GoldRush Review 6

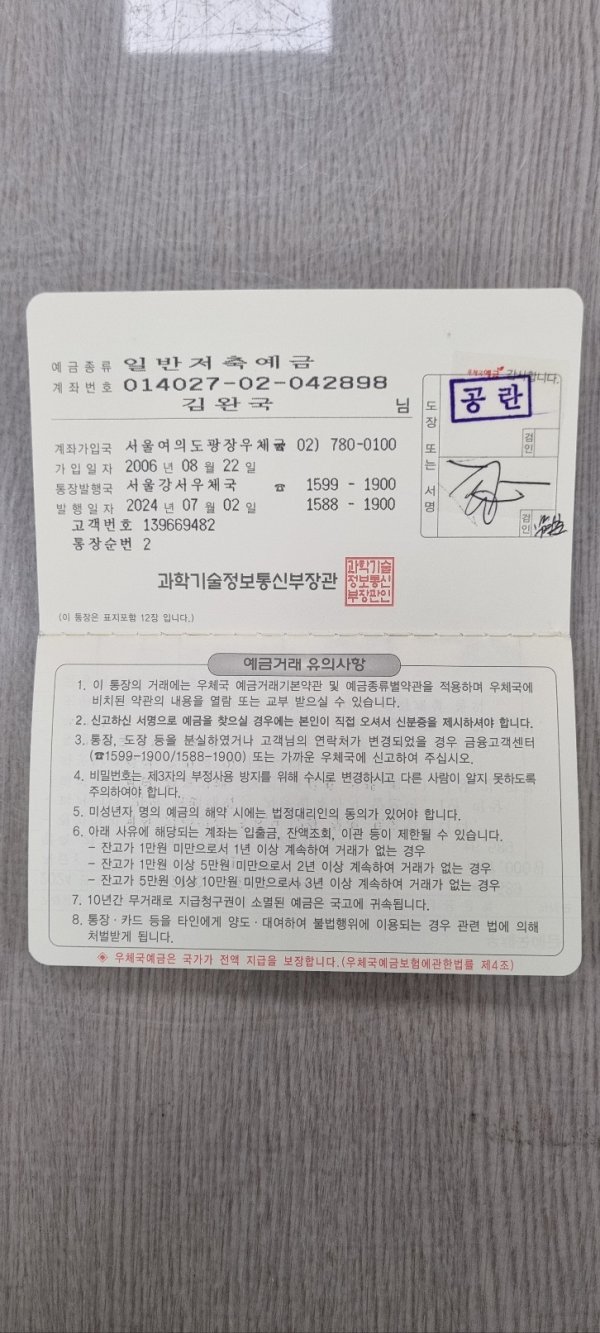

GoldRush exposes GoldRush platform as a "comprehensive department store" for 8 types of crimes such as civil and criminal closure, fraud, etc. The main contents are as follows. 1. The fact that it closed on September 9, 2024, was exposed on the website, and even though 4 months have passed, the settlement amount of approximately 90 million won is still unsettled. 2. Even though 8 months have passed, the withdrawal request for a margin of 30 million won has not been executed in 4 attempts, and the withdrawal promise has been violated 4 times in total. 3. Although a remittance fee of 13 million won was sent, the refund was not made within 24 hours, and the margin was also not settled. 4. Although an additional verification cost of 10 million won was requested, GoldRush platform voluntarily invalidated it. 5. Due to the problem of "absence of email communication channel" with the company, more than 100 emails were sent but no reply was received. In addition, problems such as fraud in the existence of the Korean branch and additional cost demands when withdrawing the margin occurred. As a result, serious economic [withdrawal request from a family account], and social damage occurred. Please refer to the attached evidence materials and take proactive measures. **Conclusion** GoldRush platform is exposed as a "comprehensive department store" with a history of 8 types of criminal acts such as closure, fraud, deception, embezzlement, misappropriation, embezzlement, coercion, and intimidation. **Attached materials:** 1. GoldRush closure screenshot (2024.9.10.) 2. Remittance history for exchange fees (about 13 million won) and 3 types of dealer background screenshots (margin $53,336.65) 3. 4 replies to received emails / 1 sent email 4. Copy of a family account in the name of the account holder

