Arena Capitals 2025 Review: Everything You Need to Know

Executive Summary

Arena Capitals presents itself as a multi-asset trading platform. Our comprehensive arena capitals review reveals significant concerns that potential traders must carefully consider before making any decisions. This broker operates without proper regulatory oversight. The lack of regulation immediately raises red flags about trader protection and fund security, which are essential for safe trading. Despite offering over 200 trading instruments across various asset classes including forex, commodities, indices, cryptocurrencies, and futures, the lack of regulatory compliance overshadows these apparent advantages.

The platform primarily targets traders seeking diversified trading opportunities across multiple markets. However, with a concerning user rating of just 2.6 out of 10, the broker's reputation among actual users tells a troubling story that cannot be ignored. The UK Financial Conduct Authority has issued warnings regarding Arena Capital Digital Trading Platforms. This warning further highlights the regulatory concerns surrounding this entity and its business practices. While the broker may appeal to those seeking variety in their trading portfolio, the substantial risks associated with unregulated operations make it unsuitable for most retail traders. This is particularly true for those prioritizing safety and regulatory protection above all other considerations.

Important Notice

This review is based on publicly available information and user feedback as of 2024. Arena Capitals operates without regulatory oversight, which means it may not comply with standard financial regulations that protect traders in various jurisdictions around the world. The regulatory landscape varies significantly across different regions. What may be permissible in one area could be prohibited in another, creating confusion for international traders.

Our assessment methodology incorporates multiple data sources, including regulatory warnings, user testimonials, and publicly disclosed company information. Given the unregulated nature of this broker, traders should exercise extreme caution and consider regulated alternatives that offer better protection and transparency for their investments.

Rating Framework

Broker Overview

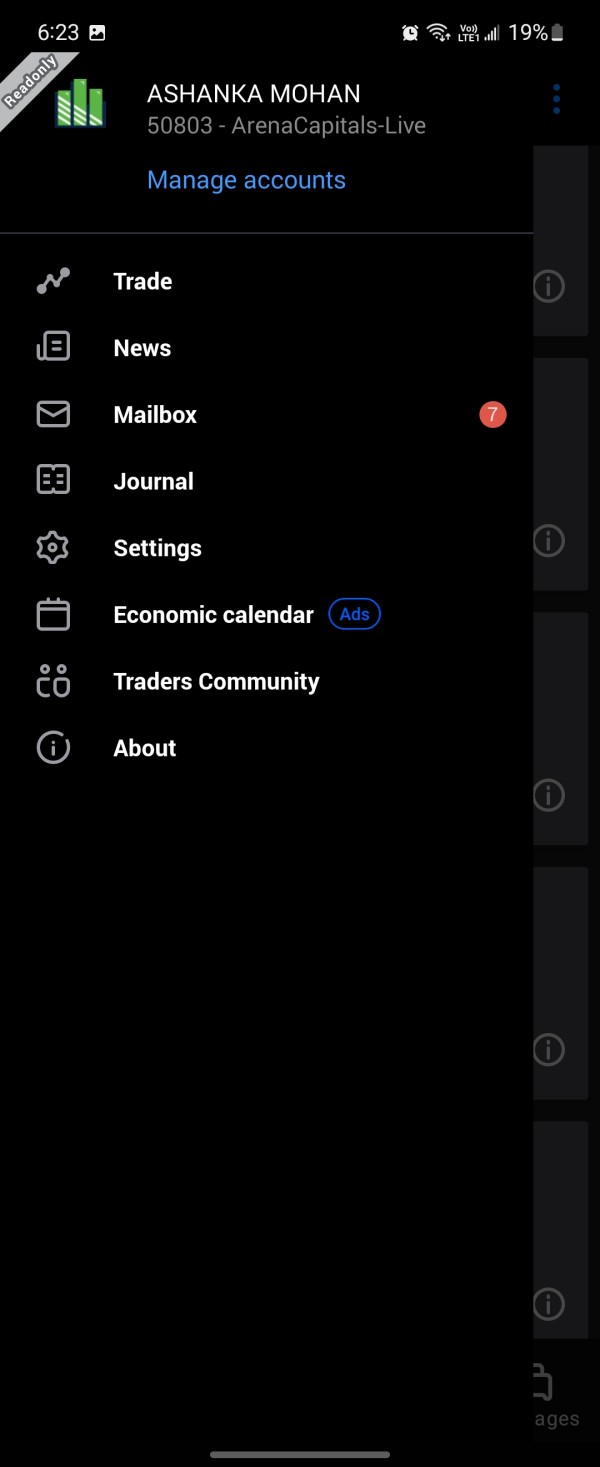

Arena Capitals positions itself as a comprehensive trading platform offering access to diverse financial markets. However, the company's background raises immediate concerns due to its unregulated status and associations with potentially fraudulent activities that have been reported by various sources. Reports suggest the broker engages in misleading advertising practices. This is particularly concerning given the lack of regulatory oversight that would normally prevent such behavior. The company's business model appears to target traders seeking portfolio diversification across multiple asset classes. The absence of proper licensing creates substantial risks for potential clients who may not understand these dangers.

