NABDG 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive nabdg review reveals serious concerns about the broker's credibility and how it operates. NABDG works as a forex broker. It offers multiple asset classes including forex, indices, stock CFDs, and commodities. However, our investigation uncovers troubling patterns that potential traders must carefully consider before making any decisions.

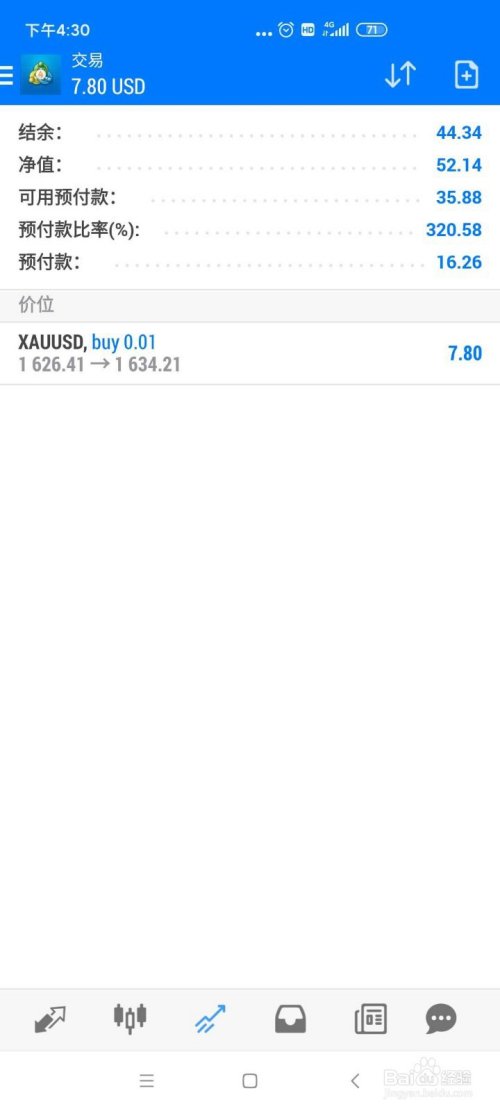

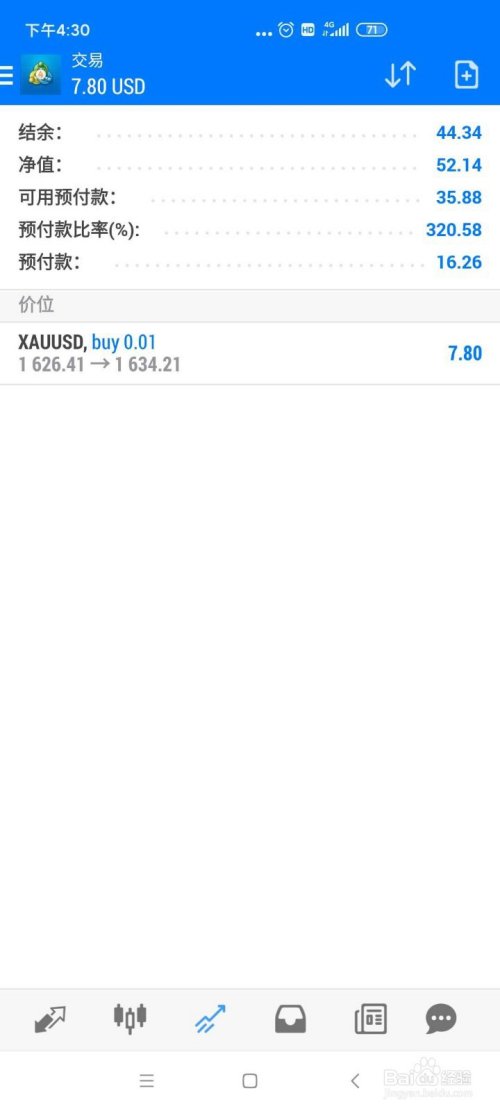

Analysis from multiple third-party sources shows that NABDG has been flagged as a potential scam by several websites including Scamdoc and Scamadviser. The broker maintains an extremely low trust score of just 1% according to Scamdoc reports. WikiBit data shows 4 positive reviews against 1 exposure report. User feedback reveals concerning issues, particularly regarding problems that arise after initial deposits, which creates serious red flags for potential investors.

