Inms 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Inms review examines a forex broker that presents a mixed profile in the current trading landscape. Based on available information, INMS operates as a forex broker with some notable technical capabilities, particularly in execution speed, though comprehensive details about their services remain limited. The broker appears to maintain basic trading operations. However, it lacks transparency in several key areas that professional traders typically scrutinize.

INMS demonstrates potential in technical execution with reported fast trading information delivery. This suggests their infrastructure may support efficient order processing. However, the overall assessment reveals significant information gaps regarding regulatory compliance, account structures, and comprehensive service offerings. The available user feedback indicates moderate satisfaction levels. Though the sample size and scope of reviews appear limited.

For traders considering INMS, this review provides a balanced assessment of what can be verified about their operations. It also highlights areas where additional due diligence may be necessary before committing to their platform.

Important Disclaimers

This Inms review is based on publicly available information and user feedback accessible at the time of writing. Potential clients should note that forex broker services and conditions can vary significantly across different jurisdictions and may change without prior notice. The regulatory landscape for forex brokers continues to evolve. Traders should independently verify current licensing and compliance status.

Our evaluation methodology incorporates multiple data sources including user testimonials, technical performance metrics, and publicly available company information. However, some aspects of INMS operations could not be comprehensively verified due to limited disclosure of detailed service specifications. Prospective clients are strongly advised to conduct their own research and consider their individual trading requirements before making any decisions.

Overall Rating Framework

Broker Overview

INMS operates in the competitive forex brokerage sector. Specific details about their founding date, corporate structure, and operational history are not comprehensively documented in available sources. The broker appears to focus on providing basic forex trading services. It emphasizes technical execution capabilities that may appeal to traders prioritizing speed and efficiency in their trading operations.

From the available information, INMS positions itself as a service provider in the forex market. Their specific business model, whether market maker or ECN, remains unclear from current documentation. The broker's operational approach appears to emphasize technical performance. It particularly focuses on areas related to trade execution speed, which could be relevant for certain trading strategies.

The platform's market positioning seems to target traders who value technical execution capabilities. The broader service ecosystem including educational resources, research tools, and comprehensive customer support frameworks require further clarification. This Inms review finds that while basic trading functionality appears available, the full scope of their service offering needs more detailed examination.

Regulatory Compliance

Current available information does not provide clear details regarding INMS's regulatory status across different jurisdictions. This represents a significant area where potential clients should conduct independent verification before engaging with the platform.

Banking and Payments

Specific information about deposit and withdrawal methods, processing times, and associated fees is not detailed in available documentation. Potential clients should inquire directly about available payment options and any related costs.

Account Requirements

Minimum deposit requirements and account opening procedures are not specified in current available information. This fundamental aspect of broker services requires direct clarification from the provider.

Details regarding welcome bonuses, loyalty programs, or other promotional incentives are not documented in accessible sources.

Trading Assets

The range of available trading instruments, including currency pairs, commodities, indices, or other financial products, is not comprehensively outlined in current information.

Cost Structure

Spread configurations, commission rates, overnight fees, and other trading costs are not detailed in available documentation. This represents a critical information gap for cost-conscious traders.

Leverage Options

Maximum leverage ratios and margin requirements across different account types and trading instruments are not specified in current sources.

While some technical capabilities are indicated, detailed specifications about trading platforms, mobile applications, and advanced trading tools require further investigation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of INMS account conditions reveals significant information gaps that impact the overall assessment in this Inms review. Without detailed documentation of account types, minimum deposit requirements, or specific terms and conditions, it becomes challenging to provide a comprehensive evaluation of their account offerings. Professional traders typically require clear information about account tiers, associated benefits, and any restrictions that may apply to different account categories.

The absence of detailed account specifications raises questions about the broker's transparency and commitment to providing clear terms to potential clients. Industry standards typically include multiple account types catering to different trader profiles, from beginners to institutional clients. The lack of accessible information about Islamic accounts, demo account availability, or special account features further contributes to the moderate rating in this category.

