Trading Pro 2025 Review: Everything You Need to Know

Executive Summary

This detailed trading pro review looks at one of the market's new forex brokers. The company has set itself up as an easy-to-use platform for both new and experienced traders. Trading Pro started in 2017 and has its main office in Saint Vincent and the Grenadines, working as a No Dealing Desk (NDD) broker that offers high leverage up to 1:2000 and zero-commission trading options across many different types of investments.

The broker stands out because it provides lots of educational materials. This makes it very appealing to people who are just starting to trade forex. Trading Pro works with both MetaTrader 4 and MetaTrader 5 platforms, covering many different trading tools including forex, indices, precious metals, oil, cryptocurrencies, and stocks. You can add money to your account through bank transfers, credit/debit cards, e-wallets, and cryptocurrency deposits.

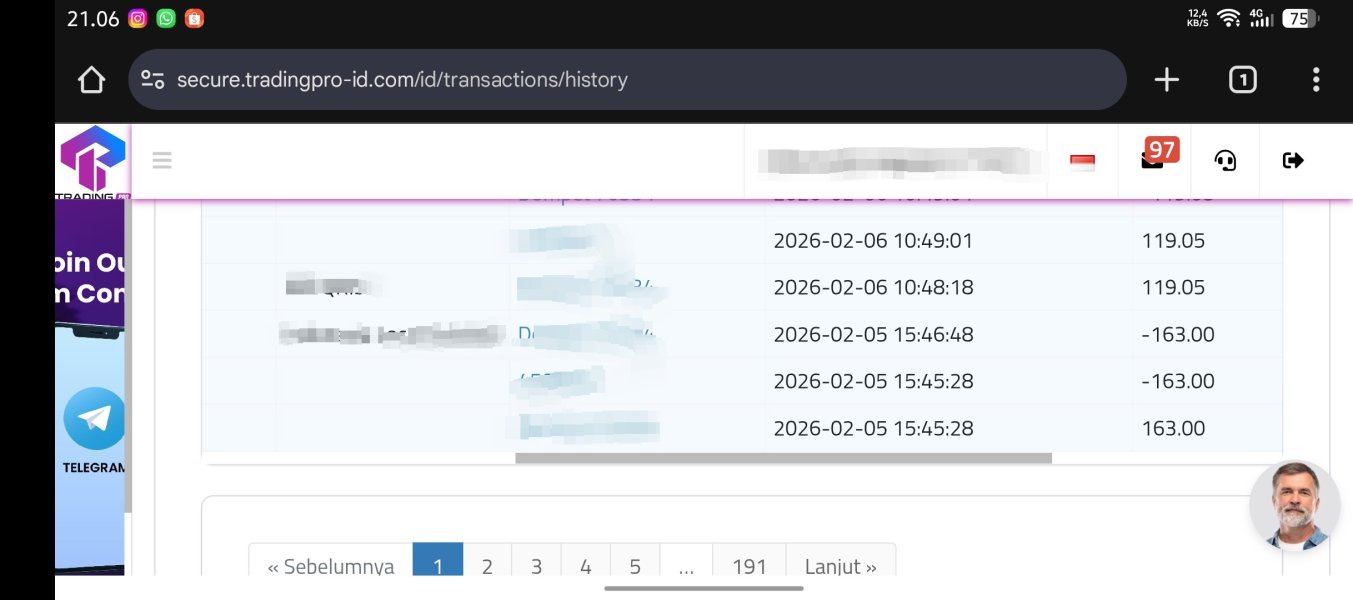

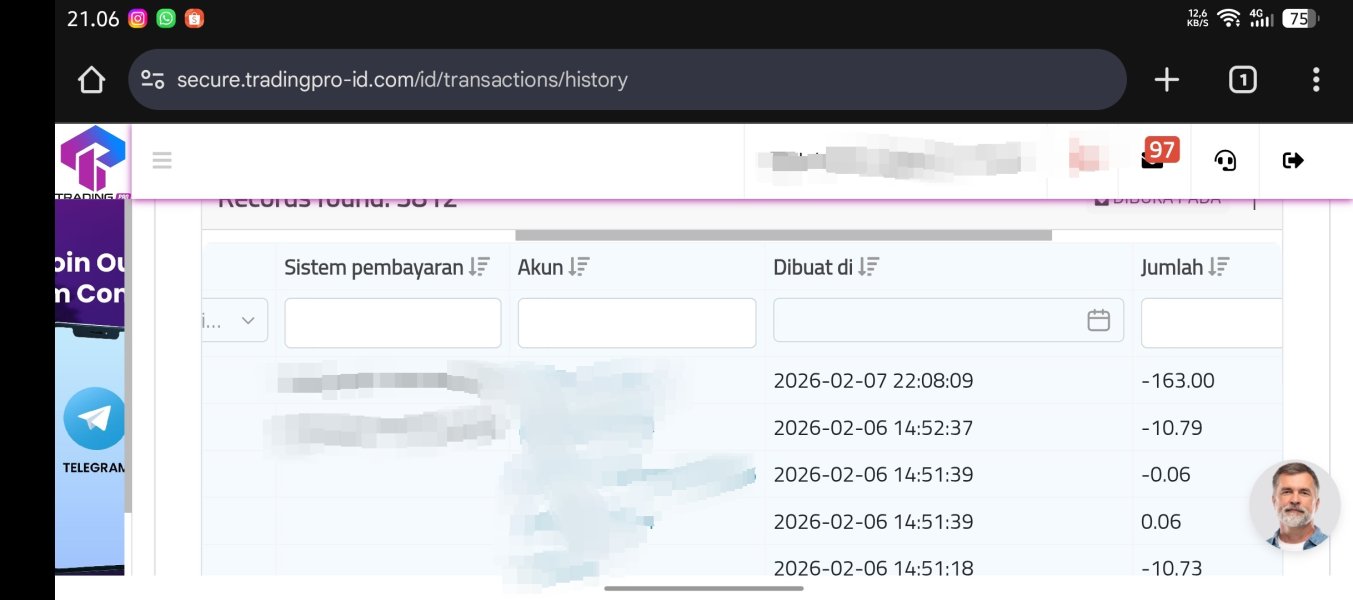

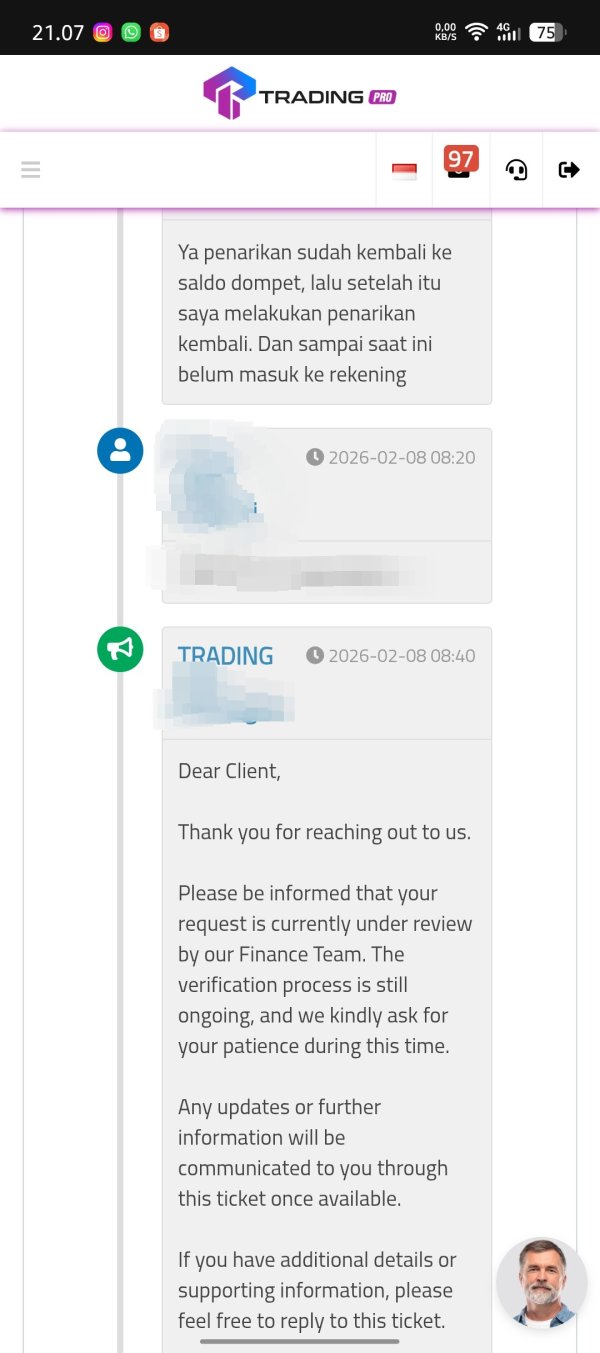

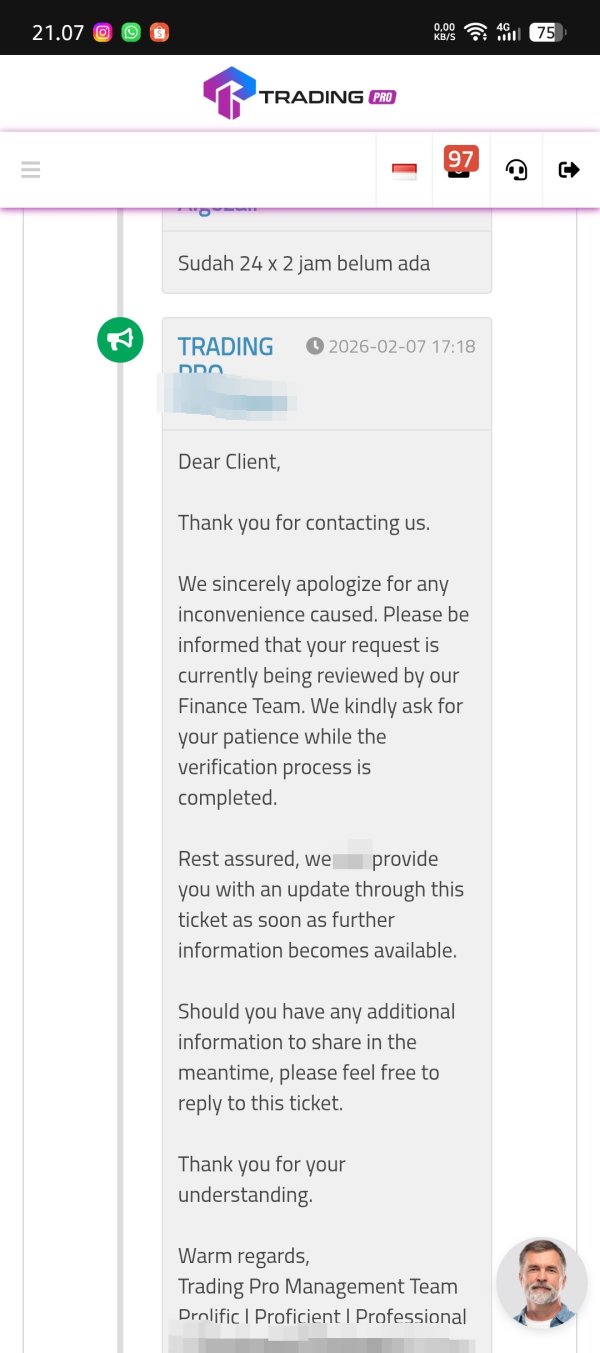

