Mabicon 2025 Review: Everything You Need to Know

Executive Summary

This detailed mabicon review looks at a new forex broker that started working in South Africa in 2022. Mabicon works under rules from the Financial Sector Conduct Authority (FSCA) in South Africa and gives access to more than 1,700 markets across different types of investments. The broker says it helps both regular people and big companies invest money, using the popular MT5 trading platform and offering zero-commission trading.

But our study shows big problems with how reliable the broker is. With a current user rating of 4.53/10, Mabicon gets a lot of criticism from traders, especially about withdrawal problems and poor customer service. The broker does offer many trading options and follows South African rules, but the bad feedback about getting money out has hurt its reputation badly.

The broker's main selling points are access to 1,700+ markets, MT5 platform, and no commission fees. But these good things are overshadowed by constant user complaints about withdrawal problems and poor customer support, making it a risky choice for traders who want reliable fund management and good customer service.

Important Notice

Regulatory Jurisdiction Differences: Mabicon is registered and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. The broker's legal status and regulatory compliance in other places outside South Africa have not been clearly established in available documents. Traders from other regions should check local regulatory acceptance before using this platform.

Review Methodology Disclaimer: This evaluation uses publicly available information, user feedback, and regulatory data current as of the review date. Information accuracy and timing may vary, and traders should do independent verification of all details before making investment decisions. Market conditions and broker policies may change after publication.

Rating Framework

Broker Overview

Mabicon started in the forex trading world in 2022 as a South Africa-based company that specializes in CFD trading services. The company has positioned itself as a multi-asset broker targeting both regular people and big companies who want exposure to global financial markets. Even though it started recently, Mabicon has tried to stand out through an extensive asset offering and competitive pricing structure.

The broker operates mainly through a web-based business model, focusing on providing direct market access to international trading opportunities. Mabicon's business strategy centers on offering a complete trading environment that combines traditional forex pairs with broader market access including commodities and other financial instruments.

The company's operational framework is built around the MetaTrader 5 platform, which serves as the main trading interface for clients. This platform choice shows Mabicon's attempt to provide professional-grade trading tools while staying accessible for regular traders. The broker offers access to over 1,700 different markets, spanning multiple asset classes including foreign exchange, commodities, and other financial instruments. Regulatory oversight is provided by the South African Financial Sector Conduct Authority (FSCA), which establishes the legal framework for the broker's operations within South African territory.

Regulatory Jurisdiction: Mabicon operates under the supervision of the South African Financial Sector Conduct Authority (FSCA), which provides regulatory compliance and oversight for the broker's operations within South African territory. This regulatory framework establishes basic investor protection standards and operational guidelines.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods has not been detailed in available documentation. This lack of transparency about payment processing options represents a significant information gap for potential clients.

Minimum Deposit Requirements: The minimum deposit requirement for opening a trading account with Mabicon has not been specified in available documentation, creating uncertainty for traders planning their initial investment.

Bonus and Promotional Offers: Available documentation does not mention specific bonus programs or promotional offers provided by Mabicon to new or existing clients.

Tradeable Assets: Mabicon provides access to over 1,700 different markets, including foreign exchange pairs, commodities, and other financial instruments. This extensive asset selection represents one of the broker's main competitive advantages in terms of market diversity.

Cost Structure: The broker advertises spreads starting from 0 pips with a zero-commission trading model. However, specific details about markup structures, overnight financing costs, and other potential fees have not been fully detailed in available documentation.

Leverage Ratios: Specific leverage ratios offered by Mabicon have not been mentioned in available documentation, leaving traders uncertain about available margin trading options.

Platform Options: Mabicon supports the MetaTrader 5 (MT5) trading platform, which provides complete charting tools, technical analysis capabilities, and automated trading support suitable for various trading strategies and experience levels.

Geographic Restrictions: Specific geographic restrictions or country limitations have not been detailed in available documentation.

Customer Service Languages: Available customer service languages have not been specified in available documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Mabicon's account conditions present several concerning aspects that significantly impact the overall trading experience. The main issue affecting this mabicon review relates to the lack of transparency about basic account information such as minimum deposit requirements and account type specifications. This information gap creates uncertainty for potential clients trying to evaluate whether the broker's offerings align with their trading capital and strategy requirements.