GoldRush platform is exposed as a "comprehensive department store" for various crimes such as civil and criminal closure, fraud, etc. The main contents are as follows. 1. The fact that it closed on September 9, 2024, was exposed on the website, and as a result, the liquidation amount of approximately 90 million won is in an unsettled state. 2. Despite the passage of 5 months, the withdrawal request for a margin of 30 million won has not been fulfilled in 4 attempts. 3. Although a remittance of 13 million won for exchange fees was made, a refund was not made within 24 hours, and the margin was also not settled. 4. An additional verification cost of 10 million won was requested, but it was voluntarily invalidated by the GRG platform. 5. The promise to withdraw a margin of 30 million won was violated a total of 4 times. 6. Due to the problem of "absence of email communication channel" with the company, 100 emails were sent but no replies were received. In addition, problems such as fraud in the existence of the Korean branch and additional cost demands when withdrawing the margin occurred. As a result, serious economic [withdrawal request from family's (spouse) account] and social damage occurred. Please refer to the attached evidence materials and take proactive measures. **Conclusion** GoldRush platform is exposed as a "comprehensive department store" for frequent occurrence of crimes such as closure, fraud, deception, embezzlement, misappropriation, embezzlement, coerced confession, and threats. **Attached materials:** 1. GoldRush closure screenshot (2024.9.09.). 2. Remittance history for exchange fees (approximately 13 million won) and 3 screenshots of dealer background (margin $53,336.65). 3. 4 email replies received / 1 email sent. 4. Copy of family's account in the name of the account.

We expose the GoldRush platform company as a comprehensive department store of crimes including civil and criminal fraud. The main contents are as follows: 1. There were 4 breaches of promise for withdrawal of 30 million won in margin after 4 months. 2. Approximately 90 million won in settlement money due to site suspension was not settled. 3. When transferring 13 million won in exchange fees, a refund condition was set within 24 hours, but no refund was made. 4. Request for additional 10 million won in verification fees was invalidated. 5. The promise to withdraw 30 million won in margin was violated 4 times. 6. There were problems such as lack of company email communication window, fraud at the Korean branch, and additional cost demands when withdrawing margin. As a result, the informant is suffering serious economic and social damage. I have attached the relevant evidence, so I request you to take active action. - I expose this as a comprehensive department store of existing crimes, including fraud, embezzlement (theft), embezzlement, breach of trust, torture of hope, and intimidation. **Attached materials** Remittance details of currency exchange fees (approximately 13 million won) and 3 screenshots of dealer background (the deposit of $53,336.35 will be submitted as attached photos at the time of secondary exposure) - 2pp

