Is JuraTrade safe?

Business

License

Is JuraTrade A Scam?

Introduction

JuraTrade is an online forex broker that positions itself as a global trading platform, offering a variety of trading instruments, including currency pairs, commodities, and stocks. In an increasingly crowded marketplace, the legitimacy and reliability of forex brokers are critical for traders looking to invest their hard-earned money. Unfortunately, the forex industry is notorious for scams and unregulated brokers, making it essential for traders to conduct thorough evaluations before committing to any platform. This article aims to provide a comprehensive analysis of JuraTrade, examining its regulatory status, company background, trading conditions, customer experiences, and overall risks involved. The information is derived from various online sources, including user reviews, regulatory databases, and financial analysis platforms.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most crucial factors in determining its legitimacy. Regulation serves as a safeguard for investors, ensuring that brokers adhere to strict guidelines designed to protect client funds and promote fair trading practices. Unfortunately, JuraTrade operates without any valid regulatory oversight, which raises significant red flags for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that traders have little recourse in the event of disputes or mismanagement of funds. Furthermore, user reviews indicate a pattern of complaints related to withdrawal issues and unresponsive customer service, suggesting a lack of accountability. The fact that JuraTrade is registered in Saint Vincent and the Grenadines, a jurisdiction often associated with unregulated brokers, exacerbates concerns about its legitimacy. In summary, the lack of regulatory oversight and the associated risks make it imperative for traders to approach JuraTrade with caution.

Company Background Investigation

JuraTrade's history and ownership structure are essential to understanding its reliability. The broker claims to have been established to facilitate global trading, but specific information about its founding and operational history is sparse. The company appears to be relatively new in the market, which may contribute to its lack of regulatory licensing.

The management teams background is also critical for assessing the broker's credibility. Unfortunately, there is limited information available regarding the qualifications and professional experience of the individuals behind JuraTrade. This lack of transparency raises questions about the broker's operational integrity and the expertise of its management team.

In terms of information disclosure, JuraTrade's website provides minimal insights into its operational practices, fee structures, and customer service protocols. This opacity is concerning, as reputable brokers typically offer detailed information about their services, policies, and team members. Overall, the insufficient background information on JuraTrade and its management team raises significant concerns about its trustworthiness.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its competitiveness and transparency. JuraTrade claims to provide various trading instruments with different fee structures. However, the absence of clear information about spreads, commissions, and other trading costs makes it challenging for potential clients to gauge the overall cost of trading.

| Cost Type | JuraTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies widely |

| Overnight Interest Range | N/A | Varies widely |

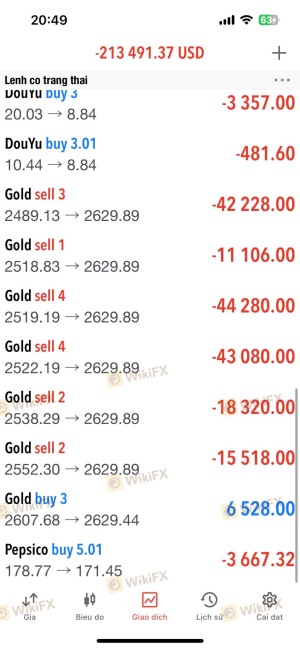

User reviews have pointed out that while deposits are processed quickly, withdrawal requests are often met with delays and complications. Some users have reported being required to meet extensive trading volume requirements before being allowed to withdraw their funds, a tactic often employed by less scrupulous brokers to retain client money. This lack of transparency regarding fees and withdrawal policies is a significant red flag and should be a major consideration for potential clients.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. JuraTrade's lack of regulatory oversight raises concerns about its fund security measures. Reputable brokers typically implement strict policies regarding fund segregation, investor protection, and negative balance protection to safeguard client assets.

However, with JuraTrade being unregulated, there is no assurance that client funds are kept in separate accounts or that they are protected in the event of insolvency. Additionally, there have been no reports of investor compensation schemes being available for clients of JuraTrade, further heightening the risk associated with trading on this platform. Historical issues with fund safety, such as unresponsive customer service and delayed withdrawals, have also been reported by users, indicating that client funds may not be secure.

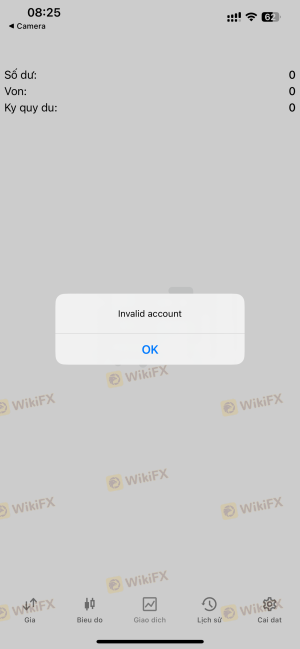

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews about JuraTrade reveal a concerning trend of complaints, primarily focusing on withdrawal issues and poor customer support. Many users have reported being unable to withdraw their funds or facing excessive delays in processing withdrawal requests.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | High | Unresolved |

| Account Blocking | Medium | Unresolved |

For example, one user reported being unable to access their account after requesting a withdrawal, while another mentioned that their account was blocked without explanation. These complaints suggest a systemic issue with client management and fund access, prompting serious concerns about the broker's operational practices.

Platform and Trade Execution

The trading platform's performance is crucial for an optimal trading experience. JuraTrade claims to offer a user-friendly platform with advanced trading tools; however, user reviews indicate mixed experiences. Reports of poor execution quality, including significant slippage and order rejections, have surfaced.

Traders have expressed frustration over the platform's stability, with some noting that trades were not executed at the anticipated prices, leading to unexpected losses. Such issues can significantly impact trading outcomes and raise suspicions of platform manipulation, particularly in a broker that lacks regulatory oversight.

Risk Assessment

Using JuraTrade presents several risks that potential traders should consider. The absence of regulation, poor customer feedback, and questionable trading conditions contribute to a high-risk environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight or accountability. |

| Fund Safety Risk | High | Lack of segregation and protection measures. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Support Risk | High | Unresponsive service and unresolved complaints. |

To mitigate these risks, traders should approach JuraTrade with extreme caution, consider starting with minimal investments, and ensure they have a clear understanding of the withdrawal policies before committing significant funds.

Conclusion and Recommendations

Based on the evidence collected, it is clear that JuraTrade raises numerous red flags that potential traders should heed. The lack of regulatory oversight, poor customer feedback regarding fund withdrawals, and transparency issues indicate that traders may be at risk of scams or unprofessional practices.

For traders seeking reliable options, it is advisable to consider well-regulated brokers with proven track records. Alternatives might include brokers that are licensed by reputable regulatory bodies such as the FCA or ASIC, which offer greater transparency and security for client funds. In summary, potential traders should exercise extreme caution with JuraTrade and consider more trustworthy options for their trading activities.

Is JuraTrade a scam, or is it legit?

The latest exposure and evaluation content of JuraTrade brokers.

JuraTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JuraTrade latest industry rating score is 1.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.