Mancu 2025 Review: Everything You Need to Know

Summary

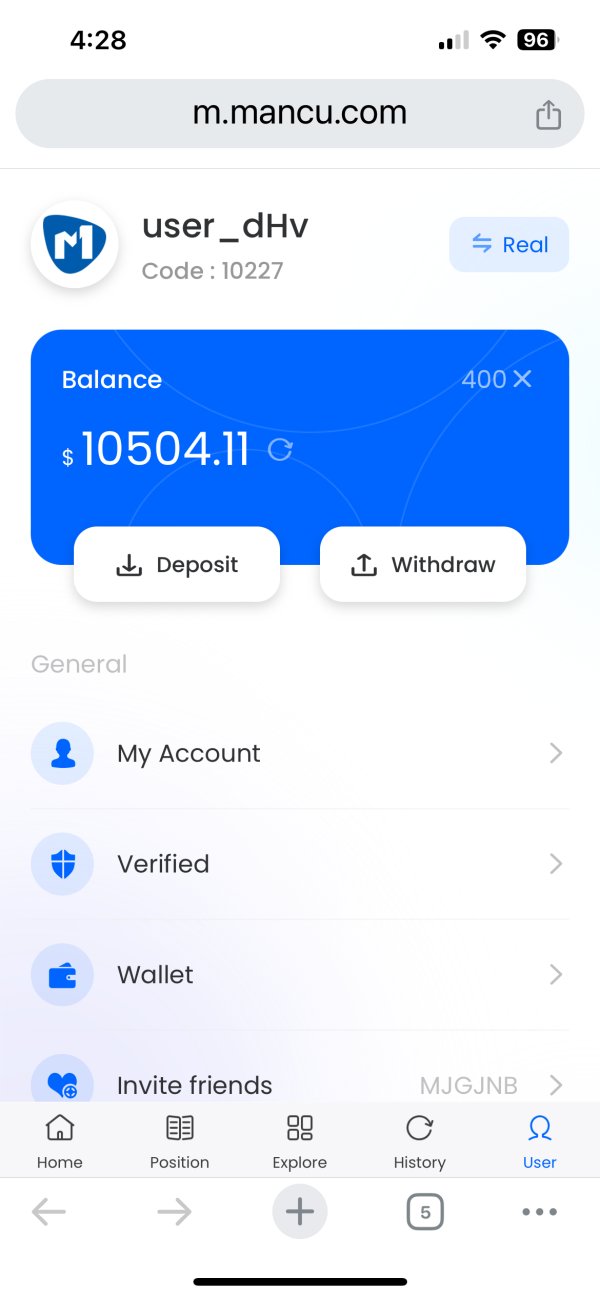

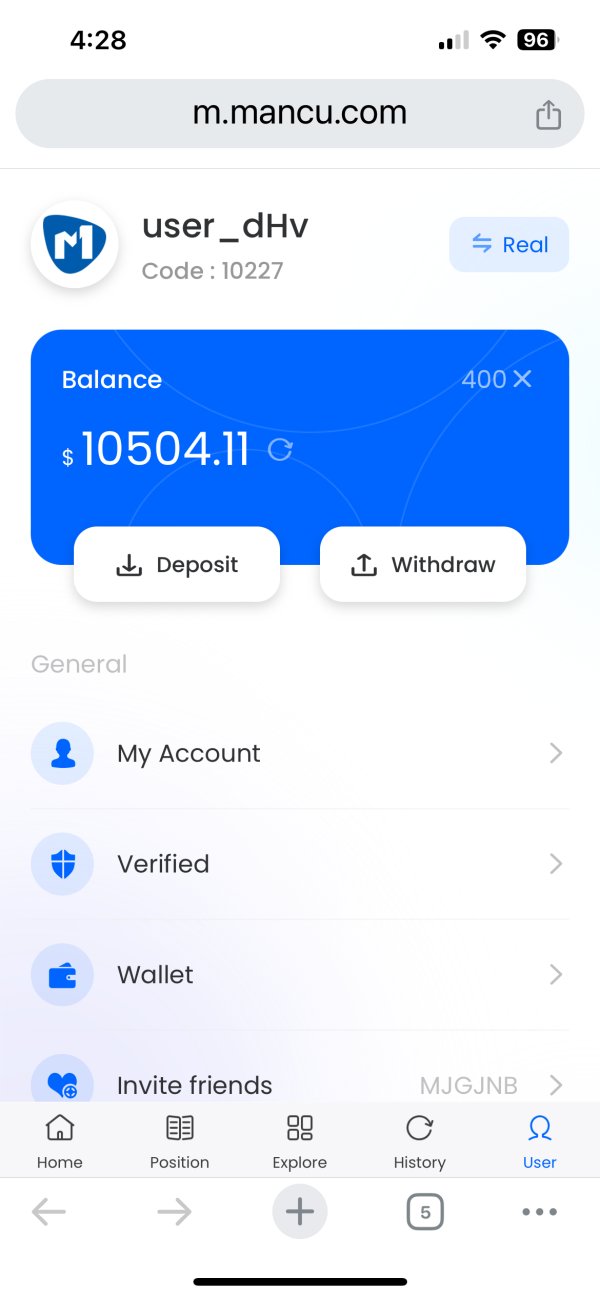

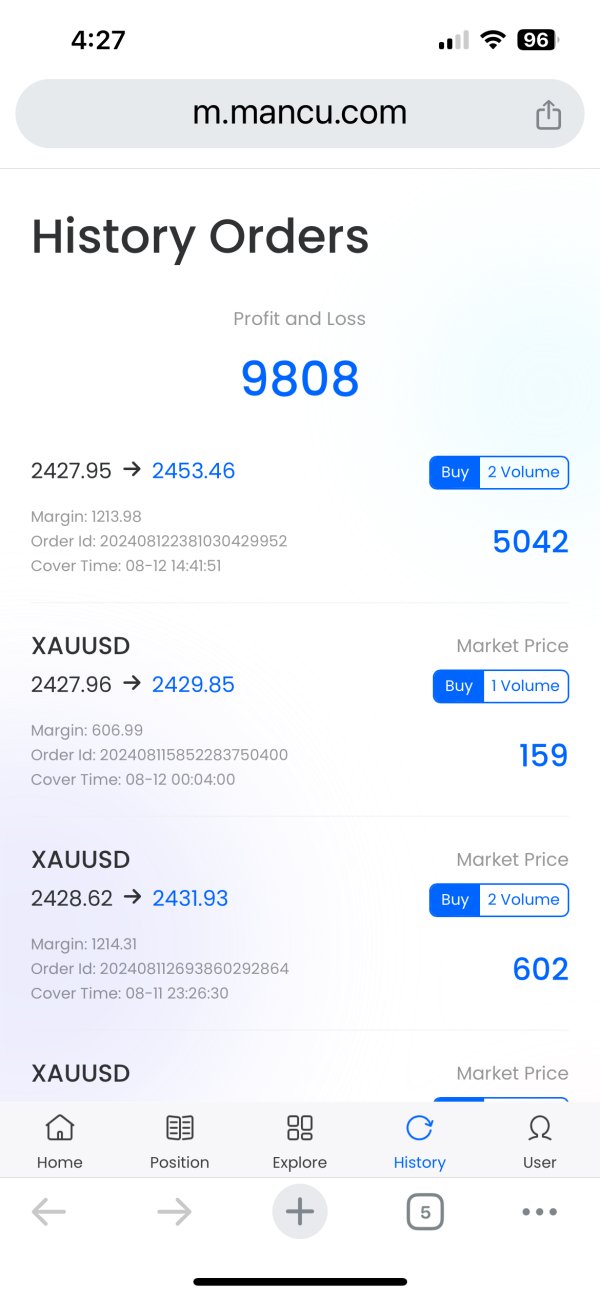

This complete mancu review shows worrying facts about the broker's work and how happy users are. The data shows that Mancu gets very bad feedback from users, with a shocking 100% negative rating and only 1-star reviews on all review websites. The broker offers features that might look good, like leverage up to 400:1 and access to many types of assets including forex, indices CFDs, stock CFDs, commodities, and cryptocurrencies. But it has big problems with trust.