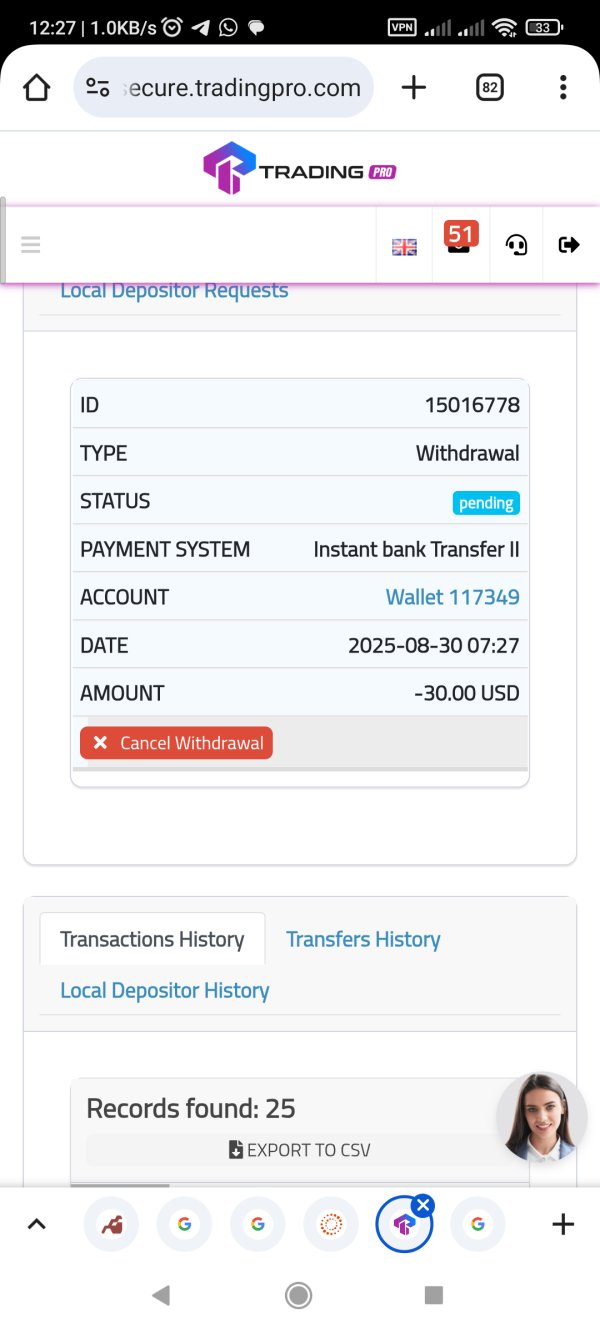

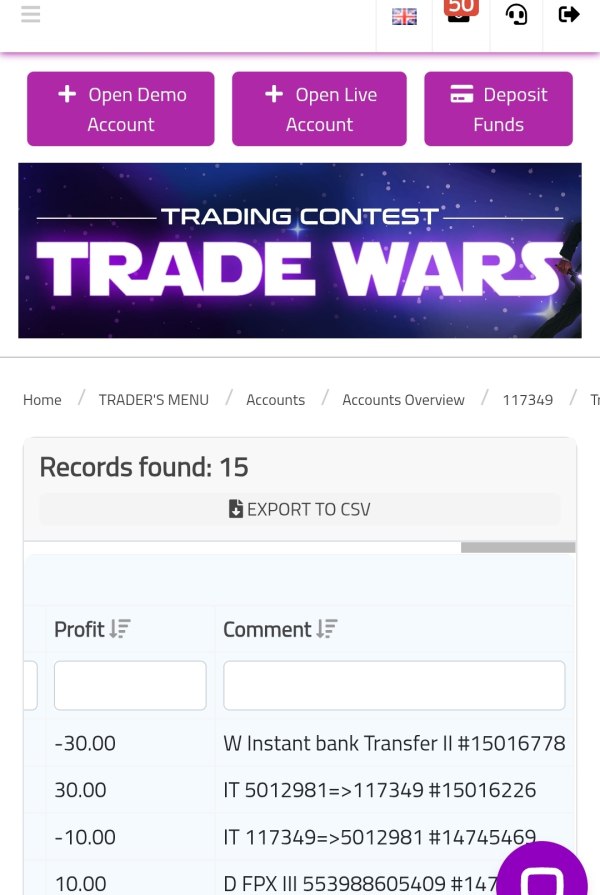

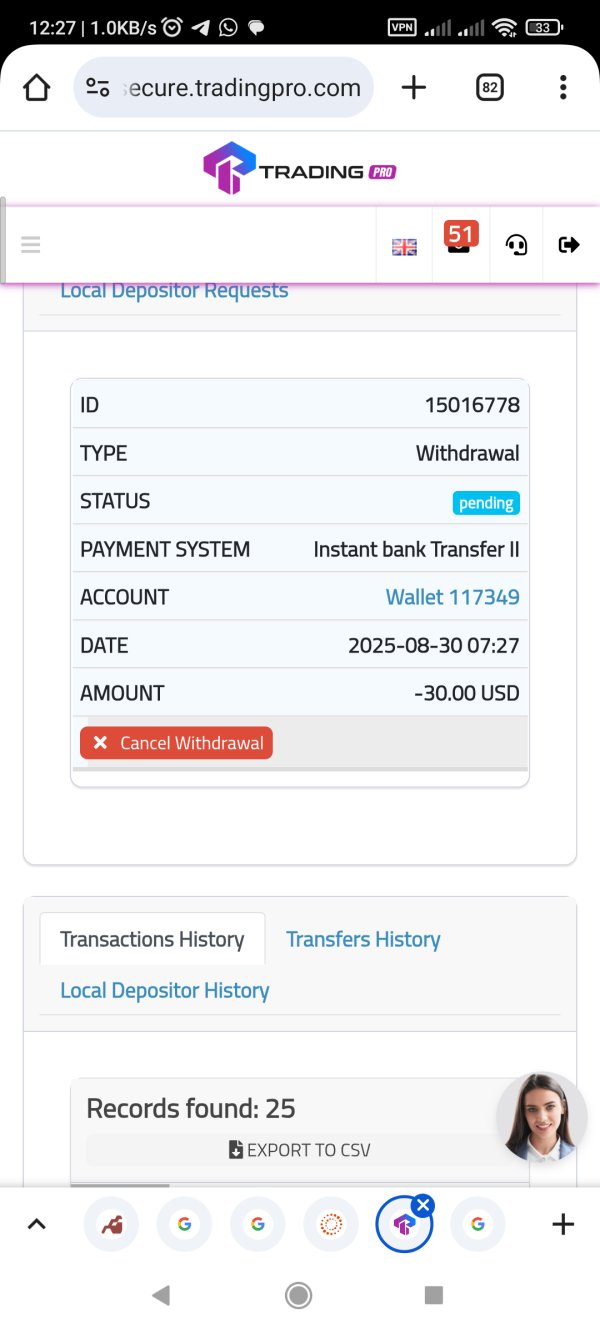

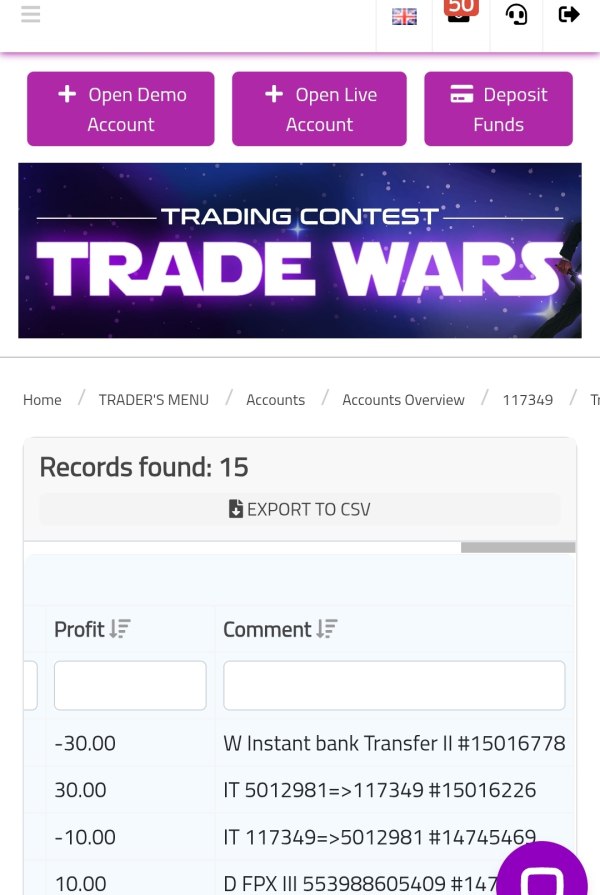

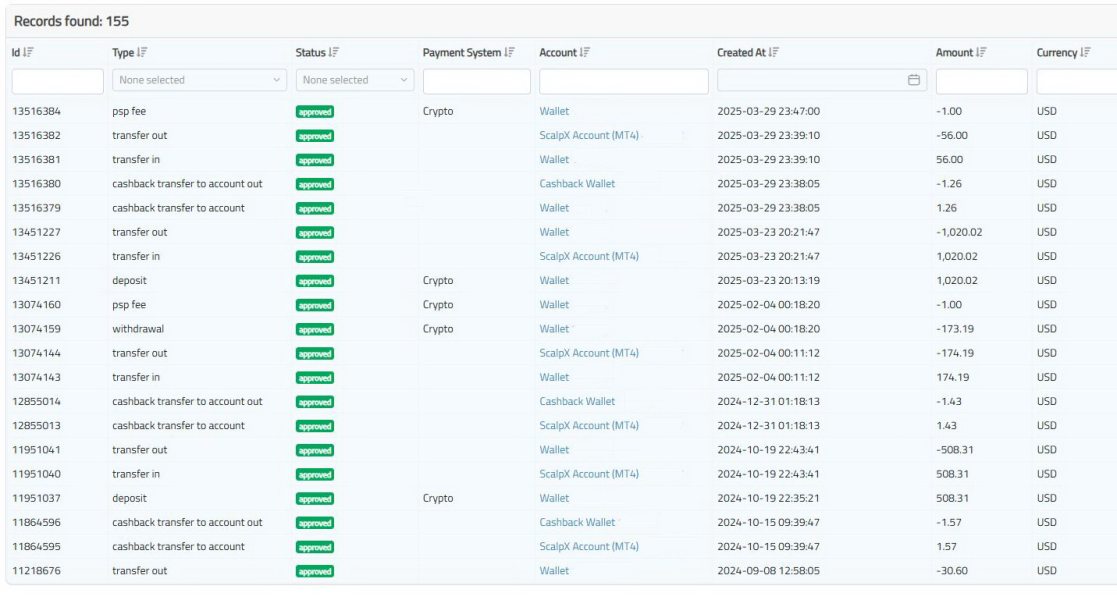

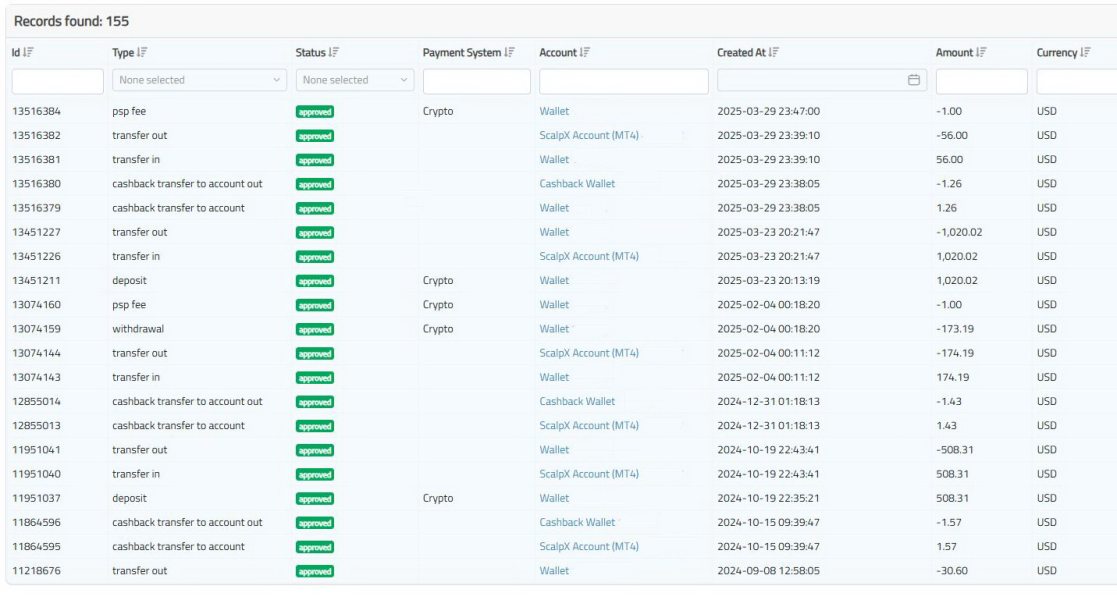

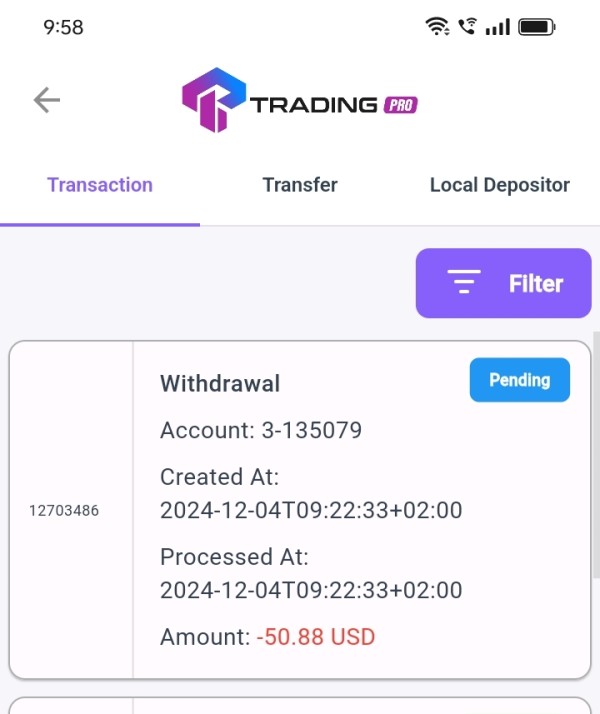

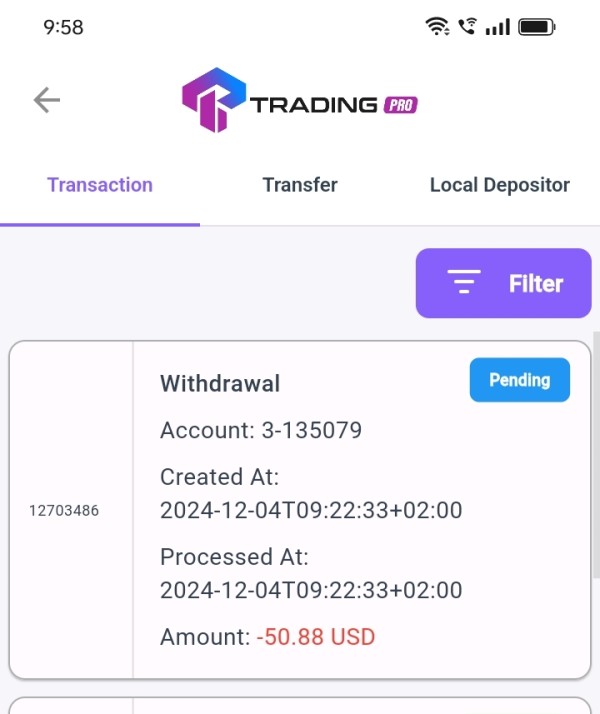

People who use the platform have mixed but mostly positive things to say about it. They like how quickly customer service responds and how much educational help they get. However, some users say their withdrawals take too long, which is something new clients should think about carefully. The main users are beginner traders who want lots of learning materials and professional traders who want high leverage in a flexible trading setup.

Important Notice

We don't have specific information about regulations from our sources. This means potential traders should know that regulatory protections and rules can be very different depending on where you live. This trading pro review uses information that anyone can find, feedback from users, and market research data from multiple sources as of January 2025.

