Inefex foreign exchange brokers specializing in providing foreign exchange trading services, the company's official website https://www.inefex.com/, about the company's legal and temporary regulatory information, the company's address Suite 803, 8th floor, Hennessy Tower, Pope Hennessy Street, Port Louis.

Inefex Forex Broker

Basic Information

Mauritius

MauritiusCompany profile

Pros

Cons

Inefex Forex Broker - Complete Information Guide

1. Broker Overview

Inefex, officially known as Novir Markets Ltd, was established in 2020. The broker is headquartered in Port Louis, Mauritius, specifically located at Suite 803, 8th Floor, Hennessy Tower, Pope Hennessy Street, 11328. As a privately held entity, Inefex aims to cater to both retail and institutional clients, offering a variety of trading services in the financial markets.

The company primarily serves a global market, targeting traders interested in forex, commodities, indices, and cryptocurrencies. Throughout its brief history, Inefex has made strides to establish itself in the competitive online trading landscape, although it faces scrutiny due to its regulatory status and user complaints.

Inefex operates under the umbrella of Novir Markets Ltd, which claims to be regulated by the Financial Services Commission of Mauritius, holding license number GB 21026833. The business model of Inefex focuses on retail forex trading and CFDs, providing traders with access to various financial instruments.

2. Regulation and Compliance Information

Inefex operates within a regulatory framework that is often viewed as less stringent compared to other jurisdictions. The primary regulatory body overseeing its operations is the Financial Services Commission of Mauritius. However, concerns arise regarding the legitimacy and effectiveness of this regulation, as the Mauritius FSC does not impose rigorous oversight like other global regulatory authorities.

The license number for Inefex is GB 21026833, but the specifics of its validity and scope remain questionable. The broker claims to implement a client funds segregation policy, ensuring that traders' funds are kept separate from the company's operational funds. However, without a robust regulatory framework, the security of these funds cannot be guaranteed.

Inefex adheres to Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance measures, which are standard practices in the industry. These procedures aim to prevent fraudulent activities and ensure the identity of their clients is verified.

3. Trading Products and Services

Inefex offers a diverse range of trading products, including:

- Forex Currency Pairs: The broker provides access to a variety of forex pairs, although the exact number of available pairs is not specified.

- CFDs on Indices: Traders can speculate on major indices, allowing for diversified investment strategies.

- Commodity Trading: Inefex facilitates trading in popular commodities such as gold, silver, and oil.

- Stocks: Clients can trade CFDs on various stocks, representing ownership in different corporations.

- Cryptocurrencies: The broker also offers trading in major cryptocurrencies, capitalizing on the growing interest in digital assets.

While Inefex claims to update its product offerings regularly, specific details on new products or categories are not clearly outlined. The platform is primarily aimed at retail traders, but it also extends services to institutional clients, although specifics on institutional offerings are limited.

4. Trading Platforms and Technology

Inefex supports the MetaTrader 4 (MT4) trading platform, which is widely recognized in the trading community for its user-friendly interface and comprehensive tools. Additionally, the broker offers a proprietary web-based trading platform that allows for easy access via web browsers without the need for software downloads.

The mobile application is available for both iOS and Android, enabling traders to manage their accounts on the go. Inefex employs an ECN execution model, which is designed to provide faster order execution and better pricing.

The broker's trading infrastructure includes servers located in the United States, providing a reliable connection for trading activities. API access for automated trading is also supported, allowing traders to implement algorithmic trading strategies.

5. Account Types and Trading Conditions

Inefex offers several account types tailored to different trading needs:

- Basic Account: Requires a minimum deposit of €250 with variable spreads starting from 3.0 pips.

- Gold Account: Specific details are not provided, but it typically requires a higher minimum deposit.

- Platinum Account: Aimed at more experienced traders, requiring a substantial initial deposit.

- VIP Account: Designed for high-net-worth individuals, this account type offers premium trading conditions.

The leverage offered by Inefex can go up to 1:500, which allows traders to control larger positions with a smaller capital investment. However, such high leverage also increases the risk of significant losses. The minimum trade size and overnight fees are not explicitly stated.

6. Fund Management

Inefex supports various deposit methods, including:

- Bank Transfers

- Credit Cards (Visa, MasterCard)

- Electronic Wallets (like Skrill and Neteller)

The minimum deposit requirement varies by account type, starting at €250 for the basic account. Deposits are typically processed instantly for credit cards and within 2-5 business days for bank transfers. However, users have reported a 3.5% fee on both deposits and withdrawals, which can significantly impact trading profits.

Withdrawal methods include credit cards and bank transfers, with processing times ranging from 24 hours to several business days, depending on the method used. The broker imposes fees on withdrawals, particularly for lower-tier accounts.

