capital fx 2025 Review: Everything You Need to Know

Abstract

Capital FX gets mixed reviews from traders. Many users like its safe online trading setup, but they worry about whether it follows the rules properly. In this capital fx review, the broker offers many trading choices including forex, stocks, and cryptocurrencies, which attracts people who want different investment options. Capital FX says it follows regulations, but it hasn't gotten approval from any real financial authority, which makes some clients nervous. Users do like how the platform focuses on safety and being clear about deposits and withdrawals. This review uses feedback from users and information from the company to show both good points and possible risks. Capital FX gets praise for being flexible and supporting many assets, but new investors should do more research because of the rule-following problems.

Important Considerations

Capital FX has its main office in London. Even though it claims to follow regulations, no official authority has approved it, which potential investors should think about carefully. Our review only uses user feedback and company details without checking things directly on-site. Different sources give varying reports that show the platform gets praise for safe trading, but it still has big gaps in being clear about regulations. New online investors especially need to be careful with Capital FX. This assessment looks at feedback about customer service, costs, and the overall trading experience that users have reported. Future clients should compare these insights with other sources before putting money into anything.

Rating Framework

Below is the detailed rating framework based on six key dimensions:

Broker Overview

Capital FX works under the name Capital FX Club and is an online trading broker based in London. The company started with a goal to give access to many different types of assets, and it presents itself as a platform for various investment strategies. The broker lets people trade forex, stocks, and cryptocurrencies, targeting traders who feel comfortable with many different assets. We don't know the exact year it started from our sources, but the company's background shows it wants to create a safe trading environment. User feedback and internal documents show that people recognize the platform's safety measures, even though some rule-following issues still worry people. This mix in how it operates shows the natural trade-offs between new online trading services and strict rule-following.

Capital FX supports an online trading platform for its trading setup. The platform probably includes popular systems like MT4/MT5, though the available information doesn't give specifics. The broker handles transactions in many assets including forex pairs, commodities, stocks, and digital currencies. The lack of regulatory approval stands out because it might hurt investor confidence even though the platform advertises safety features. This capital fx review shows that while the company ambitiously offers many investment options, the lack of formal regulatory oversight means investors need to be extra careful. The trading technology is probably competitive, but people must weigh this against how transparent and trustworthy the broker really is.

Regulatory Regions :

Capital FX is based in London according to the summary we have. However, detailed information about which regulatory areas it operates in is not clearly explained. The broker says it operates under a regulation framework, but no recognized financial authority has given it certification. This unclear situation calls for caution because the lack of clear regulatory approval could affect how well investors are protected.