People thinking about opening accounts should do their own research about regulatory status. They should also check all terms and conditions directly with the broker before opening an account. This review tries to give you a complete analysis while being honest about what we don't know regarding regulatory oversight and investor protection measures.

Rating Framework

Broker Overview

Trading Pro started working in the forex market in 2017. The company set up its main office in Saint Vincent and the Grenadines with a clear goal to create an easy trading environment for traders of all skill levels. The company has positioned itself as a technology-focused broker, using a No Dealing Desk (NDD) model designed to provide clear and efficient trade execution without conflicts of interest that usually come with market maker models.

The broker's business approach focuses on education and helping users succeed. They especially target retail traders who may be new to forex markets. This approach shows clearly in their complete educational resource library and user-friendly platform design. Trading Pro has built its reputation on providing competitive trading conditions while keeping a focus on customer education and support.

Trading Pro gives you access to financial markets through the industry-standard MetaTrader 4 and MetaTrader 5 platforms. This ensures traders have access to advanced charting tools, automated trading capabilities, and extensive technical analysis features. The broker supports trading across six major types of investments: foreign exchange pairs, global indices, precious metals, energy commodities including oil, various cryptocurrencies, and individual stock instruments. This diverse selection allows traders to build varied portfolios and explore different market opportunities within a single trading account. Available information does not specify particular regulatory oversight, which potential clients should investigate thoroughly before putting money in.

Regulatory Status: Current available information does not specify regulatory oversight authorities. This represents a significant consideration for potential clients evaluating broker security and compliance standards.

