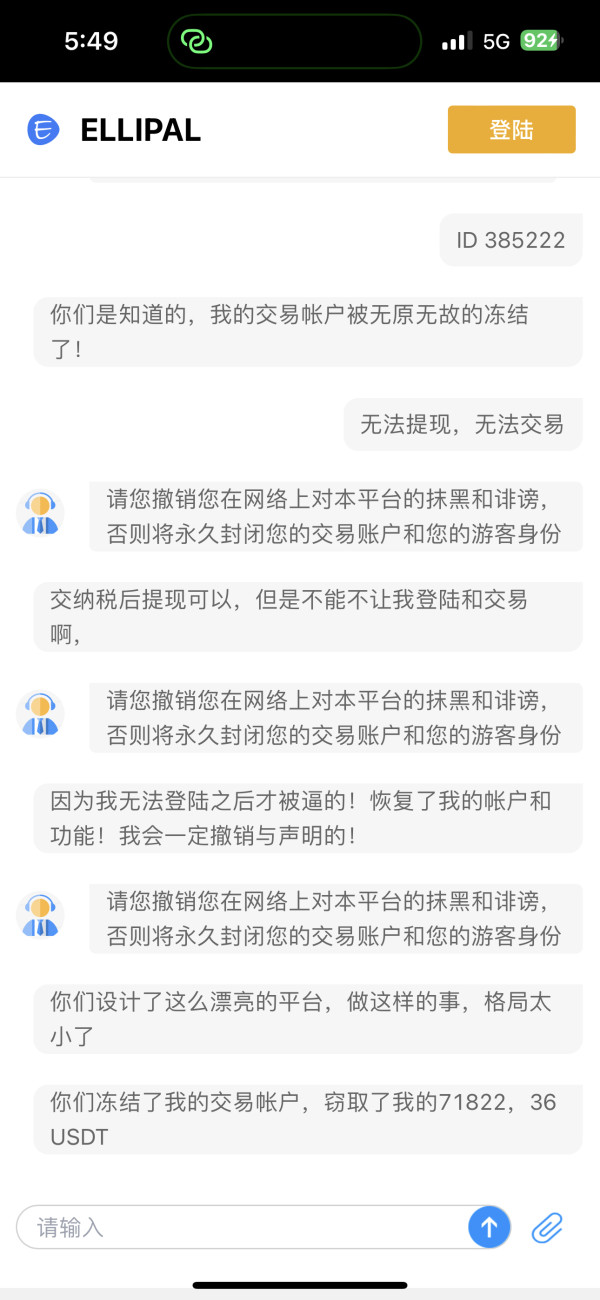

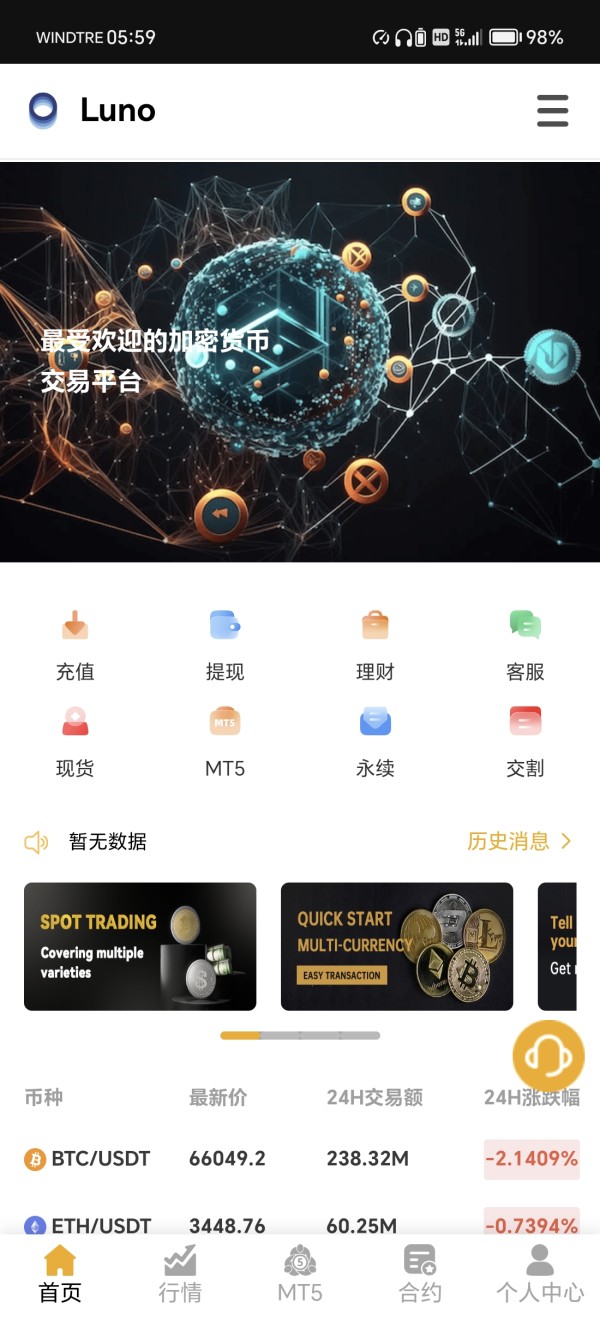

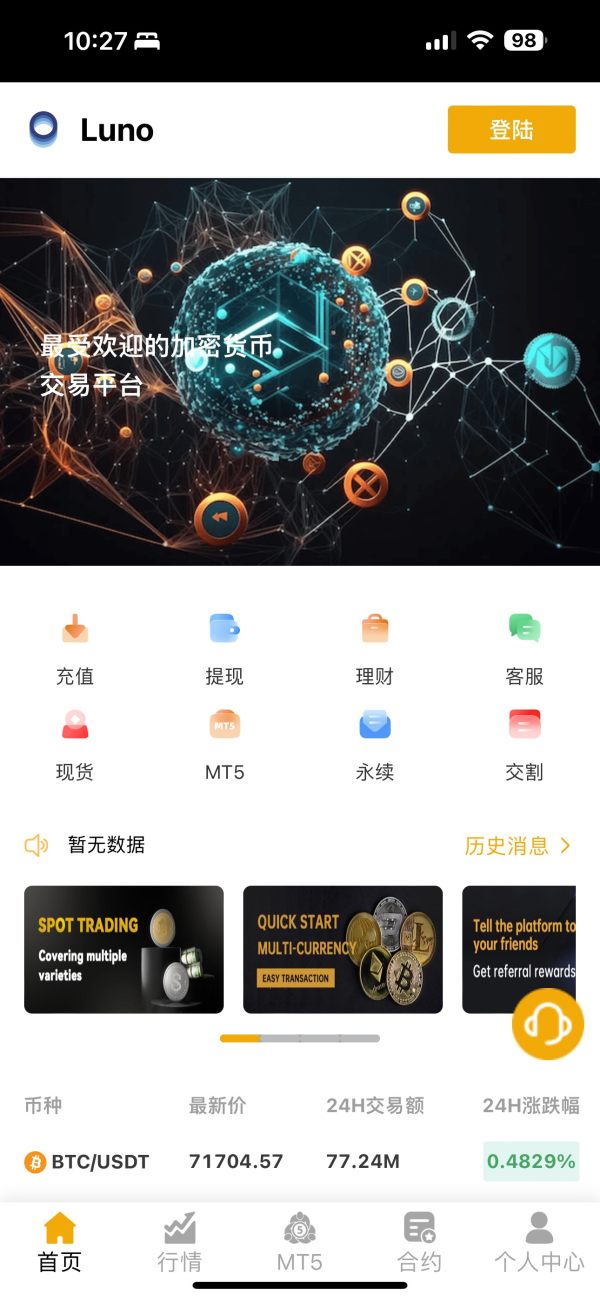

Luno 2025 Review: Everything You Need to Know

Executive Summary

This Luno review gives you a deep look at one of the crypto industry's established exchanges. Luno started in 2013 and was first called BitX, but now it focuses on being easy to use for people just starting with cryptocurrency. The company operates as an independent part of Digital Currency Group and has its main office in London, UK, where it helps people buy and sell cryptocurrencies through its broker network.

