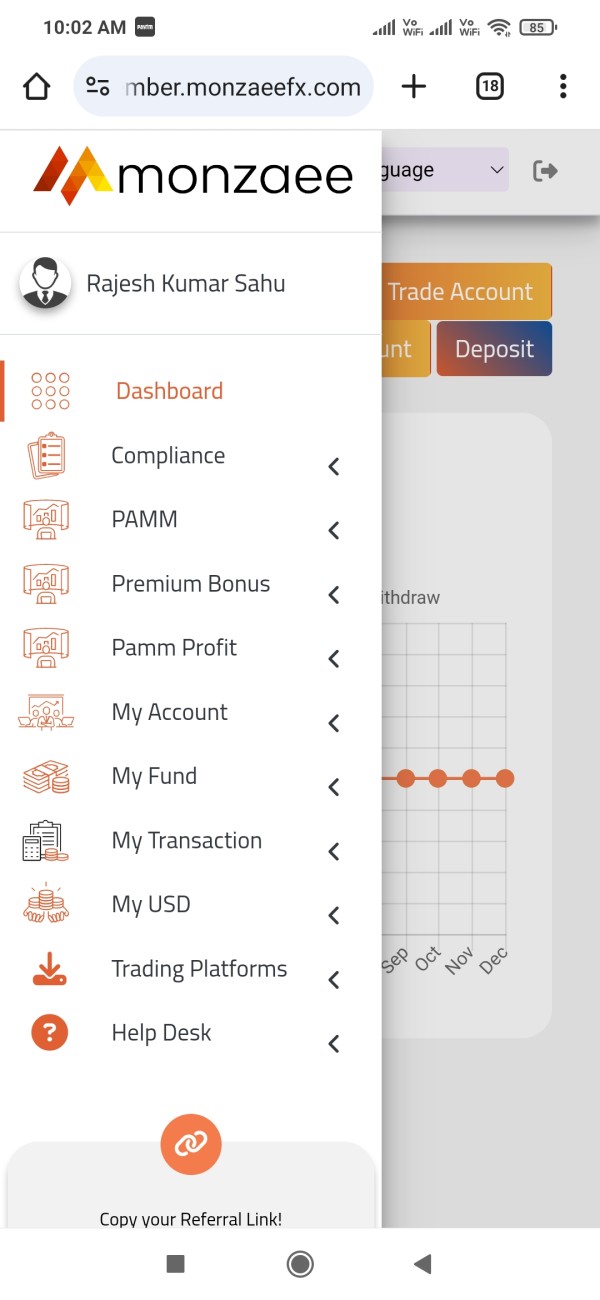

Monzaee Capital 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Monzaee Capital review evaluates a forex broker that presents significant concerns for potential traders. Our analysis of available data and regulatory information shows that Monzaee Capital operates as an unregulated forex broker with substantial risk factors that traders should carefully consider.

Monzaee Capital offers some attractive trading conditions. These include leverage up to 1000:1 and spreads starting from 0 pips, which may appeal to high-risk traders seeking aggressive trading opportunities. The broker provides access to the MT5 trading platform. It also claims to offer 24/7 customer support services. However, these features are overshadowed by serious regulatory concerns.

The broker is registered in The Autonomous Island of Anjouan, Union of Comoros. This location is widely recognized in the industry as providing minimal regulatory oversight. This lack of proper regulation raises significant red flags about trader protection, fund security, and operational transparency. Multiple industry sources have flagged potential scam risks associated with this broker. This makes it unsuitable for most retail traders.

Our assessment indicates that Monzaee Capital primarily targets high-risk investors and traders who prioritize high leverage over regulatory security. The broker offers a 100% welcome deposit bonus, which might seem attractive, but traders should view this with extreme caution given the underlying regulatory concerns.

Important Disclaimers

Regional Entity Differences: Monzaee Capital Limited operates from registration in The Autonomous Island of Anjouan, Union of Comoros. This provides limited regulatory protection compared to major financial jurisdictions. This offshore registration status significantly increases the risk profile for traders, as it lacks the consumer protections typically found in properly regulated markets.

Review Methodology: This evaluation is based on publicly available information, regulatory databases, and industry feedback collected as of April 2025. We have not conducted direct testing of the platform or verified all claims made by the broker. Traders should conduct their own due diligence and consider seeking advice from qualified financial professionals before making any investment decisions.