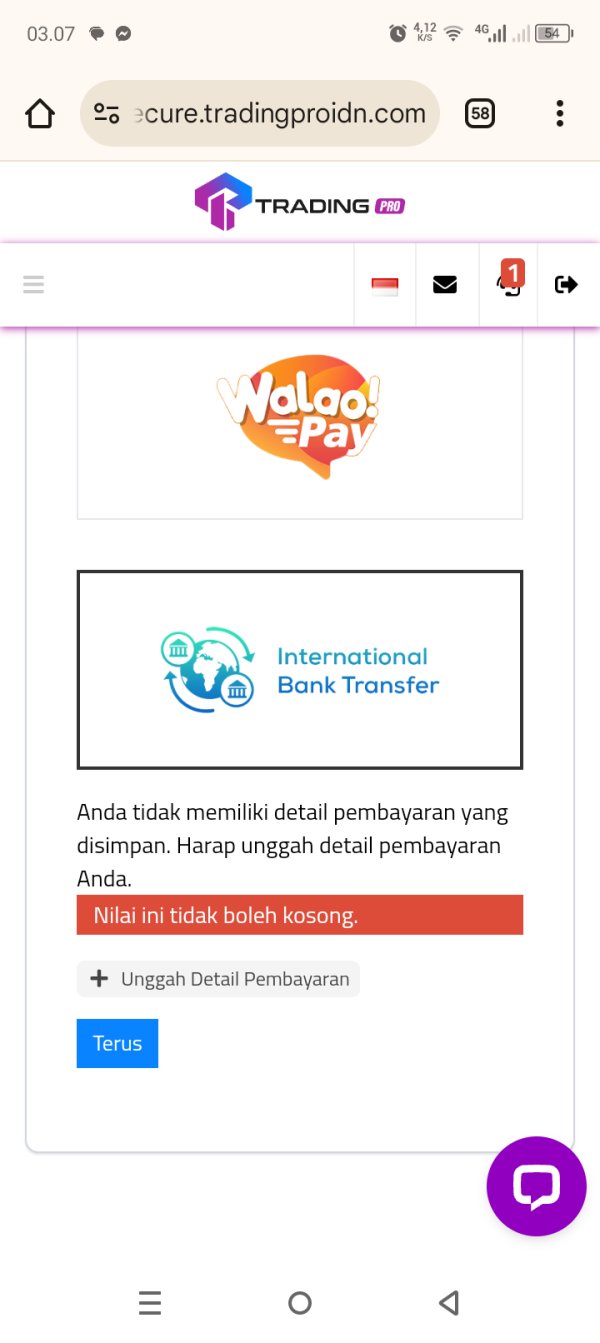

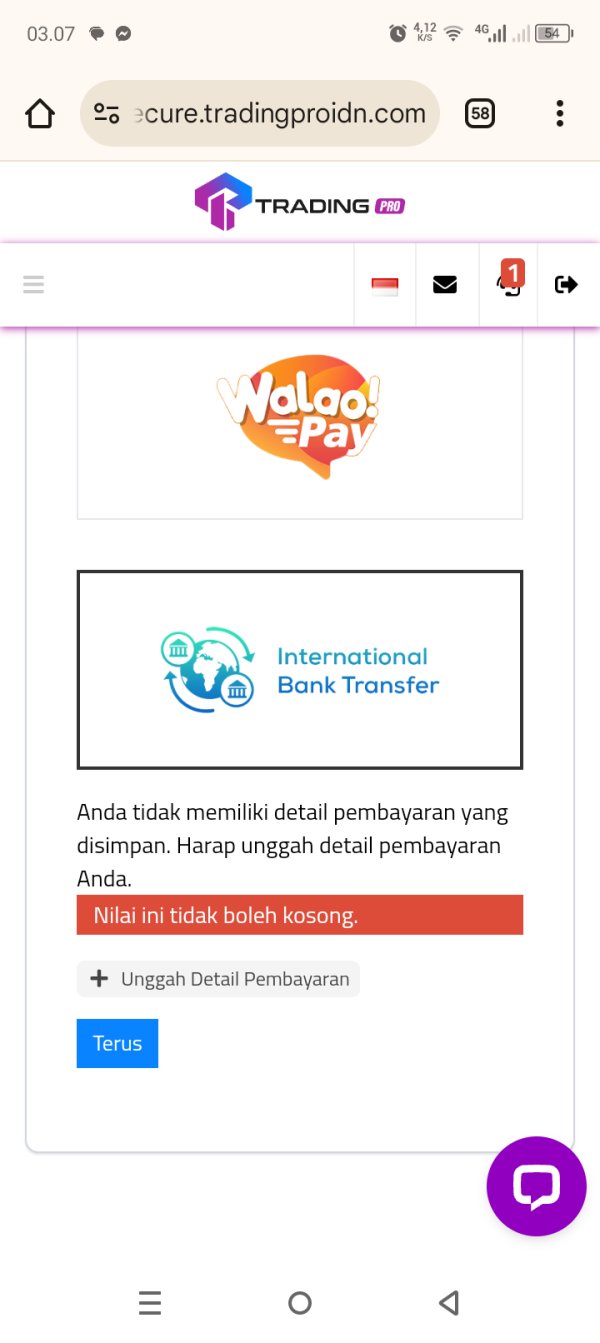

Funding Options: Trading Pro accepts different funding methods to meet various preferences. They take bank wire transfers, major credit and debit cards, popular e-wallet services, and cryptocurrency deposits, providing flexibility for international clients.

Minimum Deposit: Specific minimum deposit requirements are not detailed in available documentation. You need to ask the broker directly for account opening specifications.

Promotional Offers: Information about welcome bonuses, deposit incentives, or ongoing promotional programs is not available in current sources.

Trading Instruments: The platform provides access to major and minor forex pairs, global stock indices, gold and silver, crude oil and energy commodities, popular cryptocurrencies including Bitcoin and Ethereum, and individual company stocks.

Cost Structure: Trading Pro uses a variable spread model with commission rates starting from zero dollars. However, specific spread ranges and typical trading costs may vary based on market conditions and account types. Traders should verify current pricing structures directly with the broker.

Leverage Options: Maximum leverage reaches 1:2000. This positions Trading Pro among brokers offering substantial leverage opportunities for experienced traders, though such high leverage carries significant risk considerations.

Platform Technology: Both MetaTrader 4 and MetaTrader 5 are supported. This provides traders with choice between the established MT4 interface and the enhanced features of MT5 including additional timeframes and improved strategy testing capabilities.

This trading pro review notes that specific information about geographical restrictions and customer service language support requires direct verification with the broker.

Detailed Rating Analysis

Account Conditions Analysis

Trading Pro's account structure has both advantages and areas that need clarification for potential clients. The broker's zero-commission starting point represents a competitive advantage, especially for high-frequency traders or those working with smaller account sizes where commission costs can significantly impact profitability. The availability of leverage up to 1:2000 positions Trading Pro among the more aggressive leverage providers in the retail forex market, appealing to experienced traders seeking maximum capital efficiency.

However, this trading pro review finds several information gaps that impact the overall account conditions assessment. The absence of clearly specified minimum deposit requirements makes it difficult for potential clients to plan their initial investment. Also, available sources do not detail different account tiers or whether the broker offers specialized account types such as Islamic accounts for clients requiring swap-free trading conditions.