The broker's primary appeal lies in its extensive instrument offering, covering traditional forex pairs, commodity futures, stock indices, precious metals, and various cryptocurrencies. This arena capitals review reveals that while the breadth of available markets might seem attractive, the underlying infrastructure lacks the regulatory protections that legitimate brokers provide to their clients. Without oversight from recognized financial authorities, traders have limited recourse in case of disputes or operational issues that may arise during trading. The platform's unregulated nature means it operates outside the standard frameworks that ensure client fund segregation, fair pricing, and transparent business practices that traders expect.

Regulatory Status: Arena Capitals operates without regulation from any recognized financial authority. The UK FCA has specifically warned against Arena Capital Digital Trading Platforms, indicating serious regulatory concerns about the entity's operations and business practices.

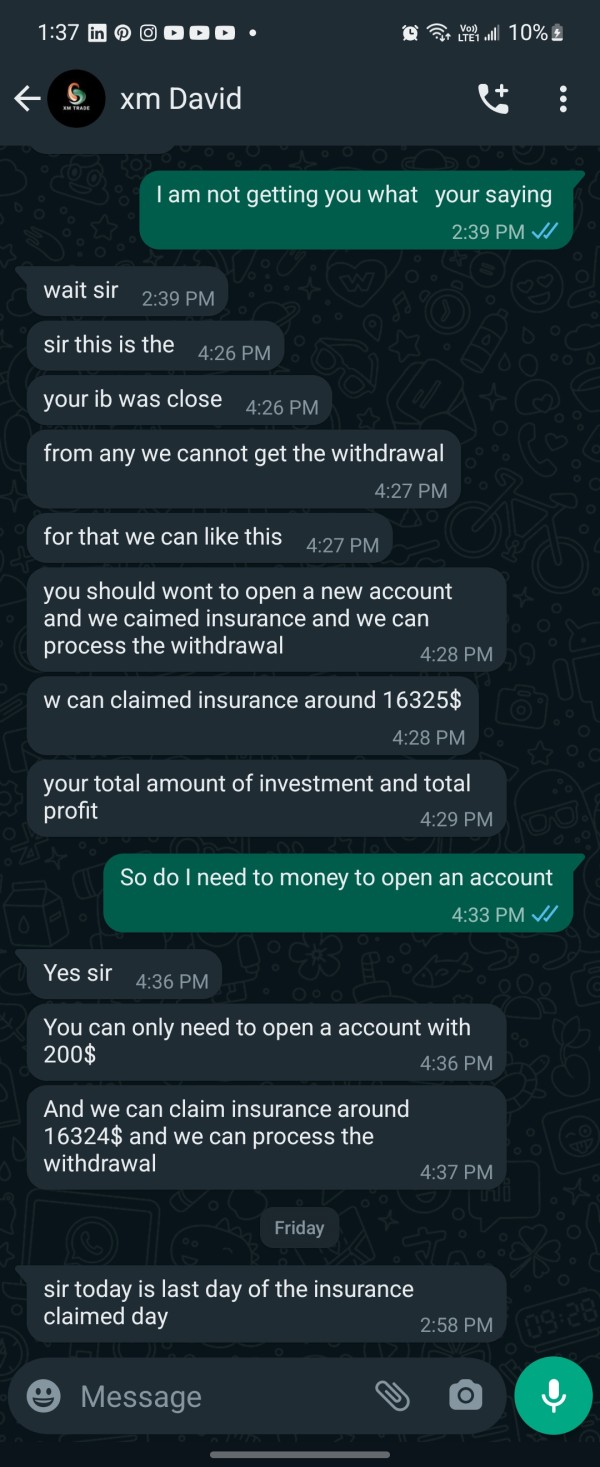

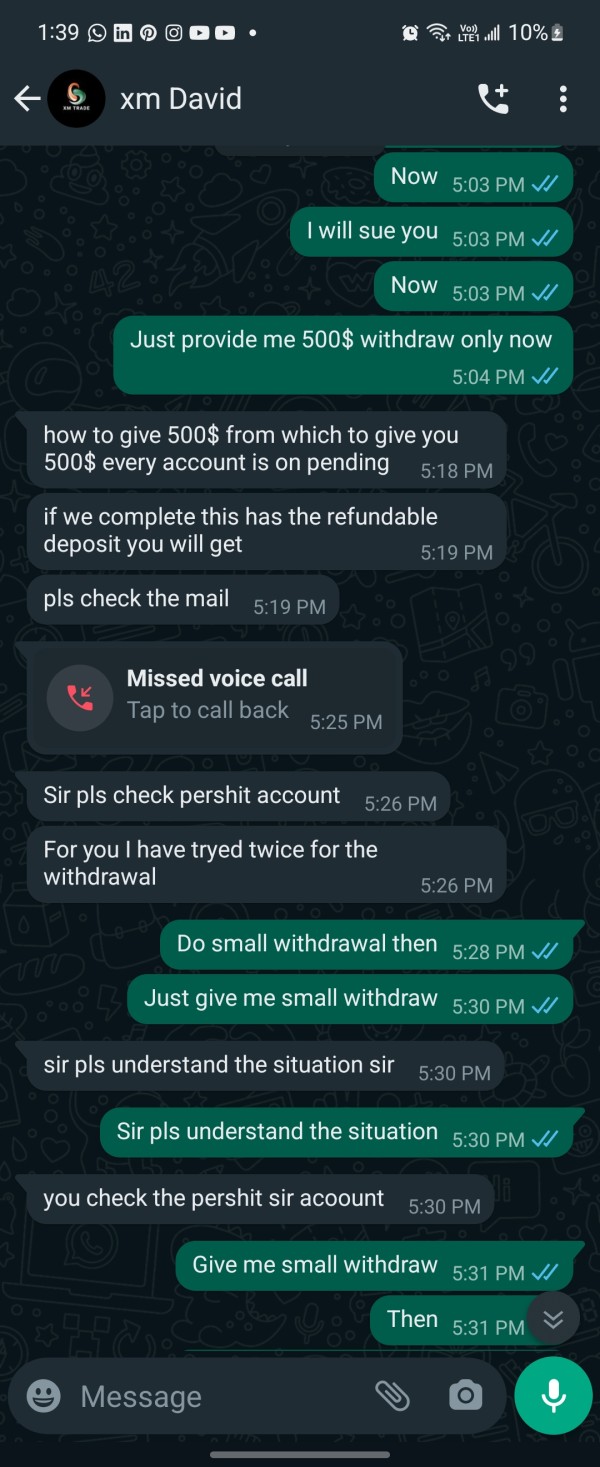

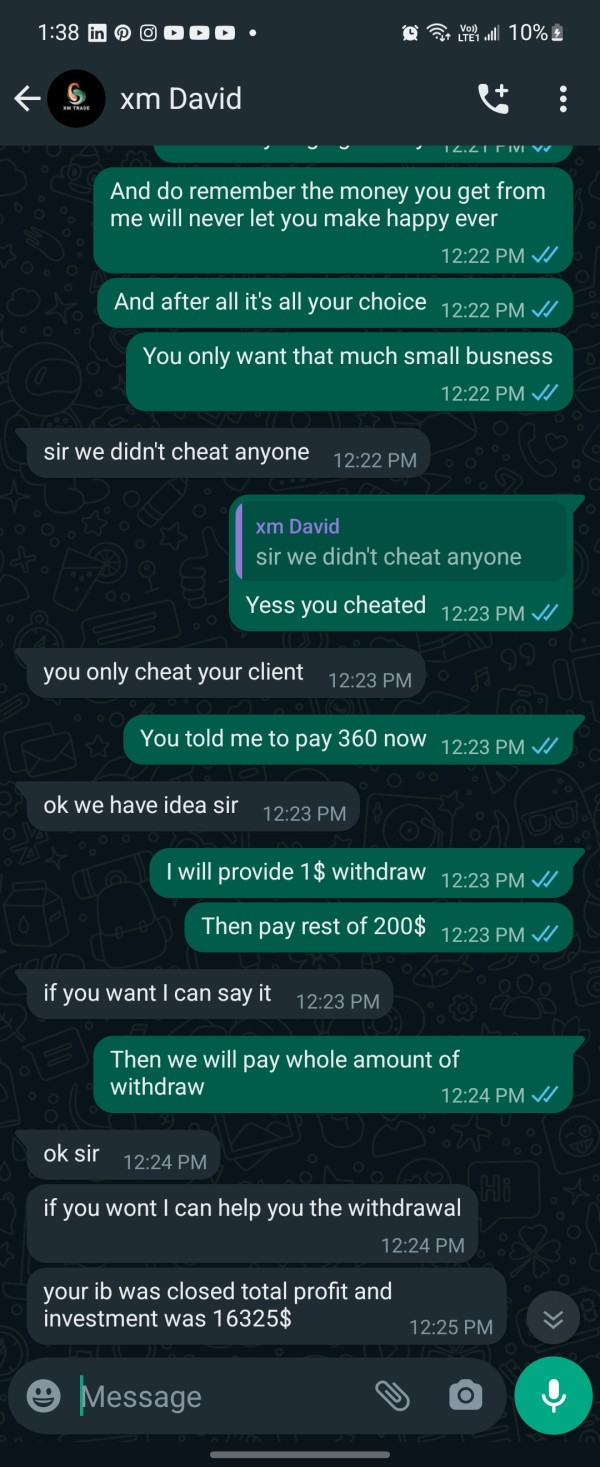

Deposit and Withdrawal Methods: Specific information regarding funding options is not detailed in available source materials. This itself raises transparency concerns for potential traders who need to understand how they can fund their accounts.