The platform tries to get traders who want different trading tools and high leverage chances. Users should be very careful because many people complain about bad customer service, possible fraud, and fake ads. The broker works under Financial Crimes Enforcement Network (FinCEN) rules, but we don't know the exact license details. A few users like how easy the platform is to use. However, most feedback shows big risks that are much worse than any good points for most trading situations.

Important Notice

This mancu review uses information that anyone can see and user feedback from different places. Readers should know that Mancu works under FinCEN rules, and different countries have different rules that might change what services you can get and what legal protection you have.

We look at user stories, official information we can find, and what other people say about them. But we might not be able to see all information about how Mancu works, and some things in this review might change. Users should really do their own research and check current terms, conditions, and rules before using any financial service.

Overall Rating Framework

Broker Overview

Mancu started in 2015 as a financial trading platform with its main office in Australia. The company wants to give foreign exchange, indices, and stock trading services to regular people and big clients. It works by trying to offer many different trading options, including forex pairs, CFDs on different types of assets, and cryptocurrency trading chances. The broker tries to get users by letting them access many financial markets through one platform and talks about how easy it is to have all trading services in one place.

But we don't know much about how the broker works or its company background from public sources. Even though it has been working for almost ten years, mancu review results show that the company has had trouble building a good name in the trading community. The platform lets you trade forex, indices CFDs, stock CFDs, commodities, and cryptocurrencies, and it works under the Financial Crimes Enforcement Network (FinCEN) rules. This rule system mainly focuses on stopping money laundering rather than complete financial services rules, which might explain some of the trust problems that users report.

Regulatory Jurisdiction: Mancu works under Financial Crimes Enforcement Network (FinCEN) watch, but we can't easily find specific license numbers and detailed rule-following information in public sources.