Overall Rating Framework

Overall Score: 4.8/10

The scoring reflects significant concerns about regulatory status and trustworthiness, despite some competitive trading conditions. The low trust score heavily impacts the overall rating, as regulatory compliance is fundamental to broker evaluation.

Broker Overview

Company Background and Establishment

Monzaee Capital Limited was established in 2020. It positions itself as a forex broker headquartered in Dubai, UAE, while maintaining its regulatory registration in The Autonomous Island of Anjouan. According to available information from industry sources, the company focuses on providing forex trading services across multiple asset classes. It targets traders who seek high-leverage trading opportunities.

The broker's relatively recent establishment in the competitive forex market coincides with a period of increased regulatory scrutiny in major financial jurisdictions. This timing, combined with its choice of offshore registration, raises questions about its commitment to transparent operations and trader protection.

Business Model and Platform Infrastructure

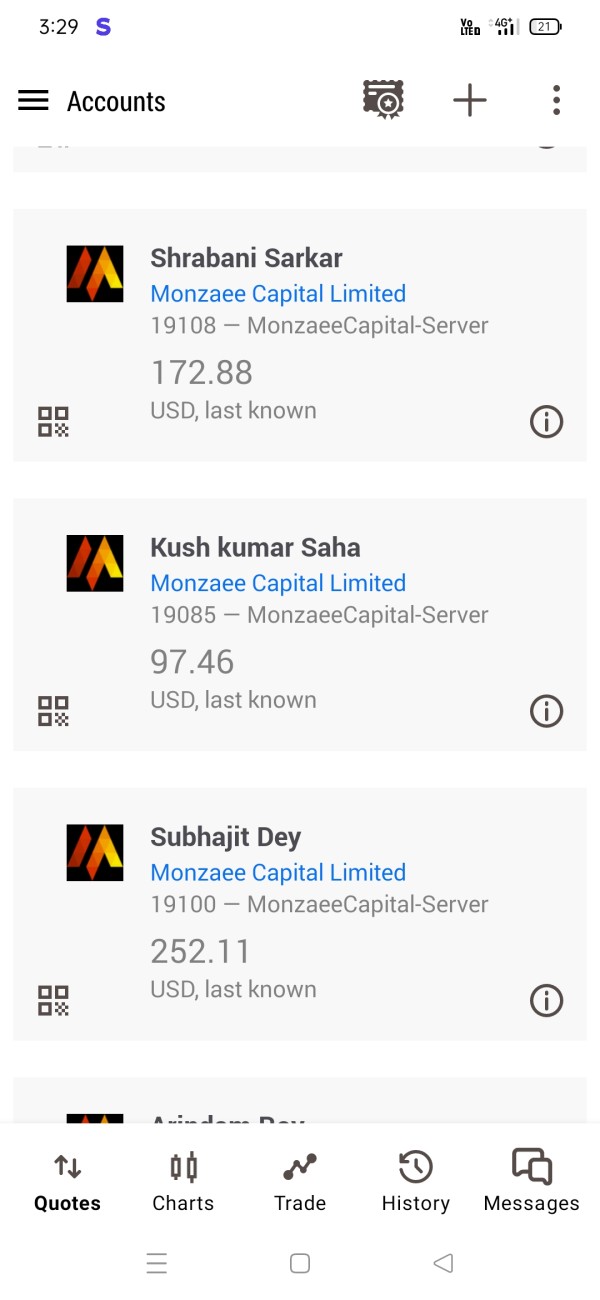

