JuraTrade 2025 Review: Everything You Need to Know

Executive Summary

This juratrade review gives you a complete look at a forex broker that worries many traders. JuraTrade appears to be a high-risk broker with little oversight and many bad reviews that warn about possible fraud, based on market research and user feedback.

JuraTrade calls itself a new trading company that offers a $30 bonus without any deposit and leverage up to 1:1000 to bring in new traders. The broker uses MetaTrader 5 platform. They want at least $100 USD for their basic account with no commission fees. But these good-looking features hide serious problems like website issues, unclear rules, and many user reports that suggest scam activities.

The platform seems to target beginners and small investors who want high-leverage trading, especially those who like no-deposit bonuses. However, the bad feedback and safety worries make this broker wrong for any serious trading.

Important Notice

This review uses market research and user feedback from many sources. Readers should know that information about JuraTrade's rules and how it works stays limited and unclear.

The broker's impact may be different in various regions, though no specific rule information has been checked through official channels. This review method uses mainly user stories, market research, and public information. Given the worrying user reports and lack of clear oversight, potential traders should be very careful when thinking about this broker.

Rating Framework

Broker Overview

JuraTrade says it is an online trading service based in Saint Vincent and the Grenadines. The company claims to provide new trading solutions and customer service, though specific details about when it started are not available in current market papers.

The broker's business plan seems to focus on getting new traders through special offers and high-leverage chances. The platform works mainly as a forex trading service, using the MetaTrader 5 (MT5) trading platform. According to available information, JuraTrade offers foreign exchange trading with focus on easy entry points for new traders.

However, the lack of detailed company background and clear operational history raises quick concerns about the broker's legitimacy and long-term success in the competitive forex market. Missing from this juratrade review is any mention of credible oversight from recognized financial authorities, which is a big red flag for potential traders thinking about this platform.

Regulatory Status: Current available information does not mention any specific oversight from recognized financial authorities, which is a major concern for trader safety and fund security.

