Torroso 2025 Review: Everything You Need to Know

Executive Summary

This torroso review shows major problems with this broker's work and trustworthiness. Torroso says it is a forex broker that offers high leverage trading up to 1:500, but detailed study of user feedback and available information shows serious warning signs about the platform's reliability and safety.

User reviews from multiple platforms show that Torroso has earned a terrible 1-star rating with 100% negative feedback from traders who used the platform. These reviews always point out problems like withdrawal troubles, bad customer service, and possible fraud. The broker has no proper oversight from regulators, which makes these problems worse and creates high risk for potential traders.

The platform mainly targets traders who want high-leverage forex trading chances, especially those drawn to the maximum 1:500 leverage ratio they advertise. But the huge number of bad user experiences shows that traders should be very careful when thinking about this broker. Many sources say that Torroso may create big risks to trader funds and should be viewed with great doubt by the trading community.

Important Disclaimers

When looking at this torroso review, traders should know that the broker's operations in different regions stay unclear because there is no real regulatory information available. Unlike real brokers that clearly show their licensing and regulatory compliance, Torroso has not given clear details about its legal status or oversight, which creates immediate concerns about whether it is legitimate.

This review comes from detailed study of user feedback, public information, and industry standard evaluation methods. The assessment focuses on the serious risks that come with unregulated brokers and why regulatory compliance matters in forex trading. Traders should understand that the lack of proper regulatory oversight greatly increases the risk of losing money and limits options for getting help if disputes happen.

Rating Framework

Broker Overview

Torroso operates in the forex trading space without giving clear information about when it was established or detailed company background. According to available sources, the company presents itself as offering forex trading services with experienced teams, but lacks the transparency and regulatory compliance expected from legitimate financial service providers.

The broker's website suggests they position themselves as specialists in forex trading, advertising their services with claims of having "the most experienced team" in the sector. However, this marketing messaging stands in stark contrast to the actual user experiences documented across review platforms. The disconnect between promotional claims and real-world user feedback raises serious questions about the broker's operational integrity.

Study of available information reveals that Torroso has been flagged by industry watchdogs as a "suspected fraud" operation. This classification, combined with the complete absence of regulatory licensing information, suggests that the broker operates outside the legal frameworks that protect traders in legitimate financial markets. The lack of proper oversight means traders have limited recourse if they experience problems with the platform.

The broker's business model appears to target traders seeking high-leverage opportunities, particularly those who may be less familiar with the importance of regulatory compliance in forex trading. This targeting strategy, combined with the documented negative outcomes for users, suggests a pattern consistent with predatory practices in the online trading space.

Detailed Analysis

Regulatory Status and Compliance

One of the most concerning aspects of this torroso review is the complete absence of regulatory information. Legitimate forex brokers typically display their regulatory licenses prominently and provide detailed information about their compliance with financial authorities. Torroso's failure to provide this fundamental information is a significant red flag that potential traders should not ignore.

The lack of regulatory oversight means that traders have no protection from financial authorities and limited recourse if they experience problems with withdrawals, account management, or other operational issues. This regulatory gap is particularly concerning given the numerous user reports of withdrawal difficulties and suspected fraudulent activities.

User Feedback Analysis

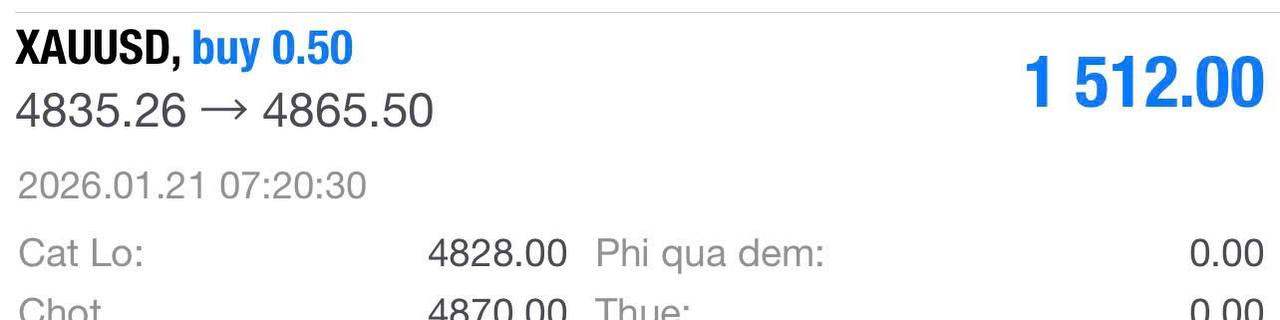

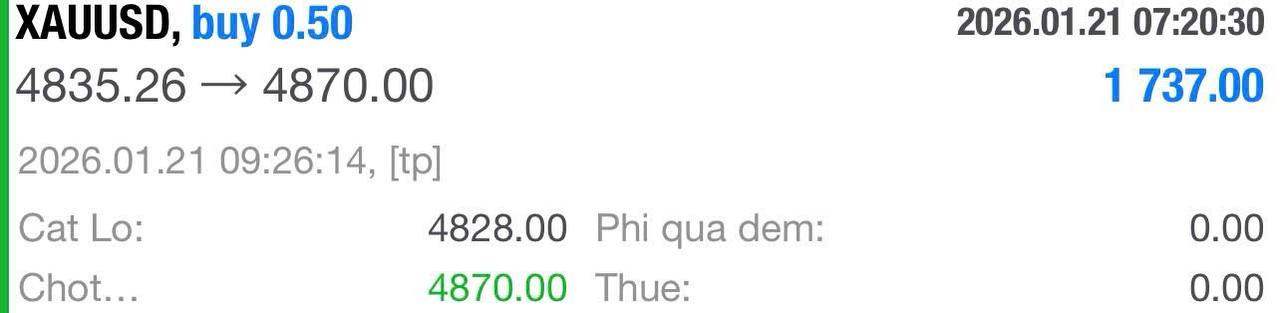

The user feedback for Torroso presents a unanimous negative picture, with 100% of reviews rating the broker at 1 star. This level of negative consensus is extremely rare in the broker review space and indicates systematic problems with the platform's operations. Users consistently report issues including:

