders who know these widely-used trading environments. Traders thinking about this platform should do more research since there's limited public information about regulatory compliance and operational transparency.

Important Notice

This review is based on limited available information, and traders should know that different regional entities may operate under different regulatory frameworks. The regulatory status and compliance measures for different geographical regions stay unclear based on current available data.

Our review method uses available user feedback, platform information, and industry standard assessment criteria. But the assessment is limited by the lack of complete operational details typically expected for thorough broker reviews. Future users are strongly advised to check regulatory status and operational details directly with the service provider before making any trading decisions.

Rating Framework

Broker Overview

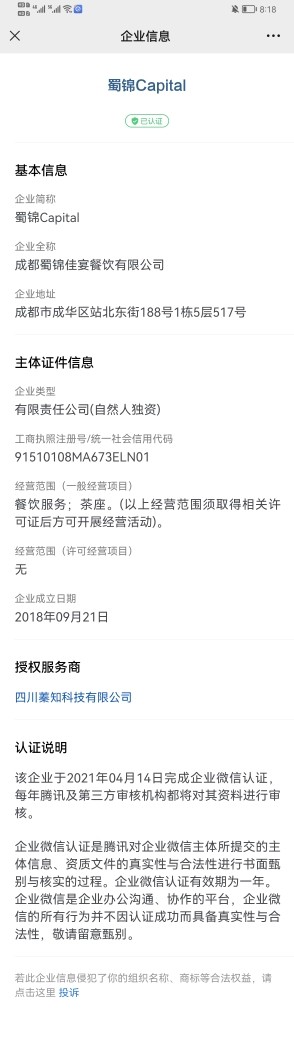

Revive's corporate background traces to operations that focus on quality and customer service, though specific establishment details for the trading division stay unclear in available documentation. The organization seems to have roots in San Francisco-based operations, with leadership including CEO Alexandria George and family-founded business principles. The company has positioned itself in markets requiring high-quality service delivery and customer satisfaction focus.

The trading platform infrastructure centers around Meta Trader 4 and Meta Trader 5 integration, suggesting a focus on giving traders familiar and widely-accepted trading environments. This revive review notes that the platform choice shows targeting of both new and experienced traders who prefer established trading software solutions. But specific asset classes, trading instruments, and regulatory oversight details remain undisclosed in available materials, limiting complete assessment of the broker's full service scope and compliance framework.

Regulatory Regions: Current available information does not specify regulatory jurisdictions or oversight bodies governing the platform's operations, representing a significant information gap for potential users.

Deposit and Withdrawal Methods: Payment processing options and procedures are not detailed in available documentation, requiring direct inquiry with the service provider.

Minimum Deposit Requirements: Specific minimum deposit amounts and account funding requirements are not specified in accessible materials.

Bonus Promotions: Information regarding promotional offers, welcome bonuses, or trading incentives is not available in current documentation.

Tradeable Assets: The range of financial instruments, currency pairs, commodities, or other tradeable assets is not specified in available information.

Cost Structure: Details regarding spreads, commissions, overnight fees, and other trading costs are not provided in accessible materials, requiring direct verification.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in current documentation.

Platform Options: Confirmed support for Meta Trader 4 and Meta Trader 5 platforms, providing access to established trading infrastructure and tools.

Regional Restrictions: Geographic limitations and restricted territories are not specified in available information.

Customer Service Languages: Supported languages for customer support services are not detailed in current materials.

This revive review emphasizes the need for direct communication with the provider to obtain complete operational details.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of account conditions faces significant limitations due to insufficient publicly available information. Standard broker reviews typically examine account type varieties, minimum deposit requirements, account opening procedures, and specialized account features such as Islamic accounts for Sharia-compliant trading. But current documentation does not provide details about account tier structures, funding requirements, or account management features.

Without specific information about account opening processes, verification requirements, or account maintenance conditions, potential users cannot properly assess whether the platform meets their individual trading needs. The absence of clear account condition details represents a notable transparency gap that this revive review identifies as requiring direct clarification from the service provider. Professional traders typically require detailed account specifications to make informed decisions about platform suitability, particularly regarding capital requirements and account feature availability.

The platform demonstrates strength in providing access to Meta Trader 4 and Meta Trader 5 trading platforms, which represent industry-standard trading environments utilized by millions of traders globally. These platforms offer complete charting tools, technical analysis capabilities, automated trading support through Expert Advisors, and extensive customization options for trading strategies.

MT4/MT5 integration suggests that users can access advanced order types, multiple timeframe analysis, custom indicators, and algorithmic trading capabilities. But beyond platform access, information about additional research resources, market analysis tools, educational materials, or proprietary trading tools remains unavailable. Professional trading environments typically provide economic calendars, market news feeds, analysis reports, and educational resources to support trader development and decision-making processes.

Customer Service and Support Analysis

Customer service evaluation cannot be completed due to absence of information regarding support channels, availability hours, response times, or service quality metrics. Standard broker assessments examine multiple support channels including live chat, telephone support, email assistance, and help desk ticket systems. Also, professional brokers typically provide multilingual support, 24/7 availability during market hours, and specialized support for different account types.