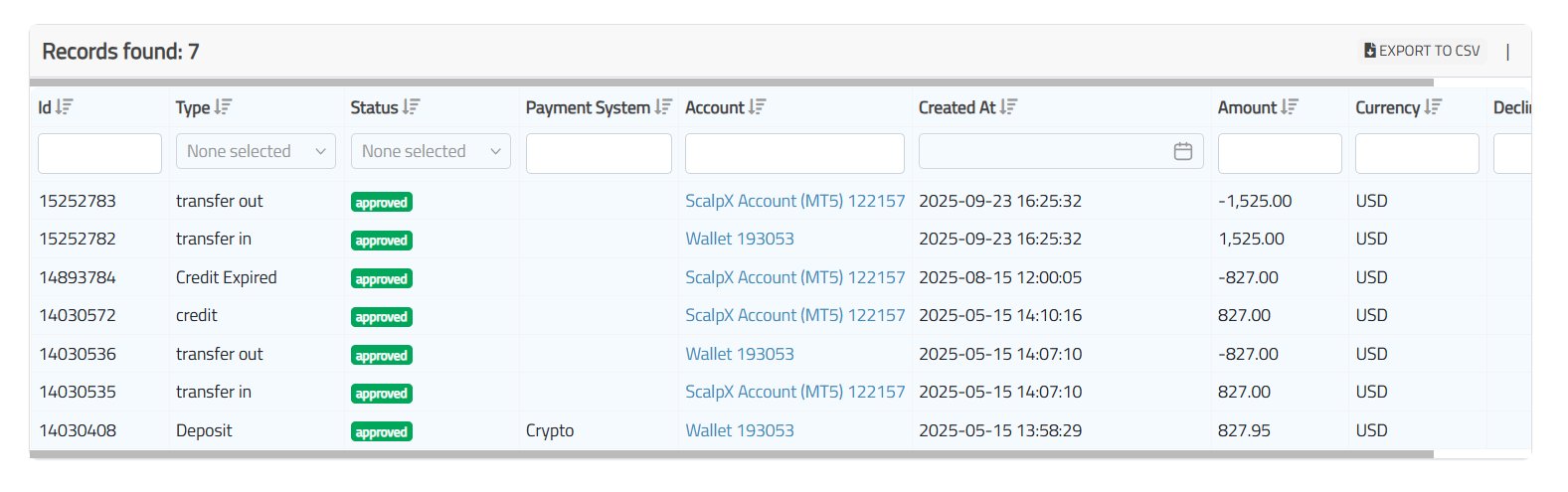

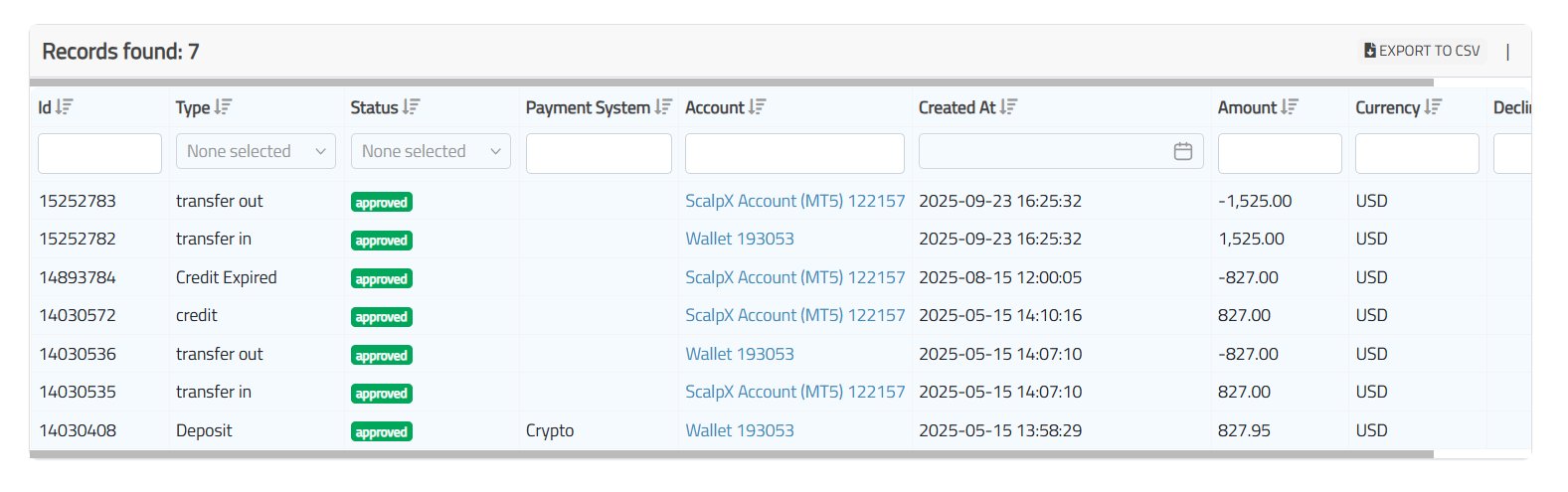

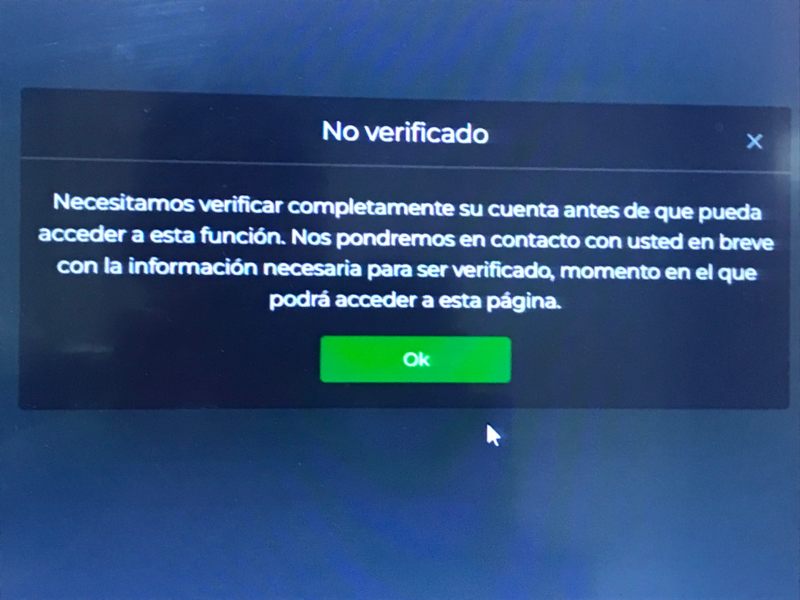

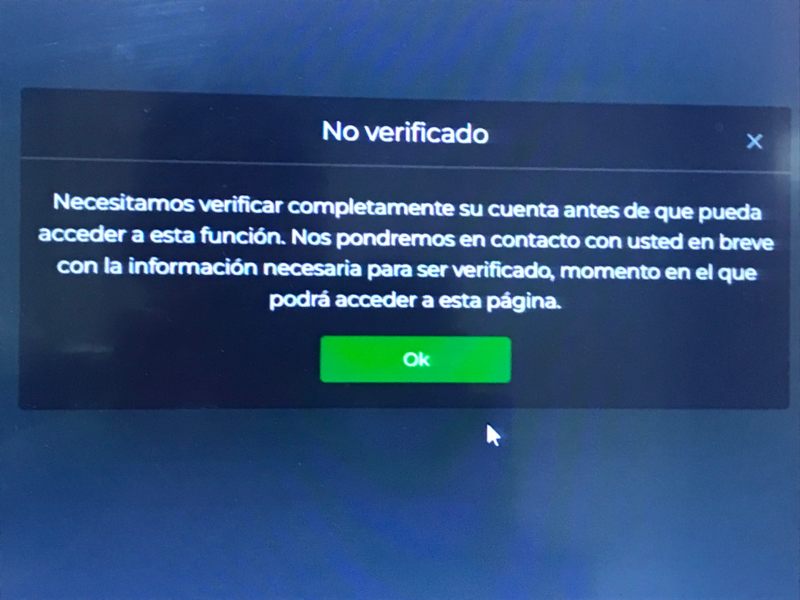

The variable spread model might offer tighter spreads during optimal market conditions, but it also creates uncertainty about trading costs during volatile periods. Without specific spread ranges or typical trading cost examples, traders cannot accurately assess the true cost of trading with this broker. User feedback about account opening procedures and verification processes is limited in available sources, suggesting potential clients should expect to gather this information directly from the broker during their evaluation process.

Trading Pro shows strong commitment to providing complete trading infrastructure through its support of both MetaTrader 4 and MetaTrader 5 platforms. This dual-platform approach ensures traders can choose between the familiar MT4 environment or leverage the enhanced capabilities of MT5, including additional timeframes, more pending order types, and improved backtesting functionality.

The broker's emphasis on educational resources represents a significant strength, particularly for novice traders entering the forex market. While specific details about the educational content are not extensively documented in available sources, user feedback suggests these resources are comprehensive and well-regarded by the trading community. This educational focus aligns with Trading Pro's positioning as a beginner-friendly broker while still maintaining the advanced tools required by professional traders.

However, this analysis notes that specific information about research and market analysis resources is not detailed in available documentation. Modern traders increasingly expect access to economic calendars, market sentiment indicators, and professional analysis to support their trading decisions. Also, details about automated trading support, expert advisor capabilities, and custom indicator development are not specified, though the MetaTrader platforms inherently support these features.

