SHD 2025 Review: Everything You Need to Know

Executive Summary

This shd review shows concerning findings about SHD as a trading entity. Our research reveals that SHD Markets appears to operate without proper authorization from major financial regulators, which creates significant risks for potential clients. The platform claims to offer forex and CFD trading services. However, it lacks transparency in crucial areas including trading conditions, platform specifications, and regulatory compliance.

Our investigation indicates significant red flags regarding this broker's legitimacy. The company presents itself as being comprised of skilled traders and investment advisors. Yet it fails to provide verifiable credentials or regulatory documentation that legitimate brokers typically display. Most concerning is the absence of clear information about trading platforms, account types, and client fund protection measures.

This comprehensive analysis suggests that potential investors should exercise extreme caution when considering SHD Markets. The lack of regulatory oversight and transparent business practices places this broker in the high-risk category. Retail traders seeking legitimate trading services should look elsewhere for their investment needs.

Important Notice

This review is based on publicly available information and regulatory databases as of 2025. Potential differences may exist between regional entities operating under similar names that could affect the accuracy of our assessment. Our evaluation methodology incorporates official regulatory sources, user feedback when available, and industry standard assessment criteria.

Readers should note that the limited availability of verified information about SHD Markets itself raises significant concerns. The broker's transparency and legitimacy remain questionable based on our research findings. All information presented has been cross-referenced with regulatory authorities where possible to ensure accuracy.

Rating Framework

Broker Overview

SHD Markets presents itself as a trading platform offering forex and CFD services to international clients. However, our research reveals substantial gaps in the company's public disclosure of essential business information that legitimate brokers typically provide. The broker's website and promotional materials lack fundamental details including regulatory registration numbers, detailed company background, and comprehensive terms of service.

The company claims to be operated by experienced trading professionals and investment advisors. Yet it provides no verifiable information about its management team, corporate structure, or operational history that potential clients could independently verify. This absence of transparency is particularly concerning in the financial services industry. Regulatory compliance and corporate accountability are paramount in this sector.

According to available information, SHD Markets focuses on providing trading services across multiple asset classes. The company primarily emphasizes forex and contracts for difference trading opportunities for its target market. However, the specific business model, execution methods, and operational framework remain unclear due to insufficient public disclosure. This shd review emphasizes the critical importance of regulatory oversight. Such oversight appears to be absent in SHD Markets' case.

The broker's target market appears to include international traders from various regions around the world. Though specific geographic restrictions and compliance measures for different jurisdictions are not clearly outlined in available materials. This lack of clarity regarding regulatory compliance across different markets represents a significant concern. Potential clients seeking legitimate trading services should be aware of these transparency issues.

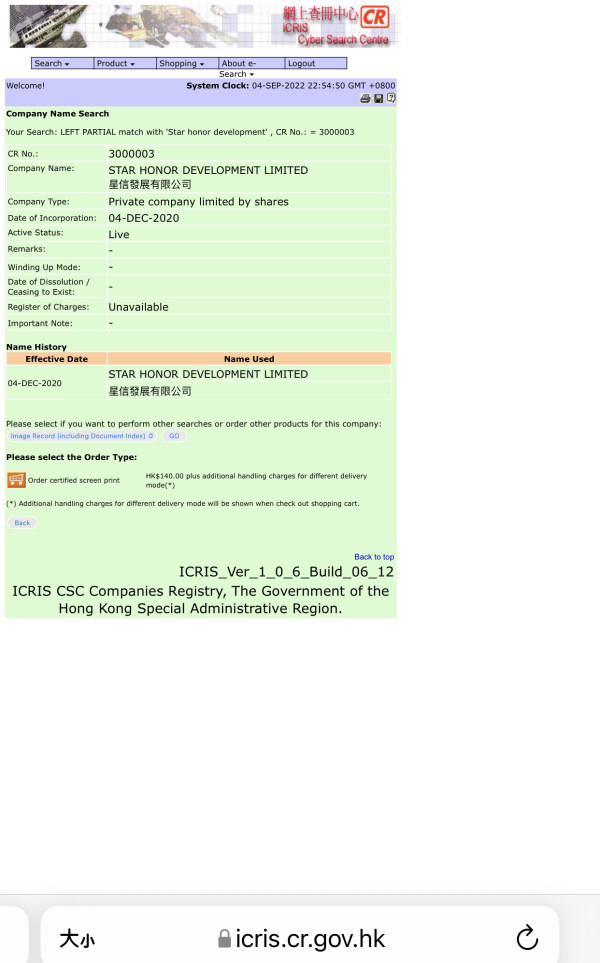

Regulatory Status: According to regulatory database searches, SHD Markets does not appear to hold authorization from major financial regulators. These include the FCA, CySEC, or ASIC, which are respected authorities in the financial services industry. This unauthorized status represents a critical risk factor for potential clients.