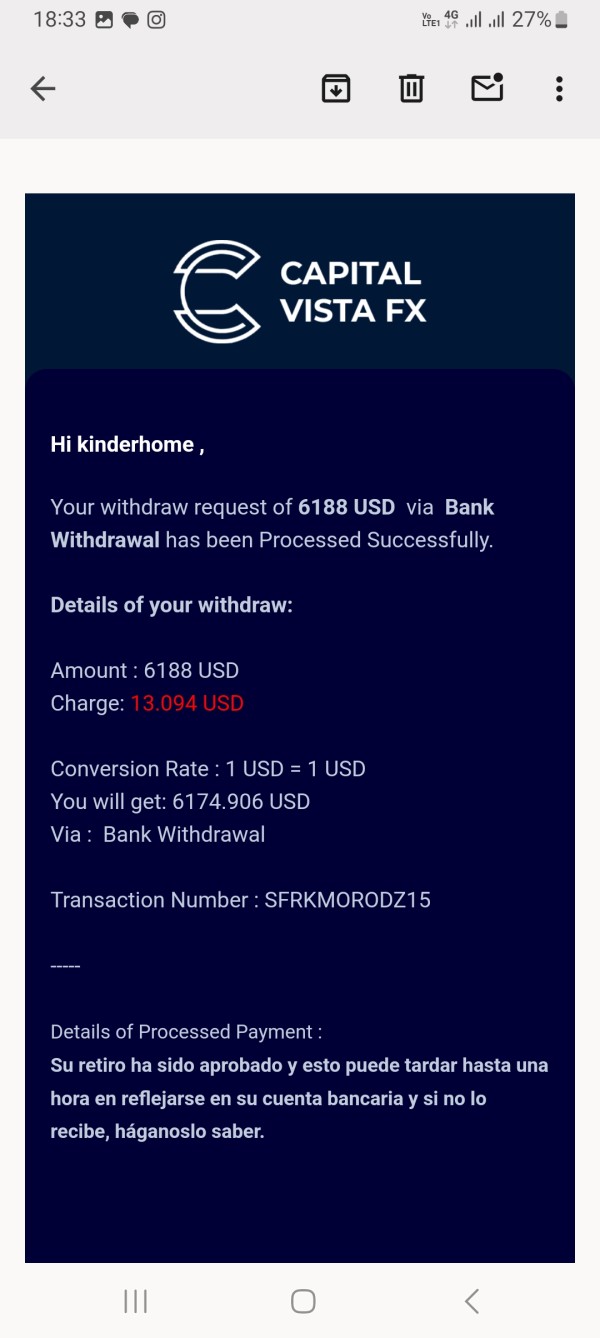

Deposit and Withdrawal Methods :

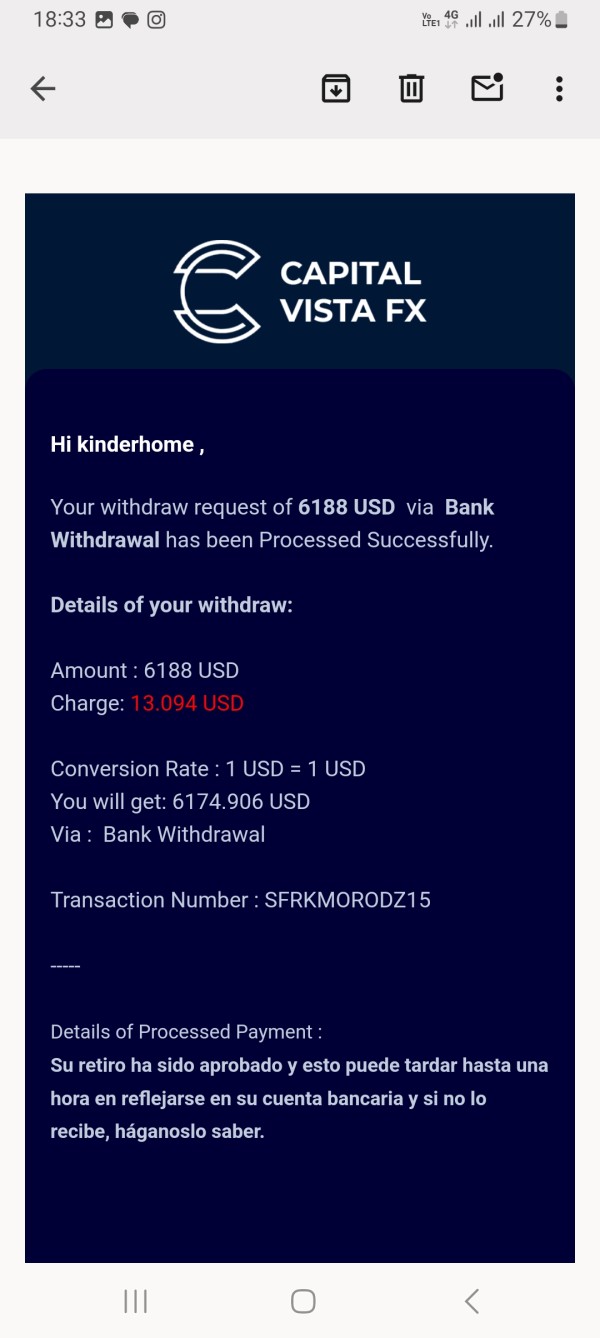

The details we have don't explain the exact deposit and withdrawal methods that Capital FX supports. Brokers usually offer options like bank transfers and e-wallets, but we lack clear information in this case. Investors should check this part independently before opening an account to make sure the method works with what they prefer.

Minimum Deposit Requirement :

The summary doesn't mention any specific minimum deposit requirement for Capital FX accounts. This lack of clarity means future users must contact the broker directly or look at more detailed sources for exact entry-level deposit information.