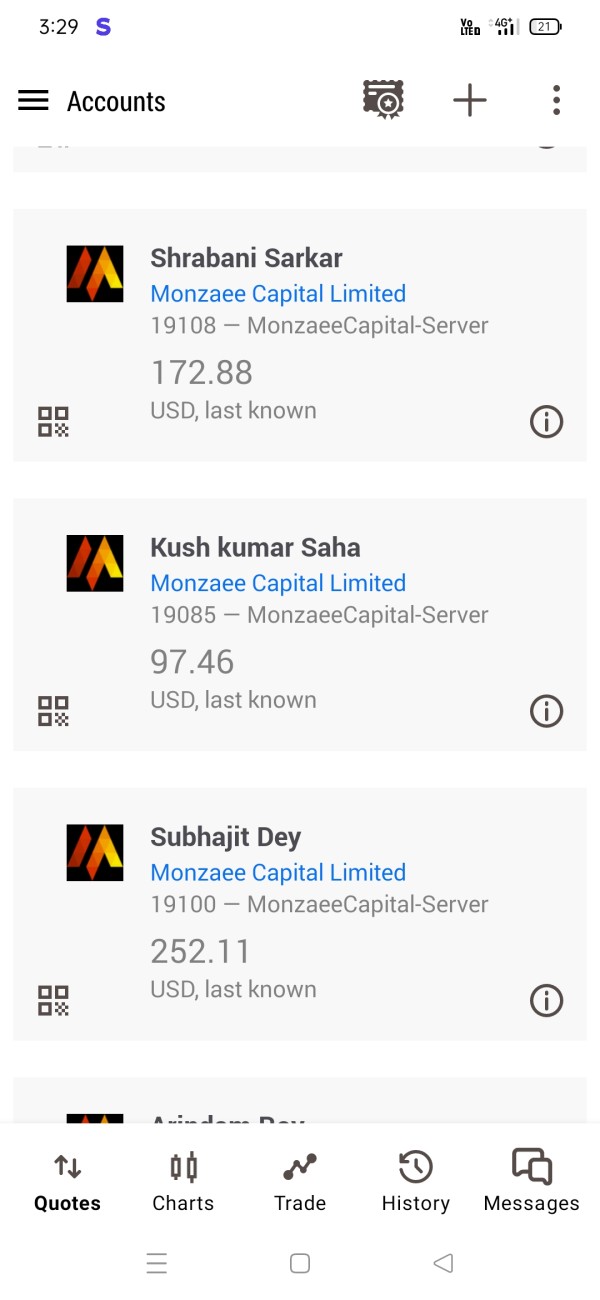

Monzaee Capital operates as a market maker. It offers trading opportunities across currency pairs, commodities, precious metals, and indices. The broker utilizes the MetaTrader 5 (MT5) platform as its primary trading interface, which provides traders with access to advanced charting tools and automated trading capabilities.

The company's business model focuses on providing high-leverage trading with competitive spreads. This appeals to traders who prioritize aggressive trading strategies over regulatory security. This Monzaee Capital review notes that while the broker offers attractive trading conditions on paper, the lack of proper regulatory oversight significantly undermines the overall value proposition for most traders.

Regulatory Status and Jurisdiction

Monzaee Capital operates under registration from The Autonomous Island of Anjouan, Union of Comoros. This jurisdiction is widely recognized in the financial industry as providing minimal regulatory oversight. This jurisdiction lacks the robust consumer protection frameworks found in major financial centers and is often associated with high-risk offshore brokers.