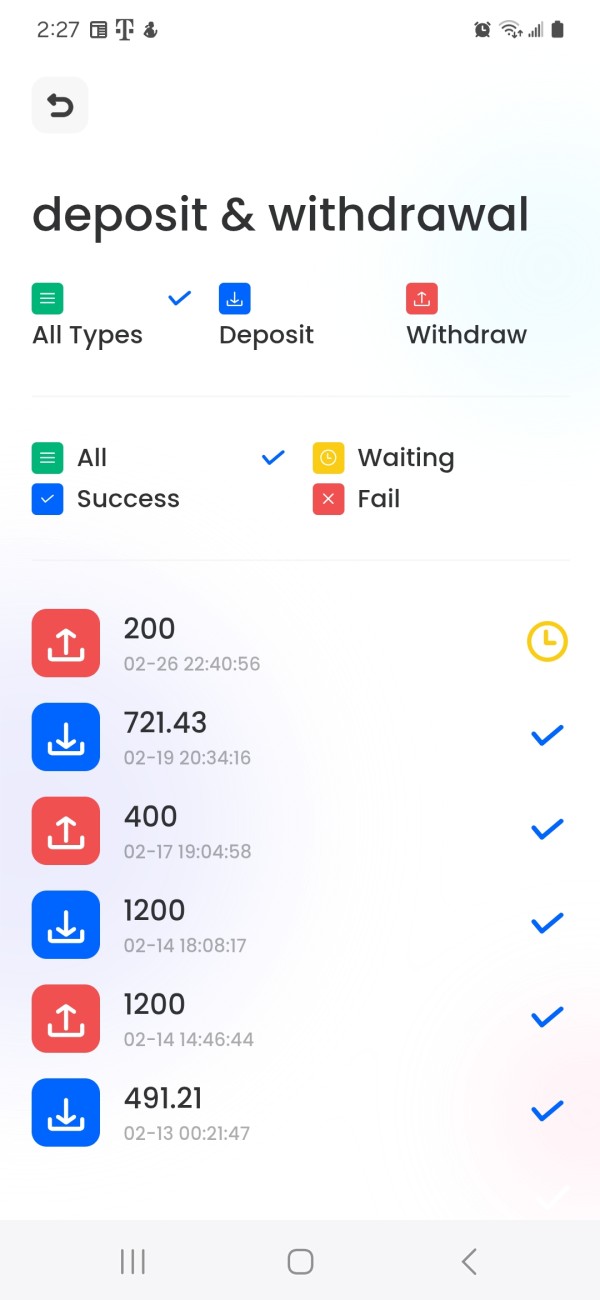

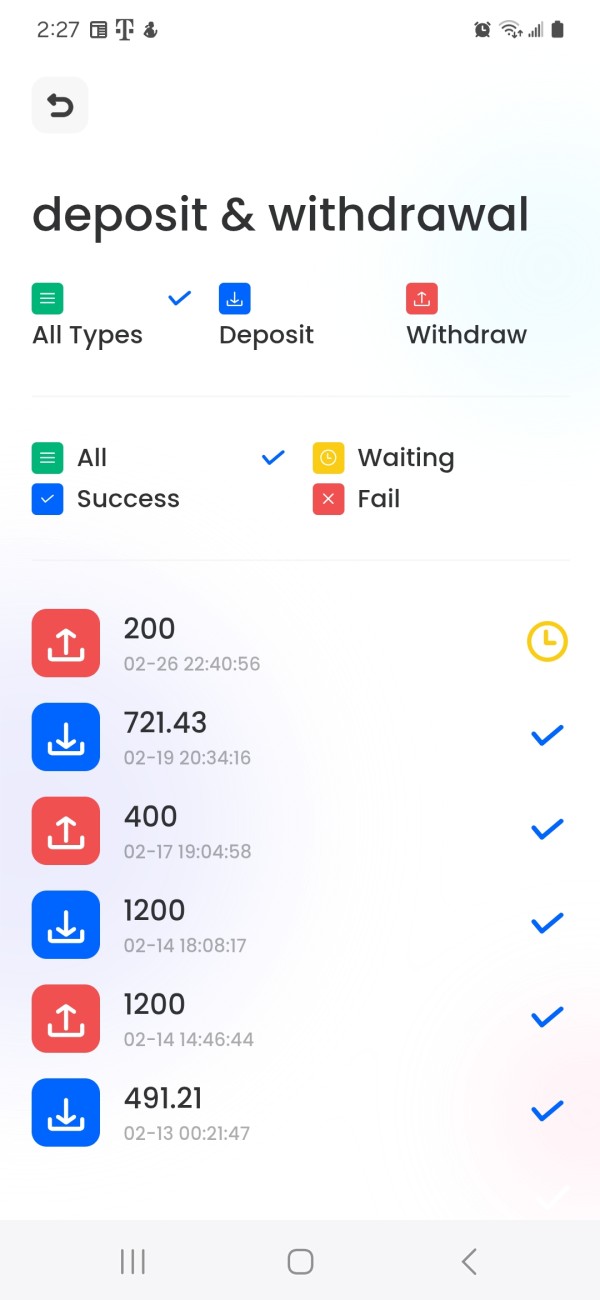

Deposit and Withdrawal Methods: We don't have specific information about what payment methods they support, how long processing takes, and what fees they charge for deposits and withdrawals.

Minimum Deposit Requirements: The broker doesn't say what the minimum deposit requirements are in papers we can see, which might make users confused and unhappy.

Bonus and Promotional Offers: We don't see details about welcome bonuses, promotional campaigns, or loyalty programs in sources we can find, but some users worry about fake promotional practices.