7. Customer Support and Educational Resources

Inefex provides customer support through multiple channels, including:

- Phone Support: Available at +815030923008

- Email Support: Clients can reach out via info@inefex.com

- Live Chat: Accessible through their website for immediate assistance.

The support team is multilingual, covering languages such as English, Arabic, Japanese, Korean, Russian, and Spanish. The service operates around the clock to assist clients with their inquiries.

In terms of educational resources, Inefex offers a range of materials, including webinars, tutorials, and market analysis. They also provide trading tools such as calculators and economic calendars to help traders make informed decisions.

8. Regional Coverage and Restrictions

Inefex primarily serves clients globally, with a focus on markets in Europe and Asia. However, there are restrictions on some countries, particularly those with stringent regulatory environments or where the broker does not hold a license.

Specific countries where Inefex does not accept clients are not explicitly stated, but potential traders should conduct thorough research to confirm their eligibility. The broker's lack of transparency regarding its operational regions raises concerns for potential clients.

In conclusion, while Inefex broker presents a range of trading products and services, potential clients should exercise caution due to its regulatory status and the numerous complaints reported by users. It is crucial to conduct detailed research and consider alternatives that offer stronger regulatory protections and better user experiences.

Inefex Similar Brokers

Latest Reviews

FX3614974043

Malaysia

Inefex and the financial advisor are total scammer... can't withdraw money ... Stupid fucking inefex... Followed the advisor and made my money all lost... Lost my money there.. seriously a cheater...

Exposure

2025-01-13

jose489

Peru

I made an investment of 200 dollars and then an analyst called me and stopped calling me and they even downloaded all my investment balances in inefex and then they left me without any dollars and they still want to deposit more, it is a scam, don't fall for it.

Exposure

2023-12-11

Even Zh

Taiwan

A small amount of money in the early stage will make you earn a lot, but you won't be able to claim any of your earnings. Within just two weeks, I kept urging you to invest and increase your savings, telling you that you would definitely make a profit, and then calling on you to increase your funds in order to increase your margin and invest in more things. In the mid-term, you suddenly realize a significant loss in profits, even increasing from $10000 to $20000 overnight. Then you will receive a notification from the system that you need to increase the deposit to protect your account, otherwise it will be frozen? Then you will receive their finance manager saying that you need to pay a 20% investment tax in order to return the original investment amount of $20000 to you? And I also told you: only you have this opportunity, others don't? But I refused... and then the financial manager will tell you: he has tried his best to fight for you, but there is no way because the company does not agree? Then he will turn around and blame you, saying: You were asked to increase the margin back then, but you didn't do that, so now your account is in this situation? I replied to him, 'I don't have any extra money to invest anymore, and I also told you back then that it's beyond my ability and there's no way to increase it. But now you're blaming me instead?'? Why don't you pay the transaction tax for me first, and then deduct it from my investment amount and give it to me? But he couldn't answer? Just asking me to give him time, asking me to wait? I have all my savings in cash, and I can't withdraw any money when I make money? Because the financial manager will only tell you: after holding on until the end of the month, you can come out with the surplus in early August. Just wait a little longer and there won't be any problems? But in the end, not only was the invested capital gone, but tonight when I looked at it, the entire official website was shut down? Even the email sent out was returned? It's really shocking and dumbfounded

Exposure

2024-07-29

FX6807822552

Brazil

A friend had posted something about the company, and I did some research, and soon they called me. I joined the chat and gave a testimonial for 200 dollars; I even earned 1.79 on my own because I didn't have anyone's attention! I tried to withdraw the 201.79 dollars that were in my account! On 07/12/2024 and until today, 07/18/2024, I have had no response to anything, and they say it takes 3 days. Finally, someone named Anderson called me and said he was my consultant and asked inappropriate questions, but I ended up answering if I was married, but anyway, I ended up depositing more than 200 dollars with the hope of winning something! He said that. Netflix was hot and highly anticipated! I did everything he taught me, and when I went to sell, I ended up losing money, and the rest that was left in the Inefex account I couldn't withdraw! Because the first withdrawal has been stopped. Look, don't fall for that. I hope this testimonial helps someone!