For traders considering INMS, the recommendation is to directly contact the broker to obtain comprehensive account documentation before making any commitments. This approach ensures that all terms, conditions, and account-specific features are clearly understood and align with individual trading requirements and expectations.

The assessment of trading tools and resources available through INMS reveals limited publicly available information about their offering in this critical area. Modern forex trading requires sophisticated analytical tools, real-time market data, economic calendars, and comprehensive research resources to support informed decision-making. The absence of detailed information about these capabilities in current documentation impacts the evaluation significantly.

Professional trading platforms typically provide advanced charting capabilities, technical indicators, automated trading support, and integration with third-party analytical tools. Without clear documentation of these features, it's difficult to assess how INMS compares to industry standards or meets the needs of serious traders who depend on comprehensive analytical capabilities.

Educational resources, including webinars, tutorials, market analysis, and trading guides, represent another important aspect where information appears limited. The development of trader knowledge and skills through educational content has become a standard expectation in the industry. The absence of clear information about such resources contributes to the conservative rating in this evaluation category.

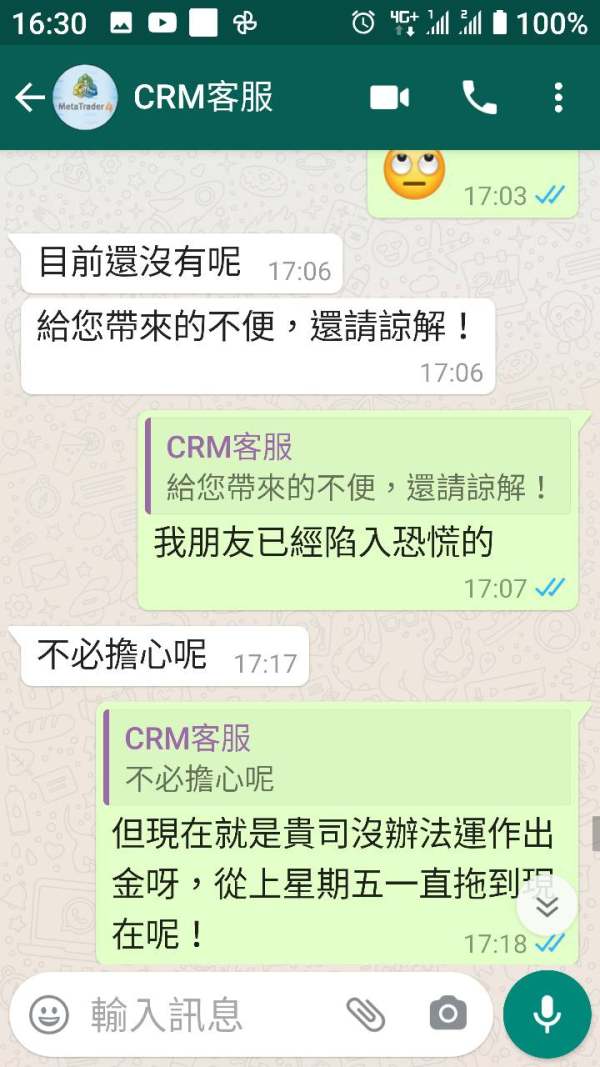

Customer Service and Support Analysis

Customer service represents a critical component of any forex broker's offering. The evaluation of INMS in this area faces challenges due to limited available information about their support infrastructure. Professional traders require reliable, knowledgeable customer support available during market hours, with multiple communication channels and reasonable response times for both technical and account-related inquiries.

The assessment considers factors such as support channel availability, multilingual capabilities, response time standards, and the technical competency of support staff. Without detailed information about these service aspects, the evaluation relies on general observations about the broker's operational presence and user feedback where available.