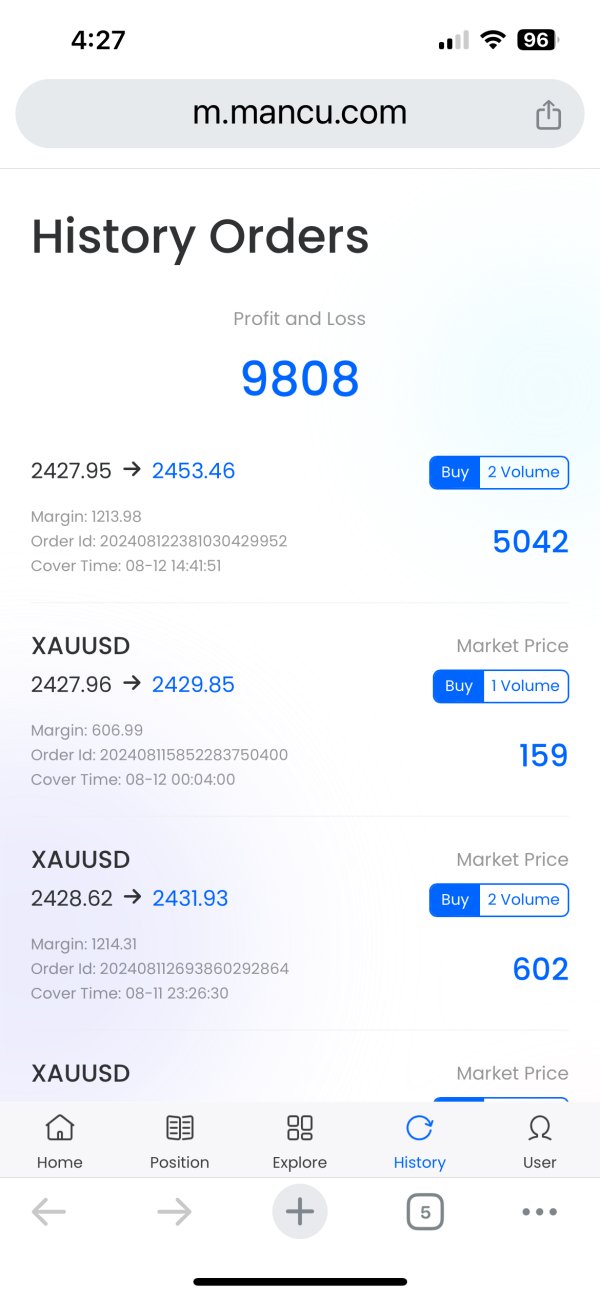

Tradeable Assets: The platform lets you access forex pairs, indices CFDs, stock CFDs, commodities, and cryptocurrency trading, giving a pretty complete range of financial tools for different portfolio strategies.

Cost Structure: We don't have specific information about spreads, commissions, overnight fees, and other trading costs in sources we can find, making it hard for potential users to figure out the real cost of trading.

Leverage Ratios: Mancu offers leverage up to 400:1, which is a pretty high leverage option that might appeal to experienced traders but creates big risk for new users.

Platform Options: We don't see details about the specific trading platforms that Mancu supports in sources we can find, leaving questions about technology infrastructure and trading tools.

Geographic Restrictions: We don't have information about countries or regions where Mancu services are restricted or not available in sources we can see.

Customer Support Languages: We don't see details about the languages that Mancu's customer service team supports in this mancu review based on information we can find.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions that Mancu offers create big concerns for potential users, mainly because there isn't clear information about account types, minimum deposit requirements, and specific account features. Sources we can find don't give details about different account levels, whether the broker offers standard, premium, or VIP account types, or what makes these potential offerings different in terms of features, costs, or benefits.