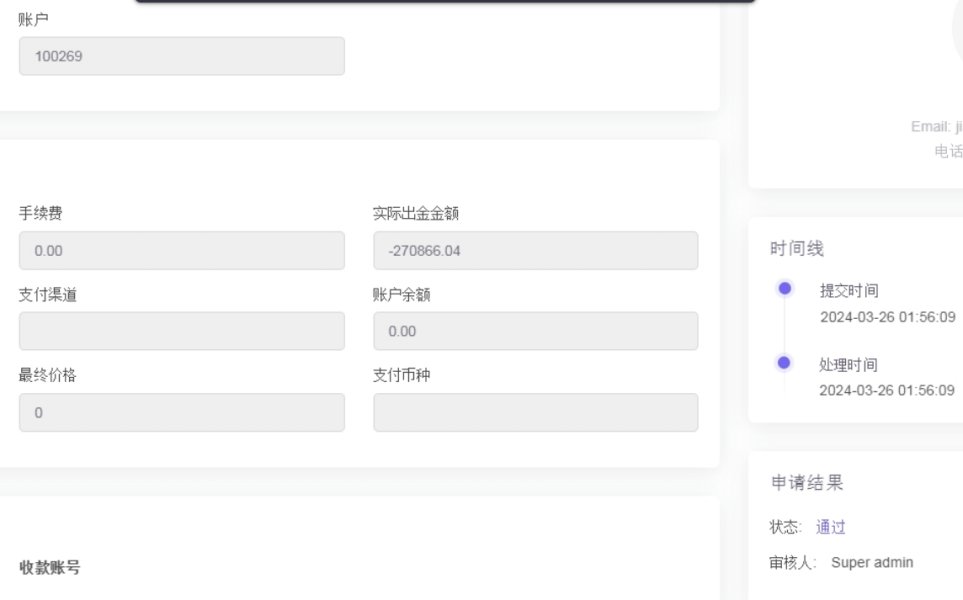

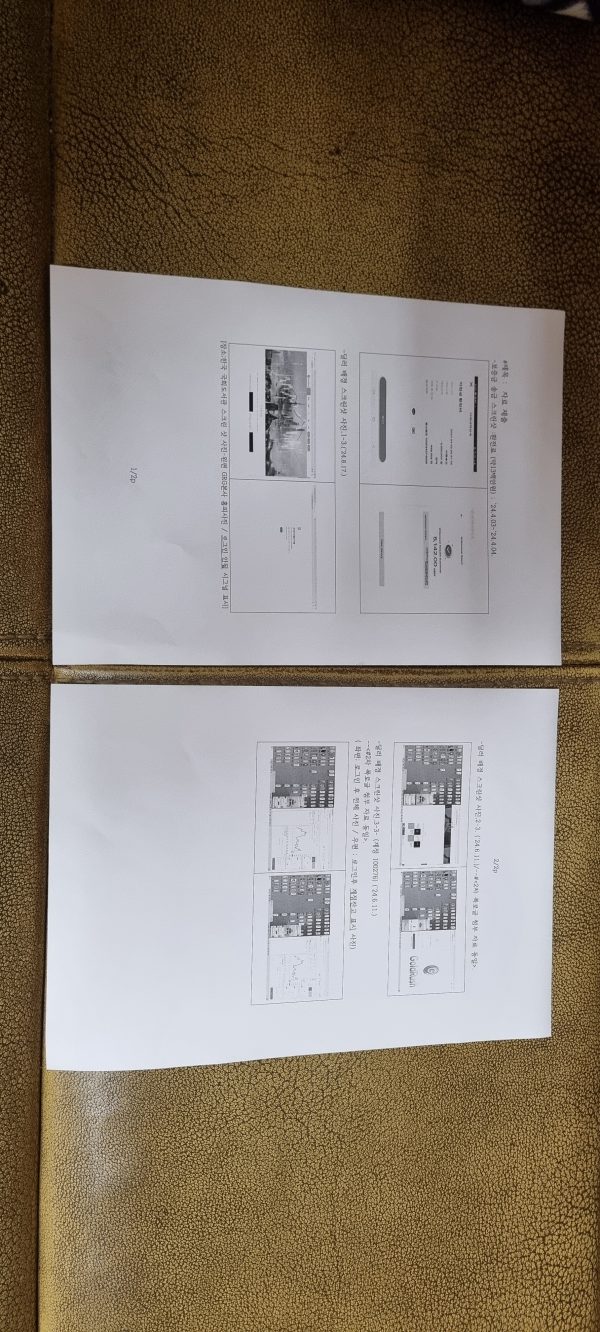

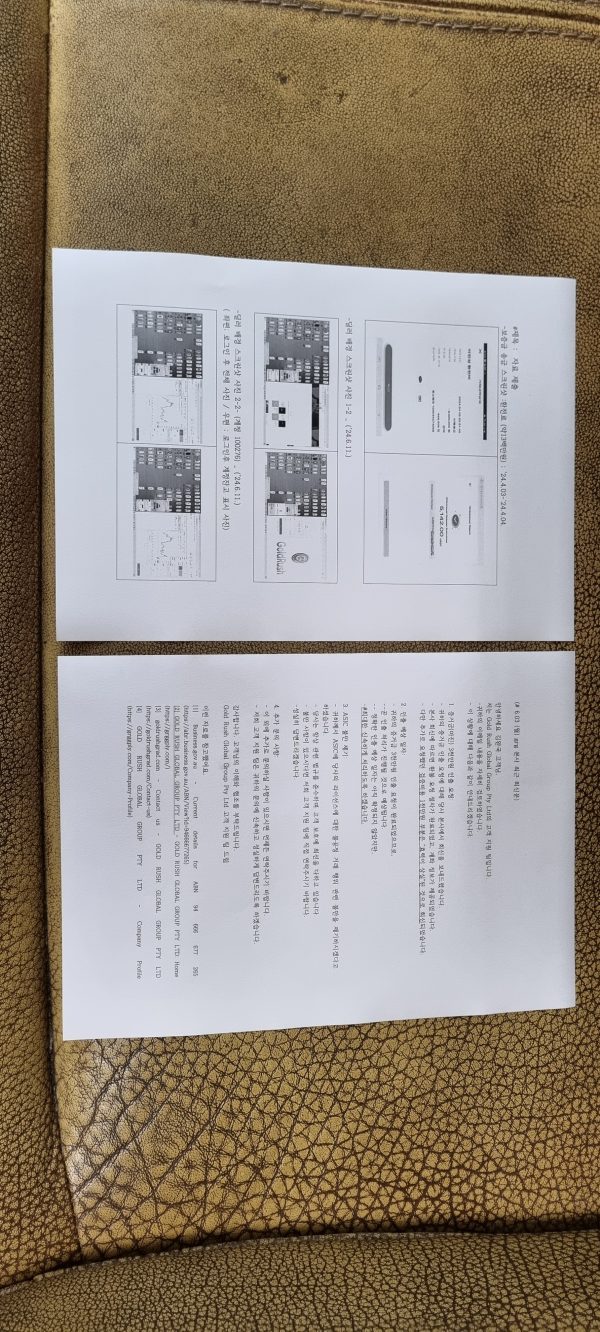

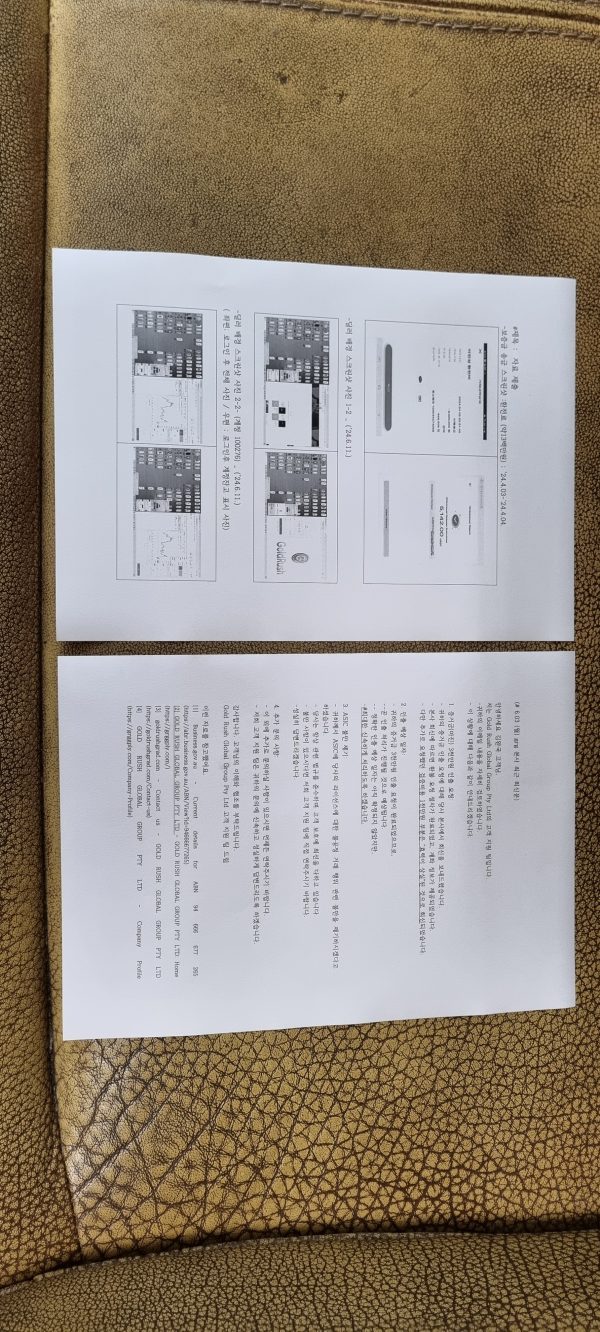

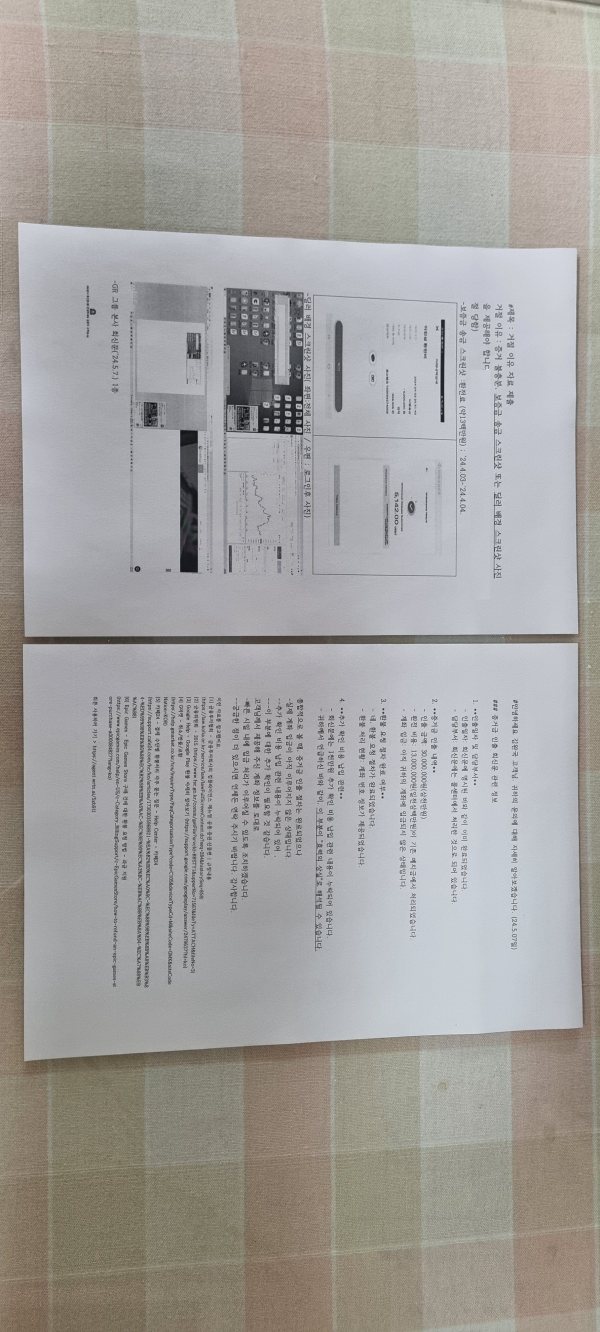

Contents: (1) Delay in margin (margin) withdrawal: I requested withdrawal of 30 million won of margin on March 28th of this year (2024), but {margin of about 73 million won ($53,336.65; account 100276 + exchange fee 13 million won = 86 million won) 10,000 won)}-Until June 11th of this year (2024) _10,000 won, even after 2 months-#Withdrawal request completed (2024.6.03.) In response to the reply--the exact withdrawal expected date is not confirmed--that it will be processed as quickly as possible Even after a week, the deposit has not yet been deposited into the account. (2) Additional cost request: In response to the withdrawal request, there was a request from GRG headquarters to remit two types of additional money of approximately 23 million won, a. “Currency exchange fee” of approximately 13 million won. Request for withdrawal of margin was made on April 5, 2024, but-# refund of exchange fee and account of deposit (margin) have not been fulfilled even after 2 months. b. Request for 10 million won as “verification fund” ( (Dated April 5, 2024) There was a fact that there was a non-compliance and a “loss of effect” treatment at the head office (May 7, 2024), -Accordingly, in protest a. above, GRG Company’s embezzlement, misappropriation, and breach of trust were