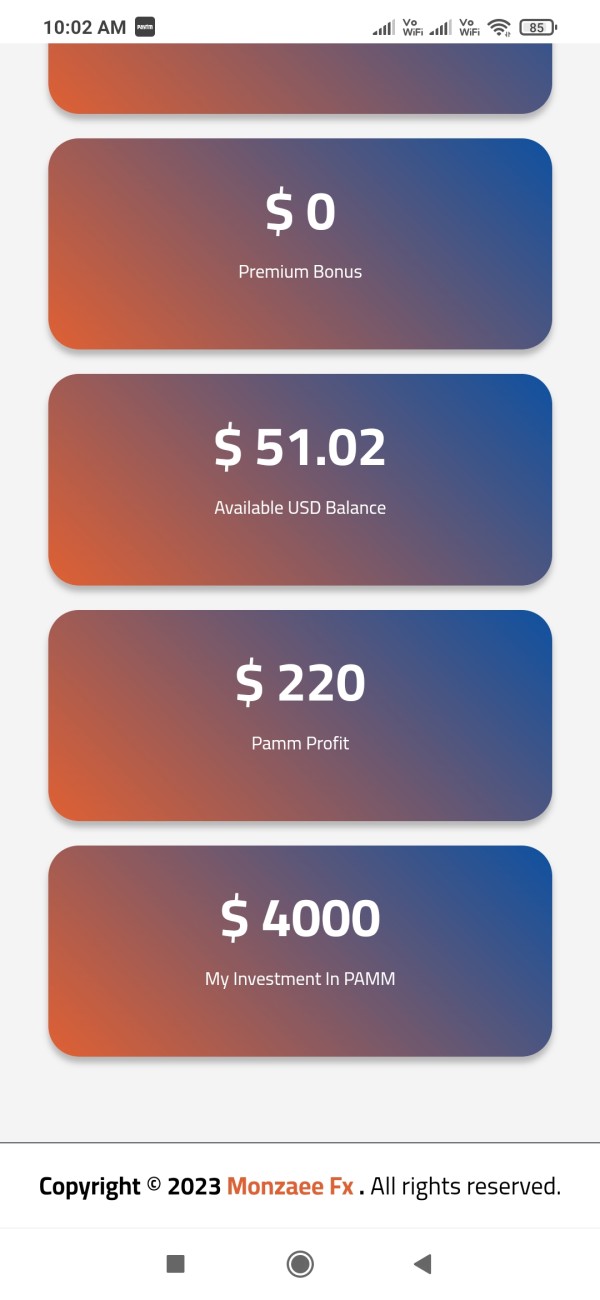

Deposit and Withdrawal Methods

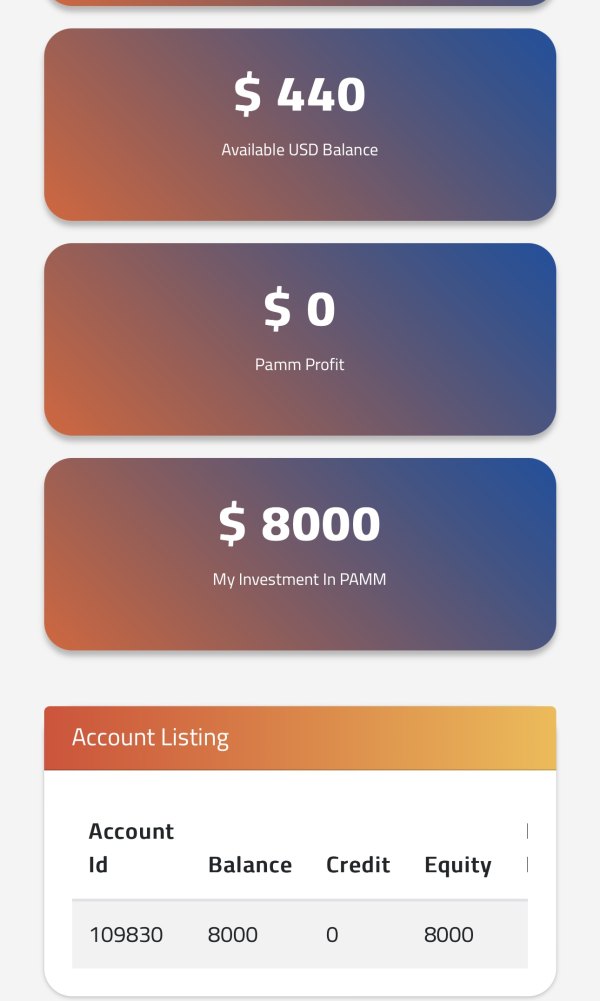

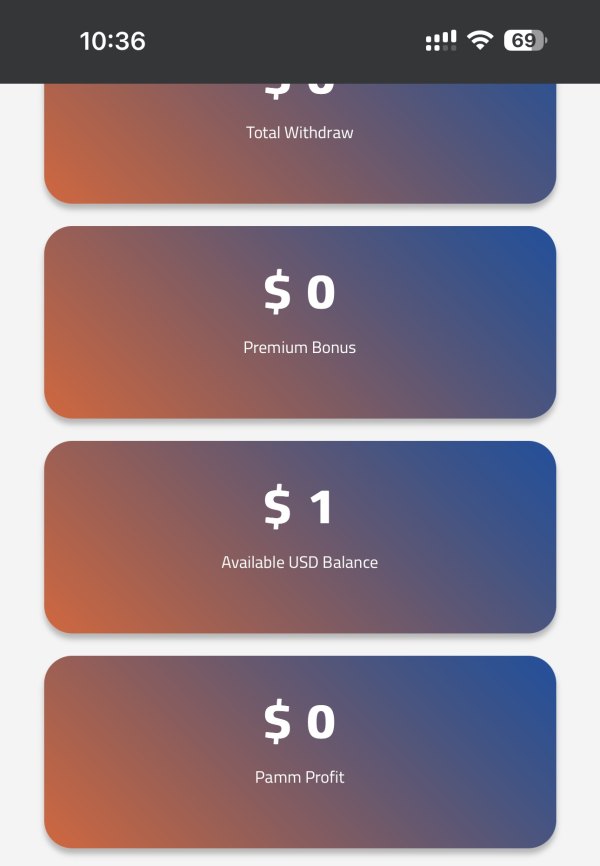

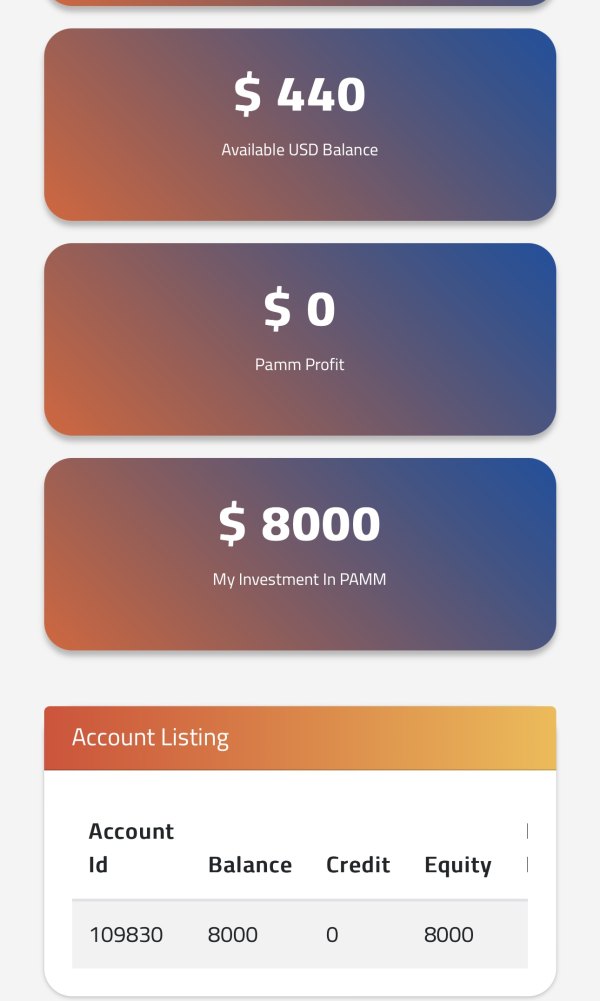

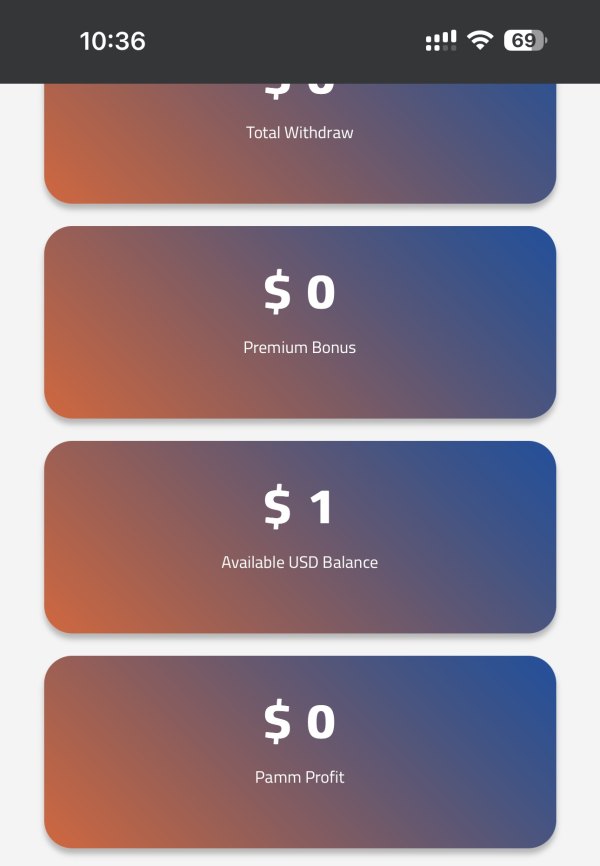

Available information does not provide specific details about deposit and withdrawal methods offered by Monzaee Capital. This lack of transparency regarding payment processing is concerning for potential clients who need to understand how they can fund their accounts and access their funds.