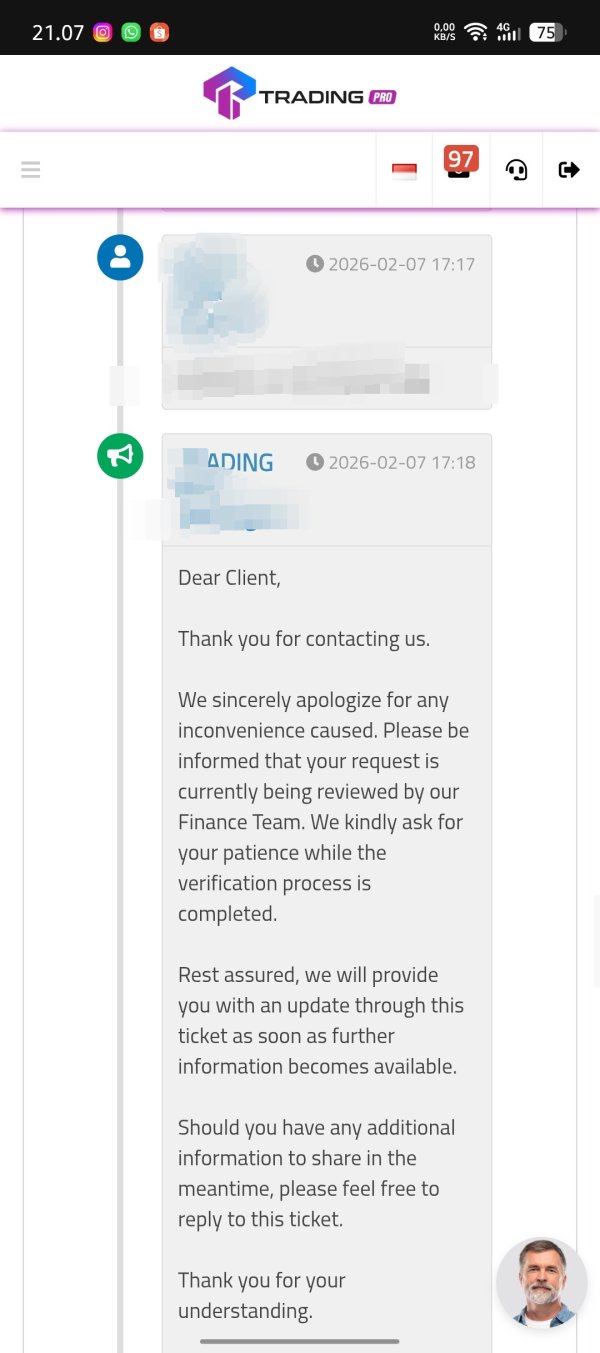

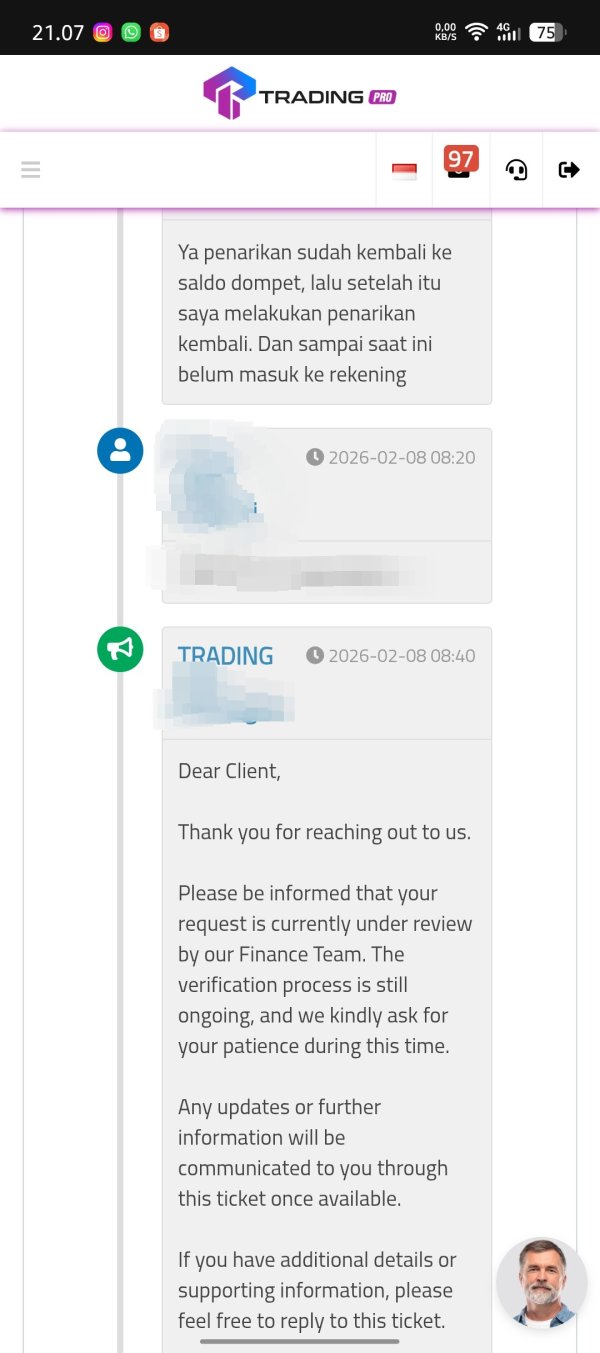

Customer Service and Support Analysis

User feedback shows that Trading Pro's customer service team demonstrates good responsiveness. Clients report satisfactory reaction times to inquiries and support requests. This positive feedback suggests the broker has invested in adequate staffing and training for their support operations, which is crucial for maintaining client satisfaction in the competitive forex market.

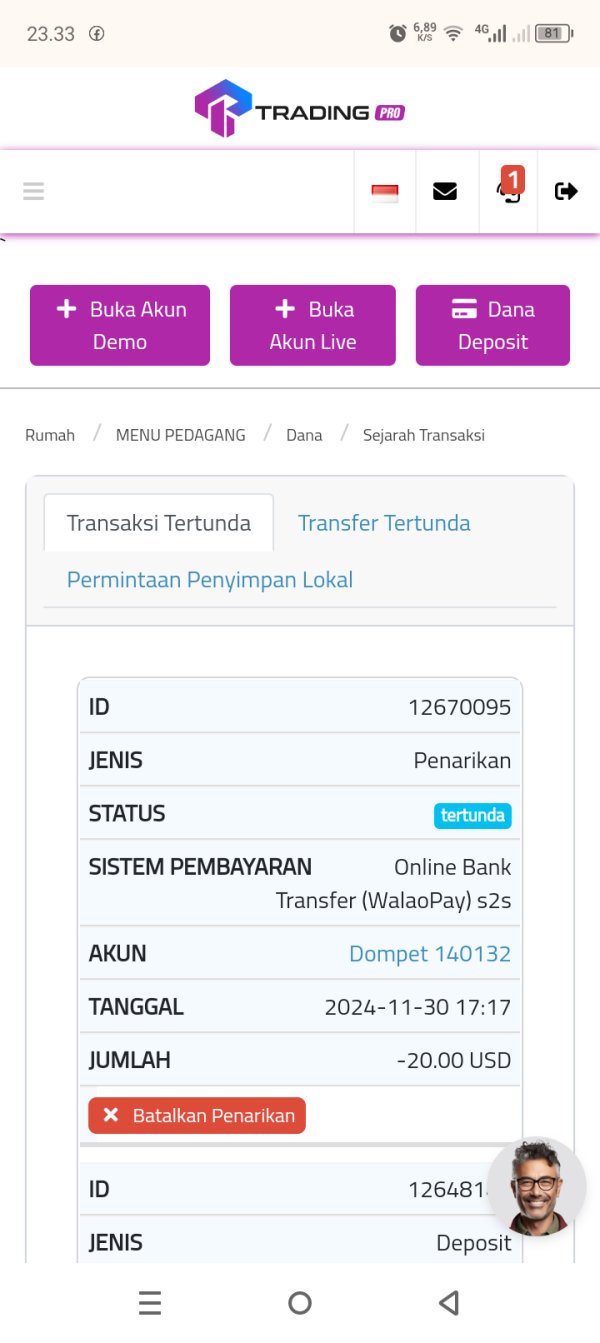

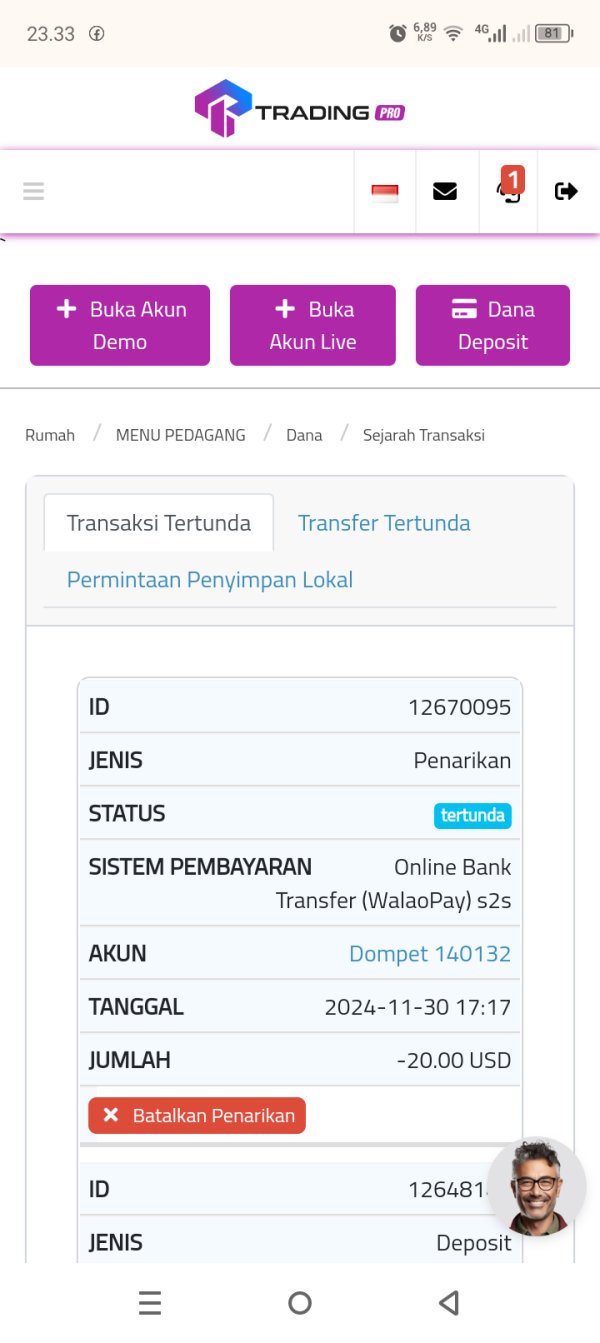

However, the customer service evaluation is significantly impacted by reports of withdrawal delays, which represents a serious concern for any trading operation. Withdrawal processing speed is often considered one of the most important indicators of a broker's operational efficiency and financial stability. These reported delays could indicate either operational challenges or potentially more serious underlying issues that prospective clients should investigate thoroughly.

The available information does not specify customer service availability hours, supported languages, or communication channels beyond general contact methods. Modern traders expect 24/5 support during market hours, multilingual assistance, and multiple communication options including live chat, email, and telephone support. The absence of these details in available documentation suggests potential clients should verify service availability for their specific needs and time zones before opening accounts.

Trading Experience Analysis

User feedback suggests generally positive experiences with Trading Pro's trading environment. However, specific technical performance data is not available in current sources. The MetaTrader platform foundation provides a solid base for trading operations, offering reliable order execution, comprehensive charting capabilities, and extensive technical analysis tools that traders expect from professional trading platforms.

However, this trading pro review notes the absence of crucial technical performance metrics such as typical execution speeds, average slippage rates, and requote frequencies. These metrics are essential for traders to evaluate whether a broker can provide the execution quality necessary for their trading strategies, particularly for scalping or high-frequency trading approaches.

The variable spread model implemented by Trading Pro means trading costs can fluctuate based on market conditions. This may benefit traders during stable market periods but could increase costs during high volatility. Without historical spread data or typical spread ranges, traders cannot accurately assess how these fluctuations might impact their trading profitability.

Mobile trading experience details are not specified in available sources. This is important because mobile accessibility is increasingly important for modern traders who need to monitor and manage positions while away from their primary trading setups.