Minimum Deposit Requirements: The broker's minimum deposit thresholds are not specified in publicly available information. This makes it difficult for traders to assess accessibility and plan their initial investment amounts.

Bonus and Promotions: Details about promotional offerings or bonus structures are not disclosed in the source materials. This limits transparency about potential incentives that might be available to new or existing clients.

Tradeable Assets: The platform offers over 200 trading instruments spanning forex currency pairs, commodities, stock indices, cryptocurrencies, precious metals, and futures contracts across multiple markets.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not provided in available documentation. This is concerning for cost-conscious traders who need to understand the full expense of trading.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in source materials. This prevents proper risk assessment for traders who rely on leveraged positions.

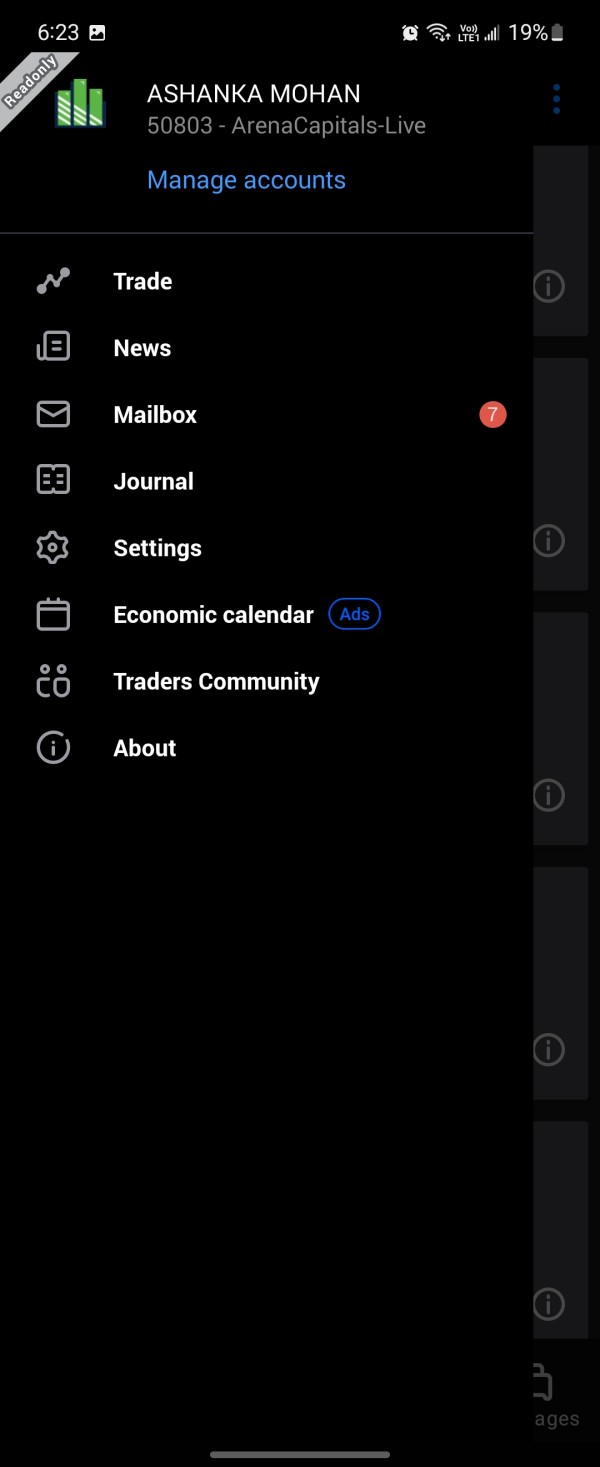

Platform Options: The specific trading platforms offered by Arena Capitals are not detailed in available information. This makes it unclear whether popular options like MetaTrader are available to clients.

Geographic Restrictions: Information about regional limitations or restricted territories is not available in source documentation. Traders need this information to ensure they can legally access the platform.

Customer Support Languages: The range of supported languages for customer service is not specified in available materials. This is important for international traders who may need support in their native language.

This arena capitals review highlights significant information gaps that legitimate brokers typically address transparently on their websites and marketing materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Arena Capitals' account offerings is severely hampered by the lack of transparent information about account types, features, and requirements. Legitimate brokers typically provide detailed specifications about different account tiers, minimum deposit requirements, and special features such as Islamic accounts for Muslim traders who have specific religious requirements. However, Arena Capitals fails to provide this fundamental information. This omission is itself a significant red flag that potential traders should carefully consider.

Without clear account structure information, potential traders cannot make informed decisions about whether the broker meets their specific needs. The absence of details about account opening procedures, verification requirements, and ongoing maintenance fees suggests either poor transparency or deliberate obfuscation of terms that might be unfavorable to clients. Professional brokers understand that clear account information builds trust and helps traders select appropriate services for their individual circumstances.