Minimum Deposit Requirements

The minimum deposit requirement for opening an account with Monzaee Capital is not specified in available public information. This represents a significant transparency gap for potential traders evaluating the broker's accessibility.

Promotional Offers and Bonuses

According to industry sources, Monzaee Capital offers a 100% welcome deposit bonus to new clients. However, traders should exercise extreme caution with such promotional offers, as high-percentage bonuses from unregulated brokers often come with restrictive terms that can make fund withdrawal difficult.

Available Trading Assets

The broker provides access to multiple asset classes. These include major and minor forex currency pairs, commodities such as oil and agricultural products, precious metals including gold and silver, and various stock indices. This diversification allows traders to build varied portfolios within a single platform.

Cost Structure and Fees

Monzaee Capital advertises spreads starting from 0 pips, which appears competitive on the surface. However, the absence of detailed commission information and the lack of regulatory oversight make it difficult to verify the true cost of trading with this broker.

Leverage and Margin Requirements

The broker offers leverage up to 1000:1. This significantly exceeds the leverage limits imposed by regulated jurisdictions. While high leverage can amplify profits, it also dramatically increases the risk of substantial losses, particularly for inexperienced traders.

Platform Options and Technology

Monzaee Capital provides the MetaTrader 5 platform. This is a well-established and feature-rich trading interface used by many brokers worldwide. MT5 offers advanced charting capabilities, automated trading support, and multiple order types.

Geographic Restrictions

Specific information about geographic restrictions and regional limitations is not clearly outlined in available documentation. This represents another transparency concern for potential international clients.

Customer Service Languages

Details about supported languages for customer service are not specified in available information. This may create communication barriers for non-English speaking traders.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by Monzaee Capital present a mixed picture that ultimately favors caution over opportunity. While the broker advertises competitive spreads starting from 0 pips and high leverage up to 1000:1, the lack of transparency regarding account types, minimum deposits, and specific terms significantly undermines the overall value proposition.

Available information does not detail the various account tiers or their specific features. This makes it impossible for traders to understand what services they would receive at different investment levels. The absence of minimum deposit information prevents potential clients from planning their initial investment, while the lack of commission structure details makes it difficult to calculate true trading costs.

The account opening process is not clearly documented in available sources. This raises concerns about the broker's operational transparency. Additionally, there is no mention of specialized account types such as Islamic accounts for Muslim traders, suggesting limited accommodation for diverse client needs.

When compared to regulated brokers that provide comprehensive account information and transparent fee structures, Monzaee Capital falls significantly short of industry standards. This Monzaee Capital review emphasizes that the lack of regulatory oversight makes any account conditions potentially risky, regardless of their apparent attractiveness.

Monzaee Capital's offering of tools and resources appears limited based on available information. While the broker provides access to the MT5 platform, which includes built-in technical analysis tools and charting capabilities, there is insufficient detail about additional trading tools, market analysis resources, or educational materials.

The absence of information about proprietary trading tools, market research, or analytical resources suggests that traders would primarily rely on the standard MT5 features without enhanced broker-specific additions. This limitation may disadvantage traders who require comprehensive market analysis or advanced trading tools for their strategies.

Educational resources, which are crucial for trader development, are not mentioned in available documentation. The lack of educational materials, webinars, or training programs indicates that Monzaee Capital may not prioritize client education and development, which is a significant shortcoming for a modern forex broker.

Automated trading support through MT5 is available. However, there is no specific information about the broker's policies regarding expert advisors (EAs) or algorithmic trading. This uncertainty may concern traders who rely on automated strategies for their trading activities.

Customer Service and Support Analysis (6/10)

According to available information, Monzaee Capital claims to provide 24/7 customer support services. This represents a positive aspect of their service offering. However, the lack of detailed information about support channels, response times, and service quality makes it difficult to assess the actual effectiveness of their customer service operations.

The absence of specific information about available communication channels (such as live chat, email, or phone support) raises questions about accessibility and convenience for traders who need assistance. Additionally, there is no information about multilingual support, which could create barriers for international clients.

Response time guarantees and service level agreements are not mentioned in available documentation. This makes it impossible to set expectations for support quality. The lack of user feedback about customer service experiences further compounds the uncertainty about service reliability.

