Nova Banka 2025 Review: Everything You Need to Know

Summary: Nova Banka has garnered a mixed reputation in the forex trading community, with several sources labeling it as a high-risk broker lacking proper regulation. Users have reported issues regarding customer support and withdrawal difficulties. However, some users appreciate its trading conditions and available platforms.

Caution: It is essential to note that Nova Banka operates under various entities across different regions, which may influence user experiences and regulatory compliance. The information presented here is based on a comprehensive review of multiple sources to ensure fairness and accuracy.

Rating Overview

How We Rate Brokers: Our ratings are based on extensive research and user feedback, focusing on critical aspects such as account conditions, customer service, and overall trustworthiness.

Broker Overview

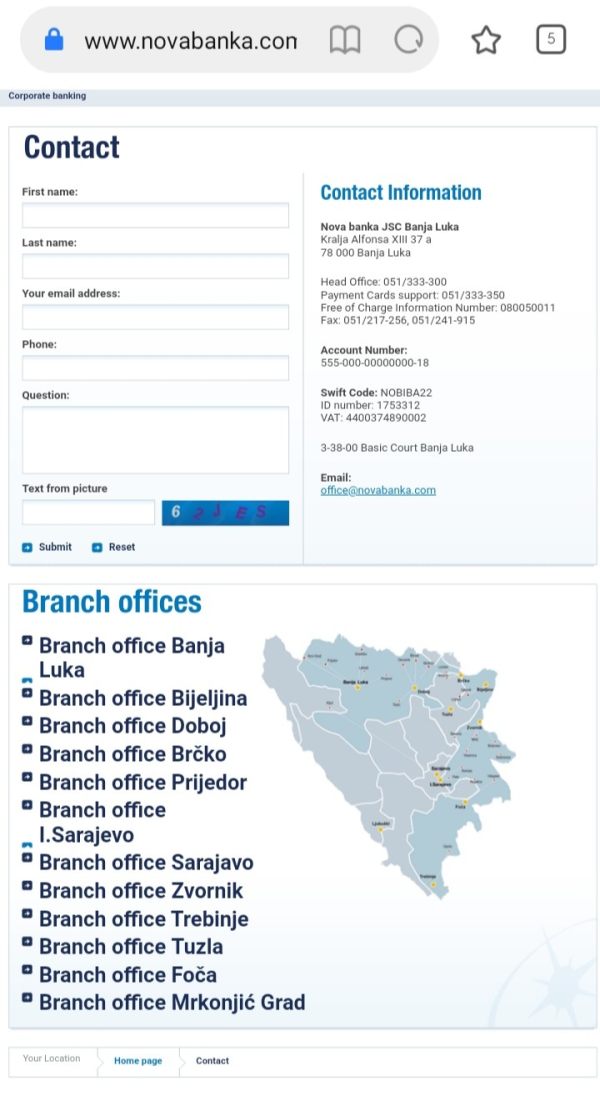

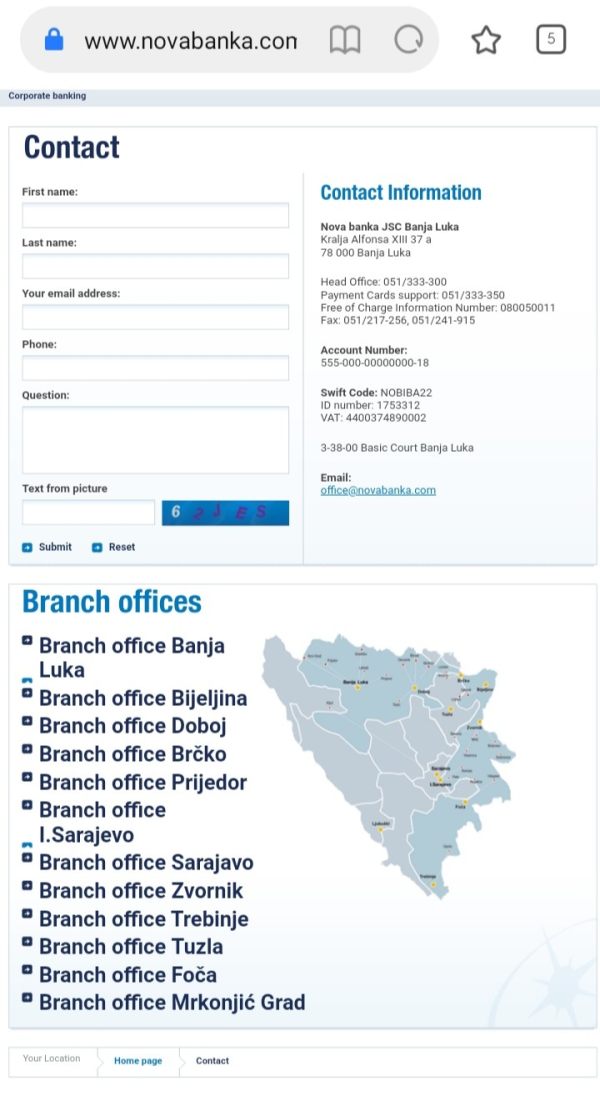

Established in Banja Luka, Bosnia and Herzegovina, Nova Banka offers a range of financial services, including forex trading through its brokerage arm, Broker Nova. The broker provides access to the popular trading platforms MT4 and MT5, allowing users to trade various asset classes, including forex, stocks, and commodities. However, it is crucial to highlight that Nova Banka lacks valid regulatory oversight, which raises significant concerns regarding its reliability and safety for traders.

Detailed Section

- Regulated Geographical Areas: Nova Banka operates primarily in Bosnia and Herzegovina, with no significant regulatory authority overseeing its operations. This lack of regulation can lead to increased risks for traders.

- Deposit/Withdrawal Currencies: Users have reported challenges with deposits and withdrawals, particularly in fiat currencies, leading to frustrations and claims of withdrawal issues.

- Minimum Deposit: The minimum deposit requirement is reportedly low, making it accessible for new traders. However, the exact amount varies based on the account type.

- Bonuses/Promotions: Some sources indicate that Nova Banka may offer promotional bonuses, but details on these promotions are sparse and often come with stringent conditions.

- Tradeable Asset Classes: The broker allows trading in various asset classes, including forex, stocks, and commodities, providing a diverse trading experience.