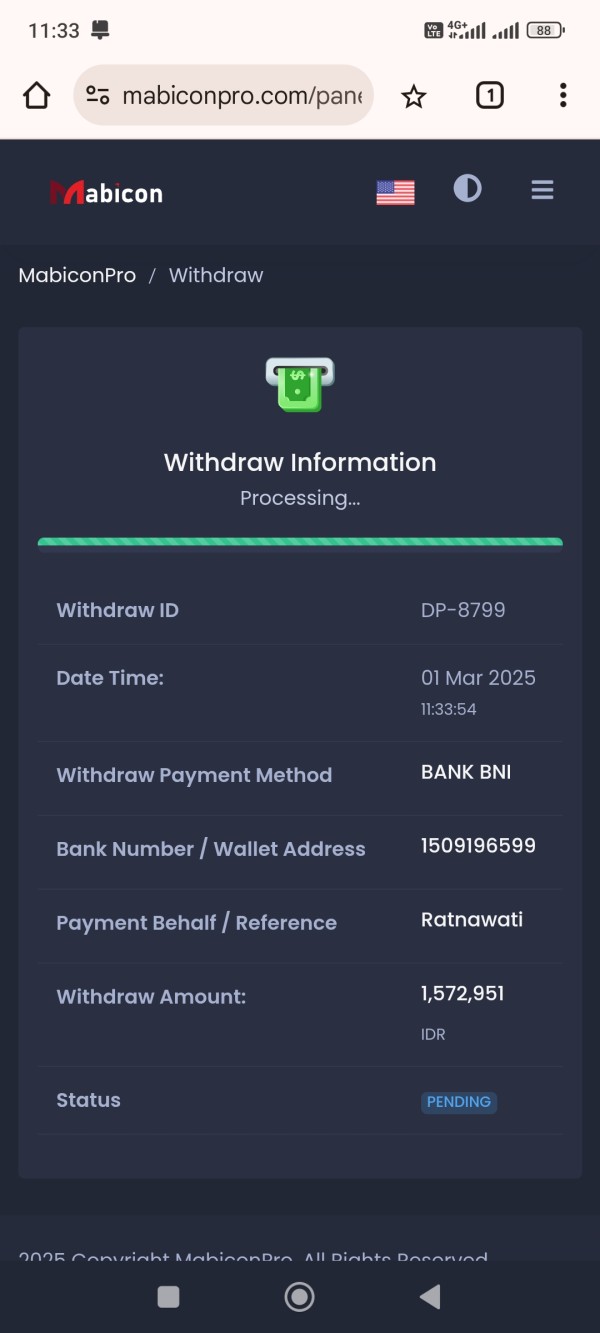

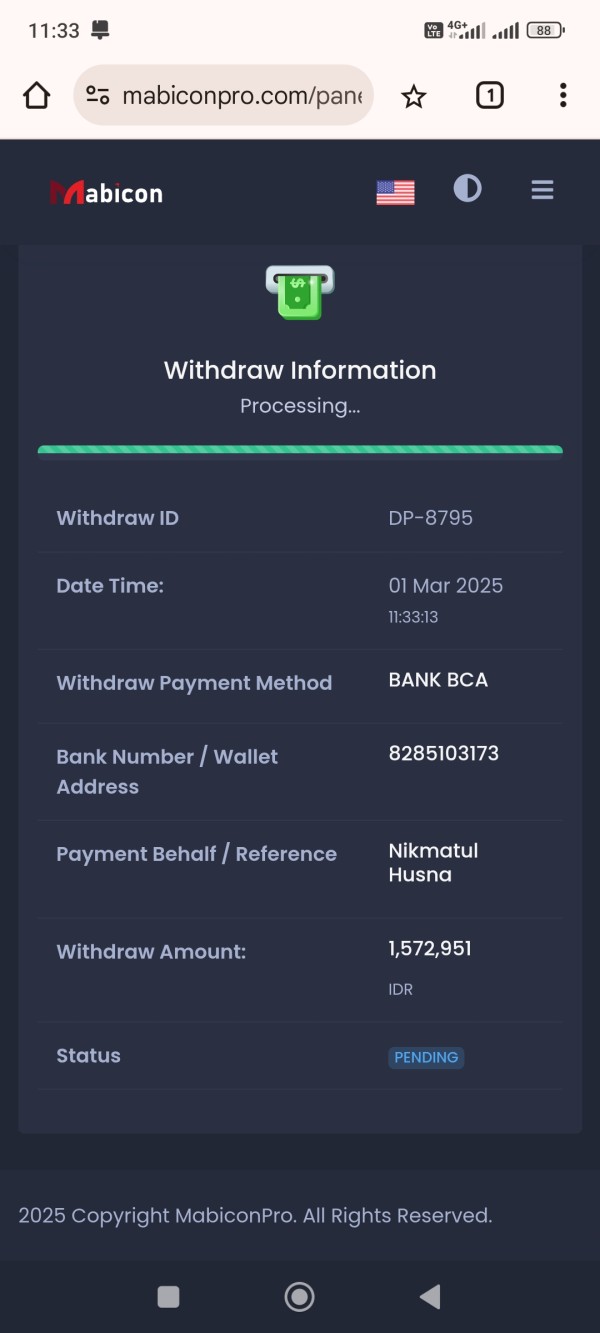

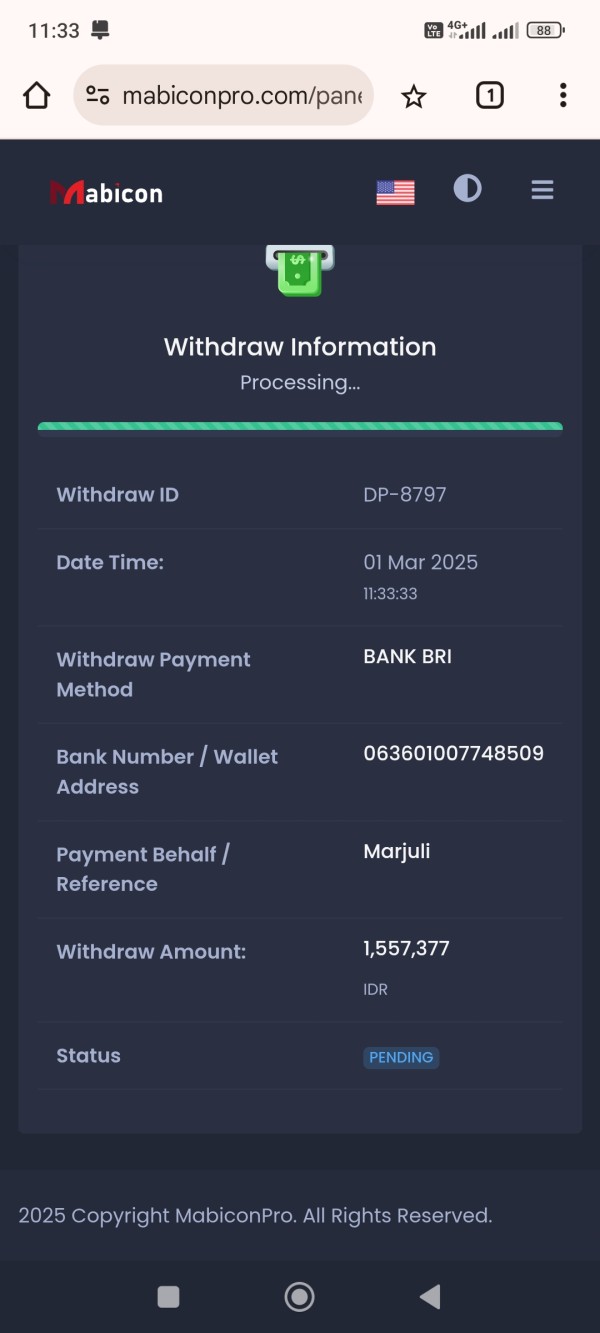

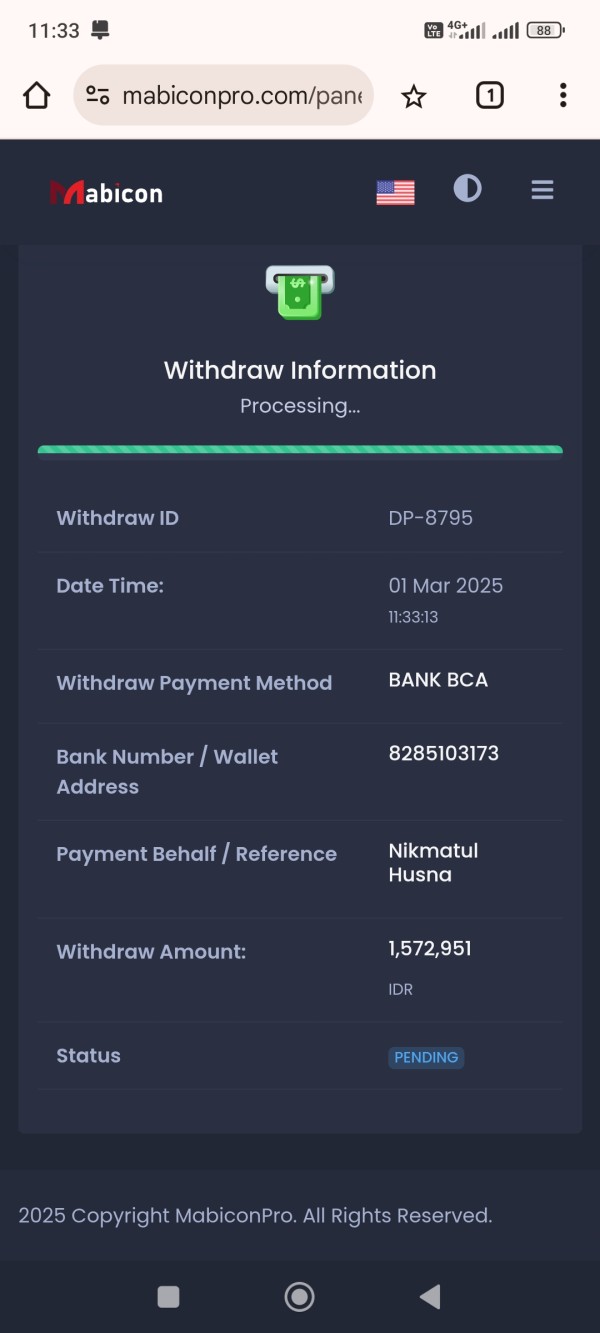

User feedback consistently highlights withdrawal processing problems as a major concern. Multiple traders have reported difficulties in accessing their funds, with some describing long delays and unresponsive communication during withdrawal requests. These issues fundamentally undermine the basic expectation that traders should have reliable access to their capital.

The absence of detailed information about account opening procedures, verification requirements, and special account features such as Islamic accounts further reduces the attractiveness of Mabicon's account conditions. When compared to established brokers in the industry, Mabicon's lack of transparency about these fundamental aspects places it at a significant disadvantage. The combination of withdrawal issues and limited account information transparency justifies the below-average rating for this category.

