Is Mega Capitals safe?

Business

License

Is Mega Capitals Safe or a Scam?

Introduction

Mega Capitals, a broker operating in the forex market, has garnered attention for its aggressive marketing strategies and promises of high returns on investments. As with any trading platform, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and safety of the broker before committing their funds. The forex market, while offering lucrative opportunities, is also fraught with risks, particularly when it comes to unregulated brokers. This article will analyze whether Mega Capitals is a safe trading option or if it operates as a scam. The evaluation will be based on a comprehensive investigation of the broker's regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulatory and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. Brokers operating under strict regulatory frameworks are generally considered safer, as they are required to adhere to stringent financial standards and provide investor protection. In the case of Mega Capitals, the information gathered indicates that it is not regulated by any recognized financial authority. This lack of regulation raises significant concerns regarding the broker's operations and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that traders using Mega Capitals have limited recourse in case of disputes or issues with fund withdrawals. Furthermore, the broker has been flagged by various regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, which has issued warnings against dealing with unregulated firms like Mega Capitals. This lack of regulation and oversight is a major red flag, prompting the question: Is Mega Capitals safe? The answer leans towards caution, as unregulated brokers can operate without accountability, potentially putting investors' funds at risk.

Company Background Investigation

Understanding the company behind a trading platform is essential in assessing its credibility. Mega Capitals claims to be based in the UK; however, there is a lack of verifiable information regarding its ownership structure and operational history. The broker does not provide details about its management team or their professional backgrounds, which further adds to the opacity surrounding its operations.

The absence of transparency in ownership and management raises concerns about the broker's legitimacy. Reliable brokers typically disclose information about their founders and key personnel, providing potential clients with insight into their expertise and experience in the financial industry. In contrast, Mega Capitals appears to lack this level of transparency, which prompts further scrutiny into its operational practices.

Moreover, the company's website does not contain sufficient information about its registration or compliance with financial regulations, leading to doubts about its authenticity. This lack of transparency raises the question: Is Mega Capitals safe? The answer remains uncertain, as the absence of clear ownership and regulatory compliance suggests that traders should approach this broker with caution.

Trading Conditions Analysis

When evaluating a broker, it's essential to consider the trading conditions it offers, including fees, spreads, and commission structures. Mega Capitals presents various account types with enticing promises of high returns on investments. However, these offers often come with hidden fees and unfavorable trading conditions that can significantly impact a trader's profitability.

| Fee Type | Mega Capitals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | Unfavorable | Favorable |

The trading fees associated with Mega Capitals appear to be higher than the industry average, which can erode potential profits. Additionally, the commission model is not clearly defined, leaving traders uncertain about the costs they may incur while trading. Such ambiguities in fee structures can be detrimental, especially for new traders who may not fully understand the implications of these costs.

Moreover, the broker's high promised returns, such as 30% to 70% weekly, raise skepticism regarding their sustainability. These types of offers can often be indicative of a Ponzi scheme, where returns are paid out from new investors' deposits rather than legitimate trading profits. Therefore, it is imperative for traders to ask themselves: Is Mega Capitals safe? Given the lack of clarity in its trading conditions and the potential for hidden fees, caution is warranted.

Client Fund Security

The safety of client funds is paramount when assessing the reliability of a trading platform. Mega Capitals does not provide sufficient information regarding its security measures or policies for safeguarding client funds. In regulated environments, brokers are typically required to maintain client funds in segregated accounts, ensuring that they are protected in the event of the broker's insolvency.

However, with Mega Capitals being unregulated, there is no assurance that client funds are kept secure. The absence of investor protection schemes, such as those offered by regulatory bodies like the Financial Services Compensation Scheme (FSCS) in the UK, further exacerbates the risk to client funds. Historical records indicate that many unregulated brokers have faced allegations of mismanaging client funds or engaging in fraudulent activities.

Given these factors, it is critical to evaluate the question: Is Mega Capitals safe? The lack of transparency regarding fund security measures and the absence of regulatory oversight suggest that clients may be exposed to significant risks when trading with Mega Capitals.

Customer Experience and Complaints

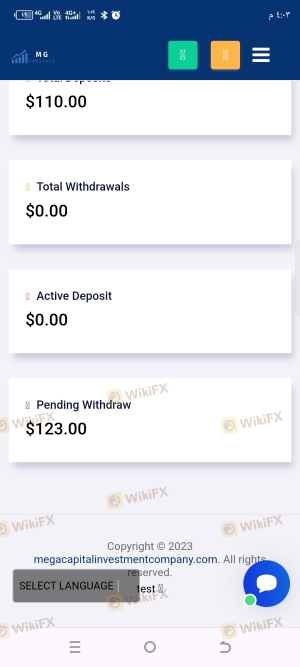

Customer feedback is a vital component in assessing a broker's reputation and reliability. Reviews and testimonials about Mega Capitals reveal a pattern of negative experiences, with many users reporting difficulties in withdrawing funds and a lack of responsive customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inadequate |

| Transparency Concerns | High | Non-Responsive |

Many users have expressed frustration over prolonged withdrawal processes, where requests are either delayed or denied altogether. Such experiences are indicative of a potentially fraudulent operation, as legitimate brokers typically facilitate smooth withdrawal processes for their clients.

A few notable cases highlight the challenges faced by users of Mega Capitals. In one instance, a trader reported being unable to withdraw their funds for several months, despite repeated requests. Another user claimed that their account was suddenly suspended without explanation, leaving them unable to access their investments. These troubling accounts raise the question: Is Mega Capitals safe? The overwhelming negative feedback suggests that traders should exercise extreme caution when considering this broker.

Platform and Execution Quality

The performance and reliability of a trading platform are crucial for a successful trading experience. Mega Capitals claims to offer a proprietary trading platform; however, reviews indicate that users have experienced issues with platform stability and execution quality.

Traders have reported instances of slippage during high volatility periods, where orders are executed at prices significantly different from the expected rates. Additionally, there are concerns regarding the rejection of orders, which can severely impact trading outcomes. Such issues can be indicative of poor platform management and may suggest potential manipulation, leading to further skepticism about the broker's integrity.

When assessing the question: Is Mega Capitals safe? The reports of execution issues and platform instability raise serious concerns about the reliability of Mega Capitals' trading environment.

Risk Assessment

Engaging with any trading platform comes with inherent risks, and Mega Capitals is no exception. The following risk assessment summarizes the key areas of concern associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of transparency regarding fund protection measures. |

| Withdrawal Risk | High | Reports of delayed or denied withdrawals. |

| Execution Risk | Medium | Issues with order execution and slippage. |

Given these risks, it is crucial for traders to consider mitigation strategies. One recommendation is to start with a minimal investment to assess the platform's reliability before committing larger sums. Additionally, traders should conduct thorough research into alternative brokers with robust regulatory frameworks to ensure the safety of their investments.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the safety and legitimacy of Mega Capitals. The lack of regulatory oversight, transparency in operations, and negative customer experiences suggest that this broker may not be a safe option for traders.

For those considering trading with Mega Capitals, it is advisable to proceed with caution. Traders should explore alternative, regulated brokers that offer better protection for their funds and more transparent trading conditions. Ultimately, the question remains: Is Mega Capitals safe? Based on the analysis presented, it is prudent to view this broker with skepticism and consider other reliable options in the forex market.

For traders seeking safer alternatives, consider brokers that are regulated by reputable authorities such as the FCA, ASIC, or CySEC, which provide a higher level of security and accountability.

Is Mega Capitals a scam, or is it legit?

The latest exposure and evaluation content of Mega Capitals brokers.

Mega Capitals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Mega Capitals latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.