Luno gets over 1 million visits each month. The platform makes its design clear and keeps fees competitive, which attracts new crypto traders. Luno mainly helps users who want to trade digital money against regular money, and it takes a simple approach to crypto investment. The exchange works in many countries with seven offices around the world, though rules change depending on where you live. People generally like Luno because it's easy to use and has clear fees, but this review will look at everything about the platform to help traders make good decisions.

Important Notice

Regional Variations: Luno has seven offices around the world in different countries, so services change based on where you live. Rules and features can be very different between regions. You should check the specific terms and rules that apply in your area before you open an account.

Review Methodology: This review uses public information, platform documents, and user feedback from many sources. This analysis doesn't give personal financial advice, so you should do your own research before making trading decisions.

Rating Framework

Broker Overview

Luno started in the cryptocurrency world in 2013, first using the name BitX before changing to what we know today. The company has its main office in London, United Kingdom, and works as an independent part of Digital Currency Group, which is a big investment company in the blockchain and cryptocurrency business. This setup gives Luno freedom to run its own operations while getting help and resources from a major industry player.

The exchange built its business around helping people trade cryptocurrency through a broker network, focusing mainly on connecting digital money with traditional regular money. Luno's plan centers on making crypto trading easy for everyday users, especially people who are new to digital asset investment. The platform has grown around the world and now has seven offices in different areas to help users everywhere.

Luno's main service involves cryptocurrency exchange, letting users buy, sell, and store different digital assets. The platform supports trading between cryptocurrencies and regular money, making itself a bridge between traditional banks and the new digital economy. While exact details about supported cryptocurrencies change by region, Luno usually focuses on major digital assets like Bitcoin and Ethereum, plus some other coins that meet their standards.

Regulatory Status

Information about Luno's specific regulatory permissions stays limited in public documents. The platform works in many countries through its seven global offices, but detailed compliance information isn't fully shared in available materials. Future users should check regulatory status in their specific area before using the platform.

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods isn't detailed in available documents. Users can typically expect standard cryptocurrency deposit options and regular money funding methods, though exact payment systems and supported methods may change by location.

Minimum Deposit Requirements

Minimum deposit requirements aren't specified in available platform information. These details likely change by region and account type, so you need to ask the platform directly for accurate information.

Current promotional offers and bonus structures aren't detailed in available public information. Luno may offer different rewards to new users, but specific terms and availability should be confirmed directly with the platform.

Available Trading Assets

Luno specializes in digital assets and regular money trading pairs. The platform typically supports major cryptocurrencies including Bitcoin, Ethereum, and other established digital assets, though the exact range of available trading pairs may change based on location and regulatory requirements.

Cost Structure

Commission fees on Luno use a variable structure that changes according to market conditions. This changing pricing model means that trading costs can shift based on market ups and downs and how much trading is happening. Specific spread information and detailed fee schedules aren't provided in available documents, so users need to check current rates on the platform.

Leverage Options

Leverage trading options and margin requirements aren't specified in available platform documents. Users interested in leveraged trading should check availability and terms directly with Luno.

Specific details about Luno's trading platform technology and available interfaces aren't detailed in accessible information. The platform emphasizes user-friendly design, particularly for beginners.

Geographic Restrictions

Regional availability and geographic restrictions aren't specifically outlined in available documents, though the platform's global office presence suggests broad international availability.

Customer Support Languages

Supported languages for customer service aren't specified in available platform information.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

Luno's account conditions get a below-average rating because of limited transparency in available documents. This Luno review finds that important information about account types, minimum deposit requirements, and specific account features stays unclear in public materials. The platform's variable commission structure, which changes with market conditions, adds uncertainty for traders trying to calculate potential costs.

