Regarding the legitimacy of Mabicon forex brokers, it provides FSCA and WikiBit, .

Is Mabicon safe?

Pros

Cons

Is Mabicon markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

NOBLEZA (PTY) LTD

Effective Date:

2022-10-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

CNR ALICE LANE 4TH FLOOR SANDOWN BUILDING SANDTON 2196Phone Number of Licensed Institution:

061 660 7510Licensed Institution Certified Documents:

Is Mabicon A Scam?

Introduction

Mabicon is a relatively new player in the forex market, having been established in 2022 and operating under the regulatory framework of South Africa. As a forex and commodities broker, Mabicon aims to provide traders with access to a wide range of trading instruments, including forex pairs, CFDs, and commodities. However, with the rise of online trading platforms, it has become increasingly important for traders to exercise caution and thoroughly evaluate the legitimacy of their chosen brokers. The forex industry has seen its fair share of scams and unregulated brokers, making it crucial for potential clients to assess the credibility and reliability of platforms like Mabicon before committing their funds.

This article aims to provide a comprehensive evaluation of Mabicon by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. The information presented here is derived from various sources, including regulatory filings, customer reviews, and industry analyses, to offer a balanced perspective on whether Mabicon can be considered a safe and reliable trading partner.

Regulation and Legitimacy

Mabicon operates under the regulatory oversight of the Financial Sector Conduct Authority (FSCA) of South Africa. This regulatory body is responsible for ensuring that financial institutions adhere to established standards and practices aimed at protecting investors. The importance of regulation cannot be overstated, as it provides a level of assurance that the broker is operating within the law and maintaining certain standards of conduct.

Core Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 52698 | South Africa | Verified |

While being regulated by the FSCA lends some credibility to Mabicon, it is essential to note that the FSCA is considered a mid-tier regulator when compared to more robust authorities like the UK's FCA or Australia's ASIC. This means that while Mabicon is subject to oversight, the level of investor protection may not be as stringent as that provided by top-tier regulators. Additionally, there have been no significant historical compliance issues reported against Mabicon, which indicates a commitment to regulatory adherence.

Company Background Investigation

Mabicon (Pty) Ltd is registered in South Africa and has positioned itself as a forex and commodities broker since its inception. The company aims to cater to a diverse clientele, including retail traders and institutional investors. Information regarding its ownership structure is somewhat limited, which can be a concern for potential clients who value transparency in the companies they choose to work with.

The management team behind Mabicon includes seasoned professionals with extensive experience in the financial services industry. However, further details about the individual backgrounds of key team members remain sparse, which could raise questions about the company's overall transparency and accountability. In an industry where trust is paramount, a lack of information about the management team can be a red flag for potential investors.

Trading Conditions Analysis

Mabicon offers various trading accounts tailored to different types of traders, including cent accounts for beginners and more advanced accounts for experienced traders. The overall fee structure appears competitive, but it is crucial to examine any unusual or problematic fees that might affect trading profitability.

Core Trading Costs Comparison

| Fee Type | Mabicon | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

Mabicon's spreads starting at 1.6 pips are slightly higher than the industry average, which could impact frequent traders who rely on tight spreads. Additionally, the absence of commission fees can be attractive; however, traders should remain vigilant about any hidden costs that may arise during trading.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader considering a broker. Mabicon claims to implement several measures to ensure the security of client funds, including segregated accounts and adherence to local regulations. Segregating client funds from the company's operational funds is a critical practice that protects traders in the event of financial difficulties faced by the broker.

Furthermore, Mabicon has not reported any significant issues regarding fund safety or disputes with clients concerning withdrawals. However, the absence of a compensation fund, which is often provided by more established brokers, could pose a risk to investors in case the company faces insolvency.

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. Reviews of Mabicon indicate a mixed bag of experiences among users. While some traders commend the platform for its user-friendly interface and efficient execution, others have raised concerns about the responsiveness of customer support and the overall trading experience.

Major Complaint Types and Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

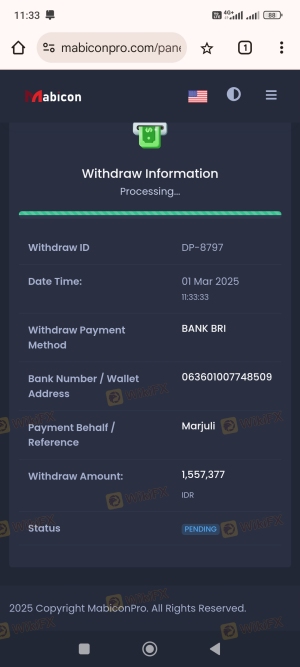

| Withdrawal Delays | High | Slow |

| Customer Support Response Time | Medium | Moderate |

| Platform Stability Issues | Medium | Active |

Typical complaints include delays in withdrawals and slow response times from customer support. These issues can significantly impact the user experience, leading to frustration and mistrust among traders. One notable case involved a trader who experienced prolonged delays in withdrawing funds, raising concerns about the broker's reliability.

Platform and Trade Execution

Mabicon offers the popular MetaTrader 5 (MT5) trading platform, known for its advanced features and user-friendly interface. The platform supports various trading instruments and provides traders with access to essential tools for market analysis.

However, the quality of order execution is a critical factor that can affect trading outcomes. Reports indicate that while most trades are executed efficiently, there have been instances of slippage and rejections during volatile market conditions. Such occurrences can be concerning for traders, especially those employing high-frequency trading strategies.

Risk Assessment

Using Mabicon entails certain risks that potential clients should consider. While the broker is regulated and offers a range of trading instruments, the absence of a compensation fund and the slightly higher-than-average spreads could pose risks to traders.

Risk Scorecard

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Regulated by a mid-tier authority |

| Fund Safety | High | No compensation fund; relies on segregation |

| Execution Risk | Medium | Instances of slippage and rejections |

To mitigate these risks, traders are advised to start with a small investment, familiarize themselves with the platform, and maintain open communication with customer support.

Conclusion and Recommendations

In conclusion, while Mabicon is a regulated broker operating under the FSCA, potential clients should approach with caution. The broker's slightly higher spreads, mixed customer feedback, and lack of a compensation fund warrant careful consideration. Although there are no immediate signs of fraudulent activity, the transparency issues surrounding its management and customer service could be concerning for some traders.

For those considering trading with Mabicon, it may be prudent to start with a small deposit and thoroughly test the platform before committing larger amounts. Additionally, traders who prioritize robust regulatory oversight and investor protection may want to explore alternatives such as brokers regulated by top-tier authorities like the FCA or ASIC.

Is Mabicon a scam, or is it legit?

The latest exposure and evaluation content of Mabicon brokers.

Mabicon Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Mabicon latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.