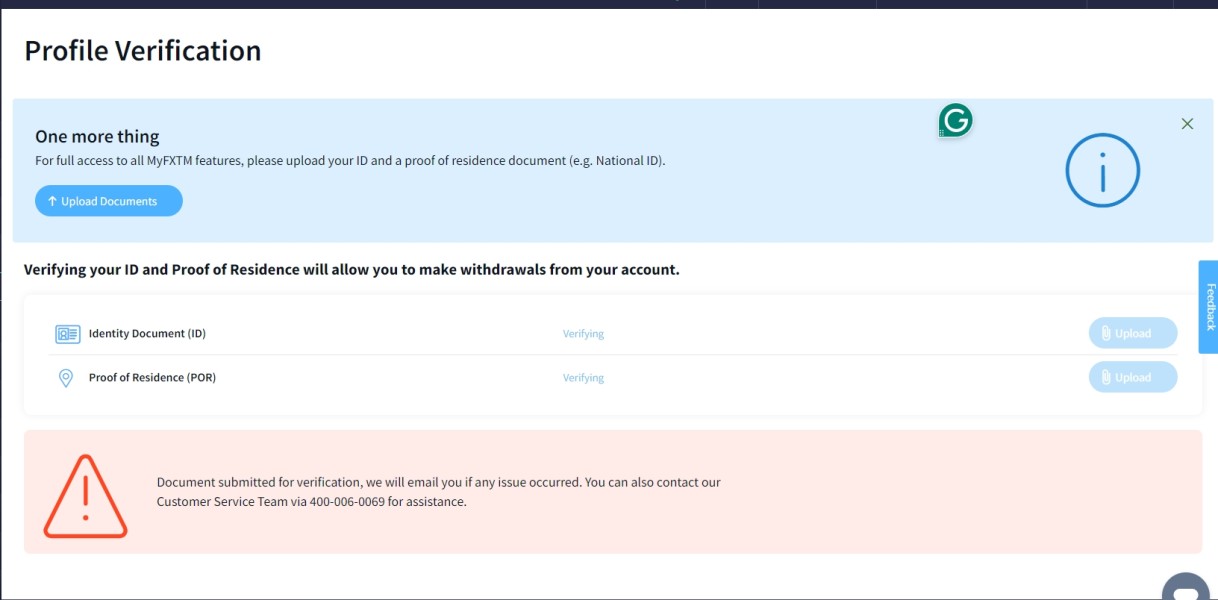

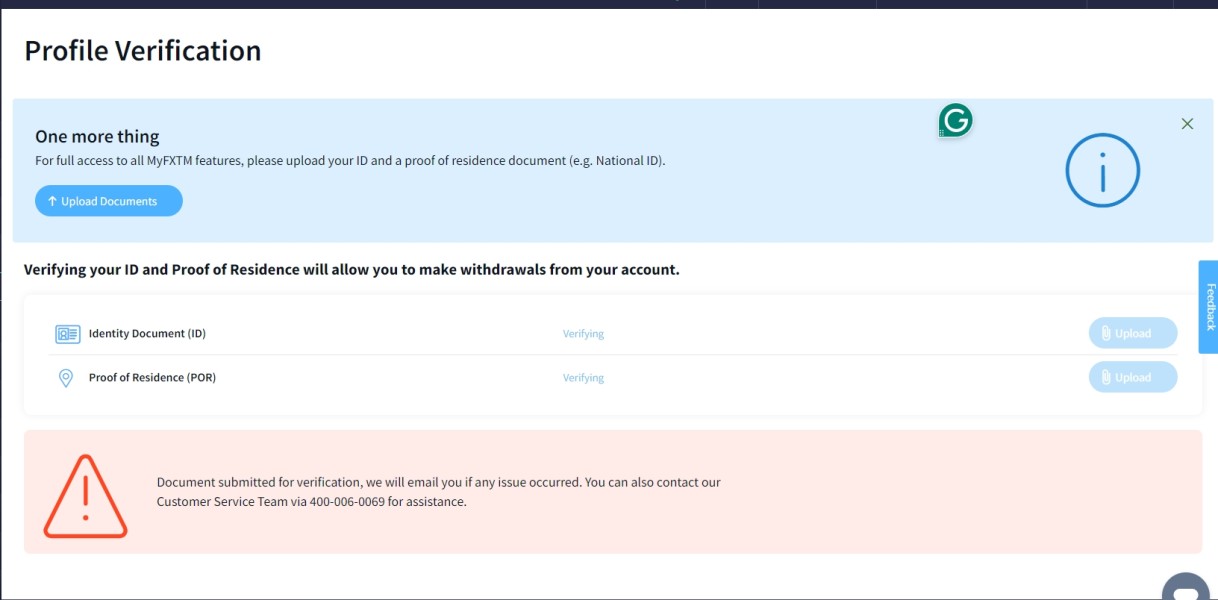

Not having clearly stated minimum deposit requirements creates uncertainty for potential users trying to figure out their initial investment obligations. This lack of clear information extends to account opening procedures, verification requirements, and the time needed to activate trading accounts. Users have said they're frustrated with the account setup process, but we don't have specific details about common issues well-documented in sources we can find.

Special account features like Islamic accounts for Muslim traders, demo accounts for practice trading, or managed account services aren't mentioned in information we can access. This mancu review finds that the overall lack of clear information about account conditions adds a lot to user dissatisfaction and raises questions about the broker's commitment to clear communication with potential clients.

The very negative user feedback specifically about account-related issues suggests that even when accounts are successfully opened, users have problems with account management, feature access, or understanding their account terms and conditions.