Mabicon shows strength in its trading tools and platform resources, mainly through its integration with the MetaTrader 5 platform. MT5 provides complete charting capabilities, technical analysis tools, and support for automated trading strategies through Expert Advisors. The platform's robust functionality includes advanced order types, multiple timeframe analysis, and extensive indicator libraries that cater to both new and experienced traders.

The broker's access to over 1,700 different markets represents a significant resource advantage, providing traders with diverse opportunities across multiple asset classes. This extensive market coverage allows for portfolio diversification and enables traders to capitalize on various global market movements within a single platform environment.

However, available documentation does not detail additional research and analysis resources, educational materials, or proprietary trading tools that might enhance the trading experience beyond the standard MT5 offerings. The absence of information about market research, daily analysis, or educational content suggests that Mabicon may rely mainly on the MT5 platform's built-in capabilities rather than providing value-added research services. Despite these limitations, the solid foundation provided by MT5 and extensive market access justifies a good rating in this category.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of Mabicon's most significant weaknesses based on available user feedback and documentation. The main concern centers on poor responsiveness to client inquiries, particularly about withdrawal processing and account-related issues. Multiple user reports indicate extended response times and inadequate resolution of customer concerns.

The most damaging aspect of Mabicon's customer service performance relates to withdrawal support. Users have reported difficulties in obtaining timely assistance when experiencing withdrawal delays or processing issues. This fundamental failure in customer support directly impacts trader confidence and satisfaction, as reliable fund access is a basic expectation in forex trading.

Available documentation does not specify customer service channels, operating hours, or multilingual support options, suggesting limited investment in complete customer support infrastructure. The absence of detailed contact information or support methodology further undermines confidence in the broker's commitment to customer service excellence. The combination of poor user feedback about responsiveness and lack of transparent support infrastructure justifies the poor rating in this critical category.