Bonus and Promotions :

We have no detailed information about bonus or promotion programs from Capital FX. Many brokers give initial deposit bonuses or seasonal promotions, but the lack of such details here suggests that either promotions are small or not heavily advertised. Traders should ask for confirmation about whether such incentives are available.

Tradable Assets :

Capital FX offers a wide range of assets, including forex, stocks, and cryptocurrencies. This multi-asset approach appeals to traders who want to spread out their portfolios. Though detailed listings aren't provided, the focus on these key asset classes suggests that the platform could also support commodities and indices. This broad selection is a noted highlight of what the broker offers, according to user feedback and company information, which reinforces how versatile it is in the online trading space.

Cost Structure :

Details about Capital FX's cost structure, including spreads, commissions, and other transaction fees, stay unclear in the materials we have. Without solid data on these parts, users have to guess about the real trading costs. In a very competitive market, clear disclosure of fees is extremely important. The unclear nature of cost components means that traders must look extra carefully at the overall trading expenses. This situation could create a problem for potential investors who need clarity and competitive trading fees. Users should do thorough research or ask for detailed fee schedules directly from the broker.

Leverage Ratio :

No specific information about the leverage ratios available for trading at Capital FX has been provided in the summary. Given how important leverage is in affecting risk and position sizes, leaving out such details means future traders need to be cautious and ask for more clarification directly.

Platform Selection :

Capital FX supports several online trading platforms, with expectations that these include industry-standard options like MT4/MT5. While the overall platform interface and abilities are highlighted as secure, more specifics about the selection or unique features remain unexplained. This lack of detailed platform comparison means that users must rely on direct questions and user reviews to confirm if it works for their trading style.

Regional Restrictions :

The information we have doesn't include any specific regional restrictions related to Capital FX's services. So while it's headquartered in London, the broker's operational boundaries and any limitations for international customers aren't clearly outlined.

Customer Service Languages :

No detailed information is provided about the range of languages supported by Capital FX's customer service. Future clients may need to ask more questions to find out if good multilingual support is available.

Detailed Rating Analysis

2.6.1 Account Conditions Analysis

In this section, we look at the account conditions that Capital FX provides. The broker hasn't detailed specific account types, which creates uncertainty about variations like standard, mini, or specialized accounts made for Islamic finance. The lack of clear minimum deposit requirements, clear details on spreads or commission structures, and the lack of guidance on a smooth account opening process makes a full analysis harder. Users haven't reported much clarity in this area, and the verification process seems to be less transparent compared with more established platforms. Also, any specialized features—like options for Islamic accounts or promotional trading benefits—aren't mentioned in the data we have. The limited information on key account parameters results in a careful rating, which matches the score of 4/10 for account conditions. This analysis uses combined user feedback and the details available from the summary we have, showing that investors must independently confirm these conditions before putting money in.

Capital FX's trading tools and resources remain important for active traders. The broker gives an online trading platform that probably supports widely used tools, but the specific types of research, market analysis tools, or educational materials aren't explained. Some users have mentioned a secure and stable environment, but detailed analysis or expert reviews on the charting abilities, integration of news feeds, or technical indicators are missing. We don't know if the broker supports automated trading features like Expert Advisors and algorithmic systems or if there's any dedicated research portal. The resource base doesn't seem to cover extensive guidance or deep market analysis, leaving traders possibly under-equipped for informed decision-making. Even though there's a moderate level of satisfaction reported among users, these gaps justify the 6/10 score. This evaluation comes from user feedback and the company information provided, highlighting the need for Capital FX to offer more detailed insights into its toolset.