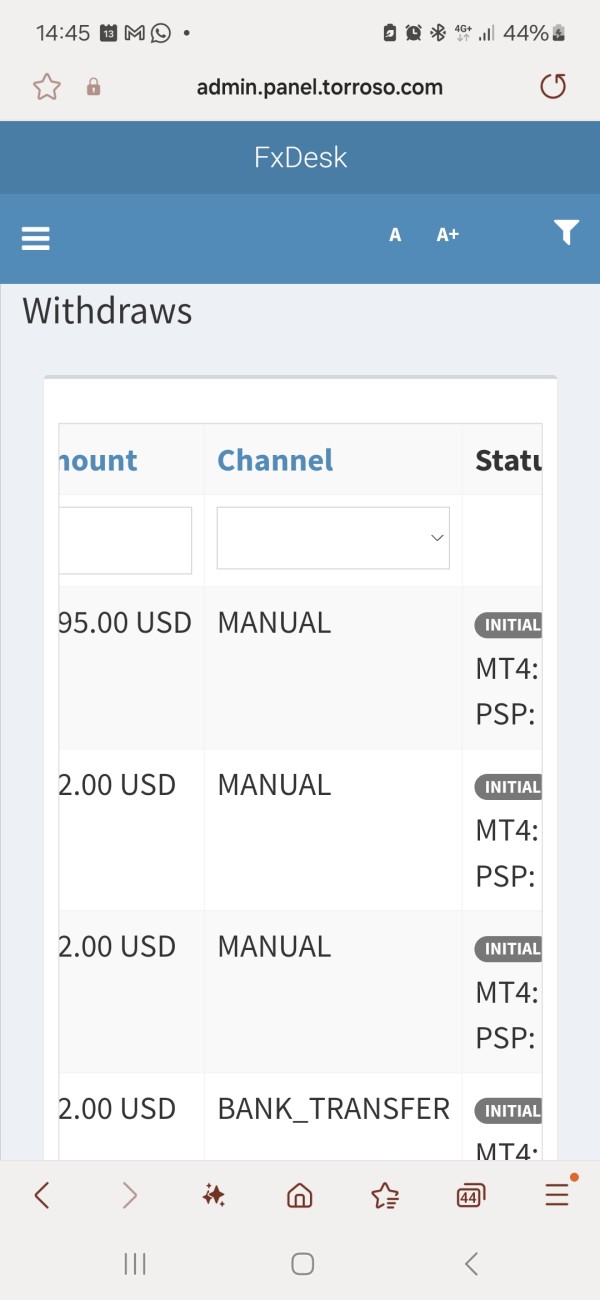

- Inability to withdraw funds from trading accounts

- Poor customer service responsiveness

- Suspected fraudulent activities

- Significant financial losses beyond normal trading risks

These reports suggest that the problems with Torroso extend beyond typical market risks and into operational and potentially fraudulent territory.

Trading Conditions Assessment

While Torroso advertises leverage up to 1:500, this high leverage offering must be viewed in the context of the broker's overall reliability issues. High leverage can amplify both profits and losses in legitimate trading environments, but when combined with withdrawal difficulties and suspected fraudulent activities, it becomes a tool that primarily benefits the broker at the expense of traders.

The absence of detailed information about spreads, commissions, minimum deposits, and other key trading conditions further undermines confidence in the platform's transparency and legitimacy.

Available information provides limited details about Torroso's trading platform capabilities, technological infrastructure, or available trading tools. This lack of transparency about basic platform features is concerning for a supposedly professional trading environment and suggests inadequate investment in trader-facing technology and services.

Risk Assessment

This torroso review must emphasize the extreme risks associated with this broker. The combination of no regulatory oversight, 100% negative user feedback, suspected fraudulent activities, and withdrawal difficulties creates a risk profile that is unacceptable for serious traders.

The classification as "suspected fraud" by industry monitoring services should serve as a clear warning to potential users. Traders considering Torroso should be aware that they may be risking not only their trading capital but also their deposited funds, with limited recourse for recovery.

Alternative Recommendations

Given the significant risks identified in this torroso review, traders should consider regulated alternatives that provide proper oversight, transparent operations, and positive user feedback. The forex market offers numerous legitimate brokers with proper licensing, comprehensive trading tools, and reliable customer service.

When selecting a forex broker, traders should prioritize regulatory compliance, positive user reviews, transparent fee structures, and reliable withdrawal processes over high leverage offerings or aggressive marketing claims.

Conclusion

This comprehensive torroso review reveals a broker that poses unacceptable risks to trader funds and financial security. The combination of no regulatory oversight, unanimous negative user feedback, suspected fraudulent activities, and operational difficulties makes Torroso unsuitable for serious forex trading.

The overwhelming evidence suggests that traders should avoid Torroso entirely and instead focus on regulated, reputable brokers with proven track records of serving their clients' interests. The forex market offers numerous legitimate alternatives that provide the security, transparency, and reliability that serious traders require.

For traders seeking high-leverage forex trading opportunities, numerous regulated brokers offer competitive leverage ratios while maintaining proper oversight and customer protection standards. The temporary appeal of Torroso's advertised leverage cannot justify the substantial risks to capital and financial security that the platform appears to represent.