Park Money 2025 Review: Everything You Need to Know

Park Money has emerged as an online trading broker that offers a range of financial services to traders worldwide. However, the consensus among various reviews paints a mixed picture. While some users appreciate the low spreads and the variety of trading instruments, many express concerns regarding the lack of regulation and the overall safety of trading with this broker. Notably, Park Money operates without proper regulatory oversight, which raises significant red flags for potential investors.

Note: It is crucial to be aware that Park Money operates under different entities across regions, which may affect the level of service and protection you receive. The information presented here aims to provide a fair and accurate assessment based on available data.

Rating Overview

We rate brokers based on a combination of user feedback, expert analysis, and factual data.

Broker Overview

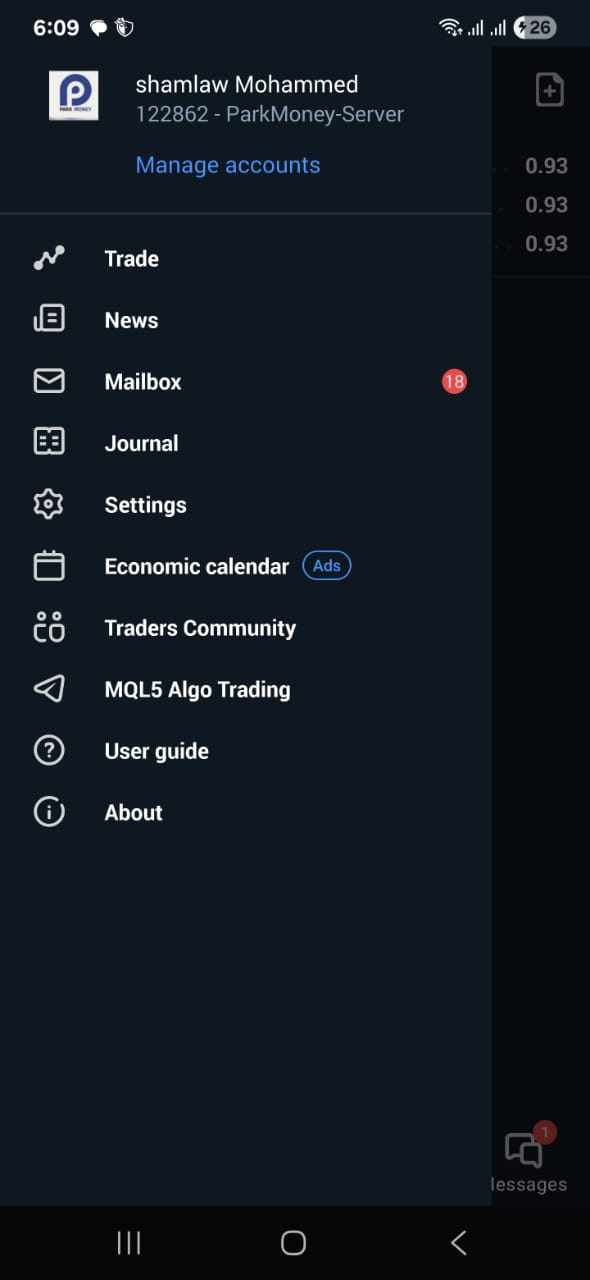

Founded in 2019, Park Money is headquartered in Saint Vincent and the Grenadines. The broker provides access to various trading platforms, including the popular MetaTrader 5 (MT5), which is available for desktop, tablet, and mobile devices. Traders can engage in a diverse range of asset classes, such as forex, commodities, indices, and shares. However, it is essential to note that Park Money is classified as an unregulated broker, which poses risks to traders regarding fund safety and operational transparency.

Detailed Breakdown

Regulated Geographical Regions

Park Money operates primarily in regions where it is not regulated, which is a significant concern for potential clients. The lack of oversight means that traders may not have recourse in the event of disputes or issues with fund withdrawals.

Deposit/Withdrawal Currencies/Cryptocurrencies

Deposits can be made through various methods, including credit cards and e-wallets like Skrill. However, specific information about withdrawal fees and processing times is often vague, leading to user frustration.

Minimum Deposit

The minimum deposit required to open an account with Park Money is reported to be around $100, making it accessible for new traders. However, some reviews suggest that higher minimums apply to certain account types, which may limit options for less experienced traders.

Park Money offers various promotions, including referral bonuses. However, the specifics of these promotions are often not clearly outlined, leading to confusion among users.

Tradable Asset Classes

The broker provides a variety of tradable assets, including over 44 currency pairs, commodities, and indices. While the range of instruments is appealing, the lack of detailed information about trading conditions raises concerns.

Costs (Spreads, Fees, Commissions)

Park Money advertises spreads as low as 0.0 pips for forex trading. However, the absence of transparency regarding commissions and hidden fees can lead to unexpected costs for traders.

Leverage

The broker offers leverage of up to 1:400, which can amplify both potential profits and losses. The high leverage is a double-edged sword, especially for inexperienced traders.

Park Money supports the MetaTrader 5 platform, which is favored for its advanced trading tools and functionalities. However, the absence of alternative platforms may limit options for traders who prefer different trading environments.

Restricted Regions

Due to its unregulated status, Park Money may not be available to traders in certain jurisdictions, particularly those with stringent financial regulations. This limitation can affect user accessibility.

Available Customer Support Languages

Customer support is reportedly available in multiple languages; however, the quality of service has been criticized, with users noting slow response times and limited assistance.

Repeated Rating Overview

In-Depth Analysis of Ratings

-

Account Conditions (5/10): While the minimum deposit is relatively low, the lack of clarity around account types and associated benefits detracts from the overall value proposition.

Tools and Resources (6/10): The availability of the MT5 platform provides traders with essential tools, but the absence of educational resources or market analysis tools is a significant drawback.

Customer Service and Support (4/10): Users have reported difficulties in reaching customer service, with slow response times and limited support options. This can be frustrating for traders needing assistance.

Trading Experience (5/10): The trading experience is generally smooth, but the lack of transparency regarding costs can lead to unexpected challenges for traders.

Trustworthiness (3/10): The most significant concern is the unregulated status of Park Money. This lack of oversight raises questions about the safety of client funds and the overall integrity of the broker.

User Experience (4/10): While the platform is user-friendly, the overall experience is marred by the lack of clear information and support, leading to a less satisfactory trading environment.

In conclusion, the Park Money review indicates that while the broker offers some appealing features, the lack of regulation and transparency raises significant concerns. Traders should exercise caution and consider these factors before proceeding with any investments.