Without regulatory oversight to ensure minimum service standards, traders cannot rely on external protection if customer service proves inadequate. This regulatory gap significantly impacts the overall assessment of customer support quality and reliability.

Trading Experience Analysis (6/10)

The trading experience offered by Monzaee Capital centers around the MT5 platform. This is generally regarded as a robust and feature-rich trading interface. The platform provides advanced charting capabilities, multiple order types, and support for automated trading strategies, which can enhance the overall trading experience for experienced users.

The advertised spreads starting from 0 pips and high leverage up to 1000:1 may appeal to traders seeking aggressive trading conditions. However, the lack of information about execution quality, slippage rates, and order processing speed makes it difficult to assess the actual trading environment quality.

Platform stability and performance data are not available in public sources. This creates uncertainty about the reliability of the trading infrastructure. Additionally, there is no specific information about mobile trading capabilities or the quality of mobile platform implementations.

The absence of user reviews and feedback about actual trading experiences represents a significant information gap. Without verified user experiences, potential traders cannot gauge whether the advertised trading conditions translate into satisfactory real-world performance. This Monzaee Capital review notes that the lack of transparency about trading execution quality is particularly concerning given the unregulated status of the broker.

Trust and Reliability Analysis (3/10)

The trust and reliability assessment of Monzaee Capital reveals serious concerns that significantly impact its overall credibility. The broker's registration in The Autonomous Island of Anjouan, Union of Comoros, provides minimal regulatory protection and is widely recognized in the industry as a jurisdiction that offers limited oversight and consumer protection.

The lack of regulation by major financial authorities means that trader funds are not protected by investor compensation schemes or segregated account requirements that are standard in properly regulated environments. This absence of fundamental protections creates substantial risks for trader capital and operational security.

Multiple industry sources have identified potential scam risks associated with Monzaee Capital. This represents a critical red flag for potential clients. The combination of offshore registration, lack of regulatory oversight, and industry warnings creates a high-risk environment that is unsuitable for most retail traders.

The broker's transparency regarding fund security measures, operational procedures, and corporate governance is insufficient based on available information. Without proper regulatory requirements for disclosure and operational standards, traders have limited insight into the broker's actual business practices and financial stability.

Company transparency regarding ownership structure, financial statements, and operational history is notably lacking. This further undermines confidence in the broker's legitimacy and long-term viability.

User Experience Analysis (5/10)

The user experience evaluation of Monzaee Capital is hampered by the lack of comprehensive user feedback and detailed information about the broker's interface design and operational procedures. While the MT5 platform provides a familiar and feature-rich trading environment, the overall user journey from registration to active trading lacks sufficient documentation.

Account registration and verification processes are not clearly outlined in available sources. This creates uncertainty about the onboarding experience for new clients. The absence of detailed information about required documentation, verification timelines, and account activation procedures may lead to frustration for prospective traders.

The lack of information about deposit and withdrawal processes significantly impacts the user experience assessment. Funding and withdrawal procedures are critical components of the overall trading experience. Without clear guidelines about payment methods, processing times, and potential fees, users cannot properly plan their trading activities.

User interface design and platform customization options beyond the standard MT5 features are not documented. This suggests limited broker-specific enhancements to improve user experience. The absence of user testimonials and experience reports makes it impossible to verify whether the broker delivers on its service promises.

The overall user experience is further complicated by the regulatory concerns and industry warnings. These create an environment of uncertainty and risk that overshadows any potential positive aspects of the trading platform or services.

Conclusion

This comprehensive Monzaee Capital review reveals a broker that presents significant risks that outweigh its potentially attractive trading conditions. While the broker offers high leverage up to 1000:1, competitive spreads starting from 0 pips, and access to the MT5 platform, these features are overshadowed by serious regulatory and transparency concerns.

The broker's registration in The Autonomous Island of Anjouan provides minimal regulatory protection. Industry sources have identified potential scam risks that make Monzaee Capital unsuitable for most retail traders. The lack of transparency regarding account conditions, deposit/withdrawal methods, and operational procedures further compounds these concerns.

Based on our analysis, Monzaee Capital is not recommended for ordinary retail traders seeking a reliable and secure trading environment. The broker may only be considered by extremely high-risk investors who fully understand and accept the substantial risks associated with unregulated offshore brokers. Even this limited recommendation comes with strong cautions about potential fund security issues.