Is Novopus safe?

Pros

Cons

Is Novopus A Scam?

Introduction

Novopus is a cryptocurrency trading platform that emerged in 2018, positioning itself within the competitive landscape of online forex and cryptocurrency trading. As the digital trading environment continues to expand, it is essential for traders to conduct thorough evaluations of brokers before committing their funds. The rise of unregulated brokers and scams in the industry has made it imperative for traders to exercise caution and diligence when selecting a trading partner. This article aims to provide an objective analysis of Novopus, assessing its regulatory status, company background, trading conditions, customer experience, platform performance, and overall risk profile. The investigation draws from various credible sources, including expert reviews and user feedback, to present a comprehensive evaluation of Novopus's legitimacy.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy and trustworthiness. A regulated broker is subject to oversight from financial authorities, which helps ensure compliance with industry standards and provides a layer of protection for traders. In the case of Novopus, claims have been made regarding its affiliation with the National Futures Association (NFA). However, further investigation reveals that these claims are misleading, as the broker operates without proper regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0553503 | United States | Clone License (Unverified) |

The aforementioned table highlights the concerning nature of Novopus's regulatory claims. Although the broker cites a license from the NFA, it has been identified as a clone license, indicating that Novopus is not legitimately regulated. This lack of oversight raises significant red flags, as trading with an unregulated broker exposes investors to higher risks, including potential fraud and loss of funds. Moreover, the absence of a credible regulatory framework means that traders have limited recourse in the event of disputes or financial losses.

Company Background Investigation

Novopus was founded in 2018 in the United States, primarily focusing on cryptocurrency trading. However, the company's ownership structure and management team remain opaque, as there is limited information available regarding the individuals behind the platform. This lack of transparency raises concerns about the broker's credibility and accountability.

The management team's background is critical in assessing the broker's reliability. A team with a solid track record in the financial industry typically indicates a commitment to ethical standards and regulatory compliance. Unfortunately, Novopus does not provide sufficient information about its management or the qualifications of its team members, further contributing to the skepticism surrounding its operations.

In terms of transparency, Novopus's website lacks comprehensive disclosures about its services, trading conditions, and company policies. This deficiency in information can hinder potential clients from making informed decisions and may suggest an attempt to obscure critical details about the broker's operations.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for traders looking to maximize their investment potential. Novopus claims to provide competitive trading conditions; however, a closer examination reveals several concerning aspects of its fee structure and trading policies.

| Fee Type | Novopus | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The table above outlines the fee types associated with Novopus, but specific values remain undisclosed. The lack of transparency regarding spreads, commissions, and overnight interest rates is a significant concern. Traders typically rely on clear and accessible information about fees to evaluate the cost-effectiveness of trading with a particular broker. The absence of this information could indicate an attempt to impose hidden fees or unfavorable trading conditions.

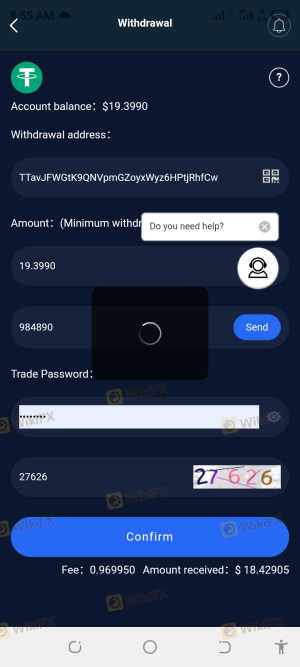

Additionally, some user reviews have raised alarms about unexpected charges and unclear policies regarding withdrawals and deposits. Such practices are often indicative of brokers that prioritize profit over client satisfaction, making it essential for traders to be vigilant when considering Novopus as a trading partner.

Customer Funds Security

The security of customer funds is paramount when evaluating a broker. Traders need to ensure that their investments are protected through measures such as segregated accounts, investor protection schemes, and negative balance protection policies. In the case of Novopus, the lack of regulatory oversight raises questions about the safety of client funds.

Novopus has not provided clear information regarding its fund security measures. Without robust safeguards in place, clients may find themselves at risk of losing their investments in the event of financial mismanagement or fraud. Moreover, any historical incidents involving fund security issues would further exacerbate concerns about the broker's reliability.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the overall experience of traders with a specific broker. In the case of Novopus, numerous negative reviews have surfaced, highlighting common complaints related to customer support and withdrawal issues.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow or No Response |

| Lack of Transparency | Medium | Limited Information Provided |

| Poor Customer Support | High | Email Only, Slow Response |

The table above summarizes the main complaints associated with Novopus. The high severity of withdrawal delays is particularly alarming, as it suggests that clients may struggle to access their funds when needed. Additionally, the limited channels of communication (primarily email) can lead to prolonged response times, leaving traders frustrated and without timely assistance.

Several users have reported experiences of being unable to withdraw their funds, which raises significant concerns about the broker's operational integrity. Such complaints are critical indicators of potential fraud or mismanagement, warranting caution for prospective traders.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for traders seeking a seamless trading experience. Novopus offers a proprietary mobile app for trading, which may appeal to some users but also raises questions about its stability and functionality.

A thorough evaluation of the platform's execution quality, slippage rates, and order rejection rates is essential for understanding its performance. Unfortunately, user reviews indicate mixed experiences, with some traders reporting issues related to order execution and delays.

Moreover, the absence of popular trading platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5) may deter experienced traders who prefer these widely recognized platforms for their advanced features and tools.

Risk Assessment

Using Novopus as a trading platform entails several inherent risks, primarily due to its lack of regulation and transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about safety and recourse. |

| Withdrawal Risk | High | Reports of withdrawal delays and issues indicate potential fraud. |

| Transparency Risk | Medium | Lack of clear information about fees and policies creates uncertainty. |

The risk assessment table summarizes the key risk areas associated with Novopus. Prospective traders should be aware of these risks and consider implementing mitigation strategies, such as starting with a small investment or seeking alternative brokers with a stronger regulatory framework.

Conclusion and Recommendations

In conclusion, the investigation into Novopus reveals significant concerns regarding its legitimacy and trustworthiness. The broker operates without proper regulatory oversight, lacks transparency in its operations, and has received numerous complaints related to withdrawal issues and poor customer support. Based on the evidence presented, it is reasonable to categorize Novopus as a potentially fraudulent entity that traders should approach with extreme caution.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers that demonstrate transparency, strong customer support, and a proven track record of protecting client funds. Brokers regulated by reputable authorities such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) are generally more trustworthy options for traders looking to engage in forex and cryptocurrency trading.

Is Novopus a scam, or is it legit?

The latest exposure and evaluation content of Novopus brokers.

Novopus Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Novopus latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.