The broker lacks clear information about trading conditions and fails to provide regulatory details. This makes it difficult for traders to assess the safety of their investments. While NABDG may attract traders interested in forex market participation due to its diverse asset offerings, the overwhelming evidence suggests extreme caution is warranted. Traders should think twice before considering this platform for trading activities.

Important Disclaimer

This evaluation is based on information gathered from multiple third-party sources and may contain data that could become outdated. NABDG's regulatory compliance may vary significantly across different jurisdictions. The broker has not provided clear regulatory information for verification, which raises immediate concerns about transparency and legitimacy.

Potential traders should be aware that regulatory differences between regions can substantially impact trading conditions, investor protections, and legal recourse options. This review methodology relies on publicly available information and user reports. These sources may not reflect the complete operational picture of the broker, but they provide important insights into potential risks and concerns.

Overall Rating Framework

Broker Overview

NABDG positions itself as a forex broker operating in the competitive online trading space. Critical information about its establishment date and corporate background remains unavailable in public sources. The company focuses primarily on providing forex trading services while expanding its offerings to include various financial instruments across multiple asset classes, though specific details about their operations remain largely hidden from public view.

The broker's business model centers around facilitating online trading through digital platforms. Specific details about their operational structure, company leadership, and corporate governance remain largely undisclosed. This lack of transparency raises immediate concerns about the broker's commitment to regulatory compliance and client protection standards, which are essential for safe trading environments.

Regarding trading assets, according to WikiFX information, NABDG offers access to forex pairs, stock indices, CFDs on individual stocks, and commodity markets. However, the broker fails to provide comprehensive information about trading platforms, specific regulatory oversight, or detailed operational procedures. The absence of clear regulatory jurisdiction information particularly stands out as a significant red flag for potential clients seeking secure trading environments where their funds will be protected.

This nabdg review finds that while the broker advertises diverse trading opportunities, the fundamental lack of transparency regarding corporate structure and regulatory compliance creates substantial uncertainty. The safety and legitimacy of trading operations remain highly questionable given these transparency issues.

Regulatory Status: Available information does not specify any regulatory authorities overseeing NABDG's operations. This represents a significant concern for trader protection and fund safety.

Deposit and Withdrawal Methods: Specific information about payment processing options, supported currencies, and transaction procedures is not detailed in available sources, making it impossible to understand how funds are handled.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit amounts or account funding requirements in publicly available information. This lack of transparency makes financial planning difficult for potential traders.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not specified in current documentation, leaving potential clients without clear information about available benefits.

Available Trading Assets: According to WikiFX data, NABDG provides access to forex currency pairs, stock indices, CFDs on individual stocks, and commodity markets. Specific instruments and market coverage remain unspecified, creating uncertainty about actual trading opportunities.

Cost Structure: Critical information about spreads, commission rates, overnight fees, and other trading costs is not transparently disclosed. This makes cost comparison with other brokers impossible and prevents informed decision-making.

Leverage Options: Maximum leverage ratios and margin requirements are not clearly specified in available broker documentation, which is essential information for risk management.

Trading Platforms: Information about supported trading software, platform features, and technological infrastructure is not detailed in current sources. This creates uncertainty about the quality of trading tools available to clients.

Geographic Restrictions: Specific countries or regions where services are restricted or unavailable are not clearly outlined, making it difficult for international traders to understand service availability.

Customer Support Languages: Available support languages and communication options are not specified in accessible documentation. This nabdg review highlights that the absence of transparent operational details creates significant barriers for informed decision-making by potential traders.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by NABDG present serious concerns due to the complete lack of transparency regarding account types, minimum deposit requirements, and specific features available to traders. Available sources do not provide information about different account tiers. The broker fails to specify whether it offers standard, premium, or VIP account categories, or what distinguishes these potential offerings from one another.