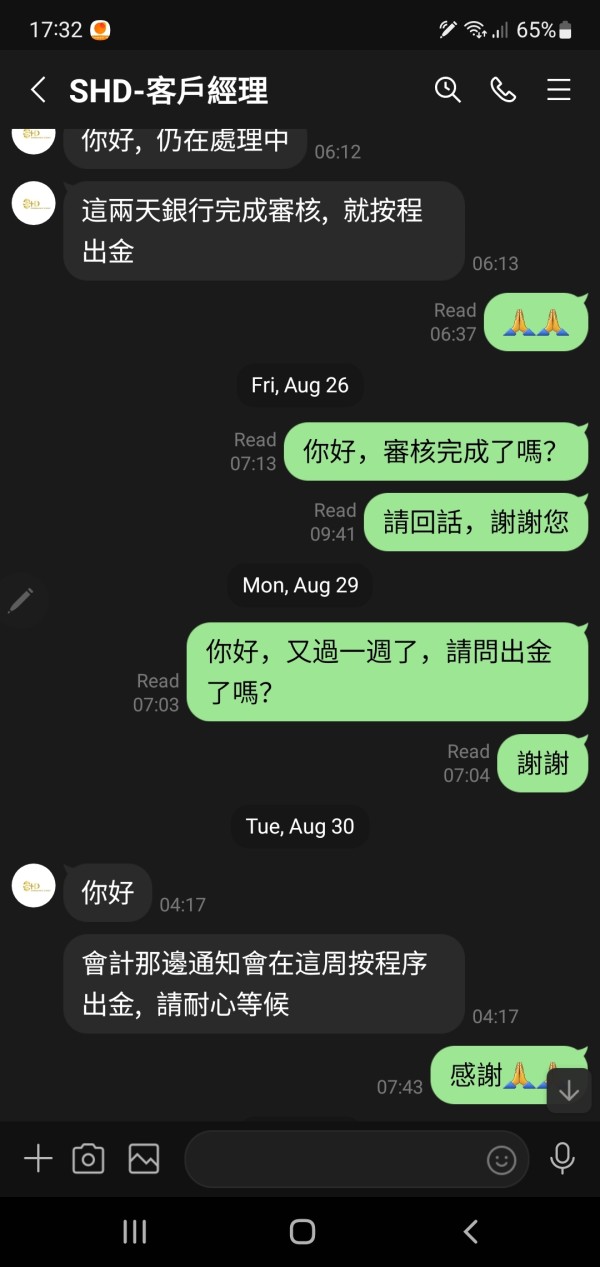

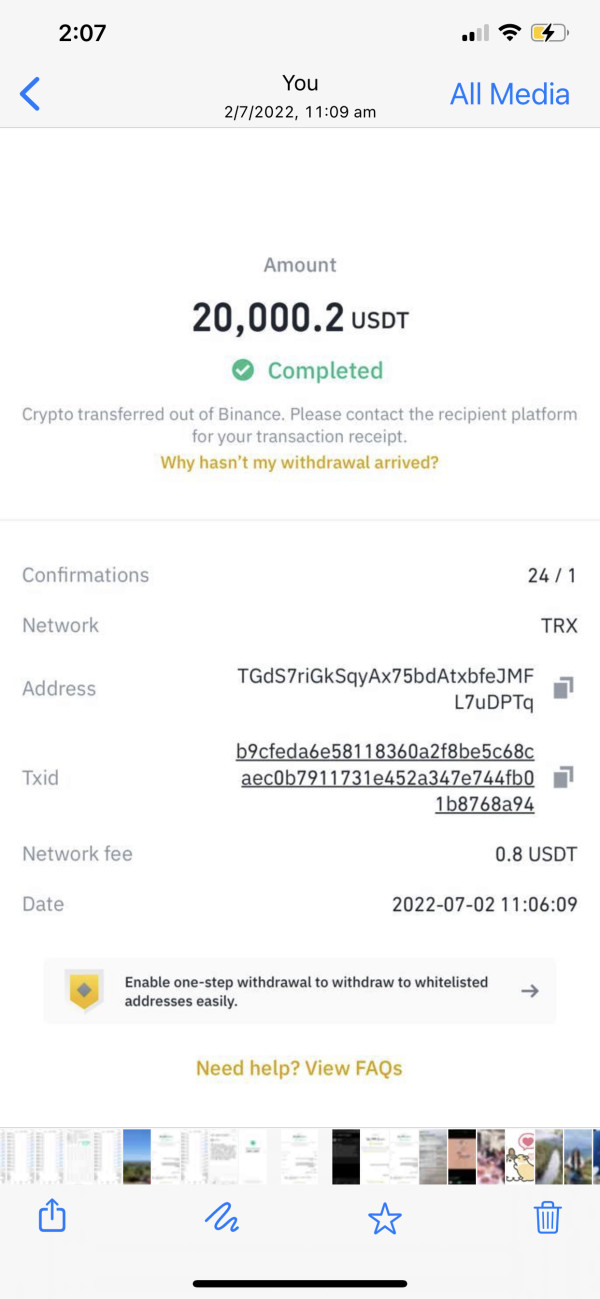

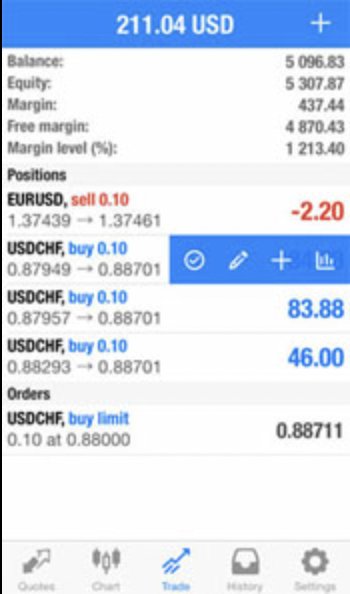

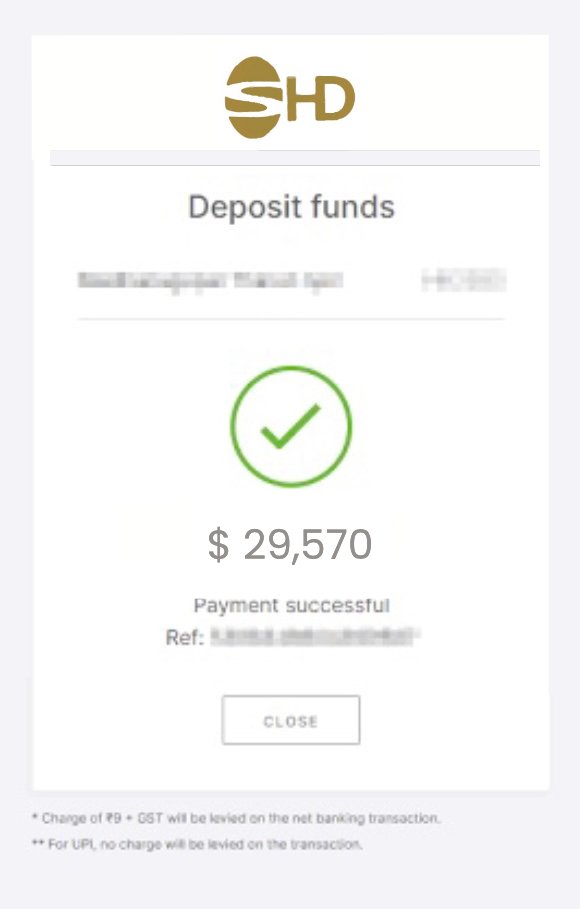

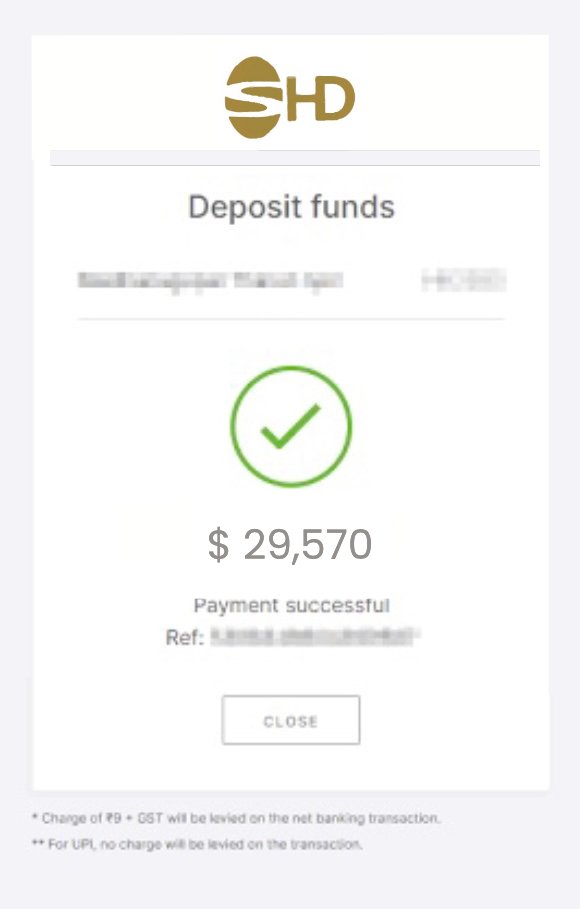

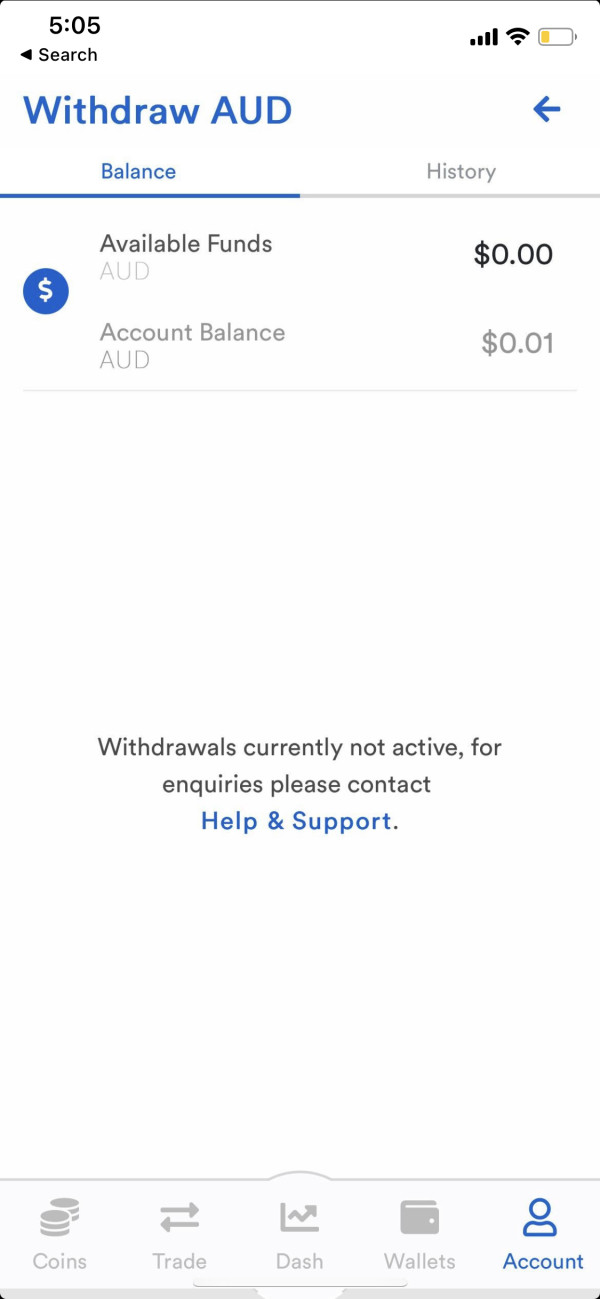

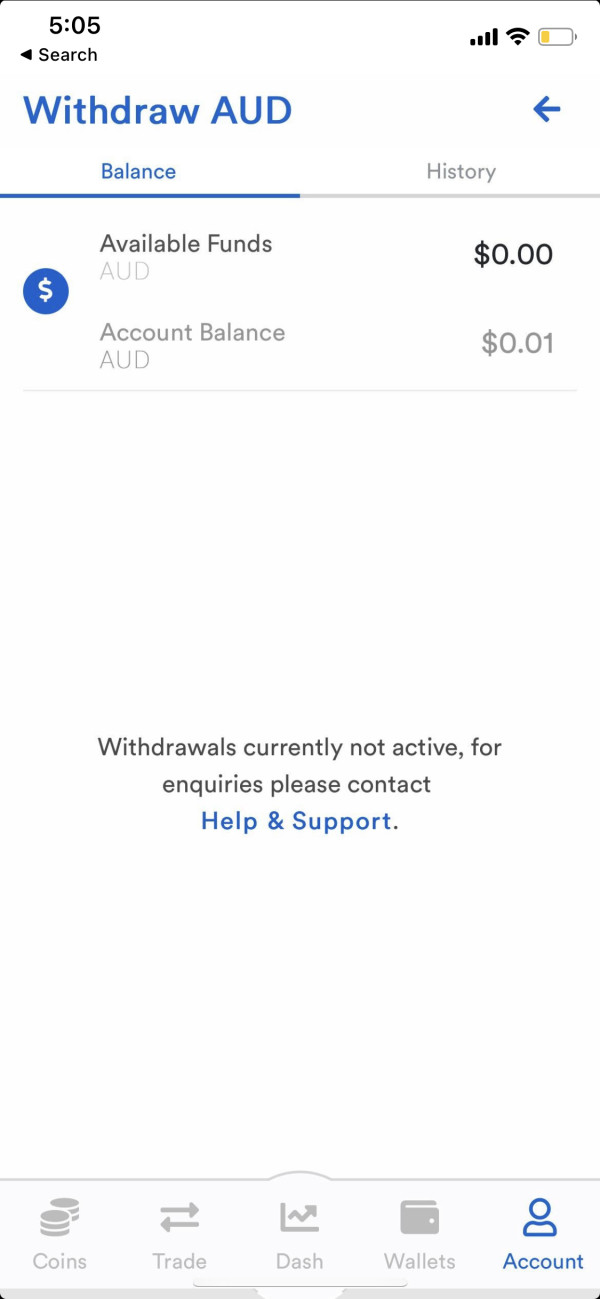

Deposit and Withdrawal Methods: Specific information regarding payment processing, supported currencies, and transaction procedures is not disclosed. This raises concerns about fund handling procedures and client money protection measures.

Minimum Deposit Requirements: The broker has not published clear information about minimum deposit thresholds or account funding requirements. This makes it difficult for potential clients to assess accessibility and plan their investment approach.

Promotional Offers: No verified information exists regarding bonus structures, promotional campaigns, or special offers. This may indicate either absence of such programs or lack of transparent marketing practices.

Available Assets: Based on limited available information, SHD Markets claims to offer forex and CFD trading. Though the specific instruments, market coverage, and asset variety remain unspecified in accessible documentation.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs is not transparently disclosed. This prevents meaningful cost analysis for potential clients considering the platform.

Leverage Options: Specific leverage ratios and risk management parameters are not clearly published. This represents a significant information gap for risk assessment purposes.

