Is Parkmoney safe?

Pros

Cons

Is Park Money Safe or a Scam?

Introduction

Park Money is an online forex broker that has positioned itself as a provider of various financial services, offering access to a range of trading instruments including forex, commodities, indices, and more. With the rise of online trading platforms, it is essential for traders to conduct thorough evaluations of brokers before investing their hard-earned money. The forex market can be rife with scams and unregulated entities, making it crucial for traders to ensure they are dealing with trustworthy platforms. This article aims to provide an in-depth analysis of Park Money, assessing its regulatory status, company background, trading conditions, customer fund safety, user experiences, and overall risk factors. The evaluation is based on data gathered from various independent sources, including reviews and regulatory information.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect clients' funds and interests. Unfortunately, Park Money is classified as an unregulated broker, which raises significant concerns regarding its legitimacy and the safety of traders' funds.

The table below summarizes the core regulatory information regarding Park Money:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that Park Money does not have to comply with any strict financial standards, and traders may have limited recourse in the event of disputes or issues with fund withdrawals. Regulatory oversight is vital as it ensures that brokers maintain transparency, segregate client funds, and adhere to fair trading practices. Without such oversight, traders are left vulnerable to potential fraud and mismanagement of funds.

Company Background Investigation

Park Money was established in 2019 and is headquartered in Saint Vincent and the Grenadines. While the company claims to provide a range of trading services, its lack of regulatory oversight raises questions about its legitimacy and operational transparency. The ownership structure of Park Money is not clearly disclosed, which is another red flag for potential investors.

The management team behind Park Money remains largely anonymous, with few details available regarding their professional backgrounds and experiences in the forex industry. This lack of transparency can be concerning, as reputable brokers typically provide information about their leadership to instill confidence among potential clients. Furthermore, the absence of clear information regarding the company's operations and financial health makes it challenging for traders to assess the risks associated with trading with Park Money.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Park Money provides various trading instruments with competitive spreads and leverage options. However, the overall fee structure and any unusual fee policies warrant careful examination.

The following table outlines a comparison of core trading costs associated with Park Money:

| Fee Type | Park Money | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not disclosed | 0.5% - 1.5% |

While the spreads offered by Park Money may appear attractive compared to industry averages, the lack of transparency regarding commissions and overnight interest rates raises concerns. Traders should be cautious of hidden fees that could impact their profitability. The absence of a clear fee structure could indicate potential issues in the company's pricing model, making it crucial for traders to proceed with caution when considering Park Money as a trading option.

Customer Fund Safety

Ensuring the safety of customer funds is paramount when choosing a forex broker. Park Money claims to keep client funds in segregated accounts, which is a standard practice among reputable brokers. However, the lack of regulation raises questions about the effectiveness of these measures.

Traders should inquire about the specific security protocols in place to protect their funds, including whether the broker offers negative balance protection and insurance for client deposits. The absence of a compensation scheme, such as those provided by regulated brokers, further amplifies the risks associated with trading with Park Money.

In summary, while Park Money may promote itself as a safe trading platform, the lack of regulatory oversight and transparency regarding its fund safety measures raises significant concerns. Traders should be wary of any broker that does not provide clear information about how they protect client funds.

Customer Experience and Complaints

User feedback and experiences can provide valuable insights into a broker's reliability and service quality. Reviews of Park Money indicate a mix of experiences, with some users expressing dissatisfaction with the platform's customer service and withdrawal processes.

Common complaints about Park Money include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Unresponsive |

| Lack of Transparency | High | Minimal info |

Many users have reported difficulties in accessing their funds, with delays in processing withdrawal requests. These issues can be particularly concerning for traders who need to access their capital promptly. Furthermore, the quality of customer support has been criticized, with reports of unresponsive service and inadequate assistance in resolving issues.

Two illustrative cases include a trader who faced a prolonged withdrawal process, taking several weeks to receive their funds, and another who reported difficulty in getting timely responses from customer support. These experiences highlight potential risks associated with trading with Park Money, raising questions about the overall reliability of the platform.

Platform and Trade Execution

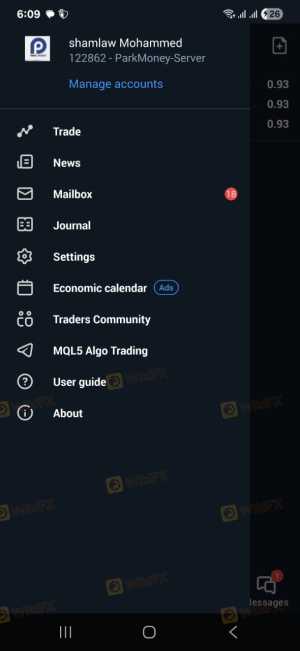

The trading platform offered by Park Money is based on MetaTrader 5, which is widely recognized for its user-friendly interface and robust features. However, the platform's performance, stability, and execution quality are critical factors that traders should consider.

Reports indicate that while the platform provides a decent user experience, there have been instances of slippage and order rejections, which can negatively impact trading outcomes. Traders should be cautious of any signs of platform manipulation, as these can indicate deeper issues within the broker's operations.

Overall, while Park Money may offer a familiar trading platform, traders should remain vigilant and conduct thorough testing to ensure that their trading experience meets their expectations.

Risk Assessment

Using Park Money presents a range of risks that traders must consider before opening an account. The absence of regulation, combined with reports of withdrawal issues and customer complaints, contributes to a higher risk profile for this broker.

The following risk assessment summarizes the key risk areas associated with Park Money:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Safety Risk | High | Lack of transparency in fund protection. |

| Customer Service Risk | Medium | Reports of poor support and withdrawal delays. |

To mitigate these risks, traders should consider using risk management strategies, such as limiting their exposure and diversifying their investments. Additionally, it may be prudent to explore alternative brokers with strong regulatory oversight and proven track records.

Conclusion and Recommendations

In conclusion, while Park Money presents itself as a competitive forex broker with attractive trading conditions, the overwhelming evidence suggests that it poses significant risks for traders. The lack of regulation, transparency, and consistent customer complaints raise red flags that should not be ignored.

Traders should exercise caution when considering Park Money, as the potential for encountering issues related to fund safety and customer support is high. For those seeking a safer trading environment, it is advisable to explore alternative brokers that are regulated by reputable authorities and offer robust investor protection measures.

In summary, Is Park Money safe? The evidence suggests that it is not a safe option for traders. It is essential for potential clients to conduct thorough research and consider more reliable alternatives in the forex market.

Is Parkmoney a scam, or is it legit?

The latest exposure and evaluation content of Parkmoney brokers.

Parkmoney Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Parkmoney latest industry rating score is 2.08, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.08 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.