The lack of detailed information about different account levels or special account features significantly impacts the user's ability to make informed decisions. While Luno positions itself as beginner-friendly, the lack of clear account structure information may actually create confusion for new users trying to understand their options. Account opening procedures and verification requirements aren't detailed in available information, making it difficult to assess how efficient and user-friendly the onboarding process is.

The platform would benefit from providing more transparent information about account conditions to better serve potential users. Without specific details about Islamic accounts, professional trading accounts, or other specialized offerings, Luno appears to focus on standard retail accounts, though this cannot be confirmed without more comprehensive documentation.

The tools and resources category gets the lowest rating in this Luno review, mainly because of insufficient information about the platform's trading tools and educational resources. Available documents don't detail the specific trading tools, charting capabilities, or analytical resources provided to users. Research and market analysis resources aren't mentioned in accessible platform information, which represents a significant gap for traders who rely on fundamental and technical analysis.

The absence of detailed information about educational materials is particularly concerning given Luno's focus on serving beginner traders who would benefit most from comprehensive learning resources. Automated trading support and API access details aren't specified in available documents. For more advanced users, the lack of information about algorithmic trading capabilities or third-party integration options limits the platform's appeal.

The platform's emphasis on simplicity and beginner-friendliness may mean that advanced trading tools are deliberately limited, but without clear documentation, it's impossible to assess the actual capabilities available to users.

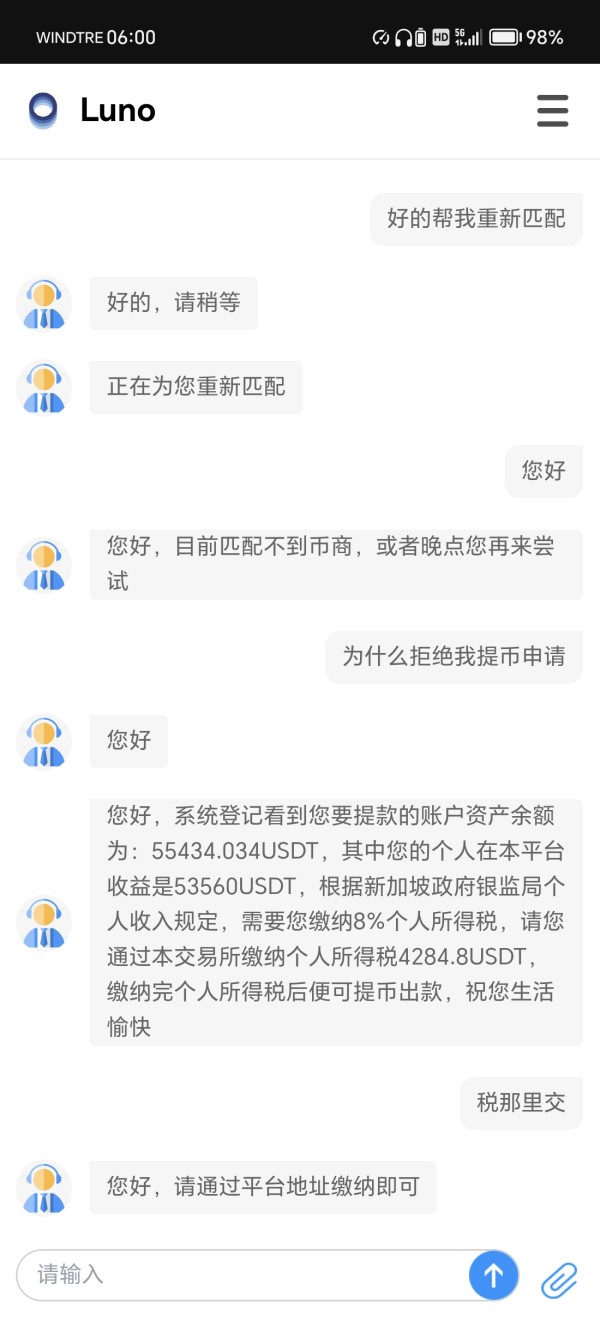

Customer Service and Support Analysis (4/10)

Customer service evaluation is hampered by the lack of specific information about support channels, response times, and service quality metrics. Available documents don't detail the customer service infrastructure, including available contact methods such as live chat, phone support, or email ticketing systems. Response time commitments and service level agreements aren't specified in accessible information.