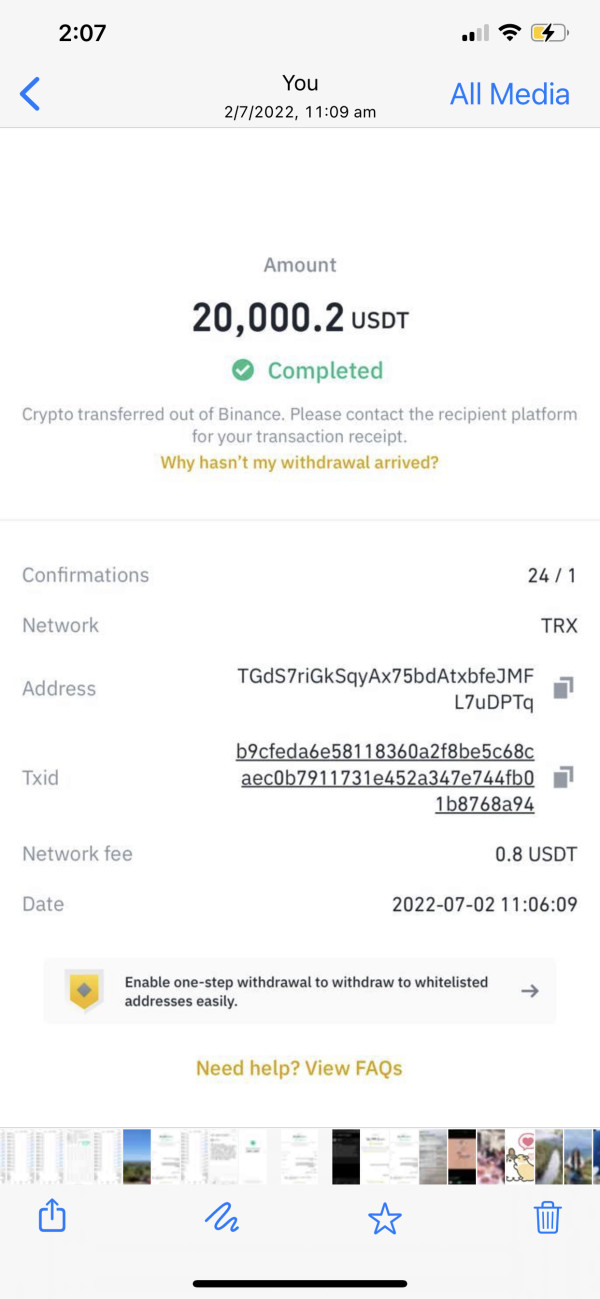

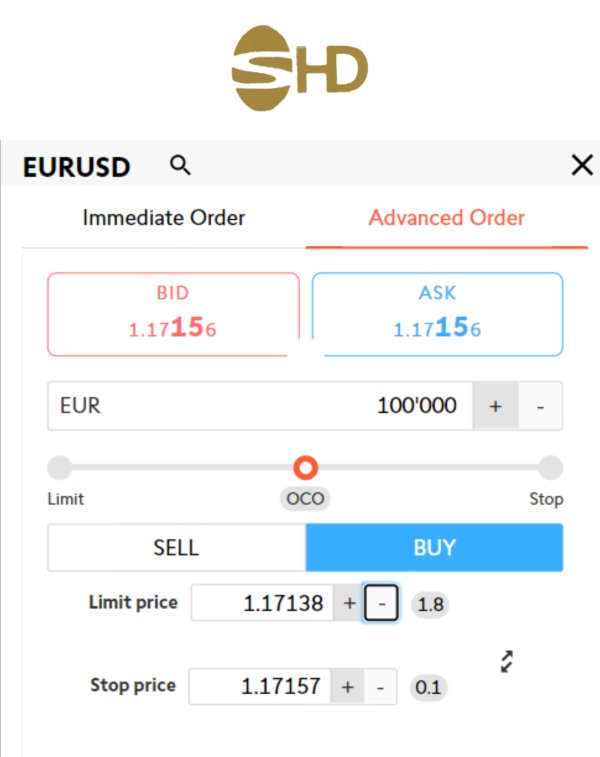

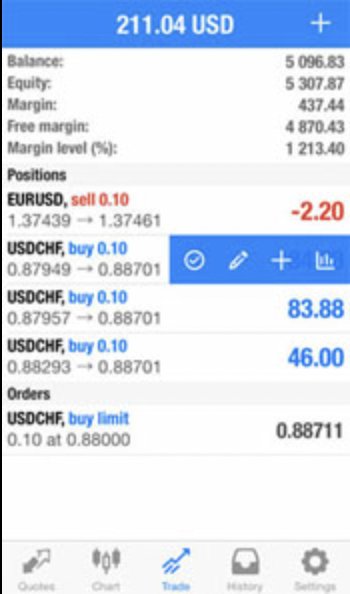

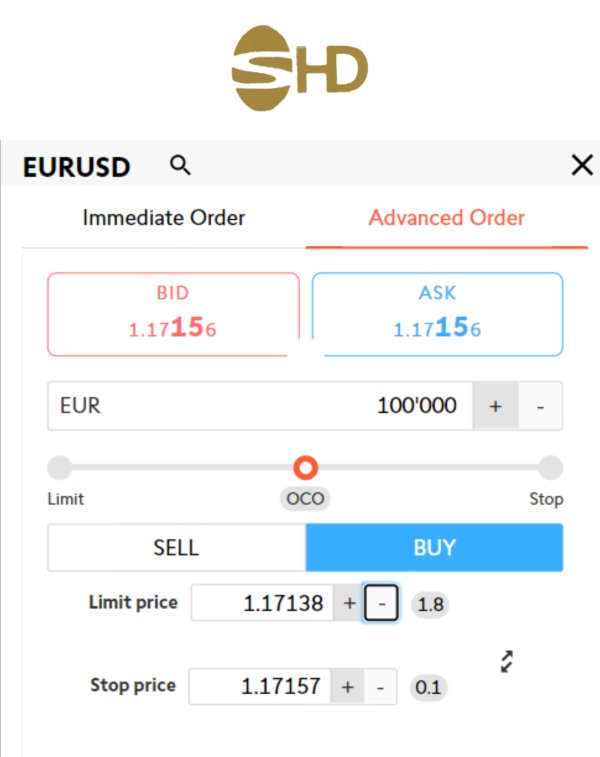

Platform Selection: Details about trading platforms, technology infrastructure, and software options are notably absent from available materials. This makes it impossible to evaluate the technical capabilities of the trading environment.

Geographic Restrictions: Clear information about jurisdictional limitations and compliance requirements for different regions is not provided. This creates uncertainty about legal trading access for international clients.

Customer Support Languages: Available communication languages and support channels are not specified in accessible documentation. This raises questions about the broker's ability to serve diverse international clientele effectively.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The evaluation of SHD Markets' account conditions reveals a complete absence of essential information. Legitimate brokers typically provide detailed information about their account offerings to help clients make informed decisions. No details are available regarding account types, their respective features, or target user categories.

This lack of transparency makes it impossible for potential clients to understand what services they would receive. Standard industry practice requires brokers to clearly outline different account tiers and their associated benefits. SHD Markets fails to meet these basic transparency standards that clients expect from professional trading platforms.

The absence of published account opening procedures, verification requirements, and documentation processes further compounds these concerns. Without access to fundamental account information, potential clients cannot make informed decisions about whether the broker's offerings align with their needs. This shd review emphasizes that legitimate brokers prioritize transparency in account conditions as a cornerstone of client relations.

The lack of special account features, promotional benefits, or loyalty programs information suggests either minimal service offerings or inadequate client communication. Professional trading platforms typically provide detailed account comparisons and clear upgrade pathways. None of these standard features are evident in SHD Markets' available materials.