The lack of information about specialized account types, such as professional trader accounts or managed account options, further limits the broker's appeal to serious traders. Additionally, without details about account protection measures, deposit insurance, or segregated fund policies, traders cannot assess the safety of their potential investments in any meaningful way. This arena capitals review cannot provide a meaningful rating for account conditions due to insufficient publicly available information. The lack of transparency itself indicates poor business practices that legitimate brokers would never engage in.

Arena Capitals' primary strength appears to be its extensive instrument selection, offering over 200 trading options across multiple asset classes. This diversity includes traditional forex pairs, commodity futures, stock indices, precious metals, and cryptocurrency options, potentially appealing to traders seeking portfolio diversification across different market sectors. The breadth of available markets suggests the broker attempts to cater to various trading strategies and preferences that different types of traders might have.

However, the mere availability of numerous instruments does not guarantee quality execution or competitive pricing. Without regulatory oversight, there are no standards ensuring fair pricing, adequate liquidity, or protection against market manipulation that could harm trader interests. The lack of information about research tools, market analysis resources, or educational materials further limits the platform's value proposition for traders seeking comprehensive support for their trading activities.

Professional traders typically require advanced charting tools, real-time market data, economic calendars, and analytical resources to make informed decisions. The absence of detailed information about these essential tools suggests either their unavailability or poor marketing transparency that fails to highlight important features. Additionally, without information about automated trading support, algorithmic trading capabilities, or API access, the platform may not meet the needs of sophisticated traders who rely on these advanced features for their trading strategies.

Customer Service and Support Analysis

The low user satisfaction rating of 2.6 out of 10 strongly indicates significant deficiencies in Arena Capitals' customer support operations. Quality customer service is fundamental to successful broker-client relationships, particularly in the complex world of financial trading where technical issues, account problems, or market-related questions require prompt, professional resolution from knowledgeable support staff.

Without specific information about available support channels, response times, or service hours, potential clients cannot assess whether the broker can meet their support needs. Professional brokers typically offer multiple contact methods including live chat, telephone support, email assistance, and comprehensive FAQ sections that address common questions and concerns. The absence of detailed support information, combined with poor user ratings, suggests inadequate investment in customer service infrastructure that could leave traders without help when they need it most.

The lack of information about multilingual support is particularly concerning for international traders who may require assistance in their native languages. Additionally, without details about support availability during different trading sessions or emergency contact procedures, traders may find themselves without assistance during critical market periods when quick resolution of issues is essential. The poor user feedback likely reflects these systemic support deficiencies. These problems make Arena Capitals unsuitable for traders who value reliable customer service and professional support.

Trading Experience Analysis

Evaluating Arena Capitals' trading experience is challenging due to the absence of specific platform information and user feedback details. Professional trading platforms require stability, fast execution speeds, comprehensive charting tools, and intuitive interfaces to support effective trading decisions that can make the difference between profit and loss. Without information about the underlying trading technology, server locations, or execution models, traders cannot assess platform reliability or performance under different market conditions.

The lack of details about order execution quality, slippage rates, or requote frequencies raises concerns about trading conditions. Regulated brokers typically provide transparency about their execution statistics and trading environment to build client confidence and demonstrate their commitment to fair trading practices. Arena Capitals' failure to disclose this information suggests either poor performance metrics or deliberate concealment of unfavorable conditions that could negatively impact trader profitability.

Mobile trading capabilities have become essential for modern traders who need market access while away from their computers. Without information about mobile app availability, functionality, or user reviews, traders cannot determine whether the broker supports their mobility needs in today's fast-paced trading environment. The overall lack of platform information, combined with the broker's unregulated status, suggests a substandard trading environment that may not meet professional standards expected by serious traders. This arena capitals review cannot provide a comprehensive assessment due to insufficient available data about the actual trading experience that clients can expect.

Trust and Reliability Analysis

Arena Capitals faces severe trust and reliability challenges due to its unregulated status and regulatory warnings from the UK Financial Conduct Authority. Operating without proper regulatory oversight means the broker lacks the fundamental protections that legitimate financial institutions must provide, including client fund segregation, regular audits, and compliance with industry standards that protect trader interests. These protections are not optional extras but essential safeguards that every legitimate broker should offer.

The FCA warning specifically mentioning Arena Capital Digital Trading Platforms indicates serious concerns about the entity's operations and potential risks to traders. Regulatory warnings typically result from evidence of questionable business practices, inadequate client protections, or failure to meet licensing requirements that are designed to protect the public from financial harm. Such warnings serve as crucial red flags for potential clients considering the broker's services and should not be ignored or dismissed lightly.