For a platform serving beginners who may require frequent support, the absence of clear customer service information raises concerns about the quality and accessibility of help when needed. Multi-language support capabilities aren't detailed, despite Luno's international presence across seven global offices. This lack of information makes it difficult for non-English speaking users to assess whether adequate support will be available in their preferred language.

Operating hours for customer support and regional support availability aren't specified in available documents. Given the platform's global presence, 24/7 support or at least comprehensive coverage across time zones would be expected, but this cannot be confirmed.

Trading Experience Analysis (5/10)

The trading experience gets an average rating, mainly based on Luno's stated focus on providing a clear interface suitable for beginners. However, the lack of specific information about platform stability, execution speed, and order types limits a comprehensive assessment of the actual trading environment. Platform reliability and uptime statistics aren't provided in available documents.

For cryptocurrency trading, where markets operate 24/7, platform stability is crucial, and the absence of performance metrics makes it difficult to assess Luno's technical capabilities. Order execution quality and slippage information aren't detailed in accessible materials. The variable commission structure that changes with market conditions may impact overall trading costs, but without specific execution data, traders cannot fully evaluate the platform's competitiveness.

Mobile trading capabilities and cross-platform synchronization details aren't specified in available information. Given the importance of mobile access in cryptocurrency trading, this represents a significant information gap in evaluating Luno's review profile.

Trust and Security Analysis (4/10)

Trust and security get a below-average rating because of limited transparency about regulatory compliance and security measures. While Luno operates as a subsidiary of Digital Currency Group, specific regulatory authorizations and compliance details aren't clearly documented in available information. Fund security measures, including cold storage policies, insurance coverage, and segregation of client funds, aren't detailed in accessible documents.

For cryptocurrency exchanges, security infrastructure is paramount, and the lack of detailed security information raises concerns about transparency. The platform's regulatory status across its seven global offices remains unclear in available documents. Different countries have varying regulatory requirements for cryptocurrency exchanges, and the absence of specific regulatory information makes it difficult for users to assess the legal protections available.

Company transparency regarding financial audits, proof of reserves, or third-party security assessments isn't evident in available materials. These elements are increasingly important in the cryptocurrency industry for building user trust.

User Experience Analysis (5/10)

User experience gets an average rating based on Luno's emphasis on providing a clear interface designed for beginners. The platform's focus on simplicity appears to be its primary strength, making it potentially suitable for users new to cryptocurrency trading. Interface design and usability receive positive mentions in available information, with the platform specifically noted for its clear presentation.

This focus on user-friendly design aligns well with Luno's target demographic of beginner traders who may be intimidated by more complex trading interfaces. Registration and account verification processes aren't detailed in available documents, making it impossible to assess the efficiency and user-friendliness of the onboarding experience. A smooth onboarding process is crucial for beginner-focused platforms.

The platform's positioning for users interested in digital asset and regular currency trading suggests a straightforward approach to cryptocurrency investment, though specific user interface features and navigation elements aren't detailed in accessible information.

Conclusion

This comprehensive Luno review reveals a cryptocurrency exchange that positions itself as a beginner-friendly platform with clear interface design and competitive fee structures. While Luno's focus on simplicity and accessibility represents a positive approach for newcomers to cryptocurrency trading, the platform faces significant transparency challenges that impact its overall evaluation. The exchange is most suitable for beginner traders seeking a straightforward entry point into cryptocurrency markets, particularly those interested in basic digital asset and regular currency trading.

However, the lack of detailed information about regulatory compliance, security measures, and platform features limits its appeal to more experienced traders requiring comprehensive documentation and advanced tools. Key strengths include Luno's established presence since 2013, its clear interface design, and competitive fee structure. The platform's backing by Digital Currency Group provides some institutional credibility.

Primary weaknesses center on limited transparency regarding regulatory status, insufficient detail about security measures, and lack of comprehensive information about trading tools and customer support infrastructure.