SHD Markets provides no verifiable information about trading tools, analytical resources, or educational materials. Legitimate brokers typically offer comprehensive trading platforms with advanced charting capabilities, technical indicators, and market analysis tools that help traders make informed decisions. The absence of such information raises serious questions about the platform's actual capabilities.

Modern trading environments require sophisticated analytical tools, real-time market data, and comprehensive research resources. Without clear documentation of available tools, potential clients cannot assess whether the platform meets professional trading standards. The lack of educational resources is particularly concerning since reputable brokers invest significantly in client education and market analysis.

Automated trading support, algorithmic trading capabilities, and third-party integration options are standard features expected from professional trading platforms. No information exists regarding SHD Markets' support for these essential functionalities. This suggests potential limitations in trading infrastructure that could impact trading effectiveness.

The absence of research departments, market commentary, or analytical publications indicates a significant gap in value-added services. These services distinguish professional brokers from basic trading platforms and provide important support for trading decisions. This deficiency impacts both novice traders seeking educational support and experienced traders requiring sophisticated analytical tools.

Customer Service and Support Analysis (Score: 1/10)

Customer service information for SHD Markets is notably absent from available sources. Legitimate financial service providers typically maintain multiple communication channels including phone support, email assistance, live chat functionality, and comprehensive FAQ sections. The lack of published customer service details raises immediate concerns about client support capabilities.

Response time commitments, service quality standards, and escalation procedures are fundamental aspects of professional customer service. These important service elements remain undocumented in SHD Markets' available materials. Without clear service level agreements or support hour specifications, potential clients cannot assess the reliability of assistance when needed.