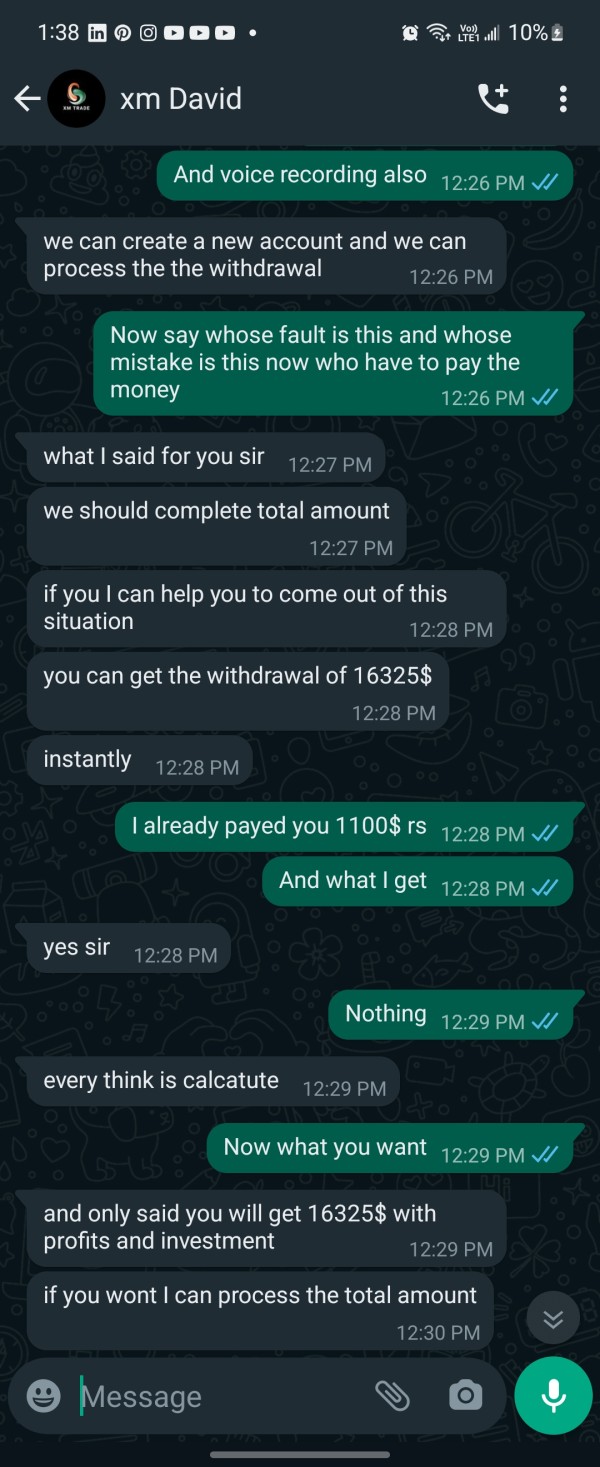

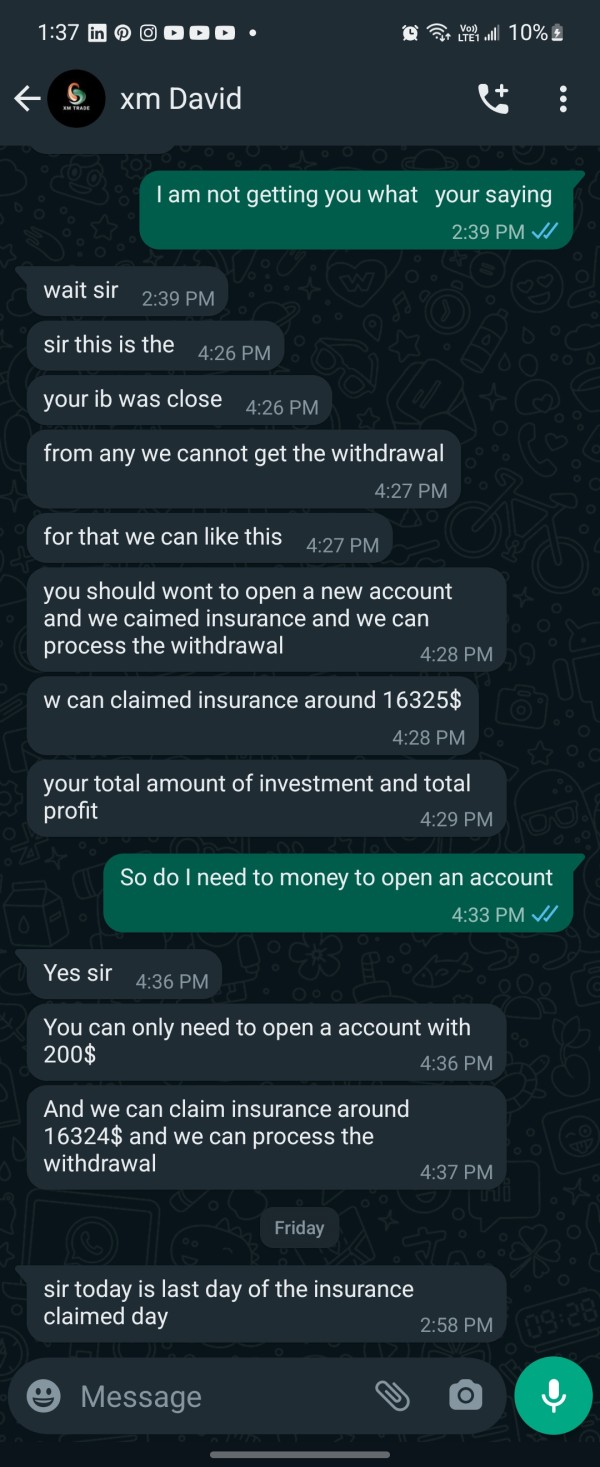

Without regulatory oversight, traders have limited recourse if problems arise with their accounts, withdrawals, or trading conditions. Legitimate brokers operate under strict regulatory frameworks that provide complaint resolution mechanisms, compensation schemes, and regular monitoring of business practices to ensure fair treatment of clients. The absence of these protections, combined with reports of potential fraudulent activities, makes Arena Capitals unsuitable for traders prioritizing safety and reliability above all other considerations. The broker's poor reputation and regulatory concerns significantly undermine any potential benefits from its trading offerings.

User Experience Analysis

The user experience at Arena Capitals appears significantly problematic, as evidenced by the extremely low user rating of 2.6 out of 10. This poor satisfaction score suggests widespread dissatisfaction among actual users and indicates fundamental problems with the broker's services, platform functionality, or business practices that affect day-to-day trading activities. Such consistently negative feedback from real users should be taken seriously by anyone considering this broker.

Without detailed information about the platform's interface design, navigation structure, or user-friendly features, potential traders cannot assess whether the broker meets modern usability standards. Professional trading platforms should offer intuitive interfaces, customizable layouts, and efficient workflow designs that enhance rather than hinder trading activities and help traders focus on market analysis instead of fighting with poor software. The poor user ratings suggest these basic requirements may not be met by Arena Capitals' platform.

The registration and account verification processes are crucial touchpoints that shape initial user impressions. Legitimate brokers provide clear, efficient onboarding procedures with transparent requirements and reasonable timeframes that respect client time and needs. The lack of information about these processes, combined with poor user feedback, suggests potential problems with account setup and verification procedures that could frustrate new clients from the very beginning of their relationship with the broker.