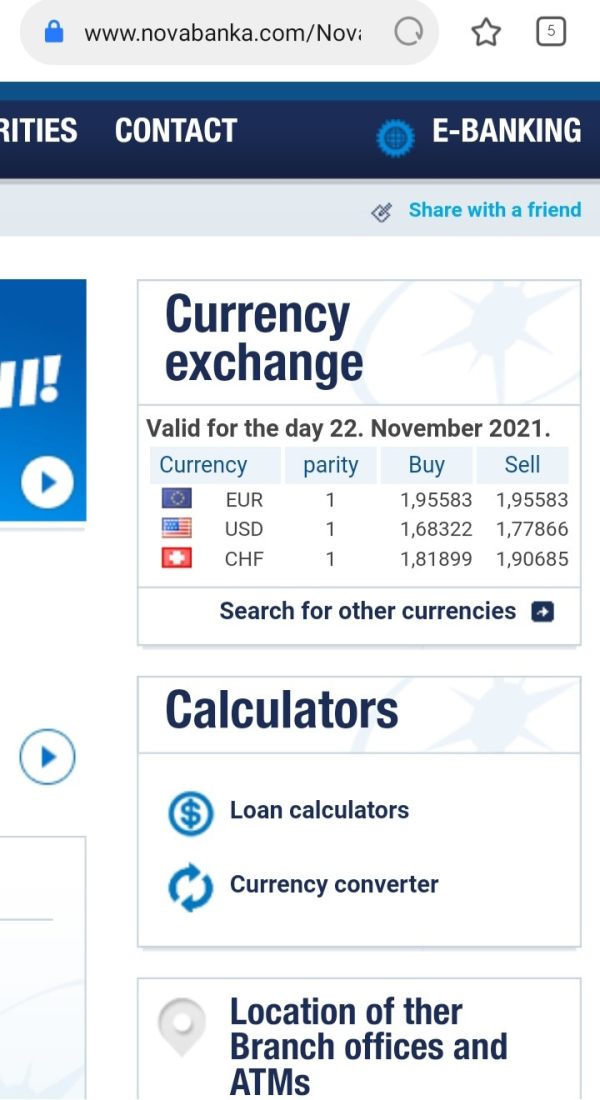

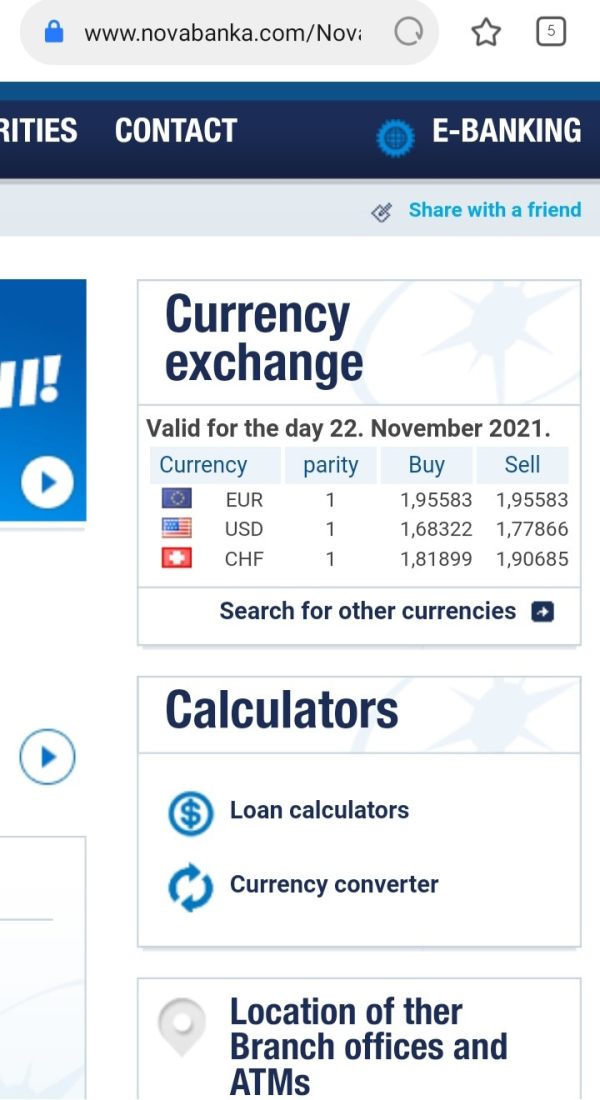

- Costs (Spreads, Fees, Commissions): The spread and commission structure is competitive, but users have noted hidden fees and unclear pricing, which can impact profitability.

- Leverage: Nova Banka offers leverage options, but the specifics are not well-documented, leading to confusion among potential traders.

- Allowed Trading Platforms: The broker supports MT4 and MT5, both of which are well-regarded in the trading community for their robust features and user-friendly interfaces.

- Restricted Regions: While Nova Banka is primarily focused on Bosnia and Herzegovina, it may restrict access to traders from certain countries, particularly those with stringent regulatory requirements.

- Available Customer Service Languages: Customer support is limited, with users reporting slow response times and inadequate assistance in resolving issues.

Rating Breakdown

Account Conditions (4/10): The account conditions offered by Nova Banka are accessible, but the lack of transparency regarding fees and conditions raises concerns. Users have expressed dissatisfaction with withdrawal processes, indicating that while the minimum deposit may be appealing, the overall experience is marred by complications.

Tools and Resources (5/10): Nova Banka provides access to popular trading platforms like MT4 and MT5, which are equipped with essential trading tools. However, the lack of educational resources and market analysis tools limits the support available to traders.

Customer Service and Support (3/10): Customer service is a significant pain point for users, with many reporting slow response times and unhelpful support agents. This lack of efficient customer service can lead to frustration, especially when traders face urgent issues.

Trading Setup (Experience) (4/10): The trading experience on Nova Bankas platforms is generally smooth, but user feedback indicates that execution times can be inconsistent. Additionally, the absence of regulatory oversight contributes to an overall sense of insecurity.

Trustworthiness (2/10): The most significant red flag for Nova Banka is its lack of regulation. Without the oversight of a reputable financial authority, traders are left vulnerable to potential fraud and mismanagement of funds.

User Experience (3/10): Overall user experience is mixed, with some traders appreciating the platform's features while others express dissatisfaction due to customer service issues and withdrawal difficulties.

Conclusion

In conclusion, the Nova Banka review indicates a broker that, while offering some appealing features, is marred by significant concerns regarding regulation, customer service, and user experiences. Traders are advised to exercise caution and consider the risks involved before engaging with this broker. The absence of a solid regulatory framework and the myriad of negative user experiences suggest that potential clients should explore more reputable options before committing funds to Nova Banka.