The lack of customer service information represents a significant concern for traders who require reliable support for technical issues, account management, or trading-related inquiries. Quality customer support often distinguishes professional brokers from less reliable services, particularly during volatile market conditions when immediate assistance may be crucial for traders. Without clear support structure information, users cannot assess the reliability of assistance when needed.

Trading Experience Analysis

Trading experience assessment requires information about platform stability, execution speeds, order processing quality, slippage rates, and overall trading environment reliability. While MT4/MT5 platform support suggests access to established trading infrastructure, specific performance metrics, server locations, execution quality statistics, and platform uptime data are not available in current documentation.

Professional trading environments typically provide detailed execution statistics, average processing times, and transparency about trading conditions during different market periods. Mobile trading capabilities, platform customization options, and integration with third-party tools also contribute to overall trading experience quality. This revive review notes that without specific performance data or user experience feedback, complete trading experience evaluation remains incomplete, requiring direct platform testing or additional user testimonials for accurate assessment.

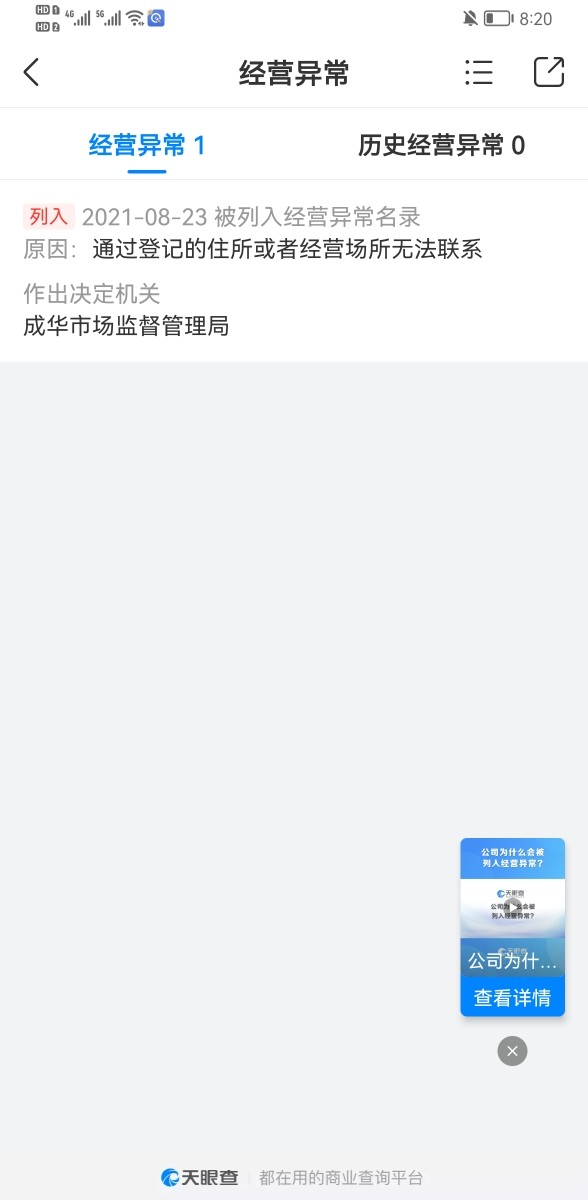

Trust Score Analysis

Trust assessment faces significant challenges due to limited regulatory information, absence of fund security details, and insufficient transparency about corporate governance structures. Professional broker evaluation typically examines regulatory licenses, compliance frameworks, segregated account policies, investor compensation schemes, and audit procedures. Also, trust assessment considers company history, regulatory actions, dispute resolution procedures, and third-party verification of operational practices.

The absence of clear regulatory oversight information represents a primary concern for traders prioritizing fund security and regulatory protection. Professional traders typically require verification of regulatory compliance, fund segregation policies, and dispute resolution mechanisms before committing capital to trading platforms. Without transparent regulatory information and security measure details, complete trust assessment cannot be completed through available documentation.

User Experience Analysis

User experience evaluation requires feedback about platform usability, registration processes, verification procedures, fund management efficiency, and overall satisfaction levels. While some user reviews may be available on Trustpilot, complete user experience assessment needs detailed feedback about platform navigation, account management processes, withdrawal experiences, and customer satisfaction metrics.

Professional user experience assessment examines registration simplicity, verification timeframes, platform learning curves, mobile application quality, and overall user satisfaction trends. Also, analysis of common user complaints, resolution procedures, and platform improvement responsiveness contributes to complete user experience understanding. Without detailed user feedback compilation and satisfaction metrics, complete user experience evaluation remains limited in this revive review context.

Conclusion

This complete revive review reveals significant information limitations that prevent thorough evaluation of the platform's complete service offering. While the confirmed integration with Meta Trader 4 and Meta Trader 5 platforms represents a positive aspect for traders seeking established trading infrastructure, the absence of regulatory information, account details, and operational transparency creates substantial assessment challenges.

The platform may appeal to traders familiar with MT4/MT5 environments, particularly those prioritizing access to proven trading technology over complete broker services. But the lack of detailed information about regulatory oversight, account conditions, and customer support represents considerable limitations for professional traders requiring complete operational transparency. Potential users should conduct extensive due diligence and direct communication with the service provider to obtain essential information not available in public documentation.