Multilingual support capabilities are essential for international brokers serving diverse client bases from different countries and regions. The absence of language support information suggests potential communication barriers for non-English speaking clients. This limitation reduces the broker's practical accessibility for international traders.

Problem resolution procedures, complaint handling mechanisms, and client protection measures are critical components of financial service customer support. The lack of transparency in these areas indicates potential deficiencies in client protection. Service quality assurance appears to be inadequate based on available information.

Trading Experience Analysis (Score: 1/10)

The trading experience evaluation reveals significant information gaps regarding platform performance, execution quality, and user interface design. Professional trading platforms require robust infrastructure, minimal latency, and reliable order execution to meet trader expectations. SHD Markets provides no verifiable information about these critical technical specifications.

Platform stability, server uptime guarantees, and technical support for trading issues are fundamental requirements for serious trading operations. The absence of published performance metrics or reliability commitments suggests potential deficiencies in technical infrastructure. These deficiencies could significantly impact trading performance and client satisfaction.

Mobile trading capabilities have become essential for modern traders requiring flexibility and accessibility in today's fast-paced markets. No information exists regarding mobile applications, responsive web platforms, or cross-device synchronization features. This indicates possible limitations in trading accessibility that could disadvantage active traders.

Order execution quality, including slippage statistics, rejection rates, and fill speed metrics, directly impacts trading profitability. The lack of transparency regarding execution statistics prevents objective assessment of the platform's trading environment quality. This information gap makes it impossible to evaluate the broker's execution capabilities.

Trust and Reliability Analysis (Score: 1/10)

Trust assessment reveals the most concerning aspects of SHD Markets' operations. The absence of regulatory authorization from recognized financial authorities represents a fundamental reliability issue. Legitimate brokers maintain licenses from respected regulators and provide transparent regulatory information to clients.

Client fund protection measures, including segregated accounts, deposit insurance, and compensation schemes, are essential safeguards. These important protections remain undocumented in SHD Markets' available materials. Without clear fund protection protocols, client assets face significant security risks that regulated brokers typically mitigate through mandatory protection schemes.

Corporate transparency, including company registration details, management information, and financial reporting, is notably absent. Professional financial service providers maintain public corporate records and provide accessible information about their business operations. They also typically share information about their leadership team and corporate governance structure.

The lack of industry recognition, professional certifications, or third-party validations further undermines confidence in the broker's legitimacy. Reputable brokers typically maintain memberships in industry organizations and receive independent audits of their operations. These credentials provide additional assurance to potential clients about the broker's professional standing.

User Experience Analysis (Score: 1/10)

User experience evaluation is severely limited by the absence of verified user feedback and transparent operational information. The lack of accessible user testimonials, review platform presence, or community engagement suggests minimal client base. It could also indicate poor user satisfaction with the platform's services.

Interface design, navigation ease, and platform usability cannot be assessed due to insufficient information about the actual trading environment. Professional platforms prioritize user experience through intuitive design and comprehensive functionality testing. These important aspects remain unknown for SHD Markets.

Registration and verification processes remain undocumented, preventing assessment of onboarding efficiency and compliance procedures. Legitimate brokers maintain streamlined yet thorough client onboarding processes that balance accessibility with regulatory compliance. The absence of this information raises questions about the broker's operational procedures.

The absence of user community features, educational webinars, or client engagement programs indicates limited commitment to user experience enhancement. Professional brokers typically invest in community building and ongoing client education as key differentiators. These value-added services are notably missing from SHD Markets' apparent offerings.

Conclusion

This comprehensive shd review reveals significant concerns about SHD Markets' legitimacy and operational transparency. The broker's failure to provide essential information about regulatory status, trading conditions, and client protection measures represents unacceptable risks. Potential investors should be aware that these deficiencies create substantial uncertainty about the safety of their funds.

Based on our analysis, SHD Markets cannot be recommended for any category of trader due to fundamental deficiencies in transparency and regulatory compliance. The absence of verifiable information across all major evaluation criteria suggests either inadequate business practices or intentional opacity. These issues contradict industry standards that legitimate brokers typically maintain.

Potential investors should prioritize regulated brokers with transparent operations, comprehensive client protection measures, and verifiable track records. The risks associated with unregulated trading platforms far outweigh any potential benefits that might be offered. This is particularly important given the availability of legitimate alternatives in the competitive forex and CFD markets.