Trading Experience Analysis (Score: 5/10)

The trading experience with Mabicon, as detailed in this mabicon review, presents a mixed picture of capabilities and concerns. The MetaTrader 5 platform provides a solid foundation for trading activities, offering professional-grade charting, analysis tools, and order execution capabilities. The platform's stability and complete feature set contribute positively to the overall trading environment.

Mabicon's advertised spreads starting from 0 pips and zero-commission structure appear competitive on paper. However, user feedback suggests that actual trading conditions may not consistently meet these advertised standards. Some traders have reported concerns about execution quality and pricing transparency during active trading periods.

The broker's access to 1,700+ markets provides extensive trading opportunities, allowing for strategy diversification and market exposure across multiple asset classes. However, the lack of detailed information about mobile trading capabilities, platform customization options, and advanced trading features limits the complete evaluation of the trading experience.

User feedback indicates mixed experiences with platform performance and execution quality, with some traders expressing satisfaction with basic trading functionality while others report concerns about reliability during volatile market conditions. The average rating reflects the platform's basic competency balanced against execution and reliability concerns reported by users.

Trust and Safety Analysis (Score: 2/10)

Trust and safety represent critical concerns for Mabicon based on available information and user feedback. While the broker maintains regulation under the South African Financial Sector Conduct Authority (FSCA), this regulatory framework provides limited protection compared to more strict jurisdictions, and the broker's short operational history since 2022 raises questions about long-term stability and reliability.

The most significant trust concern stems from multiple user reports describing withdrawal difficulties and potential scam warnings circulating in trading communities. These reports suggest systematic issues with fund access that go beyond normal processing delays, indicating potential operational or intentional barriers to client fund withdrawal.

Available documentation does not detail specific fund safety measures, segregated account structures, or insurance protections that would typically enhance client confidence in fund security. The absence of transparency about these critical safety measures, combined with the broker's recent establishment and negative user feedback, creates substantial trust concerns.

Third-party reviews and community discussions frequently mention red flags and caution warnings about Mabicon's operations. The combination of withdrawal issues, limited operational history, and negative community feedback significantly undermines trust in the broker's reliability and safety. The very poor rating reflects these fundamental concerns about the broker's trustworthiness and client fund safety.

User Experience Analysis (Score: 4/10)

Overall user satisfaction with Mabicon remains below industry standards, as reflected in the 4.53/10 user rating and multiple negative reviews across various platforms. The user experience is significantly impacted by withdrawal processing issues, which represent the most frequently cited complaint among Mabicon clients.

While specific interface design and usability information has not been detailed in available documentation, the MetaTrader 5 platform provides a familiar and functional trading environment for users experienced with this platform. However, the positive aspects of platform usability are overshadowed by operational issues that affect the overall user experience.

The registration and account verification process details have not been specified in available documentation, preventing evaluation of onboarding efficiency and user-friendliness. However, user feedback consistently highlights fund withdrawal as the main source of frustration, with many traders expressing regret about their decision to trade with Mabicon.

Common user complaints center on withdrawal delays, poor customer service responsiveness, and concerns about fund safety. These operational issues significantly detract from any positive aspects of the trading platform or market access. For improvement, Mabicon would need to address withdrawal processing transparency, enhance customer service quality, and rebuild trust through consistent operational performance. The below-average rating reflects the significant gap between user expectations and actual service delivery.

Conclusion

This complete mabicon review reveals a broker with mixed capabilities and significant operational concerns. While Mabicon offers attractive features such as access to 1,700+ markets, MetaTrader 5 platform integration, and zero-commission trading, these advantages are substantially overshadowed by persistent withdrawal issues and poor customer service quality that have damaged user trust and satisfaction.

The broker may be suitable for experienced traders with high risk tolerance who prioritize market access diversity over operational reliability. However, the documented withdrawal difficulties and low user satisfaction ratings make Mabicon a concerning choice for most traders, particularly those prioritizing fund safety and reliable customer support.

The main advantages include extensive market selection and competitive pricing structure, while the major disadvantages center on withdrawal processing problems, poor customer service, and low overall user trust ratings. Potential clients should carefully consider these operational risks before committing funds to this platform.