Industry best practices include 24/5 support during market hours, dedicated account management for higher-tier clients, and specialized technical support for platform-related issues. The absence of clear documentation about INMS's approach to customer service delivery contributes to the moderate rating. This doesn't necessarily indicate poor service quality, rather a lack of transparent information about service standards and capabilities.

Trading Experience Analysis

The trading experience evaluation focuses on technical performance aspects where some positive indicators emerge in this Inms review. Reports suggest that INMS may offer competitive execution speeds, which represents a crucial factor for traders employing strategies that depend on rapid order processing and minimal latency. Fast execution can be particularly important for scalping strategies, news trading, and other time-sensitive approaches.

Platform stability, order execution quality, and the absence of significant slippage during normal market conditions are fundamental requirements for professional trading. While specific technical performance metrics are limited in available documentation, the emphasis on execution speed suggests attention to technical infrastructure that could benefit active traders.

The evaluation also considers factors such as platform uptime, mobile trading capabilities, and the overall reliability of the trading environment. However, comprehensive assessment of these factors requires more detailed information about platform specifications, server infrastructure, and historical performance data that is not readily available in current sources.

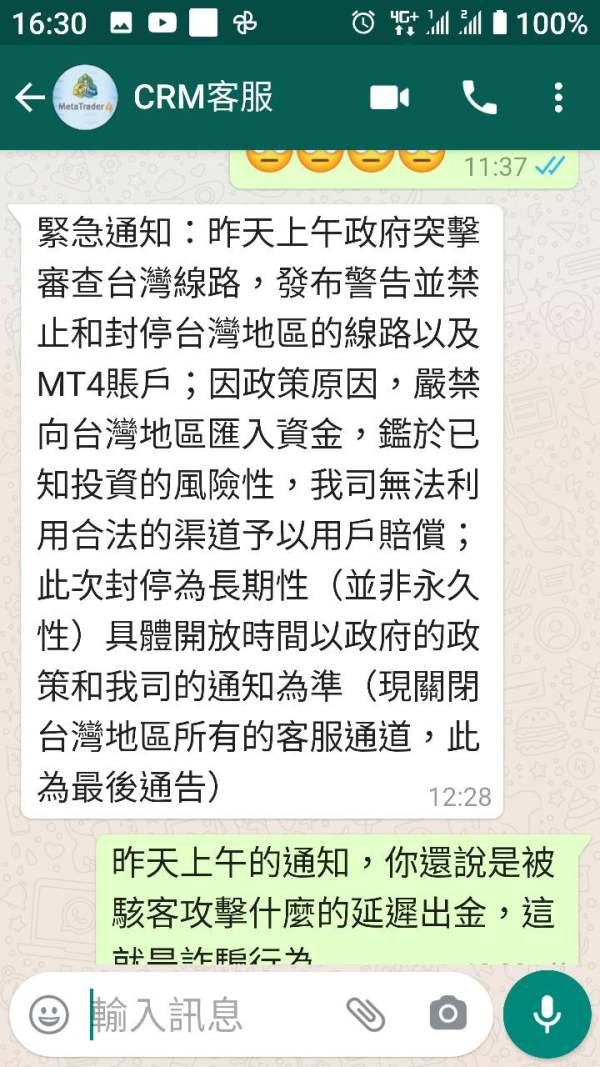

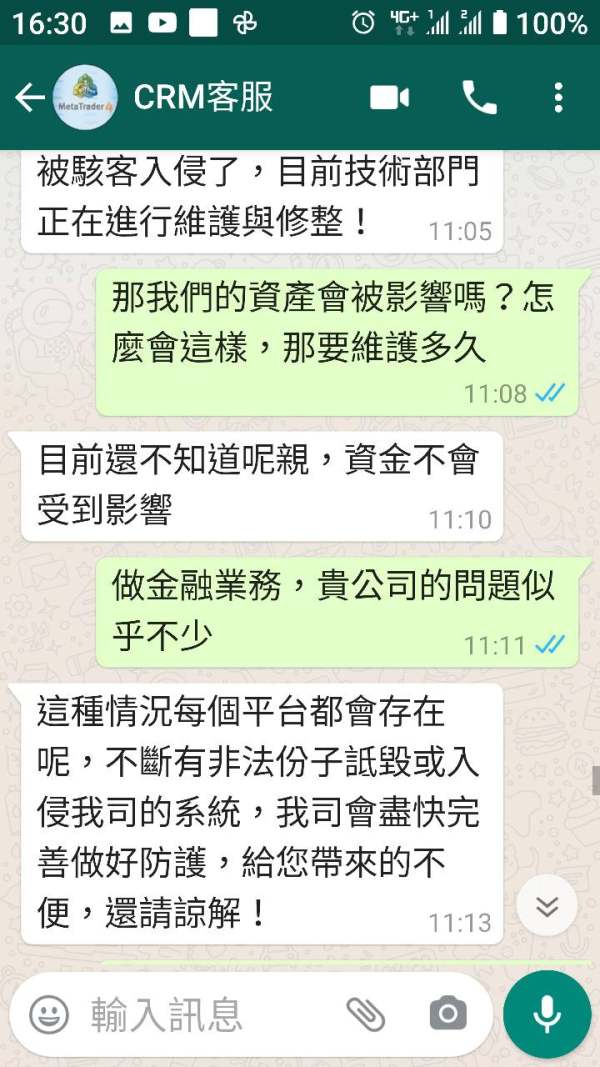

Trust and Security Analysis

Trust and security represent perhaps the most critical factors in broker selection. This area presents significant challenges in the current evaluation of INMS. The absence of clear regulatory information, licensing details, and compliance frameworks raises important questions about the broker's oversight and accountability to regulatory authorities.

Professional traders typically prioritize brokers with strong regulatory credentials from recognized authorities such as the FCA, CySEC, ASIC, or other established financial regulators. These regulatory frameworks provide important protections including segregated client funds, dispute resolution mechanisms, and operational standards that help ensure broker reliability and client protection.