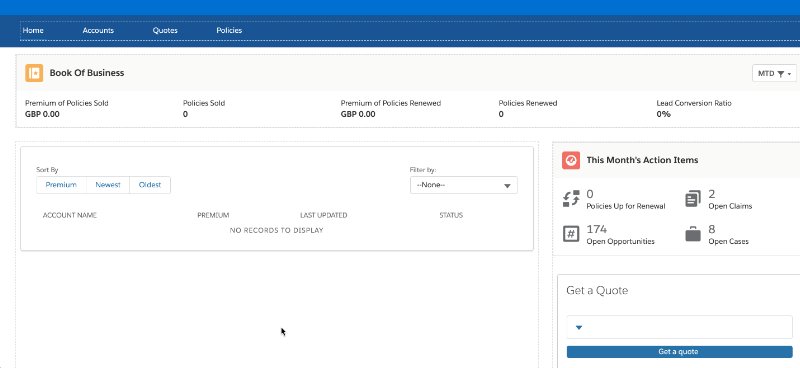

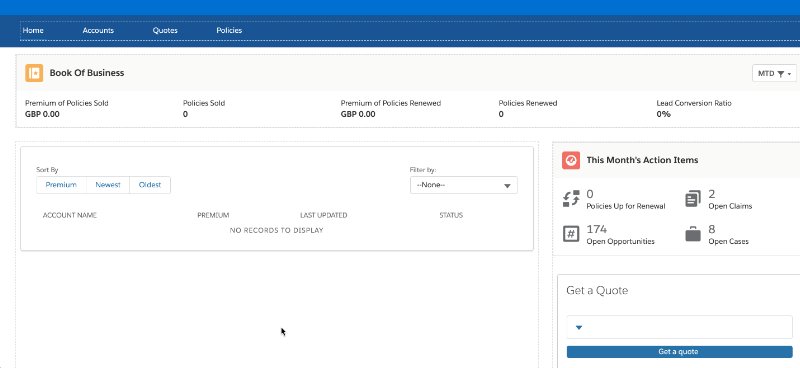

Mancu's tools and resources get a medium rating mainly based on the variety of asset classes available for trading, but specific details about trading tools, analytical resources, and educational materials remain mostly unspecified in sources we can find. The broker offers access to multiple asset categories including forex, indices CFDs, stock CFDs, commodities, and cryptocurrencies, which gives traders opportunities for portfolio diversification.

But critical information about the quality and sophistication of trading tools isn't detailed in sources we can access. Essential trading resources like technical analysis indicators, charting capabilities, economic calendars, market research reports, and real-time news feeds aren't specifically mentioned or evaluated in user feedback we can find.

Educational resources, which are crucial for trader development and success, aren't described in information we can access. Not having details about webinars, tutorials, trading guides, market analysis, or educational support materials suggests either a lack of such resources or poor communication about their availability.

Some users have mentioned that the platform offers reasonable ease of use, which suggests that basic trading functionality may be adequate. But the lack of detailed information about advanced trading tools, automated trading support, API access, or sophisticated analytical resources limits the platform's appeal for more experienced traders who require comprehensive trading infrastructure.

Customer Service and Support Analysis (Score: 1/10)

Customer service represents one of Mancu's biggest weaknesses based on user feedback and information we can find. The very negative user reviews consistently highlight poor customer service quality, unresponsive support teams, and inadequate problem resolution as major concerns that significantly impact the overall user experience.

Sources we can find don't give specific details about customer service channels, like whether the broker offers live chat, telephone support, email assistance, or help desk ticketing systems. Not having clear information about support availability, response time commitments, or service level agreements adds to user frustration and uncertainty about when and how they can receive assistance.

User feedback suggests that response times are problematic, with customers experiencing delays in receiving help for account issues, trading problems, or general inquiries. The quality of service when support is eventually provided appears to be substandard, with users expressing dissatisfaction about the competence and helpfulness of customer service representatives.

The lack of information about multilingual support capabilities raises additional concerns for international users who may require assistance in languages other than English. Operating hours for customer service aren't specified, which may create additional challenges for users in different time zones or those requiring urgent assistance during specific market hours.

