Is Freyr safe?

Pros

Cons

Is Freyr Safe or Scam?

Introduction

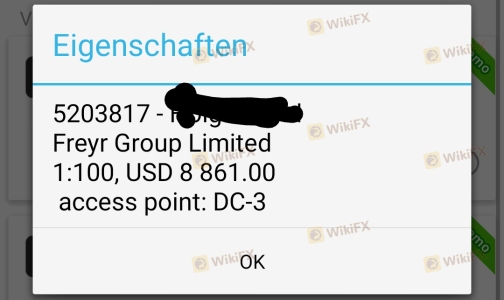

Freyr, an online forex broker, has emerged as a player in the competitive landscape of foreign exchange trading. With promises of low initial deposits and access to a wide range of trading instruments, it has attracted the attention of many traders, both novice and experienced. However, in an industry rife with potential pitfalls, it is crucial for traders to carefully evaluate the legitimacy and safety of any broker before investing their hard-earned money. This article aims to provide an objective analysis of Freyr's credibility, scrutinizing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a comprehensive review of multiple sources, including user reviews, regulatory databases, and industry reports.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and legitimacy. A regulated broker is subject to oversight from financial authorities, which can help protect investors from fraud and malpractice. Unfortunately, Freyr lacks regulation from any reputable financial authority, raising serious concerns about its legitimacy.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

As indicated in various reviews, Freyr claims to be regulated by the National Futures Association (NFA) in the United States. However, upon verification, it appears that Freyr is not listed as a member of the NFA, which casts doubt on the broker's claims. The absence of regulation not only makes it difficult for traders to seek recourse in case of disputes but also indicates a lack of oversight that could lead to potential fraudulent activities. Consequently, the question of is Freyr safe becomes increasingly relevant, as unregulated brokers often operate with fewer safeguards in place for customer funds.

Company Background Investigation

Freyr's company background is another area of concern. There is limited information available regarding its history, ownership structure, and management team. The lack of transparency in these areas can be alarming for potential investors. A reputable broker typically provides detailed information about its founders, management team, and operational history, allowing traders to assess their credibility.

The absence of publicly available information about Freyr's ownership and management raises flags about its transparency. Additionally, the company's website does not provide a physical address or contact number, further complicating efforts to verify its legitimacy. The lack of clear communication channels may also hinder customers from resolving issues effectively. In light of these factors, it is prudent for traders to question is Freyr safe and to consider the implications of investing with a company that lacks transparency.

Trading Conditions Analysis

Understanding the trading conditions offered by Freyr is crucial for evaluating its overall safety and reliability. The broker claims to provide competitive spreads and low initial deposits, but many details remain unclear.

| Cost Type | Freyr | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1-2 pips |

| Commission Structure | N/A | 0-5 pips |

| Overnight Interest Range | N/A | 0.5-3% |

The lack of clarity regarding spreads, commissions, and other trading fees is concerning. Industry standards dictate that reputable brokers should provide transparent information about their fee structures. The absence of such information may indicate that the broker is either trying to hide unfavorable conditions or simply lacks the professionalism expected in the industry. It is essential for traders to question is Freyr safe when faced with ambiguous fee structures that could lead to unexpected costs.

Customer Funds Security

The safety of customer funds is paramount when evaluating a broker's legitimacy. Freyr has not provided sufficient information about its security measures, including whether customer funds are held in segregated accounts or if there are any investor protection schemes in place.

The absence of clear policies regarding fund security raises concerns about the potential for financial loss. Traders should be particularly wary if a broker does not offer negative balance protection, which safeguards investors from losing more than their initial investment. Given the lack of information on these critical aspects, it is reasonable to question is Freyr safe for managing and protecting customer funds.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. In Freyr's case, numerous negative reviews and complaints have surfaced, indicating a pattern of dissatisfaction among users. Common complaints include issues with fund withdrawals, unresponsive customer service, and difficulties in accessing accounts.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Account Access | High | Poor |

For instance, several users have reported that they were unable to withdraw their funds after making initial deposits. This raises serious concerns about the broker's operational integrity and financial practices. When traders are left without recourse, it becomes increasingly difficult to trust the broker. Therefore, potential investors must consider whether is Freyr safe based on the experiences of others who have engaged with the platform.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a seamless trading experience. Freyr claims to operate on the widely-used MetaTrader 4 platform, known for its user-friendly interface and robust features. However, user reviews indicate that the platform may not always function optimally, with reports of slippage and order rejections.

Traders have expressed concerns regarding the execution quality of their trades, which can significantly impact profitability. If a broker's platform is prone to technical issues or manipulation, it raises serious red flags about its credibility. Thus, it is essential to assess whether is Freyr safe in terms of its platform reliability and trade execution standards.

Risk Assessment

Given the various factors discussed, it is evident that trading with Freyr involves significant risks.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Lack of transparency regarding fees and fund security. |

| Operational Risk | Medium | Complaints about platform stability and customer service. |

To mitigate these risks, traders should conduct thorough research before engaging with Freyr. It is advisable to start with a small investment, if at all, and to be prepared for potential challenges in withdrawing funds or accessing customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Freyr may not be a safe choice for forex trading. The lack of regulation, transparency, and customer support, coupled with numerous negative user experiences, raises significant concerns about its legitimacy. Therefore, potential traders should exercise extreme caution when considering is Freyr safe for their trading activities.

For those seeking reliable trading options, it is recommended to explore brokers that are regulated by reputable authorities, have clear fee structures, and maintain positive customer feedback. Brokers such as OANDA, IG, or Forex.com could serve as safer alternatives for traders looking to invest in the forex market without the associated risks of unregulated platforms like Freyr.

Is Freyr a scam, or is it legit?

The latest exposure and evaluation content of Freyr brokers.

Freyr Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Freyr latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.