Is Hengtuo Finance safe?

Business

License

Is Hengtuo Finance A Scam?

Introduction

Hengtuo Finance is a forex broker that has emerged in the crowded landscape of online trading platforms. With claims of offering a wide range of trading options and competitive conditions, it aims to attract both novice and experienced traders. However, the forex market is notorious for its complexities and potential pitfalls, making it crucial for traders to exercise caution when evaluating brokers. Given the prevalence of scams in the industry, understanding the legitimacy of a broker is paramount. This article investigates the safety of Hengtuo Finance by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our methodology relies on a comprehensive analysis of available data, user reviews, and expert opinions to provide a balanced view.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. A regulated broker is subject to strict oversight by financial authorities, which helps protect traders interests. In the case of Hengtuo Finance, the broker does not hold a valid regulatory license. According to various sources, including WikiFX, Hengtuo Finance has a regulatory index of 0.00, indicating a lack of oversight. This raises significant concerns about the broker's legitimacy and the safety of traders' funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Hengtuo Finance is not obligated to adhere to the standards set by established financial authorities. This lack of oversight can lead to potential risks, including unfair trading practices, difficulty in fund withdrawals, and inadequate customer support. Traders should be wary of engaging with unregulated brokers, as they often operate with minimal accountability, making it challenging for clients to recover their funds in case of disputes.

Company Background Investigation

Hengtuo Finance, officially known as Heng Tuo Finance Group Limited, is relatively new to the forex market, having been operational for only 1-2 years. This limited history raises questions about its stability and long-term viability. The company is registered in the United Kingdom, but the lack of a credible regulatory license diminishes its credibility.

The management team‘s background is another crucial aspect to consider. However, there is limited publicly available information regarding the qualifications and experience of Hengtuo Finance's executives. This opacity can be concerning, as a strong management team with relevant experience is often indicative of a broker's reliability. Furthermore, the company’s transparency regarding its operations and financial health is also questionable, which can hinder traders' ability to make informed decisions.

Trading Conditions Analysis

When assessing a broker's safety, understanding its trading conditions, including fees and spreads, is essential. Hengtuo Finance claims to offer competitive trading conditions; however, the specifics are often vague. Reports suggest that the broker may impose hidden fees or unfavorable trading conditions that are not immediately apparent to traders.

| Fee Type | Hengtuo Finance | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Vague | 1-2 pips |

| Commission Model | Vague | Varies |

| Overnight Interest Range | Vague | Varies |

The lack of clarity in fee structures can be a significant red flag. Traders should be cautious of brokers that do not provide detailed information about their fees, as this can lead to unexpected costs that eat into potential profits. Transparency in trading conditions is vital for building trust, and Hengtuo Finance's ambiguous policies may indicate potential issues.

Customer Funds Safety

The safety of customer funds is paramount when trading forex. Hengtuo Finance reportedly does not have robust measures in place to protect clients' funds. The absence of segregated accounts means that traders' funds may not be kept separate from the brokers operational funds, increasing the risk of loss in case of financial difficulties faced by the broker.

Moreover, there is no indication that Hengtuo Finance provides investor protection schemes or negative balance protection, which are essential for safeguarding traders' investments. Historically, brokers lacking these protections have faced significant scrutiny and have often been involved in disputes regarding fund withdrawals and mismanagement.

Customer Experience and Complaints

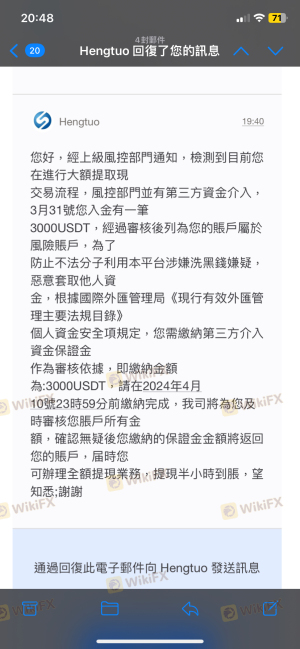

Customer feedback plays a crucial role in evaluating a brokers reliability. Reviews of Hengtuo Finance reveal a mix of experiences, with several users reporting difficulties in withdrawing funds and poor customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Unresponsive |

One notable case involved a trader who reported being unable to withdraw funds after multiple requests, leading to frustration and loss of trust in the broker. Such complaints are indicative of deeper issues within the company's operations and customer service. A broker's ability to address complaints effectively is a key indicator of its legitimacy and commitment to client satisfaction.

Platform and Trade Execution

The trading platform offered by Hengtuo Finance is another critical aspect to consider. A reliable trading platform should provide a seamless user experience, efficient order execution, and stability. However, reports suggest that Hengtuo Finance's platform may have performance issues, including frequent downtimes and slow execution speeds.

Additionally, traders have raised concerns about slippage and order rejections, which can significantly impact trading outcomes. Signs of potential platform manipulation, such as consistent slippage during volatile market conditions, should also be closely monitored.

Risk Assessment

Using Hengtuo Finance presents several risks that traders should be aware of. The absence of regulation, unclear trading conditions, and a lack of transparency collectively contribute to a high-risk environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Stability | High | Limited operational history raises concerns. |

| Customer Support | Medium | Reports of slow response times and unresolved complaints. |

To mitigate these risks, traders should conduct thorough research before engaging with Hengtuo Finance. Starting with a demo account and limiting initial investments can help gauge the broker's reliability without exposing oneself to significant financial risk.

Conclusion and Recommendations

In conclusion, the investigation into Hengtuo Finance raises considerable concerns regarding its legitimacy and safety. The lack of regulation, unclear trading conditions, and negative customer feedback suggest that traders should approach this broker with caution. While it may offer appealing trading options, the potential risks outweigh the benefits.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated by respected authorities, such as the FCA or ASIC. Brokers like HFM, FP Markets, and Black Bull Markets are known for their transparency, robust regulatory oversight, and positive customer experiences. In summary, while Hengtuo Finance may not be an outright scam, the significant red flags warrant careful consideration before investing any funds.

Is Hengtuo Finance a scam, or is it legit?

The latest exposure and evaluation content of Hengtuo Finance brokers.

Hengtuo Finance Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hengtuo Finance latest industry rating score is 1.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.