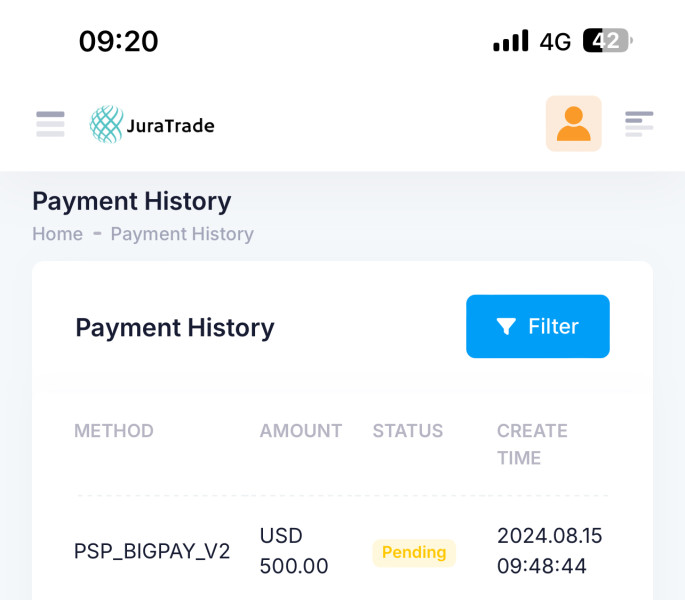

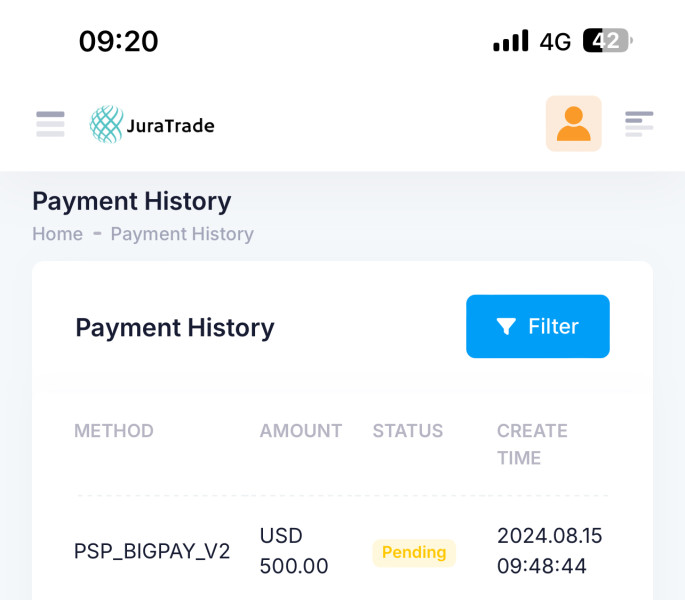

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods has not been detailed in current market papers, though the platform accepts a minimum deposit of $100 USD. Minimum Deposit Requirements: JuraTrade requires a minimum deposit of $100 USD, which puts it among lower-barrier-to-entry brokers in the market.

Bonus and Promotions: The broker offers a $30 no-deposit bonus designed to attract new users, though terms and conditions for this promotion are not clearly outlined in available materials. Tradeable Assets: The platform focuses mainly on forex trading, though the complete range of available currency pairs and other financial instruments remains unclear from current papers.

Cost Structure: JuraTrade advertises a zero-commission structure for their standard account, though information about spreads and other potential fees has not been detailed. Leverage Ratios: The broker offers maximum leverage of 1:1000, which represents extremely high risk potential and may not be suitable for new traders.

Platform Options: JuraTrade supports MetaTrader 5 (MT5), which is a widely recognized and professional trading platform. Regional Restrictions: Specific information about regional restrictions or availability has not been mentioned in current market papers.

Customer Service Languages: Available customer service language options are not specified in current available information. This juratrade review highlights the worrying lack of detailed operational information typically expected from legitimate forex brokers.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

JuraTrade's account conditions show a mixed picture that falls short of industry standards. The broker offers a standard account type with zero commission structure, which looks attractive on the surface.

The $100 USD minimum deposit requirement puts the broker in the lower-barrier-to-entry category, making it accessible to traders with limited capital. However, the lack of detailed information about account types, features, and specific terms significantly hurts the overall account offering.

Current market papers do not provide clarity on account opening procedures, verification requirements, or special account features such as Islamic accounts for Muslim traders. The absence of clear fee structures beyond the "zero commission" claim raises questions about hidden costs that may affect trading profits.

User feedback suggests that despite the seemingly attractive account conditions, the overall experience has been disappointing. The limited transparency about account features and the worrying user reports about potential fraud overshadow any positive aspects of the account structure.

When compared to established brokers with similar minimum deposit requirements, JuraTrade's offering lacks the comprehensive information and regulatory backing that serious traders require. This juratrade review finds that while the basic account parameters may appear competitive, the lack of transparency and negative user experiences significantly reduce the value proposition.

JuraTrade's tools and resources offering centers around MetaTrader 5 platform support, which is a positive aspect of their service. MT5 is a widely recognized and professionally regarded trading platform that provides comprehensive charting tools, technical analysis capabilities, and automated trading support.

This platform choice shows some understanding of trader needs and industry standards. However, the evaluation is limited by the lack of detailed information about additional tools and resources provided by the broker.

Current market papers do not mention research and analysis resources, educational materials, market commentary, or proprietary trading tools that many established brokers offer to support their clients. The absence of information about automated trading support, expert advisors, or additional analytical tools suggests a limited resource environment.

User feedback indicates that while the MT5 platform itself functions as expected, the overall trading tool experience has been poor due to platform accessibility issues and lack of additional support resources. The broker appears to rely mainly on the MT5 platform without providing substantial additional value through proprietary tools or comprehensive market analysis.

The limited scope of available information about trading tools and resources, combined with negative user experiences, suggests that JuraTrade provides minimal support beyond basic platform access, which falls short of what serious traders typically require.