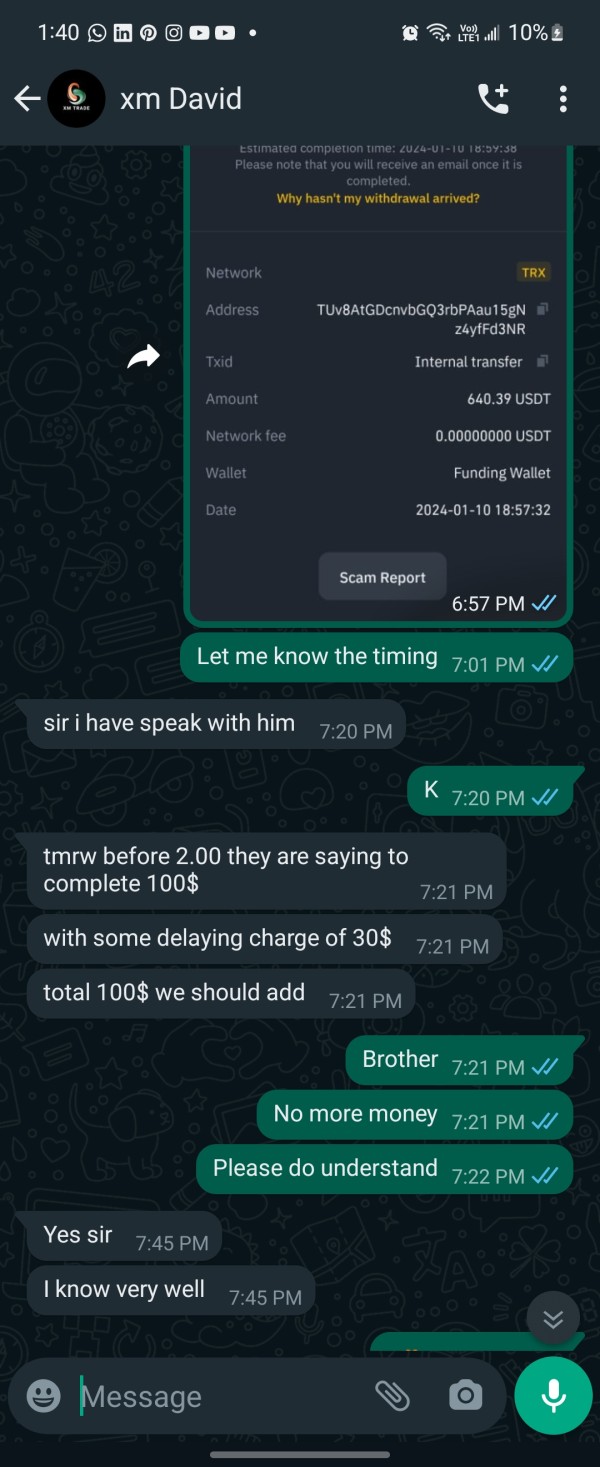

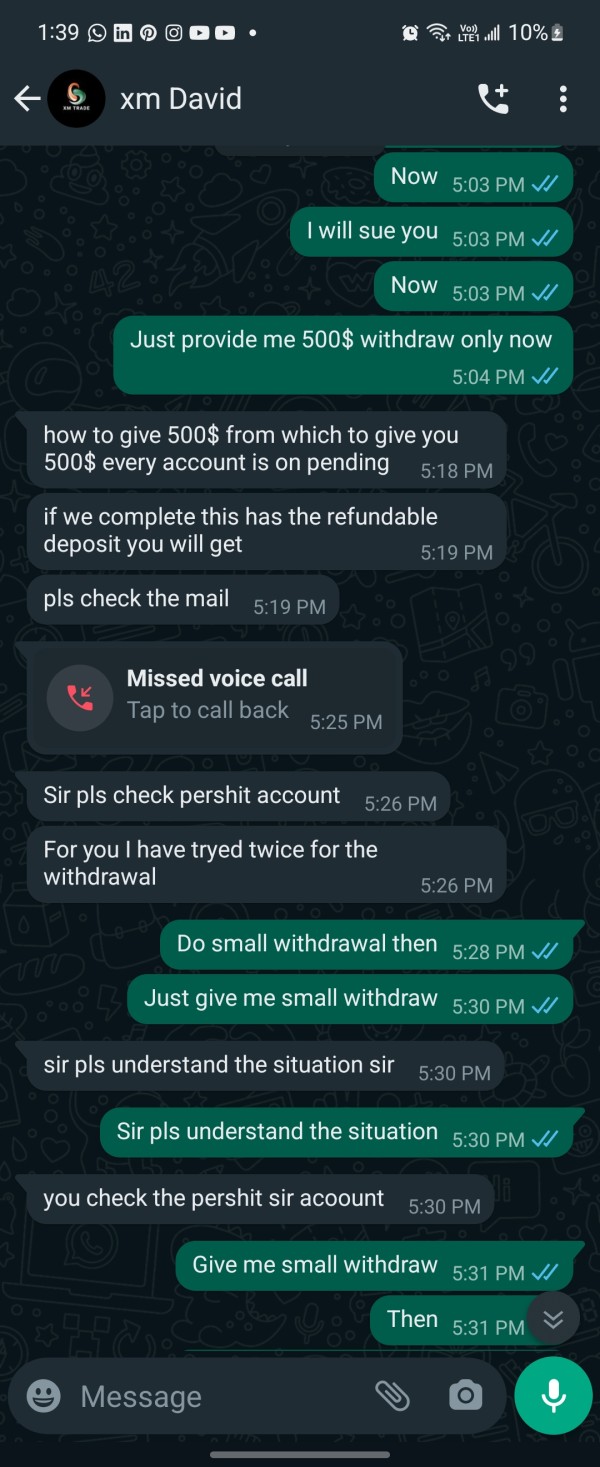

Given the regulatory concerns and reports of potential fraudulent activities, negative user experiences may extend beyond mere platform usability to more serious issues involving fund safety, withdrawal problems, or deceptive practices. The overwhelmingly poor user satisfaction rating serves as a strong warning signal that potential traders should carefully consider before engaging with this broker. Such consistently negative feedback from actual users provides valuable insight into the real-world experience of trading with Arena Capitals.

Conclusion

This comprehensive arena capitals review reveals a broker that poses significant risks to potential traders despite offering an extensive range of trading instruments. The fundamental issue of operating without regulatory oversight, combined with warnings from the UK Financial Conduct Authority, creates an environment where trader protection is minimal and recourse options are limited for clients who encounter problems.

While Arena Capitals may appeal to traders seeking access to diverse markets including forex, commodities, indices, and cryptocurrencies, the substantial risks far outweigh these potential benefits. The extremely low user satisfaction rating of 2.6 out of 10 provides clear evidence that actual users experience significant problems with the broker's services that go beyond minor inconveniences.

The broker is unsuitable for risk-averse traders, beginners, or anyone prioritizing safety and regulatory protection. Even experienced traders who typically accept higher risks should carefully consider whether the potential benefits justify exposure to an unregulated entity with documented regulatory warnings from respected financial authorities. The lack of transparency regarding essential information such as account conditions, trading costs, and platform specifications further undermines confidence in the broker's operations and suggests a business model that does not prioritize client interests.