Regarding the legitimacy of ManCu forex brokers, it provides SCB and WikiBit, (also has a graphic survey regarding security).

Is ManCu safe?

Pros

Cons

Is ManCu markets regulated?

The regulatory license is the strongest proof.

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Pepperstone Markets Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Pineapple House, Old Fort Bay, Western Road, Nassau, BahamasPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Mancu A Scam?

Introduction

Mancu, a relatively new player in the forex market, was established in 2015 and is headquartered in Australia. It offers a range of trading services, including forex, indices, and stock indices, with leverage options that can go as high as 400:1. As with any financial trading platform, it is crucial for traders to conduct thorough due diligence before engaging with Mancu. The forex market is rife with opportunities, but it also harbors risks, including the presence of potentially fraudulent brokers. This article aims to provide a comprehensive analysis of Mancu's legitimacy, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The findings are based on a detailed review of available online resources, including broker reviews and regulatory databases.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Mancu claims to be regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States, which oversees compliance with anti-money laundering and financial crime prevention regulations. However, it is important to note that Mancu is marked as “unauthorized” by the National Futures Association (NFA), which raises red flags regarding its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | 31000264986754 | United States | Regulated |

| NFA | - | United States | Unauthorized |

The dual regulatory status presents a mixed picture. While FinCEN's oversight indicates that Mancu adheres to specific financial regulations, the NFA's classification as unauthorized suggests that Mancu may not meet the more stringent requirements expected of forex brokers in the U.S. This discrepancy highlights potential risks for traders, as dealing with an unauthorized broker can lead to issues related to fund security and trade execution.

Company Background Investigation

Mancu Markets Limited was founded in 2015 and has since positioned itself as a financial trading platform catering to various trading instruments. The companys ownership structure and management team details are not extensively publicized, which can hinder transparency and trust. The lack of information about the management team raises concerns regarding their experience and qualifications in the financial sector.

Transparency is a crucial factor for any trading platform, as it fosters trust among users. Mancu's website provides limited information about its operations, which could be a red flag for potential clients. The absence of a clear outline of the company's ownership and management team may lead to skepticism among traders who prefer to engage with brokers that offer comprehensive information about their leadership and corporate governance.

Trading Conditions Analysis

Mancu offers a competitive trading environment with various instruments, including over 80 forex pairs, commodities, and indices. The broker provides two types of spreads: variable spreads with no commission and ECN spreads starting from 0.1 pips with a fixed fee of $10 per trade. However, the absence of a specified minimum deposit requirement can be concerning for new traders.

| Fee Type | Mancu | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | $10 per trade | $5 - $10 per trade |

| Overnight Interest Range | Not Specified | 0.5% - 2.0% |

Although Mancus spreads seem competitive, the lack of clarity regarding its commission structure and overnight interest rates can deter potential clients. Traders should be cautious of any hidden fees that may arise during their trading activities, as these could significantly impact profitability.

Customer Fund Safety

Fund safety is paramount in the forex trading realm. Mancu claims to implement measures for protecting client funds, including segregation of accounts. However, there is limited information available regarding the specifics of these safety measures. The absence of details about investor protection schemes or negative balance protection policies could be a cause for concern.

In the past, there have been instances where brokers with similar regulatory statuses faced issues regarding fund safety and client compensation. Therefore, potential clients should evaluate Mancu's fund safety protocols critically before committing any capital.

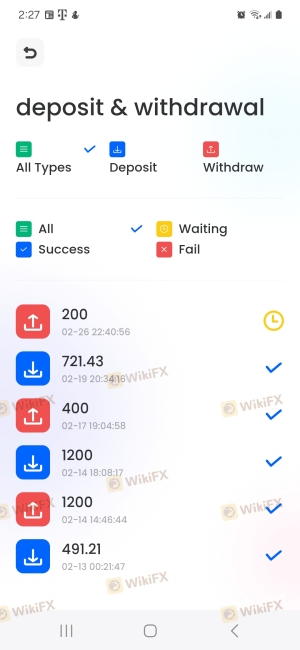

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a brokers reliability. Reviews of Mancu indicate a mix of experiences, with some users praising the platform's ease of use, while others express concerns over customer service and withdrawal processes. Common complaints include difficulties in accessing funds and slow response times from customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Customer Support Issues | Medium | Inconsistent |

Several users have reported that they faced challenges when trying to withdraw funds, leading to frustration and dissatisfaction. These issues can be detrimental to a brokers reputation, as the ability to withdraw funds is a critical aspect of the trading experience.

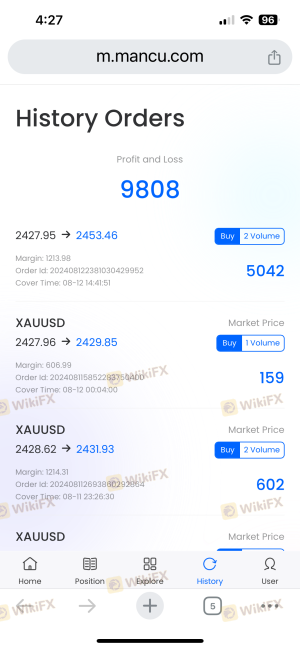

Platform and Execution

Mancu utilizes its proprietary trading platform, MancuFX6, which lacks the popularity of industry-standard platforms like MetaTrader 4 or 5. While the platform is designed for mobile and desktop use, its performance and user experience have received mixed reviews. Some traders have reported issues with order execution, including slippage and order rejections.

The quality of trade execution is a significant factor for traders, as delays or failures in order processing can lead to substantial financial losses. It is essential for potential clients to consider the platform‘s reliability and the broker’s overall execution quality before opening an account.

Risk Assessment

Trading with Mancu presents various risks that traders should be aware of. The combination of its regulatory status, customer complaints, and platform performance contributes to an overall risk profile that potential clients should carefully evaluate.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unauthorized status with NFA raises concerns. |

| Fund Safety Risk | Medium | Limited information on fund protection measures. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders should only invest what they can afford to lose and consider using risk management tools, such as stop-loss orders, to protect their capital.

Conclusion and Recommendations

In conclusion, while Mancu markets itself as a regulated broker, its status with the NFA as unauthorized raises significant concerns about its legitimacy. The lack of transparency regarding its management team, coupled with mixed customer experiences and potential fund safety issues, suggests that traders should exercise caution.

For those considering trading with Mancu, it is advisable to conduct thorough research and perhaps look for alternative brokers with a stronger regulatory framework and better customer reviews. Recommended alternatives would include brokers regulated by top-tier authorities such as the FCA or ASIC, which typically offer greater security and reliability. Ultimately, traders should prioritize safety and transparency when selecting a forex broker to ensure a positive trading experience.

Is ManCu a scam, or is it legit?

The latest exposure and evaluation content of ManCu brokers.

ManCu Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ManCu latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.