Exposure

2024-07-19

FX3164455661

Turkey

I really suggest this company people who are want to earn money from investment. You can trust them

Positive

2023-05-18

Inefex

News

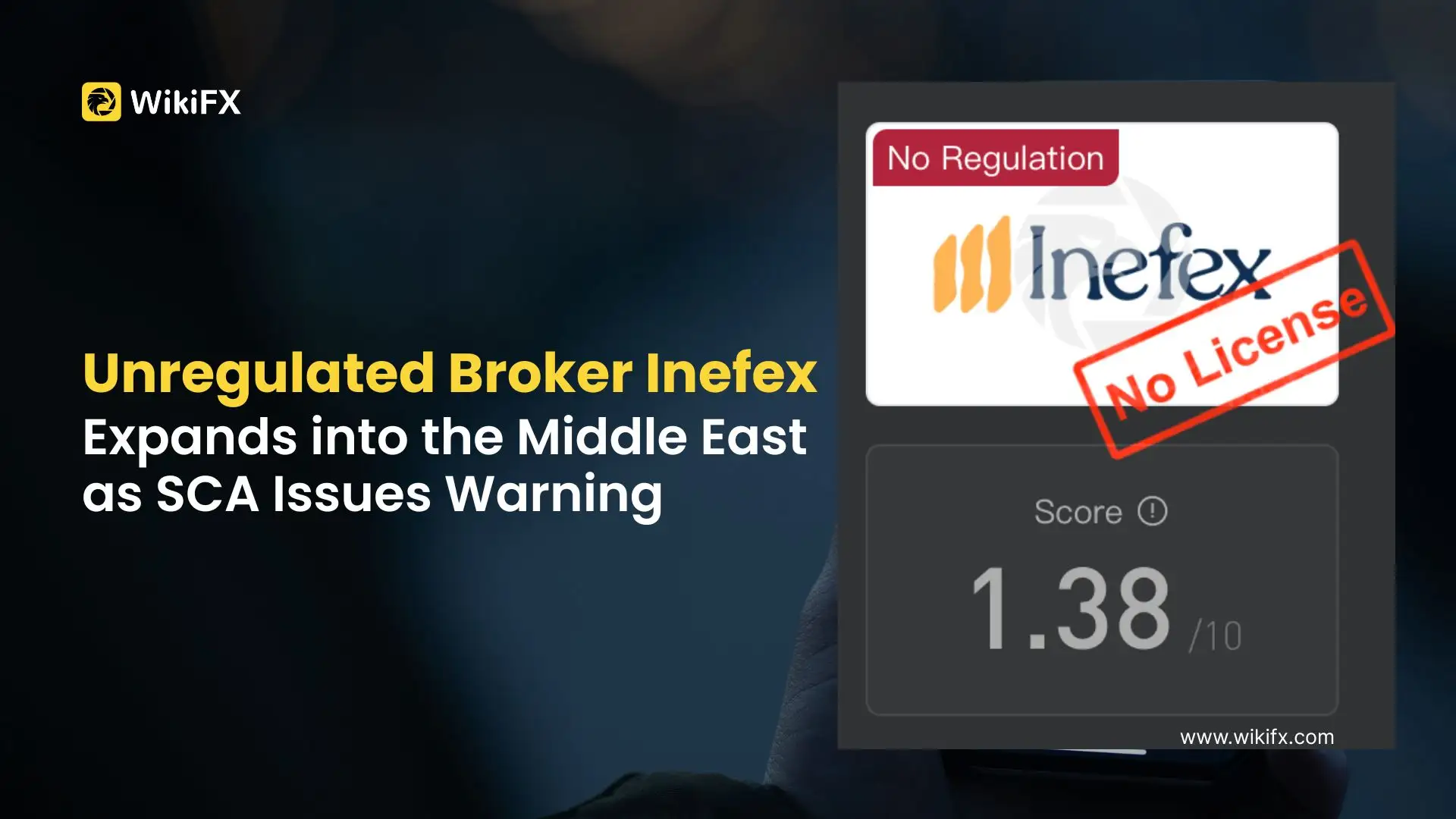

News Unregulated Broker Inefex Expands into the Middle East as SCA Issues Warning

The UAE’s Securities and Commodities Authority (SCA) has issued a warning against Inefex, an unregulated CFD broker linked to low ratings and multiple complaints on WikiFX.

Exposure Inefex: Mastering the Art of Duping Forex Investors

Fallen prey to high-return promises made by Inefex through social media and other platforms? Facing constant pressure from it to deposit funds despite consistent losses in trade? Most probably, Inefex has scammed you like many others. The constant foul play in its operation has been grabbing attention on forex broker review platforms. Check out some of their reviews.

Exposure Inefex Review: Unregulated Broker with Risky Withdrawal Issues

Inefex is an unregulated CFD broker with a poor reputation. Users report withdrawal issues, fraud, and scams. Avoid trading with this broker.

Exposure Something You Need to Know About Inefex

Inefex, a broker operating in the financial industry has faced scrutiny due to the absence of valid regulation and a suspicious regulatory license.

FX3157562345

Pakistan

I lost over $11,000 to this fake trading platform. This is not a legitimate trading company. They operate with fraudulent tactics: • First, they lure you with fake profits. • Then, their so-called “account managers” force you to deposit more.

Exposure

2025-08-07