Trading Experience Analysis (Score: 3/10)

The trading experience with Mancu presents a mixed picture, with some positive aspects overshadowed by significant concerns raised in user feedback. While certain users have praised the platform's ease of use and basic functionality, the overall trading experience receives criticism that substantially outweighs these limited positive comments.

Platform stability and execution speed are crucial factors for successful trading, yet specific information about these technical aspects isn't detailed in sources we can find. Not having data about slippage rates, requote frequency, or order execution statistics makes it difficult to assess the quality of trade execution that users can expect.

Some users have indicated that the platform interface is relatively user-friendly, suggesting that basic navigation and order placement functionality may be adequate for simple trading activities. But this mancu review notes that ease of use alone cannot compensate for other significant deficiencies in service quality and reliability.

Not having information about mobile trading capabilities, advanced order types, trading algorithms, or sophisticated trading features suggests that the platform may be limited in its appeal to serious traders who require comprehensive trading functionality. The overall negative user sentiment indicates that whatever positive aspects exist in the trading experience are insufficient to overcome the broader issues with the broker's operations and service quality.

Trustworthiness Analysis (Score: 1/10)

Trustworthiness represents perhaps the most critical concern in this mancu review, with multiple factors contributing to serious questions about the broker's reliability and integrity. The broker operates under FinCEN oversight, but the specific license number and detailed regulatory compliance information aren't readily accessible, which raises transparency concerns.

User feedback consistently indicates concerns about potential fraudulent activities and misleading promotional practices. The 100% negative rating from users suggests widespread trust issues that extend beyond simple service quality problems to fundamental concerns about the broker's business practices and integrity.

Not having detailed information about client fund protection measures, segregated account policies, or insurance coverage for user deposits creates additional trust concerns. Reputable brokers typically provide clear information about how client funds are protected and what safeguards exist in case of operational difficulties.

Third-party evaluations and industry ratings aren't prominently featured in sources we can find, which may indicate either a lack of independent assessment or poor performance in professional evaluations. The overall industry reputation appears to be significantly damaged by the consistent negative user feedback and concerns about fraudulent activities.

The broker's transparency regarding corporate structure, ownership, financial stability, and operational procedures appears to be limited, which further undermines confidence in the platform's trustworthiness and long-term viability.

User Experience Analysis (Score: 2/10)

The user experience with Mancu is overwhelmingly negative based on feedback and evaluation data we can find. With a 100% negative rating and consistent 1-star reviews, user satisfaction appears to be extremely low across all aspects of interaction with the broker.

While some users have mentioned that the platform interface offers reasonable ease of use, this limited positive feedback is vastly overshadowed by complaints about customer service quality, reliability issues, and concerns about fraudulent practices. The overall user satisfaction appears to be compromised by fundamental problems with service delivery and trustworthiness.

The registration and account verification process details aren't specified in sources we can find, but user feedback suggests that even basic account setup and management processes may be problematic. Users appear to encounter difficulties not just with advanced features but with fundamental aspects of using the platform.

Common user complaints center around poor customer service responsiveness, concerns about fund security, and general dissatisfaction with the broker's business practices. The consistency of negative feedback across multiple evaluation platforms suggests systematic issues rather than isolated incidents or individual user problems.

The user demographic that might find Mancu suitable appears to be extremely limited, with the broker clearly not recommended for beginners, risk-averse traders, or anyone seeking reliable customer support and transparent business practices.

Conclusion

This comprehensive mancu review reveals a broker with significant operational and reputational challenges that substantially outweigh any potential benefits. Despite offering high leverage up to 400:1 and access to diverse asset classes, Mancu's overwhelmingly negative user feedback and trustworthiness concerns make it unsuitable for most traders.

The broker is particularly not recommended for beginners or risk-averse traders who require reliable customer support, transparent business practices, and trustworthy fund management. While the platform may offer some ease of use and diverse trading opportunities, these limited advantages are insufficient to overcome the serious concerns about customer service quality, potential fraudulent activities, and overall reliability.

Potential users should exercise extreme caution and thoroughly investigate alternative brokers with better regulatory standing, positive user feedback, and transparent operational practices before considering any engagement with Mancu's trading services.