Customer Service and Support Analysis (Score: 3/10)

JuraTrade's customer service and support infrastructure appears severely inadequate based on available information and user feedback. The broker provides only a contact form as the primary means of communication, which is a significant limitation compared to industry standards that typically include live chat, phone support, and email assistance.

The absence of direct contact methods such as phone numbers or live chat support creates barriers for traders who need immediate assistance, particularly during critical trading situations. Current market papers do not provide information about response times, service quality metrics, or availability hours, which are essential elements of professional customer support.

User feedback consistently highlights negative experiences with customer service, with multiple reports suggesting poor responsiveness and inadequate problem resolution. The lack of multiple communication channels and the reliance on a single contact form method indicates a customer service infrastructure that is insufficient for serious trading operations.

The worrying user reports about potential fraud, combined with inadequate customer service channels, create a situation where traders may find themselves without proper support when issues arise. This combination of limited accessibility and negative user experiences results in a customer service offering that falls well below acceptable industry standards.

Trading Experience Analysis (Score: 4/10)

The trading experience offered by JuraTrade faces significant challenges that substantially impact its viability as a serious forex broker. While the platform supports MetaTrader 5, which is a robust trading environment, several critical issues undermine the overall trading experience.

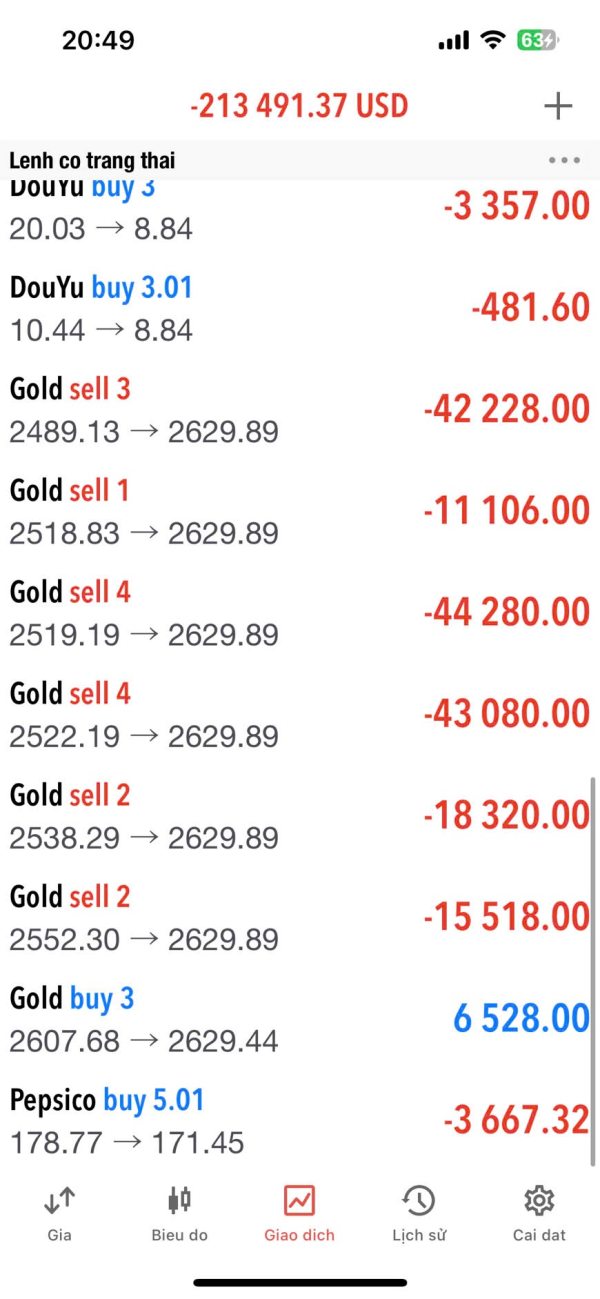

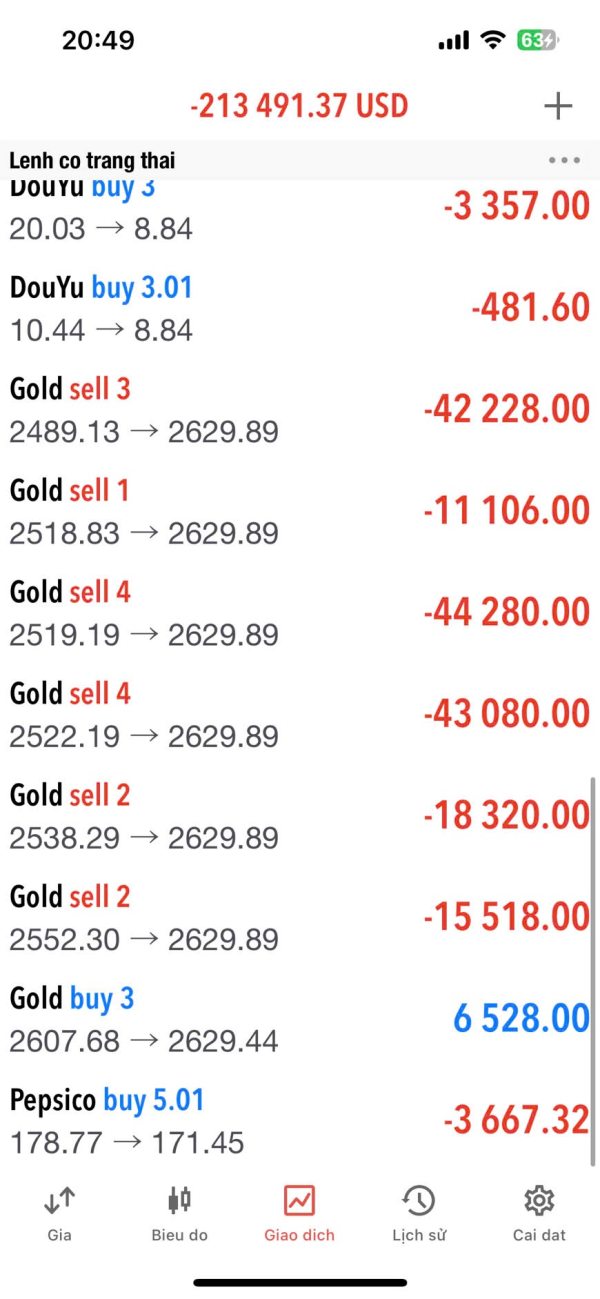

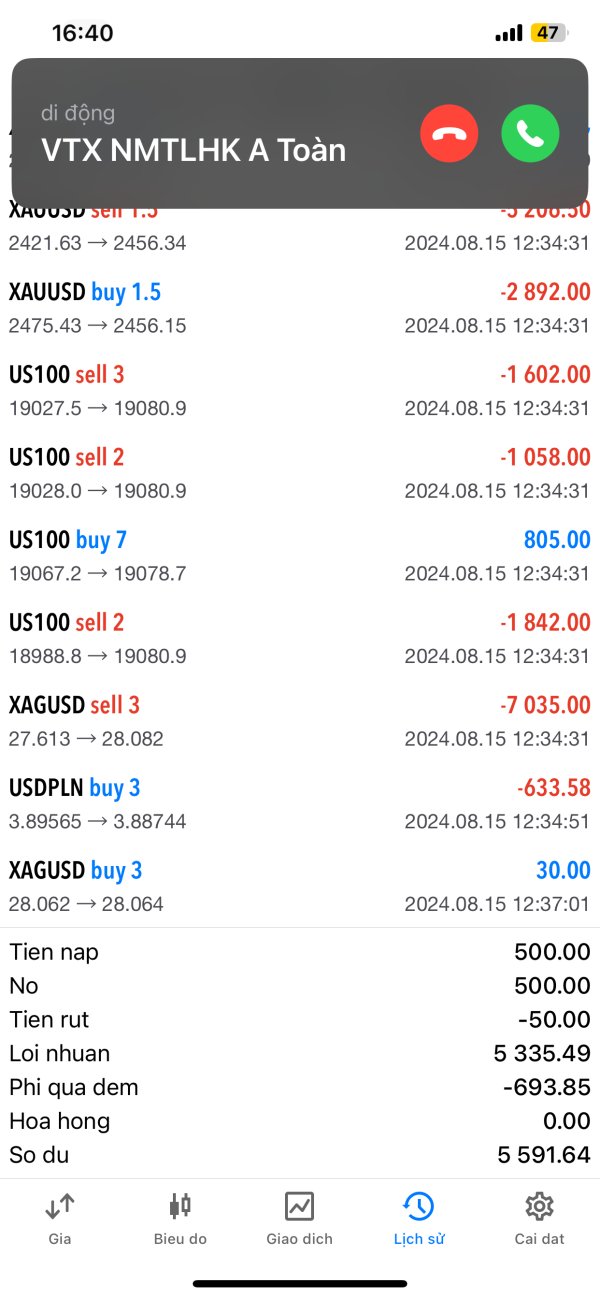

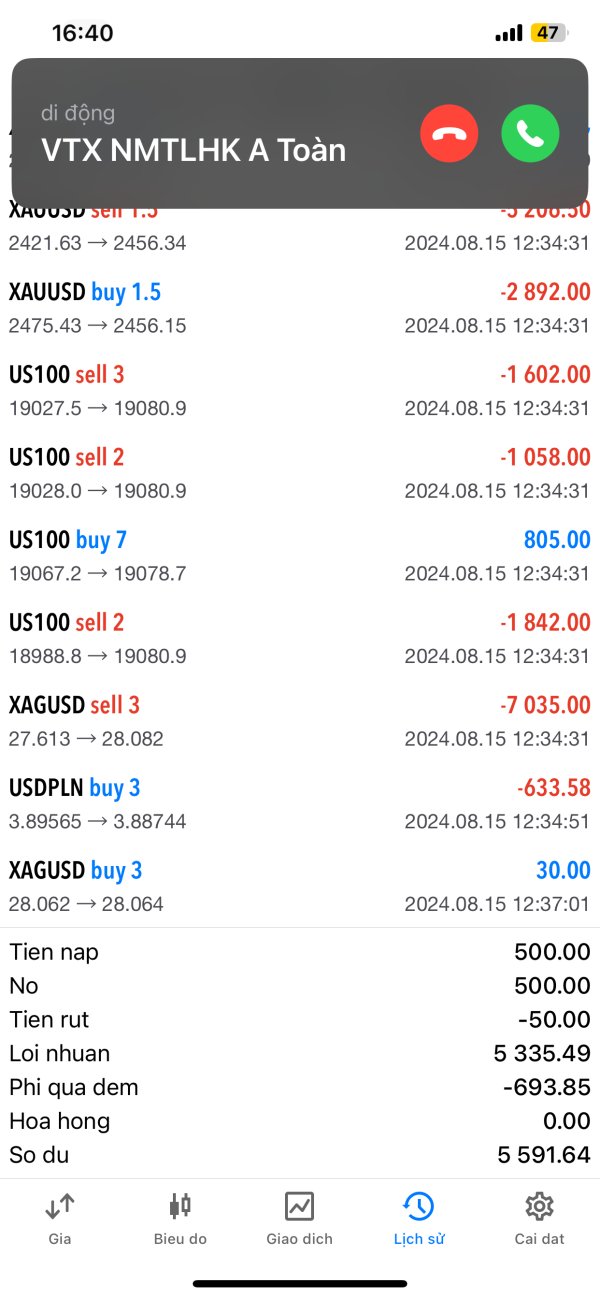

Reports indicate website accessibility problems, which directly impact traders' ability to manage their accounts and execute trades effectively. User feedback consistently points to negative trading experiences, with multiple warnings about potential fraud that create an environment of uncertainty and risk beyond normal market exposure.