The evaluation also considers factors such as fund segregation practices, insurance coverage for client deposits, audit procedures, and transparency in financial reporting. Without clear documentation of these security measures, the conservative rating reflects the importance of these factors in overall broker assessment. Potential clients should prioritize obtaining detailed information about regulatory status and security measures before engaging with any broker.

User Experience Analysis

User experience encompasses the overall interaction quality between traders and the broker's services, from initial account opening through ongoing trading activities. Available feedback suggests moderate satisfaction levels among users. The scope and depth of available reviews limit comprehensive assessment in this Inms review.

The evaluation considers factors such as platform intuitiveness, account management processes, transaction efficiency, and overall service delivery quality. User interface design, navigation efficiency, and the learning curve for new clients all contribute to the overall experience assessment. However, detailed user feedback about these specific aspects is not extensively documented in available sources.

Professional traders value streamlined processes for account verification, efficient fund management, clear reporting capabilities, and responsive platform performance. The moderate rating reflects the balance between some positive indicators and the limited comprehensive feedback available about the full spectrum of user experience factors that contribute to long-term client satisfaction.

Conclusion

This comprehensive Inms review reveals a forex broker with some potential technical capabilities, particularly in execution speed, but significant information gaps that limit full assessment. The evaluation highlights the importance of transparency in broker operations and the challenges faced when comprehensive service documentation is not readily available.

INMS may be suitable for traders who prioritize technical execution speed and are willing to conduct extensive due diligence to fill information gaps about regulatory compliance, account conditions, and comprehensive service offerings. However, the limited transparency raises important considerations for risk-conscious traders who prefer brokers with comprehensive public documentation of their services and regulatory status.

The primary recommendation for potential clients is to engage directly with INMS to obtain detailed information about regulatory compliance, account terms, security measures, and service specifications before making any trading decisions. This approach ensures that all critical factors are properly evaluated based on current, comprehensive information rather than limited publicly available data.