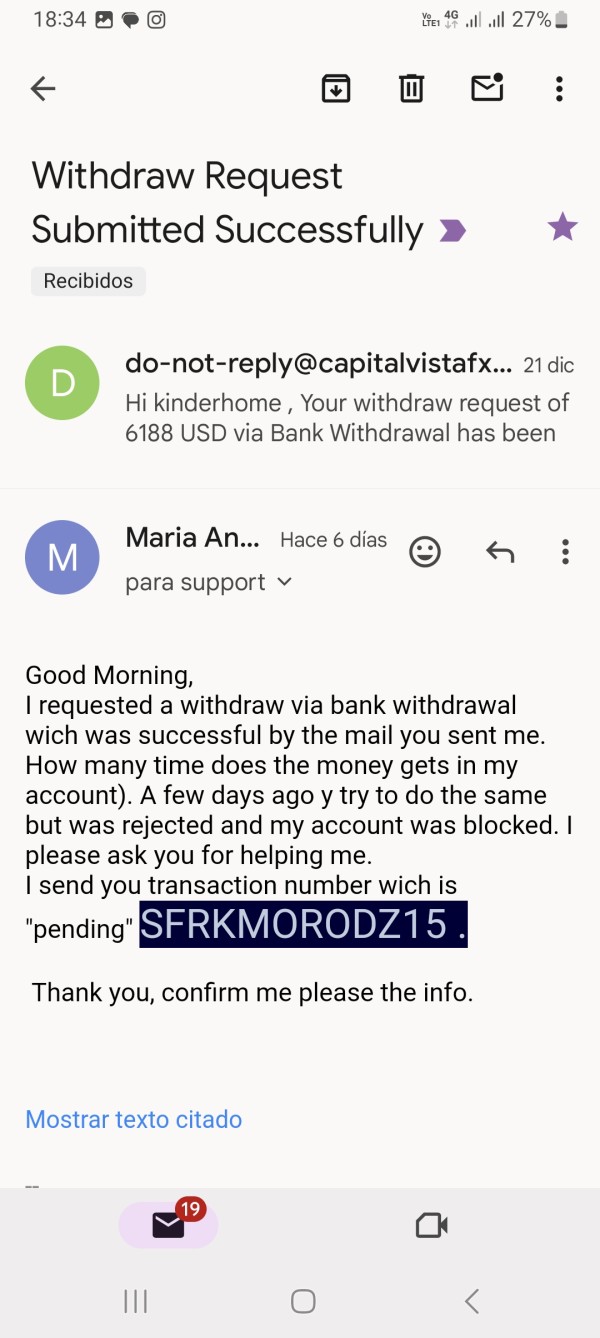

2.6.3 Customer Service and Support Analysis

Customer service remains a critical part of Capital FX's overall offering. The data suggests that support is only moderately effective. The review of customer service shows that responses tend to be neutral, with no clear agreement on whether the support comes through multiple channels like email, telephone, or live chat. There's no detailed breakdown of response times or resolution efficiency in user reports. There's also little evidence about multi-language support, which can be a big factor for a global clientele. The lack of solid feedback on working hours and dedicated support teams further hurts confidence in the broker's service quality. Some users have found the support satisfactory, but the lack of detailed case studies or resolution examples contributes to an overall rating of 5/10. The evaluation draws from the summary provided and combined user insights, suggesting that future traders should verify support availability before opening an account.

2.6.4 Trading Experience Analysis

Looking at the trading experience at Capital FX requires careful consideration of platform performance, order execution, and overall functionality. Users have generally liked the security measures the broker has in place—an aspect often highlighted in this capital fx review. The specific details on trading speed, order execution quality, and real-time price accuracy remain unspecified though. While the platform's safety and stability appear good, aspects like mobile trading support, ease of navigating the interface, and the breadth of available trading tools aren't fully explored in the data we have. Even though the trading environment is seen as secure, the overall execution and advanced features that experienced traders might expect aren't documented enough. This unclear situation contributes to a median score of 5/10, reflecting the mixed user experiences reported. The platform is operationally sound, but clear improvements in transparency about technical performance would be helpful.