The lack of detailed information about order execution quality, platform stability metrics, and trading environment specifics makes it difficult for traders to assess the technical reliability of the service. The absence of information about mobile trading capabilities, platform customization options, and trading tools integration suggests a limited trading environment that may not meet the needs of active traders.

Current market papers do not address crucial aspects such as execution speed, slippage rates, or platform uptime statistics that serious traders require for decision-making. The combination of accessibility issues, negative user reports, and lack of transparent performance metrics creates a trading environment that poses significant risks beyond normal market volatility.

This juratrade review finds that the trading experience falls substantially short of industry standards and poses unacceptable risks for serious trading activities.

Trust and Security Analysis (Score: 2/10)

Trust and security represent the most worrying aspects of JuraTrade's offering, with multiple red flags that raise serious questions about the broker's legitimacy and safety. The absence of credible regulatory oversight from recognized financial authorities represents a fundamental security concern that cannot be overlooked by prudent traders.

Current market papers provide no evidence of regulation by established financial authorities such as FCA, CySEC, ASIC, or other recognized regulatory bodies. This lack of regulatory backing means that traders have no institutional protection for their funds and no official recourse in case of disputes or fraud.

User feedback includes multiple warnings about potential scam activities, which represents the most serious concern for any financial service provider. These reports suggest that some users have experienced issues that go beyond normal trading losses or platform difficulties, indicating potential fraud that puts trader funds at risk.

The lack of transparency regarding fund safety measures, segregated account policies, or insurance protection further undermines trust in the platform. Legitimate brokers typically provide clear information about how client funds are protected and what measures are in place to ensure security, none of which appears to be available for JuraTrade.

The combination of no regulatory oversight, user scam warnings, and lack of transparent security measures creates a trust environment that poses unacceptable risks for any trader considering this platform.

User Experience Analysis (Score: 3/10)

The overall user experience with JuraTrade appears to be predominantly negative based on available feedback and market research. User satisfaction levels are reportedly low, with multiple complaints and warnings that suggest fundamental problems with the broker's service delivery and operational integrity.

Current market papers do not provide detailed information about interface design, ease of use, or user-friendly features that typically contribute to positive trading experiences. The lack of information about registration processes, account verification procedures, and onboarding support suggests a limited focus on user experience optimization.

User feedback consistently highlights concerns that extend beyond normal trading difficulties, with multiple reports suggesting experiences that have led to scam warnings. These reports indicate that users have encountered significant problems that have affected their confidence in the platform and their ability to trade effectively.

The absence of positive user testimonials, combined with the prevalence of negative feedback and scam warnings, suggests that the broker has failed to create a user environment that meets basic expectations for safety, reliability, and service quality. The user experience appears to be characterized by uncertainty, poor support, and concerns about fund safety rather than the professional trading environment that serious traders require.

The overall user experience analysis reveals a pattern of dissatisfaction and concern that makes JuraTrade unsuitable for traders seeking a reliable and trustworthy trading environment.

Conclusion

This comprehensive juratrade review reveals a broker that poses significant risks and fails to meet basic industry standards for safety, transparency, and service quality. While JuraTrade offers some superficially attractive features such as a no-deposit bonus and high leverage ratios, these benefits are far outweighed by serious concerns about regulatory oversight, user safety, and operational integrity.

The broker is not recommended for any type of investor, whether beginner or experienced, due to the combination of regulatory concerns, negative user feedback including scam warnings, and lack of transparent operational information. The primary advantages of no-deposit bonuses and MetaTrader 5 support are overshadowed by fundamental issues including absence of regulatory protection, inadequate customer service, and multiple user reports suggesting fraud.

Traders seeking legitimate forex trading opportunities should consider regulated brokers with established track records, transparent operations, and positive user feedback rather than platforms that exhibit the worrying characteristics identified in this analysis.