The absence of clear minimum deposit information makes it impossible for potential traders to understand the financial commitment required to begin trading. This lack of transparency extends to account opening procedures. No detailed information is available about the verification process, required documentation, or timeframes for account activation, which are standard disclosures among reputable brokers.

Particularly concerning is the absence of information about specialized account features such as Islamic accounts for Muslim traders, demo account availability, or educational account options for beginners. The broker also fails to disclose whether accounts include features like negative balance protection. This has become a standard safety measure among reputable brokers and its absence raises serious concerns about client protection.

User feedback referenced in available sources suggests problems arise after initial deposits, indicating potential issues with account management and client service standards. The lack of clear account condition information, combined with negative user experiences, significantly undermines confidence. This nabdg review finds that the opaque account conditions structure, combined with concerning user reports, creates an environment where traders cannot make informed decisions about account suitability and safety.

NABDG's trading tools and resources present a concerning picture due to the absence of detailed information about analytical capabilities, research provisions, and educational materials. Available sources do not specify what trading tools are integrated into the platform. The broker fails to disclose whether advanced charting packages are available, or if traders have access to technical analysis indicators and drawing tools that are standard in modern trading platforms.

The broker fails to provide information about market research and analysis resources, which are essential for informed trading decisions. There is no mention of daily market commentary, economic calendar integration, trading signals, or fundamental analysis reports. Traders typically expect these resources from professional brokers, and their absence suggests inadequate service provision.

Educational resources appear to be non-existent or inadequately promoted, with no information available about webinars, trading courses, video tutorials, or educational articles that could help traders improve their skills. This absence is particularly concerning for novice traders who rely on educational support to develop their trading capabilities. The lack of educational materials suggests the broker may not be committed to client success and development.

Automated trading support, including Expert Advisor compatibility, algorithmic trading options, or copy trading features, remains unspecified in available documentation. Modern traders increasingly expect these technological capabilities. Their absence or lack of disclosure suggests outdated platform infrastructure that may not meet contemporary trading needs and expectations.

Customer Service Analysis (Score: 4/10)

Customer service quality at NABDG raises significant concerns based on available user feedback and the lack of transparent support information. User reports specifically mention problems that arise after initial deposits. This suggests that customer support may be inadequate when clients encounter difficulties or require assistance with their accounts, which is precisely when quality support becomes most critical.

The broker has not disclosed specific customer service channels, whether support is available through live chat, email, phone, or other communication methods. Response time commitments and service level agreements are not specified. This makes it impossible for potential clients to understand what level of support they can expect when issues arise.

Multi-language support capabilities remain unclear, with no information about which languages are supported or whether the broker provides native-speaking representatives for different geographic markets. This lack of clarity is particularly problematic for international traders. They may require support in their native languages to effectively communicate complex trading issues and account problems.

Operating hours for customer support are not specified, leaving uncertainty about whether assistance is available during different trading sessions or if support is limited to specific time zones. The absence of 24/7 support information is concerning given the round-the-clock nature of forex markets. User feedback suggesting post-deposit problems indicates potential systemic issues with customer service quality and problem resolution capabilities.

Trading Experience Analysis (Score: 3/10)

The trading experience offered by NABDG cannot be adequately assessed due to the significant lack of information about platform stability, execution quality, and technological infrastructure. Available sources do not provide details about trading platform performance, server uptime statistics, or execution speed metrics. These factors are crucial for evaluating trading conditions and determining whether the platform can handle real-world trading demands.

Order execution quality remains unspecified, with no information about slippage rates, requote frequencies, or execution speeds during different market conditions. These factors are critical for traders, particularly those employing scalping strategies or trading during high-volatility periods. Execution quality becomes paramount during these times, and the absence of clear information creates uncertainty about platform reliability.