Trust and Security Analysis

The trust and security assessment for Trading Pro is significantly impacted by the absence of clear regulatory information in available sources. Regulatory oversight provides crucial investor protections including segregated client funds, dispute resolution mechanisms, and compensation schemes that protect traders in case of broker insolvency.

Operating from Saint Vincent and the Grenadines, Trading Pro falls under a jurisdiction that, while legitimate, does not provide the same level of regulatory oversight and investor protection as major financial centers such as the UK, EU, or Australia. This regulatory environment may offer operational advantages for the broker but potentially reduces client protections compared to more heavily regulated alternatives.

Available information does not detail specific fund security measures such as client money segregation, insurance coverage, or third-party fund management arrangements. These security features are standard among reputable brokers and their absence from available documentation represents a significant information gap for this evaluation.

The lack of information about company transparency, financial reporting, or independent auditing further impacts the trust assessment. Established brokers typically provide detailed company information, financial statements, and third-party verification of their operational standards.

User Experience Analysis

The user experience evaluation reveals a mixed picture with both positive and concerning elements. Trading Pro's focus on educational resources and beginner-friendly approach suggests thoughtful consideration of user needs, particularly for those new to forex trading. The availability of both MT4 and MT5 platforms provides flexibility for users with different experience levels and platform preferences.

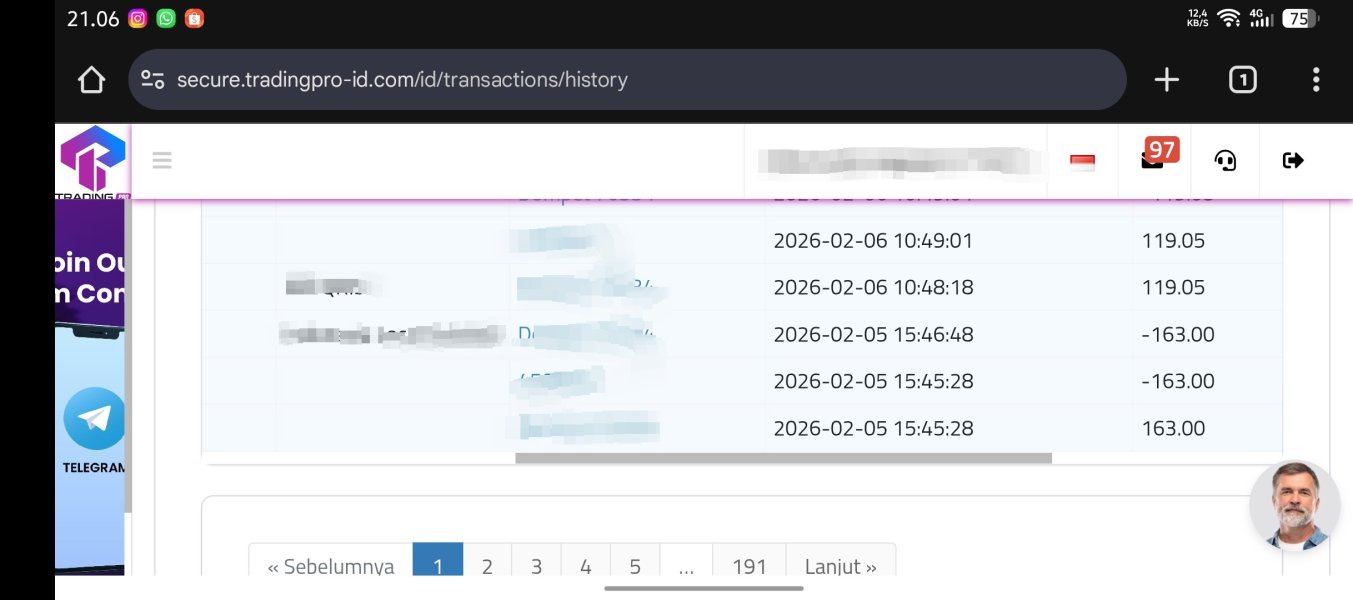

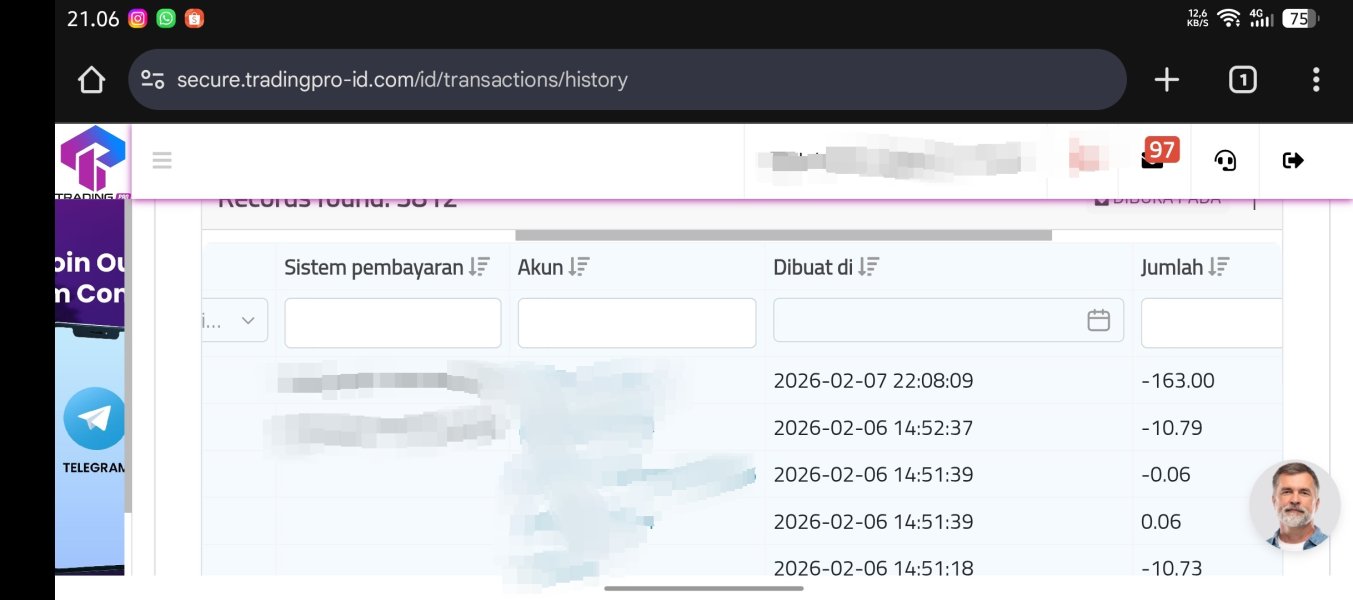

However, reported withdrawal delays significantly impact the overall user experience assessment. Fund accessibility is fundamental to trader confidence, and delays in withdrawal processing can create serious concerns about broker reliability and operational efficiency. These delays may indicate operational challenges, inadequate staffing, or potentially more serious underlying issues.

The broker's target audience of beginners and high-leverage seeking professionals represents an interesting positioning that could serve both markets effectively if executed properly. Educational resources benefit newcomers while high leverage options attract experienced traders, though this dual focus requires careful balance to serve both segments effectively.

Available feedback does not provide detailed information about account registration processes, verification requirements, or platform usability. This suggests potential clients should expect to gather this information through direct interaction with the broker during their evaluation process.

Conclusion

This trading pro review reveals a broker with both promising features and significant areas of concern that potential clients must carefully consider. Trading Pro's strengths include competitive trading conditions with zero-commission options, substantial leverage up to 1:2000, comprehensive educational resources, and generally responsive customer service. The dual MetaTrader platform offering provides flexibility for traders with different experience levels and preferences.

However, several critical concerns impact the overall assessment. The absence of clear regulatory information represents a significant trust and security issue, particularly for traders prioritizing investor protection and regulatory oversight. Reports of withdrawal delays, while not universal, raise operational concerns that could affect trader confidence and fund accessibility.

Trading Pro appears most suitable for beginner traders who prioritize educational support and competitive trading conditions over regulatory protections. It also works well for experienced traders seeking high leverage opportunities who understand and accept the associated risks. However, traders prioritizing regulatory security, transparent operations, and guaranteed fund accessibility may find better-suited alternatives in the competitive forex broker market.

Prospective clients are strongly advised to conduct thorough due diligence, verify all terms and conditions directly with the broker, and consider starting with smaller deposits to evaluate service quality before committing significant trading capital.