confirmed. Existence revealed. c. The domestic call center said it would handle it according to the regulations, and - despite the head office providing a reply with no effect (reindicated on May 7-6.03, 2024) - when the funds are ready, they will help with the deposit account. There were only 10 comments saying they would give it ('24.5.02~'24.5.14.) - We are continuously requesting 10 million won as verification funds in item b. above, and -# Withdrawal of the domestic call center as of '24.4.11. There is a precedent for doing so - even after receiving the attached reply from the customer support team - unable to apply for withdrawal - revealing the dissatisfaction of eagerly awaiting the deposit, (3) Financial disadvantage: This investor is not able to receive margin withdrawal in a timely manner, and we emphasize that this investor is being driven out onto the streets at a significant financial disadvantage. #The above facts are considered unfair trading practices. This is the second disclosure (the first was on May 29, 2024). (4) Attachment; - Screenshot of deposit remittance: Currency exchange fee (approximately 13 million won); ’24.4.03-‘24.4.04. - 2 types of dealer background screenshot photos (4 before and after login) - 1 copy of the GRG headquarters reply dated June 3, 2024 (1 sheet)

(1) Delay in margin withdrawal: I requested withdrawal of 30 million won of margin on March 28th of this year (2024), but {out of about 70 million won of margin ($53,336.65; account 100276)}_only 2 months have passed until May 29th of this year (2024). Even though the head office said that the withdrawal decision had been made, the account has not been deposited yet. (2) Request for additional costs: In response to the request for margin withdrawal, there was a request from GRG head office to transfer two types of additional amounts, a. - Approximately 13 million won. A remittance was made on April 5, 2024 to withdraw the margin in response to the request for "currency exchange cost", but -# the refund of the exchange cost and the accounting of the deposit (margin) have not been implemented even after 2 months. b.- When I objected to the request for 10 million won as “verification funds” (dated April 5, 2024), there was a reply from the head office (May 7, 2024) that the request was “ineffective.” (3) Financial Disadvantages: This investor is notified that he is suffering significant financial disadvantages (approximately 10 financial institutions demand debt every day) due to not receiving margin withdrawals in a timely manner, and exposes the above unfair trading practices. (4) Attachment; Deposit remittance screenshot photo, dealer background screenshot photo, and one type of reply letter from GR Group headquarters.

I was introduced to trade on this platform. In the beginning, deposits and withdrawals were normal. But after half an month, it shows withdrawn, but I didn't receive the money. I found customer service but they didn't give me money. It's totally a scam.