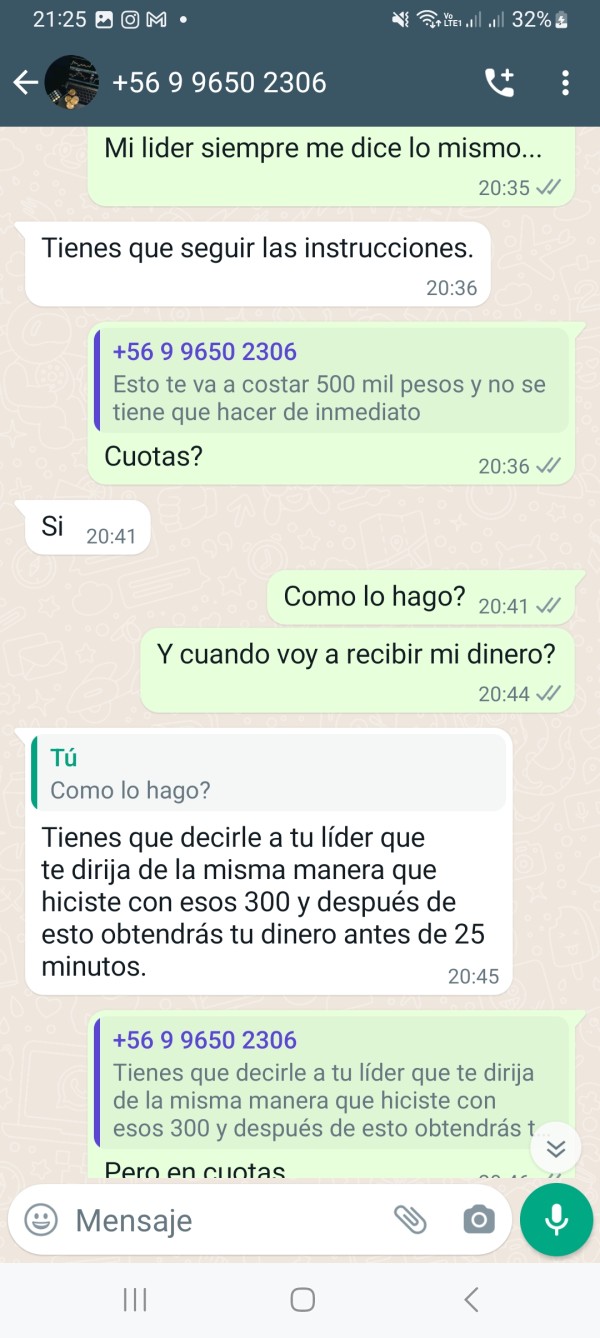

2.6.5 Trustworthiness Analysis

Trust is extremely important for any financial broker, and Capital FX faces big challenges in this area. With claims of regulatory oversight but no formal certification from recognized authorities, the trustworthiness of the broker is naturally compromised. Users express concerns about the lack of detailed information on fund protection measures, transparency in financial reporting, and audited disclosures. The combined impact of regulatory uncertainty and limited independent validation results in a low confidence score. Negative signals, like the lack of endorsements from well-known industry organizations or a history of awards, further impact the overall trust. The evaluation of these aspects, based on user feedback and public disclosures highlighted in the summary provided, justifies the low rating of 3/10. Future investors are therefore urged to do more research to fully understand the natural risks before engaging with the platform.

2.6.6 User Experience Analysis

The overall user experience of Capital FX is characterized by a mix of positive feedback and noticeable gaps. Users report that the interface, while generally user-friendly, lacks some of the refined features that might make navigation easier. Specific aspects like the registration and verification process haven't been detailed enough, and there's a perceived lack in the efficiency of funds transfer operations. Common user complaints include delays or inconsistencies in accessing certain platform functions and an apparent lack of customization options for the dashboard. Despite these shortcomings, some users appreciate the security features and the multi-asset offerings available. The balance of positive elements with notable areas for improvement results in a moderate satisfaction score of 6/10. This user experience analysis is based on combined reviews and insights from the summary provided, emphasizing that while the platform shows promise, further improvements are necessary for an optimized trading environment.

Conclusion

Capital FX provides a multi-asset trading environment that appeals to investors interested in forex, stocks, and cryptocurrencies. The broker's regulatory uncertainties pose big concerns though. Users acknowledge the platform's secure trading environment, but its lack of formal certification and transparent cost disclosures takes away from its overall credibility. This capital fx review emphasizes that while there are notable advantages in asset variety and perceived safety, traders should be careful and do additional research before committing to the platform. Capital FX may be suited for experienced investors willing to accept natural risks, rather than those seeking fully regulated services.