Platform functionality and feature completeness are not detailed in available sources, making it impossible to assess whether the trading interface meets modern standards for usability, customization, and analytical capabilities. The absence of platform screenshots, feature lists, or user interface demonstrations raises questions. This suggests either inadequate platform development or reluctance to showcase platform capabilities to potential clients.

Mobile trading capabilities, which have become essential for contemporary traders, are not specified. There is no information about mobile app availability, mobile platform features, or the quality of trading experience on smartphones and tablets. This nabdg review finds that the lack of transparent information about trading experience creates uncertainty that may significantly impact trader satisfaction and performance.

Trust and Safety Analysis (Score: 1/10)

Trust and safety represent the most critical concerns in this NABDG evaluation, with multiple serious red flags that potential traders must carefully consider. The broker has been flagged as a potential scam by several reputable websites including Scamdoc and Scamadviser. These websites maintain databases of suspicious financial services providers and their warnings should be taken seriously by potential investors.

Scamdoc reports assign NABDG an extremely low trust score of just 1%, indicating severe concerns about the broker's legitimacy and operational practices. This exceptionally poor rating suggests significant risks associated with depositing funds or conducting trading activities through this platform. Such low trust scores are typically reserved for the most problematic financial service providers.

Regulatory oversight appears to be non-existent or inadequately disclosed, with no clear information about licensing authorities, compliance frameworks, or regulatory reporting requirements. The absence of regulatory protection means traders would lack access to compensation schemes, dispute resolution mechanisms, or regulatory oversight. Legitimate brokers typically provide these essential protections to ensure client safety and fund security.

Fund safety measures, including segregated client accounts, deposit insurance, or third-party fund management, are not specified in available documentation. This absence of clear fund protection information creates substantial risks for client deposits and trading capital. User reports specifically mention problems arising after initial deposits, suggesting potential issues with fund withdrawal, account access, or service provision once clients have committed financially.

User Experience Analysis (Score: 3/10)

User experience with NABDG appears problematic based on available feedback and the overall lack of transparency in broker operations. User satisfaction levels are difficult to assess comprehensively, but available reports suggest significant issues. These problems particularly affect post-deposit experiences and service quality, which are critical aspects of the overall trading relationship.

Interface design and platform usability cannot be evaluated due to the absence of detailed information about platform features, user interface design, or navigation capabilities. The lack of platform demonstrations, screenshots, or user guides suggests problems. This indicates either inadequate platform development or reluctance to showcase platform capabilities to potential clients.

Registration and account verification processes remain undisclosed, with no information about required documentation, verification timeframes, or onboarding procedures. This opacity creates uncertainty about the ease of account opening and the professionalism of client onboarding processes. Fund operation experiences, including deposit and withdrawal procedures, processing times, and transaction fees, are not clearly outlined in available sources.

User reports mentioning post-deposit problems suggest potential difficulties with fund management and account access once clients have deposited money. These patterns are concerning and align with problematic broker behaviors identified by scam-detection services. The overall user experience appears to be compromised by the combination of operational opacity, concerning user feedback, and the absence of clear service standards that would typically ensure positive client experiences.

Conclusion

This comprehensive nabdg review reveals substantial concerns that make NABDG unsuitable for serious forex traders. The broker's extremely low trust score of 1%, combined with scam warnings from multiple detection websites, creates compelling reasons to avoid this platform entirely. These warning signs should not be ignored by potential investors.

NABDG may offer diverse asset classes including forex, indices, stocks, and commodities, but these potential advantages are completely overshadowed by fundamental transparency and safety issues. The complete absence of regulatory information, unclear trading conditions, and concerning user feedback about post-deposit problems create an unacceptable risk environment. Traders seeking legitimate investment opportunities should look elsewhere for properly regulated and transparent brokers.

The broker is not recommended for any trader category, particularly risk-averse individuals who prioritize capital safety and regulatory protection. The significant red flags identified in this evaluation suggest that traders should seek properly regulated alternatives. These alternatives should have transparent operations and positive user feedback records to ensure safe and successful trading experiences.